Hyperliquid: Timing is always the best entry point to break existing structures

TechFlow Selected TechFlow Selected

Hyperliquid: Timing is always the best entry point to break existing structures

What Are Big Players Really Earning in the Era When Retail Investors Refuse to Trade

Original author: Zuo Yeye Wai Bo Mountain

Hyperliquid's liquidity never fails to surprise—sometimes delightfully, sometimes shockingly.

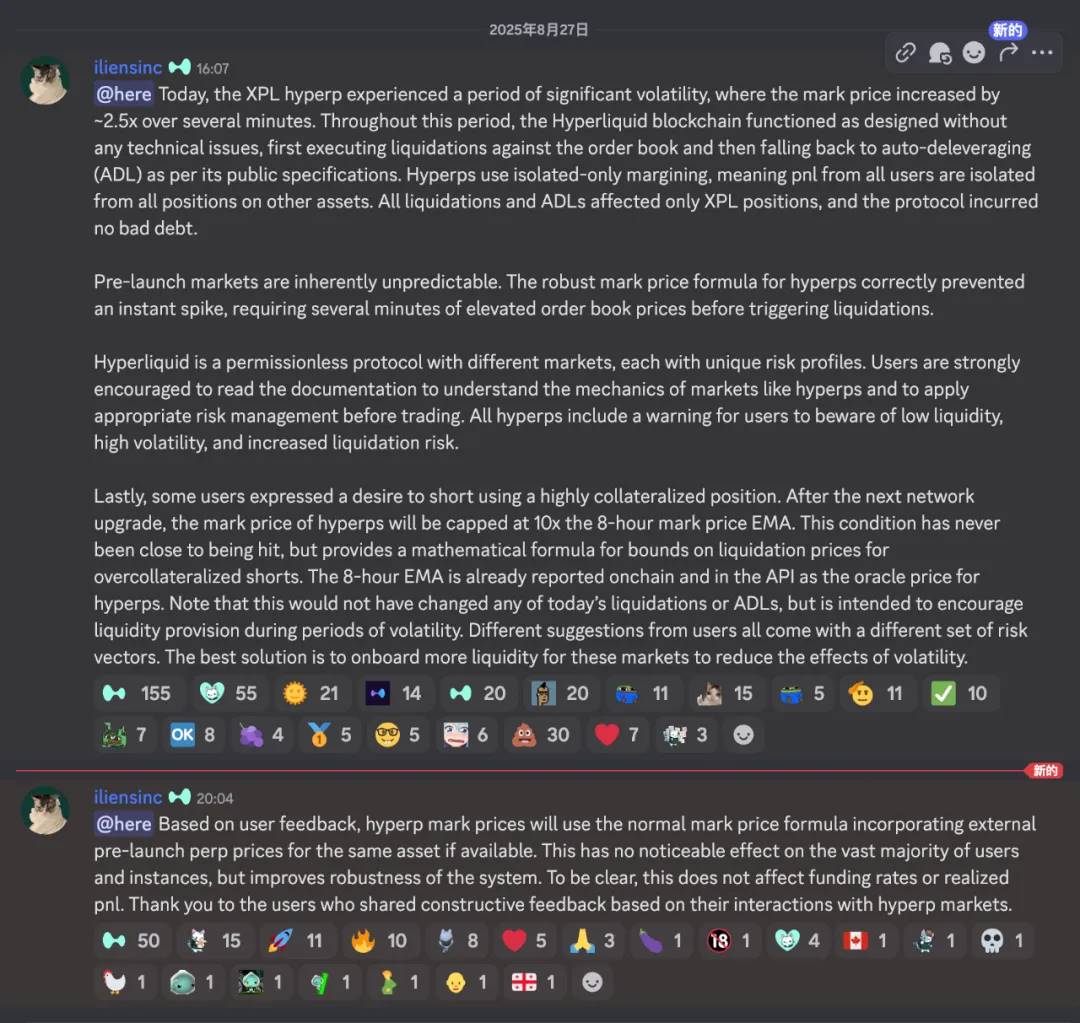

On August 27, just as news broke that Hyperliquid’s BTC spot trading volume ranked second only to Binance and had surpassed Robinhood last month, a super whale address linked to Sun Guo placed an "attack" order on the $XPL pre-market contract, causing user losses amounting to tens of millions of dollars.

