Forbes: Reshaping Wall Street's financial infrastructure—Is Ethereum the best choice?

TechFlow Selected TechFlow Selected

Forbes: Reshaping Wall Street's financial infrastructure—Is Ethereum the best choice?

Ethereum is not perfect but the optimal solution.

Author: Jón Helgi Egilsson

Compiled by: TechFlow

Vitalik Buterin, co-founder of Ethereum, has seen his foundation join Electric Capital and Paradigm in backing Etherealize’s $40 million launch—a startup with one mission: to rebuild Wall Street on Ethereum. (© 2024 Bloomberg Finance LP)

Every day, Wall Street’s financial system processes trillions of dollars in flows—many still running on systems built decades ago. Mortgage and bond trades can take days to settle. Intermediaries add layers of cost, tie up capital, and amplify risk. For the world’s largest banks and asset managers, choosing the wrong tech infrastructure could lock in a new generation of inefficiencies. Blockchain technology has the potential to change that. But the question remains: which blockchain is best suited for the job?

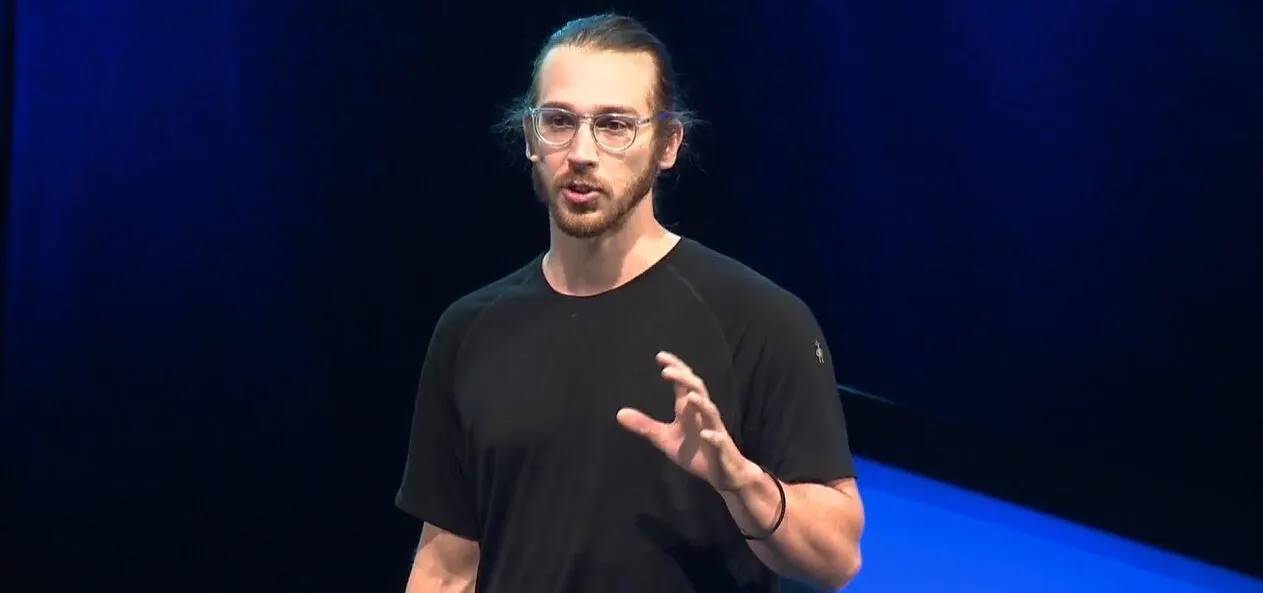

Critics argue Ethereum is slow and expensive, while competitors claim higher throughput. Fintech giants are even building their own blockchains. Yet Danny Ryan, co-founder and president of Etherealize and a core architect of Ethereum's evolution—who led coordination of the historic “proof-of-stake” “Merge”—insists Ethereum’s security, neutrality, and cryptographic privacy make it uniquely capable of bearing the weight of global finance. Yes, Wall Street needs rebuilding—and Ryan believes Ethereum is the only blockchain up to the task.

Ryan spent nearly a decade at the Ethereum Foundation, working closely with Vitalik Buterin and shaping the protocol through its most critical turning points. Now, with Etherealize securing $40 million in funding from Paradigm, Electric Capital, and the Ethereum Foundation—including initial grants from the Foundation—he is convinced Ethereum is ready for Wall Street.

Ryan’s answer—direct, precise, and somewhat surprising—goes far beyond crypto hype, as he elaborates why Ethereum may be the safest choice for reshaping the financial system.

Danny Ryan, co-founder and president of Etherealize, believes Ethereum is the only blockchain with the security and neutrality required to rebuild Wall Street.

Security Is a Scarce Resource

I started with the obvious question: given Ethereum’s congestion and high fees, why would Wall Street trust it?

