What new investment opportunities are available during the National Day holiday?

TechFlow Selected TechFlow Selected

What new investment opportunities are available during the National Day holiday?

SUI-backed SUI ecosystem project, a $400 million funding project with traditional institutional backing, and the first collaborative launch by Legion and Kraken—this National Day is turning out to be quite lively?

Author: BUBBLE

In the past month, major projects have seemingly coordinated to launch their TGEs in September and October, with new tokens delivering substantial wealth effects led by STBL, 0G, and Aster.

With the National Day holiday upon us, if you're not keen on monitoring markets, why not spend some time participating in new token offerings? BlockBeats has compiled several recently trending projects worth watching.

Momentum

Momentum is a decentralized exchange (DEX) backed by prominent VCs including Sui, Coinbase, and Circle. On June 5th this year, it secured strategic funding at a $100 million valuation from investors such as OKX.

The product suite includes multisig fund management, token vesting, and liquidity configuration. The team originated from MSafe (Momentum Safe), a multisig wallet project, which explains their strong focus on asset management security.

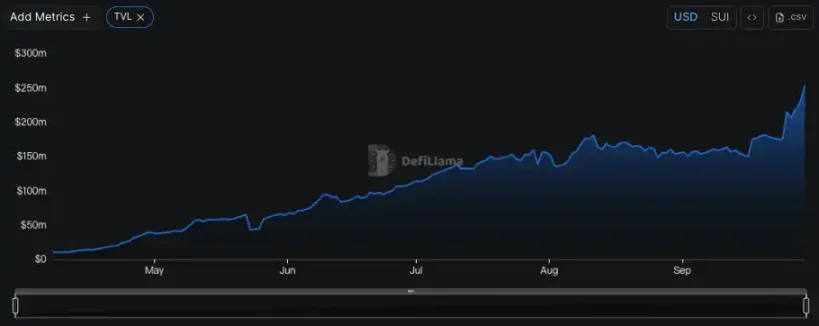

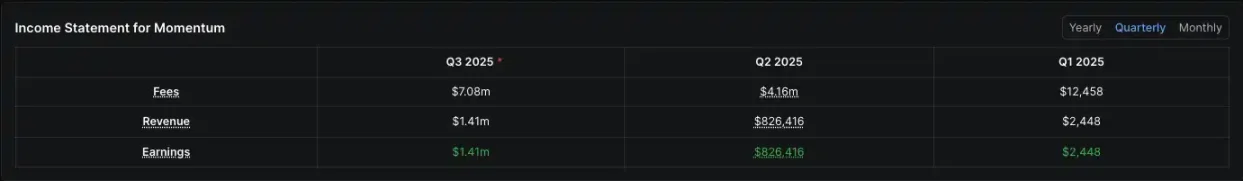

Since launching its testnet at the end of March this year, Momentum has rapidly accumulated users and capital. It currently boasts a TVL of approximately $240 million,累计交易量 exceeding $12 billion, over 1.7 million users, and 890,000 liquidity-providing addresses. In Q3 this year, quarterly trading fees surpassed $7 million.

