Hotcoin Research | "10·11" Night of Panic: Reviewing the Causes, Transmission, Impact, and Outlook from Boom to Collapse

TechFlow Selected TechFlow Selected

Hotcoin Research | "10·11" Night of Panic: Reviewing the Causes, Transmission, Impact, and Outlook from Boom to Collapse

This article will provide an in-depth analysis of the background causes and transmission mechanisms of this sharp decline, the USDe de-pegging incident, impact assessment, and offer predictions and outlook for the subsequent market trends in the fourth quarter of 2025.

Author: Hotcoin Research

1. Introduction

In the early hours of October 11, the cryptocurrency market experienced a "night of terror." Within just an hour and a half, mainstream cryptocurrencies such as Bitcoin plunged double digits in value within minutes, altcoins collapsed rapidly, and total liquidations over 24 hours reached a staggering $19.3 billion—setting a record for the largest single-day liquidation in crypto history.

Beneath the surface prosperity of a bull market cycle lies a bubble built on excessive leverage, circular borrowing, and layered derivatives—all planting the seeds for disaster. A single macro-level black swan event is enough to trigger systemic risk across the entire system. When prices collapse, leveraged positions cascade into liquidation, and liquidity evaporates instantly, what we witness is not only a chain reaction of panic but also a life-or-death test of the clearing system under extreme stress.

What exactly caused this "October 11 flash crash"? What risks and vulnerabilities did it expose? And what impact and lessons has it delivered to the market? This article provides an in-depth analysis of the background, transmission mechanisms, the USDe de-pegging incident, impact assessment, and offers predictions and outlooks for the crypto market in Q4 2025.

2. Background and Causes Behind the Crash

2.1 Trigger: Macro Black Swan Strikes the Market

The direct trigger of this sharp decline was a macro-level black swan—the unexpected announcement by U.S. President Trump imposing a new 100% tariff on Chinese goods. On the evening of October 10, Trump threatened via social media to implement a fresh round of tariff policies, abruptly escalating tensions in Sino-U.S. trade relations. The news dramatically heightened global investor risk aversion, prompting capital to flee into safe-haven assets like the U.S. dollar and Treasury bonds. Since the announcement came after Friday’s traditional stock market close, high-risk assets like cryptocurrencies were the first to face massive sell-offs.

Psychological factors cannot be overlooked either. Market concerns over a slowing global economy and intensifying trade wars further weakened already fragile investor confidence. Fear tends to reinforce itself, creating a vicious cycle of selling, falling prices, and more selling. Additionally, the timing was particularly unfavorable—occurring late Friday (early Saturday in Asia), when most institutional traders in both Western and Asian markets had already left work or reduced positions for the weekend. The combination of low liquidity and sudden negative news laid the groundwork for the subsequent flash crash.

2.2 Leverage Bubble: Dominoes Under False Prosperity

Trump's tariff threat was merely the surface spark; the true underlying cause of the market collapse was the accumulation of a high-leverage bubble and hidden risks over recent months.

In the second half of 2025, mainstream cryptocurrencies like Bitcoin and Ethereum repeatedly hit new highs, seemingly thriving. However, analysis suggests that much of this apparent growth wasn't driven by long-term spot buying, but rather speculative capital fueled by leveraged contracts, circular lending, and yield farming. Amid bullish sentiment, traders increasingly used leverage to bet on rising prices, causing risk exposure among crypto hedge funds and institutional investors to climb rapidly. As prices rose, actual market leverage increased silently, masked by the illusion of prosperity.

This leverage-fueled boom backfired when negative news hit: the initial price drop triggered by the news directly impacted highly leveraged long positions. A large number of leveraged longs breached their margin thresholds and were forcibly liquidated. These forced sales further drove down prices, triggering even more long-position liquidations. The selling pressure snowballed, and the hidden web of high-leverage longs fell like dominoes, culminating in a cascading avalanche effect.

