15 Billion Vanished Overnight, the Sky Fell for Black Market "Local Tyrants"

TechFlow Selected TechFlow Selected

15 Billion Vanished Overnight, the Sky Fell for Black Market "Local Tyrants"

Build the tower, host the banquet, the tower collapses.

By Jin Cuodao

The Southeast Asian online fraud empire is collapsing at an accelerating pace.

On October 9, the de facto leader of the Wei family—one of Myanmar's former "Four Great Families"—and his criminal gang were formally indicted in Fujian.

Not only were the fraud amounts staggering, but their methods were exceptionally brutal. For instance, as reported in news outlets, if someone wanted to become sworn brothers with them, they had to randomly abduct a stranger and kill them as a sacrificial ritual—purely for ceremonial effect.

Yet compared to the man we're about to discuss, the so-called "Four Great Families" of northern Myanmar are mere amateurs.

This man is Chen Zhi—a business tycoon born in Fujian who holds dual British and Cambodian citizenship.

He once publicly claimed that his businesses generate $30 million in revenue per day.

Even more astonishingly, when a fellow villager once flattered him as the true "richest person in China," he accepted it without hesitation. In his hometown, it’s commonly said that his net worth exceeds 300 billion yuan.

Though this may sound like exaggeration, Chen Zhi's power is undeniable. Recently, the U.S. government cracked down on Chen Zhi’s criminal activities, seizing approximately 127,000 bitcoins on October 14—worth around $15 billion (over 100 billion yuan).

The U.S. Department of Justice called it the largest seizure in its history.

The UK government also followed suit, freezing all his assets there—including an office building in central London valued at nearly £100 million.

Chen Zhi, who didn’t even finish middle school, proves exceptionally sharp at making (or scamming) money.

From Internet Cafe Attendant to the "Crown Prince of Fraud"

If he hadn't worked as an internet cafe attendant back then, Chen Zhi might still be just an ordinary nobody today.

According to classmates and neighbors from his hometown, young Chen Zhi was unremarkable in appearance, short in stature, and average in academics—likely dropping out after the second year of junior high.

His life story seemed utterly ordinary, except for one thing: Chen Zhi possessed an extraordinary nose for business—albeit not legitimate business.

While working as an internet cafe attendant, Chen Zhi quickly recognized the profit potential of "private game servers"—unauthorized pirated game servers where players could pay real money to buy in-game items or currency.

At the time, the South Korean-developed game *Legend* was wildly popular in China. He even created a dedicated portal listing private server addresses. Other operators wanting traffic had to pay him for advertising space.

Bigger waves bring bigger fish—but also higher risks of capsizing.

The Korean game company finally reported the operation to Chinese police, leading to a crackdown that wiped out the entire gray-market server industry. Chen Zhi immediately pivoted—to the next big wave: online fraud.

Around 2005 marked the first peak of telecom fraud in China, evolving from early "lottery win scams" and "scratch cards" to more sophisticated schemes like "impersonating officials," "hostage blackmail," and "fake e-commerce." Chen Zhi kept up with these trends and quickly mastered every new scam technique.

Later, as mainland China intensified its anti-fraud campaigns, he lost his footing domestically and was forced to relocate.

In 2009, at age 22, he moved to Cambodia—where he finally found room to "spread his wings."

Especially in 2014, when Cambodia issued its *Royal Decree on Commercial Gambling Management*, legalizing casinos and online gambling, and subsequently granted 169 gambling licenses—Chen Zhi secured one of them.

In 2015, Chen Zhi founded the "Crown Prince Group," operating both legally and illegally. On one hand, he entered real estate, microloans, tourism, and leisure; on the other, he expanded into online gambling and "pig-butchering" scams, while also establishing industrial parks and collecting rent.

