Interpreting b402: From AI Payment Protocol to Service Market, BNBChain's Infrastructure Ambitions

TechFlow Selected TechFlow Selected

Interpreting b402: From AI Payment Protocol to Service Market, BNBChain's Infrastructure Ambitions

b402 is not just a x402 alternative on BSC, but could be the starting point of a larger opportunity.

By: TechFlow

The market is currently undergoing another deep adjustment, and everyone is waiting for a rebound after the overreaction.

But when the market does rebound, which sectors do you think will benefit first?

The biggest possibility comes from those hot narratives that led the market before the crash but were interrupted. For example, take a look at how privacy coins have been performing recently; beyond the renewed interest in old privacy coins, another narrative capable of heating up related assets is naturally x402.

Previously, we’ve also written that most x402 opportunities are currently on Base chain; yet reviewing this year’s market trends, BNB Chain has delivered real wealth effects (albeit controversial ones) in areas like Perp DEXs and meme coins—except it's been absent from x402.

(Further reading: x402 Goes Wild on BASE – Where Are the Asset Opportunities on BSC and Solana?)

So let’s re-examine the logic:

If the market recovers in the short term, could the combination of BNB Chain—which brings built-in buzz—and x402 spark an explosion? If you believe in this logic, then naturally you should prepare early while few are paying attention.

And following the crypto ecosystem inertia of “fluid applications, solid infrastructure,” projects playing the role of “picks and shovels” in a given narrative often stand to gain the most.

Who is the most值得关注 pick-and-shovel player on BNB Chain? b402 protocol is certainly one answer.

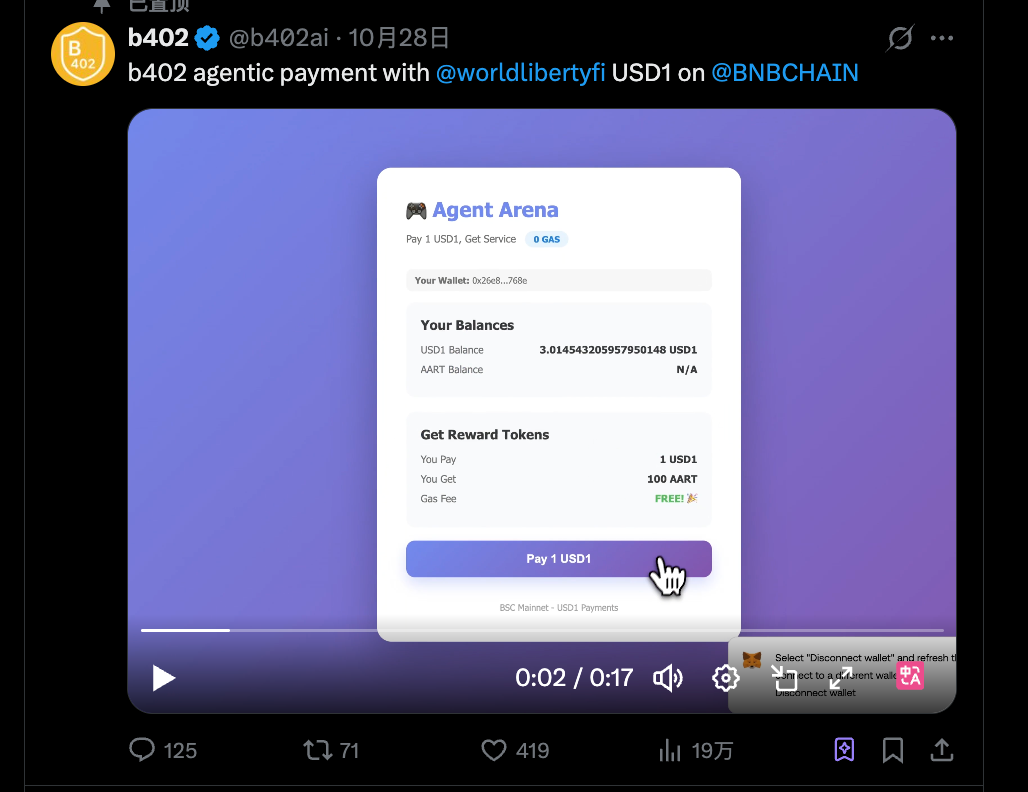

You might not yet understand what b402 really is or grasp its potential. However, a recent video posted by the b402 official Twitter account might spark your imagination about what this project is doing:

On BNBChain, using USD1—the stablecoin from Trump family’s WLFI project—based on the x402 protocol, a payment is smoothly transferred to an AI Agent.

Don’t forget that nearly 80% of USD1’s supply operates on BNB Chain.

So within the broader x402 narrative, beyond base and USDC, there may be another technical solution you’ve overlooked:

When b402 protocol connects with BNB Chain, potential support from Binance for projects across various tracks to stay competitive, and USD1, technological narratives can ferment through buzz, capital, and controversy—potentially unleashing even greater energy.

Therefore, in this article, we’ll examine the b402 protocol, assess whether it holds up, and explore how it stands out compared to other x402 protocols.

x402 Can't Be Directly Copied—b402 Fills the Gap

I believe most people’s instinctive reaction upon hearing the name b402 is:

Why not just port x402 directly to BNB Chain? Why create b402—isn’t this reinventing the wheel?

The b402 official Twitter once gave a brief explanation that precisely answers this question:

“x402 enables AI Agents to pay each other using USDC, while b402 allows them to use all BEP-20 standard tokens for payments.”

