JustLend DAO's 2025 Leapfrog Growth: Steady Rise in TVL and Yields, JST Deflation and Global Expansion Accelerate

TechFlow Selected TechFlow Selected

JustLend DAO's 2025 Leapfrog Growth: Steady Rise in TVL and Yields, JST Deflation and Global Expansion Accelerate

JustLend DAO's impressive achievements: cumulative net revenue of approximately $62 million, TVL consistently ranking among the top four global lending platforms, $59 million in ecosystem rewards driving JST buybacks and burns, with offline events spanning globally

Against the backdrop of overall volatility in the DeFi market, JustLend DAO, a core DeFi protocol within the TRON ecosystem, achieved leapfrog development during the first three quarters of 2025. It made comprehensive breakthroughs not only in total value locked (TVL) growth, product functionality expansion, and global influence, but also continuously released value through a recently implemented large-scale JST buyback and burn mechanism, demonstrating strong ecological vitality and growth potential.

According to Messari's Q3 income report on TRON, JustLend DAO’s TVL increased by 46.1% quarter-on-quarter, rising from $3.4 billion to $5 billion. It has long remained among the top four lending protocols globally, firmly establishing itself as a leading player in the global DeFi arena.

More notably, the large-scale JST buyback and burn program—valued at approximately $59 million—has now been executed. The first round burned around 560 million JST tokens, accounting for 5.66% of the total supply, with over $41 million still allocated for subsequent burns.

At a time when the broader crypto market remains volatile and weak, such a significant buyback action by JST fully reflects the platform strength and ecosystem confidence of JustLend DAO, directly driving positive market feedback. According to CoinGecko data from November 11, JST rose more than 20% over the past 30 days, climbing from $0.030 to $0.037, with deflationary value consensus steadily strengthening.

JustLend DAO Continuously Upgrades Product Capabilities: Expanding Beyond Lending into Staking, Energy Rental, and More

As a core DeFi platform in the TRON ecosystem, JustLend DAO was launched by JUST, an organization focused on providing DeFi solutions for the TRON ecosystem. Since its launch in 2020, it has深耕d the DeFi lending space for five years. With continuously enhanced product capabilities and expanding service boundaries, it has evolved from a single lending service into a "DeFi all-in-one platform" integrating lending, staking, energy services, and smart wallets—becoming an indispensable financial infrastructure within the TRON ecosystem.

In terms of product features, JustLend DAO has deeply integrated multiple core DeFi modules, including the Supply & Borrow Market (SBM), liquid staking (sTRX), energy rental, and GasFree smart wallet. As a one-stop DeFi gateway on TRON, it delivers comprehensive financial services to users.

Supply & Borrow Market (SBM): Serving as the foundational business of JustLend DAO, SBM functions as a highly efficient asset allocation hub. Users can deposit idle crypto assets to earn stable interest, achieving steady asset appreciation. Alternatively, they can collateralize existing assets to borrow other cryptocurrencies for leveraged operations or diversified investments, unlocking broader use cases for their holdings.

In terms of asset coverage, SBM offers extensive options. In addition to major global cryptocurrencies like ETH, BTC, and USDT, it comprehensively includes native TRON ecosystem assets such as TRX, USDD, JST, NFT, SUN, sTRX, and BTT, covering dozens of crypto assets in total. This creates a diverse and comprehensive investment pool for users. Furthermore, SBM continues to onboard emerging assets: in August this year, it added support for the compliant stablecoin USD1.

Liquid Staking (sTRX) is the preferred entry point for TRX liquid staking within the TRON ecosystem, allowing users to stake TRX and receive sTRX tokens. Holding sTRX enables users to earn base staking rewards from the TRON network while maintaining liquidity to participate flexibly in various DeFi activities, generating additional yield during the staking period.

To expand sTRX utility, JustLend DAO collaborates with other DeFi applications across the TRON ecosystem. For example, in April, the stablecoin USDD introduced a vault function where users can mint USDD directly using sTRX as collateral, easily unlocking asset value.

