Top signals have appeared—could the market trend be heading for a reversal?

TechFlow Selected TechFlow Selected

Top signals have appeared—could the market trend be heading for a reversal?

After the Federal Reserve meeting, there is a very high probability of market correction; it is recommended to lock in existing profits first.

Written by: arndxt

Translated by: Saoirse, Foresight News

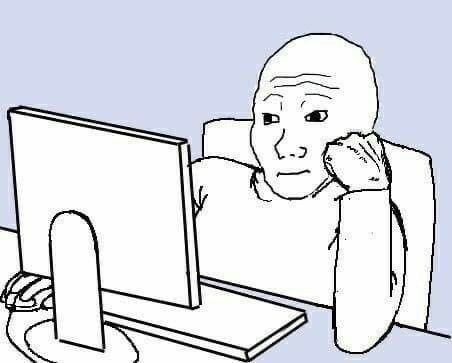

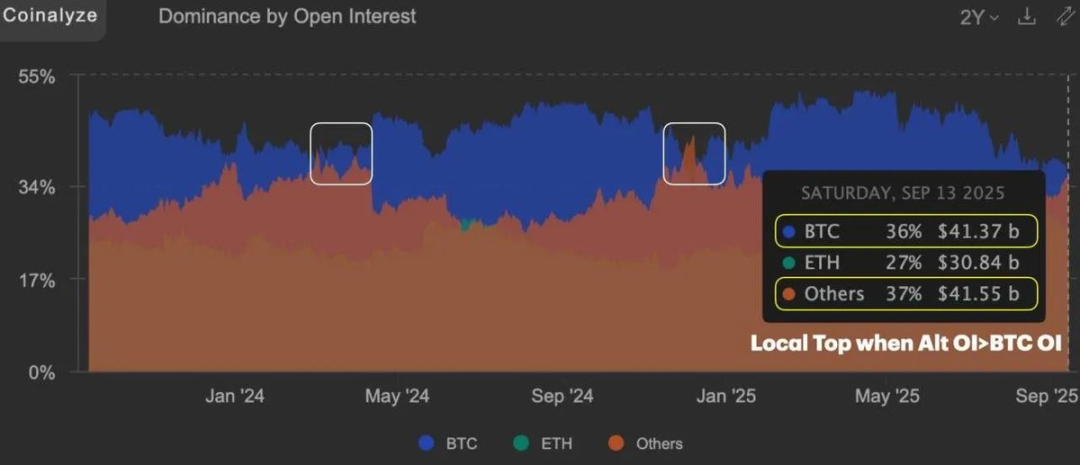

Editor's Note: The market is at a delicate turning point. The author believes that amid high interest rates, the continued rise in asset prices represents an unnatural balance that is about to break. Notably, altcoin open interest has surpassed Bitcoin’s for the first time—a phenomenon that coincided with local market tops during its previous two occurrences, making it a historical peak signal. Meanwhile, there is an 88% probability of a pullback following the Federal Reserve meeting, severely skewing the risk-reward ratio. Based on this, locking in profits now may be the best strategy to avoid downside exposure, and investors should stay vigilant and adjust their portfolios promptly.

The current trend is nearing its end.

Our research models indicate the market is approaching a reversal point. From a risk-to-reward perspective, the current setup is clearly unbalanced: the likelihood of a market correction following the Federal Open Market Committee (FOMC) meeting is extremely high.

It is advisable to lock in existing gains before the final leg of the rally begins.

Image source: @RamboJackson5

Since last December, open interest in alternative investments (cryptocurrencies other than Bitcoin) has exceeded Bitcoin’s for the first time. The last two times this occurred, the market had just reached local peaks.

Now, perhaps only 1% of market participants are truly experiencing market euphoria. For everyone else, the real winners will be those who position themselves around assets capable of sustaining market attention during periods of tightening liquidity.

The defining feature of today’s market: liquidity is exhibiting “selective concentration,” macro conditions remain bearish overall, and fiat currencies continue to depreciate. Despite these adverse conditions, asset prices continue to rise against the tide.

The key difference between this cycle and previous ones lies here: the 2021 market cycle was driven by liquidity expansion—when credit was cheap and liquidity abundant, risk assets broadly benefited from loose conditions;

The 2025 market is entirely different: interest rates are now high and liquidity tight, yet risk assets (Bitcoin, equities, even gold) continue to climb gradually.

Why does this contradiction exist? The core driver is fiat currency depreciation—investors are allocating into assets to hedge against cash devaluation.

This trend has fundamentally changed market dynamics: broad-based risk-on rallies are being replaced by structural flows concentrating into quality, resilient assets. Market logic has shifted from “chasing all assets blindly” to “timing precision, patience, and strict discipline.”

In essence, the depreciation of fiat currency itself is the key. Today, investors allocate not only for growth but also to protect against the erosion of cash value.

-

2021: Liquidity expansion drives growth → risk assets lead performance;

-

2025: Fiat currency depreciation drives growth → hard assets (gold, commodities, etc.) and high-quality assets perform strongly.

