AI Gold Rush IREN: Is 10x in Six Months Just the Beginning?

TechFlow Selected TechFlow Selected

AI Gold Rush IREN: Is 10x in Six Months Just the Beginning?

Investing in IREN means betting on the most scarce computing resources in today's AI infrastructure sector, combining the stability of a utility with the explosive potential of a tech stock.

Author: RockFlow

Key Points

① IREN has completed one of the most remarkable strategic transformations in the U.S. stock market: evolving from a Bitcoin-mining company constrained by the Bitcoin cycle into a "utility company" focused on AI computing infrastructure. This repositioning allows it to directly participate in the most certain long-term trend in technology today, earning extraordinary attention and value re-rating.

② Against the backdrop where AI computing bottlenecks are shifting from chips to power and land, IREN’s vertically integrated model provides structural cost advantages and years of first-mover advantage. The company's financial turnaround—achieving profitability and 168% revenue growth in its fiscal 2025 earnings—represents the financial realization of its highly profitable "hardware margins" in AI cloud services and successful application of "heavy-asset" expertise.

③ The RockFlow research team believes IREN’s rapid expansion coincides with the most imbalanced phase of supply and demand during the "AI gold rush." Investing in IREN means betting on the most scarce computing resources in today’s AI infrastructure sector, combining the stability of a utility with the explosive potential of a tech stock.

Main Text

In the U.S. stock market, there is no shortage of dramatic and grand-narrative companies and promising investment targets. The subject of this article, IREN, is a prime example.

IREN represents one of the most compelling transformation stories in crypto and technology. Born during the Bitcoin mining boom, the company achieved a strategic leap within just three years, positioning itself as one of the firms best poised to benefit from surging demand for AI infrastructure.

Throughout this transformation, IREN did not abandon its mining DNA—its Bitcoin mining operations continue to generate cash flow. However, it no longer aims to remain a miner at the mercy of Bitcoin price volatility. Instead, it has set its sights on a broader, more certain, trillion-dollar赛道: AI computing infrastructure.

The company has recently gained widespread attention due to a share price surge exceeding 1000% over six months. The RockFlow research team believes IREN is not merely a crypto or AI concept stock, but a representative of a new generation of "AI computing utility companies." Its core investment value lies not in short-term speculation, but in its moat—built around power, land, and high-density design—that cannot be quickly replicated by competitors.

This article will deeply analyze the fundamental logic behind IREN’s potential for tenfold returns from three dimensions: “IREN’s transformation story,” “current core investment value,” and “why now is the right time to invest.”

1. IREN’s Transformation: From Bitcoin Miner to AI Computing Infrastructure Provider

IREN’s story began in the Bitcoin mining space. Founded in 2018 in Sydney, Australia by brothers Daniel Roberts and Will Roberts, who now serve as co-CEOs, the company was initially named Iris Energy.

Daniel Roberts became interested in cryptocurrency back in 2013. He and his brother Will bought Bitcoin when it hit $1,000, but sold it at $500 after witnessing a sharp drop. Later, they participated in Ethereum’s presale and made substantial profits.

When the next Bitcoin bull run began in late 2017, the Roberts brothers studied monetary history and came to understand Bitcoin’s significance as a hedge instrument.

The brothers firmly believed in Bitcoin’s inevitable rise, but also recognized its massive energy costs—one Bitcoin mined consumed as much electricity as a household uses in nine years. From that point, the Roberts brothers aimed to solve the energy challenge while continuing to invest heavily in Bitcoin. In 2018, they left their jobs to found Iris Energy.

"We realized the world would need high-power data centers specifically designed for raw processing power," Daniel said in a recent interview. Clearly, these could be used for AI, high-performance computing, analytics, and machine learning. They don’t need expensive urban hubs—just access to energy.

The brothers backpacked across the globe searching for such locations. Their initial strategy focused on rapidly deploying capacity—not out of opportunism, but to build an operational platform capable of delivering cost advantages.

In recent years, IREN has proven its ability to manage large-scale operations with dense, stable energy consumption, enabling it to weather periods of extreme Bitcoin price volatility.

This experience in designing, building, and operating high-density data centers later became the key that unlocked competition in the broader market—artificial intelligence infrastructure.

