The Pokémon Card Craze Through the Eyes of a Veteran Crypto User and TCG Collector

TechFlow Selected TechFlow Selected

The Pokémon Card Craze Through the Eyes of a Veteran Crypto User and TCG Collector

What are the similarities and differences between Pokémon cards and cryptocurrency?

Author: simple_peanut

Translation: Felix, PANews

Given the rising热度 in the TCG RWA space, and considering that non-collectors from crypto and non-crypto-native collectors have knowledge gaps in this unfamiliar territory they may never have explored, I decided to write this article last weekend. The purpose of this piece is threefold:

-

Introduce crypto players to the Pokémon TCG hobby and its market

-

Help those familiar with only one domain understand both, and identify gaps Pokémon RWA protocols need to fill—or don't need to fill

-

Share personal insights on this niche segment

I am a cryptocurrency enthusiast and work in this industry. My approach to the crypto world resembles collecting Pokémon cards and engaging with fellow enthusiasts—social, enjoys making friends, loves hanging out with them, yet values personal privacy.

I've been collecting Pokémon cards since childhood (paused during high school/college, then resumed later).

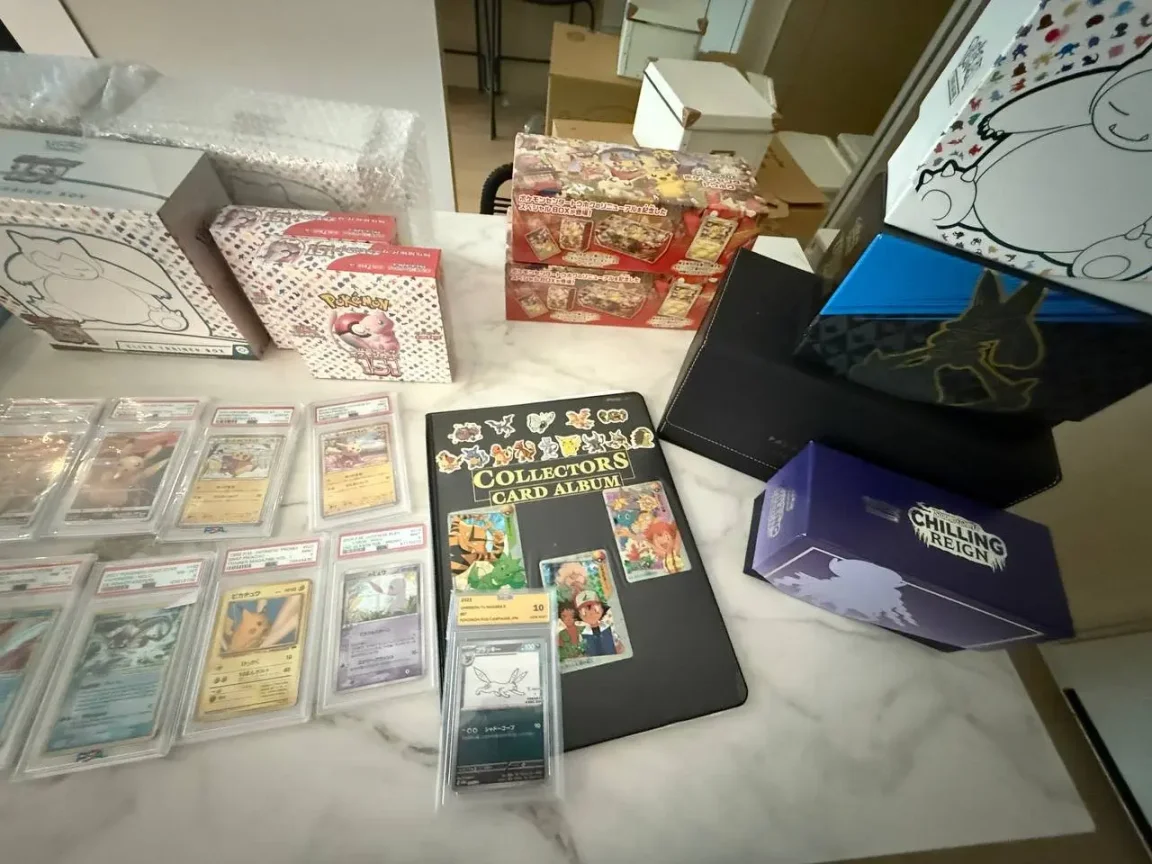

Few friends in the crypto circle know about this hobby, but given the current hype, now seems like a good time to share—it’s clear from the photos below that I’m a serious collector. I also own unopened cards and products. You might say I'm jumping on the bandwagon, recently buying all these items for show. But the truth is, these cards and products (both in the photos and in storage) originate from childhood innocence, combined with adult effort and persistence (paused during college because Pokémon wasn’t “cool” back then).

