Hyperliquid in its prime: Why is this crypto "outlier" growing against the trend?

TechFlow Selected TechFlow Selected

Hyperliquid in its prime: Why is this crypto "outlier" growing against the trend?

"Own HYPE, and you're a winner."

Author: Omnia.hl π

Compiled by: TechFlow

The Obvious Summary

Undoubtedly, Hyperliquid has had another year—and this time, its victory is overwhelming. This is the first time in nearly six months that I've written about this ecosystem again, perhaps my longest "silent period" so far. This article will cover a series of observations, all supporting Hyperliquid’s long-term developmental trajectory—rising continuously by orders of magnitude.

To date, Hyperliquid's performance can only be described as “insane.” It breaks its own all-time highs almost every month across every metric—from trading volume and user count to revenue and beyond. Without question, Hyperliquid has become the single greatest threat to centralized exchanges since the dawn of electronic trading, disrupting traditional powers just as profoundly as the internet revolutionized information dissemination.

Today, it's no longer speculation to say that hundreds of teams are building on Hyperliquid. From our own team @kinetiq_xyz to various DeFi projects and retail application developers, Hyperliquid’s ecosystem is rapidly expanding.

Yet many may not immediately grasp how significant this success truly is. Some might attribute it to its closed-source nature, lack of deep interaction with the community or teams at foundational levels (more bluntly: offering no grants or special treatment), or believe it's solely due to daily perpetual trading volume.

But their misjudgment and complacency are precisely (your) our opportunity.

Hyperliquid: The Logic Behind Breaking the Mold

Before diving deeper, you must understand: Hyperliquid is a complete outlier. Its existence shatters the current industry landscape—an extreme embodiment of trying to fit a square peg into a round hole, constantly challenging and overturning the rules of the game it aims to destroy.

Every existing blockchain—yes, including Bitcoin (the most controversial exception, as a "peer-to-peer electronic cash system") and Ethereum—is not built around a flagship application designed specifically for the chain itself. Nearly all applications are developed atop 99.99999% of blockchains, meaning these use cases or apps are created externally, outside the core team or original purpose of the chain, then migrated to or directly built on top of the base network. There are multiple reasons behind this phenomenon, the most common being clearly unsustainable monetary incentives (e.g., biased grants, poor selection, guaranteed “magic tokens”), while technical aspects (like TPS, privacy) are usually secondary factors—even though they do play some role.

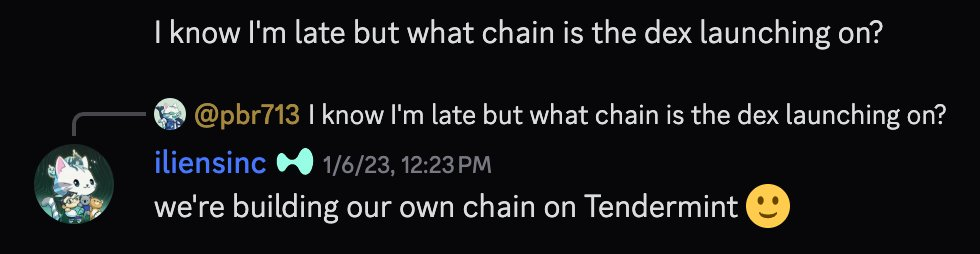

Perhaps most people today don’t realize (understandably) that Hyperliquid was originally built on the Tendermint consensus mechanism, only switching in May 2024 to a fully custom implementation of Hotstuff, with the new consensus named HyperBFT.

In my view, @asxn_r remains the leading researcher on HyperBFT to date. You can learn more via this link: Hyperliquid: The Hyperoptimized Order.

An interesting (and extremely brief) glimpse into Hyperliquid before changing consensus comes from a short conversation between @pbr713 and @iliensinc back in January 2023 (four months before I joined Discord).

