Pantera Capital Deep Dive: The Value Creation Logic of Digital Asset Treasuries (DATs)

TechFlow Selected TechFlow Selected

Pantera Capital Deep Dive: The Value Creation Logic of Digital Asset Treasuries (DATs)

At this moment, we stand at the intersection of old and new cycles in the crypto world, witnessing a profound transformation beneath the surface.

Author: Pantera Capital

Compiled & Translated: Janna, ChainCatcher

This article is written by Cosmo Jiang, General Partner and Portfolio Manager at Pantera Capital. The era of digital asset investment based purely on "buy and hold" is long gone. Digital Asset Treasuries (DATs), with their unique logic of "increasing net asset value per share and earning more underlying tokens," have become highly sought-after assets among institutional investors. Pantera has committed $300 million heavily into DATs, while BitMine has gained prominence through its impressive ETH reserves. This article will unpack the value proposition behind DATs, reveal why leading industry institutions are choosing this sector, and help you understand the new direction of digital asset investing.

(1) Investment Logic Behind Digital Asset Treasuries (DATs)

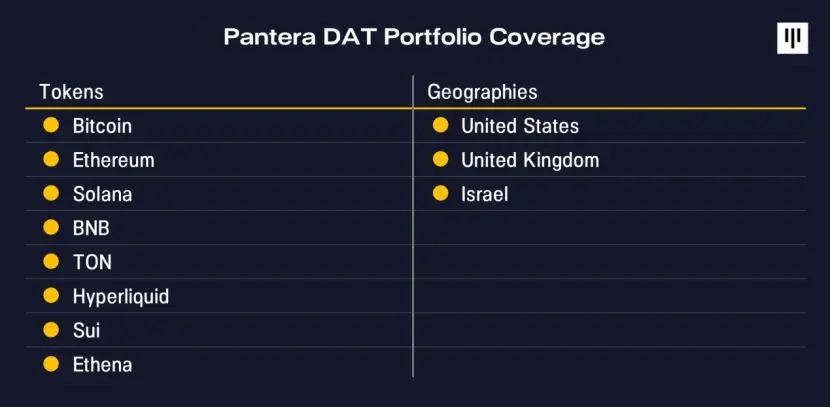

Our investment thesis for DATs rests on a simple premise: DATs can generate returns that increase net asset value per share, ultimately accumulating more underlying tokens than passive spot holdings. Therefore, investing in DATs may offer higher return potential compared to directly holding tokens or accessing them via ETFs. Pantera has deployed over $300 million globally across multiple DATs holding various tokens. These DATs are leveraging their unique advantages to strategically accumulate digital assets and grow per-share value. Below is an overview of our DAT portfolio.

BitMine Immersion is an innovative company focused on blockchain technology and digital asset monetization, listed on the NYSE under the ticker BMNR. As Pantera’s first investment from its DAT fund, BitMine demonstrates a clear strategic path and exceptional execution capability. Tom Lee, Chairman of BitMine, has articulated the company’s long-term vision: acquiring 5% of the global ETH supply—the so-called “5% Alchemy Plan.” We believe that a deep analysis of BitMine’s value creation process offers a compelling case study for understanding how high-execution DATs operate.

Since launching its reserve strategy, BitMine has become the largest global holder of ETH and the third-largest DAT (after Strategy and XXI), holding 1.150263 million ETH valued at $4.9 billion as of August 10, 2025. Meanwhile, BitMine ranks as the 25th most liquid stock in the U.S., with a five-day average daily trading volume reaching $2.2 billion as of August 8, 2025.

(2) The Strategic Value of Ethereum

The success of any DAT hinges on the long-term investment merit of its underlying token. BitMine’s DAT strategy is built on the following conviction: as Wall Street goes fully on-chain, Ethereum will emerge as one of the most significant macro trends of the next decade. As we noted last month, the “Great On-Chain Migration” is underway—tokenization innovation and stablecoins are growing increasingly critical. Currently, $25 billion in real-world assets have been tokenized, alongside $260 billion in stablecoins (equivalent to the 17th largest holder of U.S. Treasuries), collectively driving this transformation. As BitMine Chairman Tom Lee stated in early July 2025, “Stablecoins have become the ChatGPT moment for crypto.”

Most of these activities occur on the Ethereum network, allowing ETH to benefit directly from rising demand for blockspace. As financial institutions increasingly rely on Ethereum’s security for their operations, they will have stronger incentives to participate in the proof-of-stake network, further boosting demand for ETH.

(3) Real Evidence of DAT Value Creation

Once the investment value of the underlying token is established, the DAT business model focuses on maximizing per-share token accumulation. Key methods include:

-

Premium stock issuance: issuing shares at prices above net asset value (NAV) per share

-

Issuing convertible bonds: monetizing the volatility between stock and token values through equity-linked securities

-

Reinvesting earnings: using operating income from staking rewards, DeFi yields, etc., to acquire more tokens (a unique advantage for smart contract-based token DATs like ETH, which traditional Bitcoin-focused DATs such as Strategy lack)