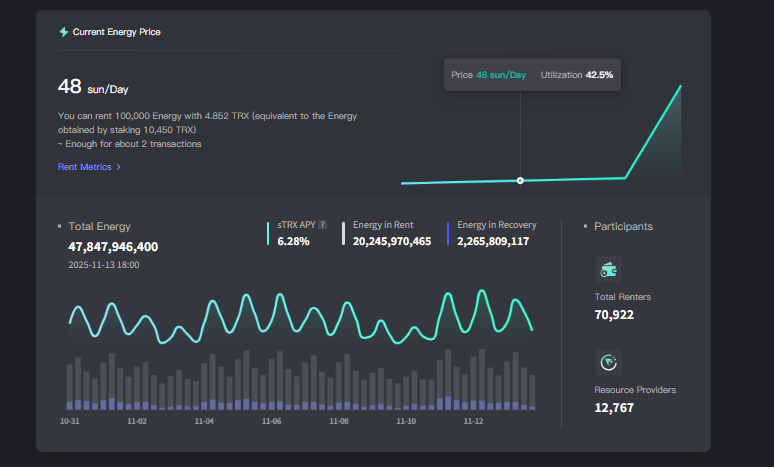

Energy Rental is an innovative service unique to the TRON ecosystem. Leveraging TRON’s dual-resource gas fee mechanism (“bandwidth + energy”), it helps users save approximately 70% on transaction gas costs, significantly optimizing the on-chain operational experience on TRON.

Compared to traditional methods requiring long-term TRX staking or direct burning to obtain energy, JustLend DAO allows users to rent energy on-demand and per-use without long-term commitments, greatly lowering the barrier and cost for small and mid-sized users, enabling everyday users to enjoy low-cost on-chain interactions.

To continuously improve user experience, JustLend DAO has iterated energy rental parameters multiple times this year: On September 19, the energy rental deposit was reduced from 40 TRX to 20 TRX, further lowering the entry threshold; On August 29, the TRON network reduced the base energy price from 0.00021 TRX to 0.0001 TRX (a 60% reduction in smart contract costs), and JustLend DAO responded on September 1 by reducing the basic rental tax rate from 15% to 8%, allowing users to benefit from both lower base prices and reduced rental taxes; On July 13, the annual percentage yield (APY) for rentals was adjusted, effectively reducing the overall energy rental cost.

As of November 13, the daily energy rental price on JustLend DAO is 48 SUN—only 4.8 TRX are needed to rent 100,000 units of energy (equivalent to the energy obtained by staking 10,450 TRX), sufficient for two contract transactions. Cumulative participants have exceeded 70,000, making it one of the most frequently used and essential services within the ecosystem.

Overall, JustLend DAO builds a closed-loop ecosystem centered on lending, liquid staking, and energy rental. These three modules work synergistically and efficiently, delivering end-to-end services—from asset lending, storage, and staking to low-barrier on-chain operations—truly realizing one-stop on-chain asset management.

Beyond core products, JustLend DAO innovatively launched the GasFree smart wallet, which allows users to deduct transaction fees directly from transferred tokens, completely breaking the industry limitation that “native tokens must be held to conduct transactions.” After launching in March this year, JustLend DAO also rolled out a 90% transaction fee subsidy campaign, enabling users to pay only about 1 USDT in fees per GasFree USDT transfer, regardless of amount.

In ecosystem development and token incentives, JustLend DAO is empowered by Grants DAO, a community-driven incentive organization. Centered on diversified support, Grants DAO provides resources and targeted incentives for projects and builders advancing the JustLend DAO and JUST ecosystems, while implementing fine-grained risk controls to strengthen ecosystem security. To date, Grants DAO has allocated approximately $189 million cumulatively across user incentives, ecosystem buybacks and burns, market stability measures, and developer support.

From core product synergy and user experience tools to incentive mechanisms, JustLend DAO has established a complete, mutually reinforcing, and co-developing ecosystem through comprehensive strategies across product innovation, user experience, and ecosystem building.

TVL Firmly Among Top Four Global Lending Protocols, Cumulative Net Revenue Near $62 Million – JustLend DAO Strengthens Growth Foundation Through Diversified Revenue Model

While continuously expanding its product capabilities, JustLend DAO has also seen steady growth in key operational metrics—its TVL consistently ranks among the top four in the global lending sector, and cumulative net revenue is approaching $62 million.