To highlight Hyperliquid’s development speed: after announcing HyperBFT in April 2024, it deployed on mainnet just two weeks later—no so-called “decentralization theater,” paid media campaigns, or pre-launch tours. The introduction of HyperBFT instantly made Hyperliquid the highest-performing blockchain today, capable of handling 200,000 transactions per second (TPS). Hyperliquid continues breaking social barriers that “old powers” tried to erect around it—for example, introducing permissionless validators by end of 2024, starting with only 11 nodes and now growing to 24, including 5 foundation nodes.

As I mentioned earlier, several key factors drew me to adopt and advocate for Hyperliquid:

A severely underrated podcast hosted by @chameleon_jeff.

Perpetual DEXs aren't novel, but one built on a custom chain is unprecedented.

During a period when high-frequency trading (HFT) and other trading forms were particularly attractive, Jeff’s intellectual charm and charisma deeply resonated with @0xmagnus and me.

Hyperliquid hosts the purest “faith-based community” you can find.

Driven by extreme capitalism, immune to typical foundation-style “socialization” influences.

Proudly embraces high risk and wears it as a badge of honor.

From single-digit to three-digit IQ individuals, all are forced into this ever-expanding arena.

Hyperliquid adheres strictly and uncompromisingly to an “internal abstinence” principle in operations.

It raised zero funds from any venture capital (VC), forcing potential buyers to acquire tokens only through open markets, with full transparency;

Accepted no liquidity provider (LP) agreements, paid no market maker fees for liquidity, yet attracted massive organic liquidity (still growing);

Leaked no information to third parties—all announcements released simultaneously via official channels, ensuring fairness and transparency.

To truly understand Hyperliquid’s underlying logic, you must first grasp the norms of the industry game—and how Hyperliquid actively breaks them in real time, continuing to disrupt.

