99% of People Don't Understand: The Crypto World Is Actually Divided into Two Types

TechFlow Selected TechFlow Selected

99% of People Don't Understand: The Crypto World Is Actually Divided into Two Types

From perpetual contract tokens to privacy tokens, now it's AI tokens.

By: Yash

Translation: AididiaoJP, Foresight News

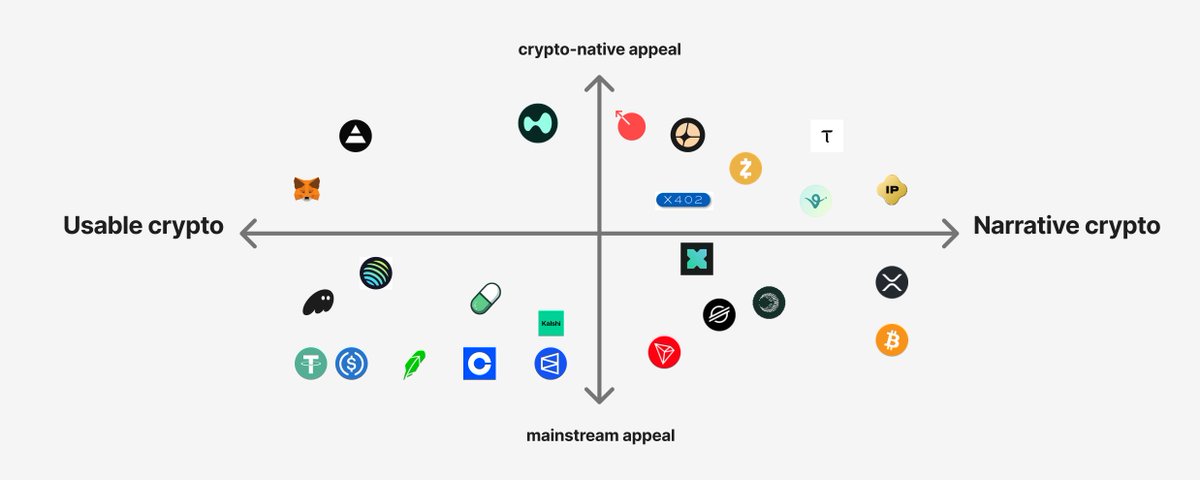

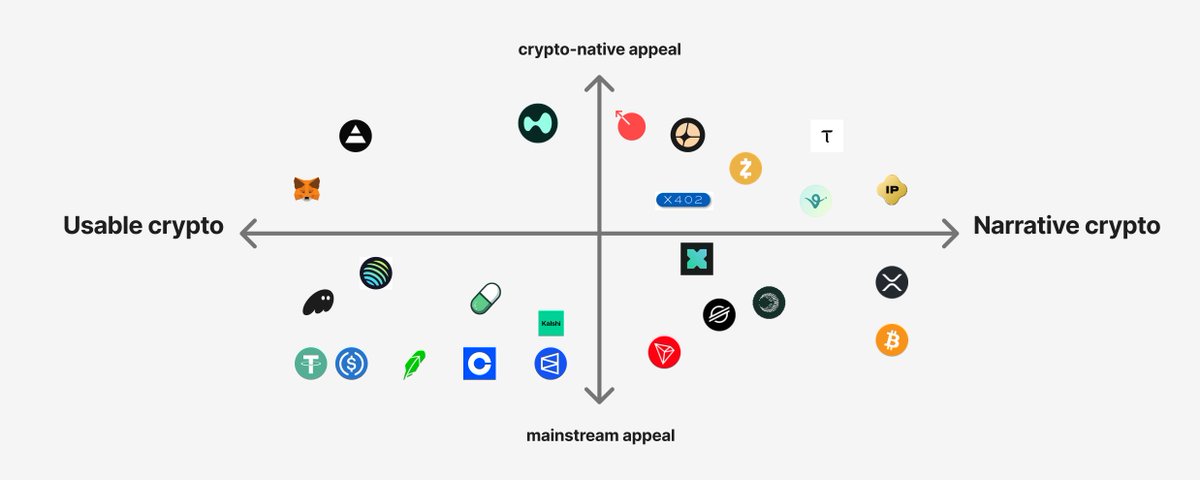

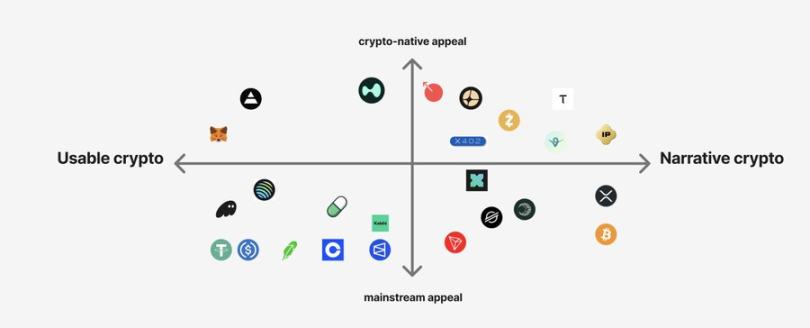

I once thought the crypto world was a complete system, but recently my perspective has shifted. I now view the crypto world from a builder's standpoint as two main domains:

-

Narrative-driven crypto

-

Utility-driven crypto

I'll explain how to accurately understand them and how to build projects and earn money from each.