-

Acquiring undervalued assets: purchasing other DATs trading at or below NAV

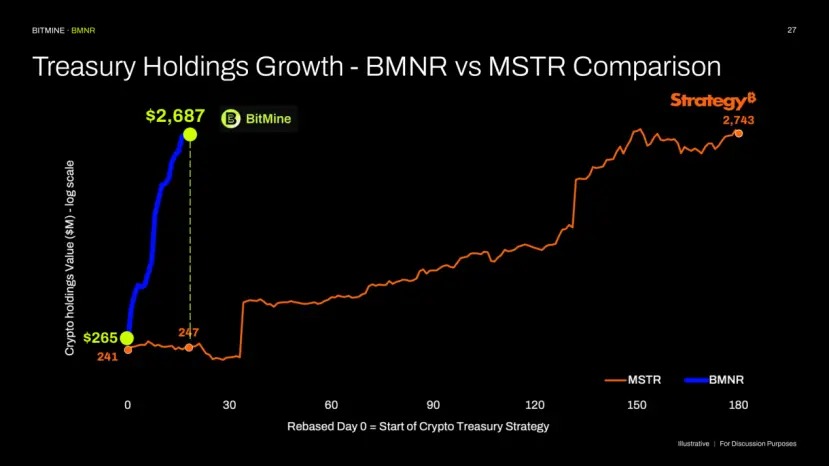

BitMine achieved remarkable growth in ETH per share during the first month of its ETH reserve strategy, outpacing peers significantly. Its first-month ETH accumulation surpassed Strategy’s total acquisition over its first six months. BitMine primarily grew through stock issuance and staking rewards and is expected to soon expand into financing tools like convertible bonds.

Source: BitMine, July 27, 2025

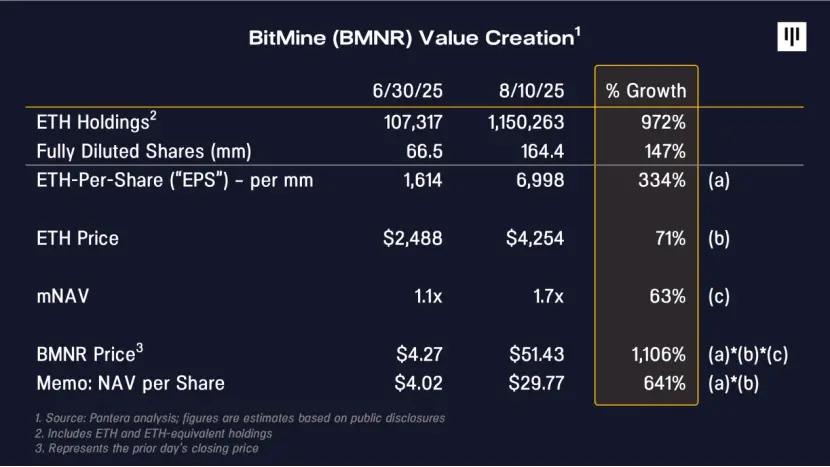

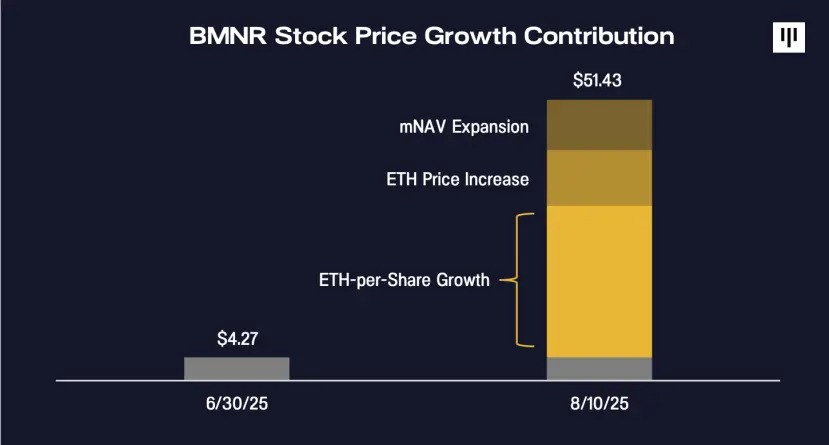

A DAT’s price can be broken down into three multiplicative components: (a) tokens per share, (b) token price, and (c) NAV multiplier (mNAV).

At the end of June, BitMine’s stock price was $4.27 per share, approximately 1.1x its post-initial-DAT-funding NAV of $4 per share. Just over a month later, the stock surged to $51 per share, roughly 1.7x its estimated $30 per share NAV.

Of the 1100% rise during that month, about 60% came from EPS growth (330%), 20% from ETH price appreciation (rising from $2,500 to $4,300), and 20% from mNAV expansion (to 1.7x).

This shows that the core driver behind BitMine’s stock appreciation was the growth in ETH per share (EPS)—a controllable engine managed by leadership and the key differentiator between DATs and passive spot holdings.

The third factor we haven’t discussed yet is the NAV multiplier (mNAV).

A natural question arises: why would anyone pay more than net asset value (NAV) for a DAT’s shares?

This can be understood by analogy with balance sheet-driven financial institutions like banks: banks generate income from their assets, and investors assign valuation premiums to those perceived as consistently earning above their cost of capital.

High-quality banks often trade above their book value—for example, JPMorgan Chase (JPM) trades at over 2x price-to-book. Similarly, if investors believe a DAT can consistently grow its per-share net asset value, they may be willing to value it at a premium to NAV.

We believe BitMine’s ~640% monthly growth in net asset value per share is sufficient to justify its mNAV premium.

Whether BitMine can sustain execution of its strategy remains to be seen, and challenges along the way are inevitable. However, its management team and track record so far have attracted support from major traditional financial players such as Stan Druckenmiller, Bill Miller, and ARK Invest. We expect, as demonstrated by Strategy’s trajectory, that the growth potential of high-quality DATs will gain broader recognition among institutional investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News