Ryan didn’t hesitate: “Cryptoeconomic security is a scarce resource.” In proof-of-stake systems, validators must lock up capital to make attacks prohibitively expensive. Today, Ethereum has over one million validators and nearly $100 billion in staked value. “You can’t replicate that overnight,” he added.

In contrast, newer blockchains can create faster networks but often rely on a small number of institutional supporters. “That looks more like a consortium model,” Ryan explained. “You’re trusting the companies involved, the contracts, and legal recourse. That’s a different kind of security. It’s not the same as maintaining a neutral global network handling tens of billions of dollars.”

Data backs his claims. According to Etherealize’s latest research, Ethereum secures over 70% of stablecoin value and 85% of tokenized real-world assets. If security scale matters, Ethereum clearly holds the advantage.

With over one million validators and more than $120 billion in staked value, the Ethereum network is the most secure blockchain—a “scarce resource” for institutions managing counterparty risk. (getty)

Privacy: Promise vs. Mathematics

Privacy is another key concern. No bank will place customer transactions on a fully public ledger. Is this why projects like Canton, backed by major financial institutions, are gaining attention?

Ryan’s response was sharp. “Canton relies on honesty assumptions—trusting counterparties to delete sensitive data. That’s obfuscation, not real privacy. With cryptography, you solve privacy at the foundational level.”

He refers to zero-knowledge proofs (ZKP), a field of cryptography developed long before blockchains, now being deployed at scale on Ethereum. ZKPs already underpin “rollups,” technologies that batch thousands of transactions for settlement on Ethereum. The same tools are expanding into privacy: enabling selective disclosure, where regulators can verify compliance without exposing all transaction details to the market.

“You use math to solve privacy,” Ryan added—a statement that feels like a guiding principle for how Ethereum meets institutional demands.

Institutional finance demands confidentiality. Ethereum’s zero-knowledge tools aim to protect privacy through cryptography, not intermediaries. (getty)

Modularity: Institutions Control Their Infrastructure

I pressed him on Ethereum’s architecture. Compared to Stripe and Circle now attempting to build lean blockchains from scratch, isn’t Ethereum’s design overly complex?

Ryan pushed back: the seemingly complex architecture is actually an advantage. “Institutions love the L2 model,” he explained. “It lets them customize infrastructure while inheriting Ethereum’s security, neutrality, and liquidity. They gain control over their stack while still connecting to global network effects.”

He pointed to Coinbase’s Base network as proof of concept. Built as an L2 on Ethereum, Base generated nearly $100 million in sequencer revenue in its first year, demonstrating economic viability and institutional-scale adoption.

For Ryan, modularity isn’t just a technical detail—it’s the blueprint for how institutions can build their own blockchain infrastructure without losing the benefits of a shared network.

Ethereum’s scaling strategy combines rollups with data availability sampling—the path aims for over 100,000 TPS without sacrificing security. (getty)

Neutrality and Throughput

What about speed? Solana and others claim thousands of transactions per second. Isn’t that more practical for global finance compared to Ethereum’s relatively limited throughput?

Ryan reframed the question. “When institutions consider blockchains, they don’t just ask, ‘How fast is it?’ They also ask: Can this system execute correctly and stay online? Who do I have to trust? On Ethereum, the answer is: no one.”

This is what he calls “credible neutrality”—a protocol-level guarantee that the rules don’t favor insiders. Ethereum hasn’t had a single day of downtime since 2015—a track record worthy of recognition in financial systems.

As for scalability, Ryan referenced the roadmap laid out by Ethereum co-founder and think tank architect Vitalik Buterin. He emphasized that capacity comes from the aggregate of numerous L2s running on Ethereum, not a single chain. Today, this already means the overall system handles tens of thousands of transactions per second—and with upcoming upgrades like data availability sampling, Ryan says total throughput could exceed 100,000 TPS within just a few years. “Scalability is here—and without sacrificing trust,” he said.

As Wall Street modernizes its financial rails, the real question is which blockchain can meet institutional demands for scale, security, and privacy. (SOPA Images/LightRocket via Getty Images)

The Bigger Picture

Ryan doesn’t claim Ethereum is perfect. His argument is that only Ethereum offers the full package of security, privacy, modularity, and neutrality that institutions truly care about.

Stripe, Circle, and others may experiment with their own blockchains. But Ryan insists they’ll eventually face a harsh reality: “Most companies will end up reconnecting to Ethereum. Because security isn’t free—it’s a scarce resource.”

For Wall Street, this could be a pivotal decision point: build on proprietary silos, or connect to a neutral global network proven resilient for a decade? Ethereum’s base layer may not yet be the fastest blockchain, but for Wall Street, it may be the safest choice—one with rapidly expanding capacity and privacy guaranteed by mathematics, not promises that institutions can break.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News