Trump's trade war reignites: analysis of macro factors behind the dual decline in crypto and stocks

TechFlow Selected TechFlow Selected

Trump's trade war reignites: analysis of macro factors behind the dual decline in crypto and stocks

Tariffs = stock market/crypto crash, but today's impact goes far beyond that.

Author: Spicy Rich

Compiled by: TechFlow

Why did the stock market and cryptocurrency crash today? — Bitcoin, Dow Jones, S&P 500, and Nasdaq all plummeted.

The worst day since April.

Below are the main reasons behind the current market turmoil.

Main Trigger

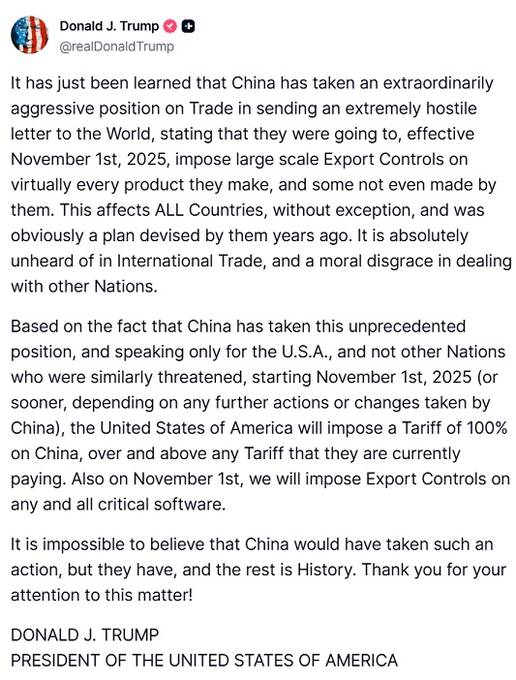

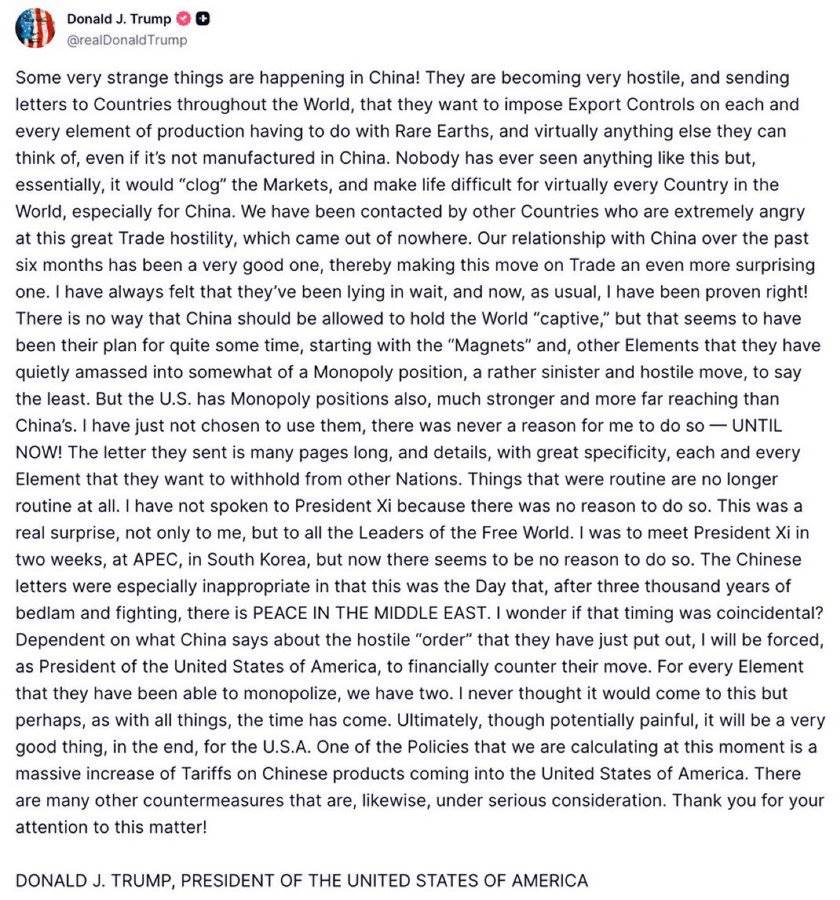

U.S. President Trump posted on Truth Social suggesting possible "massive" new tariffs on goods from China.

First, I thought it was all over.

We all know that tariffs = stock/crypto market crash.

Unfortunately, it's not over yet.

Tariffs act as extra taxes on imported goods, making products more expensive for American consumers.

Trump indicated these tariffs could reach up to 60%, or even 100% on certain items. He also mentioned possibly canceling his meeting with Chinese President Xi Jinping.

This spooked investors, as it sounds like the beginning of another major U.S.-China trade war.

Why is Trump saying this?

It’s a response to actions taken by China.

China introduced new rules restricting exports of rare earth minerals—critical materials used in manufacturing tech products such as computer chips, electric vehicle batteries, and even weapons.

In addition, China began charging U.S. vessels docking at its ports starting October 14, launched an antitrust investigation into Qualcomm, and halted purchases of U.S. soybeans.

These moves have raised concerns among U.S. companies about potential disruptions to their supply chains.

Many American tech firms rely on Chinese components to produce smartphones, computers, and electric vehicles.

If rare earth minerals become harder to obtain, production will slow, costs will rise, and innovation will suffer.

This has made investors nervous about future profits, prompting them to sell off stocks in these sectors.

Broad Economic Impact

Tariffs could trigger inflation—as companies pass higher costs onto consumers, driving up prices.

If trade contracts, businesses may cut hiring and investment, slowing economic growth.

In the worst case, if tensions escalate further, it could lead to a recession.

Another Contributing Factor

The U.S. government shutdown has entered its 10th day, adding further uncertainty.

Without funding, critical services have been suspended, and key economic data (such as employment reports) have been delayed.

This makes it harder for investors and the Federal Reserve to make informed decisions, deepening overall concerns.

Why is this downturn especially severe?

Trading mechanisms are playing a role.

When bad news hits, automated trading systems and large investors quickly begin selling.

This triggers stop-loss orders—automatic sell orders designed to limit losses—creating a cascade effect that amplifies the market decline.

Increased short selling, algorithmic stop-loss triggers, and expiring options are further intensifying the drop.

Rapid unwinding of concentrated tech stock positions—a classic momentum reversal—occurs after post-election market highs.

What happens next?

This could be a negotiation tactic ahead of leader-level talks.

If issues are resolved, markets may rebound.

But if tensions persist, continued volatility is expected, rising costs will affect everyone, and global economic growth will face pressure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News