a16z: Moving Beyond Web2 Growth Models: What New Metrics Do Crypto Projects Need?

TechFlow Selected TechFlow Selected

a16z: Moving Beyond Web2 Growth Models: What New Metrics Do Crypto Projects Need?

The best crypto growth strategy is a balance of data and intuition.

Author: Maggie Hsu

Translation: TechFlow

How do you evaluate the success and growth of a crypto protocol or product? In Web2, marketers have multiple strategies for measuring success. In crypto, especially in L1s, L2s, and protocols, marketing strategies are still being developed. Some metrics aren’t yet available, some are less relevant, and many need to be rethought specifically for blockchains.

I've spoken with many growth and marketing leads, each using different dashboards—which makes sense because what defines growth for an L1 or L2 differs from that of a DeFi protocol, wallet, or game. Let’s explore these differences more broadly:

Growth for L1s and L2s is deeply tied to user and developer communities. We can measure their success by looking at monthly active addresses (MAA) and the number of applications built on them. Growth in MAA without significant app growth might simply indicate a few popular or spammy apps; ideally, both should grow together. In this context, the role of the Chief Marketing Officer (CMO), beyond promoting the protocol itself, becomes more like a community marketing engine.

The core growth metrics for protocols are user count, transaction volume, and Total Value Locked (TVL)—the total dollar value of assets deposited into a protocol’s smart contracts—or Total Value Secured (TVS), the total value secured by the protocol. While TVL is a controversial metric, when combined with other metrics discussed below, it offers a rough picture of protocol growth. One founder shared that they also calculate the “capital cost” of “active TVL”—the ratio between rewards paid out to achieve a certain level of locked value versus fees or additional locked value generated as a result.

Growth for infrastructure and other software-as-a-service (SaaS) products often aligns closely with individual product growth. For example, developer platform Alchemy tracks customer and revenue growth within each product line, similar to what we see in traditional SaaS companies. More specifically, tracking recurring revenue as a percentage of existing customers retained, or Gross Revenue Retention (GRR), indicates product stickiness and stable customer base—critical for measuring recurring revenue. Net Revenue Retention (NRR) further accounts for upsells and reflects the ability to increase revenue from the existing customer base.

Growth for wallets and games appears more traditional (similar to the SaaS example above). Here, however, it focuses on measuring overall usage and revenue through the following metrics:

-

Daily Active Addresses (DAA): the number of unique addresses active on the network each day

-

Daily Transacting Users (DTU): the number of unique addresses conducting revenue-generating transactions on the network (a subset of DAA)

-

Average Revenue Per User (ARPU): revenue generated from users or customers over a specific period

However, if tokens are involved, then token price and holder distribution come into play—but even these depend on your goals. For instance, do you want many small token holders or a few whales? This depends on your product or service category, stage, and strategy, requiring you to choose appropriate metrics accordingly.

So how do you build a company-specific metrics dashboard? Below are some potential metric suggestions, along with insights based on where they sit in the marketing funnel. Ultimately, though, you must decide what to measure, how to weigh each metric's importance, and how to act on the data…

Core Metrics: What Matters?