In other words, you can’t easily copy-paste the x402 setup from Base to BNB Chain.

To understand why, we first need to clarify what the core of x402 actually is.

It’s not the HTTP 402 status code, nor simply a payment protocol—it’s enabling AI Agents to make payments without managing Gas.

Imagine how cumbersome it would be if every AI Agent had to hold both USDT (for payments) and BNB (for gas). It would need to monitor BNB balances, top up when insufficient, and handle gas price fluctuations. This is annoying even for humans—let alone programs.

x402’s solution on Base is clever: it leverages a special feature of USDC. The USDC issued by Coinbase implements a standard called EIP-3009, which allows users to sign a single authorization message:

“I agree to transfer X USDC to a certain address,” after which anyone can take that signature and execute the transaction on-chain, with the executor covering the gas fee.

This is why x402 achieves low-gas payments: the AI Agent only needs to sign, and x402’s Facilitator executes the transaction using the signature—the Agent never touches ETH.

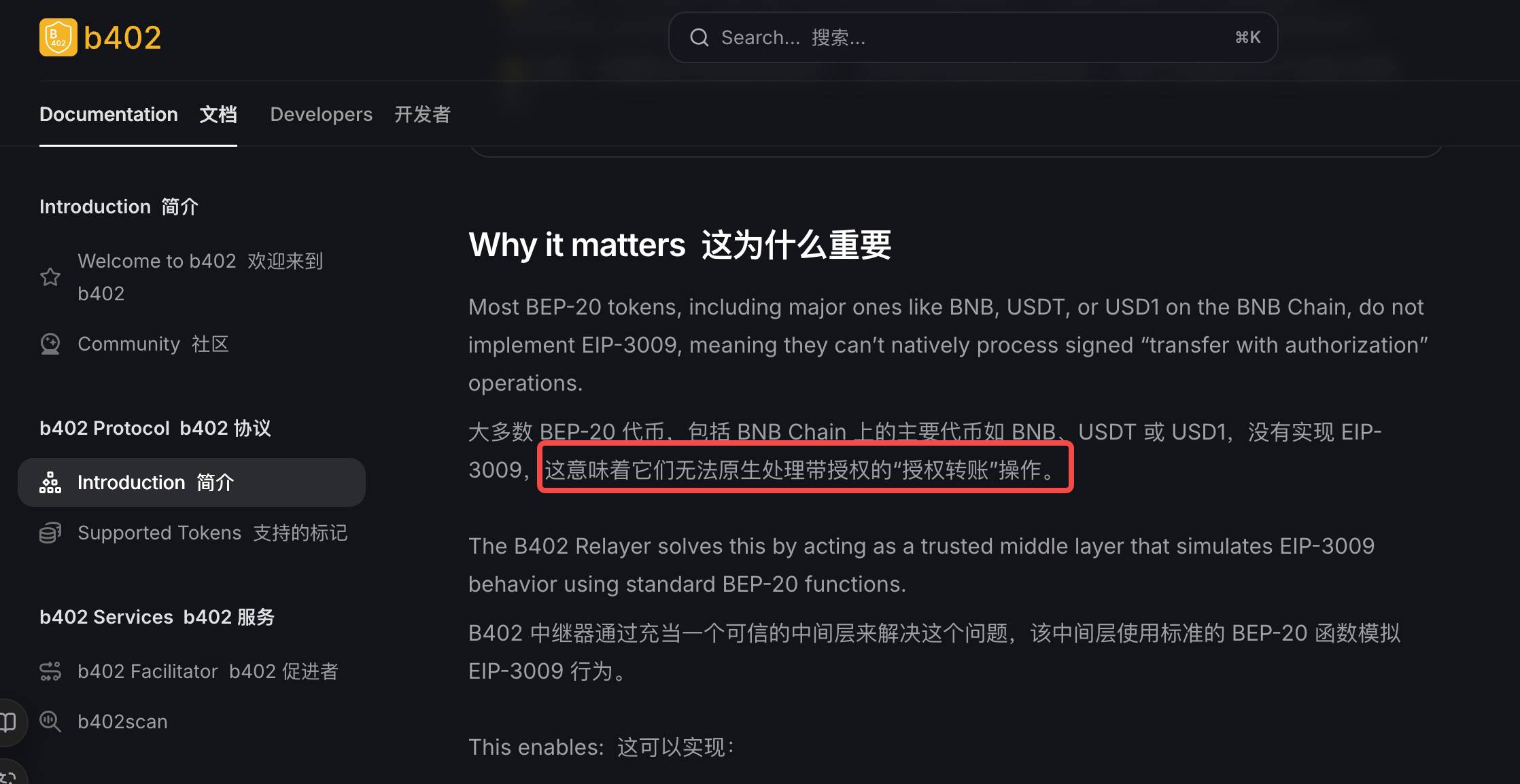

However, this path doesn’t work on BNB Chain.

USDT, BUSD, and even the new USD1 on BSC don’t support EIP-3009. They’re standard ERC-20 tokens that only recognize on-chain transactions, not off-chain signatures. If you present a signature to a USDT contract, it simply ignores you.

Thus, b402’s innovation lies in creating its own intermediate layer since BNB Chain’s token contracts don’t support signature-based authorization.

