CARDS: The Crypto Card Market Behind a 260% Daily Surge – When Pokémon Meets Blockchain

TechFlow Selected TechFlow Selected

CARDS: The Crypto Card Market Behind a 260% Daily Surge – When Pokémon Meets Blockchain

Collector Crypt holds over 95% of the market share in the entire crypto card space.

Author: San, TechFlow

The once globally popular Pokémon trading cards are now making a comeback on the blockchain.

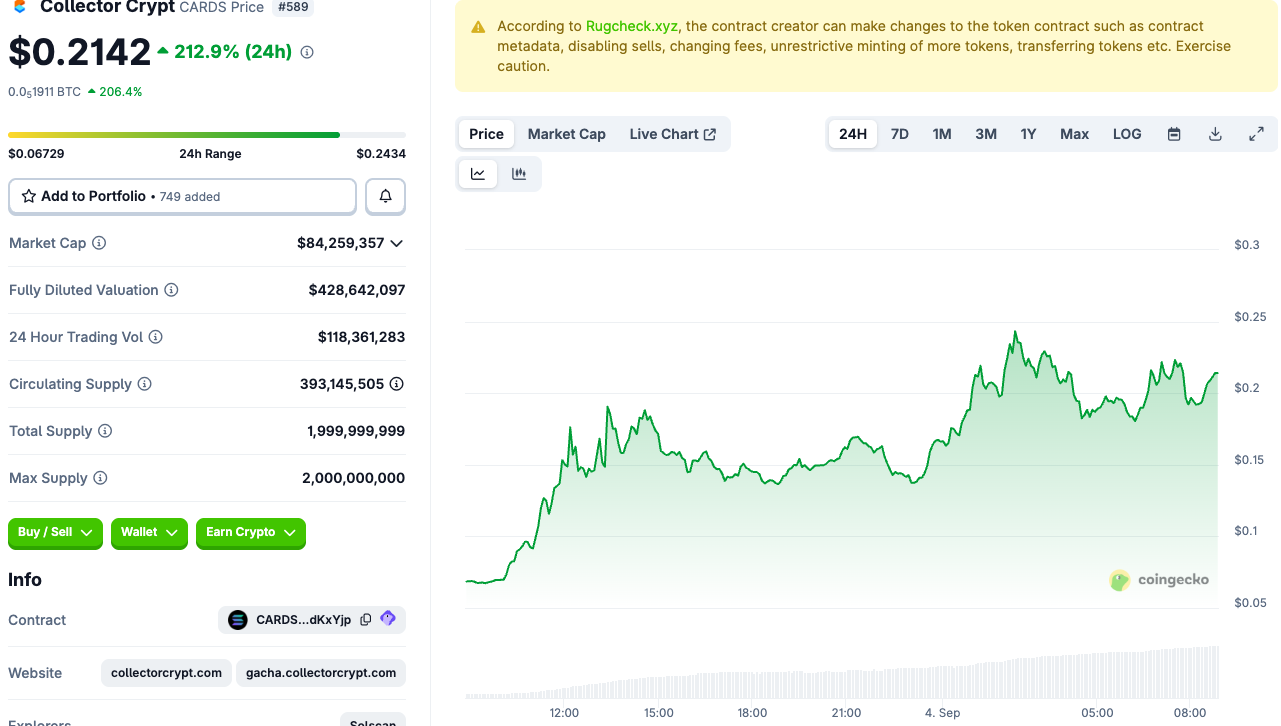

Yesterday, CARDS, the token of Collector Crypt—a blockchain-based collectible card trading platform incorporating RWA concepts—surged in price, drawing massive investor attention to the encrypted card sector.

In fact, the narrative around crypto cards is not new. According to on-chain data, the total transaction volume of TCG (trading card games) alone on Solana has already exceeded $95 million.

What sparks will fly when crypto meets trading cards?

Let’s dive deep into the Crypto+TCG (trading card game) space and explore the projects and assets worth watching.

Collector Crypt: The King of TCG in Solana's Ecosystem

Founded in 2021, Collector Crypt is one of the earliest TCG RWA platforms on Solana and has established an undisputed leading position in the sector. With monthly revenue exceeding $1.2 million and annual revenue nearing $40 million, it commands over 95% of the market share in the entire crypto card industry.