Unlike mainstream markets such as BTC/ETH, Hyperliquid’s pre-market contract market has inherently low trading volume. Whales can exploit trading rules without permission, ultimately leading to human tragedy.

Had this occurred on centralized exchanges like Binance, the whale would have long been manually banned, making sniper attacks nearly impossible. After the incident, Hyperliquid’s team responded on Discord with: “deeply understand, learn lessons, resolutely improve, no compensation for now.”

Caption: HL team response

Image source: @hyperliquidx

Let’s revisit the security incidents involving HL and their outcomes:

1. In November 2024, BitMEX founder Arthur Hayes and others accused Hyperliquid of architectural centralization;

2. Early 2025, a 50x whale blew up the HLP treasury event, after which the HL team adjusted leverage multiples for multiple tokens;

3. March 26, 2025, facing malicious targeting of $JELLYJELLY, the HL team directly pulled the plug to protect itself;

4. August 27, 2025, whales targeted the pre-market contract $XPL, official stance: “users bear their own risks.”

It becomes evident that the HL team adopts entirely different measures in response to various security incidents. If the protocol’s own treasury or interests are not involved, they claim decentralized governance; but if the protocol itself is truly threatened, they directly exercise admin privileges.

I do not intend to make a moral judgment here, but merely point out that any venue where trading liquidity concentrates inevitably faces the “accident” of choosing between protecting retail traders or whale-driven liquidity—from Binance’s opaque listing standards to Robinhood’s retail vs. Wall Street battles, none are exempt.

Time and space form a circle; liquidity is the gravitational source

In 2022, during the Perp DEX wave, the collapse of FTX left a void in the perpetual contracts market. Binance, adhering to its listing-centric mindset, faced a reshaping of pricing strategy by PumpFun.

Hyperliquid isn't special—it mimics the $BNB = Binance main platform + BNB Chain model, migrating all liquidity onto a no-KYC blockchain. While Binance grew rapidly via regulatory arbitrage, HL attracted retail users through permissionless arbitrage.

Going back to 2022, everything in crypto originated from FTX’s sudden collapse: Backpack claimed Solana’s orthodoxy, Polymarket took over political event prediction, while Perp DEXs continued struggling under GMX and dYdX dominance, plus encroachment from Bybit and Bitget.

A brief market vacuum emerged. Binance was under investigation and vulnerable; Biden was in office, and Democratic presidents weren’t fond of crypto—SBF, who donated millions to Biden, still ended up imprisoned. Gary Gensler, then SEC chair, was aggressively cracking down on crypto, even forcing Jump Trading to retreat.

All was silent—yet within crisis lies opportunity.

Binance under scrutiny, FTX collapsed, BitMEX aging, OK/Bybit/Bitget fighting off-chain. At that time, CEXs didn’t deny the trend toward on-chain migration, but chose wallets as their path.

Hyperliquid chose to embrace CLOBs (Central Limit Order Books), adopting off-chain matching with on-chain settlement, combined with a copied GMX LP token mechanism—the Incentive Game officially launched.

Caption: Perp DEX landscape

Image source: @OAK_Res

But this mechanism wasn’t even novel by 2023–2024. At a critical moment, Pump Fun shattered Binance’s pricing system, and the Meme frenzy allowed HL liquidity to earn its first batch of loyal users.

Prior to Pump Fun, NFTs or Meme shitcoins already existed—even BNB Chain was the main battleground in 2021—so when “Big Brother” claims not to understand Memes, it’s purely marketing. But Pump Fun chose an inside-outside market mechanism and leveraged the Solana ecosystem.

-

• The inside-outside market mechanism enabled small capital pools to test large-scale possibilities;

-

• The Solana ecosystem maximized the rapid birth and death nature of Meme trading.

This disrupted the traditional VC funding → project assembly → Binance exit → empower BNB cycle. The collapse of high-valuation models foreshadowed Binance’s liquidity crisis. Today, BNB is essentially Binance’s debt, and Binance Alpha reflects passive defense born of helplessness.