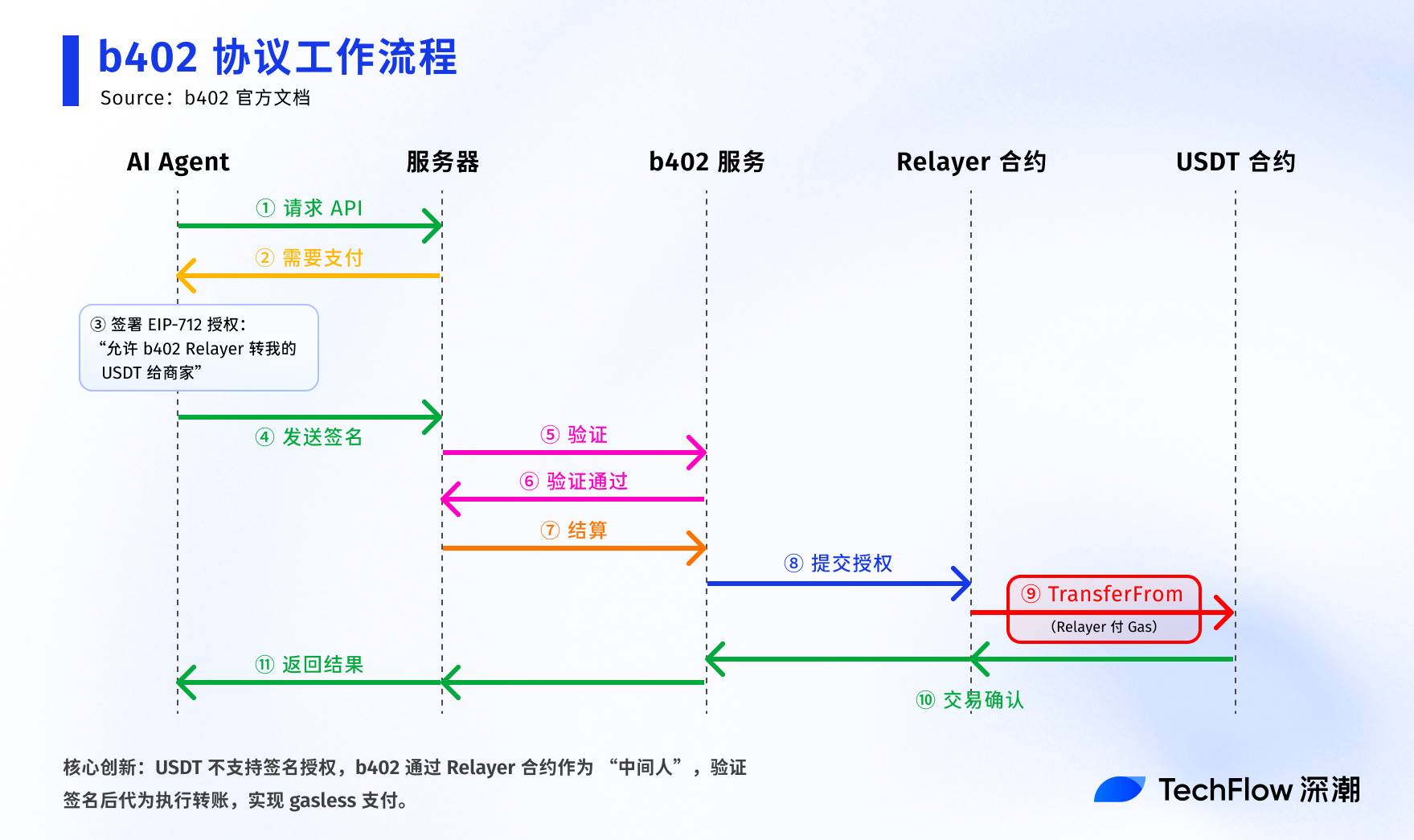

b402 calls this middle layer a Relayer, which is essentially a deployed Relayer contract—think of it as a “translator”:

It receives user-signed authorizations, verifies their authenticity, and then calls the USDT transfer function on behalf of the user.

From USDT’s perspective, it’s the Relayer making the transfer; from the user’s view, they merely signed a message. The process works as follows:

-

The user signs a message stating: "Transfer X USDT from my address to the merchant, valid until a certain time."

-

b402’s Facilitator receives the signature and submits it to the Relayer contract.

-

The Relayer verifies the signature, checks if the token is whitelisted, and confirms the time window is valid.

-

Once all checks pass, it calls USDT’s transferFrom function to complete the transfer.

The result? AI Agents still only need to sign—they don’t need to hold BNB. Although the technical approach is completely different, the user experience is identical to x402.

Even better, because the Relayer is b402’s own contract, it can support any BEP-20 token.

As long as a token is whitelisted, USDT works, USD1 works, and future new stablecoins will work too. This flexibility is something the original x402 cannot achieve.

So, to answer the opening question:

b402 isn’t reinventing the wheel—it’s finding a new way under BSC’s technical constraints for AI Agents to use on-chain tokens for payments.

Build a New Wheel, Open a New Market

Solving the technical issue is just the first step. For BSC to claim a share in the AI Agent economy, having a protocol alone isn’t enough—real usable infrastructure is required.

