To avoid being "pinned," the crypto market might need this "magic weapon"

TechFlow Selected TechFlow Selected

To avoid being "pinned," the crypto market might need this "magic weapon"

The crypto market doesn't lack smart code; what it lacks is a bottom line that everyone must abide by.

Author: Daii

I've always said: today's crypto market resembles a "wild west."

The most glaring evidence is "spikes." It's not mysticism, but the result of thin depth + leveraged chain liquidations +叠加 on-exchange matching preferences: prices are violently smashed to your stop-loss level within critical milliseconds, wiping out your position, leaving only a long, thin "wick" on the candlestick chart—a cold jab you didn't see coming.

In such an environment, what’s missing isn’t luck—it’s a baseline. Traditional finance already codified this baseline into regulation—the Trade-Through Rule. Its logic is simple and powerful:

When better public prices clearly exist in the market, no broker or exchange may ignore them, nor execute your order at a worse price.

This isn’t moral persuasion; it’s an enforceable constraint. In 2005, the U.S. Securities and Exchange Commission (SEC) explicitly enshrined this principle in Regulation NMS Rule 611: all market participants (with trading centers prohibited from trading through protected quotations, and brokers bearing FINRA Rule 5310’s best execution obligation) must fulfill “order protection,” prioritizing the best available price, with routing and execution fully traceable, verifiable, and accountable. It doesn’t promise a non-volatile market, but ensures that during volatility, your execution isn’t arbitrarily degraded—if a better price exists elsewhere, you can’t be casually matched locally at an inferior one.

Many ask: "Can this rule prevent spikes?"

Straight answer: it won’t eliminate long wicks, but it breaks the harm chain of "long wicks affecting your execution."

Imagine a clear scenario:

-

At the same moment, Exchange A shows a downward spike, instantly crashing BTC to $59,500;

-

Exchange B still has active bids at $60,050.

If your stop-market order gets executed "locally" on A, you’re exited at the spike price. With order protection, routing must send your order to B’s better bid, or reject execution at A’s inferior price.

Result: the spike remains on the chart, but it’s no longer your execution price. That’s the value of this rule—not eliminating spikes, but preventing them from piercing you.

Of course, managing contract liquidation triggers also requires mechanisms like mark/index pricing, volatility bands, auction restarts, and anti-MEV tools to govern "spike generation." But for execution fairness, the "no trade-through" baseline is nearly the only immediately actionable, implementable, and auditable solution.

