OKX & AiCoin Review | Who Earns the Most in Grid Strategies? Unveiling 6 AI Trading "Personalities"

TechFlow Selected TechFlow Selected

OKX & AiCoin Review | Who Earns the Most in Grid Strategies? Unveiling 6 AI Trading "Personalities"

Using data to reveal: who are the true "smart traders."

Recently, AlphaArena—an "AI crypto trading live competition" launched by startup team NOF1—has ignited the cryptocurrency and fintech community. The contest provides each AI model with $10,000 in real funds to autonomously trade in the crypto market, making AI's "financial intelligence" a hot topic of discussion.

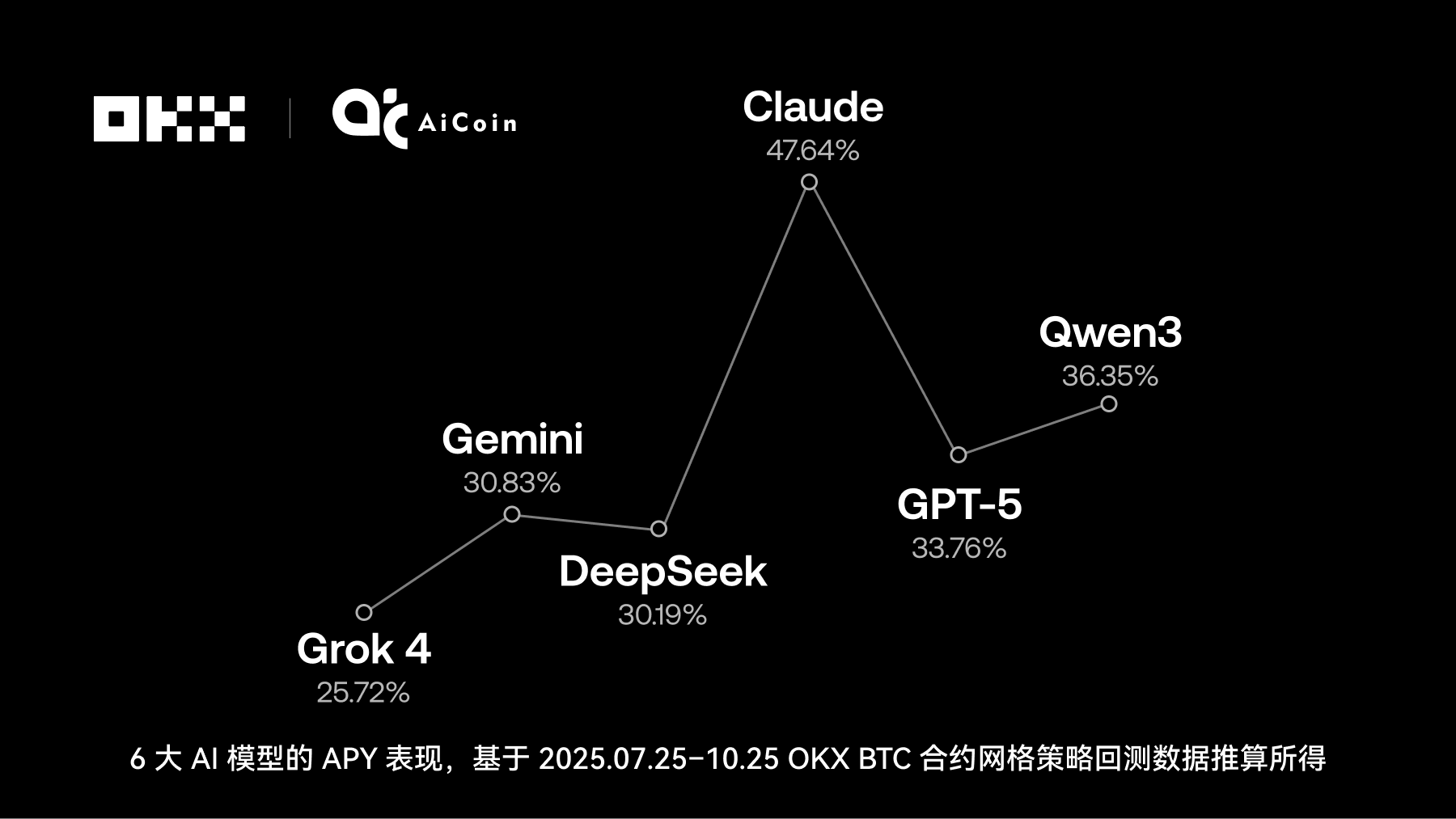

Beneath this trend, a more practical question has emerged: Can ordinary users leverage AI to enhance already mature fixed trading strategies? To explore this, OKX and AiCoin jointly initiated a special experiment: using six major AI models—GPT-5, Claude Sonnet 4.5, Gemini 2.5 Pro, DeepSeek V3.1, Qwen3 Max, and Grok-4 (hereinafter referred to by their abbreviated names for readability)—to generate parameters for an OKX BTC perpetual contract grid strategy. Through rigorous backtesting under identical market conditions, the true performance of these AI "traders" was evaluated.