In November 2021, shortly after Bitcoin reached an all-time high, Iris Energy went public on Nasdaq. Days later, Bitcoin crashed. By 2022, Iris Energy’s stock price followed suit.

As Bitcoin prices remained depressed, they planned a move into AI, purchasing NVIDIA H100 GPUs to offer high-performance, low-cost processing powered by green energy. After raising $126 million, Poolside AI became their first customer. They invested $22 million in additional NVIDIA chips and developed a two-year ROI plan.

In January 2024, Iris Energy rebranded as IREN, reflecting its diversification. This shift was largely driven by visionary leadership. Rather than falling into the trap of endless mining expansion, the management decided to pause once the company reached critical scale and redirect resources toward AI. This disciplined capital allocation is one of its key strengths.

The most significant marker of IREN’s transformation was securing NVIDIA’s Preferred Partner status in 2024. This wasn’t just a title—it represented strategic endorsement for access to the rarest resources in AI infrastructure: GPU supply and customer channels.

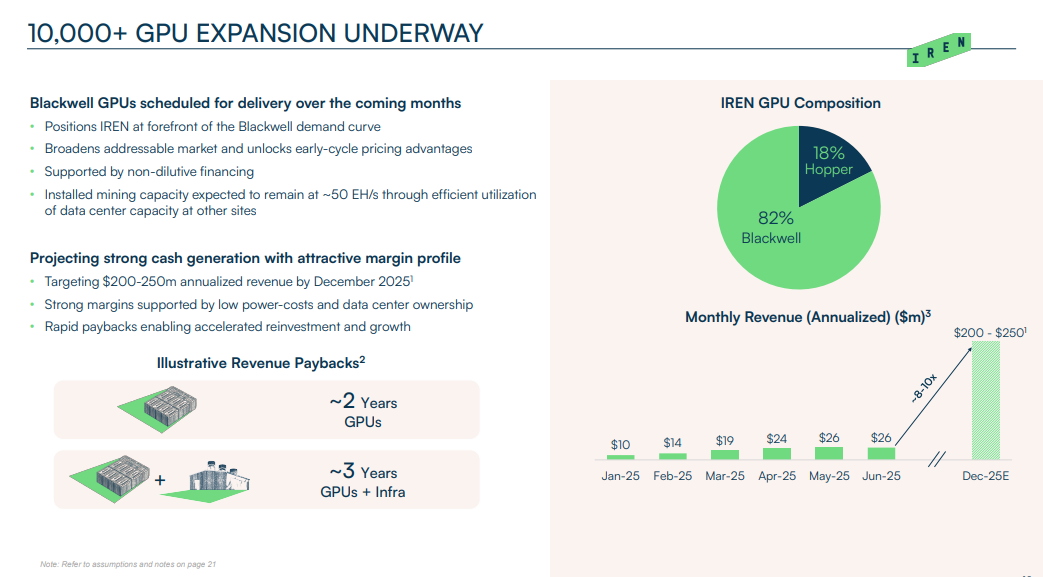

In terms of GPU scale, IREN’s AI cloud has committed to approximately 10,900 GPUs, with plans to scale further beyond 23,000 units.

IREN has completed its strategic evolution from a “Bitcoin mining company” to an “AI computing infrastructure” provider. Today, it operates as a vertically integrated computing infrastructure provider, with a business model defined by three keywords: Power, Hardware, Service.

With full control over land, data centers, power infrastructure, and hardware, this model enables IREN to respond quickly to client needs, expand rapidly and with low risk, maintain direct oversight of project timelines, and reduce reliance on third parties.

2. Core Investment Value: “Heavy-Asset” Experience + High-Growth Market

The RockFlow research team believes IREN’s investment value lies in its successful transfer of “heavy-asset” expertise accumulated during its Bitcoin mining era into today’s most explosive AI infrastructure market, creating a hybrid entity integrating infrastructure, cloud computing, and energy arbitrage.