2.3 Structural Market Flaws: Fragile Liquidity and Market Maker Withdrawal

The flash crash exposed structural weaknesses in the crypto market’s liquidity provision—market makers unable to handle extreme scenarios and severely inadequate liquidity for tail assets. When shocks occur, these flaws cause certain asset prices to plummet almost freely.

Currently, active market makers (MMs) are the primary liquidity providers in the crypto market. They tend to allocate most of their capital toward major assets like BTC and ETH, offering only limited support to mid-to-long-tail altcoins. Under normal conditions, this suffices for everyday trading volatility, but during extreme events, they lack the capacity to stabilize the market. Moreover, with a surge of new projects this year, the number of small-cap tokens has exploded, while market makers’ capital and attention have not grown proportionally. In other words, market depth for tail assets is extremely fragile.

Source:https://x.com/yq_acc/status/1977838432169938955

During the October 11 crash, when macro headwinds ignited panic, market makers prioritized protecting themselves by preserving liquidity for major coins. They urgently pulled capital previously allocated to small-cap tokens to stabilize large-cap assets like BTC and ETH. As a result, minor coin markets instantly lost their primary counterparty. Massive sell orders crashed down with no buyers to absorb them, leading to near-freefall price drops. Multiple tokens plunged 80–95% within seconds. The IoT token IOTX nearly dropped to zero, while TUT and DEXE briefly showed 99% declines, losing all bid support. This serves as a warning: the spreads and depths seen during normal times can vanish in moments during storms, and tail risks ignored in calm periods can tear markets apart during crises.

3. Analysis of the Flash Crash Transmission Mechanism

As prices began to fall rapidly on the morning of October 11, internal microstructural issues in the crypto market amplified the downturn. Initial declines triggered cascading liquidations, compounded by a collapse in liquidity supply—forming the core transmission mechanism behind the flash crash.