To wealthy crypto players, this may seem trivial, but for me, it has taken considerable time and energy, thoughtful consideration, intuition, and luck (not professionally, but as a Pokémon collector) to grow my collection to its current scale.

Cards from childhood (pulled from packs) and adulthood (bought in previous cycles). Most sealed products here are from the current cycle. Other cards from past cycles are stored in a warehouse.

Childhood binder

Since most readers (if any) come from the crypto world, I won't delve into $CARDS FDV or Pokémon TCG RWA protocol data, as such discussions are already abundant; instead, I aim to offer deeper insights from a Pokémon collector/investor perspective.

Pokémon TCG Collecting / Investment Market Cycles

In short:

-

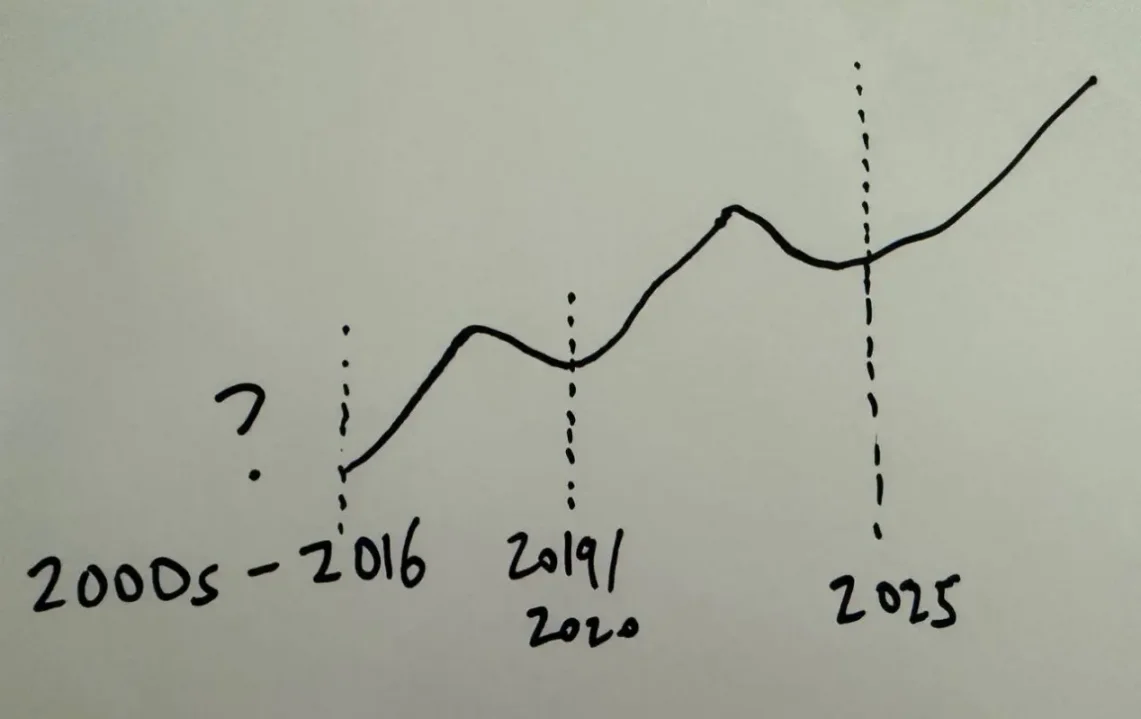

The Pokémon TCG market experiences boom and bust cycles, very similar to macroeconomic and/or crypto markets.

-

Despite these cycles, Pokémon card and sealed product prices have steadily climbed like steps over the years.

-

That said, like stocks or tokens, not every card or sealed product moves in a "binary fluctuation"—rising prices don’t guarantee profits.

For context, during the 2000s, I was transitioning from childhood to adolescence, with no financial knowledge or awareness of cycles. It wasn't until university and adulthood that I understood and experienced cycles within the Pokémon TCG space.

Below is a rough sketch of the Pokémon TCG cycles I’ve lived through, along with catalysts for each boom period.

Catalyst for the 2016 Boom Cycle:

Nearing college graduation, I rekindled this hobby (around 2016/17), coinciding with the release of the Pokémon TCG XY Evolutions set.