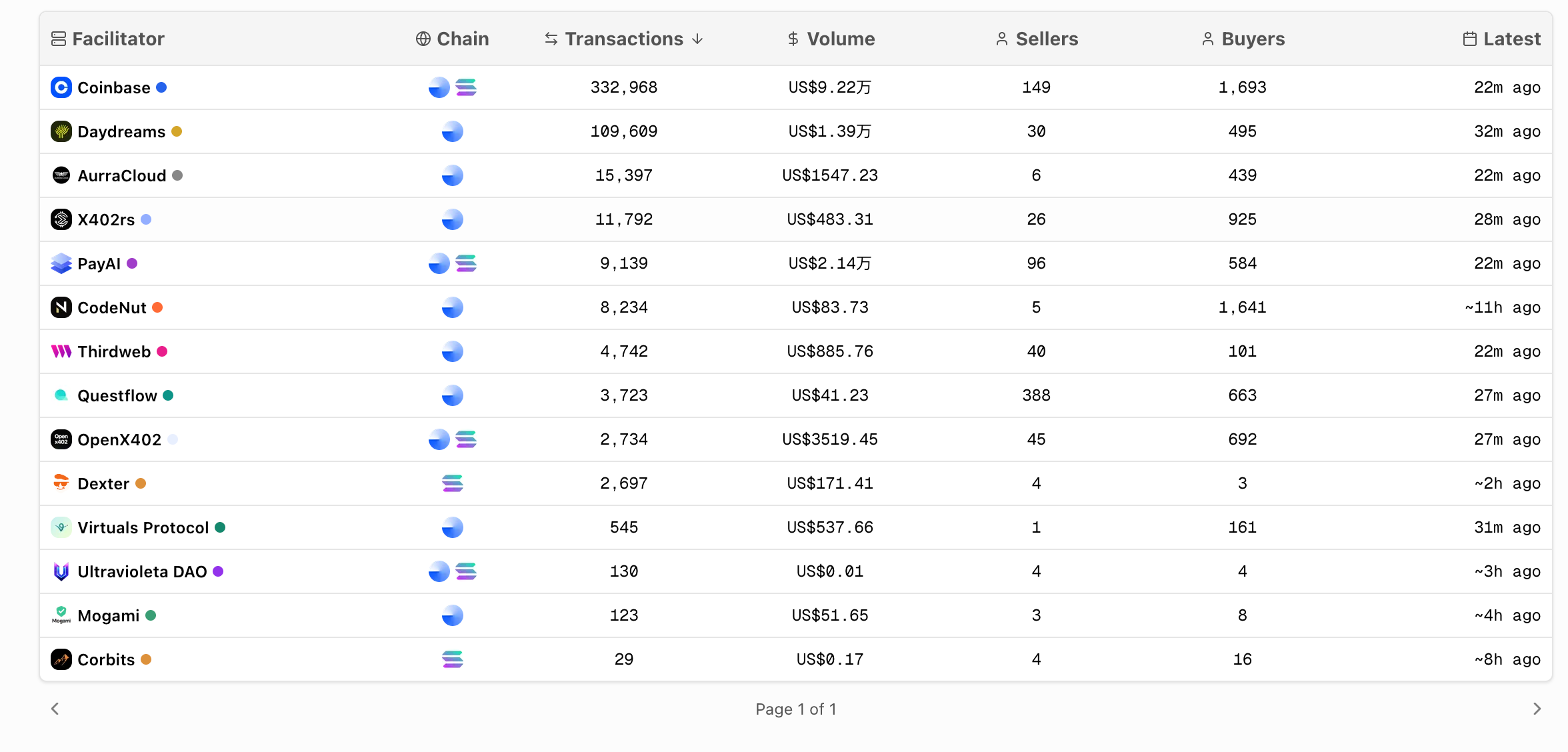

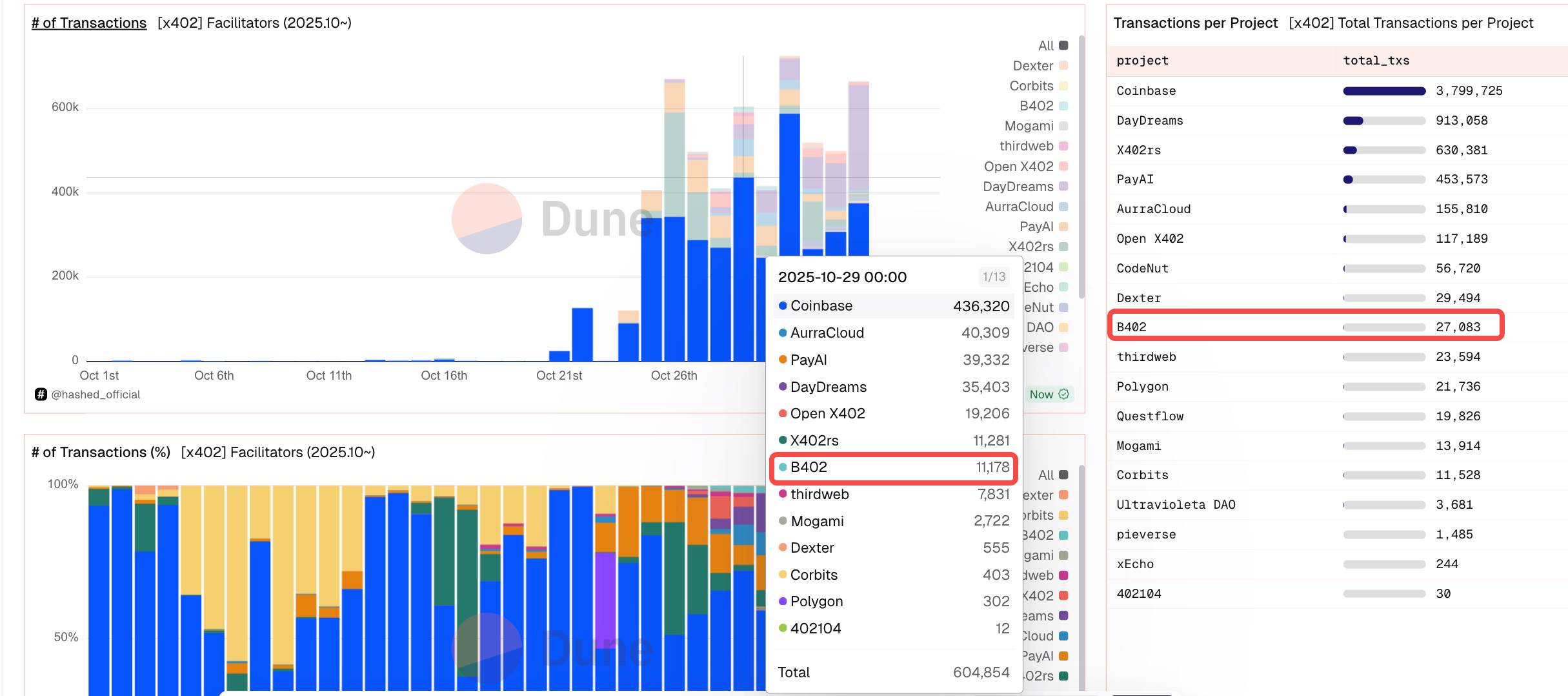

Just look at the x402 Facilitator leaderboard to see how awkward the current situation is. Coinbase ranks first, handling 330,000 transactions. Then come Daydreams, AurraCloud, PayAI… all operating on Base and Solana. BSC? Not a single one.

What is a Facilitator?

It’s the core infrastructure of the x402 ecosystem—essentially a payment gateway. When an AI Agent wants to pay to call an API, the Facilitator validates the payment request, checks balances, executes the on-chain transaction, and returns the result. Without Facilitators, the x402 protocol is meaningless.

You could say whoever controls the Facilitator controls the AI Agent payment gateway.