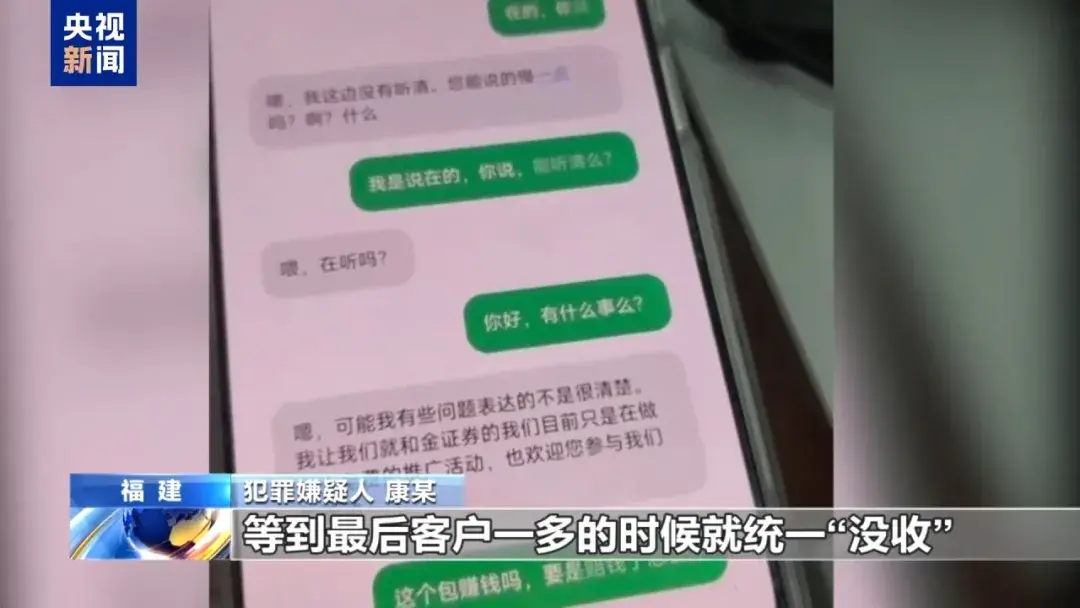

For example, court documents describe how members of Chen Zhi’s network set up so-called "phone farms," with just two locations housing 1,250 phones and controlling about 76,000 social media accounts.

To help employees build trust with victims, internal guidelines advised against using photos of "overly attractive" women as profile pictures, to appear more authentic.

In Cambodia, Chen Zhi thrived, living extravagantly—owning private jets was basic, and he purchased a Picasso painting from a New York auction house. A TikTok influencer even claimed Chen Zhi gave her 20 million yuan monthly as pocket money.

Chen Zhi’s unorthodox business instincts found increasingly fertile ground.

From Outlaw to "Cambodian Duke"

Operating in both legal and illegal spheres often means intertwining with political power.

The once-powerful "Four Great Families" of northern Myanmar were exactly like this. Publicly, they served the state and protected border security; privately, they used state machinery to protect family interests.

The Wei family mentioned earlier had clear divisions: the second son in politics, the third in the military, and the children handling business.

In countries where connections determine everything, business acumen matters less than understanding the local political survival rules.

Chen Zhi’s success in Cambodia similarly relied on powerful patrons.

For instance, he co-founded the "Golden Bay" company with Sok Sophorn, son of Sok An—the then Deputy Prime Minister and Minister of Interior. This company oversaw most of Chen Zhi’s "parks" and casinos.

He also maintained close ties with Hun Duea, nephew of Cambodian Prime Minister Hun Sen, enabling Chen Zhi’s "Crown Prince Bank" to obtain an official banking license and enter Cambodia’s financial sector.

When Hun Sen visited Cuba in 2022, he invited Chen Zhi to participate in bilateral talks, helping him secure a 25% stake in Havana Cigar Company. That same year, Hun Sen met Chen Zhi at Peace Palace, stating: "We will work together to build a better future."

In return, Chen Zhi engaged in extensive charity work in Cambodia, such as producing public service films, setting up scholarships, and providing jobs for people with disabilities. During the pandemic, he even funded Cambodia’s vaccine purchases.

Eventually, Chen Zhi earned not only elite approval but also an honorary title of "Duke."