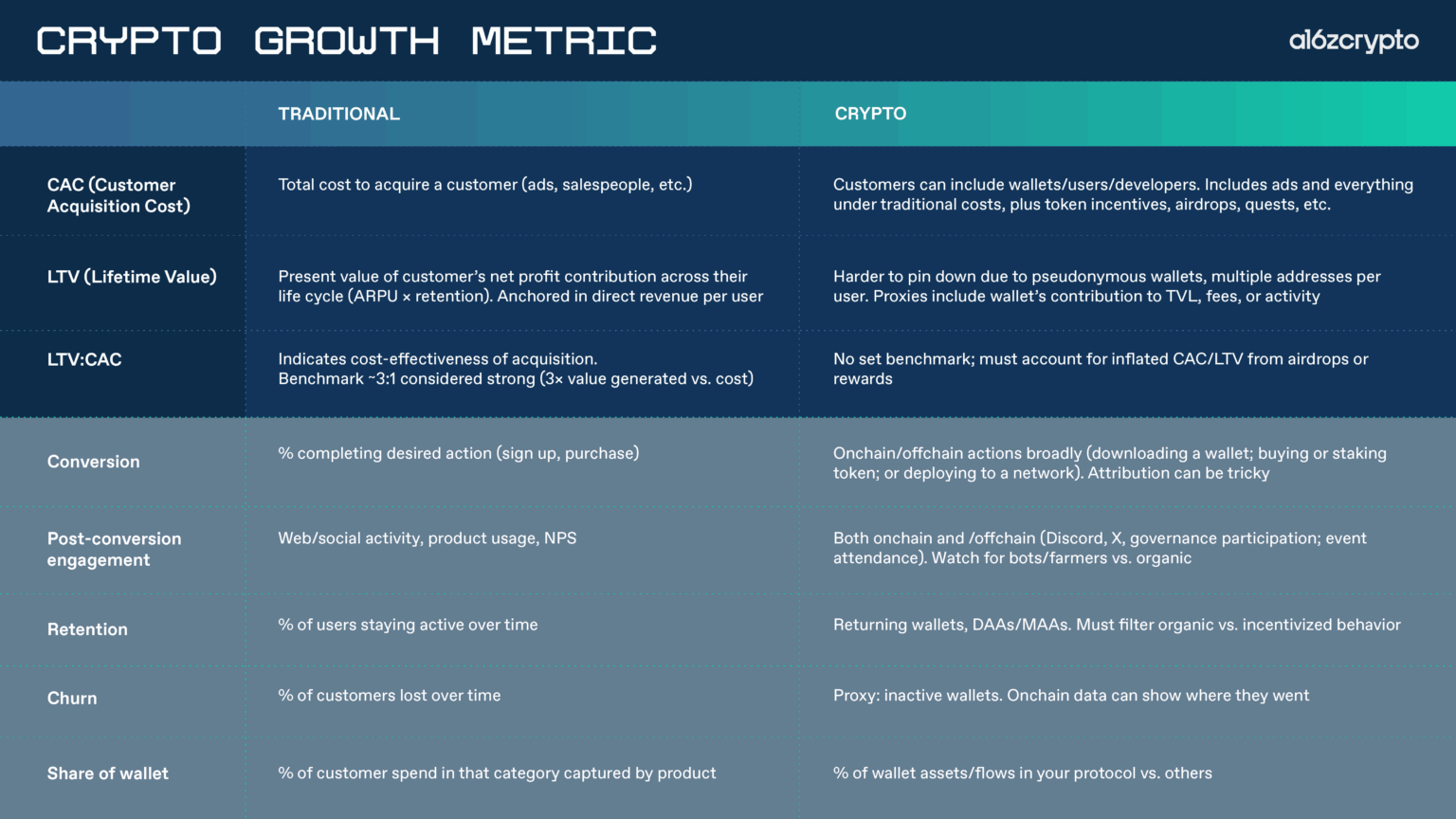

Metrics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Average Revenue Per User (ARPU) are central to understanding the success and efficiency of customer acquisition efforts (we define these below).

While these concepts are well-established in traditional SaaS, they require adaptation in crypto since "customers" here usually mean "wallets," and value creation takes different forms. We’ll redefine these metrics below and explore their unique nuances in the crypto context.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the total cost of acquiring one customer and can be measured in several ways:

-

Broadly, blended CAC is calculated by dividing total acquisition costs by the total number of new customers. It tells you the average price paid across all channels per new customer—not just paid acquisition but also organic growth costs (making it hard to identify which specific growth strategies are driving results).

-

On the other hand, paid CAC only considers customers acquired through paid marketing. Often, teams spend on paid marketing “blindly” without measuring outcomes. Paid CAC reveals the true cost of acquiring these customers and whether specific campaigns are actually effective. This is particularly important in crypto, where early observations show many teams get distracted by paid incentives without fully understanding what their product truly does.

