Tech giants advancing in parallel: The next phase of AI payment development and opportunities from Google AP2 and Coinbase x402

TechFlow Selected TechFlow Selected

Tech giants advancing in parallel: The next phase of AI payment development and opportunities from Google AP2 and Coinbase x402

The next phase of AI Payment will be defined by both standards and execution-layer products.

Author: KevinY

TL;DR

-

AI payment era begins: Google collaborates with the industry to launch AP2 (Agent Payments Protocol), integrating mandate-based authorization and verifiable credentials to bring AI-to-user transactions into a unified, auditable framework.

-

Coinbase, alongside the Ethereum community, advances x402, making API calls equivalent to payments—natively stablecoin-enabled, A2A (Agent-to-Agent) direct connectivity.

-

Two tracks converge: fiat and stablecoins progress in parallel toward one ultimate goal—the emergence of an Agent-oriented payment semantic layer.

-

Startup opportunity: atop these protocols lies a critical gap—usable productized components and secure risk-control middleware. FluxA chooses to build the first mass-producible vehicles on this road.

Opening: Tech giants race into AI payments—true inflection point emerges

The AI arena is likely the most sleepless battlefield today. While tech giants continue their fierce arms race in model development, a new front—the domain of AI payments—is quietly emerging. Stripe has announced plans to launch its own payment L1, Tempo; PayPal announced investment in Kite.AI; and just days ago, Google unveiled its open-source payment protocol, Agent Payments Protocol (AP2), and revealed collaboration with Coinbase’s previously launched X402 by integrating X402 into Google's own A2A framework.

As AI evolves, industry thinking around AI capabilities and monetization is entering a new phase. More people are recognizing that payment capability is essential for Agents. Payment isn’t merely a feature—it represents a fundamental shift: when Agentic AI becomes a first-class citizen of the internet, it will disrupt traditional e-commerce operations, advertising and distribution models, and internet finance, giving rise to a new paradigm centered on AI-driven Agentic Commerce.

This article provides an in-depth analysis of the latest developments from two leading players in AI payments: Google's AP2 and Coinbase's X402, using them as entry points to explore trends and opportunities in the AI payment space.