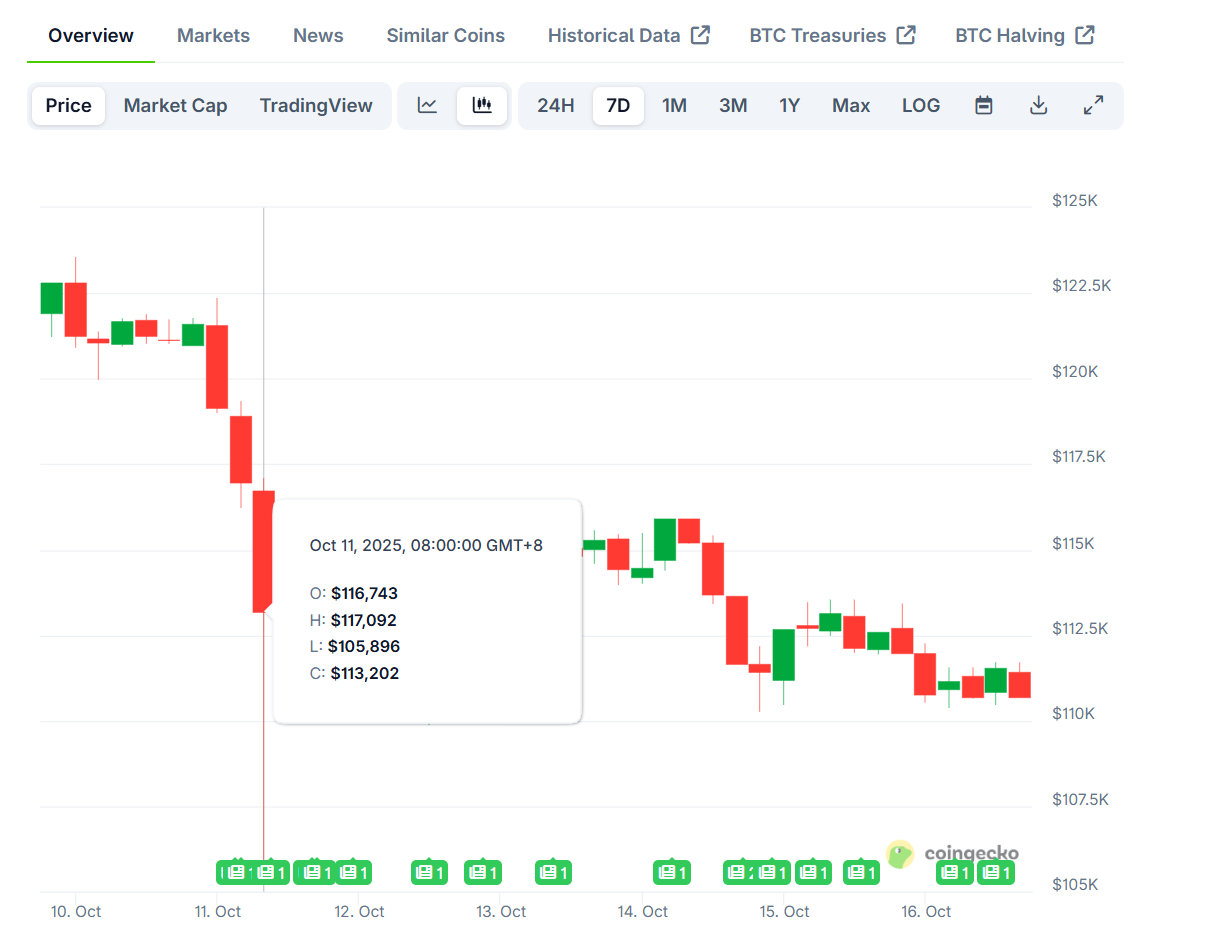

Source:https://www.coingecko.com/en/coins/bitcoin

Phase One (~5:00 AM): Following the tariff news, Bitcoin began declining from around $119,000. Trading volume increased during this phase but remained within normal ranges. Markets operated orderly, with market makers maintaining standard bid-ask spreads. Major coins declined gradually, and some highly leveraged longs started getting liquidated, though the impact was relatively contained.

Phase Two (~5:20 AM): About 20 minutes later, the market suddenly entered a liquidation waterfall. Altcoin declines accelerated sharply, with numerous mid- and small-cap tokens crashing within minutes, triggering another wave of forced liquidations. Observations show that overall trading volume spiked to ten times normal levels. More dangerously, key market makers appeared to begin rapidly pulling orders to protect themselves, leaving many trading pairs without bid support. During this phase, market liquidity contracted significantly, and sell-side pressure went largely unmatched.

Phase Three (~5:43 AM): Approximately 23 minutes after the first wave of liquidations, a dramatic de-pegging event unfolded on Binance. Three specific assets on Binance—USDe, WBETH, and BNSOL—plummeted in price almost simultaneously:

-

The stablecoin USDe crashed from $1 to ~$0.6567, a 34% drop. Meanwhile, on other exchanges, USDe remained above $0.90, showing no such extreme de-pegging.

-

WBETH (Binance’s staked Ether) experienced a cliff-like drop, plunging 88.7% from ~$3,800 to just ~$430.

-

BNSOL (Binance’s version of SOL) similarly collapsed, falling 82.5% from ~$200 to a low of $34.9.

This moment marked the full breakdown of market structure—bid-side liquidity on Binance neared complete exhaustion, price discovery failed, and even stablecoins and pegged assets were trampled.

Final Phase (~6:30 AM): With major assets de-pegging and market makers fully withdrawing, the market descended into chaos around 6:30 AM. Prices swung wildly amid panic, and cumulative forced liquidations surged. By 9:00 AM, 24-hour liquidations exceeded $192 billion, with approximately 1.64 million positions forcibly closed. The largest single liquidation exceeded $200 million. From news release to market collapse, the entire process took only about 90 minutes.