The hobby gained traction because the XY Evolutions cards were reprints of the original Base Set, slightly different but clearly nostalgic. This evoked strong nostalgia among young adults who played the Base Set as kids, sparking the Pokémon craze in 2016.

Fun fact: 2016 was also the year the Mario & Luigi Pikachu promo card launched—then priced at $30–40 per box. Today, the full-art Mario Pikachu sells for $10,000–$14,000.

Catalyst for the 2020 Boom Cycle:

1. Global success of Pokémon GO (mobile game).

2. The pandemic:

-

People were bored

-

Government stimulus checks

3. Post-pandemic macro environment with elevated risk appetite.

4. Influence of Logan Paul and other celebrities—high-value cards seen as status symbols:

-

Logan (influencer) showcased his BGS 10 First Edition Base Set Charizard and PSA 10 Shadowless Pikachu

-

Logan publicly opened first-edition Base Set booster boxes on live stream

-

Steve Aoki (Japanese-American DJ, music producer) revealed his collection passion and launched Aoki Cards

5. Many ordinary people followed suit—buying sealed products and opening them live, selling cards at premium prices to viewers.

Catalyst for the 2025 Boom Cycle:

1. Favorable macro conditions supporting risk assets / bull market.

2. Pokémon TCG entering the Chinese market:

-

Official Chinese version of Pokémon cards launched in China

-

Wealthy Chinese players buying high-value cards, which are relatively affordable to them

3. Launch of Pokémon Pocket—digital card packs on mobile devices, encouraging real-life experiences.

4. Rise of card shows and dealers; growing popularity of dealer commentary on YouTube—people enjoy watching deals happen.

5. Chain reaction from above factors: (i) crypto-native users and RWA protocol users buying full sets and sealed products for investment and/or resale; (ii) Kevin O'Leary announced he recently became a card collector (sports cards); (iii) streamers once again buying sealed products, just like in the last cycle, reselling at premiums and opening live.

Common Features Across Every Pokémon Boom:

-

Positive macro environment / risk-on sentiment

-

Pokémon Company skillfully introduces a nostalgia-triggering catalyst

-

Like in crypto, regular people (non-Pokémon collectors) start talking about it, asking you, sharing cards on Instagram

-

Like in crypto, new players enter the market

-

Pokémon product shortages; scalpers fight over products at Target/Walmart (a stabbing incident occurred in July), disputes over queues happen every cycle

-

Celebrity involvement: Logan Paul and Steve Aoki highlighted the 2020 boom, Kevin O'Leary the 2025 boom

-

Rise of streamers: bulk-buy sealed products (further driving up sealed product prices), open them live, and sell to audiences for profit

New elements in the 2025 cycle (may ultimately prove insignificant from financial/market cycle perspectives):

-

Rise of dealers and card shows + dealer-focused videos—a Pawn Stars-style experience

-

Chinese market and big Chinese buyers

-

Crypto-native participants and crypto whales

Similarities Between Crypto and Pokémon TCG Collecting / Investing

-

Both are forms of gambling: whether responsibly and strategically, or degen-style (e.g., pack pulling, blind box openings, trading NFTs/meme coins), both trigger psychological responses tied to gambling instincts, herd mentality, and hoarding behavior in the human brain.

-

Both experience boom and bust cycles: public sentiment can be fickle—chasing during booms, dismissing during busts. (Like mocking Ethereum last year, now proudly holding it.)

-

Both are highly volatile asset classes: both significantly outperform traditional asset classes (e.g., S&P Index).

Subtleties: What Crypto-Natives and Pure Pokémon Collectors/Investors Need to Know

This section will emphasize "what crypto enthusiasts need to know," since most readers of this article are likely crypto folks, not pure Pokémon collectors/investors.

-

Buying Pokémon RWA protocol tokens or meme coins may seem silly, yet there's still profit potential—just like Pokémon-printed paper cards that seem trivial but can yield returns.

-

Blockchain technology enables TCG RWA protocols to potentially offer unique value to collectors. But in their current state, we haven’t seen their full potential yet.

-

Using cards as loan collateral is commendable—this offers significant value uplift for both crypto players and collectors, representing a key advantage of TCG RWA protocols over existing traditional solutions in this space.

-

Just like Pokémon cards and sealed products, in crypto, token rallies don’t lift all boats (generate profits).

What Crypto Enthusiasts Need to Know (Skip if Uninterested)

1. Like crypto, collecting Pokémon requires experience, skill, knowledge, intuition, and luck.

2. The idea that Pokémon RWA protocols solve liquidity fragmentation is foolish, for the following reasons:

-

Take stock markets: many traditional venues exist, like Saxo, IBKR, etc. Beyond tokenized stocks, there’s a broader world and larger market. Similarly, most TCG secondary market volume occurs on eBay, TCGplayer, via Telegram OTC (face-to-face trades), numerous global card shows, and Facebook Marketplace-like platforms.