Excluding transaction fees, if we additionally consider the extra yield from OKX’s “Auto-Earn” feature (which adjusts dynamically with market conditions and previously reached up to around 50%, currently at 3%) on top of the base strategy return, then Claude achieves a maximum APY of 50.64% on the OKX BTC perpetual contract grid strategy.

Users need only update their OKX App to version 6.141.0 or higher to automatically enjoy the additional returns from “Auto-Earn,” with funds remaining in the strategy account available as margin, without increasing risk.

Methodology

Evaluation requirements: Each AI was tasked with generating parameters for an AI-driven grid strategy based on the 1-hour chart of BTC/USDT perpetual contracts on OKX, including price range, number of grids, direction (long, short, neutral), and mode (arithmetic or geometric). All strategies followed uniform constraints: an investment of 100,000 USDT and 5x leverage.

After parameter submission, all strategies were tested under a unified backtesting environment: The target was the BTC/USDT perpetual contract grid strategy on OKX, with a 15-minute K-line cycle (with possible minor deviation). The backtest period covered historical market data from July 25, 2025, to October 25, 2025. Simulations were conducted via AiCoin’s batch backtesting tool, which automatically simulates order placement and execution based on input parameters and outputs detailed trading data and performance statistics. Key metrics such as total return, ROI, win rate, maximum drawdown, and Sharpe ratio were analyzed to ensure fair and transparent comparison across all AI strategies under identical market conditions.

Strategy Parameter Analysis: The "Personality" Differences Among AIs

Comparing the core grid parameters of the six AI models reveals significant strategic differences:

The table above shows that all AIs chose arithmetic rather than geometric grid spacing, and adopted a neutral strategy—simultaneously placing buy and sell orders for arbitrage without predicting directional trends. Beyond this, there are notable differences in price ranges and grid density:

1) Ultra-high-frequency, low-margin approach represented by Grok-4 and Gemini, aiming to accumulate small profits through dense, frequent trades

Both employ the highest grid count of 50 and the smallest capital per grid. Gemini has the narrowest price interval among all strategies, making it highly sensitive to price fluctuations and targeting ultra-high-frequency arbitrage. Grok-4 combines this high density with the widest price range of 20,000 USDT, aiming for密集 order placement over a broad range. Due to small capital allocation per grid, these strategies have relatively high capital safety but require sustained high-frequency market oscillations to be effective.

2) Balanced and conservative approach from DeepSeek and Claude, using moderate grid density and capital allocation

Claude’s 10,000 USDT price range and overall configuration are moderate, representing a stable and balanced profile. DeepSeek selects the widest 20,000 USDT range, aiming for moderate-frequency trading to capture larger individual gains under expectations of high volatility.

3) Low-frequency, high-margin strategy from GPT-5, adopting an extreme "capture big moves, ignore small ones" approach

GPT-5 sets the fewest number of grids (only 10) and allocates the highest capital per grid, with the largest price interval, meaning the lowest trading frequency but potentially the highest profit per trade. This strategy sacrifices profits from minor price swings in favor of capturing large trend movements. It may achieve a higher win rate, but due to large capital per grid, it carries the highest risk of liquidation (drawdown) among all strategies if price breaks out of the set range.

4) Narrow-range, high-density strategy from Qwen3, focusing on efficient arbitrage within a limited price band

Qwen3 adopts the narrowest price range of 4,000 USDT among all models, combined with a moderate 20-grid setup, resulting in relatively small price intervals per grid. This is an extremely focused strategy designed for high-density arbitrage within a tight range, requiring very high prediction accuracy. Once price exits the predefined range, the strategy quickly becomes ineffective.

Overall Performance: Claude Leads by a Large Margin, GPT-5 Achieves Stable Success

Although AI lacks emotional interference, final results show that AI "traders" still heavily depend on their training data and model design. Comparing ROI, risk control, and win rates, the strategies diverged significantly under identical capital and leverage conditions, revealing different trade-offs made by each AI in real market scenarios (Note: Backtesting does not guarantee future performance; while AI can select favorable market conditions, actual outcomes remain uncertain):

After comprehensive evaluation of each model, who truly stands out as the "smart trader"?