b402’s Facilitator is currently BSC’s answer. It doesn’t just replicate x402’s functionality—it’s optimized for BSC’s unique characteristics. The biggest difference is multi-token support: not just USDT, but any BEP-20 token can be used.

This means new stablecoins like USD1 can plug in directly without additional development.

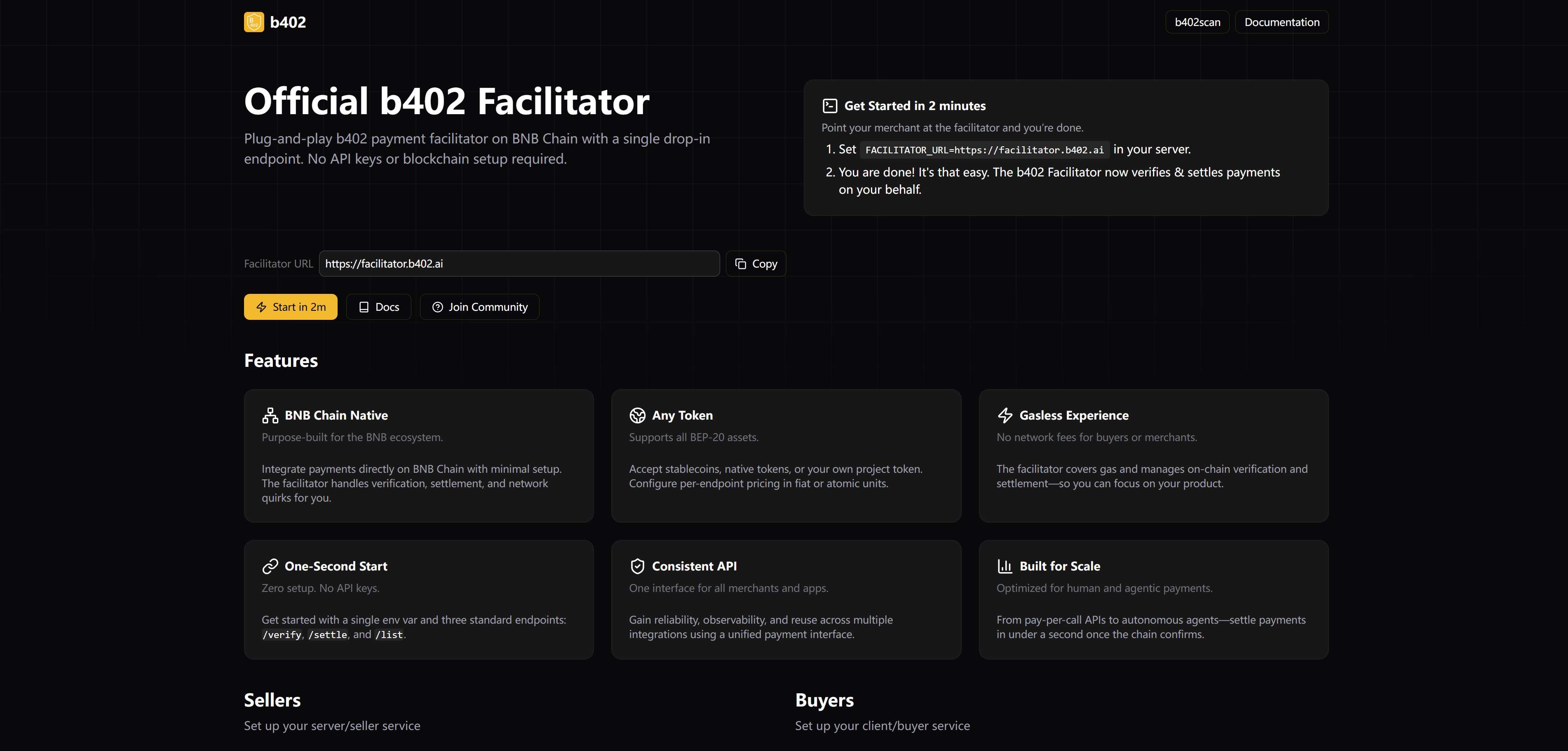

For developers, integrating the b402 Facilitator is extremely simple. Just add one line to your server config: “FACILITATOR_URL=https://facilitator.b402.ai”, and your API can start charging AI Agents. No blockchain knowledge needed, no private key management—b402 handles all technical details.