-

Moreover, current RWA-protocol tokenized stocks suffer weak liquidity. And more RWA protocols offering tokenized stocks in their own wrappers only further fragment the stock market.

3. For non-collector crypto-natives, TCG RWA protocols may seem novel/revolutionary, but for actual collectors, this is mostly myth:

-

Markets like eBay and grading services like PSA already offer vault custodial services—send your cards to their vault, they even verify authenticity (i.e., grade cards). You can leave cards there for easy trading or redeem and receive physical cards back. Compared to existing traditional solutions, TCG RWA protocol proposals currently lack significant moats.

-

A major reason asset tokenization (e.g., stocks, treasuries) works well is blockchain enabling t+0 settlement—(i) improved over traditional t+1/t+2, (ii) extends trading from Mon-Fri to 24/7 year-round, (iii) buyers of stocks or treasuries don’t want physical assets. In contrast, passionate collectors/investors often want physical possession—for emotional satisfaction and practical enjoyment of handling real cards.

-

However, card tokenization is viable when used as loan collateral—this offers massive value uplift for consumers and could be transformative for non-crypto-native TCG RWA protocols.

-

That said, some investors participate purely for yield, not love of Pokémon or art—perhaps these non-crypto-native collectors benefit from TCG RWA protocols. But such solutions already exist, just without blockchain ledger tech.

-

Traditional platforms already host gambling-like activities—like Whatnot. Still, it’s worth noting that Gacha elements in TCG RWA protocols perform at least as well as, if not better than, traditional platform Gachas.

4. Like tokens in the current crypto cycle, rising tides don’t necessarily lift all boats in the Pokémon card world.

5. Like tokens, there are blue-chips, mid-tier tokens, and low-priced/meme coins with slim chances of mooning—most likely staying at cents/dollars forever.

6. Unlike mediocre meme coins or NFTs, high-quality Pokémon cards and sealed products don’t go to zero—this has held true throughout Pokémon TCG history (~30 years).

7. Collectors form subjective, personal emotional (sometimes sentimental) bonds with Pokémon card art and the Pokémon themselves. This intangible factor is crucial and a key differentiator between cards and tokens, stocks, or meme coins.

8. You can sell 1 BTC or 10 billion meme coins today and easily buy back anytime on various exchanges if prices surge tomorrow. But take an extreme example: if I sell today a Pikachu Illustrator card, of which only 41 exist globally, it might take months or years to repurchase. (This leads to discussions on fungibility vs. non-fungibility, supply, trading venues, etc.)

So What?

Are TCG RWA Protocols a Necessary Solution?

If you’ve read the above, you’ll see that currently, TCG RWA protocols haven’t truly created anything revolutionary. Aside from lending, they’re like meme coins and NFTs—offering another gambling and trading avenue for non-collector crypto-natives and crypto-native TCG collectors. Yet such solutions already exist, so from a collector’s standpoint, I don’t believe TCG RWA protocols fill gaps left by existing traditional solutions.

That said, I still think TCG RWA protocols can (i) attempt to compete with existing traditional solutions, (ii) fill certain gaps if blockchain tech is fully leveraged. I hope this happens, as it would only benefit both the hobby and the crypto space.

Market Cycles and How to Handle Your Collection

Given market cycles, knowing Pokémon TCG has boom and bust phases, you might argue for taking profits or selling part of your collection at some point.

I won’t sell. From a purely financial view, call me a fool—I agree. But again, unlike crypto, selling now might mean you can’t immediately repurchase at desired prices. Rare cards are hard to find, and owners are reluctant to part with them.

Due to early entry, I can afford some losses—I entered very early. That said, just like in trading, entry and exit timing matter, and I consider this when managing cards or products in my collection. You should too, just like in trading.

What’s concerning are crypto-native non-collectors who dive into trading—if Pokémon cards stop delivering high returns or the market crashes, they’ll dump and abandon the hobby—because like stocks or crypto, these non-collectors view collectibles purely as financial assets, not emotionally connected items. I acknowledge this is inevitable, just like in any market during bull/bear cycles, and I don’t mind.

When this narrative fades with the end of a broader bull run or Pokémon card bull cycle, this article may be forgotten, and writing it might seem like a waste. But I believe the insights here transcend the Pokémon card bull cycle, so feel free to explore them.