01|Google AP2: Bringing AI spending under a regulated, universal language

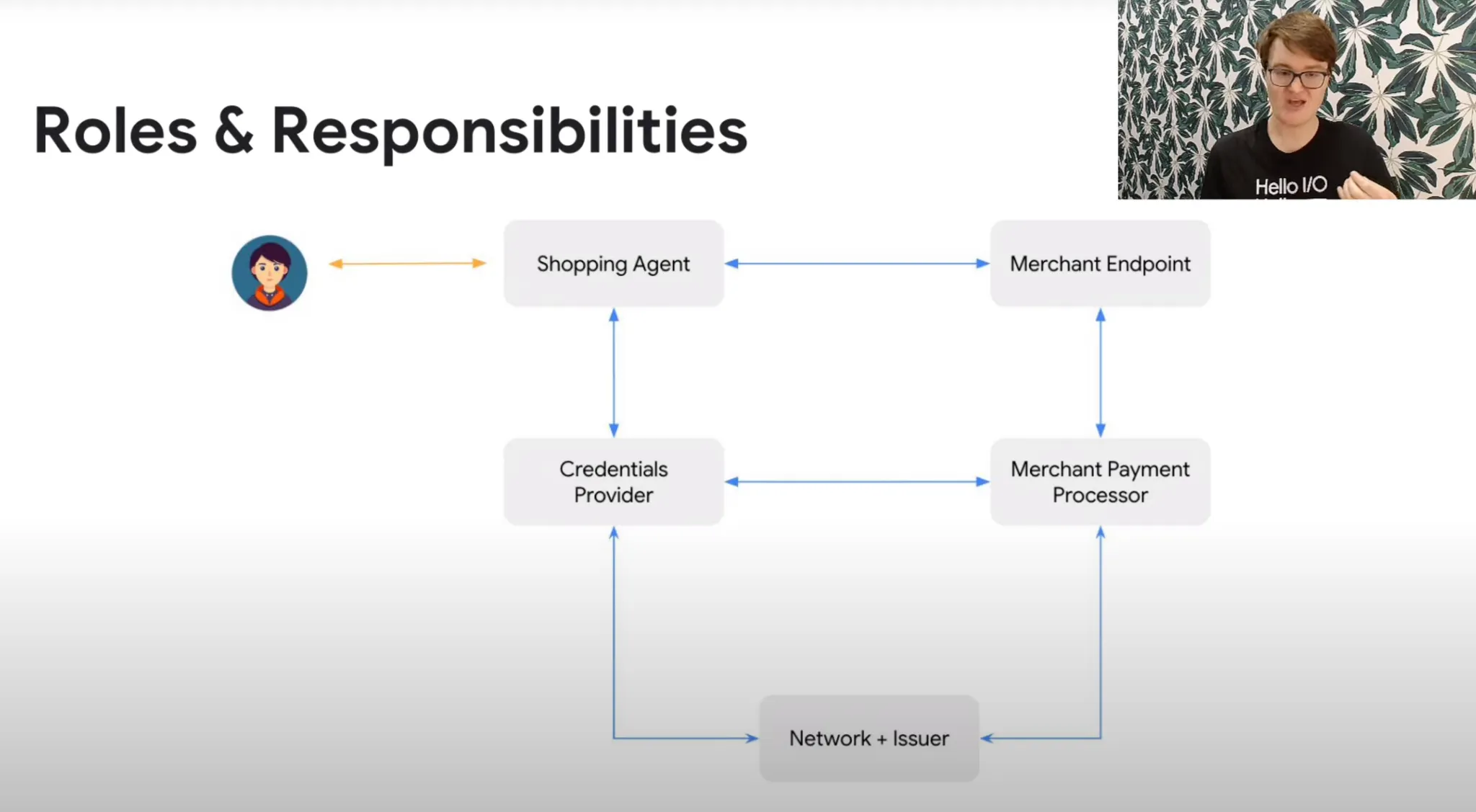

This week, Google partnered with over 60 payment networks, financial institutions, e-commerce platforms, and blockchain companies to launch AP2 (Agent Payments Protocol), aiming to establish a unified standard at the intersection of AI and payments.

Before AI, traditional payments were completed when a human clicked “Buy” on a payment interface. Any automated, non-human-initiated transaction would be flagged as “unsafe” by the entire payment system, which has evolved a mature risk control framework to manage such risks. However, in the AI era, this becomes a challenge: if we allow AI to initiate transactions on behalf of humans, how do we confirm: 1. Whether the user truly authorized the AI to make this transaction? 2. Whether the AI’s request reflects the user’s actual intent? 3. How to hold the AI accountable if something goes wrong?

AP2 addresses these questions directly. Google defines an open protocol standard—a common language for secure and compliant communication between AI and merchants. This is essentially a dual-authorization mechanism linking user–AI–merchant:

-

Intent Mandate: The user specifies clear intent—what they want to buy, budget cap, time window;

-

Cart Mandate: The agent locates specific items and prices, then requests user signature for final confirmation.

Both authorizations are cryptographically signed as verifiable credentials, forming a non-repudiable chain of evidence upon user confirmation. For merchants and clearing networks, this means payment requests aren’t coming from an unidentifiable bot but from a user-authorized, verifiable "transaction mandate." Using Google’s defined “transaction mandate,” merchants and clearing networks can confidently validate and approve the transaction.

AP2 does not aim to rebuild settlement layers like Visa, ACH, stablecoins, or blockchains. Instead, it adds a trust semantic layer on top—answering who is spending, why they’re allowed to spend, and enabling accountability for overreach. It seeks to adapt across different settlement networks (stablecoins, fiat, etc.) to solve the problem of confirming AI payment intent. In traditional scenarios, this intent is conveyed manually via clicking “Buy.” But in the “dark forest” of AI and stablecoin interactions, we need cryptography and procedural constraints to bring order to every AI’s actions, ensuring AI doesn’t misuse spending privileges to harm users’ funds.