4. The USDe Stablecoin De-Pegging Incident

A notable episode during this crash was the de-pegging of USDe, a new synthetic USD stablecoin. However, this deviation was not a typical systemic failure of a stablecoin, but rather a case of price dislocation due to localized exchange liquidity drying up.

USDe is a synthetic dollar asset launched by Ethena, designed to maintain a 1:1 peg to the U.S. dollar using a delta-neutral hedging strategy combining spot holdings and perpetual futures ("long spot + short perps"). It is essentially an over-collateralized stablecoin: users must provide sufficient collateral to mint USDe, and the protocol hedges price fluctuations by holding spot assets and shorting futures. Under normal conditions, USDe can be stably exchanged in on-chain liquidity pools (e.g., Curve, Uniswap), supported by minting and redemption mechanisms that ensure price stability. Prior to the crash, USDe had a circulating supply of about $9 billion and remained over-collateralized.

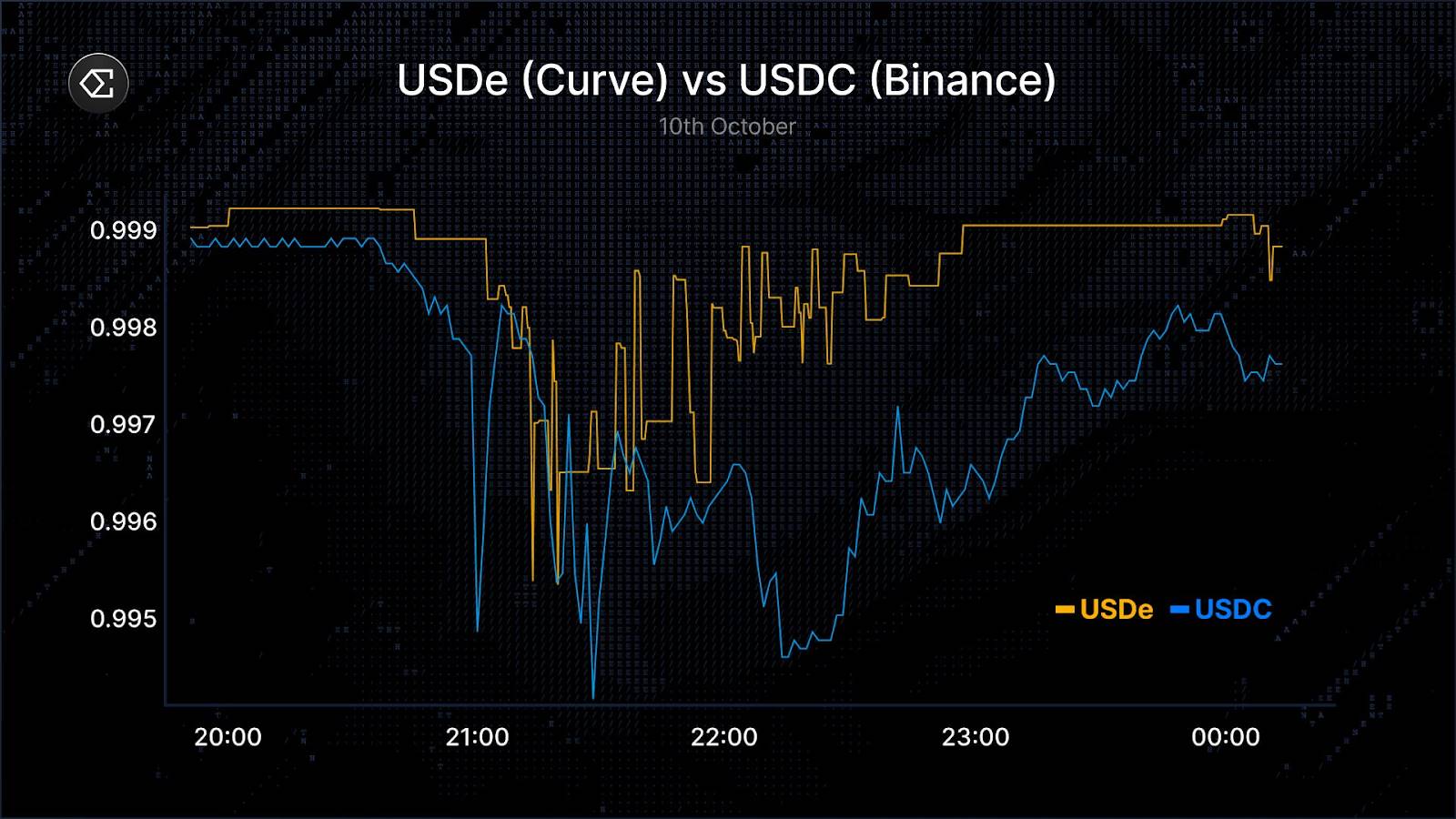

During the market turmoil, the USDe/USDT trading pair on Binance saw an abnormal plunge, with USDe briefly dropping to ~$0.6567. However, at nearly the same time, USDe held steady on other major platforms—including decentralized pools like Curve and the exchange Bybit. On Curve, the spread between USDe and other stablecoins was less than 1%; on Bybit, USDe dipped only to ~$0.92. Clearly, this was not a systemic loss of peg by the USDe protocol, but a localized issue confined to Binance.

Source:https://x.com/gdog97_/

Two main factors contributed to the plunge in USDe price on Binance:

-

Liquidity Shortage and Infrastructure Deficiencies: Binance is not a primary trading venue for USDe. Its platform liquidity for USDe is only in the tens of millions of dollars, far shallower than venues like Curve, which have pools exceeding $100 million. Normally, professional market makers arbitrage across platforms using USDe’s mint/redeem mechanism to keep prices aligned. But Binance lacked a direct redemption channel with the Ethena team, and during the crisis, deposits and withdrawals faced temporary disruptions. When Binance’s infrastructure buckled under stress, price deviations could not be corrected by external liquidity. Bid-side support for USDe quickly dried up, allowing sell orders to drive the price below its peg.

