Hidden Concerns Behind the Boom of Digital Asset Treasuries (DATs): Which Tokens Are at Highest Risk?

TechFlow Selected TechFlow Selected

Hidden Concerns Behind the Boom of Digital Asset Treasuries (DATs): Which Tokens Are at Highest Risk?

During cryptocurrency bull markets, DATs' stocks tend to rise significantly and trade at a substantial premium to their net asset value (NAV).

Written by: Anthony DeMartino - ADM

Compiled & Translated: Janna, ChainCatcher

Since the beginning of this year, digital asset treasury (DAT) companies have emerged as typical representatives of the convergence between crypto and equities, experiencing rapid growth. However, while injecting liquidity into mainstream assets such as Bitcoin and Ethereum, these treasury-type firms have also revealed certain vulnerabilities.

This article is based on an analysis by Anthony DeMartino, Founder of Sentora and General Partner at venture capital firm Istari, examining the potential risks behind the DAT sector's boom.

Below is the original text:

In 2025, a new type of publicly traded company has attracted significant investor attention: Digital Asset Treasuries (DATs). These entities typically hold cryptocurrencies like Bitcoin as core reserve assets and have raised over $15 billion in funding this year alone—surpassing traditional venture capital investments in the crypto space. This trend was initially driven by companies like MicroStrategy and has since gained momentum, with more businesses leveraging public markets to accumulate digital assets. While this strategy has delivered massive gains during bull markets, it also carries inherent risks that could lead to painful liquidations, exacerbating volatility in both stock and crypto markets.

(1) Operating Model of DATs

DATs are typically established using innovative financing structures, including reverse mergers into NASDAQ-listed shell companies. This allows private entities to go public quickly without undergoing the rigorous scrutiny of a traditional IPO. For example, in May 2025, Asset Entities merged with Strive Asset Management via a reverse merger to form a Bitcoin-focused treasury company.

Other examples include Twenty One Capital, backed by SoftBank and Tether, which completed a reverse merger with Cantor Equity Partners to create a $3.6 billion Bitcoin investment vehicle. After going public, these companies raise capital through stock offerings and allocate nearly all proceeds to digital assets. Their mission is clear: buy and hold cryptocurrencies such as Bitcoin, Ethereum, SOL, XRP, or even TON.

This model enables a crossover between traditional finance and crypto, offering investors leveraged exposure to digital assets without directly holding them.

(2) Stock Price Appreciation and Premium Trading

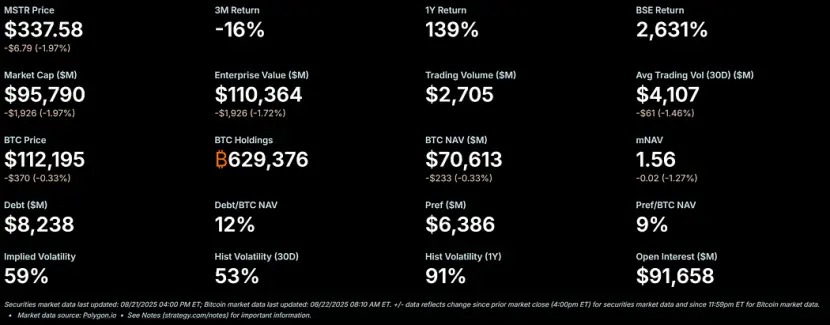

During crypto bull markets, DAT stocks often surge significantly and trade at substantial premiums to their net asset value (NAV). As a leading example, MicroStrategy’s stock once traded at over a 50% premium to its Bitcoin NAV, with its multiple-to-NAV (mNAV) ratio recently reaching 1.56.

This premium arises from several factors: access to low-cost public market capital, investor enthusiasm for leveraged crypto bets, and the perception of these companies as vehicles to amplify equity returns.

When share prices exceed NAV, each dollar raised results in less dilution than the incremental value created by asset purchases—creating a virtuous cycle. In 2025, listed companies and investors collectively acquired over 157,000 Bitcoins (worth over $16 billion), further fueling this momentum. Stocks like Metaplanet, Bitmine, and SharpLink saw outsized gains, often exceeding the price appreciation of their underlying cryptocurrencies.

(3) Leveraging: Adding Fuel to the Fire

As premiums persist, DATs often increase leverage to magnify returns. They issue convertible bonds or conduct secondary stock offerings to purchase additional digital assets—essentially borrowing against future appreciation. For instance, MicroStrategy extensively uses convertible notes, with its debt already accounting for 11% of its Bitcoin NAV.