What counts as “cost”? When calculating CAC, costs may include ad spend, sponsorships, marketing swag development, task-based token incentives (on platforms like Galaxe, Layer3, or Coinbase Quests), and airdrops to target wallets.

Who counts as a “customer”? Here, “customer” may refer to “user” or “developer”; for example, a brand-new wallet conducting a transaction on a protocol could be considered a customer of that protocol.

Lifetime Value (LTV) and Average Revenue Per User (ARPU)

Lifetime Value (LTV) represents the present value of future net profit expected from a customer during the relationship. LTV essentially measures how much a customer gives back after becoming a customer, including how much they spend on the product.

LTV itself is a complex calculation and concept. In crypto, it doesn't always translate directly because “users” aren’t always equivalent to traditional “customers.” For example, they might be anonymous wallets, and one user might control multiple wallets. Thus, LTV might reflect a single wallet’s contribution to Total Value Locked (TVL)—the total dollar value of assets stored in protocol smart contracts, introduced earlier.

For DeFi protocols, TVL provides a snapshot of “current asset volume,” while LTV helps answer “what is the value of a specific wallet to the protocol over its lifetime?”

LTV:CAC Ratio

Lifetime Value (LTV) is typically used to assess initial Customer Acquisition Cost (CAC) against the future “value” of that customer. The LTV:CAC ratio, comparing the value a customer brings versus the cost to acquire them, offers insight into the cost-effectiveness of attracting new customers.

For traditional SaaS products, a 3:1 ratio is considered healthy, meaning you generate three times the value from a customer compared to acquisition cost, leaving room for reinvestment into growth. In crypto, we haven’t established such benchmarks yet.

When evaluating LTV:CAC ratios in crypto, other acquisition incentives like airdrops or points must also be considered, as they can distort metrics. Ideally, such incentives help attract users and onboard them, but when users genuinely like the product, growth continues even without incentives—in which case, CAC decreases and LTV increases, improving the LTV:CAC ratio.

Below is a brief summary of the key metrics outlined in this article and how to think about them in the context of crypto:

Together, these metrics provide a foundation for measuring how effectively your growth marketing efforts attract users across different stages of the marketing funnel, while accounting for the associated costs.