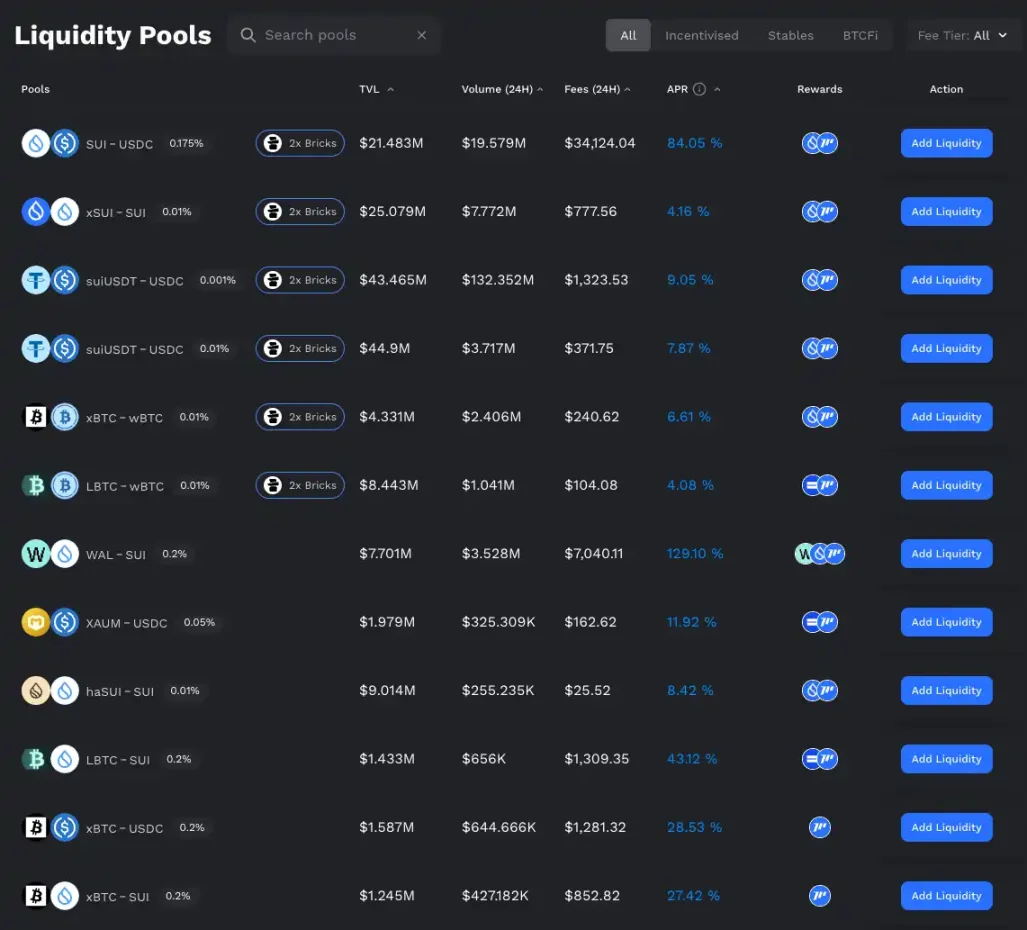

From September 26th to October 19th, Momentum is partnering with BuidlPad to launch the "HODL Yield Campaign," offering up to 155% annualized yield for liquidity pools involving SUI, stablecoins, and Bitcoin. Participants will also receive double Bricks points (granting access to private sale allocations and potential airdrops—officially stated that early supporters will benefit first).

The process is straightforward: users simply visit the Momentum HODL campaign page on BuidlPad (detailed steps available on the official Medium), connect their wallet, and provide liquidity to designated pools (e.g., SUI/USDC, xBTC/wBTC).

During the campaign, rewards are calculated proportionally. Users can deposit using SUI or USD-pegged stablecoins, and after the event concludes, the system will automatically settle and distribute MMT tokens and Bricks rewards.

Yield Basis

Yield Basis is a Bitcoin-native yield protocol launched by Michael Egorov, founder of Curve, which raised $5 million at a $50 million valuation earlier this year.

Yield Basis uses an auto-releveraging mechanism to generate trading fee returns for BTC liquidity providers while hedging against impermanent loss caused by AMM curve risk. LPs can choose to receive transaction fees directly in BTC or forgo fees in exchange for YB token incentives. Locked veYB enables governance participation and a share of protocol fees.

After a one-day delay, Kraken announced that Yield Basis would be the inaugural project on its LaunchPad collaboration with Legion. Legion's "Legion Score" system allocates allocation rights based on on-chain behavior, social media activity, and developer contributions, allowing projects to filter out sybil attackers and ensure genuine builders and core users get priority access. Combined with Kraken’s listing pathway advantage, the market is closely watching this partnership.