This strategy amplifies gains in rising markets but exposes companies to significant risk during downturns. Leverage reduces resilience, potentially triggering margin calls or forced selling. The appeal is evident: in bull markets, leverage can turn modest crypto gains into explosive stock performance. However, the inherent high volatility of digital assets may cause rapid value erosion.

(4) Inevitable Downturn: From Premium to Discount

The high volatility of crypto markets is well known. When cryptocurrency prices fall, DAT stock prices may drop even more sharply. If prices decline too rapidly or confidence in these companies wanes, the premium to NAV can quickly turn into a discount. Leveraged positions worsen this effect: falling NAV forces de-risking, creating a volatility trap where bets designed to amplify gains now inflict greater losses on holders.

A discount to NAV suggests market skepticism about a company’s ability to manage assets or cover operating costs during value declines. Without intervention, this triggers a chain reaction: eroding investor confidence, rising borrowing costs, and potential liquidity crises.

(5) Crisis Response: Three Possible Paths Forward

Assuming a DAT holds sufficient cash reserves to cover operating expenses, it faces three primary choices when trading at a discount:

1. Maintain Status Quo: The company continues holding assets, awaiting a market rebound. This preserves crypto holdings but may lead to prolonged shareholder dissatisfaction, accelerating stock declines. To date, Strategy has maintained its Bitcoin holdings through multiple bear markets without selling.

2. Acquisition by Peers: If discounts widen significantly, speculative buyers—often other DATs—may acquire the company at a low price, effectively purchasing its underlying tokens below market value. This drives industry consolidation but pulls forward demand, weakening new buying flows that are currently key drivers of the rally.

3. Sell Assets to Repurchase Shares: The board may sell part of its digital assets to fund share buybacks, narrowing the discount and restoring parity between stock price and NAV. This actively manages premium/discount dynamics but involves selling crypto during market weakness.

These three options highlight the fragile balance between asset preservation and shareholder value.

(6) Selling Pressure: Motivations and Impacts

DAT executives are typically compensated primarily in stock. While this aligns their interests with stock performance, it also incentivizes short-term solutions. With personal wealth tied directly to share prices, boards face intense pressure during discount periods to pursue asset sales combined with share buybacks.

This incentive structure may push companies to prioritize short-term NAV parity over long-term holding strategies, leading to hasty decisions that contradict the original logic of reserve asset accumulation. Critics argue this mechanism mirrors historical "boom-to-bust" asset cycles, where leveraged bets ultimately collapse violently. If multiple companies adopt this strategy simultaneously, it could trigger cascading effects and broader market turmoil.

(7) Broad Impact on Cryptocurrency Prices

The transition of DAT valuations from premium to discount could profoundly affect underlying crypto prices, often creating negative feedback loops: when companies sell tokens to fund buybacks or cover leveraged positions, they inject additional supply into an already declining market, further driving down prices. For example, banking analysts warn that if Bitcoin falls more than 22% below corporate average entry prices, forced selling may be triggered.

This introduces systemic risk: large holders' actions influence market dynamics, amplify volatility, and may spark cascading liquidations. However, some data suggest enterprise holdings have limited direct price impact, implying the market may overestimate DAT influence.

Nonetheless, in a highly leveraged ecosystem, coordinated selling could further depress asset values, deter new entrants, and prolong bear markets. As the DAT trend matures, its unwinding could test the entire crypto market’s resilience, turning today’s reserve asset boom into tomorrow’s cautionary tale.

(8) Which Tokens Will Be Most Affected by the Shift to Discount?

Since early 2025, Ethereum-focused DATs have become major players in the crypto ecosystem. Through public market fundraising, they’ve accumulated substantial ETH holdings. While this fueled ETH price growth during the bull run, the model introduces added risk in bear markets: when DAT stock prices shift from premium to discount relative to NAV, boards may face pressure to sell ETH to fund share buybacks or cover operating costs—potentially accelerating downward price pressure. The following sections analyze possible ETH price floors under such scenarios, incorporating historical context, current holdings, and market dynamics.

(9) Historical Context: Ethereum Price Movement Around the First DAT Announcement

The first Ethereum-focused DAT announcement came from BioNexus Gene Lab Corporation on March 5, 2025, marking its official transformation into an Ethereum asset strategy company. The day before, on March 4, 2025, Ethereum closed around $2,170—a reflection of market consolidation amid broad uncertainty following the 2024 bull run.