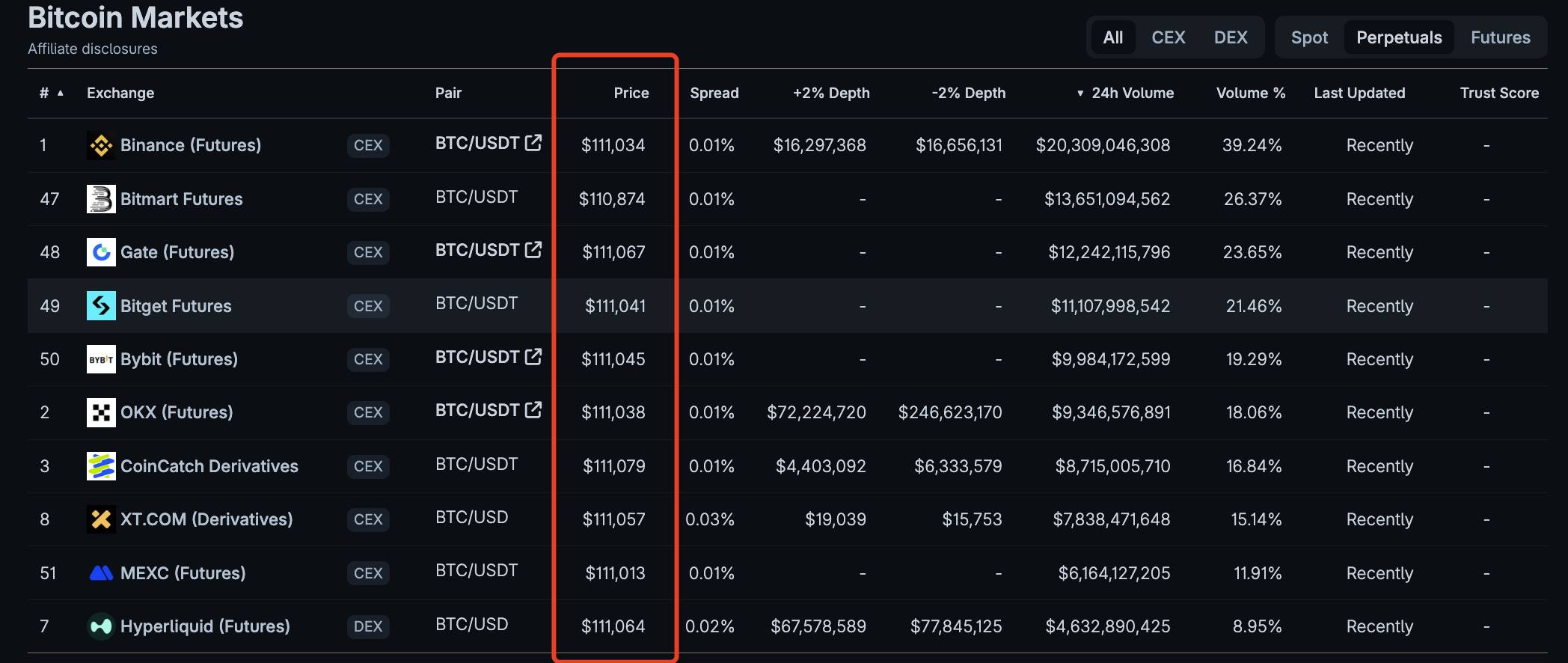

Unfortunately, crypto markets lack such a baseline. A single table speaks louder than words:

From this BTC perpetual contract quote table, you’ll notice none of the top ten highest-volume exchanges quote the same price.

The current crypto landscape is highly fragmented: hundreds of centralized exchanges, thousands of decentralized protocols, prices disconnected from each other, compounded by cross-chain dispersion and dominance of leveraged derivatives—making a transparent, fair execution environment harder than climbing to heaven.

You might wonder why I’m raising this now?

Because on September 18, the U.S. SEC will hold a roundtable on the Trade-Through Rule, debating its merits and future within the National Market System (NMS).

This may seem relevant only to traditional securities, but to me, it’s a wake-up call for crypto: if even in the highly concentrated, rules-mature U.S. equity system, trade protection mechanisms require reevaluation and upgrades, then in the more fragmented and complex crypto world, ordinary users need basic safeguards even more urgently:

Crypto providers (including CEXs and DEXs) must never ignore better public prices, nor allow investors to be executed at inferior prices when avoidable. Only then can crypto evolve from the "wild west" into a truly mature and trustworthy market.

This may sound like fantasy, even delusional. But once you understand the benefits the Trade-Through Rule brought to U.S. equities, you’ll realize that however difficult, it’s worth trying.

1. How Was the Trade-Through Rule Established?

Looking back, the rule evolved through a complete journey: legislative authorization in 1975, experimental inter-market connectivity via the Intermarket Trading System (ITS), a full electronic leap in 2005, and phased implementation starting in 2007. It wasn’t meant to eliminate volatility, but to ensure that amid volatility, investors still receive the better prices they deserve.

1.1 From Fragmentation to a Unified Market

In the 1960s–70s, the biggest problem facing U.S. stock markets was fragmentation. Exchanges and market-making networks operated in silos, making it impossible for investors to know where the true "best market-wide price" could be found.

In 1975, the U.S. Congress passed the Securities Act Amendments, first明确提出 establishing a "National Market System (NMS)," requiring the SEC to lead development of a unified framework connecting all trading venues, aiming to enhance fairness and efficiency [Congress.gov, sechistorical.org].

With legal authority, regulators and exchanges launched a transitional "interconnection cable"—the Intermarket Trading System (ITS). Like a dedicated network linking exchanges, ITS enabled sharing of quotes and order routing across venues, preventing local inferior executions while better prices existed elsewhere [SEC, Investopedia].

Though ITS faded with the rise of electronic trading, the principle—"never ignore a better price"—was firmly planted.

1.2 Regulation NMS and Order Protection

By the 1990s, the internet and decimalization made trading faster and more fragmented, rendering the old semi-manual systems obsolete. In 2004–2005, the SEC introduced the landmark Regulation NMS, comprising four core rules: Fair Access (Rule 610), Trade-Through (Rule 611), Minimum Pricing Increment (Rule 612), and Market Data Rules (Rule 603) [SEC].

Among these, Rule 611, the famous "Order Protection Rule," means in plain terms: if another venue displays a better protected quotation, you cannot match orders here at a worse price. A "protected quotation" must be immediately auto-executable, not slow manual orders [SEC Final Rule].