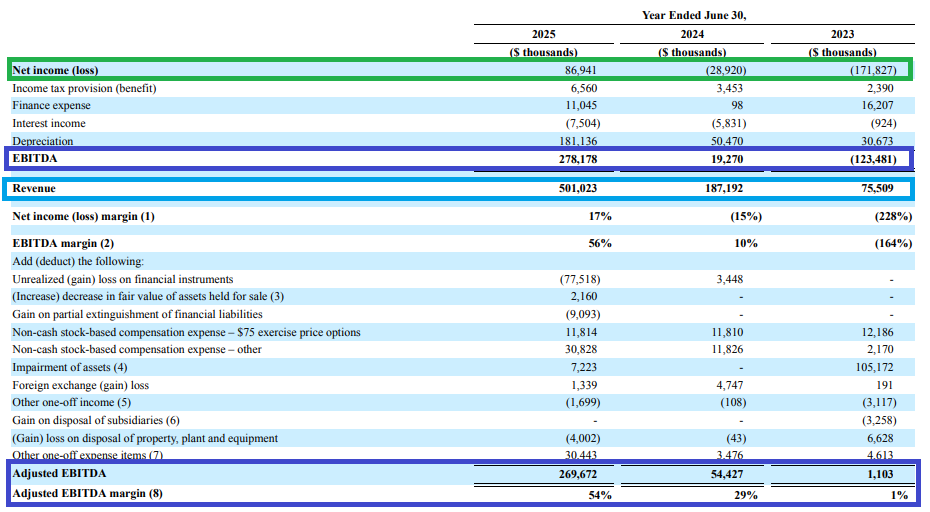

At the end of August, IREN’s fiscal 2025 annual report marked a turning point in its development, with multiple financial metrics demonstrating the viability of its business model:

-

Profitability and High Growth: Total revenue surged 168% year-over-year to $501 million, with net profit turning positive to $87 million after a loss in 2024. Notably, Q4 of fiscal 2025 marked IREN’s first quarterly profit.

-

AI Profitability: Even at small scale, the "hardware margin" (revenue minus electricity cost) of AI cloud is extremely high, proving that running cutting-edge chips in low-power-cost regions generates substantial profits.

-

Cost Advantage: IREN maintains exceptionally low power costs, giving it a structural cost advantage in AI colocation and cloud services—a competitive edge rivals struggle to match.

Beneath these impressive financial results lies IREN’s unique competitive moat—power + liquid cooling + contracts—in action.

In the AI infrastructure space, IREN’s competitive advantages stand out:

-

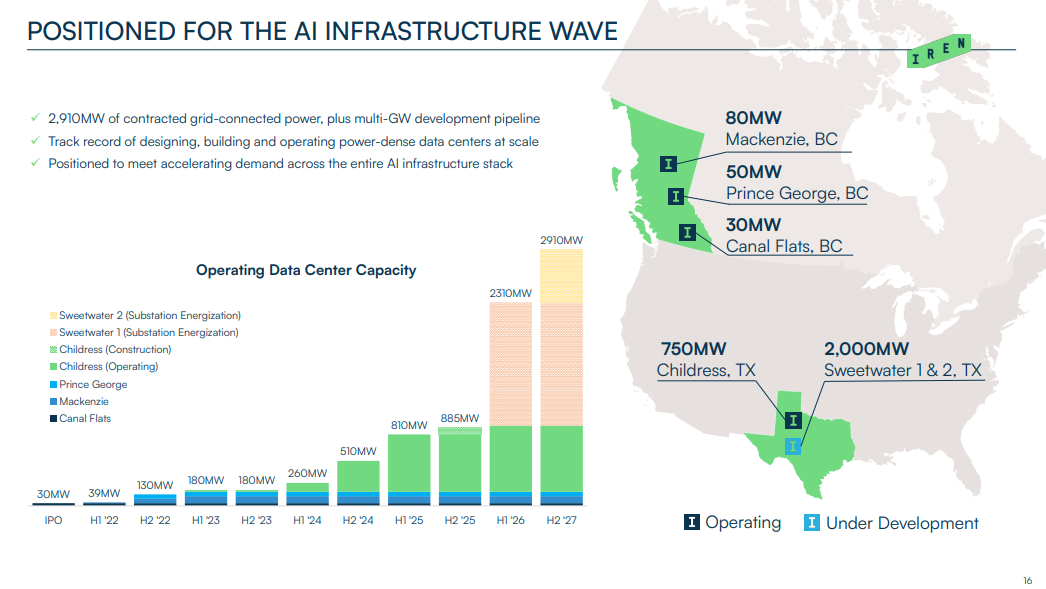

Rare Power and Permit Advantages: At a time when grid capacity prices are soaring and interconnection queues take years, IREN’s secured 2.91GW of power capacity represents the highest barrier to entry. It saves years of grid connection time compared to companies building hyperscale data centers from scratch.