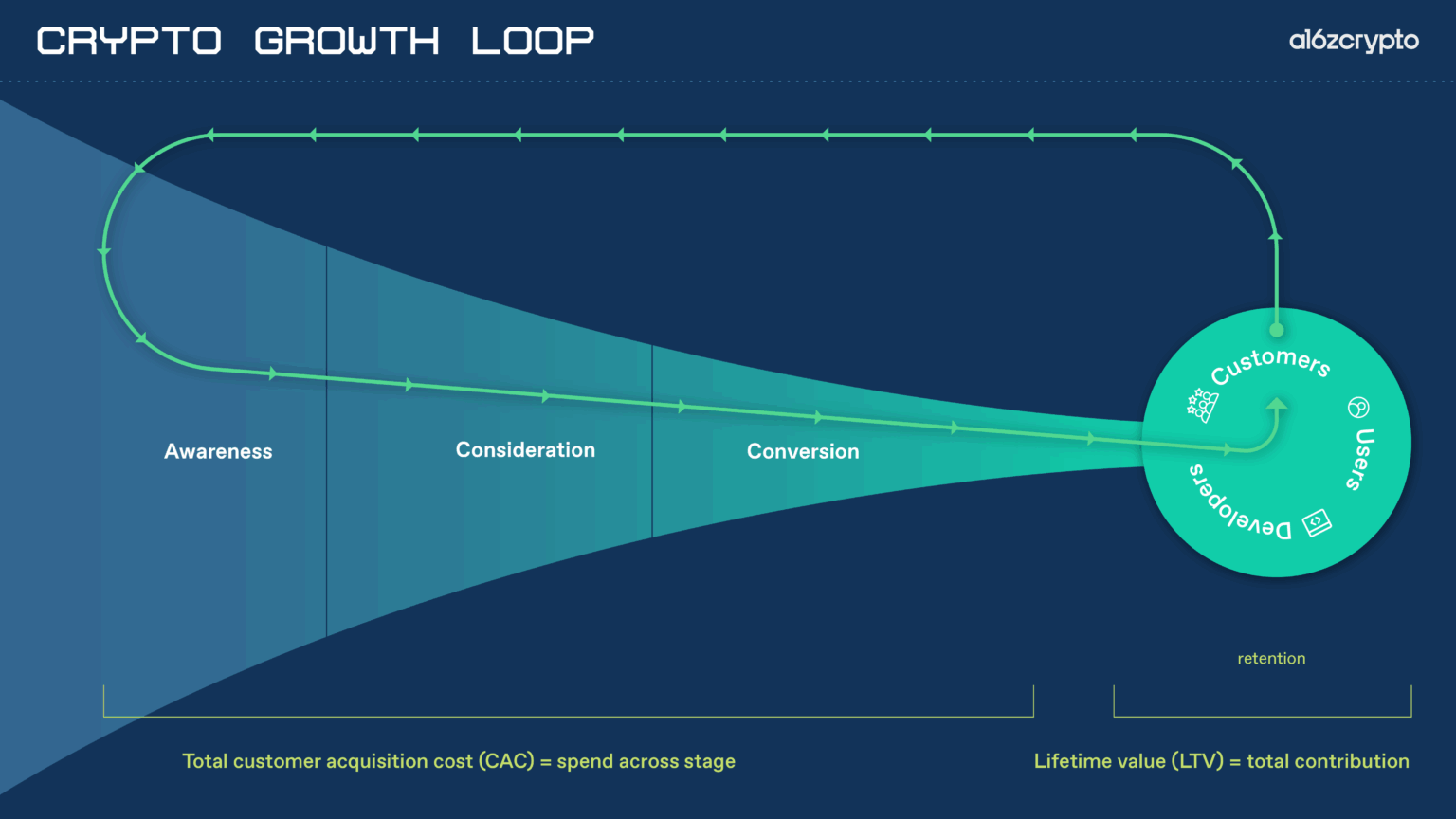

Analyzing the Growth Funnel in Crypto

After identifying core metrics, the next step is mapping them vertically across the marketing funnel. Note that while the crypto growth marketing funnel differs from traditional Web2 funnels, the distinctions lie mainly in crypto-specific marketing tactics, behavioral traits, and unique opportunities at each stage—such as on-chain behavior, token incentives, and community-driven dynamics.

We’ll now walk through each stage of the funnel, analyzing key strategies, measurement approaches, and how they differ in crypto versus Web2…

Awareness / Lead Generation

Whether via traditional or crypto-native channels, the first stage of any marketing funnel is building brand awareness. Even in crypto, raising awareness is a prerequisite for everything that follows.

At this stage, you begin measuring Customer Acquisition Cost (CAC). “Reach”—the number of distinct individuals who see your content—should also be a core metric. Reach is especially critical when evaluating the success of broad marketing channels like news, media, and PR. A key challenge here is distinguishing short-term spikes in attention from genuine “sticky” interest: Are users merely curious, or truly interested in using the product?

Beyond core acquisition metrics, the channels you use to find new users each have unique strengths, risks, and nuances specific to crypto:

Key Opinion Leaders (KOLs) and Influencers

Paying random influencers or KOLs with large followings may seem like a reliable way to boost visibility, but it often fails to generate meaningful engagement—especially when influencers lack authentic connection to the project, causing their audience to disengage.

However, partnering with influencers aligned with your project’s ethos can be valuable, as they share enthusiasm in credible ways. Consider “micro-influencers”—niched, targeted voices trusted by their audiences—or even native influencers such as experts within your team who’ve already built strong personal brands. Claire Kart, CMO of privacy-focused L2 Aztec, is a prime example: she acts as an internal influencer while actively identifying emerging voices, forming organic relationships, and bringing them into the Aztec ecosystem.