-

Risk Control and Oracle Design Issues: Binance uses a unified margin account system where different assets share the same margin pool. When USDe’s price plummeted, accounts using USDe as collateral were instantly liquidated, further increasing selling pressure—an恶性 cycle. Furthermore, Binance used its own shallow order book price as the oracle input for USDe instead of referencing deeper external markets like Curve. This caused the mark price of USDe to crash, triggering automatic deleveraging and cascading liquidations, exaggerating the price drop.

-

High-Leverage Risks from Circular Lending: Binance offered high-yield USDe wealth management products (12% annualized), encouraging users to engage in circular borrowing and interest arbitrage. This led to widespread leveraged lending using USDe, hiding up to 10x leverage exposure. Many traders also used USDe as general-purpose margin, resulting in high concentration of collateral.

In summary, the extreme movement of USDe on Binance was merely a false appearance of de-pegging. In reality, throughout the incident, USDe’s protocol maintained healthy over-collateralization, and its redemption mechanism functioned normally. During the flash crash on Binance, market participants quickly redeemed USDe, reducing its supply from ~$9 billion to ~$6 billion—without any death spirals or bank runs.

This event served as a wake-up call for both exchanges and stablecoin issuers: balancing transparency and security is critical. On one hand, Ethena’s transparent data and open mechanisms preserved market confidence. On the other, exchanges need to improve risk models—especially for assets where they are not the primary trading venue—by adopting more robust oracle sources or limiting unreasonable forced liquidations during extreme volatility. Binance acted swiftly post-event: updating the pricing mechanisms for WBETH and BNSOL originally scheduled for October 14 to October 11, and compensating affected users with nearly $400 million in losses. These measures helped calm market skepticism, but also highlighted the fragility of centralized platforms during crises. In contrast, decentralized platforms like Curve provided deeper liquidity, and protocols like Aave executed automated liquidations smoothly, demonstrating DeFi’s resilience during extreme volatility.