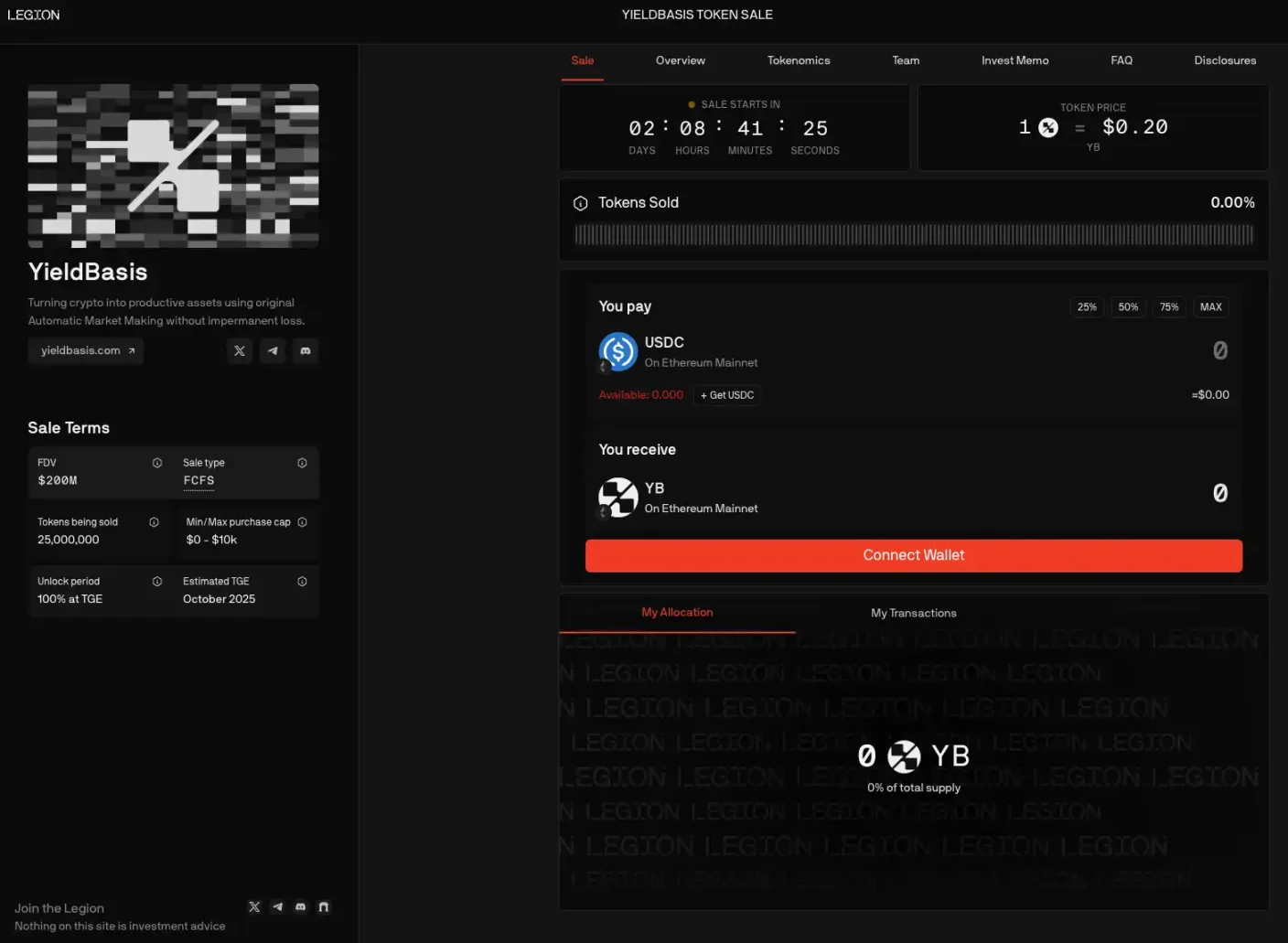

The current known presale model consists of two phases: first, 20% of tokens are reserved for high-scoring Legion users (pre-deposit is now open; project side determines allocation based on your Legion score). The remaining 80% will be sold publicly on both Kraken and Legion via FCFS (first-come, first-served), with $YB listing directly on Kraken upon sale completion.