Though AP2 is still in early design and development stages, Google’s strategic focus on AI payments is clear: alleviating concerns among all parties in the Agent payment flow about uncontrollable, unverifiable Agent behavior—one of the essential prerequisites for AI to conduct payments:

-

For consumers: Define boundaries of AI payment behavior through authorization. Budgets, categories, time windows, and exception rules are all fixed within mandates. Confirming the agent’s scope before payment enables pre-emptive prevention of overreach and post-event dispute resolution.

-

For merchants and payment networks: Upgrade verification of genuine user intent from verbal/interface checks to encrypted, verifiable credentials. Chargebacks and disputes now have traceable evidence, reducing gray-area losses and compliance uncertainty.

-

For the ecosystem: Establishes a shared language for AI participation in payments, enabling multi-party innovation (identity, risk control, clearing/settlement, factoring) on a consistent foundation.

-

For enterprise IT/compliance: Migrates AI-era processes like automated procurement, subscription scaling, and bill payments from policy documents + manual review to protocol-level execution. Real-time auditing lays the groundwork for future transparent regulation.

02|x402: Binding payment and service delivery, building a new machine economy with stablecoins

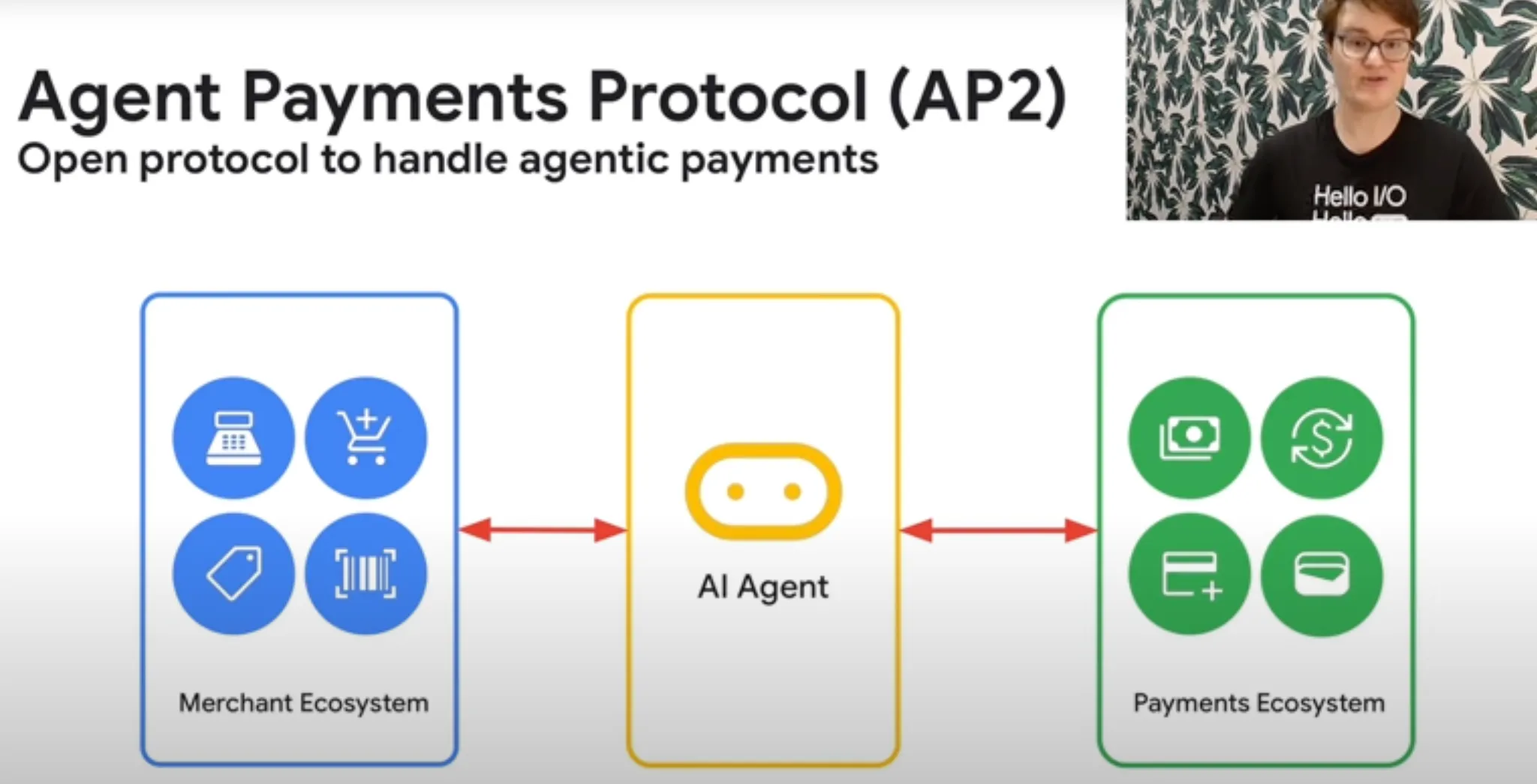

If Google focuses more on authorization and security in AI payments, Coinbase—naturally closer to stablecoins and blockchain—reaches directly into AI transaction behavior and settlement itself. Through the x402 protocol developed with the Ethereum Foundation, Coinbase aims to position stablecoins and blockchain as the native currency and payment primitives for AI, tightly coupling AI payment and consumption behaviors.

x402 draws inspiration from HTTP 402, a status code meaning “payment required for resource access.” Historically, this code was rarely standardized or used. But recent AI growth reveals its potential: as web and API access increasingly originates from AI rather than humans, should AI also pay for its usage?

x402 tackles this by embedding payment directly into the service call workflow:

When an AI agent invokes a service, x402 returns a payment “invoice” via HTTP based on the provider’s predefined pricing. The AI agent can then use USDC or other stablecoins to settle the invoice directly on-chain, after which the service provider immediately grants access.

