Crypto capitalism, crypto in the AI era

TechFlow Selected TechFlow Selected

Crypto capitalism, crypto in the AI era

One-person media companies, an era where everyone is a founder.

Author: Zuoye

What are you prepared to do?

We now face two possible futures: web capitalism and crypto capitalism.

• Sun travels globally, talking about AI or nuclear fusion, all solely for maximizing personal capital gains

• Peter Thiel is "Western," capitalist at core, aiming to preserve Western civilization's hegemony

Caption: You in me, me in you

Image source: @justinsuntron @TheFP

For Thiel, preserving capitalism equals preserving Western civilization. In a sense, Thiel doesn't mind transcending conventional democratic ideals and universal values.

For Sun, economic capital appreciation is the ultimate goal. Globalization is increasingly fragmented and irreversibly crumbling, an anxiety already eroding deep beneath.

Especially in the AI era, productivity hasn't yet surpassed traditional models, but demands on infrastructure like energy are rising. New Yorkers' desire for stable institutions is becoming younger.

Where should the crypto industry—and especially its practitioners—go as volatility continues to decline?

AI Eliminates Volatility

After 34-year-old democratic socialist Adams was elected mayor of New York City, an email Peter Thiel wrote to Zuckerberg in 2020 began circulating—Thiel had already detected five years ago young people’s widespread disillusionment with capitalism.

This disillusionment directly motivated Thiel’s support for Trump. When youth can’t afford rent, student loans, or healthcare, blaming them for lacking drive is meaningless. Protecting housing prices only benefits those from the postwar and neoliberal eras.

While old-school crypto OGs hold their bags and build hierarchies among mining, chain, and token circles, meme-embracing Gen Z is nearing rage, with $100K Bitcoin becoming a direct symbol of intergenerational conflict.

Whether Labubu or Adams, both reflect distribution problems. To solve distribution, we have two approaches: one is pursuing AGI and UBI, believing AI will eliminate human labor and become the economic主体, where energy + computing power + storage represent the hardest foundational upgrade when we can neither solve housing nor abolish capitalism.

Caption: It’s time to speak.

Image source: @liangsays

The second path is experimenting with crypto capitalism—Vitalik’s low-risk DeFi, a16z’s emphasis on new media fellowships—all stressing reconnecting the globe, differing only in whether through internet, AI, or Web3.

Expression is the lowest-cost lever, and the power law of global founder connections will be infinite. They will transcend language, institutions, and technological narratives, preserving sparks of global applications.

This remains crypto’s enduring advantage over AI: Claude won’t open access to specific regions, but Ethereum doesn’t care where you’re from or going.

In response to web capitalism—where rentier classes across nations transcend national sovereignty, entangling tightly like spiderwebs—workers (formerly), youth (now) feel omnipresent constraints.

Crypto makes such connections effortless and essential GTM behavior. Dalio has already predicted collapse; in recovery after hard times, crypto will show capital’s proper efficiency.

Looking back, Sun’s profits stem from Italian-blooded USDT, Chaoshan merchant-controlled Southeast Asian parks, mainland followers in Tron’s public sale, and projects like USDD that surprisingly didn’t blow up despite YBS’s unexpected crash.

The essence of crypto capitalism isn’t eliminating crypto or surrendering to AI. Rentiers can link up; the counter-newcomers can also interact directly.

If mass emergence of stablecoins marks crypto’s maturity, then capturing and amplifying external signals will become the dominant opportunity in this mature phase.

-

• AI startups don’t need IPO success—token issuance alongside founding offers better cost-performance. Hangzhou has Unitree, Binance Alpha has Sapien. Becoming DJI or Agent Smith ultimately depends on monetization paths

-

• Web3 Robotics and Agentics may not reach mainstream adoption, but they can become mainstream assets. If Solana can make phones, Shenzhen’s Huaqiangbei supply chain could pivot to affordable Web3 hardware

Don’t resist this historical process. Clinging to the notion of physical superiority ignores reality—Tangshan steel is cheaper than cabbage. Human overcapacity is an inevitable result of industrial concentration. Any channel absorbing it is beneficial.

Stability Under Strongmen

In an age of capital surplus, effective organizers reign supreme.

Before America embraced neoliberalism, finance and the real economy weren’t separated. One dollar didn’t equate to gold, but represented American goods and Middle Eastern oil—a dynamic Soviet gold rubles couldn’t beat.