My Speculation on Remaining HYPE Distribution

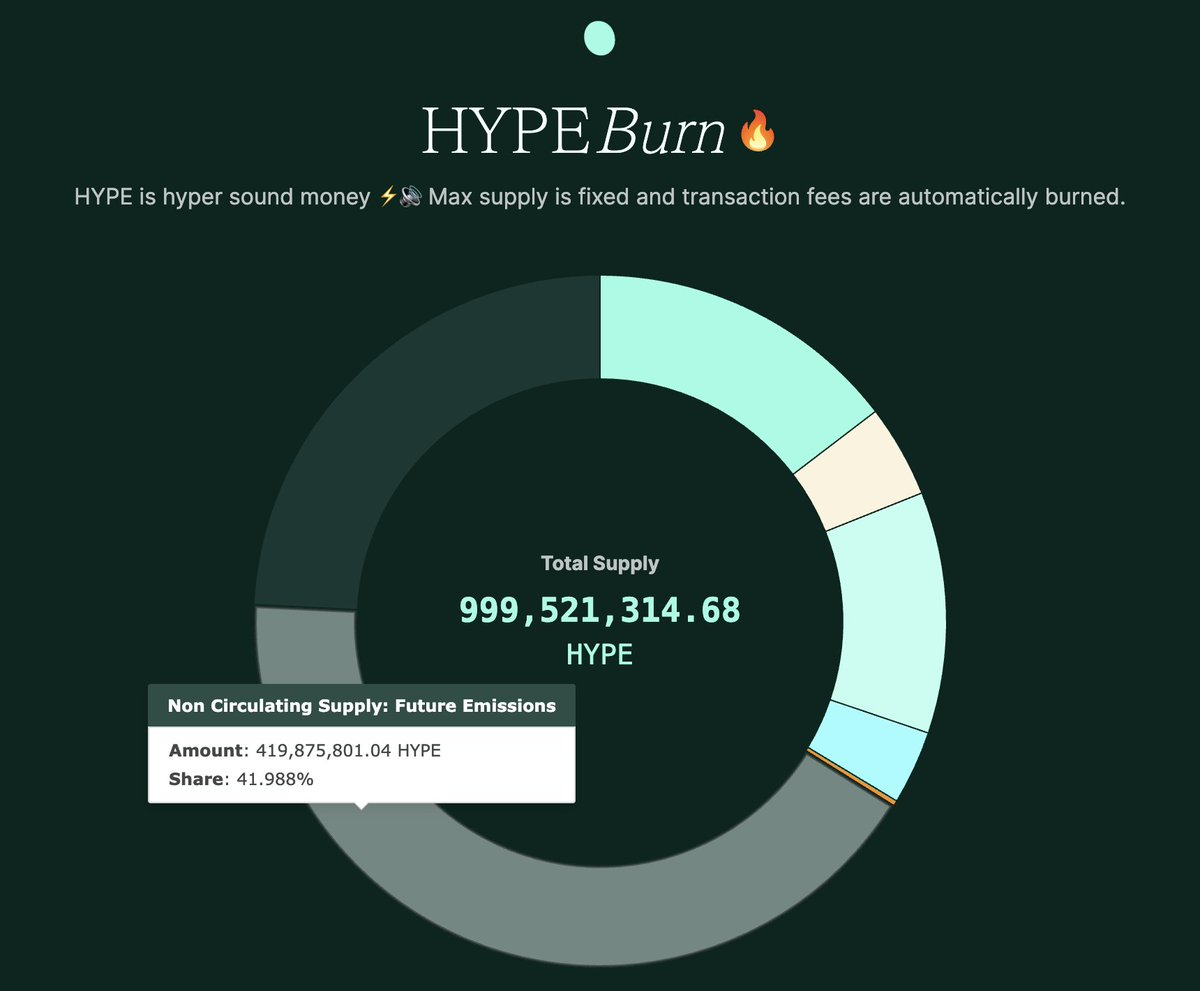

There is endless speculation about future HYPE distribution beyond the two “seasons” already completed. While I agree with some views on remaining HYPE allocation, as Hyperliquid’s influence grows, I grow increasingly confident in my theory: the remaining HYPE will either be gradually burned or entirely eliminated at once.

My primary reasoning is: Burning HYPE is the most objective way to reflect proportional, unbiased value to existing HYPE holders, without incentivizing specific activities (similar to BNB’s burn mechanism, but completely free of misconduct). Thus, those seeking returns need only make one simple, direct choice—hold HYPE like the rest of us.

Reference: https://www.hypeburn.fun/ by @janklimo

Counterarguments to my theory:

If HYPE is burned, the team’s token share would increase unless the team reduces its current total supply proportion to match ~25% circulating distribution, forming a final supply cap.

Hyperliquid might see future incentives as the most strategic path, focusing on expanding activity within its ecosystem to drive growth and deliver heavy blows to competing products and ecosystems.

Perhaps both—a portion of HYPE burned, another used for growth initiatives.

Maybe no clear decision will be made in the foreseeable future, waiting instead for the optimal moment to act.

Surprisingly, whether my theory is correct or not, this question ultimately doesn’t matter much. HYPE’s success is almost guaranteed regardless of the final choice.