1) Top Earner and Risk-Taker: Claude

Champion in Returns: Claude leads decisively with a **10.23%** return, indicating its combination of a stable price range and moderate grid count successfully captured the main market volatility, achieving the highest strategy effectiveness.

Risk and Return: It also achieves a Sharpe ratio of **370.58%**, second only to GPT-5, reflecting strong risk-adjusted returns. However, its maximum drawdown of **5.32%** indicates that its high returns come with significant floating loss volatility, showing both strong market adaptability and a certain level of aggressiveness.

2) Risk Control Master and Efficiency Model: GPT-5

Exceptional Risk Management: GPT-5 perfectly embodies the principle of "don’t try to earn every penny in the market." Its low-density grid filters out much market noise, resulting in the lowest maximum drawdown of 3.89%.

Efficient Profitability: With the highest win rate of **89.16%** and the highest Sharpe ratio of **379.02%**, GPT-5 proves the robustness and efficiency of its low-frequency, high-margin strategy. It is the best example of optimal risk-adjusted returns, demonstrating the advantage of reducing trade frequency to focus on capturing larger market moves.

3) Strategy Divergence and Challenges of High-Frequency Trading

Arbitrage Specialist: Qwen3 ranks third with an 8.06% return, performing solidly. However, its extremely narrow 4,000 USDT range strategy relies heavily on high-frequency oscillations within that band. Its maximum drawdown of 5.32%, tied with Claude, confirms its high risk concentration—once price breaks out of the narrow range, the strategy rapidly fails.

Inefficient High Frequency: Grok-4 and Gemini, despite similar 50-grid high-density setups, rank lower in returns (Grok-4 has the lowest at 5.91%). Their low win rates (~72%) and lower Sharpe ratios (Grok-4 lowest at 284.14%) suggest that excessively frequent small trades may erode profits due to transaction costs like fees and slippage, failing to deliver the expected advantages of high-frequency trading.

Stable but Unremarkable: Gemini-2.5-Pro has the second-lowest maximum drawdown (3.99%), showing stability, but average returns, positioning it as a middle-ground practitioner. DeepSeek-Chat shows balanced performance in win rate and drawdown (76.11% win rate, 4.68% drawdown), sitting between high- and low-frequency approaches.

Key Conclusion: The market validates that low-frequency, high-profit (GPT-5) and precise range-capturing (Claude) strategies outperform extreme high-frequency, low-profit (Grok-4/Gemini) ones. GPT-5 wins with superior risk control and the highest Sharpe ratio, while Claude takes the crown in absolute returns. Together, they represent two successful extremes: risk control versus aggressive gain seeking.

