TRON Ecosystem: The dual benchmark of stablecoin yields and public chain token appreciation, ushering in a new era of amplified on-chain returns

TechFlow Selected TechFlow Selected

TRON Ecosystem: The dual benchmark of stablecoin yields and public chain token appreciation, ushering in a new era of amplified on-chain returns

Stablecoin ecosystem bottoming out, combined with DeFi infrastructure empowerment, TRON enables crypto assets to steadily appreciate and weather volatile cycles

Since October, the crypto market has undergone two consecutive deep corrections. After a surge, Bitcoin pulled back and entered a phase of broad-range consolidation. Coupled with the pause in the Fed's rate hike cycle and slowing inflows of institutional capital into the crypto market, investor sentiment has shifted from "aggressive momentum chasing" to "cautious stability seeking." Demand for assets offering "stable returns + strong security" has significantly increased, making "certainty" the core criterion in current capital allocation.

In fact, this bull market differs fundamentally from previous retail-driven broad rallies, showing clear institutionalization and fundamentals-driven characteristics: listed companies are adding Bitcoin to strategic reserves; traditional financial institutions like JPMorgan and Fidelity have launched spot Bitcoin and Ethereum ETFs, enabling professional capital entry. Market holdings are shifting from retail dominance to institutional control, and the market trend is evolving from "broad-based gains" to a "structural bull market."

Investor preferences have also changed—no longer fixated on widespread gains of the past—but increasingly focused on "return certainty": First, after multiple market cycles, risk appetite has notably declined, with practical needs for "capital preservation + appreciation" outweighing the pursuit of "excess returns"; second, global macro uncertainty persists, making the safe-haven properties and stable return capabilities of crypto assets key factors in capital allocation.

Accordingly, investment strategies have shifted from "chasing high risk and high returns" to "anchoring on certain returns." Among these, stablecoins with risk-free yield attributes, and leading public chain tokens combining staking rewards with appreciation potential, have become essential core holdings due to their return certainty and defensive characteristics.

The TRON ecosystem excels in both asset categories: its ecosystem stablecoins lead in risk-free yields compared to major global public chains such as Ethereum, BNB Chain, and Solana; its native public chain token TRX ranks among the top-performing mainstream crypto assets in annual price gains, demonstrating exceptional downside resilience and upside potential.

This combination of "leading stablecoin yields + strong public chain token appreciation" positions TRON as a core destination for global capital retention and growth. Supported by a robust DeFi infrastructure, TRON offers practical, ecosystem-backed diversified risk-free yield solutions, helping investors achieve stable performance throughout crypto market volatility.

TRON Ecosystem: Dual Benchmark in Stablecoin Yield and Public Chain Token Appreciation

In today’s market, where “certain returns” are highly sought after, the TRON ecosystem stands out through two core strengths: high risk-free yields from stablecoins and significant appreciation potential combined with attractive staking rewards from its native public chain token TRX. Backed by “high security” and “large-scale ecosystem,” TRON-chain assets uniquely unify high yield with stability, establishing itself not only as a central hub for capital preservation and growth but also as a preferred platform for steady asset appreciation in the crypto market.

Currently, investor demand for the two core asset types—“stablecoins and leading public chain tokens”—has distinct focuses:

Stablecoins, widely recognized as a “safe-haven anchor,” allow users to earn risk-free returns via staking, lending, or liquidity mining without exposure to token price volatility, making them ideal for conservative investors and risk-averse capital.

Mainstream public chain tokens offer fixed returns from base network staking, while also providing opportunities for price appreciation driven by ecosystem development (e.g., growing DeFi activity and user base), creating a dual-engine model of “fixed staking income + variable price appreciation from ecosystem growth.” This precisely meets investor demands for “stable foundation + growth flexibility” in diversified portfolios.

The TRON ecosystem perfectly aligns with the dual needs of “stable returns + growth potential.” Its stablecoins’ risk-free high yields and TRX’s appreciation capability outperform comparable assets across the board, forming an irreplaceable competitive edge.

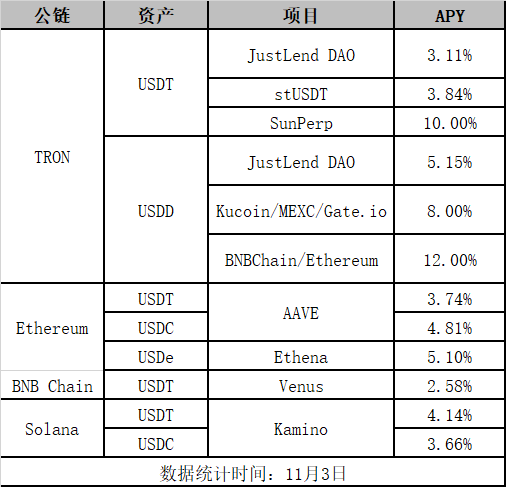

In terms of stablecoin yields, TRON’s ecosystem stablecoins lead the market, significantly outperforming other major public chains. As of November 5, stablecoins within the TRON ecosystem offer annualized yields exceeding 10%, far above those on Ethereum, BNB Chain, and Solana (typically between 3%–5%), presenting a highly attractive option for stablecoin investors seeking risk-free returns.