Data Performance

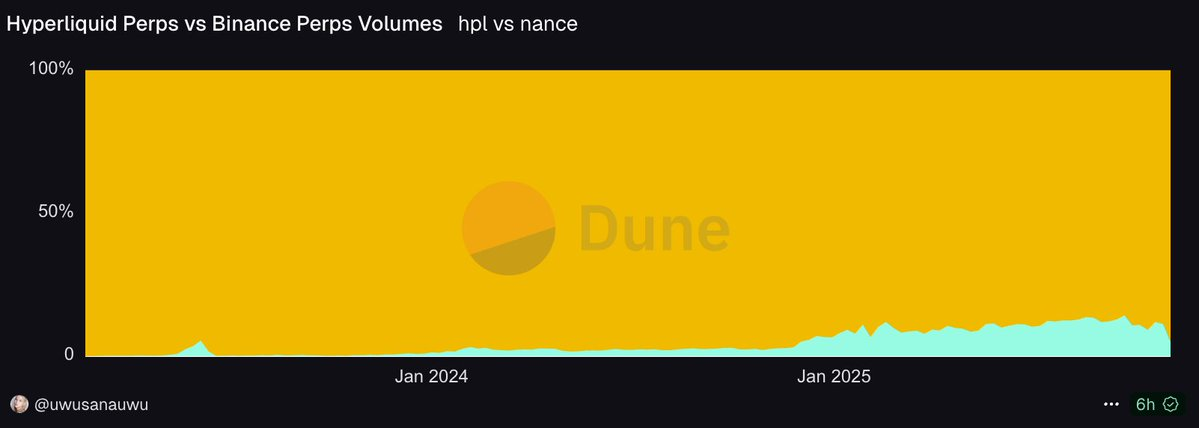

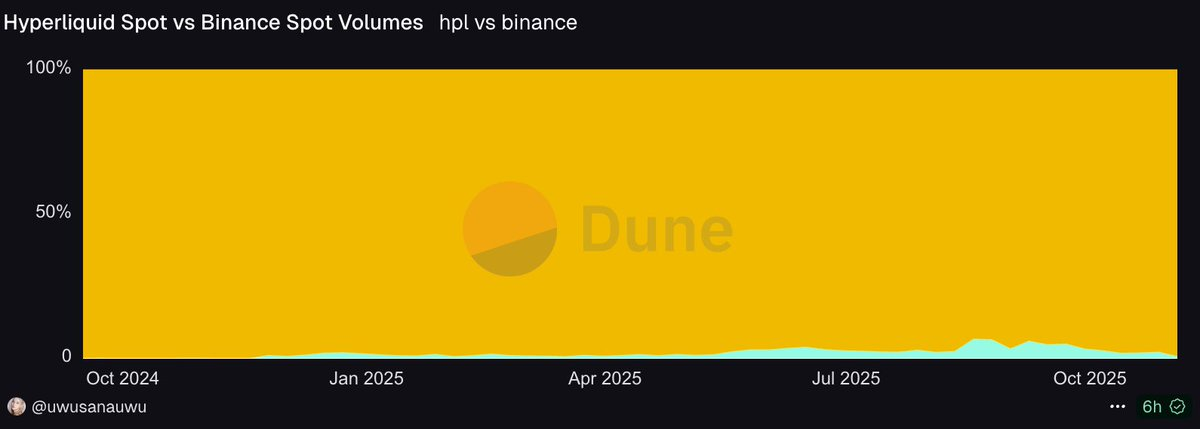

Challenging Giant Binance: By the end of September 2024, Hyperliquid captured approximately 14% of Binance’s weekly trading volume.

Impact on Spot Markets: By the end of August 2024, Hyperliquid reached about 7% share of spot market trading volume, showing strong potential to further erode Binance’s dominance. For instance, @hyperunit made Hyperliquid one of the cheapest platforms to trade spot BTC.