Recent Q3 reports on TRON from Messari and CoinDesk highlighted JustLend DAO’s significant TVL growth, with a 46.1% quarter-on-quarter increase, rapidly climbing from $3.4 billion to $5 billion, solidifying its position among the top four in the global lending sector.

Both liquidity and borrowing demand have steadily risen. As of November 12, the platform’s total TVL reached approximately $6.9 billion, with nearly 480,000 ecosystem users. The SBM lending market performed particularly well, managing $4.4 billion in assets (including $4.28 billion in supplied assets and $140 million in borrowed assets), clearly reflecting the depth and activity of the lending ecosystem.

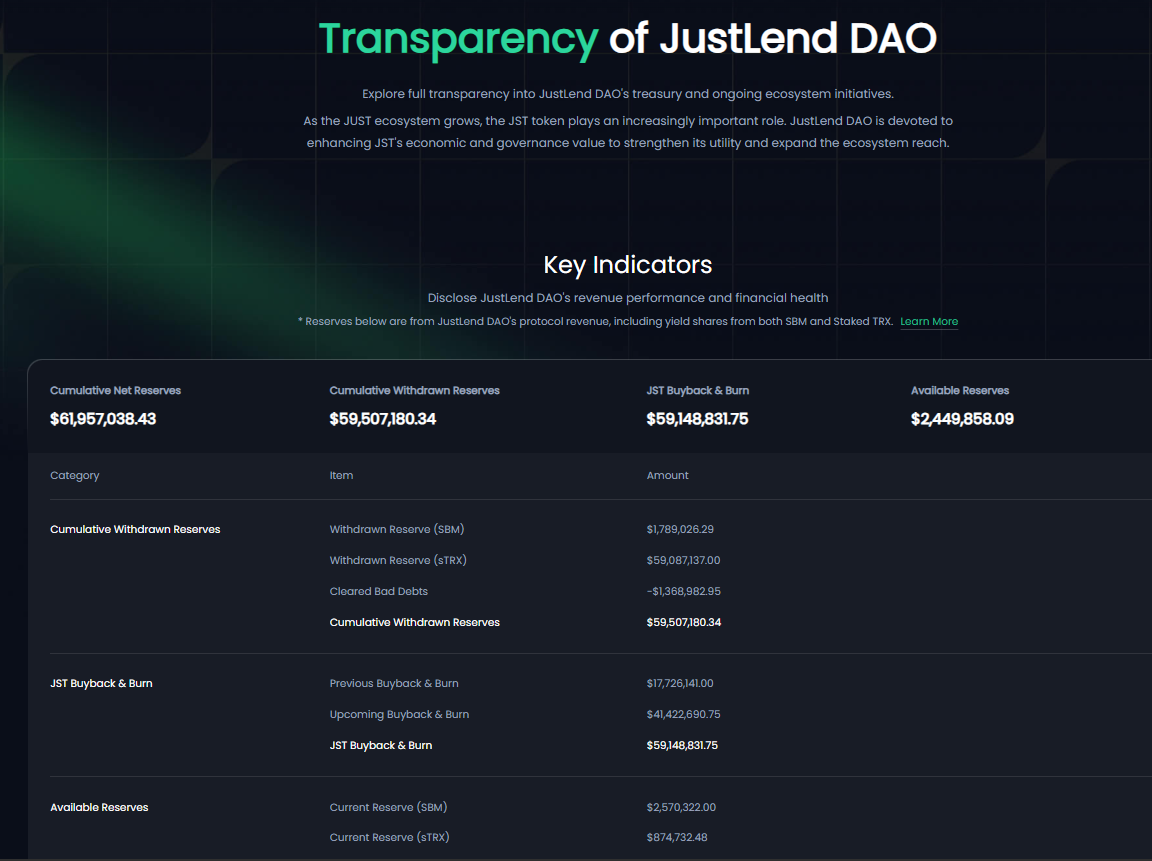

On the revenue front, financial transparency has improved. On November 1, JustLend DAO officially launched its "Transparency" dashboard on its website, fully disclosing key financial indicators—including cumulative net revenue (primarily from SBM lending and sTRX staking), withdrawn net revenue, remaining net revenue, and progress on JST buybacks and burns.