But b402’s ambitions go further. If the Facilitator is infrastructure, then b402scan is the superstructure.

If you only see “scan” in the name, you might mistake it for a blockchain explorer—but in fact, it’s an “AI Service Marketplace.”

A marketplace means service providers can list APIs, set prices, and showcase what their AI can do; other AI Agents can search for needed services, review transaction history, and directly invoke these functions.

Currently, this marketplace isn’t fully open yet, but it’s worth tracking the project’s progress to see what interesting AI services emerge.

Overall, b402’s pick-and-shovel positioning is clear: the Facilitator acts more like a technical gateway, while b402scan resembles a business model like Shopify or Amazon.

This creates a complete closed loop:

-

Developers use b402 Facilitator to monetize their API services;

-

Developers use b402scan to make their APIs discoverable;

-

AI Agents complete the full cycle—discovery, invocation, payment—within the same system. Each transaction reinforces BSC’s position as the AI Agent payment chain.

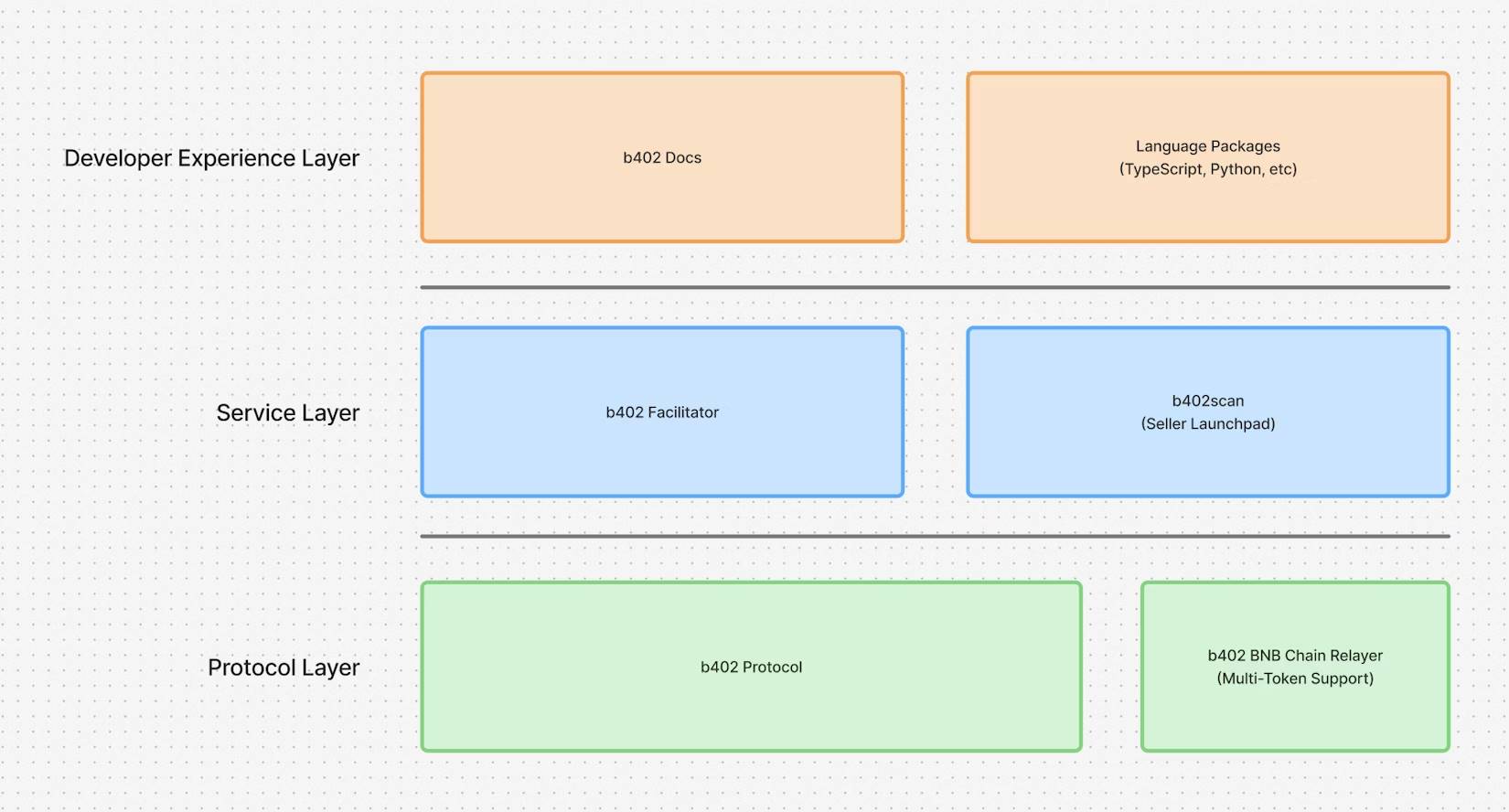

Meanwhile, b402’s official technical diagram tells an even bigger story:

The foundation consists of the protocol and Relayer contracts solving technical issues; the middle layer includes Facilitator and b402scan providing service capabilities; the top layer features various SDKs lowering entry barriers. This full-stack layout, in my view, is filling every missing piece of BSC’s puzzle in the AI Agent economy.

