2 days up nearly 10x, is Pokémon card trading a real demand or fake sentiment?

TechFlow Selected TechFlow Selected

2 days up nearly 10x, is Pokémon card trading a real demand or fake sentiment?

The demand is real, but it's not the demand for Pokémon card trading itself.

Author: Cookie, BlockBeats

While crypto enthusiasts are focused on the controversy surrounding Trump's health and waiting for potential trading opportunities, a token called $CARDS has surged nearly 10x from September 2 to date, briefly pushing its market cap beyond $400 million and capturing widespread attention.

$CARDS is the token of Collector Crypt, a physical Pokémon card trading platform built on Solana. In February 2023, Collector Crypt announced it had closed a seed round with undisclosed funding from GSR, Big Brain Holdings, FunFair Ventures, Genesis Block Ventures, Master Ventures Investment Management, StarLaunch, and Telos.

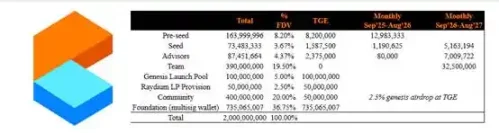

Although the seed round closed over two and a half years ago, the $CARDS presale only launched last week. A total of 5% of the token supply (100 million $CARDS) was allocated to the presale, which raised 16,500 SOL (approximately $3.5 million), with 718 participants.

In addition, 2.5% of the total supply—part of the 20% allocated to the community—was made claimable at the same time as the presale. According to the official tokenomics, if project team holdings are excluded from initial circulation (the team claims there is currently no plan to sell), the current circulating supply of $CARDS is approximately 212 million tokens.

Based on current prices, the pre-seed, seed, and advisor tokens unlocked at TGE are worth about $1.67 million

The team states there is currently no plan to sell their tokens

Looking at the project itself, Collector Crypt’s focus on blockchain-based Pokémon card trading isn’t particularly novel.

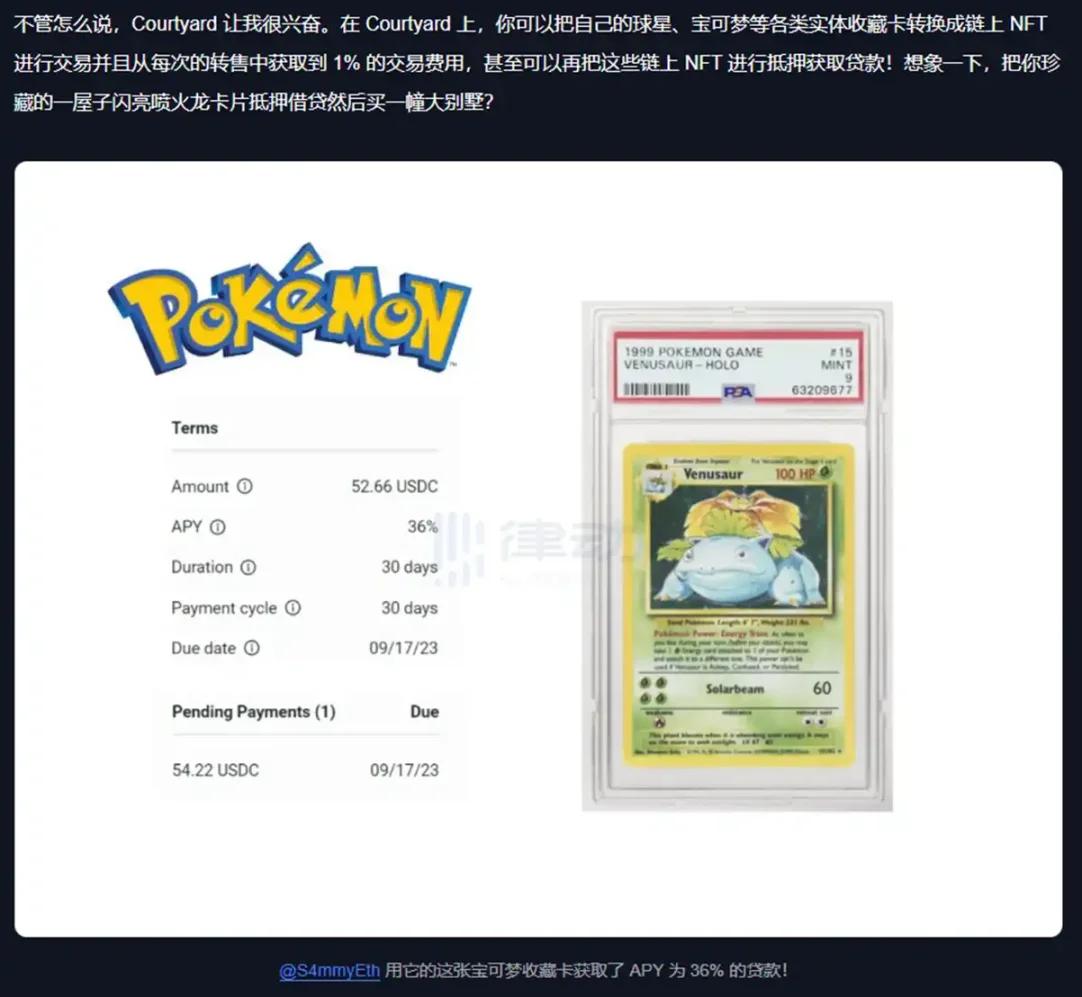

Courtyard.io on Polygon has been operating for over two years. Last month, Courtyard set a new monthly sales record of approximately $78.43 million. Since February this year, its monthly sales have consistently exceeded $40 million.