Per disclosed data, JustLend DAO’s cumulative net revenue is nearing $62 million, with $59.5 million already withdrawn and approximately $2.44 million remaining, indicating a stable and controllable financial position.

Within JustLend DAO’s revenue structure, sTRX stands out as the primary revenue driver. Of the $59.5 million withdrawn, $590.8 million came from sTRX, while SBM lending contributed approximately $1.79 million.

Within JustLend DAO’s revenue structure, sTRX stands out as the primary revenue driver. Of the $59.5 million withdrawn, $590.8 million came from sTRX, while SBM lending contributed approximately $1.79 million.

With steadily increasing sTRX staking volume, associated revenues are expected to grow significantly. Official data shows over 9 billion TRX backed by sTRX, with nearly 13,000 staking addresses and a current annual yield of 7.26%. In June, there were only about 4,200 staking addresses, highlighting the rapid growth momentum.

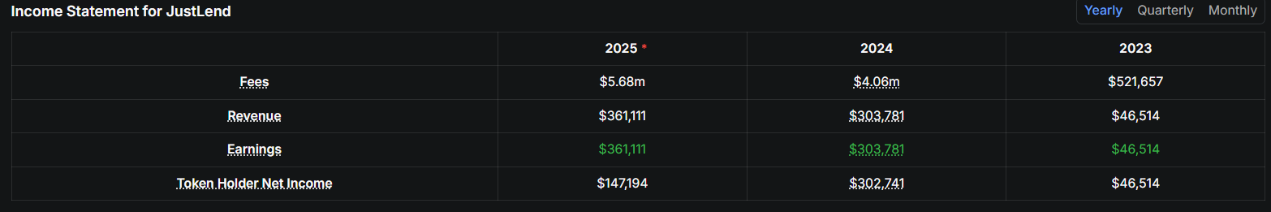

The SBM lending market also performs strongly, with consistently growing fee capture. According to DeFiLlama data, as of November 12, the platform had captured approximately $5.68 million in fees in 2025 (this figure counts only borrower-paid interest), already exceeding the full-year 2024 total of $4.06 million by over $1.5 million—an evident sign of JustLend DAO’s expanding lending scale.

Beyond these two core businesses, JustLend DAO also operates the high-frequency, essential energy rental service. In the future, this service may be incorporated into the revenue reporting system, becoming a new growth engine and injecting sustained momentum into overall revenue growth.

By strategically positioning "liquid staking + lending + energy rental," JustLend DAO has successfully built a diversified revenue model. This approach effectively mitigates risks associated with reliance on a single business line, enhancing the robustness and sustainable growth potential of its overall financial structure, showcasing strong competitiveness and vitality in the intense market landscape.

$59 Million JST Buyback and Burn Completed, Ecosystem Earnings Continue Driving JST Deflationary Value Growth

As the governance token for JustLend DAO and the broader JUST ecosystem, JST remains a focal asset in the crypto market. Since 2025, JST has made continuous progress in ecosystem expansion and value enhancement. The recent ~$59 million JST buyback and burn program has now been fully launched, laying a solid foundation for its long-term deflationary value.

On October 21, the long-term JST buyback and burn initiative—jointly launched by JustLend DAO and the USDD multi-chain ecosystem—was officially implemented, with the first large-scale burn completed, marking JST’s entry into a new phase of value growth.

Data shows that JustLend DAO allocated approximately $59 million in USDT from existing earnings for this buyback and burn cycle. The first round executed 30% (~$17.72 million), burning around 560 million JST tokens—5.66% of the total supply. The remaining 70% (~$41.42 million) has been deposited into the SBM USDT lending market and will be gradually burned over four quarters. Users can now track real-time burn progress and pending funds via the Grants DAO or Transparency page on the JustLend DAO official website.