Utility-Driven Crypto

These are typically "the best businesses":

-

Wallets (@Phantom, @MetaMask)

-

Stablecoins (USDT, USDC)

-

Exchanges (@HyperliquidX, @Raydium, @JupiterExchange)

-

Launch platforms (@pumpdotfun)

-

Bots and trading terminals (@AxiomExchange)

-

DeFi (@aave, @kamino, @LidoFinance)

These projects have real-world use cases and generate massive revenue.

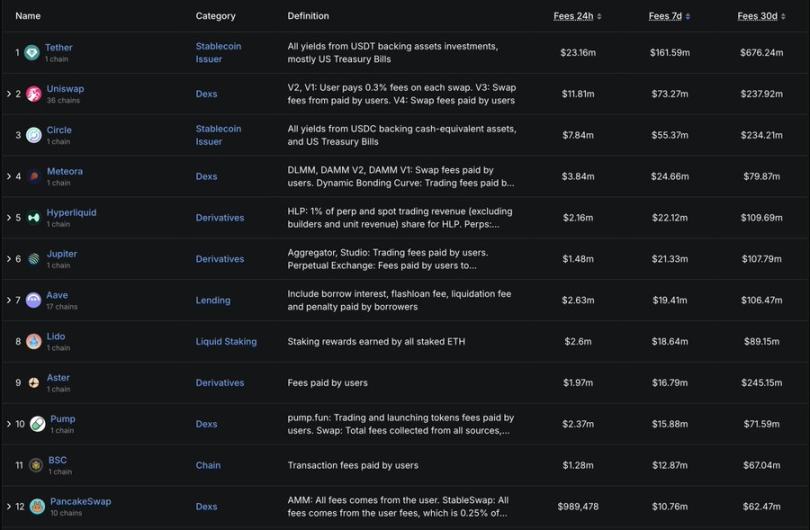

Highest fee-generating projects in crypto

Narrative-Driven Crypto:

Usually features a strong story and vision (valued over $100 billion), powerful enough to change the world:

-

Bitcoin (digital gold narrative)

-

AI x Crypto (most GPU infrastructure and agent frameworks)

-

DeSci or IP-related (Story Protocol)

-

Newer L1/L2s (e.g., stablecoin L1 or perpetuals L2)

-

Privacy (@Zcash)

-

Restaking and any infrastructure

-

x402

It generates almost no revenue, but due to the compelling story attracting institutions and retail investors, the token price rises.

Now, narrative-driven and utility-driven crypto are not mutually exclusive.

Consider this:

People do actually use Zcash (5-10 thousand transactions per day), but it currently has a very strong privacy narrative, hence higher attention. And such attention could eventually drive its utility.

Likewise, @CoinbaseDev's x402 has almost no usage yet, but it’s a hot topic recently and will surely drive more awareness and usage through speculation.

Zcash daily transaction count (Source: bitinfocharts.com)

Both are equally important because they reinforce each other:

Narrative-driven crypto drives → speculation, speculation drives → adoption of utility-driven crypto

In utility-driven crypto, your product (users) is king; in narrative-driven crypto, your community is king.

The Builder's Dilemma

Every builder faces this dilemma: whether to build for narrative-driven or utility-driven crypto.

A rule of thumb:

If you're good at the attention game and have enough influence to start a movement, you should build for narrative-driven crypto.

For example, if you're skilled in tokenomics games (and CEX listings / inner circles), you should focus on building grand narratives and visions.

Of course, with enough momentum, it can also become genuinely useful. For instance, blockchains like Solana—capital did attract talent, making these chains useful.

If you want to own a billion-dollar-plus narrative, you must think from first principles about what unique things can be built using the crypto tech stack.

Is the vision compelling enough that, if successful, it could capture a market worth over $100 billion? Is it exciting enough to spark retail hype?

For example, Plasma had a trillion-dollar stablecoin market narrative, enabling its token generation event at a $14 billion valuation despite lacking actual usage.

If you're skilled at product building, you should build for utility-driven crypto—solve a niche problem (e.g., Axiom serving Memecoin traders, or a DeFi protocol).

Utility-driven crypto is about building; traders or crypto-native users directly demand things via terminals/exchanges.

It doesn't necessarily exist only to fuel speculation—these same products can have non-speculative use cases. For example, stablecoins used for payments.

Narrative still matters here—for Polymarket, the narrative is prediction markets. Because narratives attract users, treat narrative as marketing.

Of course, you can eventually do both, but it's better to start by focusing on one. Identifying your strengths is difficult—you must find your edge.

For Traders

You must always bet on the narrative.

Bet on what you believe will be the most forward-looking narrative in the coming weeks, months, or years.

Everyone trading tokens plays the "attention arbitrage" game—buying things gaining attention, selling things that have already peaked. For example, rotating from perpetuals tokens to privacy tokens, now to AI tokens.

For a specific narrative, you must bet on teams you believe will gain attention and become alpha and beta plays. If they succeed, your bet takes off.

Summary:

Both utility-driven and narrative-driven crypto are crucial aspects of the space.

As a builder, always start by choosing one and excel deeply in either narrative or utility. Once you master one, you can expand into the other—that’s the end goal.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News