Advertising

Crypto advertising faces numerous challenges. For instance, due to ambiguous and evolving policies, many crypto companies cannot run ad campaigns on traditional platforms like Google or Meta. Additionally, the crypto community tends to be wary of traditional ads, as similar formats have been used by scammers to direct users to malicious sites.

Crypto marketers have found more success promoting specific apps on X (formerly Twitter), LinkedIn, Reddit, TikTok, or the Apple App Store. Alternative options include Brave browser ads, Coinbase/Base in-app Spindl ads, Farcaster MiniApps and sponsored posts, or even optimizing prompts to appear in AI search answers.

Referral and Affiliate Marketing

The idea behind referral programs mirrors traditional marketing: you earn rewards when others sign up via your link. The difference in crypto is that rewards can be instantly delivered and verified directly on-chain, aligning incentives and streamlining the process. Projects like Blackbird demonstrate how on-chain referrals can evolve into compounded network effects through ongoing loyalty programs and community engagement, rather than just one-off acquisition events.

Word-of-mouth is one of the most powerful growth drivers in crypto: for consumer-facing products, adoption is often driven by referrals, as users enjoy the experience and recommend it to others. For infrastructure projects, referrals typically stem from existing customers and developers.

Measuring organic growth can be done simply by tracking Net Promoter Score (NPS) or directly surveying new users upon registration or onboarding completion to ask whether they were referred and by whom.

In this sense, referrals resemble an inverted, bottom-up marketing funnel: users don’t stop at conversion—they reintroduce new prospects back to the top of the funnel. Early users become advocates, bringing more people into the network (and potentially earning rewards for their contributions), thus spinning the growth flywheel forward.

Note on Accuracy: Accurately measuring real user/customer growth versus bot activity is a challenge across industries, especially in social media. Crypto has unique identity primitives available—such as verifying “proof of humanity” via World ID, or identity verification using zero-knowledge proofs (via zkPassport)—that can distinguish real users from bots or airdrop farmers. Growth teams can leverage these tools not only to build Sybil resistance into community growth mechanisms like airdrops but also to better understand actual users and inform product retention planning.

The Power of Growing Networks

Finally, one uniquely crypto-native growth lever is tokens, often the best way to attract users, developers, and liquidity into markets traditionally plagued by cold-start problems. But this isn’t just for speculation: more importantly, rising token prices can attract new users eager to participate in a movement or growing ecosystem. Developers take notice too, as price increases may signal active communities and real demand, making the platform more attractive.

Consideration / Interest

The next stage in the traditional marketing funnel is consideration, where prospects actively engage with the product, evaluating it and comparing it to alternatives.

In crypto, this is especially critical because nearly every decision—from buying tokens to ordering a hardware wallet—requires substantial education, given that crypto remains relatively new and complex for both users and developers. Providing the right information to help users make informed decisions and compare competing products or platforms makes a significant impact. That’s why companies ranging from Coinbase to Alchemy invest heavily in educational content for consumers and developers alike.

Effective educational content goes beyond listing features and benefits—it explains how the product works (e.g., security, custody, community and treasury governance, tokenomics). Developers may need deep technical documentation and tutorials, while consumers often require explanatory materials (e.g., before transferring real funds between wallets or blockchains).

Standard tools include email-based user education during key flows (like registration or purchase), in-product tips and tooltips, interactive walkthroughs, and product trials or “testnet” setups to demo functionality before committing real assets. Companies are also beginning to optimize educational content for large language models (LLMs), ensuring their materials surface when questions are asked.

Successful teams measure interest not just by clicks or downloads, but by intermediate actions demonstrating trust and intent—such as joining a waitlist or depositing small amounts to test functionality. However, assessing whether these efforts succeed depends on chosen channels, each having their own set of metrics. Ultimately, though, you must map these metrics to some form of conversion, which we cover next.

Conversion

Conversion is the stage in the marketing funnel where users complete the desired action. By this point, users have been attracted, engaged, and informed, and finally take the action you intended.