His group grew so powerful that it was dubbed a "shadow government," with risk resilience far beyond typical online fraudsters.

In August 2019, under international pressure, Cambodia announced it would no longer tolerate unchecked growth of its gambling industry—most notably banning all forms of "online gambling." Official reports stated that within months, as many as 447,000 Chinese nationals had left the country.

Thanks to his strong political backing, Chen Zhi’s operations were affected but remained deeply entrenched and highly profitable.

First, using his legally obtained casino licenses, he used casinos, hotels, and nightclubs as cover to continue "pig-butchering" operations. His parks began hosting numerous fraud gangs. According to prior media reports, his largest parks housed between 5,000 and 10,000 people, with one park registering over 700,000 fraud accounts.

Second, laundering illicit funds became easy—through global asset acquisitions and shell companies, such as 19 properties in the UK, two listed companies, and a 25% stake in Havana Cigar Company.

Additionally, according to U.S. investigations, Chen Zhi’s criminal empire operated through over 100 shell companies. To the uninformed, his "Crown Prince Group" might easily appear as a powerful multinational corporation.

From Traditional Scams to Tech-Driven Crime

In terms of wealth and influence, Chen Zhi may be titled "Crown Prince," but in reality functions as a "local emperor."

Such dominance wasn’t achieved solely through traditional fraud.

Traditional scams primarily target Chinese victims—perpetrators know the playbook well, including how much savings an average Chinese household might have. As reported, Chinese workers trapped in scam compounds must pay ransoms of hundreds of thousands of yuan just to be allowed to go home.

As anti-fraud awareness grows in China, many in Chen Zhi’s parks have shifted their "pig-butchering" scams to target South Koreans, Europeans, and Americans.

This explains why he drew heavy retaliation from the United States. Over recent years, U.S. citizens have lost over $16.6 billion to online investment scams. In 2024 alone, Southeast Asian fraud schemes caused over $10 billion in losses—an increase of 66% year-on-year. The U.S. needed a high-profile target—and Chen Zhi was the perfect candidate.

U.S. prosecutors stated that the scale and cruelty of his operations far exceed any previously exposed Southeast Asian "pig-butchering" groups.

Another key difference from traditional fraud: Chen Zhi heavily leveraged technology.

As the saying goes: "Thugs aren’t scary—it’s thugs with education that are dangerous."

Cryptocurrencies, artificial intelligence, and instant cross-border payments—technologies that average people struggle to use or haven’t even adopted—are already standard tools for many criminals.

Chainalysis data shows criminal proceeds growing at an astonishing rate of nearly 25% annually. In 2024, cryptocurrency-related fraud generated at least $9.9 billion in revenue, averaging 24% annual growth since 2020. "Pig-butchering" scams increased by 40%, with deposits into fraud platforms surging 210%.

With his keen business sense, Chen Zhi naturally seized on these fast-profit trends.

As early as before 2020, Chen Zhi established a mining company—LuBianMining. At its peak, LuBian controlled about 6% of global Bitcoin mining hashrate. Thus, among the 120,000 Bitcoins seized from Chen Zhi, some were laundered illicit gains, while others were legitimately mined by himself...

No wonder U.S. prosecutors described Chen Zhi’s criminal network as a "fusion of modern slavery and high-tech fraud."

He had the awareness to use technology to accumulate wealth, but not the capability to use it to protect that wealth. Even cryptocurrencies offer no secrecy against overwhelming force.

Just before Chen Zhi’s Bitcoin was seized, another Chinese national, Qian Zhimin, admitted in a UK trial to money laundering charges.

Between 2014 and 2017, she illegally raised hundreds of billions of yuan in China before fleeing overseas. Similarly, she used Bitcoin’s anonymity and cross-border transfer features to convert illicit funds into cryptocurrency. But over the past few years, her digital wallet was fully seized—containing over 61,000 Bitcoins.

Trying to exploit technology for massive profits while relying on it to conceal crimes is nothing but greed swallowing one whole—collapse was inevitable.

Technology was never meant for fraud.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News