100% Win Rate Myth Ends: How a Whale Drained Itself

TechFlow Selected TechFlow Selected

100% Win Rate Myth Ends: How a Whale Drained Itself

The fairness of the market lies in its never distinguishing between geniuses and ordinary people.

Author: Sanqing, Foresight News

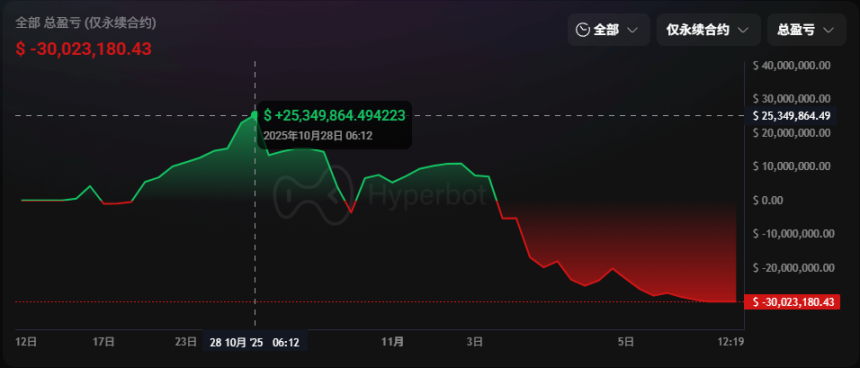

On November 5, an anonymous whale who had previously achieved a 100% win rate over fourteen consecutive trades on Hyperliquid was forced to liquidate their entire position. The account plummeted from a peak profit of over $25.34 million to a net loss of $30.02 million, leaving only about $1.4 million in margin. This 21-day trading cycle, which began with precise short and long positions on October 14, reached its profitability peak on October 28. Within just one week afterward, due to concentrated leverage, market pullback, and the compounding effect of逆势 adding positions, all profits and principal evaporated by this morning.

Image source: Hyperbot

From Accumulation to Peak

On October 14, 2025, the anonymous whale began a streak of fourteen consecutive profitable trades on Hyperliquid, using the address:

0xc2a30212a8ddac9e123944d6e29faddce994e5f2

The trader bought 5,255 ETH, then sold all of it the next day for 22 million USDC, taking a ~5x leveraged short position on BTC. Just one night later, they closed the position at 8:00 AM on October 16, earning $2.6 million. This marked their first winning trade—and the cleanest move of the entire cycle.

In the following week, they precisely switched directions amid market volatility. On the morning of October 17, they turned bullish, increasing exposure in two rounds to a total position size of $222 million. Before the market declined early on October 22, they exited approximately $300 million worth of long positions ahead of time, securing a $6.04 million profit. This move became known on social media as "the big guy reacted fast," cementing their myth of a 100% win rate.

From October 24 to 28 marked their golden period. They steadily added to BTC and ETH positions in batches, maintaining leverage under 8x while expanding exposure from $274 million to $447 million. On Hyperbot’s profit/loss chart, this was the only fully uninterrupted green upward line—on October 28 at 6:12 AM, the account reached a floating profit of $25.349 million.

This was the last single-direction climb in their P&L curve. In the following week, their rhythm began to subtly shift.

From Taking Profit to Obsession

On October 29, the whale chose to close profitable positions while holding onto losing ones. At 4:00 AM, during a market dip, they exited a $268 million BTC long, locking in only $1.4 million in profit. Later that afternoon, they closed a $163 million ETH long for a $1.63 million gain, leaving only the underwater SOL position open.

Two days later, they increased their SOL position to a total of $105 million, bringing their average cost to $198.30. Early on October 30, Fed Chair Powell's remarks triggered a brief market drop. The whale attempted to bottom-fish BTC and ETH while simultaneously increasing their SOL exposure. By evening, all three positions were underwater, with a floating loss of $9.73 million.

At 4:00 AM on October 31, floating losses exceeded $18 million, though they narrowed slightly with a market rebound. The whale tried to hold out for breakeven. By 8:00 AM on November 3, floating losses had shrunk to just $1.98 million—they were one step away from recovering everything, yet failed to reduce exposure. Just three hours later, the market turned downward again, and all four long positions re-entered floating loss territory.

They were moments away from exiting safely, but through hesitation and waiting, handed control back to the market.

From Stop-Loss to Self-Destruction

In the early hours of November 4, their perfect winning streak officially ended. They cut losses by closing BTC, ETH, and SOL longs worth $258 million, realizing a $15.65 million loss—nearly equal to the $15.83 million in profits earned over the prior 20 days across 14 winning trades. At this point, they still held $148 million in long positions in ETH, SOL, and HYPE, with floating losses of $18.86 million and only 8% buffer remaining before liquidation.

Market prices continued falling during the day. The gap to liquidation narrowed to just 4%. Their account equity had dropped 40.4 million USD from its peak, erasing all gains and principal—returning them to square one. As liquidation loomed, any rational trader would have stopped, but instead, at ETH $3,497 and SOL $159, they added 2,196 ETH and 78,724 SOL. This pushed up their liquidation prices further: ETH liquidation now at $3,348, SOL at $151.60—just $130 below current price for ETH, and only $8 for SOL.

On November 5, it was over. Around 5:00 AM, they were forced to close all positions. Only $1.4 million in margin remained—effectively equivalent to full liquidation. Thus, this 21-day trading saga ended in complete zeroing. All $15.83 million in profits from 14 straight wins, combined with $28.76 million in principal—totaling $44.67 million—wiped out in a single loss.

Between Leverage and Human Nature

In Hyperliquid's trading records, nearly every legend ends in a similar fashion: James Wynn once held a $1.2 billion BTC long at 20x leverage, peaking at $87 million in profit before ending with a $21.77 million loss; qwatio compounded a $3 million starting capital infinitely, briefly earning $26 million, only to end at zero; veteran trader AguilaTrades turned $300k into $41.7 million at peak, ultimately losing $37.6 million. And now, this anonymous whale known for "14 consecutive wins" also erased $44.67 million in a single night.

Winning streaks may rely on skill and luck, but survival always depends on discipline. When everyone is mesmerized by an upward curve, the ending has often already been written beneath the leverage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News