As a metric, “conversion rate” is a broad term: in traditional marketing, it might refer to the number of customers purchasing a product, signing up for a demo, or requesting a sales call. In crypto, conversions may include downloading a wallet, buying a token, or even deploying code on a platform. The exact definition depends on the product and goals, but clearly defining conversion metrics is essential for accurate measurement.

Tracking conversions by marketing channel (e.g., wallet downloads driven by offline events) is crucial. Knowing which sources drive results helps teams optimize budget allocation, messaging, and more.

Accurate conversion measurement also relies on attribution mechanisms, which are particularly complex in crypto due to fragmented user journeys across traditional websites, social networks, and on-chain behavior (e.g., moving from off-chain to on-chain or vice versa).

Web tracking tools like Google Tag Manager can track website conversions, while newer tools targeting wallet users (e.g., Addressable) bridge the gap between off-chain ads and on-chain behavior, allowing teams to trace actions from websites or Web2 ads to on-chain activity. However, user journeys are rarely linear—for example, a user might see a post on X, attend an in-person event, and only then make their first transaction.

Although attribution tracking in crypto has historically been difficult, improved analytics tools now allow teams to gain a more holistic view of growth. While many users hold multiple wallets, advances in analysis are making it easier to associate multiple wallets with a single user, linking on-chain behavior to specific individuals. As privacy regulations (like GDPR and cookie restrictions) make Web2 attribution harder, the transparency of on-chain data offers advantages while preserving user anonymity.

Post-Conversion Engagement

In traditional marketing funnels, the engagement/interest stage typically measures pre-purchase interactions. These interactions help users understand the product and brand better and are key to turning initial interest into loyal participation.

In crypto marketing funnels, post-conversion user engagement is equally important, encompassing both online and offline, on-chain and off-chain behaviors. This helps teams understand user retention and maintain overall community health regardless of where users interact.

For example, online engagement (also covered in our social media guide) may include:

-

Discord or other forum/chat platform activity

-

Activity on X (formerly Twitter)

-

Sentiment analysis across social channels

-

User participation in governance or voting

While many crypto marketers still rely on traditional social listening tools, these methods need adjustment for the crypto context. Sentiment tracking can directionally indicate how the community feels about a project but shouldn’t be the sole basis for decisions. It can help teams identify active contributors, key influencers, and assess message effectiveness. However, crypto communities are scattered across platforms with varying data quality and depth, and a few highly active accounts may skew results, creating noisy data.

Beyond sentiment tools, some teams use other social monitoring tools (like Fedica) to track and reward user engagement—identifying those amplifying content, creating memes, joining discussions, or energizing the community. However, incentive-based activities are prone to manipulation: certain rewards may attract people more interested in incentives than the project itself, leading to short-term activity without long-term sustainability.

Meaningful organic growth in crypto marketing is still possible without incentives or paid promotions. For example, through strategic content layering. Stablecoin liquidity layer Eco implemented an organic content strategy based on a “4-1-1 rule”: publish 4 educational pieces about market opportunities; 1 “soft sell” piece (e.g., third-party endorsement); 1 “hard sell” piece (e.g., “use our product”); repeat this cycle hourly over 7 days. Using only organic posting, major product announcements, and co-marketing campaigns, Eco increased its monthly total impressions by nearly 600%.

Offline engagement—such as attending conferences or events—also plays a vital role in fostering deeper user connections. Traditionally, event success is measured by collecting emails to grow mailing lists (e.g., scanning attendee QR codes). More sophisticated tools include tagging giveaways with NFC chips (e.g., via IYK) and running campaigns to encourage users to tap or scan them. Online platforms like Discord or Towns offer dedicated spaces for continuous interaction and relationship-building, allowing teams to track user interactions (posts, likes, replies) over time and perform qualitative and sentiment analysis.

Retention

Retention rate answers a critical question: “Who is staying?” Retention can be measured as the percentage of users completing on-chain actions after a set period, or more broadly, as sustained levels of user activity. It’s calculated by dividing the number of existing users at the end of a period by the number at the start. If measuring newsletter subscribers or wallet downloads, retention isn’t tracked at initial sign-up but rather by how many remain active over time. Common retention metrics include returning users or daily active addresses (DAA) over time.