To make this rule operational, the U.S. market built two key foundations:

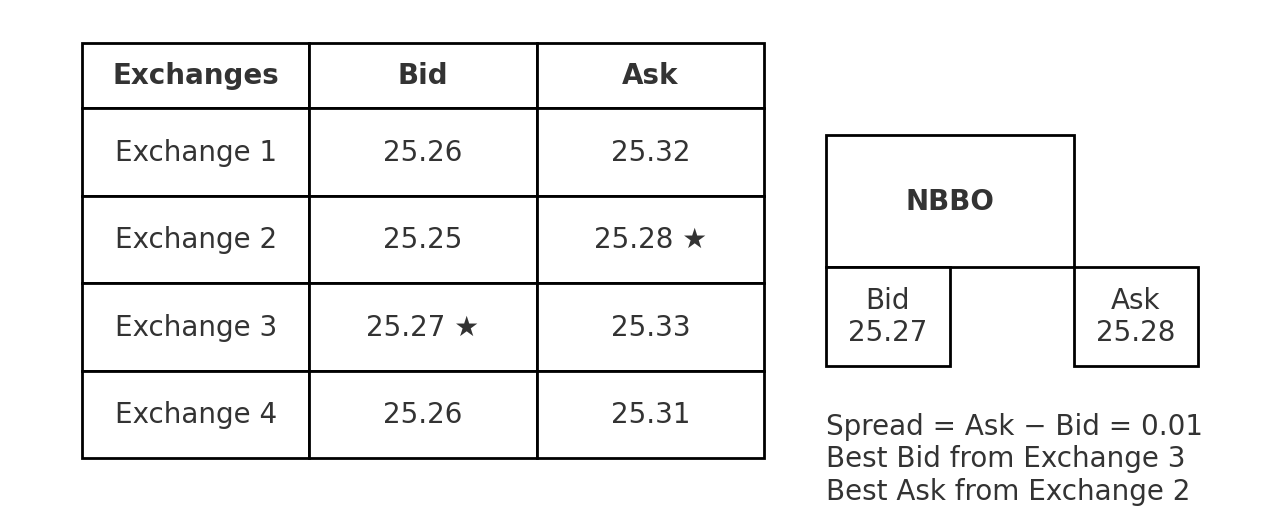

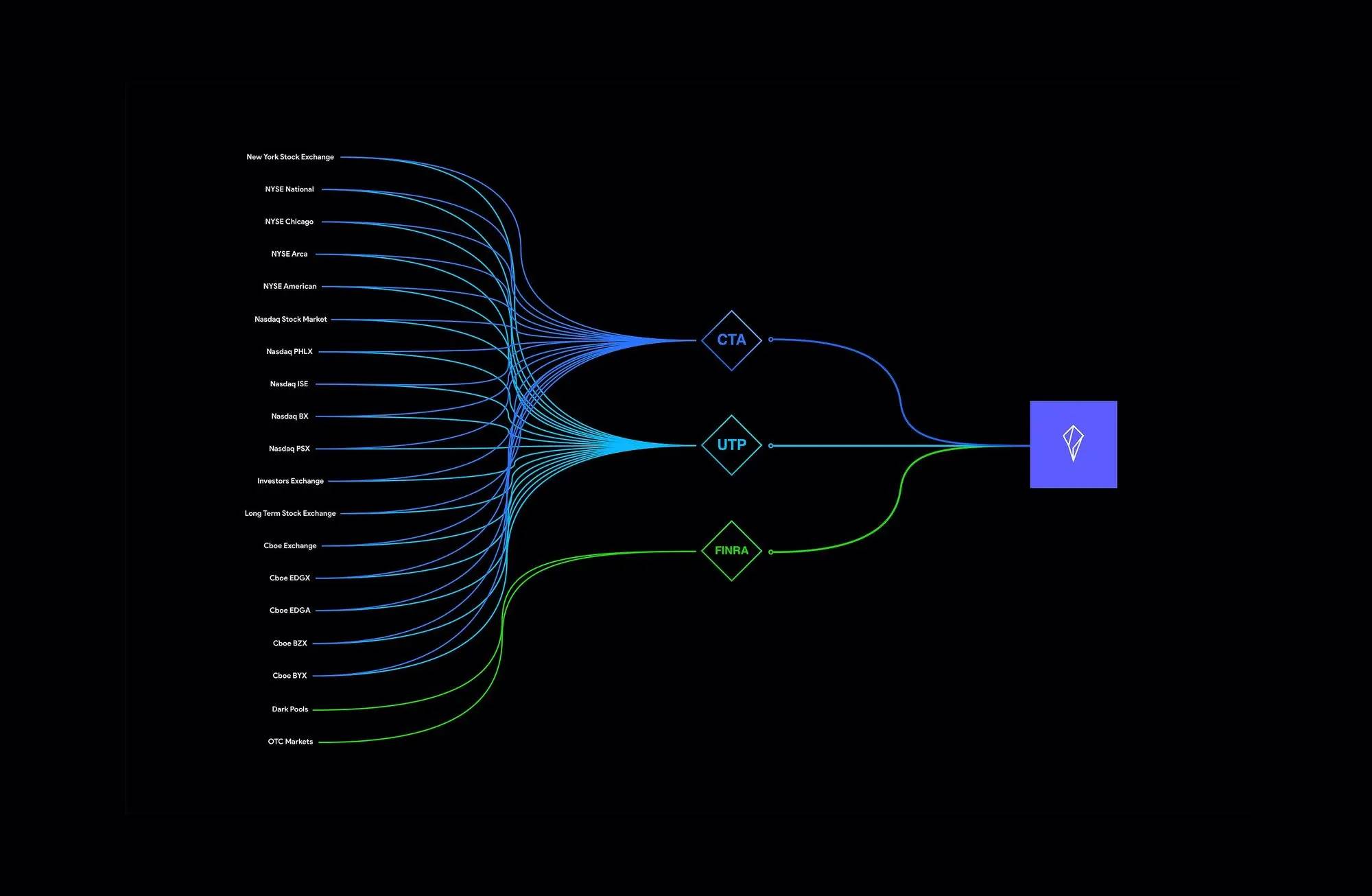

NBBO (National Best Bid and Offer): combining the best bid and offer across all exchanges to create a unified benchmark for determining "trade-through." For example, in the image above, Exchange 3’s 25.27 is the best bid, Exchange 2’s 25.28 the best offer.

SIP (Securities Information Processor, as shown above): responsible for real-time aggregation and dissemination of data, becoming the market’s "single source of truth" [Federal Register, SEC].

Reg NMS took effect on August 29, 2005, with Rule 611 first applied to 250 stocks on May 21, 2007, and fully extended to all NMS stocks by July 9, 2007, establishing an industry-wide norm of "no trading through better prices" [SEC].

1.3 Controversy and Significance

It wasn’t smooth sailing. SEC Commissioners Glassman and Atkins objected, arguing that focusing only on displayed prices might overlook net transaction costs and potentially weaken competition [SEC Dissent]. Yet most commissioners supported the rule, reasoning clearly: despite debates over cost and efficiency, "no trade-through" at least establishes a fundamental baseline—

Investors won’t be forced to accept worse executions when better prices are clearly available.

That’s why, to this day, Rule 611 remains one of the cornerstones of the U.S. securities market’s "best execution ecosystem." It turned "better prices must not be ignored" from a slogan into a regulatory-auditable, enforceable reality. This baseline is precisely what crypto lacks—and what it should learn from most.

2. Why Does Crypto Need This "Baseline Rule" Even More?

Let’s state it plainly: in crypto, the moment you place an order, no one necessarily looks across the entire market for you. Different exchanges, chains, and matching mechanisms act like isolated islands, each quoting independently. The result? Better prices exist elsewhere, yet you get "locally matched" at an inferior price. This is strictly forbidden under Rule 611 in U.S. equities, but in crypto, there’s no unified safety net.

