When the tide goes out: who is "swimming naked"?

TechFlow Selected TechFlow Selected

When the tide goes out: who is "swimming naked"?

From the acquisition fate of Clanker and Padre.

Written by: mary in sf

Translated by: AididiaoJP, Foresight News

In the short term, the market is a voting machine, but in the long term, it is a weighing machine—Benjamin Graham.

We are now in a phase of industry consolidation, and everyone can see who’s been swimming naked.

Liquidity has been declining for some time, but on October 10, it dramatically vanished altogether. "Death of a Salesman" serves as a striking metaphor for this moment in crypto history. The play centers on the corrosive illusion of the American Dream, the fragility of familial bonds, and the psychological cost of societal expectations—each mirroring the illusions of superstructures, the vulnerability of real-world crypto companies, and the emotional toll borne by market participants burned by one token after another.

Now that we’ve woken up from the fantasy of what crypto could be—as sold to us in 2021—we speculators are left cleaning up the mess instead of confronting what crypto actually is in reality.

Last year, I read "Built to Last," a book about what distinguishes visionary, enduring companies from ordinary ones. The authors go into detail about the dot-com bubble, with one key insight being that during every innovation cycle, the public speculates on [new mysterious technology], but what truly separates good from great is the people behind each company. Tokens that lack clearly codified legal rights for holders are somewhat worthless—but recent weeks have revealed which tokens are backed by teams that care about their long-term survival, and which are short-term plays with no real plan all along.

For all those rhetorical questions we've treated more like memes until now, this is a moment of reckoning:

-

Where does value accrue?

-

If value accrues to equity entities, why buy the token?

-

Are all tokens just memecoins then?

Here’s my mental framework for tokens I believe will endure in the future:

-

Bitcoin

-

Revenue-backed: e.g., Hyperliquid

-

Social capital, attention tokens

This piece will lean more observational than my previous analytical writing, because while I find this interesting, I don’t have time to dive as deep as zachxbt might.

Acquisitions

This week gave us two examples of token acquisitions: one where the token went up (Clanker), and one where it went down (Padre).

Clanker

Yesterday, @farcaster_xyz announced the acquisition of Clanker. Clanker is a token launch platform on Base built by a strong team, whose corresponding token launched roughly a year ago:

-

Protocol fees will be used to buy and hold $CLANKER

-

The Clanker team burned tokens collected as protocol fees across product versions v0 to v3.1.

-

The team permanently locked approximately 7% of total $CLANKER supply into a one-sided liquidity pool to provide additional liquidity (reducing circulating supply).

The token subsequently rose, as it became clear the Clanker team treated their token like equity in their deal with Farcaster.

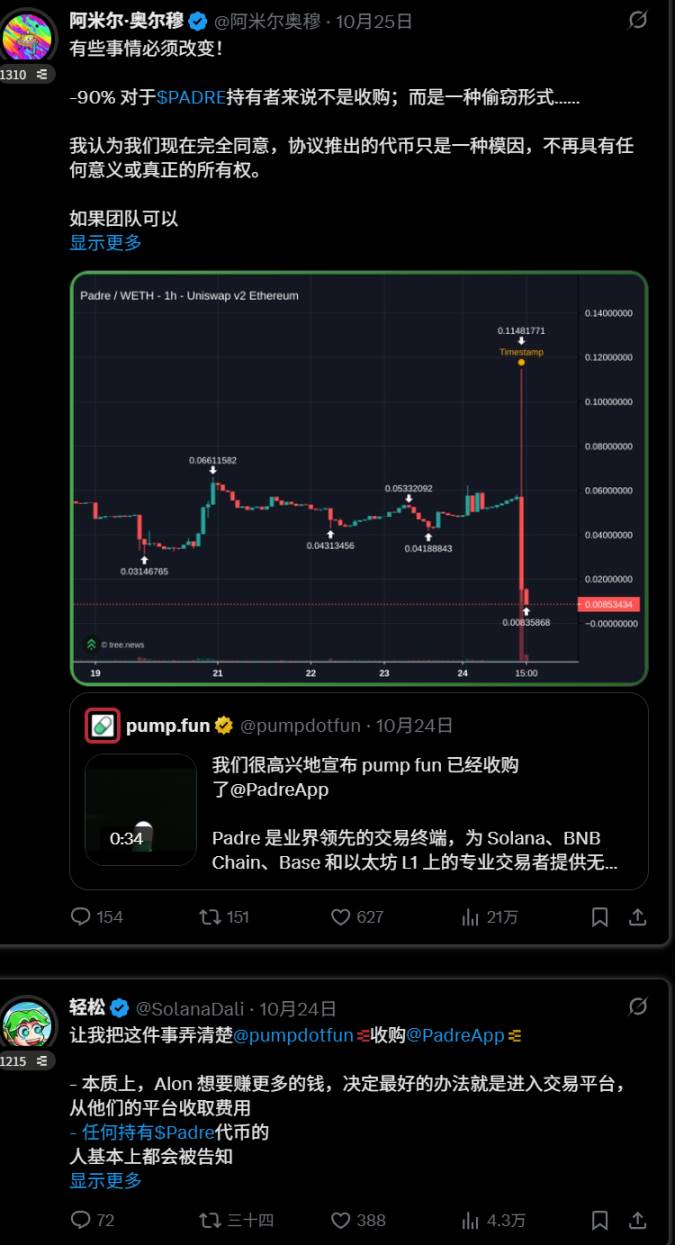

Padre

The market rarely gives you an experiment without confounding variables. Both Clanker and Padre were seemingly revenue-generating products. See what happens to a token when a team fails to act.

The team raised funds on an ICO-like platform, promising buybacks and revenue sharing, then failed to deliver. Instead, they kept all profits, occasionally hinting at reviving buybacks and revenue sharing, while their token continued trading. Now that Padre has been acquired, token holders received nothing—the token was revealed as worthless.

Ironfish

If someone has time to explain the details of this acquisition to me, I’d love to know. As far as I understand, the token is still trading because the network remains maintained by the Iron Fish Foundation, while the core team was effectively acquired/hired by Base. It feels a bit odd seeing the former founder tweeting about price movements. Does this mean Base acquired the Labs entity? Did they purchase any amount of the token?

Collapses

Eclipse and Kadena

These companies surfacing scandals just as other blockchains approach their TGEs and mainnet launches serve as a stark reminder: not all blockchains are sound structures. In fact, they remind us that blockchains trade on trust in their potential, and team strength and conviction are critical indicators.

I won’t dwell on Eclipse’s token price or further tweets, but I do find this somewhat laughable. Eclipse was doomed from the start because its intent was never to operate a blockchain with a long-term vision—it was always about extracting liquidity.

The crypto world has many different circles. Our little corner of crypto Twitter has long known Kadena was never a functioning blockchain. Employees from various companies have told me their organization lacked viable products, merely existing in suspended animation until the music stopped.

This is a particularly rough and disheartening period for the crypto space. We need better rights protection for token holders and more small-cap productive assets.

I find that if you view crypto simply as accelerated economic experimentation, it becomes slightly less depressing—but the downside is that believers who placed faith in the wrong teams lose significant money.

What does it say about decentralized technology when it remains so dependent on trusted teams? Up only.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News