Particularly noteworthy is the variable of USD1. When b402 showcased AI service payments using USD1 on its official Twitter on October 28, it may have unintentionally tapped into a major trend.

Trump family’s WLFI chose BSC as the primary issuance chain for USD1, with 80% of its supply located here.

What does a new stablecoin need most? High-narrative, high-yield use cases. Frequent micro-payments by AI Agents could be one such answer.

If we compare the AI Agent economy to a war, Base has already seized the high ground via Coinbase’s resources, while Solana is rapidly advancing through hackathons.

BSC, through b402, is building its own stronghold—one defined not by being first or largest, but by openness: any token, any service, any Agent can join.

Current Progress and Token Expectations

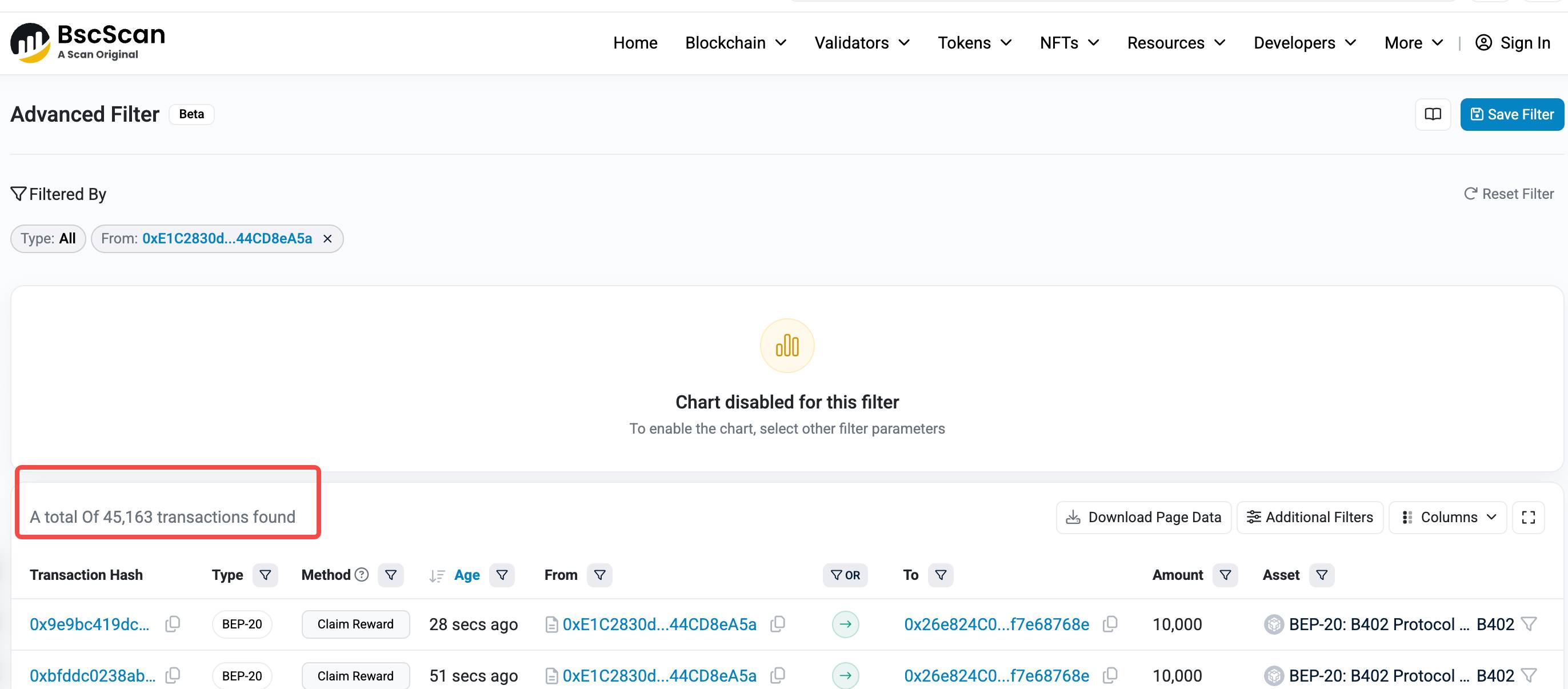

According to data from bscscan, b402 has quietly gone live.

As of November 7, b402’s latest relayer contract has generated around 45,000 transactions; adding in the older relayer contract (soon to be deprecated due to technical reasons), b402 has already processed nearly 86,000 transactions.

Third-party Dune data shows that while transaction volume still lags behind Coinbase’s, considering b402 has been live for less than a month, this starting pace is not slow.

More interesting is the transaction distribution: b402’s volume began steadily growing after October 26—exactly when they released the USD1 payment demo.