Specifically, TRON has built diverse yield mechanisms around the dominant stablecoin USDT and its native decentralized stablecoin USDD:

- As the primary circulating asset in the ecosystem, USDT offers multiple income paths on TRON: 1. Interest-bearing storage: depositing USDT directly on the lending platform JustLend DAO yielded approximately 3.11% on November 3, with instant deposit and withdrawal support;

2. RWA yield: locking USDT via the RWA product stUSDT allows indirect access to traditional financial market returns, such as U.S. Treasury yields, achieving an annualized return of 3.84% as of November 3;

3. Contract platform staking yield: locking USDT on the decentralized derivatives platform SunPerp can yield up to 10%.

- As TRON’s native decentralized stablecoin, USDD supports cross-chain flexible yield generation and is now deployed across Ethereum and BNB Chain, with different yield scenarios per chain:

1. On the TRON chain, USDD yields fall into two main categories: first, depositing USDD directly on JustLend DAO offers a base annual yield of 5.2%; second, participating in exchange staking subsidy programs (e.g., KuCoin, MEXC) can boost annual returns up to 8%;

2. In multi-chain ecosystems (Ethereum/BNB Chain), staking USDD generates interest-bearing tokens sUSDD, yielding up to 12% annually.

Critically, TRON’s DEX platform Sun.io features PSM, a stablecoin swap tool enabling 1:1, zero-slippage, fee-free conversion between USDD and USDT. This allows USDT holders to seamlessly convert their holdings to USDD and capture higher yields with no added risk.

Regarding native public chain token appreciation, TRX performs strongly in both price gains and staking yields. It offers impressive price upside alongside reliable staking returns and can further amplify investment returns through synergies with DeFi applications within the TRON ecosystem—making it a truly “balanced offensive and defensive” quality asset.

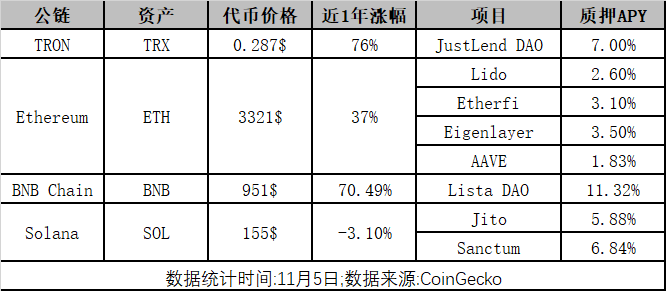

Despite two recent sharp market corrections, data as of November 5 shows TRX achieved a remarkable 76% price gain over the past year, highlighting its strong “resilience and growth potential.” In comparison, ETH rose 37%, BNB gained 70.49%, and SOL declined by 3.1%. These figures confirm TRX’s leading position among major public chains in both downside protection and appreciation capacity.

Beyond price performance, TRX also offers competitive staking yields. Currently, TRX offers a base annual staking yield of 7% on JustLendDAO. By comparison, staking yields on other major public chains are: ETH (via Lido) at 2.6%, SOL (via Jito) at 5.88%, and BNB (via ListaDAO) at just 0.99% base yield, rising to 11.32% only when including Binance Launchpool incentives. Thus, TRX delivers substantial and stable returns through base staking alone, without relying on additional incentives—making it more attractive and accessible to average investors.

Additionally, supported by TRON’s mature and comprehensive DeFi ecosystem, users can further amplify TRX staking returns through strategic combinations. For example, TRX’s liquid staking receipt sTRX can be deposited directly into JustLend DAO, earning up to 7.1% APY. Meanwhile, sTRX can serve as collateral to mint the stablecoin USDD, which can then be deposited back into JustLend DAO. Through this “stake-borrow-reinvest” loop, users may achieve total returns exceeding 15% in coin-denominated terms.

This blend of “stable staking returns + high-growth price appreciation” makes TRX a well-balanced premium asset—meeting fixed-income needs for conservative investors while offering ample upside for aggressive ones—positioning it as a core asset suitable for all investor profiles.

With its leading-edge risk-free yields exceeding 10% from stablecoins, TRX’s superior overall returns, and flexible yield-switching and amplification mechanisms, the TRON ecosystem firmly holds its status as the dual benchmark in “stablecoin yield + public chain token appreciation,” emerging as an indispensable anchor of certain returns in the crypto market.

DeFi Infrastructure Secures Long-Term Stable Returns, TRON Builds a Cyclical-Resilient Value Ecosystem

As the crypto market shifts from “broad euphoria” back to “value investing,” the TRON ecosystem leverages its advantages in “high risk-free stablecoin yields + high-growth native token TRX” to deliver a sustainable yield framework capable of weathering market cycles and enabling steady asset appreciation. Its competitiveness lies not only in leading annual percentage yields (APYs) but also in a mature, fully developed DeFi infrastructure that deeply integrates “asset returns” with “ecosystem vitality,” delivering stable and sustainable returns for investors.