5. Impact Assessment: Aftermath, Damage, and Opportunities for Reform

Such a violent market shift will take weeks to fully digest, but several broad impacts are already evident:

1. Loss of Confidence in the Altcoin Season: This event created clear "winners" and "losers." Investors, funds, and even market makers suffering heavy losses will inevitably see shaken confidence and impaired capacity. Some crypto hedge funds may face liquidation or severe losses. Arthur, founder of DeFiance Capital, admitted his fund incurred losses but noted they “didn’t rank among the top five volatile days in history,” remaining manageable. He also stated bluntly that this crash set the entire crypto space back significantly—especially hurting the altcoin market, as most altcoin price discovery relies on offshore centralized exchanges. This could prompt professional capital to reduce altcoin exposure and shift toward more reliable investment targets. In the short term, the altcoin sector may remain depressed, and pessimistic views like “the altseason may never come” are now spreading.

2. Exchange Responses and Improvements: The incident damaged Binance’s reputation and forced platform introspection and upgrades.

-

Compensating Users: Beyond reimbursing user losses, Binance quickly completed the switch to new pricing systems for WBETH/BNSOL to prevent similar pegging loopholes.

-

Expanding Insurance Funds: Exchanges like Binance may accelerate plans to expand insurance fund sizes to better withstand extreme volatility. Hyperliquid has already announced allocating part of its daily revenue to a larger insurance pool to strengthen platform resilience.

-

Fixing Mechanism Flaws: Binance may reevaluate its unified margin model and oracle mechanisms to prevent future chain reactions caused by mispriced assets like USDe.

-

Introducing Circuit Breakers: Temporarily pausing trading when prices drop beyond a threshold could allow liquidity to recover. While standard in traditional finance, implementing this in 24/7 crypto markets poses challenges in balancing continuity and stability.

3. Advantages of Decentralized Finance Revealed: During this turmoil, DeFi proved resilient and even demonstrated strengths. Top-tier protocols like Aave handled large-scale liquidations steadily—$180 million in liquidations executed seamlessly without human intervention, proving smart contract reliability. DEXs like Uniswap saw trading volume surge while continuing to provide liquidity without lag or failure. Stablecoin pools like Curve absorbed the USDe shock and maintained price stability. This has prompted renewed reflection: should core crypto infrastructure become more decentralized?

4. Regulatory and Compliance Implications: Such a severe crash will inevitably draw regulatory scrutiny. Regulators may accelerate requirements on leverage caps and risk reserves, restricting retail over-leverage and mitigating systemic risks. If evidence emerges of deliberate market manipulation, legal authorities may investigate and hold responsible parties accountable. The U.S. Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) have repeatedly warned about manipulation risks in crypto—this event could bolster their push for stricter oversight. For exchanges, strengthening compliance and transparency has become more urgent; otherwise, both investor trust and regulatory standing could suffer.

5. Shifts in Investor Psychology and Strategy: "312," "519," and now "10·11"—each brutal crash marks a milestone in crypto history and deeply shapes investor psychology. After this event, many retail and institutional investors will reassess their risk management strategies. Leverage usage may decline in the coming period, with capital shifting from high-risk small caps to more stable blue-chip and core assets like Ethereum. Additionally, users heavily concentrated on a single exchange may start diversifying across platforms. These behavioral shifts will gradually foster a more mature and rational market ecosystem.

In conclusion, the immediate damage from the October 11 crash was immense, but in the long run, it may catalyze industry reform. On the surface, it appears to be an accident caused by a macro black swan, but the real culprit was the long-standing illusion of leverage and structural flaws. If the crypto industry can reform its leverage practices, liquidity frameworks, and risk control architecture, this disaster could become a turning point toward healthier development.