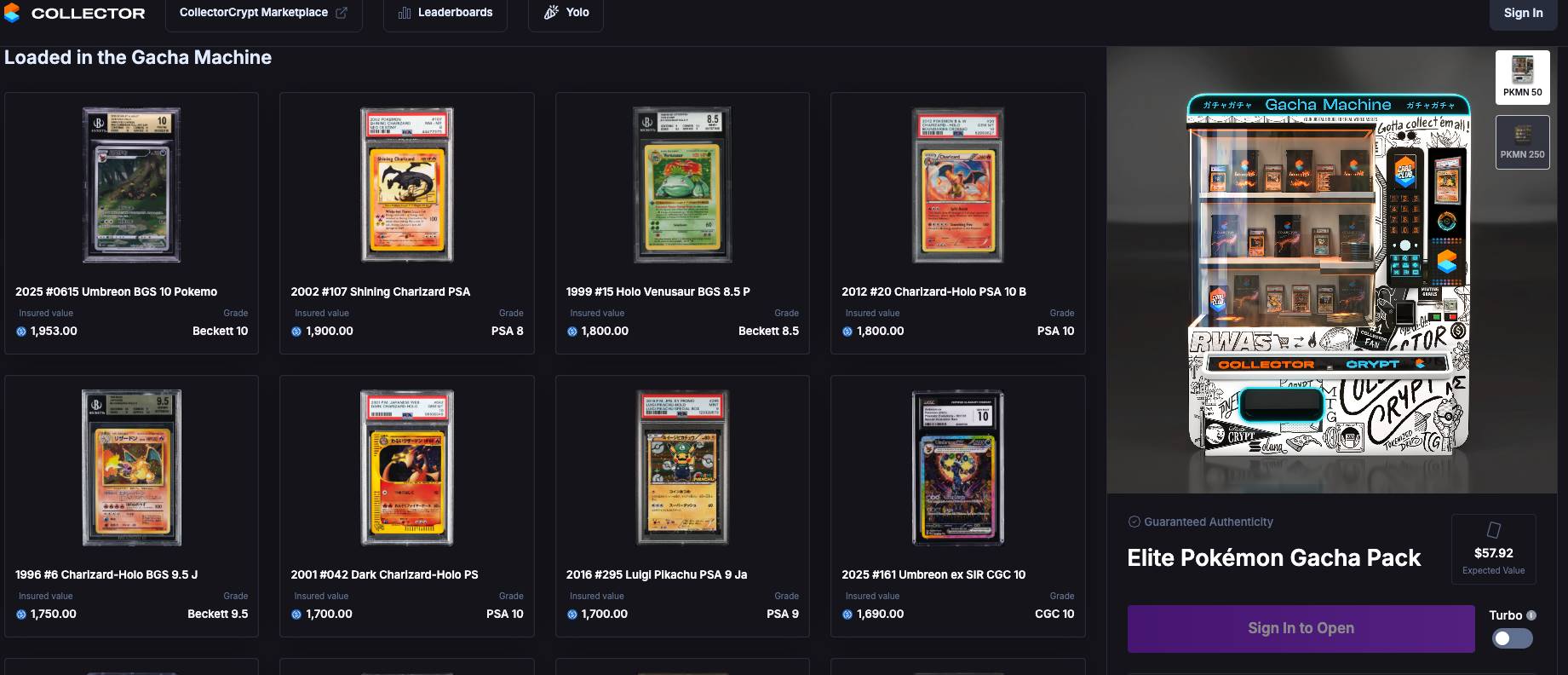

Collector Crypt's core innovation lies in its Gacha (capsule toy) mechanism—akin to opening mystery boxes in the real world. For about 50 USDT, users can obtain a random Pokémon NFT card, each corresponding to a physical card valued between $30 and $5,000. This model skillfully combines the thrill of blind-box draws with the satisfaction of collecting.

To date, more than 3,000 unique wallets have cumulatively spent over $49.6 million on Gacha draws at Collect Crypt, averaging a staggering $16,500 per user—far surpassing figures from other platforms and reflecting strong user recognition and spending enthusiasm. Two Pikachu cards featuring cloaks were even sold for $15,099 and $16,750 respectively.

On August 29, 2025, Collector Crypt officially launched its CARDS token, becoming the first Pokémon trading platform with a native token. According to Coingecko data, the token surged by 260% and 212% in the past two days, reaching a current market cap of $84.25 million, with daily trading volume doubling for two consecutive days to hit $118 million.

The uniqueness of the CARDS token lies in being backed by the platform’s multi-million-dollar inventory of Pokémon cards, providing investors with tangible asset support.

Beyond the Gacha model, Collector Crypt also offers an industry-leading eBay sniping tool that helps users acquire desired cards at the lowest possible prices. This comprehensive service ecosystem makes it not only the largest crypto card trading platform but also a full-service center for card enthusiasts.