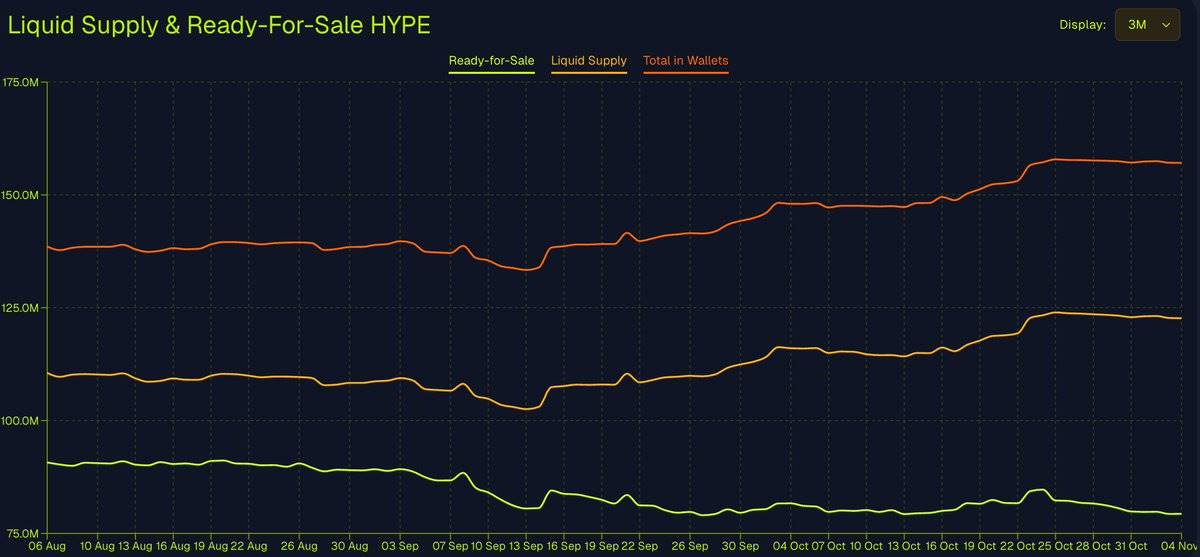

HYPE Supply-Demand Dynamics: Despite recent market downturns, RFS (Ready-For-Sale) HYPE remains near all-time lows, indicating tight supply.

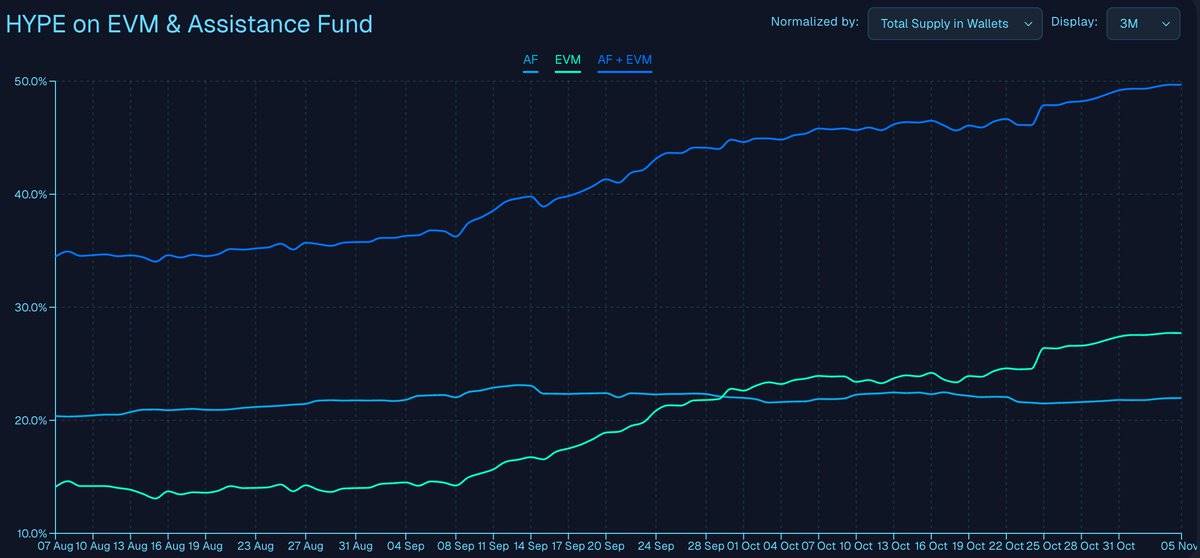

Usage of HYPE in HyperEVM and the aid fund continues to rise, with 99% of transaction fees directly used to repurchase HYPE, fueling ecosystem expansion.