Potential Impact of Pokémon Card RWA Protocols on the Pokémon Card Market

Perhaps many crypto players trading digital Pokémon cards have no emotional attachment—they’re in it for profit, gambling, or both.

Like most hyped concepts in crypto, the hype won’t last, as most TCG RWA protocol users are crypto natives. And since many players trading digital Pokémon cards lack emotional ties, when the concept fades, they’ll dump the cards—and the protocol tokens—just like worthless meme coins and generic NFTs.

Dumped cards might be repurchased by the protocol, but if reduced revenue makes this unsustainable, the protocol might dump them itself, or founders might return their card inventory to the traditional Pokémon TCG market.

This is why the Pokémon card RWA hype/narrative could negatively impact the Pokémon card market, harming non-crypto-native Pokémon card collectors who don’t even know why. For newcomers, this could be a lesson, or they might abandon the hobby entirely. Likewise, new crypto entrants whose first on-chain experiences involve FOMO-buying $CARDS, only to see $CARDS crash after entry, might develop fear toward participating in crypto.

That said, the counterargument is: from a broader view, the Pokémon card RWA space is too small to meaningfully impact the vast TCG market long-term. I agree with this too.

Regardless, I hope this article offers some insight. If not, at least I hope it gives you something.

Tools: Pricing and Tracking Mechanisms for Cards / Products

How to Evaluate Card Value When Trading / Common Price Tracking Methods

Below are how Pokémon card collectors/investors actually negotiate prices and tools you can use—different people have different philosophies/methods, possibly adapting based on circumstances:

1. Check average of last X completed eBay sales: the most common method when trying to reach agreements in real transactions.

2. Aggregator: price charts (https://www.pricecharting.com/)—may or may not be used in real trading, serves as reference for card valuation. However, compared to the above tool, usage frequency is much lower. I see it as a convenient way to roughly check prices for ungraded (raw) or graded cards.

3. Other aggregator—Collectr (mobile app): same as above. Good for logging your cards and sealed products, buy/sell prices, and getting an overall portfolio valuation. Other similar alternatives exist.

4. TCGPlayer (tcgplayer.com)—same as above. However, listed prices mostly reflect raw cards or products in condition ranging from lightly played to near mint.

Flaws in TCG Market Pricing / Additional Factors

TCG market pricing differs from crypto markets, where oracles pull price references from major CEXs and DEXs—relatively centralized. TCG pricing, however, is fragmented.

Over the years, aggregators emerged, compiling sold items from major markets like eBay. But note:

-

Many "OTC" trades occur at card shows, Facebook Marketplace, Telegram/WhatsApp groups—informal markets not tracked. Thus, pricing remains somewhat fragmented and inefficient.

-

Many arbitrage between online and OTC/offline markets—dealers at card shows do this at scale, earning primarily like market makers or liquidity providers, profiting from spreads, relying on volume and volatility.

-

While aggregators improve pricing, manipulators still inflate auction prices to skew aggregator data, simply to "raise their own inventory prices."

Typical Participants / Players in This Hobby Space:

1. Scalpers/flippers: opportunistic. During boom cycles, many flood into the hobby and leave just as easily. Arguably the least interested, least passionate group. Some know little about Pokémon itself, joining purely for economic gain.

2. Collectors/Investors:

-

Collectors/investors play the game their way—many approach the hobby intelligently and financially literately, combining genuine passion with investment mindset.

-

Others may just collect and buy things with no value and no appreciation potential—purely because they love them—and that love itself is priceless.

-

Like traders, some frequently trade over short periods, while others adopt slow-and-steady or dollar-cost averaging (DCA) approaches. Some may just keep buying, never selling, purely out of passion.

3. Vendors: appear at card shows, with varying levels of card passion. Most are enthusiastic. Think of them as market makers/liquidity providers in the crypto world.

4. Distributors: if you know any, these are likely veteran figures, possibly companies. They have direct links to Pokémon Company, enabling bulk purchases at low prices. They supply sealed products to Pokémon Centers and select card shops. Becoming a distributor relies mainly on long-standing relationships, requiring continuous purchase of Pokémon TCG products regardless of market conditions.

5. Sub-distributors: similar to above, but without long-term operations. Could be B2B (e.g., supplying card shops) or B2C (e.g., selling to collectors/investors).

Hope the above helps. As a seasoned collector, I sincerely hope you continue this hobby even after the Pokémon craze ends. Like crypto cycles, the end of hype drives exits, but new entrants will always emerge. If you're in it purely for profit, best of luck.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News