Canton Coin: How Should We View FDV?

TechFlow Selected TechFlow Selected

Canton Coin: How Should We View FDV?

Canton Coin (CC) has no hard cap on its supply, but each transaction burns CC, thereby offsetting the newly issued amount.

Author: Canton Network

Many people see the issuance curve of Canton Coin (CC) and assume its maximum supply is fixed at 100 billion. However, this is a misconception—this article will explain the issue in detail.

Dynamic Supply, Not Fixed Cap

Canton Coin (CC) operates similarly to ETH on Ethereum or SOL on Solana: theoretically infinite, but practically stable.

Canton Coin (CC) has no hard cap on supply. Instead, every transaction burns CC, offsetting newly issued coins. Over time, issuance and burning reach equilibrium based on network activity and market price.

This means that as the burn rate increases with usage, the total supply stabilizes far below the theoretical issuance trajectory.

FDV and Market Cap

For Canton Coin, FDV and market cap are effectively the same:

FDV = Market Cap = Current Total Supply × Current Market Price

Future supply depends on the ratio between burning and issuance, which in turn depends on network demand.

In the short term, CC inflation will be higher than Ethereum or Solana, but as issuance halves and burn volume rises, inflation will steadily decline.

How Supply Adjusts

Canton fees are denominated in USD (per MB of transaction data) but paid by burning CC tokens at the on-chain exchange rate.

When network demand is high (i.e., CC price is low relative to usage), more CC tokens are burned, slowing supply growth—or even causing deflation.

When network activity is low, the burn rate slows, allowing supply to increase.

This dynamic creates a natural Burn-Mint Equilibrium (BME)—a feedback loop between usage, price, and supply.

Long-Term Equilibrium

Once the market reaches equilibrium under BME, issuance and burning should roughly balance.

At that point, total supply will remain relatively stable, adjusting slowly based on long-term demand.

Because supply dynamically adjusts, market cap (not theoretical maximum supply) is the correct measure of value.

Illustrative Example

Scenario: Network reaches equilibrium between validators and application pools

Assumption: All tokens allocated to validators and applications are burned within one block

Super Validator (SV) rewards are the sole source of inflation

Then, if equilibrium is reached by mid-2026, total supply might look like this:

Projected Total Supply

July 2026: < 42 billion CC

July 2029: < 48 billion CC

July 2034: < 50 billion CC

These estimates may be on the high side. Over 1 billion CC have already been burned, and the network currently burns approximately $900,000 worth of CC daily.

In this scenario, if SV is the only distribution source, annual inflation would be around 32.5 million CC—less than 0.1% annually based on a 40 billion CC supply.

Key Issuance Milestones

The most important upcoming event in Canton’s dynamic supply model is the halving on January 1, 2026, which will trigger a "double halving" of Super Validator (SV) token issuance.

First, total block issuance will be halved.

Second, since more rewards will be allocated to validators and applications, SV’s share of total issuance will drop from 48% to 20%.

Three years later, a similar “double halving” will occur again:

Total issuance will halve once more, and SV’s share will further decline from 20% to 10%.

This compounding effect means that once the network achieves Burn-Mint Equilibrium (BME) between validators and applications, the SV pool will become the primary—and rapidly shrinking—source of new issuance.

By the early 2030s, SV issuance will constitute only a small fraction of total supply, making Canton Coin one of the lowest-inflation mainstream Layer 1 networks.

Conclusion

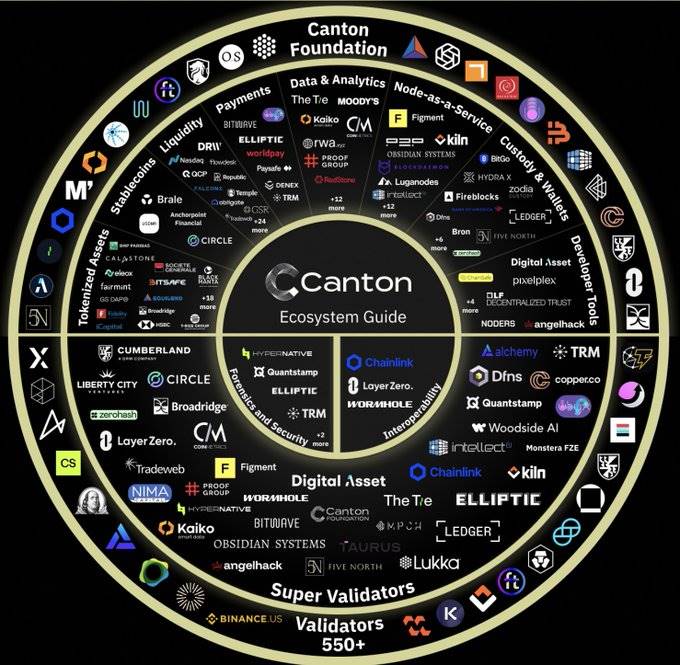

Like any resilient network, value grows with utility. Through its fee-burning mechanism, each transaction enhances resource scarcity and alignment. The Canton ecosystem is vividly demonstrating this dynamic process.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News