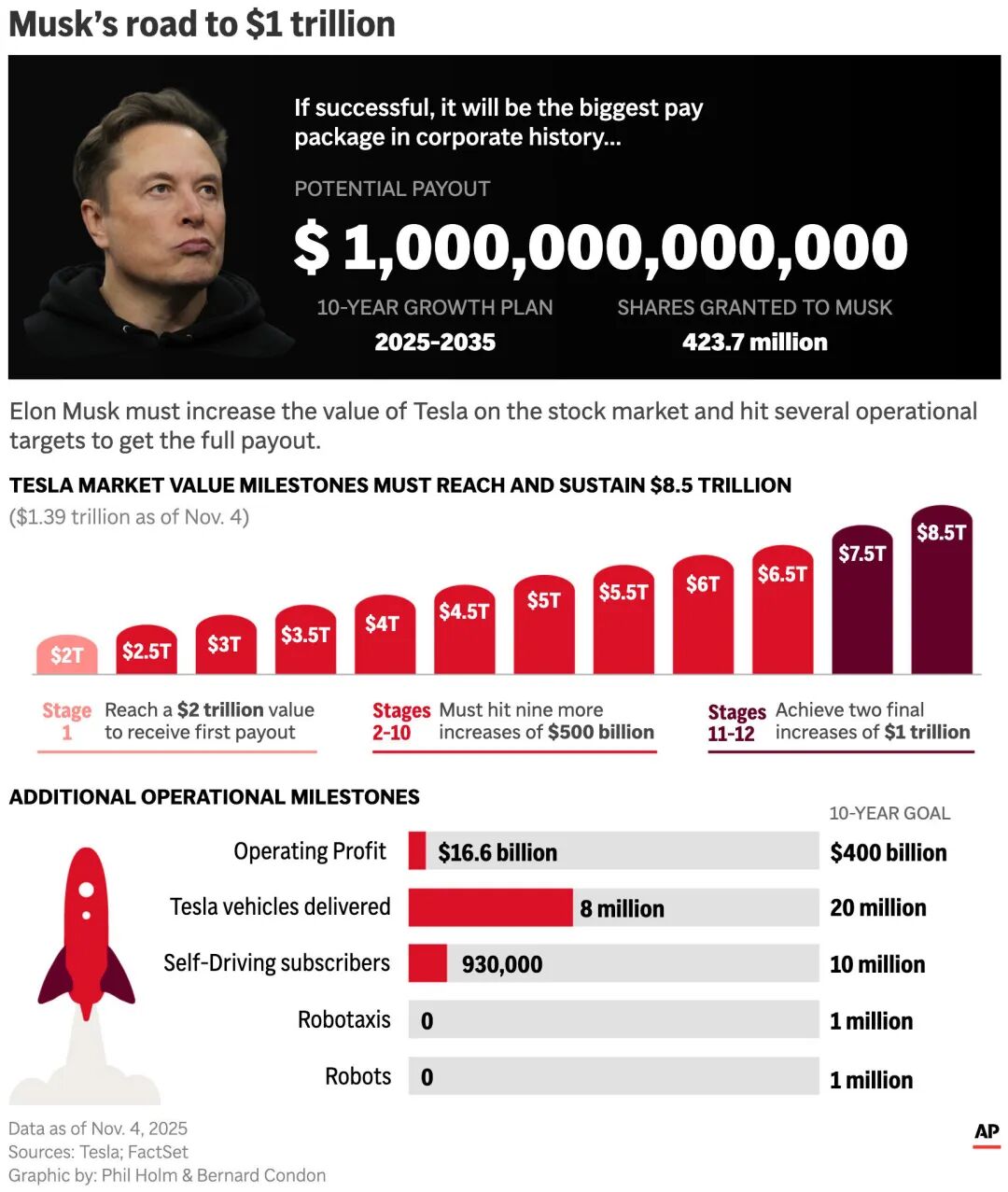

Golden houses are fine, but human basic needs still require physical fulfillment. Amid waves of virtualization, Musk has shown how industry leverages finance—at least you can actually see Tesla and SpaceX.

Caption: Musk’s trillion-dollar bet compensation plan

Image source: @AP

AI inflates bubbles; moral criticism is worthless. The key lies in coexisting with and leveraging bubbles. a16z sees media as the answer—global expression creates emotional resonance, thus seizing control of trends and narratives.

