Michael Burry, the Big Short investor, fires again: tech giants are engaged in collective fraud

TechFlow Selected TechFlow Selected

Michael Burry, the Big Short investor, fires again: tech giants are engaged in collective fraud

He warned that cloud giants including Meta, Amazon, and Microsoft are underestimating depreciation and artificially inflating profits by "extending the lifespan of equipment."

Author: Hedge Against Whales

1. The core allegation is that they systematically underestimated depreciation through accounting methods, artificially inflating earnings.

Burry estimates that between 2026 and 2028 alone, this practice will cause tech giants to underreport $176 billion in depreciation expenses.

2. Why does Burry call it fraud?

Burry's logic is simple:

Tech giants—META, GOOGLE, MSFT—are aggressively purchasing $NVDA chips/servers for the AI arms race. These hardware assets have an actual product lifecycle of only 2–3 years.

Yet on their financial statements, these companies are extending the useful life of such computing equipment to 5 or even 6 years.

By spreading massive costs over a longer period, they report lower annual depreciation expenses and higher profits.

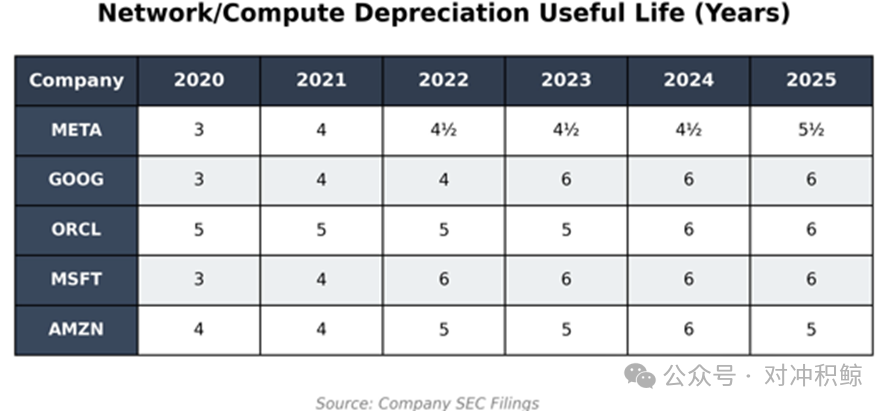

3. Burry provided evidence from company SEC filings, showing how widespread this accounting practice has become in recent years:

$META: depreciation period extended from 3 years ➔ 5.5 years

$GOOG: from 3 years ➔ 6 years

$MSFT: from 3 years ➔ 6 years

$AMZN: from 3 years ➔ 6 years

As AI hardware iteration accelerates, depreciation on financial reports is slowing down—an alarming signal.

4. What does this mean for investors?

- True P/E ratios are higher; the price-to-earnings multiples you see may be misleading. If Burry is correct, earnings (the "E") are systematically overstated, meaning investors' real cost basis is far higher than it appears.

- Hidden costs: this is the hidden expense of the AI arms race. Giants are using accounting tricks to mask the staggering capital expenditures required to maintain their AI dominance.

- Burry even quantified the impact: by 2028, $ORCL's earnings could be inflated by 26.9%, META by 20.8%.

5. Burry is exposing a systemic risk: during the AI gold rush, tech giants may be using creative accounting to hide the true cost of the shovels—the Nvidia chips.

6. Burry has announced he will release more details on November 25.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News