Take Profit or Build Position: Plain Language Explanation of How to Observe Recent Market Changes from a Macro Perspective

TechFlow Selected TechFlow Selected

Take Profit or Build Position: Plain Language Explanation of How to Observe Recent Market Changes from a Macro Perspective

As Powell adjusts the Fed's decision-making logic, the performance of the U.S. labor market in the short term determines market confidence in a September rate cut, thereby affecting prices in risk asset markets.

Author: @Web3Mario

Summary: The market recently appears to have entered a hard-to-predict phase. Blue-chip cryptocurrencies remain in high-range consolidation without a clear directional breakout, while the altcoin market has not delivered the expected broad bull run. Meanwhile, DAT assets or crypto equities are leading the way in traditional financial markets. Prior to this, many voices on social media have already characterized this bull market as driven by traditional capital. The author largely agrees with this view, noting that this capital differs from previous market cycles in several ways: it is more influenced by macro factors, has lower risk appetite, is more concentrated, shows weaker wealth effect spillover, and lacks evident sector rotation. Therefore, as the macro environment undergoes significant changes, reassessing these shifts will help us make better-informed decisions. Overall, the author believes that as Powell adjusts the Fed's decision-making logic, the performance of the U.S. labor market will determine market confidence in a September rate cut in the short term, thereby impacting prices in risk asset markets.

What Did Powell’s Speech Change?

We know that in the past few months, the central macroeconomic debate in markets revolved around whether the Fed under Powell would deliver significant rate cuts within the year as desired by the Trump administration. So why is the Trump administration so eager to force the Fed into cutting rates, even at the risk of undermining the Fed's independence and consequently the credibility of the dollar, by using executive power to influence monetary policy? As previously analyzed in earlier articles, the Trump administration’s economic policy centers on the goal of “reshoring manufacturing,” which has encountered two major obstacles in practice:

l Internal production costs are too high to compete with international rivals;

l Government debt levels are too high, leaving insufficient budget to incentivize industrial reshoring.