Courtyard: Cross-chain Exploration in TCG Finance

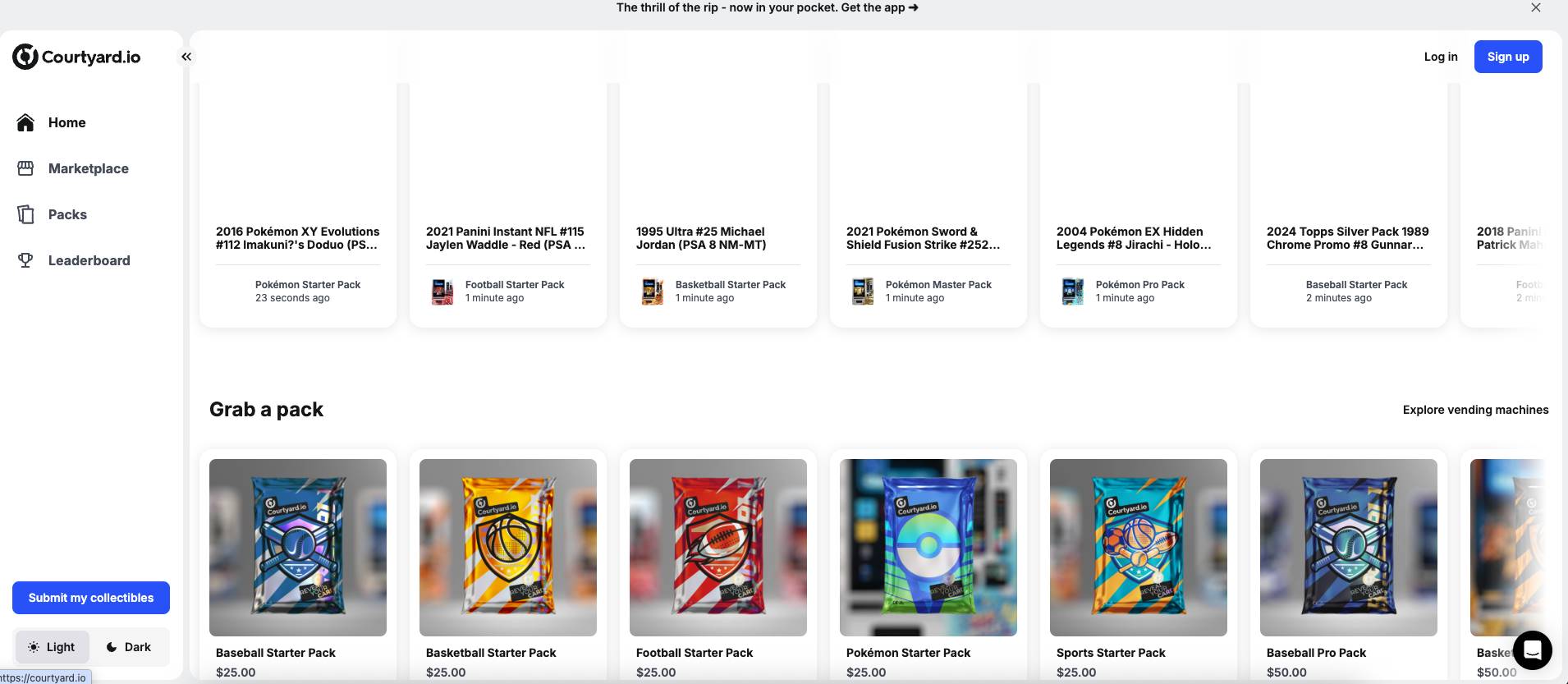

Launched in 2021, Courtyard is another collectible card trading platform that briefly set a global NFT market transaction record in April this year, achieving a weekly volume of $20.7 million—outpacing the total NFT trading volume on the Ethereum network during that week.

Courtyard’s key competitive advantage lies in its Web2-native user experience: it supports credit card top-ups, charges zero storage fees, and features a clean, intuitive trading interface, significantly lowering the barrier for traditional collectors entering the crypto space. Currently, the platform maintains a daily trading volume above $1 million.

Unlike other crypto card platforms, Courtyard focuses on a critical concern for collectors—card grading. Every NFT card on the platform comes with complete PSA certification records and insurance coverage. This professionalized service model has attracted many high-value card holders.

Phygitals: The Fastest-Growing Emerging Force

Although Phygitals is a relatively new project, officially launching only in December 2024, its growth rate is remarkable. Since late July this year, the platform’s weekly revenue has sharply increased, generating over $665,000 in Gacha revenue. Within just a few months, it has attracted 6,200 unique wallet users, 63% of whom are new users from 2025.