Understanding this explains a16z’s long-term bet on SocialFi—they can invest in 99 unprofitable ones, but must not miss the one that succeeds.

Various AI-powered tools—reading, writing, editing, publishing, managing—have lowered individual entry barriers infinitely, driving marginal costs toward zero. Individuals are now part of a vast network of Agents.

Musk excels at using media leverage—he is Tesla’s media; Sun is TRC-20 USDT’s media; Peter Thiel is Western civilization’s media. Each is a one-person media company.

Daily tweets matter as much as SpaceX rocket plumes. Expressiveness fuels Mars exploration.

Besides, relics of this AI bubble are already locked in. AI coding / vibe coding has become routine. Even if GPT-5 disappoints, Kimi K2 suffices.

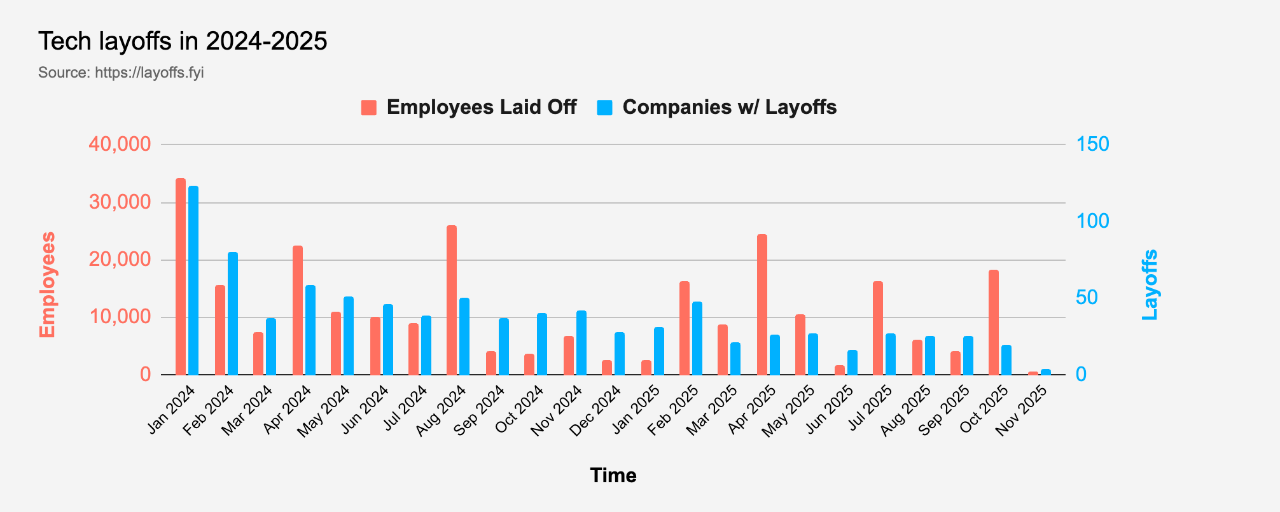

Caption: A new wave of layoffs

Image source: @Layoffsfyi

Entrepreneurship grows increasingly personal—or gang-like. Traditional bureaucratic peaks aren’t found in government systems, but in tech giants’ KPIs and 996 culture. Humans being less efficient than GPUs is becoming real. Luddites attacked big machines, but smashing GPUs won’t hurt Nvidia’s $5 trillion valuation.

This doesn’t mean humans pushed aside by AI can only cyber-loaf. Rather, humanity must coordinate within AI-driven production systems—an evolutionary process requiring sacrifices, and those sacrifices are the “ox and horse.”

Media and code have become cheaper than air and water—artificial natural resources everyone must learn to live with. Coincidentally, the crypto industry masters this best.

Conclusion

Super individuals, AI Agents, a new wave of mass entrepreneurship.

We begin from Peter Thiel’s interrogation of capitalism, witnessing the stumbling of industrial capitalism and financial/information capitalism. If AI capitalism might still gain acceptance, crypto capitalism remains in its infancy.

Crypto continuously redefines capital—the core concept of capitalism—through programming, modification, and misuse. In an AI era of dual oversupply of capital and industrial goods, crypto experiments are no less noble than spaceflight or nuclear fusion.

Crypto practitioners, especially founders, must master the relationship between media and code, defeating competitors with new productive architectures and systems. This future isn’t distant.

Great waves, great waves, keep rising! Crypto! Crypto! Unleash your strength, bear the rise and fall of AI!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News