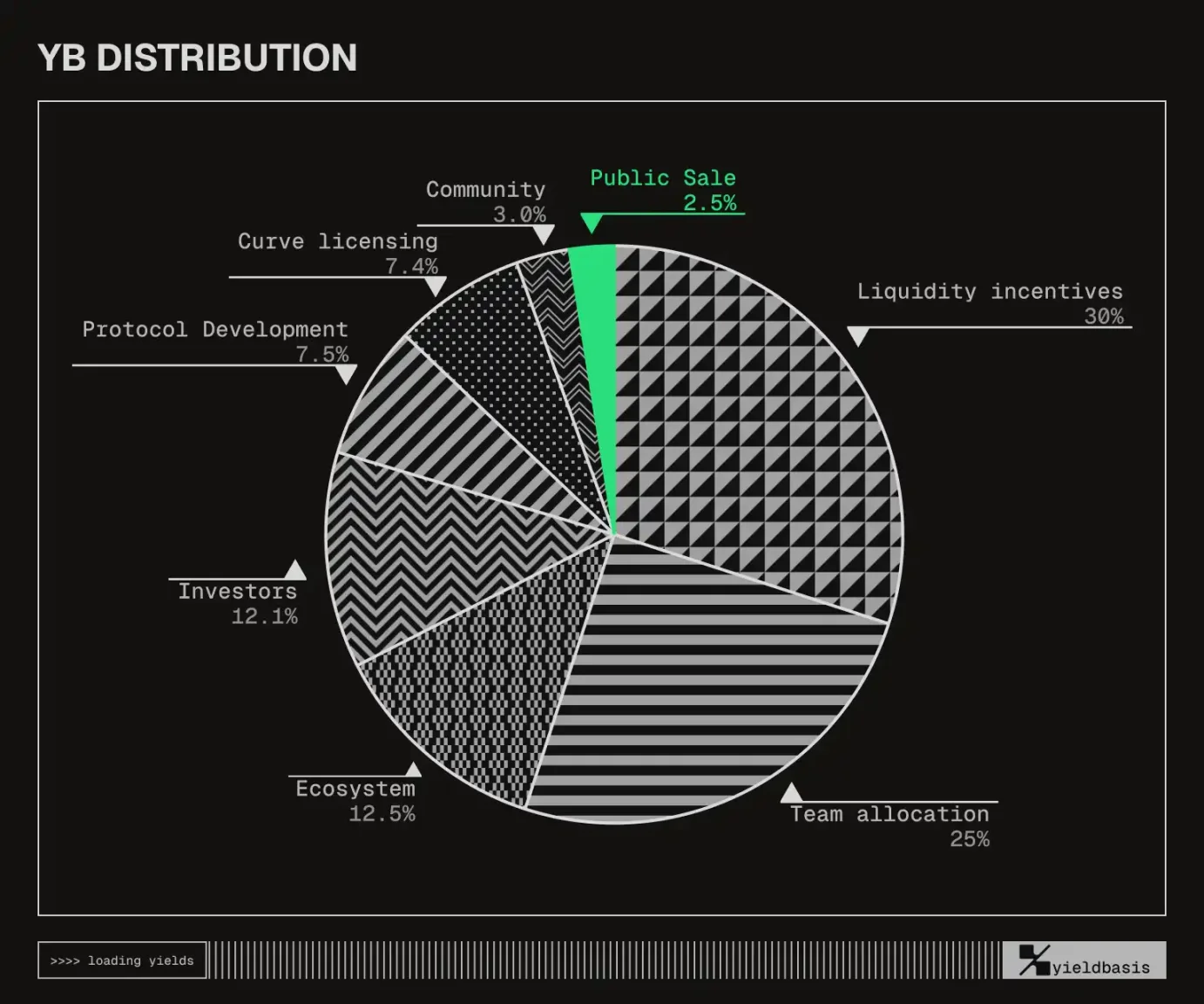

Total token supply is 1 billion, with 2.5% (approximately 25 million) offered in this community sale at a fixed price of $0.20 each, capped at $10,000 per user. Token distribution includes 30% for liquidity mining incentives, 25% for team, 12.5% for ecosystem reserve, 12.1% for investors, 7.5% allocated to Curve protocol licensing fees, 7.4% for developer reserves, and 3% for Curve governance incentives.

Notably, Curve DAO has voted to use crvUSD to accelerate funding for YB, aiming to boost liquidity in Bitcoin pools. Although the initial fundraising valuation was only $50 million, strong support from the Curve community, Egorov’s influence, and sentiment premium from Kraken and Legion have pushed the presale valuation of YB to $200 million—significantly higher than prior private rounds.

Canton Network

Canton Network is a blockchain developed by Digital Asset targeting institutional financial markets, emphasizing privacy protection and synchronized settlement across multiple institutions. Since 2016, Digital Asset has completed eight funding rounds totaling nearly $400 million, with repeated lead investments from traditional finance giants including Goldman Sachs, IBM, and JPMorgan Chase. Most recently, on June 24th, its Series E round attracted more crypto-native VCs such as Yzi Labs, Paxos, Polychain, and Circle.

We are now at a pivotal moment where TradFi and blockchain are becoming increasingly interconnected, with top-tier financial institutions like Goldman Sachs, Citigroup, JPMorgan, HSBC, and BNP Paribas already engaging in testing and real-world applications. There have already been practical implementations—for example, issuing a €100 million digital native bond for the European Investment Bank (EIB) in November 2024, and completing tokenization tests with Euroclear and the World Gold Council in October 2024 involving UK gilts, Eurobonds, and gold.

To further promote interoperability among ecosystem applications, Canton officially introduced its native token "Canton Coin" ($CC) as a payment and incentive tool for covering global synchronization service fees. $CC can be issued by participants providing computing power or services to the network, rewarding app builders, users, and infrastructure providers.

Previously, $CC supply was limited to node mining, with a maximum of 100 billion $CC minted in the first 10 years, followed by 2.5 billion annually thereafter. Currently, 28.48 billion $CC have already been mined. The distribution model initially allocated 80% to super validators, gradually decreasing over time and stabilizing at 5% after 10 years, while shares for application providers and regular validators increase accordingly. As a result, $CC liquidity on secondary markets remains extremely thin.

This time, Canton Network is collaborating with Temple within its ecosystem to launch the first-ever trading platform allowing KYC-compliant users to buy, sell, and manage Canton Coin. However, whether retail users can participate and how they might do so remains unclear and awaits further announcements.

What we can currently engage with is the airdrop campaign for Canton Wallet, launched by SEND—a wallet project within the Canton Network ecosystem—on September 28th. Officials stated that to test Canton Wallet, participants will be allocated $CC quotas (after submitting a Google form verification). The specific steps involve purchasing a SENDTAG, holding 7,000 $SEND, and staking 20u into the vault. This may be the most accessible way for ordinary users to join, though Canton Wallet will only distribute 30% of its earned $CC as airdrops, suggesting limited profit potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News