6. Outlook: Q4 Market Trends Amid Risk and Opportunity

After this ordeal, where is the crypto market headed in Q4 2025? Looking ahead, we must recognize both risks and opportunities:

1. Short-Term Aftershocks and Bottoming Expectations: Sharp crashes are typically followed by aftershocks. In the coming weeks, there may be reports of secondary effects—such as individual fund liquidations or project treasury collapses—that could repeatedly shake market sentiment. However, barring further major shocks, the market is likely to gradually absorb the negative impact. After this large-scale deleveraging, much of the selling pressure has been released. Concentrated sell-offs often signal the approach of a bottom zone. Absent new black swans, major coins may stabilize through consolidation, with sentiment slowly recovering.

2. Macroeconomic Variables: Macro factors remain key drivers for Q4. Ongoing attention is needed on Sino-U.S. trade tensions and global risk appetite trends. If Trump’s tariff threats escalate into actual retaliatory trade measures, global risk assets—including crypto—will face pressure. Conversely, if tensions ease or the market digests the news, crypto may resume its intrinsic momentum. Additionally, Federal Reserve monetary policy and inflation data will play crucial roles in Q4. Should inflation remain under control and the Fed signal a pause in rate hikes—or even hint at easing—risk assets could receive a broad boost.

3. Market Structure Improvements and Opportunities: After this shakeout, market leverage has dropped significantly. Bitwise reported that around $20 billion in leveraged positions were wiped out during the crash—the largest single deleveraging event in crypto history. Fortunately, no core institutions collapsed and no systemic breakdown occurred, meaning there is no basis for prolonged bearishness. Long-term drivers—such as institutional adoption, stablecoin payment expansion, and on-chain traditional assets—continue progressing. In the short term, the market is actually healthier post-deleveraging. Any future rally will be supported by stronger spot fundamentals. New inflows won’t need to overcome stubborn leveraged resistance as before, potentially enabling lighter, more sustainable rebounds.

4. Potential Rally Catalysts: Several potential catalysts in Q4 deserve attention. For example, approval decisions on diversified crypto ETFs may arrive by year-end—any green light would be a major positive. Additionally, Ethereum network upgrades, Layer2 advancements, and breakthroughs in AI and RWA applications could reignite market enthusiasm. If no major negatives emerge and these positives materialize, major coins could regain upward momentum by late Q4 or early 2026.

5. Increasing Fragmentation in Crypto Landscape: Post-crash recovery potential may vary significantly across sectors. Bitcoin and Ethereum, as market cornerstones, may see their market share increase further after this turmoil. Investors may prefer allocating capital to these more "shock-resistant" assets, expecting them to rebound first and reach new highs. In contrast, the altcoin sector may remain weak in the short term. The collective surge of an "altseason" is unlikely to return, with only a few fundamentally strong projects with real catalysts expected to sustain gains.

Conclusion: The crash of October 11, 2025, will be remembered as another milestone in crypto history. This night of market terror—sparked by a macro black swan and intensified by bursting leverage bubbles—delivered a harrowing lesson in risk management to all participants. Whether orchestrated or not, we now clearly see two faces of the crypto market: one fragile, vulnerable to high leverage and thin liquidity under extreme stress; the other resilient, sustained by robust DeFi operations, self-healing mechanisms, and enduring belief in long-term value—even in the darkest hours. Looking forward, the crypto market will mature through regulatory adaptation and internal innovation. As investors, we must remain vigilant, always remembering the iron rule: "survival is the only path to the future," while also maintaining faith in the industry’s innovation and growth. Wishing you all successful and safe investing in this ever-changing market.

About Us

Hotcoin Research, the core investment research arm of Hotcoin Exchange, is dedicated to transforming professional insights into practical tools for your trading success. Through our Weekly Insights and In-Depth Reports, we help you understand market dynamics. Our exclusive column Top Pick Coins (powered by AI plus expert screening) identifies high-potential assets and reduces trial-and-error costs. Every week, our analysts host live streams to discuss hot topics and forecast trends. We believe that informed guidance combined with personal engagement empowers more investors to navigate market cycles and capture Web3 value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News