2.1 The Cost of Fragmentation: Without a "Market-Wide View," Inferior Executions Are Easier

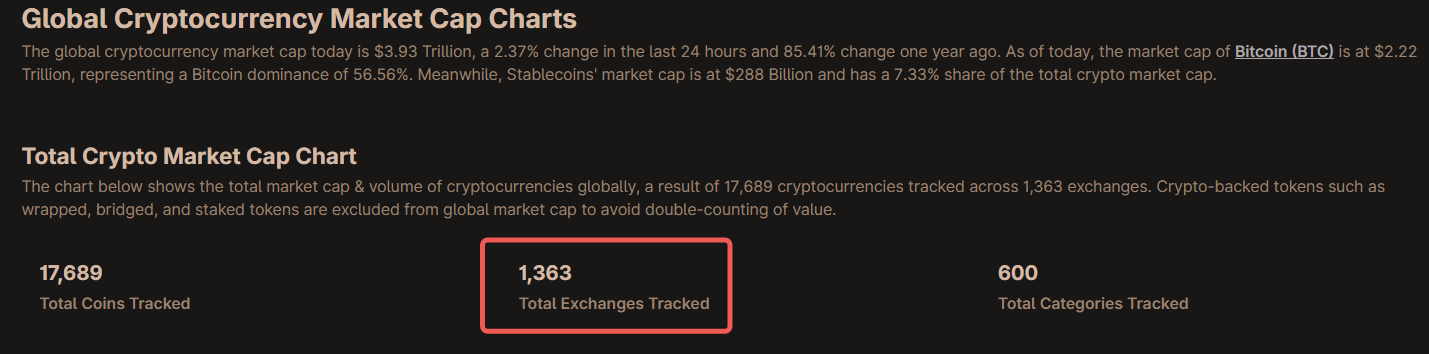

Today, there are easily over a thousand tracked crypto trading venues globally: CoinGecko’s "Global Chart" alone tracks 1,300+ exchanges (see below); CoinMarketCap’s spot list consistently features over 200 actively quoting venues—excluding countless derivative platforms and long-tail DEXs across chains. This landscape means no one naturally sees the "true market-best price."

Traditional securities rely on SIP/NBBO to synthesize a "market-wide best price band"; in crypto, no official consolidated quote feed exists, and even data providers admit "crypto has no 'official CBBO.'" This turns "where it’s cheaper/dearer" into something only known in hindsight. (CoinGecko, CoinMarketCap, coinroutes.com)

2.2 Derivatives Dominance and Amplified Volatility: Spikes Happen More Easily and Hurt More

Derivatives dominate crypto trading.

-

Multiple industry monthly reports show derivatives consistently account for ~67%–72% of volume: CCData reports 72.7% (2023/3), ~68% (2025/1), ~71% (2025/7), etc.

-

The higher the share, the easier it is for high leverage and funding rates to trigger instantaneous extreme prices ("spikes"); if your platform doesn’t compare prices or calculate net cost, you may be "locally executed" at a worse price even when better ones are available simultaneously.

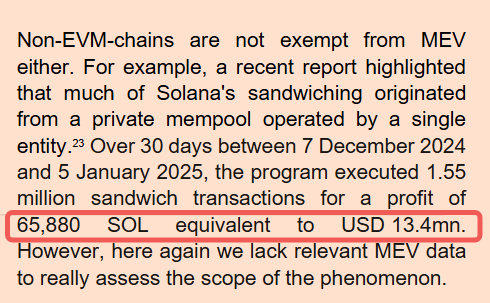

On-chain, MEV (Maximal Extractable Value) adds a layer of "hidden slippage":

An ESMA 2025 report found that in just 30 days (Dec 2024–Jan 2025), sandwich attacks totaled 1.55 million trades, earning 65,880 SOL (~$13.4M); (esma.europa.eu)

Academic studies also show tens of thousands of sandwiches monthly, with gas costs reaching tens of millions USD.

For ordinary traders, these represent real monetary "execution losses." (CoinDesk Data, CryptoCompare, The Defiant, CryptoRank, arXiv)

If you want to understand how MEV attacks happen, read my article "MEV Sandwich Attack Deep Dive: The Deadly Chain from Ordering to Flash Swaps," which details how an MEV attack cost a trader $215,000.

2.3 Technology Exists, But Lacks "Principle-Based Safeguards": Turning 'Best Price' Into a Verifiable Promise

The good news: native "self-help" technologies are emerging:

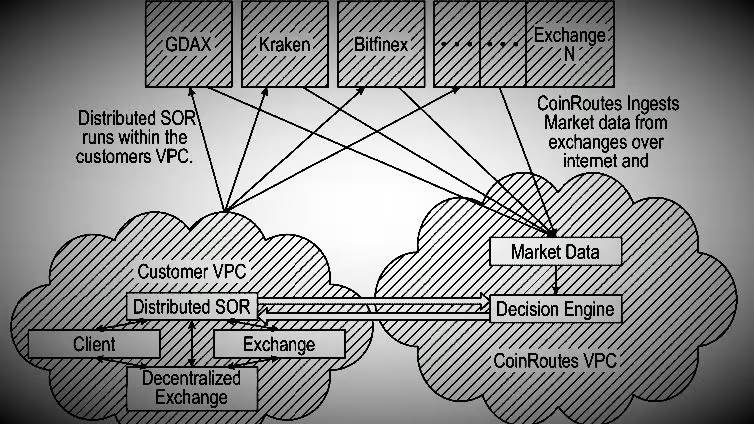

Aggregators and smart routers (e.g., 1inch, Odos) scan multiple pools/chains, split orders, factor in gas and slippage to calculate "true net execution cost," aiming for a better "net price"; (portal.1inch.dev, blog.1inch.io)