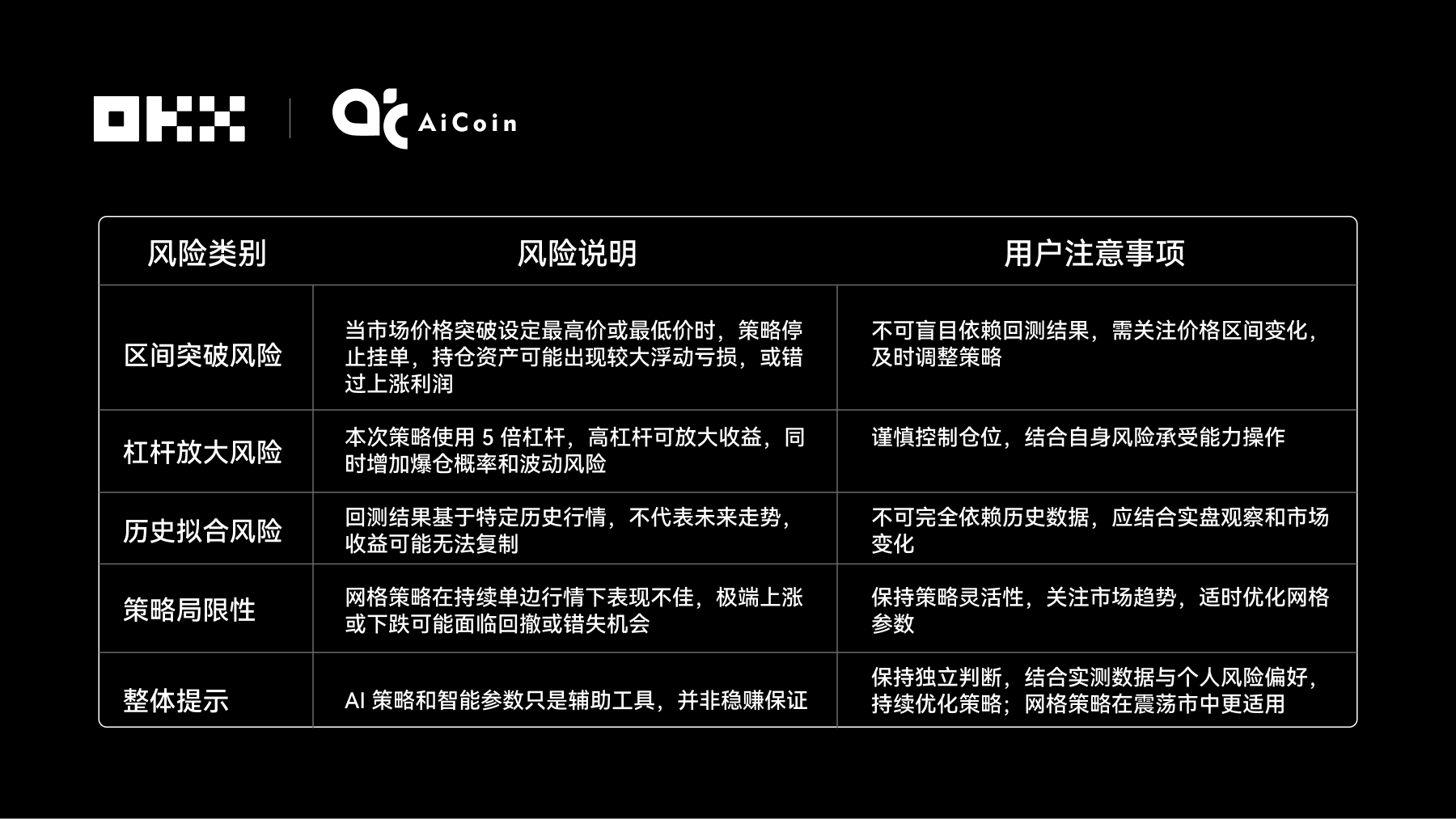

Implications and Risk Warnings for Strategy Users

This AI grid trading showdown is not just a technical demonstration but a vivid lesson in trading strategy. There is no universal strategy—only strategies suited to current market conditions. The divergent results highlight that success depends on how well a strategy matches prevailing market dynamics. GPT-5’s case clearly shows users that a good strategy must not only generate profits but also control drawdowns. When setting up grid parameters, users should prioritize high win rates and high Sharpe ratios over raw return percentages and set appropriate stop-loss levels according to their own risk tolerance.

Moreover, the combination of grid count and price range defines a strategy’s "personality," and users should select accordingly based on their assessment of the current market phase.

• Low-frequency, high-profit vs. high-frequency, low-profit: GPT-5’s low-density strategy demonstrates higher efficiency in specific market conditions by filtering noise and capturing major trends. In contrast, Grok-4/Gemini’s high-density strategies, despite frequent trading, failed to achieve top returns due to transaction costs, suggesting that high-frequency, low-profit strategies demand stricter market conditions.

• Precise Arbitrage: Both Claude’s high returns and Qwen3’s narrow-range strategy emphasize the importance of accurately identifying price ranges.

Users can combine insights from this evaluation with OKX platform features for rational parameter tuning:

• Beginners or conservative traders: Consider GPT-5’s low-density, high-capital-per-grid approach to pursue stability, reduce trading frequency, and minimize psychological stress.

• Experienced or return-seeking traders: Follow Claude’s approach—after accurately forecasting market range, use a moderate-density grid to amplify returns, but prepare for larger volatility.

• Use AI tools for decision support and parameter tuning: AI-generated parameters are optimized based on historical backtesting. Users can reference the AI strategy design logic provided in OKX’s strategy trading features, but must ultimately adjust dynamically based on their own judgment of coin trends and volatility—for example, narrowing the range or reducing grids during strong directional moves, or expanding the range to capture bigger trends.

• Do not allocate all funds to a single strategy; diversify assets and instruments: Use OKX’s "take-profit/stop-loss" functions or periodically close positions to lock in gains, and set stop-loss orders outside the grid range to mitigate losses during sharp trend reversals.

Final preview: Beyond backtesting data, we are continuously collecting live performance data for the six AI models on the OKX BTC perpetual contract grid strategy. Stay tuned to official updates from OKX and AiCoin!

Disclaimer:

This article is for informational purposes only. It represents the author’s views and does not reflect the position of OKX. This article is not intended to provide (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of the information provided. Holding digital assets (including stablecoins and NFTs) involves high risk and values may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For your specific circumstances, please consult your legal/tax/investment professional. You are solely responsible for understanding and complying with applicable local laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News