Though just a simple protocol and not a full product, x402 leverages the real-time settlement and high programmability of stablecoins in AI payment contexts, illustrating what AI payments could look like in the stablecoin era:

For AI agents, x402 enables seamless integration of service invocation and payment. By leveraging decentralized, highly programmable stablecoin networks, AI bypasses the traditional human workflow of “binding credit card → initiating payment → waiting for service activation,” achieving true instant pay-and-use. Unlike humans’ relatively low-frequency payments, AI’s parallel processing leads to vastly higher transaction frequency. x402 adapts better to AI agents, enabling fine-grained automated micro-payments and streaming payments. AI agents don’t need pre-configured accounts or API keys—they can automatically negotiate pricing upon encountering an x402 challenge.

For AI service providers, x402 pushes “access equals pricing” down to the protocol layer. In the future, developers in the x402 ecosystem can granularly monetize pages, APIs, and data shards via micro-payments, charging per request, per token, per duration, or other complex models. Leveraging stablecoins enables instant, cross-border, low-fee settlements, simplifying reconciliation even under extremely high transaction volumes.

03|Two tracks, one ultimate destination

If AP2 represents an AI extension of traditional payment systems, x402 resembles a nascent, AI-native payment model for the stablecoin era. Together, they reflect how tech giants are collaboratively building foundational infrastructure across the full AI payment stack, revealing a dual-track landscape: both fiat and crypto payments evolving toward Agent-callable interfaces.

-

AP2: Embeds real-world regulation, risk control, and consumer protection into Agent transactions;

-

x402: Integrates Web3’s instant settlement and programmability into Agent transactions.

The conclusion is clear: the next stage of AI payments won’t be a choice between the two, but rather coexistence and interoperability:

-

Users and merchants gain compliance and trust via AP2;

-

Compute power, data, and microservices gain speed and programmability via x402;

-

Upper-layer products require unified abstraction to seamlessly orchestrate both tracks for Agent use.

04|Entrepreneurial opportunity: Above protocols, usable execution-layer products are most needed

Giants often start by defining standards to shape ecosystems and influence. However, standards like X402 and AP2 remain far from being usable AI payment products in real-world environments. Building usable, scalable, productized components atop these protocols is precisely where startups can find their entry point.