Private "consolidated best bid-offer" (e.g., CoinRoutes’ RealPrice/CBBO) synthesizes depth and fees from dozens of venues into a "tradable, fee-included reference net price," even adopted by Cboe for indices and benchmarks. This proves "finding better prices" is technically feasible. (Cboe Global Markets, Cboe, coinroutes.com)

But the bad news: without a "no trade-through" baseline, these tools remain optional; platforms can freely execute your order locally without checking or comparing.

In traditional securities, best execution is already a compliance duty—not just price, but speed, likelihood of execution, fees/rebates—all subject to "regular, rigorous" quality assessment. That’s the spirit of FINRA Rule 5310. Bringing this "principle + verifiability" into crypto is the crucial step to turn "better prices must not be ignored" from slogan to commitment. (FINRA)

In short:

The more fragmented, 24/7, and derivatives-driven crypto becomes, the more ordinary users need a baseline rule: "Better public prices must not be ignored."

It doesn’t need to copy U.S. equity technical details; but at minimum, "no trade-through" must become an explicit obligation—requiring platforms to either deliver a better net price or provide auditable reasons and evidence. When "better price" becomes a verifiable, accountable public promise, unjust losses from "spikes" can finally be suppressed.

3. Can the Trade-Through Rule Really Be Implemented in Crypto?

Short answer: Yes, but not by rote copying.

Mechanically replicating the U.S. model of "NBBO + SIP + mandatory routing" won’t work in crypto. But elevating "not ignoring better public prices" to a principle-based duty, combined with verifiable execution proofs and market-driven consolidated quotes, is entirely feasible—and already has "semi-finished" versions operating in the wild.

3.1 First, Face Reality: Why Is It Hard for Crypto?

Three main challenges:

-

No "unified display" (SIP/NBBO). U.S. equities prevent trade-through because all exchanges feed data into the Securities Information Processor (SIP), giving the market a shared "ruler"—the NBBO. Crypto lacks an official quote feed, fragmenting prices into many "information silos." (Reg NMS’s market data and consolidated tape were infrastructure refined from 2004–2020.) [Federal Register, SEC]

-

Different settlement "finality." Bitcoin often requires "6 confirmations" for relative safety; Ethereum PoS relies on epoch finality, needing time to "finalize" blocks. When defining "protected quotes must be instantly executable," the meaning and delay of "executable/final" on-chain must be redefined. (Bitcoin Wiki, ethereum.org)

-

Extreme fragmentation + derivatives dominance. CoinGecko tracks 1,300+ exchanges; CMC’s spot list shows ~250 active venues; add DEXs and long-tail chains, and the ecosystem fragments further. Derivatives consistently take 2/3–3/4 of volume, amplifying volatility via leverage, making "spikes" and transient deviations more frequent. (CoinGecko, CoinMarketCap, Kaiko, CryptoCompare)

3.2 Second, See Opportunity: Ready-Made "Parts" Are Already Running

Don’t be intimidated by "no official quote feed"—there are already prototypes of consolidated quotes.

CoinRoutes RealPrice/CBBO: synthesizes real-time depth, fees, and quantity constraints from 40+ exchanges into a tradable consolidated best bid-offer; Cboe secured exclusive licensing in 2020 for digital asset indices and benchmarks. Thus, "routing fragmented prices to better net execution" is already mature engineering. (Cboe Global Markets, PR Newswire)

