Coin prices declining, market becoming increasingly competitive—crypto in 2025 is too hard

TechFlow Selected TechFlow Selected

Coin prices declining, market becoming increasingly competitive—crypto in 2025 is too hard

Whether you think the market will reach new highs or has already entered a bear market, you should start accumulating "exclusive knowledge" to protect yourself.

Author: Route 2 FI

Compiled by: TechFlow

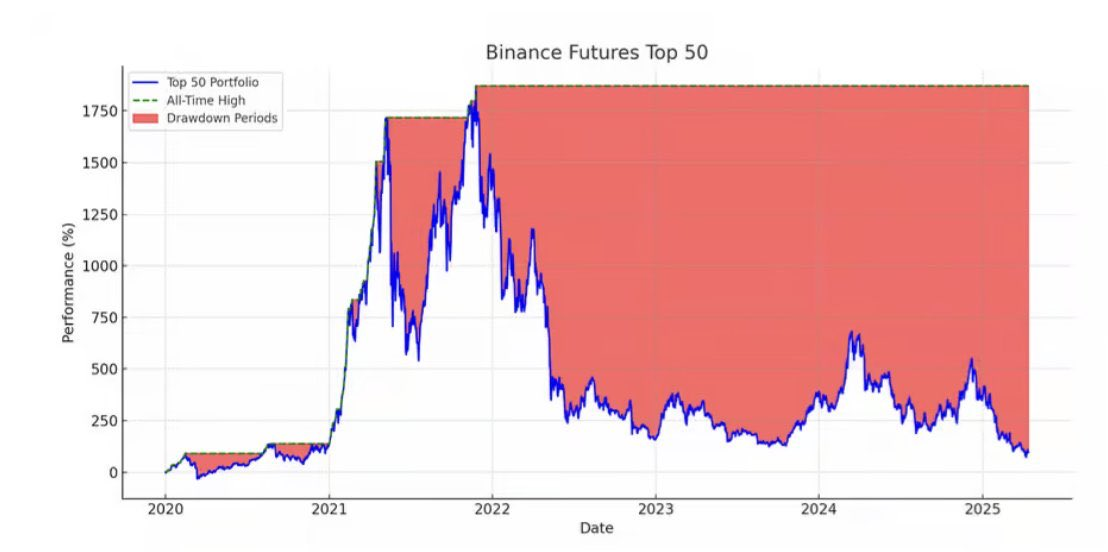

If you're still wondering why most people on Crypto Twitter are feeling down, consider this fact: the current prices of the top 50 altcoins have now fallen below their levels after the FTX collapse in 2022 (data from @VentureCoinist).

Moreover, major cryptocurrencies like SOL, ETH, and BTC have also retreated to their December 2024 levels.

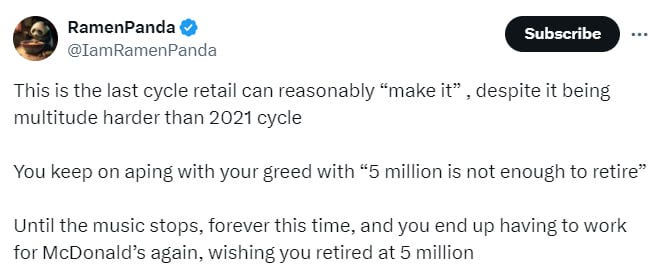

Many traders on Crypto Twitter haven't made any real gains during this cycle and are becoming increasingly desperate, hoping to catch a final opportunity. Yet market sentiment is weak, and according to the "four-year cycle theory," we're already in the later stages of this cycle. In fact, historically speaking, we've already passed the 18-month window, which typically marks the early peak of a Bitcoin cycle.

The crypto market is quietly transforming before our eyes. Over the past four years, most new token launches have followed a model of low circulating supply and high fully diluted valuation (FDV). In July, Polychain Capital sold $240 million worth of $TIA—a move that might only be the tip of the iceberg. But can we really blame them? If you think about it, they were simply following their investment strategy. In fact, anyone holding unlocked tokens might have made a similar decision.

Remember the "golden age"? When a token listing on a centralized exchange (CEX) meant an instant price surge. Those days are long gone. Now, everyone in the market is frustrated:

Traders are adapting to new rules; memecoin players are fighting each other; project founders complain users don't adopt their protocols; retail investors complain the market is oversaturated; VCs miss the easy money days (since the tough times began in 2023).

Traditional finance (TradFi) has entered crypto, but they aren't buying our altcoins. By 2025, we're facing:

-

Too many tokens;

-

Technology without real demand;

-

Projects failing to find product-market fit (PMF);

-

Unsound tokenomics;

-

Airdrops immediately dumped into stablecoins by recipients;

-

Trading has become significantly harder, as any valuable and liquid asset now faces intense competition.

Yes, now almost nobody has confidence in anything.

Since "Black Friday," roughly half of crypto traders have lost all their capital, and many may never return to trading. While one successful trade means another's loss, in this event, funds flowed to exchanges—meaning both retail and professional traders became poorer.

The altcoin market is entering a new phase. The problem is that too many new projects launch with high valuations, not only fragmenting liquidity but also weakening originally strong, fundamentally sound projects, making the entire market weaker.

In recent years, altcoin launches have followed a trend: high FDV, large airdrops, low circulating supply, and later massive unlocks by VCs. This model has seemingly become the industry standard.

We often hear the claim: Given the right conditions, every token can moon. But is that true? Keep in mind, today's market is flooded with far more "functional" tokens than in 2021. Every week, 3–5 so-called "high-quality" tokens enter the market, Total3 (total altcoin market cap) gradually rises, and on the surface, everyone seems happy. But think deeper—who will actually buy these tokens? Without institutional inflows or mass retail participation, the market is inevitably just a player-versus-player (PvP) battleground.

Now, every week brings new "high-quality" projects, yet they often come with extremely high FDVs. This means the market faces an endless supply of new tokens, and without new buyers entering, their prices are doomed to fall over time.

By October 2025, capital inflows into altcoins have become more selective, but clearly insufficient to offset the pressure from massive token unlocks. The market is undergoing endless internal competition, and a real way out remains elusive.

Despite the downturn, there's reason for optimism: whether you believe the market will reach new highs or has already entered a bear market, you should start building "proprietary knowledge" to protect yourself. "Proprietary knowledge" refers to skills only you possess, or things you do slightly better than others. Everyone has innate strengths—focus on these advantages and turn them into your weapons.

For example, I'm good at writing, so I prefer long-form threads over YouTube videos or podcasts. For you, it might be trading, networking, sales, or something else. The key is, once you start honing your skills, you can find your place in this industry. Compared to traditional finance (TradFi), breaking into crypto requires much lower barriers. Whether content creation, CEX trading, research, memecoin trading, NFTs, airdrops, YouTube, newsletters, Telegram groups, or podcasts—the industry offers diverse opportunities.

To connect with top talent in this space, the best way is to make yourself "visible" on Twitter. Write about topics you care about, share what interests you, post fun content occasionally, and interact with people you admire. Tweet daily—even just a "gm." DM others proactively, offer advice, and don't expect anything in return. This is how friendships are built—who knows, maybe you'll collaborate someday. Just stay helpful, kind, and consistently engaged.

Twitter is the resume of the crypto world. You don't need LinkedIn; your best credential is the content you create on Twitter. If you ever go to a job interview, your tweets will be your strongest proof.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News