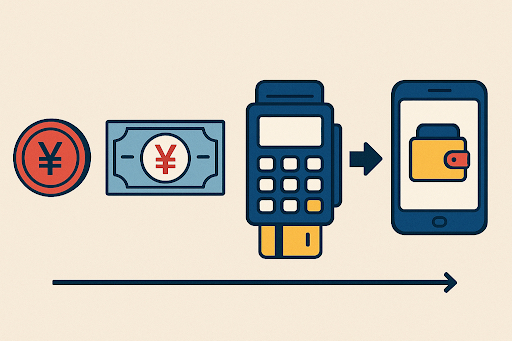

Google outlines multiple roles and responsibilities involved in Agent payments. Protocols like AP2 primarily coordinate trust among parties along the payment path through verifiable credentials. Notably, AP2 is not an execution layer—Google intentionally leaves execution open for other participants to build upon.

The Credentials Provider, Merchant Payment Processor, and Network/Issuer form the three key roles in the payment execution layer. In the age of Agent payments, innovators are exploring whether this execution layer can give rise to the next trillion-dollar market and players.

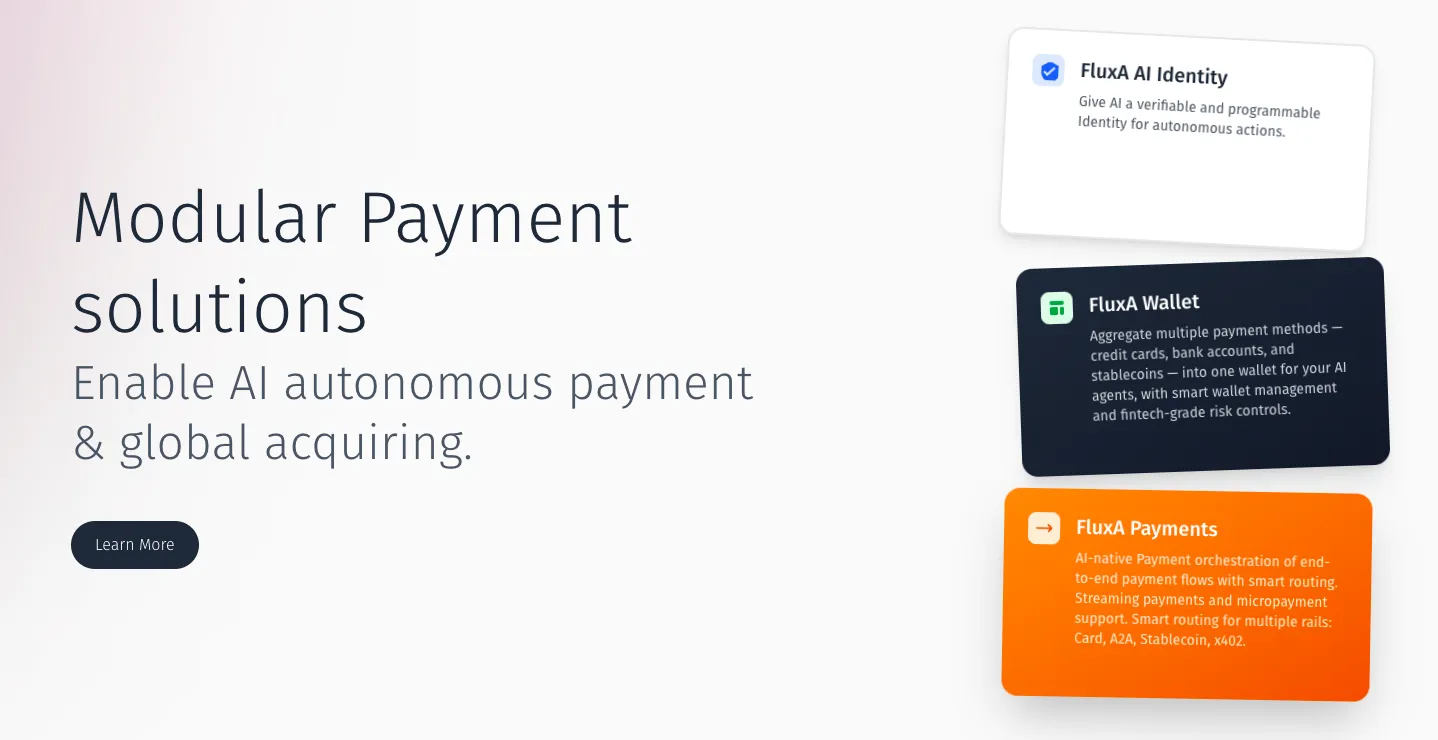

05|FluxA: Building production vehicles on the protocol highway

FluxA is an AI-native payment execution layer. Founded by former executives from Alibaba and Ant Group, the team is actively joining the Agent payment race.