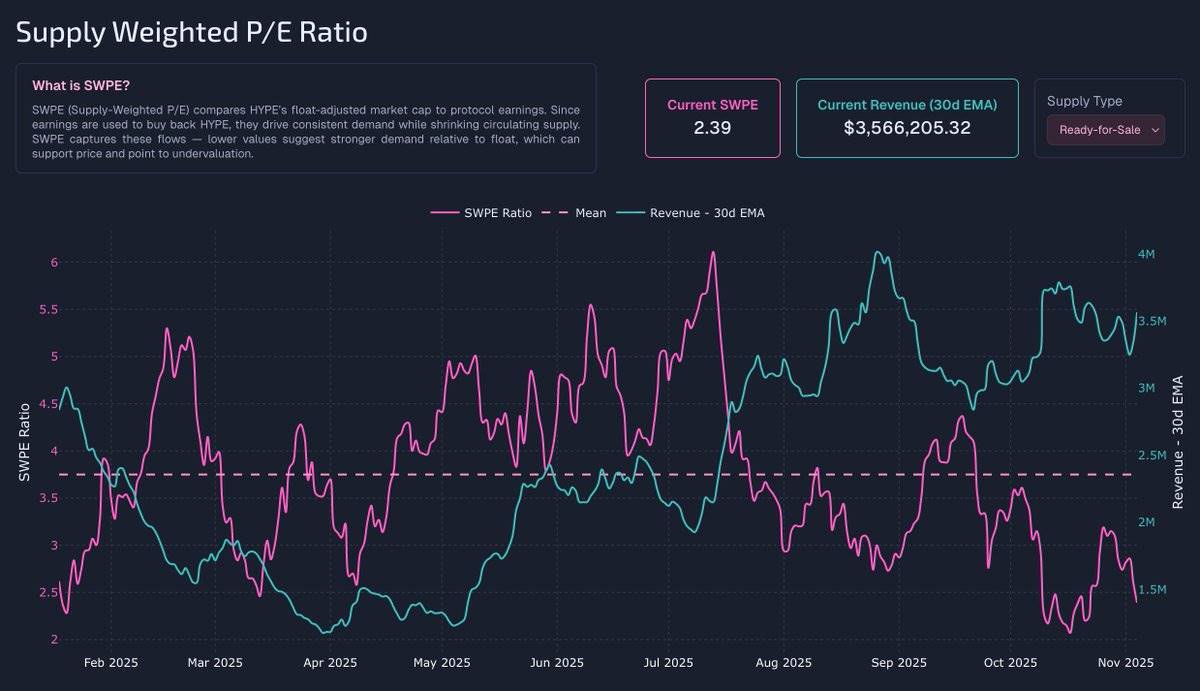

Scarcity and Rising Demand: SWPE (Circulating Supply vs. Price Elasticity Indicator) is at historical lows, while 30-day EMA (Exponential Moving Average) revenue approaches both historical lows and highs, signaling decreasing circulating supply amid rising demand.