This rapid growth may explain Courtyard’s recent large funding round. On July 28, Fortune reported that Courtyard raised $30 million in a Series A round led by Forerunner Ventures, with participation from existing investors including NEA and Y Combinator.

When Courtyard first caught the attention of a small group of NFT users back in August 2023, we covered it. At that time, some NFT users were already using Courtyard to acquire Pokémon cards and use them as collateral for loans on-chain.

Besides Collector Crypt and Courtyard, other crypto projects offering similar services include Beezie, Drip, Emporium, and phygitals.

However, Collector Crypt is the only one among them to launch a token, giving $CARDS a first-mover advantage. That said, Collector Crypt also performs strongly on its own merits—last month, its monthly trading volume reached approximately $44 million, not far behind Courtyard.

You might wonder: is there really that much genuine demand for trading Pokémon cards on-chain?

The answer is no. Both Collector Crypt and Courtyard primarily make money through gambling-like "blind box" mechanics.

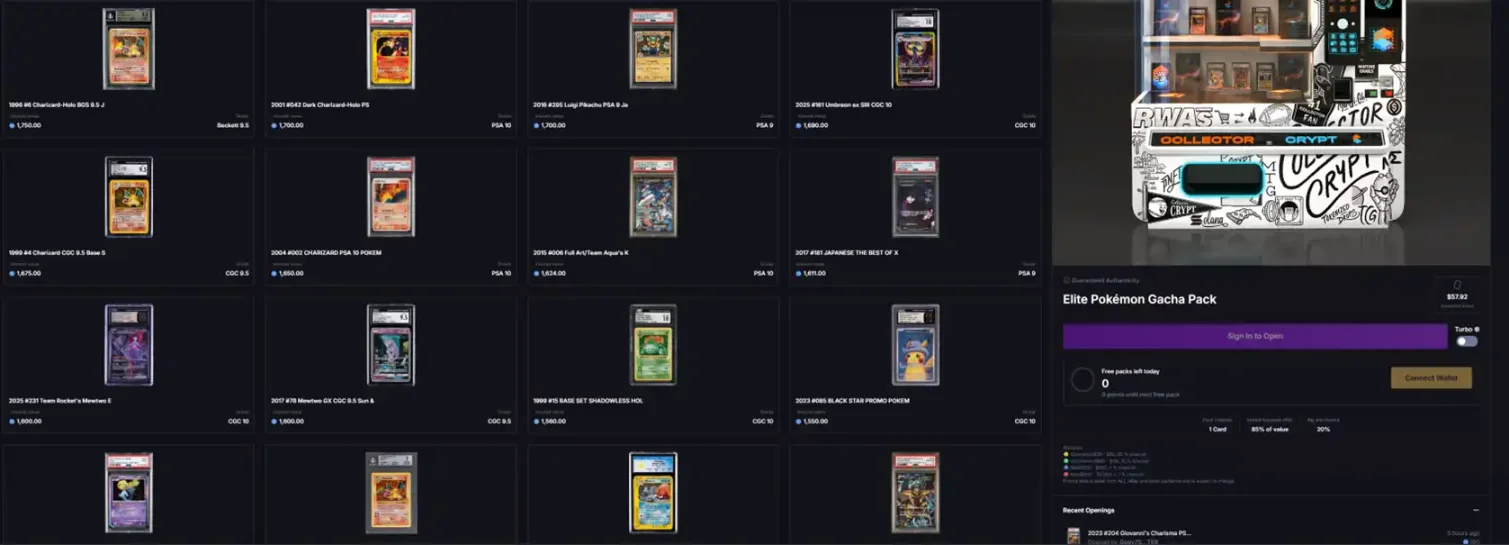

The image above shows Collector Crypt’s Pokémon card gacha system. For around $60, users have an 80% chance of drawing a card worth $30–60, a 15% chance for $60–110, a 4% chance for $110–250, and a 1% chance for a card worth $250–2,000.

What if you pull a bad card? No problem—you can resell it directly back to Collector Crypt at 85% of its value and keep playing.

Collector Crypt officially launched this gacha system in January this year. It generated around $2 million in sales that month, grew to $12.55 million in March, reached $22.31 million in May, and hit $43.89 million last month. Meanwhile, actual marketplace trading volume for Pokémon cards on Collector Crypt last month was only about $120,000.

On Collector Crypt’s monthly total sales bar chart, revenue from the card marketplace is almost invisible

While there is no direct data on gacha revenue, insights from Courtyard’s previous interviews help illustrate just how profitable this business model is. In a recent interview with Fortune, Courtyard revealed it buys back gacha cards from customers at 90% of their value and resells them as new gacha packs. On average, each card is sold eight times per month on the platform.

Even so, it's hard to argue that $CARDS’ price rise reflects organic market-driven “price discovery.” Until two days ago, $CARDS had remained stagnant since the end of the presale, leading many presale participants to believe they had “lost again.”

But the involvement of influential figures pow and gake dramatically shifted the trend. After both publicly endorsed $CARDS on social media, confidence surged.

With that, here’s a summary of $CARDS:

-

The narrative isn’t new, but the revenue performance is strong—Collector Crypt is clearly the leader in this niche on Solana.

-

Demand is real, but not driven by Pokémon card trading itself—it’s fueled by gambling-style “gacha” mechanics, a pattern shared across similar projects.

-

No other players in this space have launched tokens yet, so there are currently no competing assets with the same concept.

-

Holders are still relatively few; the recent surge is largely due to endorsements from key influencers (“cartops”).

There’s substance behind the project, but after the sentiment-driven rally, whether $CARDS can sustain momentum remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News