The Meme boom was HL’s first real validation: liquidity must be accessible everywhere. Only after small-scale, minor-token experiments do large funds and major coins arrive. Marketing narratives are always reversed—claim big players first, so retail dare to enter. But in reality, without retail losses, there would never be profits for MM (market makers), whales, or protocols.

Hyperliquid cannot possibly operate ultra-high liquidity solely on internal funds—it must have external capital inflows. This doesn’t conflict with lack of traditional VC involvement. In November 2024, Paradigm had already entered the $HYPE ecosystem, purchasing an estimated 16 million tokens according to @mlmabc.

Caption: Paradigm buys $HYPE

Image source: @matthuang

Venture capitalists can directly buy in—this hardly qualifies as traditional investment. Similarly, market makers may participate the same way. Logically, both act identically to ordinary retail: airdrops and purchases.

Narratively, token emissions and sell-offs represent a classic game theory crisis. With mutual distrust among project teams, multiple VCs, and exchanges, everyone opts to dump immediately upon unlock—preserving current gains despite sacrificing future benefits. Thus emerges a world where only exchanges and project teams get hurt.

Hyperliquid stabilized the flywheel’s initial momentum by retaining project control during $HYPE airdrops and listing $HYPE spot primarily on its own exchange—dual control ensured stability. Bybit listed $HYPE spot only around mid-2025, most likely buying directly to add trading pairs, unlikely pushed by HL.

HL isn’t mysterious. When Pump Fun launched on Hyperliquid, its wealth creation effect surpassed Binance. Binance has merely regained ground today. Such competitions will continue for a long time—during $JELLYJELLY, Binance and OK even set aside differences to jointly target Hyperliquid.

Business is war. The race is long, but decisive moments are few.

Retail trades memecoins; institutions rush to HL

In an era when retail refuses to trade, what exactly are big players earning?

Memes go bankrupt. Compare Pump Fun, Berachain, and Story Protocol—guess whose protocol revenue is highest? It’s Pump Fun, where retail is supposedly leaving. Meanwhile, DeFi-native Berachain has become irrelevant.

Yet retail won’t touch altcoins anymore. Current rallies stem from U.S. equity market liquidity spillover. Unfortunately, DAT has begun selling tokens. The strategy (MSTR) creates an attractive stock-bond-crypto flywheel—but it’s easy to admire, hard to imitate. Even ETH pales in comparison to BTC in terms of sustained upside potential.

In this retail-averse era, everyone targets institutions and big players. Their logic is curious—they believe as long as whales trade among themselves, they’ll collect spreads and fees. This isn’t mere laziness—it’s an insult to Hyperliquid.

Liquidity is always the most fundamental infrastructure in crypto. Hyperliquid succeeded precisely by establishing direct ties with retail users.

If 500,000 no-KYC users were all whales, crypto would have already replaced the existing financial system. Trump’s $5 million golden card couldn’t sell that many. Like USDT, permissionless access exerts massive financial appeal. You may argue many are illicit actors, but such a phenomenon cannot be created by a select few alone.

In this recent attack incident, Twitter (X) posts describe real affected users. Even in low-volume pre-market contracts, this proves Hyperliquid’s influence and user base. The sole issue is HL messed up this time—using its own liquidity to crush its governance system.