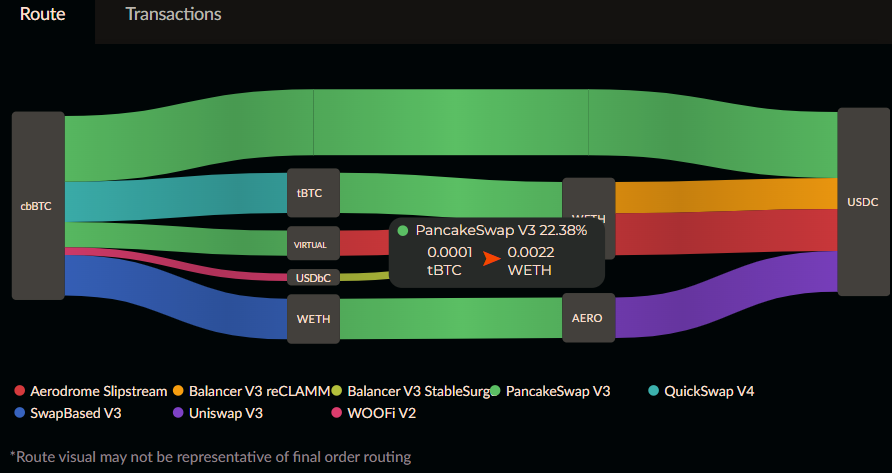

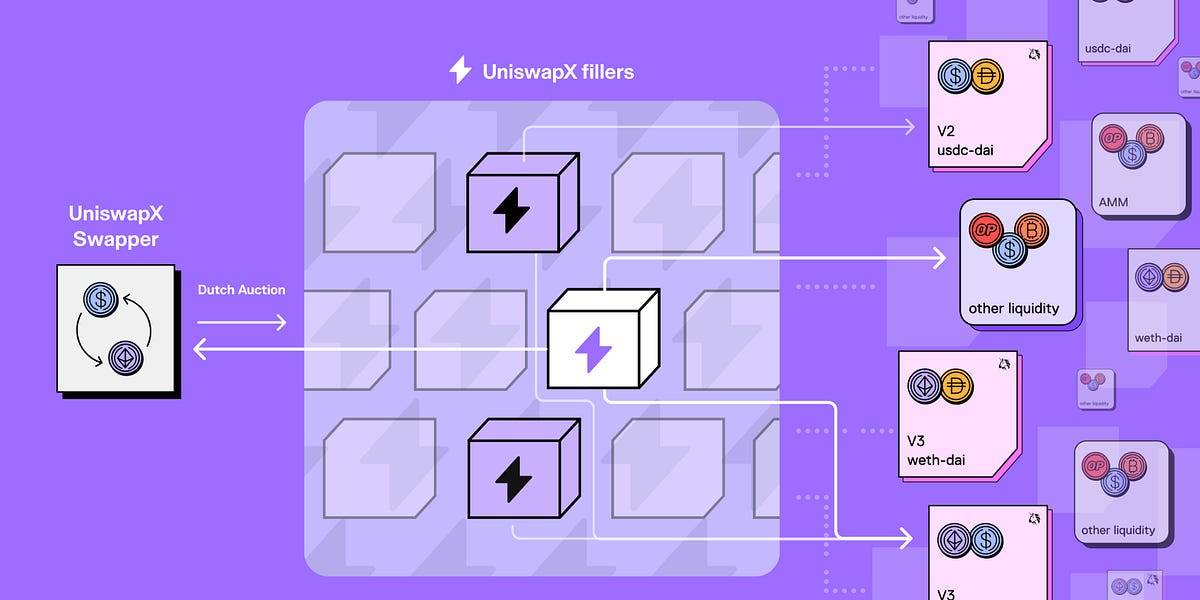

Aggregators and smart routers (as shown above): split orders, search paths across pools/chains, factoring gas and slippage into true execution cost; UniswapX further uses auctions/intent-based aggregation to combine on/off-chain liquidity, offering zero-cost failure, MEV protection, and scalable cross-chain capabilities—essentially pursuing "verifiable better net prices." (blog.1inch.io, portal.1inch.dev, Uniswap Docs)

3.3 Third, Focus on Rules: Don’t Force a "Single Bus," Establish "Baseline Principles"

Unlike U.S. equities, we won’t force a global SIP. Instead, progress in three layers:

-

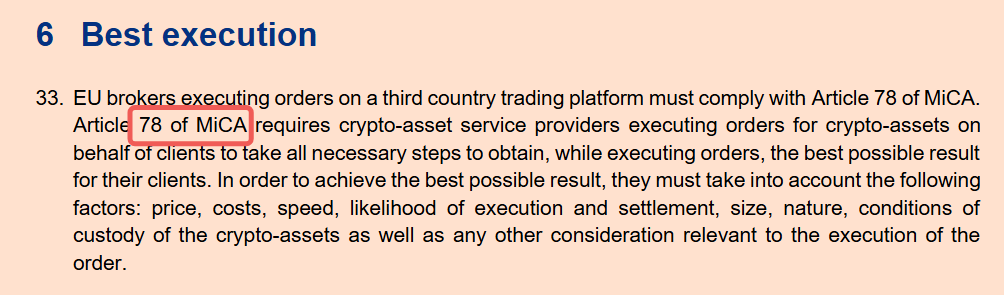

Principles first (within compliant circles): Among regulated platforms/brokers/aggregators in a single jurisdiction, establish a clear duty: "do not trade through better public/net prices." What is "net price"? Not just the nominal price on screen, but including fees, rebates, slippage, gas, and retry costs upon failure. The EU’s MiCA Article 78 already codifies "best outcome" as a legal checklist (price, cost, speed, execution/settlement likelihood, size, custody conditions, etc.). This principle can anchor a "crypto anti-trade-through" regime. (esma.europa.eu, wyden.io)