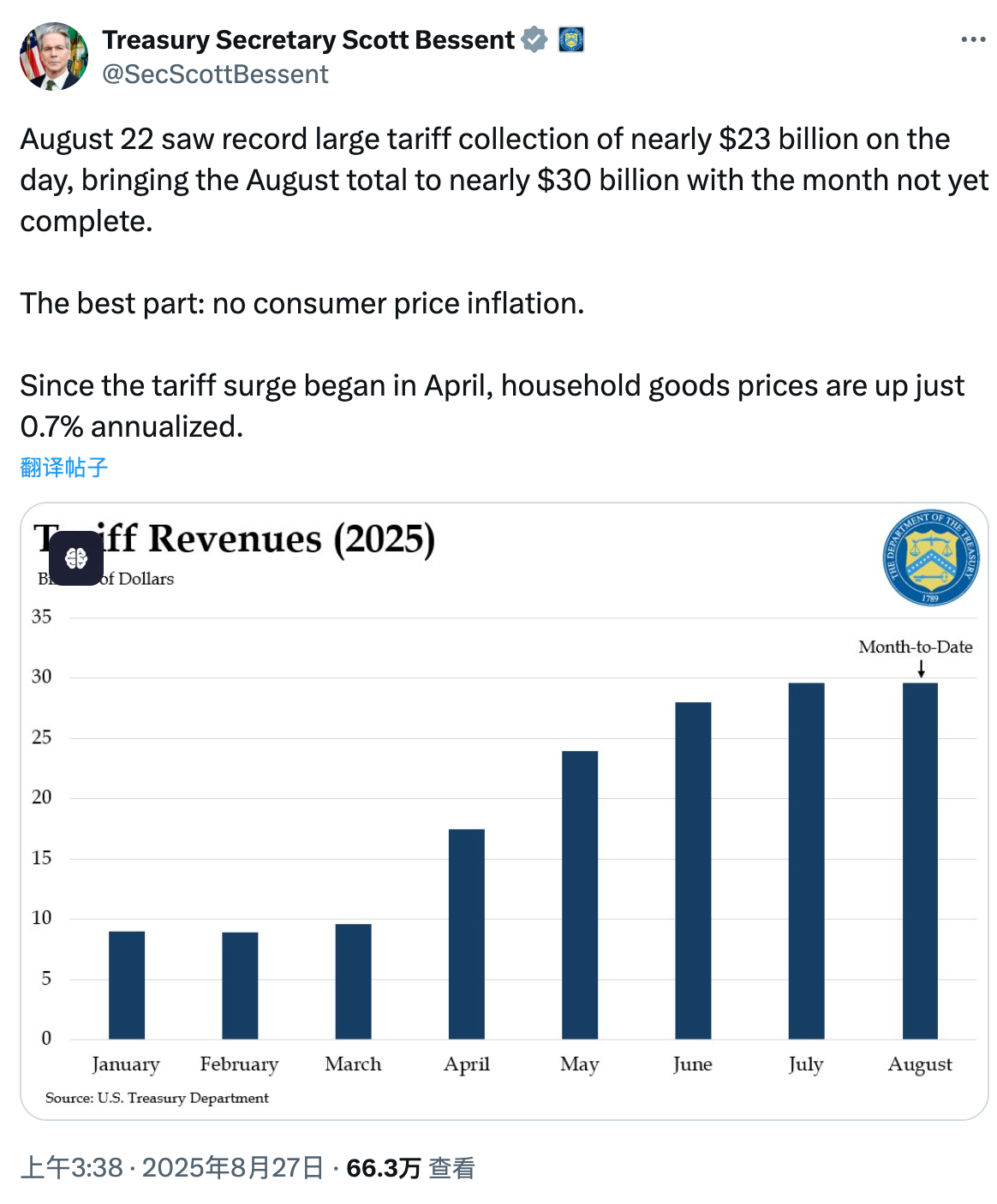

Observing the first half-year of the Trump administration, its policy rollout can be broadly divided into two phases. First, immediately after taking office, it focused on fulfilling key campaign promises to strengthen its political authority—such as granting DOGE significant roles and shifting stance on crypto policies. After consolidating its core support base, the administration moved aggressively on tariffs. The reason for delaying tariff actions until after securing political backing was that higher tariffs could trigger concerns over imported inflation, increasing domestic resistance. Now, having established strong authority, the Trump administration has, through months of negotiations, built an initial tariff framework that is already showing results. According to U.S. Treasury Secretary Bessent, as of August 22, tariffs have generated nearly $100 billion in fiscal surplus over the past six months, with expectations to reach $300 billion by year-end. Additionally, the administration has secured investment commitments from multiple countries, including Japan’s $550 billion investment pledge, and $600 billion and $750 billion energy orders from the EU.

While internal costs—such as labor and logistics—cannot be reduced quickly (as they require a major market-clearing event like a depression to reset factor prices), the Trump administration has used tariffs to reshape domestic competitive and capital structures to some extent. This makes the timing ripe for the next phase of policy: Fed rate cuts.

What can rate cuts achieve? Two main things. First, alleviating debt pressure. During former Treasury Secretary Yellen’s tenure, the U.S. Treasury increased issuance of short-term debt, a strategy retained by Bessent. The benefit is that short-term rates are directly influenced by the Fed, reducing long-term debt burdens on the fiscal budget. Moreover, current strong demand for short-term Treasuries helps lower financing costs. However, the downside is shorter debt duration, increasing near-term repayment pressure—this explains the heightened attention on recent debt ceiling negotiations. Rate cuts would reduce interest payment burdens on short-term debt. Second, rate cuts lower financing costs for small and medium enterprises (SMEs), aiding supply chain development. Unlike large corporations, SMEs rely heavily on bank loans for working capital. In a high-rate environment, their willingness to expand financing diminishes. After reshaping domestic competition via tariffs, it’s urgent to stimulate SME production and expansion to fill supply gaps and prevent inflation. Hence, the Trump administration’s push for Fed rate cuts is serious and persistent, not mere posturing.

Whether through active intervention in the renovation of the Fed headquarters or relentless attacks on progressive, left-wing, hawkish理事Cook, the Trump administration has clearly demonstrated its determination. These efforts appear to have borne fruit following Powell’s speech last week at the Jackson Hole global central bankers’ symposium. Most strikingly, Powell—who has consistently emphasized Fed independence—seemed to yield to Trump’s mounting pressure. Several key points in his speech reveal this shift:

1. Clearly stated that risks in the U.S. economy have shifted from inflation to the labor market;

2. Argued that the inflationary impact of tariffs will take time to materialize and is not a driver of inflation spirals;

3. Updated the monetary policy framework, notably reducing emphasis on the effective lower bound as a "feature of normal economic conditions."

In simple terms, the Fed now cares less about tariff-driven inflation and more about the risk of recession-induced labor market collapse. Moreover, the scope for rate cuts is now perceived as virtually unlimited. A brief note on the effective lower bound: it refers to the point at which further conventional rate cuts (via short-term policy rates) cease to stimulate the economy. This conceptual shift aligns perfectly with the core of Trump’s policy agenda. This apparent "mutual convergence" has fueled market expectations for further liquidity easing.

Implications for the Cryptocurrency Market

Cryptocurrency markets are often seen as the canary in the coal mine for global risk asset speculation. Following Powell’s speech, crypto assets initially rallied. However, the subsequent pullback suggests that markets had already partially priced in potential rate cuts this year. With a new trading paradigm confirmed, sentiment has shifted from emotional anticipation to rational expectation—meaning more concrete evidence is needed to assess the scale of future rate cuts.

As for how deep the correction might go, the price action of ETH—the most discussed asset recently—is worth watching. The author believes that as long as ETH does not break below its current upward channel in the short term, investor sentiment remains intact and risks are manageable. Over the coming week, labor market indicators will significantly influence crypto market movements. In particular, next Friday’s nonfarm payrolls data will bring substantial volatility. If employment data falls short of expectations, the probability of a September Fed rate cut will rise sharply. Conversely, if the data shows unexpectedly strong resilience in the labor market, rate-cut pressures will ease, potentially leading to further market corrections. Either way, the current policy-driven market reminds the author of the CPI-dominated行情 of 2023.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News