This shift in market logic significantly raises investment difficulty—you can no longer rely on an environment of “flooding capital and ubiquitous opportunities.” But for investors who adapt to the new logic, it also presents clearer structural opportunities.

Liquidity Reality Check

Despite numerous bullish signals (declining Bitcoin dominance, altcoin open interest exceeding Bitcoin’s, CEX token rotation), overall liquidity remains scarce. Over recent years, meme coin-driven “scam-and-dump” projects and celebrity-endorsed tokens have left many investors with investment-related post-traumatic stress disorder (PTSD).

Image source: @JukovCrypto

Due to this “investment PTSD,” many traders chase newly launched trendy projects for short-term thrills, but offer almost no sustained funding support to genuine project developers.

The result: market liquidity continues to concentrate into “high-market-cap assets with loyal communities”—those capable of consistently attracting attention and capital inflows.

Federal Reserve and Bond Markets

Bond markets have already priced in expectations of a downturn. According to FedWatch data, the market assigns an ~88% probability to a 25-basis-point rate cut by the Fed, and only a 12% chance to a 50-basis-point cut. It’s important to note:

-

Historically, a “first 50-basis-point rate cut” is typically seen as a recession signal, often leading to a “slow bleed” in markets;

-

A “first 25-basis-point rate cut” is more often interpreted as signaling a “soft landing,” providing support for economic growth.

The market is now at a critical inflection point. Combined with seasonal indicators, volatility risks are increasingly apparent following the FOMC meeting.

Key Conclusions

“Consistent resilience” beats “short-term speculation”;

“Patient positioning” beats “FOMO (fear of missing out)”;

“Precise timing” beats “pursuit of alpha (excess returns).”

The following analysis covers macro event outlooks, Bitcoin sentiment indicators, market-wide review, and core economic data interpretation, with data current as of September 14, 2025.

Macro Event Outlook

Last Week Recap

Next Week Preview

Bitcoin Sentiment Indicators

Market-Wide Review

-

Dogecoin ETF Milestone: The DOJE ETF, jointly launched by REX Shares and Osprey Funds, became the first U.S. fund directly tracking Dogecoin’s price. This marks a degree of recognition for “meme coins” in traditional finance, though given Dogecoin’s lack of real-world utility, demand is expected to remain retail-driven.

-

Cboe Perpetual Futures Plan: Proposed Bitcoin and Ethereum futures contracts with maturities up to 10 years and daily cash settlement. If approved, this could reduce roll costs for investors, enrich institutional derivatives strategies, and enhance market liquidity.

-

Ant Digital Asset Tokenization: Ant Digital tied $8.4 billion in renewable energy assets to AntChain, enabling “real-time production data tracking” and “automated profit distribution.” This “institution-first” model highlights blockchain’s value in large-scale infrastructure financing.

-

Forward’s Solana Treasury Buildout: A $1.65 billion private investment in public equity (PIPE) led by Galaxy and Jump Crypto positions Forward Industries as a core holder within the Solana ecosystem. This marks the first major institutional allocation to crypto assets beyond Bitcoin and Ethereum, potentially reshaping Solana’s capital narrative.

Core Economic Data Interpretation

Key Takeaways for Ordinary Users

-

Tightening labor market: Especially declining opportunities in traditional industries; upgrading skills to enter more resilient sectors like healthcare and services is advised.

-

Purchasing power improved temporarily, but risks remain: Wages currently buy more, but tariff-driven inflation may soon erode this gain—cautious spending on big-ticket items is recommended.

-

Debt relief opportunity approaching: Rate cuts may ease debt burdens, but household financial pressure is rising steadily—maintain conservative budgets and prepare for refinancing.

-

Rising investment volatility: Rate cuts may provide a short-term boost, but inflation risks could quickly reverse gains—be alert to volatility.

Labor Market Dynamics

-

Job growth continues to decline → intensified competition, especially for low-skill roles;

-

Sharp sector divergence: Strong demand in healthcare (+46.8k jobs) and hospitality (+28k jobs); hiring slowdown evident in manufacturing, construction, and business services;

-

Job growth sharply cooling: New jobs dropped from 868k in Q4 2024 to 491k in Q1 2025 and 107k in Q2 2025; only 22k added in August 2025, nearly stagnant;

-

Root causes of divergence: Tariff pressures, investment uncertainty, and immigration policies restricting labor supply are causing contractions in cyclical sectors (manufacturing, construction, etc.).

Wage and Labor Participation Trends

-

Wage growth +3.7% YoY: Though slower than prior levels, still above inflation—meaning real purchasing power has slightly improved, a rare positive sign;

-

Beware of tariff-driven inflation: If tariffs push up goods prices, wage gains’ purchasing power benefits could vanish quickly;

-

Income growth: Up 3.7% YoY—the lowest since mid-2021—though easing wage-inflation spiral pressures, still exceeds inflation, net-positive for consumer buying power;

-

Labor market structure: Labor participation slowly rising, but unemployment has climbed to 4.3% (highest since 2021); job pressure concentrated among low-skill workers, while high-skill, high-education groups remain stable.