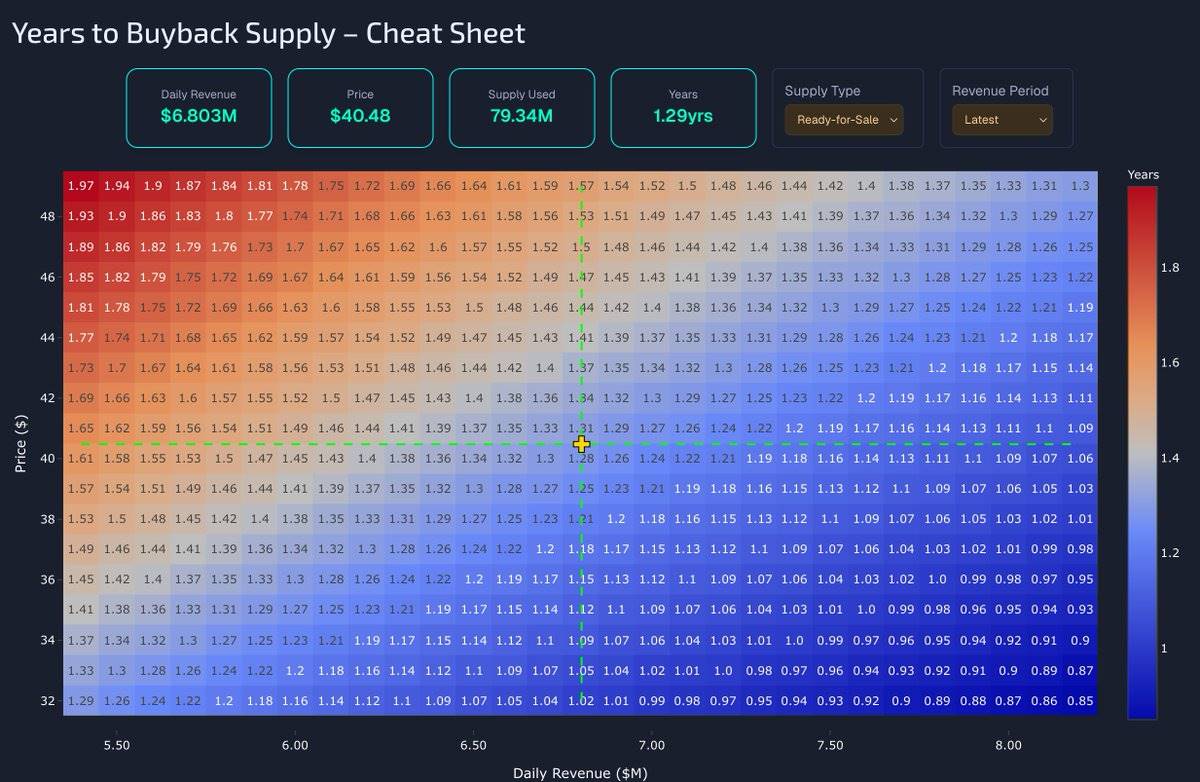

Programmatic Buyback Mechanism: The HYPE protocol automatically buys back more HYPE from the open market based on price and volatility. At current income and pricing levels, the aid fund could repurchase all RFS-supplied HYPE within just 1.29 years.

Trillions of Dollars

To date, Hyperliquid’s cumulative trading volume has exceeded 3.13 trillion USD.

Yet global financial markets span millions—or even more—trillion dollars. To Hyperliquid, this seems nearly impossible, yet this is exactly where its ultimate ambitions lie.

In a TBPN interview, when asked “How big can Hyperliquid get?”, Jeff’s response was telling. His comments revealed the team’s profound belief in the Hyperliquid system—even though its current scale remains tiny, they believe one day Hyperliquid could carry the entire flow of global finance.

“If Hyperliquid succeeds, it will become something unprecedented in this world.”

Hyperliquid has become one of the most profit-efficient companies globally, currently operating with only 11 members, yet generating over 1.5 billion USD in annualized revenue—equivalent to roughly 136 million USD in profit per employee. And Hyperliquid’s history spans merely three years.

As Hyperliquid’s influence expands, Wall Street has begun noticing. One way or another, traditional finance will eventually join.

Hyperliquid’s technological innovations are also remarkable, including breakthroughs like HIP-3 and CoreWriter, delivered through weekly network upgrades with virtually no downtime exceeding a few minutes.

Today, Hyperliquid stands as the industry’s first project to seamlessly combine a highly efficient on-chain trading platform with a thriving DeFi ecosystem. An increasing number of developers and traders are flocking to this ecosystem, driving its evolution into a unique financial hub. From basic mathematical logic, this trend will only further enhance Hyperliquid’s value.

We are likely to see HYPE reach at least 2000 USD before 2028. It’s no longer a question of “if,” but “when.”

“Holding HYPE means winning.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News