FluxA aims to create payment primitives for the Agent economy, abstracting identity, wallets, and payments into modular components. Developers can assemble their own Agentic economic services using FluxA’s building blocks.

FluxA’s core product covers four essential aspects of AI Agent payments: identity, wallet, acquiring, and payment channels.

-

AI Wallet: Aggregates all AI-accessible payment methods (credit cards, digital wallets, stablecoin wallets, etc.), providing a unified payment gateway for AI Agents. Security and risk control are central, ensuring agents act within user-defined intents.

-

AI Identity: Naturally provides trusted AI identity IDs. Beyond user authentication, it includes verification of the AI Agent’s operational integrity. With FluxA’s AI identity, merchants and downstream payment participants can enhance risk controls and mitigate exposure from offering programmable interfaces to AI Agents.

-

AI Payment: Enables merchants to receive payments from AI Agents. FluxA’s AI Payment aggregates acquiring and multiple AI-compatible payment channels, eliminating merchant concerns about failed AI payments. It integrates industry protocols like AP2 and x402 to offer diverse AI-native payment options.

-

Stablecoin Rail: Stablecoins are still early in mainstream adoption, requiring improvements in consumer wallet experience and merchant acceptance. FluxA will build a seamless, low-friction stablecoin channel focused on mainstream compliance and ease of use, tailored specifically for AI payments.

If Google’s AP2 and Coinbase’s x402 provide the highways, FluxA aims to build the first mass-producible vehicles:

-

Integrate with AP2, x402, and other protocols → Ensure global payment standard compatibility.

-

Provide SDKs/APIs → Enable developers to quickly equip AI with payment capabilities without mastering underlying protocols.

-

Application-focused → Whether B2B SaaS auto-procurement or C2C Agent e-commerce, FluxA serves as the payment execution layer.

In the early stages of an innovation cycle, startups often move faster than giants. Open protocols are just getting started, and truly usable products remain scarce. Enterprises want to rapidly integrate AI payments but must ensure speed without chaos—creating urgent demand for compliant, auditable operational middle platforms. Meanwhile, developers no longer want to juggle dozens of gateways or wallets; they need a single, unified abstraction layer that makes payment capabilities as simple as calling an API.

FluxA won’t invent its own protocols but will deeply align with and follow the evolution of AP2 and x402, prioritizing integration with mainstream payment providers and wallet ecosystems. Its value lies in bridging the gap—transforming protocols into usable products, standards into deployable business capabilities, and security requirements into default configurations. Thus, while giants set rules and build highways, startups lead by launching the first mass-producible vehicles on those roads.

Payment is a vast ecosystem—startups and giants aren’t rivals but complements:

-

FluxA doesn’t create protocols but aligns deeply—tracking AP2/x402 evolution and prioritizing mainstream payment and wallet integrations;

-

FluxA’s value is in its niche: turning protocols into products, standards into runnable businesses, and security into built-in defaults.

Conclusion: From conversation to transaction, the AI economy truly begins

As Google and Coinbase drive protocol standardization on parallel tracks, the market no longer needs slogans—but bold execution. AP2 ensures compliance and trust; x402 unlocks instant settlement and programmability; FluxA transforms these abstract standards and protocols into callable payment primitives and practical product components.

The next phase of AI payments will be defined jointly by standards and execution-layer products. Agents must not only be granted permissions but also be verifiable and accountable. Payment workflows must go beyond simple transfers to include orchestration, observability, and scalability. For developers, the ideal state is to integrate and launch AI payment capabilities in days, not months.

The inflection point has arrived. FluxA aims to work with ecosystem partners to move the Agent economy from whitepapers and demos into reliable, usable, and scalable reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News