Macroeconomic Implications

-

Rate cut window approaching: If the Fed cuts as expected, mortgage, consumer, and credit card borrowing costs may fall;

-

Household debt stress rising: Default rates on credit cards, auto loans, and student loans continue climbing—if under financial strain, plan ahead; refinancing conditions may improve later this year;

-

Bond market signals: 10-year U.S. Treasury yield fell to 4.1% (lowest in 10 months), reflecting market pricing of “slowing economy + Fed rate cuts”;

-

Fed policy outlook: Futures suggest ~90% chance of a September cut, with 2–3 cuts expected by year-end—despite sticky inflation, markets still bet on aggressive easing;

-

Financial stress divergence: Households face rising credit defaults and student loan repayment restarts, while corporate financing conditions remain accommodative.

Strategic Implications

-

Economy shows “divergent structure”: Institutions (corporations, financial markets) enjoy easy financing, while households face rising financial pressure;

-

Policy dilemma: If the Fed cuts, inflation may worsen; if not, slowing employment and rising defaults intensify;

-

Investment guidance:

-

Resilient sectors: Healthcare, hospitality—benefiting from demographic trends and experiential consumption;

-

High-risk sectors: Trade-sensitive industries (manufacturing, construction)—heavily impacted by tariffs and labor supply bottlenecks;

-

Macro summary: Rate cut expectations + labor market slowdown may drive asset price rebounds, but inflation risks could trigger “asymmetric volatility” across equities, credit, and commodities.

Eurozone Policy Outlook

-

Inflation status: Down significantly from 2022 highs, but still above target and showing “plateauing” behavior, limiting ECB room for easing;

-

Policy divergence risk: The Fed leans dovish due to “slowing employment,” while the ECB stays cautious due to “sticky inflation”—this divergence may amplify EUR/USD exchange rate swings;

-

Investor perspective:

-

Rates: Limited ECB easing room means Eurozone bond yields may stay relatively high;

-

Equities: Falling service-sector inflation supports earnings, but global tariff-driven cost shocks may squeeze margins;

-

Macro risks: Weak growth momentum, but ECB unable to ease—risks slipping into “mild stagflation”;

-

ECB stance: Inflation still above 2% target—low chance of a September cut, December cut remains uncertain;

-

Market expectations: Futures imply ~50% chance of a cut by year-end—markets lean toward easing, but ECB signals remain cautious;

-

Lagarde (ECB President) stance: Prefers “wait-and-see,” inclined to hold rates steady to avoid premature loosening.

Global Spillover Effects

-

Tariff spillover risk: U.S. tariff hikes may raise imported input costs via global supply chains—ECB officials (Schnabel) have flagged this as an “upside risk” to Eurozone inflation;

-

Transmission mechanism: Even with weak domestic demand in the Eurozone, “imported inflation (high-cost imports)” may constrain ECB policy flexibility.

China Focus

China is currently adopting a “dual-track strategy”: strengthening cooperation with India at the political level to counter external shocks, while injecting liquidity and guiding market expectations at the economic level to mitigate vulnerabilities.

-

Core logic: Hopes to offset economic growth weaknesses through leadership in technology;

-

Potential risk: If the real economy remains stagnant and markets are propped up solely by liquidity, it could lead to structural fragility beneath surface-level prosperity.

Current Impact of Tariffs

-

CICC data shows: Chinese exporters bore only 9% of U.S. tariff costs—far below European and Southeast Asian counterparts;

-

Implication: U.S. importers are absorbing most tariff costs, compressing their own margins. This model is unsustainable—eventually, U.S. consumers will face higher prices, exacerbating inflation risks;

-

Export pressure on China: Declining exports to the U.S., rising factory idling rates—may create latent domestic stability risks. Though not immediately visible, the implications are significant.

Geopolitical Realignment

-

U.S. “contain China” strategy falters: The U.S. imposed a 50% tariff on Indian oil imports due to India buying Russian oil, weakening its own “anti-China coalition”;

-

China’s strategic response: Quickly exploited this rift, facilitating a long-overdue trilateral meeting between China, India, and Russia in Beijing;

-

Key insight: If China and India deepen cooperation, the U.S.-led Quad (U.S., Japan, Australia, India) faces strategic hollowing-out risks.

Capital Markets as a “Safety Valve”

-

Market-economy divergence: Despite weak fundamentals, Chinese equities hit a 10-year high—not driven by corporate earnings, but by “liquidity injection” and a shift of ¥22 trillion ($3 trillion) in household savings from deposits (~1% yield) into stocks;

-

Attractiveness logic: With 10-year government bond yields at just 1.7%, equities offer structural appeal on relative return grounds. Global investors are also chasing China’s tech-leading assets;

-

Core insight: Current market optimism reflects bets on “liquidity easing + tech narratives,” not confidence in real economic recovery.

Macro Risk Warnings

-

Bubble risk: If the real economy fails to recover, the current stock rally could turn into another “liquidity-driven bubble”;

-

Deepening policy dependence: Should exports keep falling and consumer demand remain weak, China may need further monetary easing and additional capital market interventions to maintain stability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News