-

High-Density Liquid Cooling Technology: IREN’s new campuses are purpose-built for Blackwell-class liquid-cooled clusters. For instance, the Sweetwater campus is designed to support over 700,000 liquid-cooled NVIDIA Blackwell GPUs. This high-density, low-PUE (Power Usage Effectiveness) design is essential for next-gen GPUs and increases revenue per megawatt.

-

"Colo 3.0" Model: IREN is transitioning from traditional power-and-space leasing (Colo 1.0/2.0) to a "manufacturer partnership model" (Colo 3.0), signing direct agreements with chipmakers. Through financing or leaseback arrangements, it acquires GPUs, aligning capital costs with revenue growth to enable light-asset operations and rapid scaling, while retaining control over power and infrastructure.

The narrative that IREN could reach a hundred-billion-dollar market cap isn’t baseless—it stems from the high leverage in its business model. According to industry research using unit economics for Blackwell-class racks, each megawatt (MW) of AI-dedicated capacity can generate approximately $15.6–17.5 million in annual revenue at 85%-90% utilization.

Moreover, as AI labs and hyperscalers (e.g., Stargate program) sign multi-year, take-or-pay capacity contracts with specialized suppliers in advance, IREN’s future cash flows gain strong financing potential, justifying the high valuations investors are willing to assign.

3. Why Now? The AI Gold Rush and IREN’s Unique Position

As previously mentioned, IREN’s transformation and rapid expansion coincide with a historic macro trend.