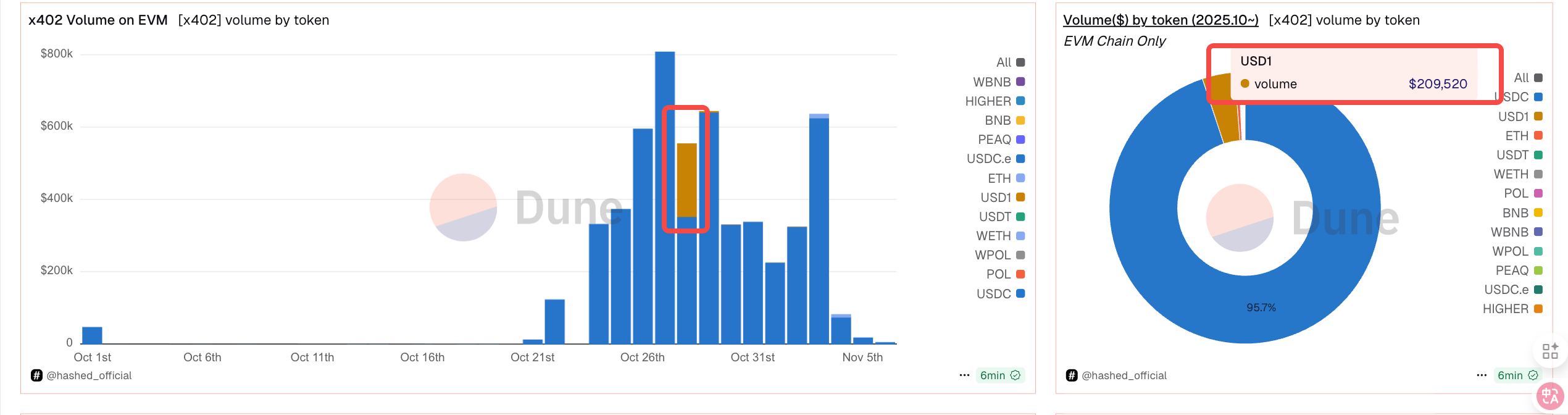

Token distribution reveals even more. Across the entire x402 ecosystem, 98.7% of transaction value uses USDC, with the remaining 1.3% scattered among a dozen tokens including USD1, USDT, and ETH.

This extreme concentration highlights a problem: the current x402 ecosystem heavily relies on Coinbase and USDC. b402’s multi-token design is perfectly positioned to break this monopoly.

Granted, USD1’s current transaction value is only $200,000—but this precisely indicates the opportunity is still early-stage.

If the Trump narrative heats up again next year, USD1 usage could explode. At that point, b402 will be BSC’s only mature AI payment protocol.

This also ties into expectations for the b402 token. While the team hasn’t released specific tokenomics yet, we can infer several directions from the technical architecture.

First, protocol fees: possibly 0.1–0.3% per transaction, which could fund buybacks or dividends. Second, governance rights: deciding whitelisted tokens, fee adjustments, protocol upgrades. Third, staking mechanism: operating a Facilitator may require staking a certain amount of tokens as collateral.

Such a design links token value directly to protocol usage. More transactions mean higher revenue, greater token value, and alignment with the “real yield” narrative.

Of course, this is speculative. Interested parties should follow updates from the official b402 Twitter for actual developments.

Overall, watching b402 is essentially betting on whether BSC can secure a place in the AI Agent economy. Conservatively, it’s an infrastructure project growing with the BSC ecosystem. Aggressively, it might spawn multiple projects with significant wealth effects under the AI economy narrative.

Conclusion

By now, the b402 story is mostly laid out. But finally, let’s discuss the bigger picture behind this project.

x402’s breakout wasn’t accidental. It solved a real problem—enabling AI Agents to make autonomous payments—a demand that will grow exponentially as AI Agents become widespread. How much of this pie b402 can capture remains unclear.

Yet looking back at crypto project history, the current state of b402 and x402 reminds me of the early days of Uniswap versus 0x Protocol.

Back then, 0x Protocol was technically advanced with a sophisticated order book—but too ahead of its time, misaligned with on-chain needs. Uniswap, technically a step back with no order book and only simple swaps, perfectly hit the sweet spot of DeFi’s breakout demand.

Today, Uniswap has become DeFi infrastructure.

x402’s use of USDC for micropayments is indeed elegant, but current use cases remain scattered—far from truly shining. b402’s implementation was originally a compromise forced by BSC’s inability to copy x402, but this “compromise” might have serendipitously created something powerful.

Why? Because b402 enables any BEP-20 token to perform gasless transactions, unlocking at least three unexpected opportunities:

First, the barrier to entry for regular users and AI Agents disappears entirely. Imagine a new user or Agent receiving any token into an empty wallet, then immediately transferring or trading it on PancakeSwap—without needing to first top up BNB for gas.

Second, the on-chain Agent economy may finally explode. With all tokens capable of gasless transactions, Agents’ trading and financial strategies become far more flexible. A DeFi Agent can freely switch between tokens without worrying about gas management. This convenience could lead to exponential growth in Agent transaction volume.

Third, on-chain behavior may become more anonymous. As large volumes of transactions go through Relayers without requiring accounts to refill gas, external observers can no longer trace wallet relationships via gas sources.

This brings us back to the initial question: if the market rebounds, what will you buy?

Now it appears b402 is not just an x402 alternative on BSC, but potentially the starting point of a much larger opportunity. It’s not just solving AI Agent payments—it’s solving gasless transactions for the entire BSC ecosystem. That market is vastly larger than AI Agents alone.

If you believe the AI Agent narrative will dominate crypto markets for years, if you think gasless transactions are key to Web3 adoption, if you suspect on-chain privacy will become the next hotspot—then b402 deserves your attention.

Not because it’s guaranteed to succeed, but because it might have accidentally opened a much bigger door. Like Uniswap back then, the simplest solution often holds the greatest opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News