Today, crypto investors no longer blindly chase headline APYs but instead scrutinize transparency of yield strategies, sustainability of returns, real ecosystem profitability, protocol security, maturity, and underlying risks.

As a veteran public chain tested through multiple market cycles, TRON demonstrates clear differentiation across these critical dimensions, perfectly aligning with evolving market demands. With authoritative positions in both security and scale, TRON’s on-chain assets combine high yields with strong stability, backed by long-term, real ecosystem cash flows—establishing itself as a core destination for global capital preservation and growth.

Amid recent security incidents such as the Balancer hack and de-pegging of stablecoins like xUSD, asset security has become the top priority for investors. The TRON network and its core DeFi protocols (JustLend DAO, Sun.io, etc.) have operated stably for years, enduring multiple extreme market conditions without any major security breaches, providing a solid foundation for fund safety.

In terms of ecosystem scale, TRON’s multi-billion-dollar ecosystem provides hard-backed support for sustained yield stability. Specifically, in asset size: as a global settlement hub for stablecoins, TRON hosts a stablecoin market cap consistently around $80 billion, with total value locked (TVL) maintaining a high level of $28.8 billion—ensuring abundant liquidity for yield-generating activities. In user scale: TRON has surpassed 342 million on-chain users, with daily active accounts exceeding 5 million, driving continuous ecosystem expansion. In profitability: according to Messari’s latest Q3 report, TRON generated $1.2 billion in revenue, up 30.5% quarter-on-quarter and reaching a new record high—further validating the ecosystem’s high-quality, sustainable development.

Beyond sheer scale and capital depth, TRON’s core advantage lies in the fact that both stablecoin yields and TRX appreciation are rooted in real DeFi business activity within the ecosystem. TRON has established a full-cycle DeFi infrastructure spanning “asset issuance – trading & exchange – yield generation – cross-chain circulation,” supporting efficient asset movement and providing solid operational backing for returns on both core asset types.

In detail, each core component complements the others with comprehensive coverage: the one-stop DEX platform Sun.io integrates multiple services, including SunSwap (decentralized trading), SunCurve and PSM (stablecoin exchange tools), SunPump (Meme token launchpad), and the newly launched SunPerp (derivatives trading), covering the entire spectrum from asset creation to basic swaps and derivatives. The lending core, JustLend DAO, offers rich functionality beyond lending and interest-bearing deposits (SBM), including TRX staking and energy leasing. The RWA product stUSDT opens cross-sector yield pathways, while the native stablecoin USDD establishes a high-yield system across multiple chains. The cross-chain protocol BTTC enables seamless asset transfers between TRON and EVM-compatible chains like Ethereum and BNB Chain, ensuring smooth cross-chain liquidity. The new brand AINFT expands into AI and NFT innovation, continuously enriching the ecosystem’s service offerings.

These DeFi and ecosystem products create a “full-cycle yield ecosystem” on TRON, ensuring every stage—from entering the ecosystem to achieving multi-dimensional appreciation—is supported by mature applications, guaranteeing stable and sustainable returns independent of short-term policy incentives.

Taking stablecoins as an example, the ecosystem’s peak risk-free yields exceeding 10% stem from the robust foundation of a “complete product matrix + closed-loop DeFi scenarios”: base deposit yields from JustLend DAO, high-yield contract staking on SunPerp, cross-chain yield returns from USDD, plus zero-risk conversion via PSM and traditional finance integration through stUSDT—all grounded in real application use cases rather than temporary subsidies.

Likewise, TRX’s excess returns are powered by deep DeFi infrastructure: beyond base staking rewards, derivative use cases on platforms like JustLend DAO (e.g., re-investing staking receipts, looping borrowing) further amplify returns, creating a “base yield + derivative gains” multi-layered model that unlocks higher return potential.

More importantly, TRON benefits from long-term capital inflows enabled by “compliant infrastructure.” Through U.S.-listed entity Tron and other regulated channels, traditional finance and institutional capital are continuously drawn into the ecosystem, injecting long-term liquidity that reinforces yield stability. In June, publicly traded Tron staked 365 million TRX via JustLend DAO; in September, Tron secured a new $110 million investment, adding 312.5 million TRX to its treasury; as of November 5, the listed company holds over 670 million TRX. This “long-term locked + infrastructure-staked” capital enhances TRX price stability and provides strong liquidity support for yield mechanisms on core protocols like JustLend DAO.

Leveraging end-to-end DeFi infrastructure and external ecosystem expansion, TRON has built a “multi-dimensional, multi-tiered” asset return system covering the full spectrum from “basic appreciation to cross-sector investment,” satisfying both conservative users’ need for safety and aggressive users’ pursuit of high returns.

Whether it’s risk-averse investors seeking “capital preservation + steady growth” (via USDT/USDD deposits and staking), aggressive investors focused on “fixed income + price upside” (by holding TRX for compounded returns), or institutional investors prioritizing compliance (choosing stUSDT), the TRON ecosystem provides clear, actionable asset allocation pathways.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News