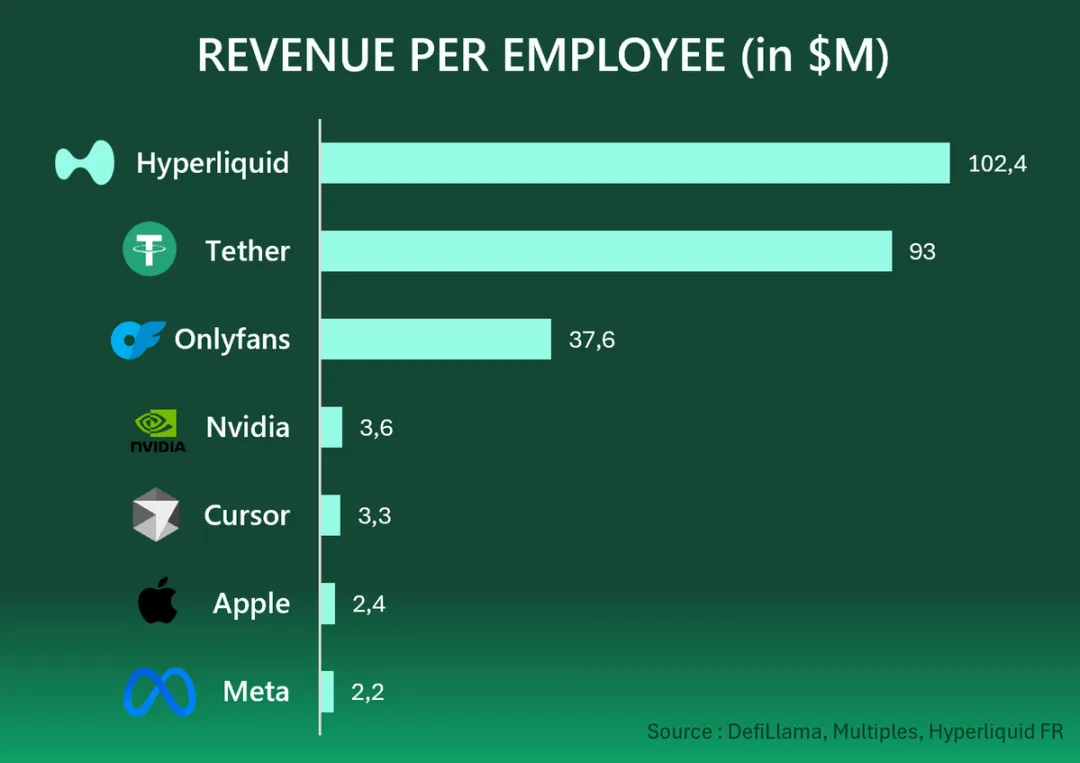

Eleven people generated $1.167 billion in annual revenue—$106 million per person. Tether follows at $93 million per person, then OnlyFans at $37.6 million. Internet scale effects, combined with humanity’s most primal desires, have forged a dazzling underground and on-chain world across Africa, Asia, Latin America, and developed nations’ niche industries.

Caption: Web2 & Web3 company revenue per employee

Image source: @HyperliquidFR

If you believe Hyperliquid is just whales trading with each other, do you also think Tether is merely large players swapping? Or that OnlyFans is full of tycoons diving into adult content?

In an era when retail avoids altcoins and Memes, high leverage on BTC and ETH represents one of the few remaining “opportunities”—irresistibly tempting to all, though being squeezed short brings equally fatal losses.

One cannot deviate twice from the path of their own success.

Binance will keep optimizing around listing logic until overfitting traps it in a death spiral;

CEXs will keep boosting rebates to attract liquidity until they erode their slim profit margins;

CLOB DEXs will merely mimic Binance, then after launching tokens become GMX clones.

Truly independent thinkers are rare. Many want to offer asset management services to big players. But if you still assume CEXs hold the greatest liquidity today, you’re simply unfit for the next phase of crypto markets.

Retail enters permissionless free markets, big players earn liquidity exit opportunities, Paradigm profits from $HYPE price surge and holdings, retail gains high-risk/high-reward chances—provided they avoid small-cap assets.

Everyone prices their own fate, and then All in Crypto remains the eternal theme.

Conclusion

Human intervention is a traditional feature of Hyperliquid. The entire Perp DEX sector remains heavily governed by individuals.

It wasn’t because HL’s airdrop and incentive distribution were perfectly executed, nor because Jeff’s technical architecture was superior. Rather, after FTX collapsed and while Binance faced regulatory constraints creating a market gap, Hyperliquid actually had limited competition. Timing is always the best entry point to break existing structures.

FTX collapse → Binance restrained by regulation + Binance management stuck in listing mindset → PumpFun shatters Binance’s listing and pricing logic → Perp DEX becomes a vast untapped market → Bybit benefits from established thinking + Hyperliquid builds the $HYPE flywheel.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News