-

Market-driven consolidated quotes +抽查 verification: Regulators recognize multiple private "consolidated quotes/reference net prices" (e.g., RealPrice/CBBO) as compliance baselines. The key isn’t mandating a "single data source," but requiring transparent methodologies, coverage disclosures, conflict statements, and random comparisons/external audits—avoiding monopolies while giving practitioners clear, verifiable benchmarks. (Cboe Global Markets)

-

"Best Execution Proof" and periodic reconciliation: Platforms and brokers must keep records: which venues/paths were queried, why a better nominal price was rejected (e.g., settlement uncertainty, high gas), and differences between final net execution and estimates. Following traditional securities, FINRA Rule 5310 mandates "per-order or regular and rigorous" execution quality assessments (at least quarterly, by product type)—crypto should adopt equivalent self-certification and disclosure. (FINRA)

3.4 Fourth, Define Boundaries: Innovation Shouldn’t Be "Choked"

The principle is "don’t ignore better public prices," but implementation must be technology-neutral. This is also the lesson from the U.S. reopening the Rule 611 roundtable: even in the highly concentrated U.S. equity market, order protection is being rethought for upgrades—let alone imposing a one-size-fits-all rule in crypto. (SEC, Sidley)

So what would implementation look like? Here’s a vivid operational picture (imagine):

You place an order on a compliant CEX/aggregator. The system queries multiple venues/chains/pools, consults private consolidated quotes, factoring in fees, slippage, gas, and expected finality time for each candidate path. If a path has a better nominal price but fails finality/fee criteria, the system documents the reason and retains evidence.

The system selects the route with better net price and timely execution (splitting orders if needed). If it fails to route you to the best available net price, the post-trade report flags red, creating compliance risk—subject to audit, requiring explanation or even compensation.

You see a clear execution report: best available net price vs. actual net price, path comparison, estimated vs. actual slippage/fees, execution time, and on-chain finality. Even spike-sensitive beginners can judge: was I "locally executed at a worse price"?

Finally, address concerns head-on:

"Without a global NBBO, is it impossible?" Not necessarily. MiCA already imposes "best execution" principles on crypto service providers (CASP), emphasizing multi-dimensional factors like price, cost, speed, and execution/settlement likelihood. The U.S. tradition of self-certification +抽查 can be adapted. Using multiple consolidated quotes + audit reconciliation can build a "consensus price band" without forcing a "central tape." (esma.europa.eu, FINRA)

"MEV exists on-chain—won’t slippage still eat me?" That’s exactly what protocols like UniswapX (shown above) aim to solve: MEV protection, zero-cost failure, cross-source bidding, returning margins once captured by "miners/ordering parties" into price improvements. Think of it as a "technical version of order protection." (Uniswap Docs, Uniswap)

One-sentence conclusion:

Implementing "anti-trade-through" in crypto doesn’t mean copying U.S. equity machine rules, but anchoring on MiCA/FINRA-level principle-based duties, combining private consolidated quotes with on-chain verifiable "best execution proof," starting within a single regulatory perimeter and gradually expanding outward. As long as "better public prices must not be ignored" becomes an auditable, accountable commitment—even without a "global bus"—we can suppress the harm of "spikes" and claw back every penny retail investors deserve from the system.

Conclusion | Turn 'Best Price' From Slogan Into Institution

Crypto doesn’t lack smart code—it lacks a baseline everyone must follow.

The Trade-Through Rule isn’t about restraining the market, but clarifying rights and responsibilities: platforms must either route you to a better net price or provide verifiable reasons and evidence. This isn’t "limiting innovation"—it’s paving the way for it. When price discovery is fairer and execution more transparent, truly efficient technologies and products will shine.

Stop treating "spikes" as market fate. What we need is a technology-neutral, outcome-verifiable, layered approach to a crypto-native "order protection." Turn "better price" from possibility into an auditable promise.

Only when "better prices must not be ignored" becomes the norm can the crypto market be considered grown up.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News