In crypto, retention metrics must account for tensions between “long-term” and “short-term” behaviors due to powerful token mechanics and incentives. For example, a surge of airdrop farmers at launch may look like growth, but many leave once rewards stop. This is why defining your “ideal” user and measuring retention relative to that cohort matters more than raw total user counts. It’s also why measuring product-led metrics—metrics inherent to the product and reflecting natural interest—is crucial, so you don’t confuse what works versus what doesn’t, especially if your product hasn’t yet achieved product-market fit. Otherwise, you might believe you’ve achieved product-market fit when you haven’t—the interest wasn’t in your product, but in the rewards.

Retention naturally drives Lifetime Value (LTV), as longer user lifespans lead to higher spending or transaction volumes. This not only increases LTV but also improves the LTV:CAC ratio.

Churn

Churn is the inverse of retention, measuring how many users are lost and when during their lifecycle. Churn rate is calculated by dividing the number of users lost during a period by the total number at the start, expressed as a percentage. In crypto, an alternative metric (though not perfectly mapped to traditional churn) is the proportion of inactive wallets after a certain time. For example, users register wallets during a marketing hype cycle but never use them again. Some may re-engage later, but measuring churn requires identifying active, consistently engaged, and returning users—not just “dormant” users who performed a single on-chain action.

Tools exist to monitor user interactions with decentralized apps (dApps) (e.g., Safary), helping identify friction points causing churn—such as high transaction fees, poor UX, or multi-step onboarding processes. For instance, when Solana launched the Seeker phone, some users wanted pre-funded wallets (similar to early Saga phones) to reduce initial friction, as manual funding delays adoption. Although Solana shifted toward dApp reward campaigns after phone delivery, reducing onboarding friction remains critical.

To reduce churn, funnel tracking and audience segmentation platforms tailored to crypto-specific engagement (e.g., Absolute Labs’ “wallet relationship management”) can be used. These tools let teams create custom user segments and re-engage them via Web2 channels and crypto-native tactics like targeted airdrops. Additionally, sending timely, personalized nudges directly to wallets via secure decentralized messaging tools (like XMTP) can encourage users to return and stay engaged.

Share of Wallet

Another way to track churn and retention is through “share of wallet”—the proportion of a customer’s total spending in a category allocated to your product or service. In crypto, this concept applies very concretely. By analyzing wallet composition, teams can see what assets are held, in what quantities, and where activity is directed. If users stop interacting with your protocol, on-chain data can reveal whether they’ve moved to competitors. Of course, as protocols diversify offerings, reasons for migration become harder to pinpoint. But if you observe user behavior shifting toward a competitor or another product with unique features, that could signal important insights.

Likewise, if many of your token holders also hold tokens from a related project, this could open co-marketing opportunities—such as joint events or gifting your token to their holders. General analytics tools like Dune, a crypto data platform, enable such analysis, while specialized platforms offer deeper insights for specific tokens. Since most users have multiple wallets, linking them to a single end-user identity is also important; on-chain analytics tools (like Nansen) provide cross-chain wallet labeling for more accurate share-of-wallet analysis.

Growth measurement in crypto isn’t about copying Web2 methods—it’s about adapting what works, discarding what doesn’t, and building new frameworks around blockchain’s unique advantages. Given the diversity of crypto products—from L1s to games—each team’s growth dashboard will differ.

But data alone doesn’t tell the full story. Ultimately, quantitative metrics are only part of the narrative: qualitative insights—deep understanding of your audience and users—are irreplaceable. Conversations within the community (whether project-related discussions, memes, or vibes), the energy felt at events, and even gut instincts about what works and what doesn’t—all play crucial roles in guiding growth strategy. In early stages, the behavior of a few core users may carry more weight than others. These qualitative signals are often the earliest indicators of product-market fit. The best crypto growth strategies balance data and intuition, combining short-term tactics to spark excitement with long-term strategies to build stronger communities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News