The JST buyback and burn marks the beginning of a long-term deflationary model built on genuine ecosystem earnings. Based on ~$59 million in existing earnings from JustLend DAO, this deflationary model will continue to incorporate future net earnings from the platform, along with incremental earnings exceeding $10 million from the USDD multi-chain ecosystem. This “existing foundation + incremental fuel” design tightly links JST’s value to the growth of JustLend DAO and the USDD ecosystem, creating a virtuous cycle of “stronger ecosystem → higher profits → greater deflation,” thereby establishing a clear and sustainable long-term deflationary path for JST.

As the burn plan progresses, JST’s long-term value proposition becomes increasingly clear. The initial burn alone reduced the total supply by approximately 5.66%. With ongoing quarterly buybacks, and based solely on JustLend DAO’s existing earnings, the cumulative deflation rate for JST could surpass 18% (calculated at current market prices), making JST one of the most heavily burned tokens in today’s DeFi market.

Given JST’s fixed total supply of 9.9 billion tokens, each burn reduces circulating supply. Continuous deflation in circulation significantly enhances scarcity, providing strong price support and pushing JST toward a long-term upward value trajectory.

Backed by genuine ecosystem earnings, combined with compliance advancements and high liquidity, JST’s long-term value narrative continues to strengthen, with its growth potential becoming ever clearer.

Global Expansion Accelerates: Offline Activities Span Dozens of Countries, Ecosystem Influence Expands

This year, JustLend DAO intensified its global expansion through exchange partnerships, connections with mainstream financial institutions, and frequent offline events, comprehensively broadening its reach, funding channels, and brand influence.

In exchange collaborations, JST’s global circulation strategy has delivered notable results. In the first half of the year, it was listed on several top-tier platforms, boosting both regulatory recognition and market liquidity. In April, Kraken, a globally compliant crypto exchange, launched JST/USD and JST/EUR spot trading pairs, opening up European and American markets, significantly increasing global visibility and liquidity, and marking a key step forward in TRON’s compliance journey. Shortly after, Binance, a leading global exchange, listed JST/USDT perpetual contracts, offering investors diverse trading strategies. Platforms such as Lbank followed suit, further refining the global trading matrix.

As of November 12, JST has been successfully listed on dozens of major centralized exchanges (CEX), including Binance, Upbit, and Kraken, establishing a solid foothold in the global crypto market.

In bridging mainstream financial resources, JustLend DAO has created a vital link between traditional capital and blockchain ecosystems: At the end of June, Tron, the publicly traded U.S. company behind TRON, staked 365 million TRX via JustLend DAO, signaling the platform’s role as a key gateway for institutional capital entering the TRON chain—with potential to attract even more institutional inflows. In July, JustLend DAO completed full integration with Binance Wallet, enabling seamless lending and staking for Binance users and leveraging Binance’s global traffic to expand its user base and ecosystem influence.

In addition, JustLend DAO partnered multiple times this year with core TRON Eco projects such as SunPump, AINFT, and BitTorrent, appearing at nearly ten high-profile international blockchain summits across Asia, Europe, and the Middle East. Events included Hong Kong Web3 Summit, Japan WebX 2025, Dubai TOKEN 2049 in the first half, followed by Singapore TOKEN 2049, Thailand Blockchain Week, Korea Blockchain Week, Vietnam GM Vietnam 2025, and Istanbul Blockchain Week in the second half. Together with ecosystem partners, JustLend DAO presented a unified brand presence showcasing technological depth and collaborative progress.

At each summit, JustLend DAO and its TRON Eco partners set up professional booths to present the latest ecosystem achievements and data, while enhancing brand recognition and community cohesion through customized merchandise and themed giveaways. Through diverse formats and multi-regional exposure, they not only demonstrated the collective strength of ecosystem collaboration but also brought cutting-edge Web3 technologies and innovations to a broader global audience, accelerating the worldwide adoption of blockchain technology and strengthening TRON Eco’s global industry influence.

Today, JustLend DAO’s operations span dozens of countries and regions, showing strong momentum in global expansion and ecosystem synergy, emerging as a core force driving the globalization of the TRON ecosystem.

Through continuous product iteration, relentless user experience optimization, explosive TVL growth, and steadily expanding global influence, JustLend DAO is securing its place among the world’s top-tier DeFi applications, further consolidating TRON’s status as a central hub in decentralized finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News