By August 21, 2025, Ethereum had reached approximately $4,240, up about 95% from pre-announcement levels. In contrast, BTC rose only 28% over the same period. Additionally, the ETH/BTC exchange rate hit a 2025 high (above 0.037), underscoring Ethereum’s outperformance.

This rally was driven by multiple factors: inflows into spot Ethereum ETFs (over $9.4 billion since June), rising institutional adoption, and corporate buying linked to the DAT trend itself. However, a significant portion of this gain stemmed from speculative capital inflows tied to the DAT narrative—making it vulnerable to pullbacks.

(10) Corporate Ethereum Holdings and Supply Share Since the Start of the DAT Trend

Following BioNexus’ announcement, which launched the Ethereum DAT wave, public companies began actively accumulating ETH as reserve assets. By August 2025, around 69 entities held over 4.1 million ETH, valued at approximately $17.6 billion. Key players include BitMine Immersion Technologies (holding $6.6 billion worth as of August 18, the industry leader), SharpLink (728,804 ETH), ETHZilla (~82,186 ETH), Coinbase, and Bit Digital.

These corporate holdings represent over 3% of Ethereum’s total supply. Since the Ethereum DAT trend began in March 2025—and prior to that, virtually no public companies held ETH as strategic reserves (e.g., Coinbase’s holdings were primarily operational rather than strategic)—this 3.4% stake is almost entirely new acquisition post-DAT emergence. Including institutional and ETF holdings, Ethereum’s institutional ownership stands at about 8.3% of total supply, with recent accumulation primarily driven by DAT-related corporate buying.

(11) Ethereum Price Outlook During DAT Discount Scenarios

DAT stocks typically trade at premiums to NAV during bull markets, but in bear markets, those premiums may reverse into 20%-50% discounts, triggering one of three responses: maintain status quo, get acquired, or sell assets to repurchase shares. Given executive compensation is tied to stock performance, management tends to favor selling ETH to narrow the discount—injecting additional supply into the market. For Ethereum, this could create a negative feedback loop, especially considering the concentration of large holdings among a few firms.

1. Base Case (Mild Discount, Partial Selling)

If Ethereum enters a correction due to macro factors (e.g., rising interest rates) and DAT stocks fall to a 10%-20% discount, companies might sell 5%-10% of their ETH holdings (approximately 205,000–410,000 ETH, worth $870 million–$1.74 billion at current prices) to fund share buybacks. With Ethereum’s daily trading volume around $15–20 billion, this could add 5%-10% downward pressure, pushing prices down to $3,600–$3,800 (a 10%-15% drop from the current $4,240). This scenario assumes gradual over-the-counter (OTC) sales to minimize slippage.

2. Severe Case (Deep Discount, Coordinated Selling)

If the crypto market enters a full bear phase (premiums vanish, discounts widen to 30%-50%), multiple DATs may initiate simultaneous liquidations—especially if leveraged positions (e.g., convertible bonds) force de-risking. If 20%-30% of corporate ETH holdings (roughly 820,000–1.23 million ETH, worth $3.5–5.2 billion) flood the market within weeks, it could overwhelm liquidity capacity, causing a 25%-40% price drop. Ethereum could fall to $2,500–$3,000—approaching pre-DAT levels but not fully reverting, supported by ETF inflows and on-chain growth (e.g., Ethereum’s daily transaction count reached 1.74 million in early August). Drawing parallels to institutional sell-offs in the 2022 bear market, and considering today’s 3.4% corporate holding concentration, Ethereum’s volatility could intensify further.

3. Worst-Case Scenario (Full Liquidation)

If intensified regulatory scrutiny (e.g., SEC action against treasury companies) or a liquidity crisis forces widespread ETH selling—potentially over 50% of holdings, exceeding 2 million ETH—prices could plummet to $1,800–$2,200, erasing all gains since the start of the DAT trend and testing 2025 lows. However, this scenario is unlikely, as peer acquisitions could absorb some supply, and the 8% held by ETFs provides a buffer.

These projections factor in improved Ethereum fundamentals, such as whale accumulation of 200,000 ETH in Q2 2025, yet still highlight DAT-specific risks. Ultimately, the extent of Ethereum’s price decline depends on sell-off scale, market depth, and external catalysts. Under discount-driven liquidation scenarios, a drop to the $2,500–$3,500 range is plausible—exposing the fragility of the DAT model.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News