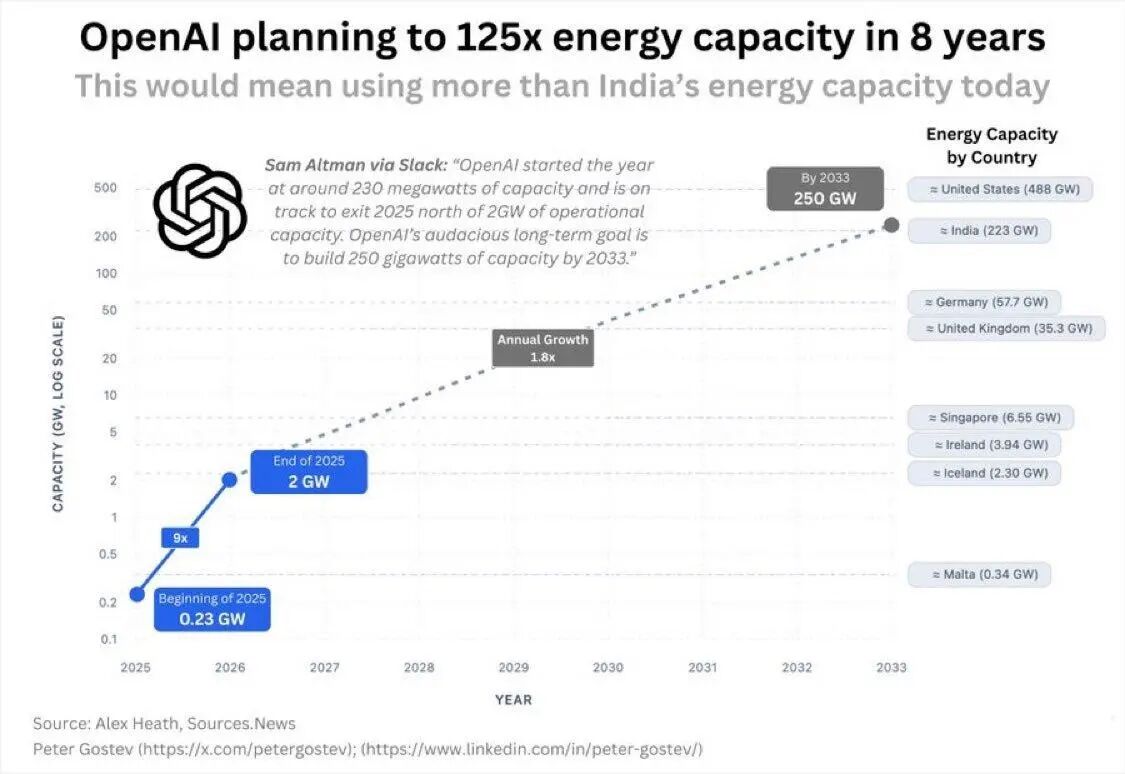

Today, trillion-dollar computing demand is exploding, and the AI infrastructure market is expanding at an astonishing pace. Not long ago, NVIDIA CEO Jensen Huang estimated that the AI arms race could become a $3–4 trillion opportunity. McKinsey predicts that of the ~$7 trillion in data center capital expenditures over the next decade, about $3.5 trillion will go toward server chips.

OpenAI itself estimates that by 2033, its capacity will reach 250 GW—125 times its projected 2025 capacity of 2 GW.

Yet, despite this vast market, supply and demand are currently severely imbalanced. As a result, GPU leasing has emerged as a hot new AI revenue model.

Beyond directly supplying millions of GPUs to OpenAI, NVIDIA may have another plan—to lease its GPUs to large clients like OpenAI.

GPU leasing offers tech giants, frontier AI labs, and other AI-focused firms a way to manage forward-looking expenses, budget projects more precisely, and reduce dependence on costly capital expenditures, thereby stabilizing future free cash flow.

Billion-dollar capacity contracts like CoreWeave-OpenAI and the launch of NVIDIA DGX Lepton services indicate that "chip leasing" is becoming mainstream. This presents a major growth opportunity for infrastructure-backed companies like IREN.

Among AI infrastructure providers, IREN holds a favorable position:

-

Difference from CoreWeave/Nebius Models: Although CoreWeave and Nebius have seen soaring valuations (combined market cap reaching $100 billion), they mostly rely on contracted infrastructure. In contrast, IREN owns and vertically integrates its infrastructure. IREN’s model resembles a "utility" company with pricing power over power and land.

-

Compared to other crypto miners pivoting to AI (like CIFR), IREN’s advantages lie in scale, strategic partnership with NVIDIA, and clear GW-level expansion plans. It’s not simply attaching GPUs to mining facilities, but designing next-generation AI data centers from the ground up.

-

IREN’s strong balance sheet is also notable: after achieving profitability in 2025, it holds $565 million in cash, with a net debt-to-EBITDA ratio of approximately 1.98x—indicating a healthy financial position. This provides flexibility to finance multi-billion-dollar capital expenditures.

Finally, while bullish on IREN’s future, investors must acknowledge risks. The RockFlow research team identifies three main concerns:

-

Execution Risk: Larger future projects involve long construction cycles. Power and permitting risks remain central challenges, with possible delays in interconnection timelines and substation deliveries.

-

Cyclicality: Despite rapid AI growth, most of the company’s revenue still comes from Bitcoin mining, meaning its stock price remains sensitive to Bitcoin price fluctuations in the short term.

-

Valuation and Capital Expenditure: The AI sector is highly speculative, and high capex is inherent to IREN’s model. While contract financing helps, potential dilution risks should be monitored.

Nonetheless, the market currently leans strongly toward optimistic projections. Notably, several near-term catalysts could drive IREN’s stock:

-

AI Cloud ARR Update: With 10,900 GPUs coming online, annualized revenue is expected to reach $200–250 million by year-end.

-

Major Customer Contracts: Any announcement of long-term, take-or-pay contracts modeled after CoreWeave-OpenAI deals.

-

Sweetwater Commissioning Schedule: Phased energization of Sweetwater 1 (2026) and Sweetwater 2 (2027).

Conclusion

IREN’s story is one of “structural scarcity.” At a time when global AI demand is growing exponentially while physical infrastructure remains severely limited, IREN has taken a crucial step toward building a hundred-billion-dollar computing empire—leveraging its first-mover advantages in power, land, and high-density liquid cooling.

The RockFlow research team believes that investing in IREN is to bet on a new industrial revolution, combining the stability of a utility with the explosive power of a tech stock.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News