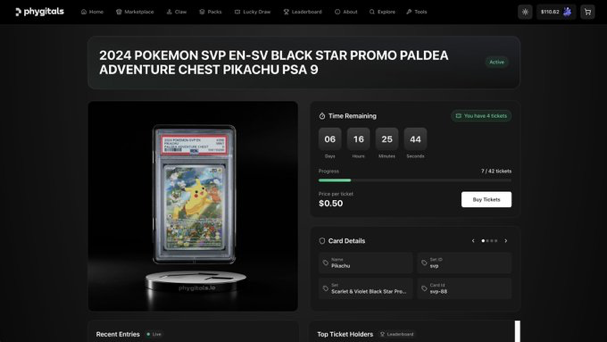

Compared to the standard Gacha model, Phygitals introduced an innovative "LuckyDraw" lucky-draw system in late May: users can purchase low-cost "tickets" for a chance to win high-value cards; meanwhile, owners of high-value cards can issue tickets for others to participate in LuckyDraws. All draw logic, ticket quantities, and end times are encoded into Solana smart contracts to ensure transparency.

This innovative model allows users to enjoy frequent, low-stakes draws for instant gratification while lowering participation barriers, tripling Phygitals’ daily trading volume in a short time.

Additionally, Phygitals places strong emphasis on social elements. Users unlock achievements through card collections, compete on leaderboards, and can instantly redeem their NFTs for physical cards. This gamified social design transforms collecting from a solitary hobby into a connected community experience, building bridges among collectors.

TCG Emporium: A Latecomer’s Breakthrough Path

Launched on May 6, 2025, TCG Emporium entered the market later than others but has delivered impressive results. In just 90 days, its trading volume reached $36 million, capturing 38% of the entire Solana TCG ecosystem.

Compared to its predecessors, TCG Emporium adopts lower platform fees, pursuing rapid market share growth through high-volume, low-margin sales. It also introduced a unique "buy-the-dip" buyback mechanism: when high-value cards remain unsold on the secondary market for extended periods, the platform automatically purchases them at 60% of the oracle price, effectively reducing price spreads and improving market liquidity.

For marketing, TCG Emporium showcases high-value cards obtained via Gacha to create viral effects—including a Mario Pikachu card sold for a record $11,300. This strategy has effectively boosted brand visibility.

Other Types of Projects in the TCG Space

Besides the above-mentioned TCG trading platforms, the intersection of TCG and blockchain has given rise to other types of projects.

Project O

Founded in 2024, Project O is a mobile-focused TCG battle game that also released limited physical card sets. Each match lasts 7–9 minutes, where players use 13 cards to battle across three lanes in-game.

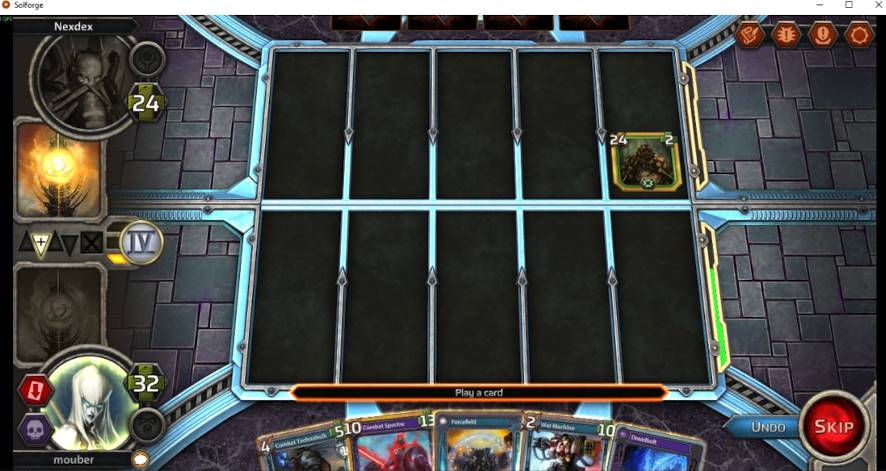

SolForge Fusion

SolForge Fusion was co-designed by Richard Garfield, the renowned creator of the Magic: The Gathering card game. It features an innovative "hybrid deck-building" model: each physical starter deck has a corresponding NFT version, and players can scan physical cards to mint NFTs, enabling over 40,000 unique card combinations.

The projects mentioned above reveal the rising momentum in the current crypto card market. This growth stems not only from technological innovation but also from countless collectors embedding their emotions into the fusion of digital and physical collectibles.

Traditional TCG markets face issues such as fragmented liquidity, counterfeits, and high trading fees. But moving this market onto the blockchain solves these pain points and injects unprecedented vitality into this multi-billion-dollar industry through tools like smart contracts, NFTs, and DeFi mechanisms.

As someone once said, “The best Web3 applications are often not entirely new concepts, but upgrades and financialization of existing behavioral patterns.” Perhaps for the collectible card industry, crypto could be an effective solution to longstanding challenges. As this global trend sweeps into the crypto market, investors should closely monitor the evolution of this sector.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News