Western Union's Stablecoin Gamble: Can the 172-Year-Old Traditional Giant Make a Graceful Turnaround?

TechFlow Selected TechFlow Selected

Western Union's Stablecoin Gamble: Can the 172-Year-Old Traditional Giant Make a Graceful Turnaround?

Western Union at the cryptocurrency crossroads: decline or rebirth?

Author: Stablecoin Blueprint

Translation: TechFlow

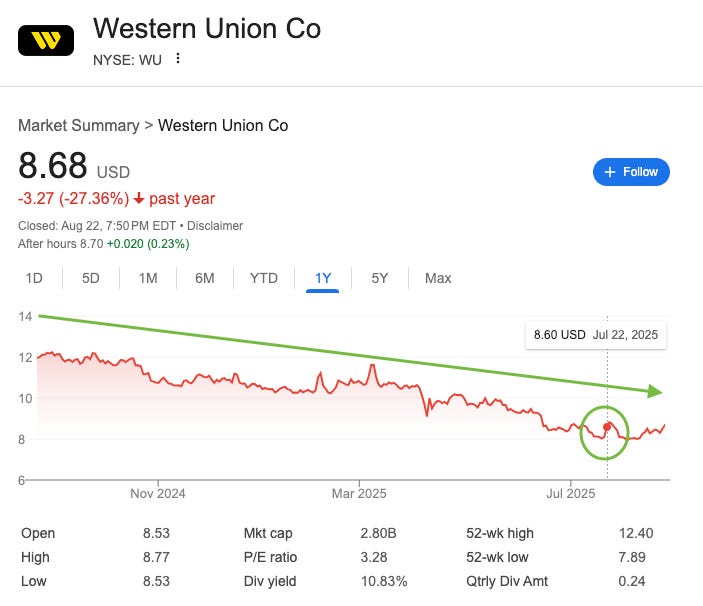

On July 22, Western Union seemed to catch a long-awaited break. After its CEO mentioned in a Bloomberg interview that the company would explore the stablecoin space deeply, the stock of this traditional payments giant surged nearly 10% by market close, sparking a wave of investor "bottom-fishing" not seen in years. Yet this hope was short-lived. A week later, Western Union's earnings report once again missed analyst expectations, and its stock quickly fell back to previous lows, erasing all earlier gains.

This brief market excitement wasn't just about Western Union—it reflected Wall Street’s new preference for stablecoins. Against the backdrop of the landmark Genius Act passing and Circle, a stablecoin issuer, seeing its stock surge fivefold, investors have almost developed a conditioned reflex: at the mention of “stablecoin,” they rush in. But this enthusiasm stems more from misunderstanding the buzzword than from sound business strategy. Stablecoins won’t save Western Union’s core business. However, if the company takes the right actions, they might open an entirely new future.

The Fall of a Giant

Founded in 1851, Western Union was once the dominant force in global money transfers, but its financial performance tells the story of a giant struggling in the new era. In recent years, Wall Street has viewed this world-leading remittance company as a melting “ice cube,” and data supports this: since 2021, revenue has shrunk from over $5 billion to an expected $4.1 billion in 2025, while market share continues to be eroded by digitally-native competitors. This decline is mirrored in its stock price—falling from a 2021 peak of $26 to currently hovering between $8 and $9.

The foundation that once powered this 172-year-old giant—its global network of nearly 400,000 physical agent locations—has now become its biggest structural weakness. The agent-dependent model is costly, accounting for about 60% of Western Union’s service expenses. This network primarily serves one key customer segment: cash-reliant, often unbanked migrant workers. For decades, this model served as Western Union’s moat.

Yet, as global digitization accelerates, this cash-dependent customer base is undergoing long-term structural decline. And in the digital arena—the battlefield of the future—Western Union lags far behind rivals. Last quarter, Western Union’s own digital revenues grew only 6%, while competitors like Wise and Remitly posted growth rates of 20%-30% or higher. Once the undisputed king of remittances, it is now being steadily outpaced in the digital domain.

An Alluring but Flawed Solution

On the surface, Western Union’s proposed stablecoin plan appears comprehensive. During its recent earnings call, the company outlined four key strategies:

-

Improving its own financial management;

-

Enabling global payments via stablecoins;

-

Offering buy, sell, and hold functionality within digital wallets;

-

Most importantly, leveraging its global network as an on-ramp and off-ramp for the crypto ecosystem.

However, the company’s current focus is clearly on the first strategy. As CEO Devin McGranahan stated, “The majority of our time and energy is focused in this area”—using stablecoins to improve back-end operational efficiency.

The appeal of this strategy is undeniable. McGranahan emphasized that stablecoins could “significantly speed up settlement and reduce the amount of pre-funded capital required by partners.” He cited a recent weekend liquidity crunch in India that delayed payments, noting that stablecoins could replenish liquidity in real time, enabling 24/7 service and greatly improving customer experience.

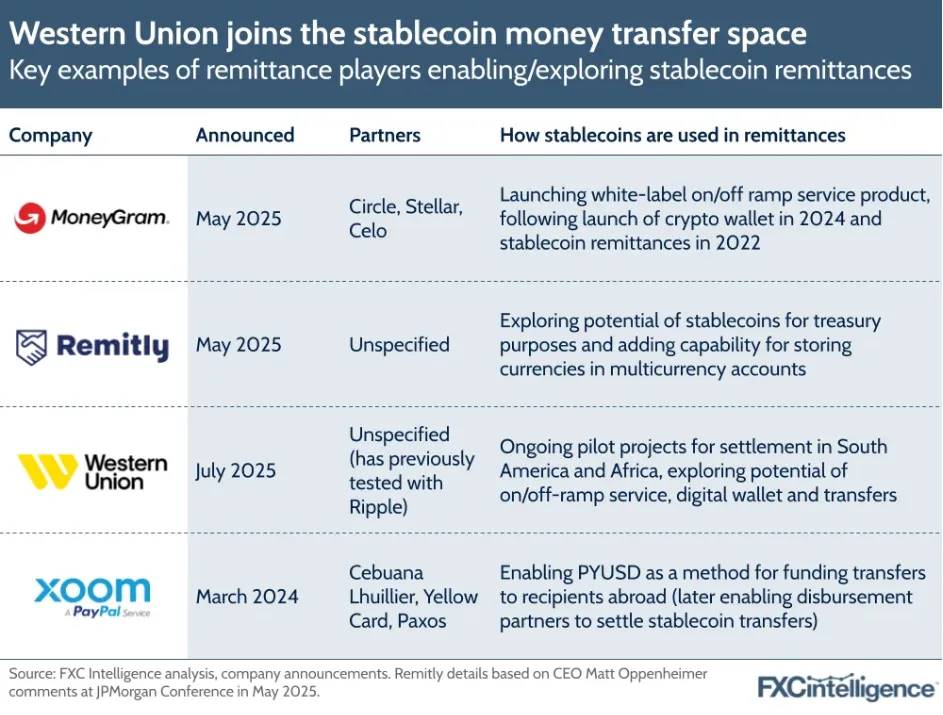

Yet, while optimizing financial operations with stablecoins is a sensible goal, it offers no long-term competitive advantage. Western Union’s main competitors, such as MoneyGram and Remitly, are already implementing similar stablecoin-based settlement strategies. Any cost savings may be eroded under competitive pressure, especially against digital-first firms with inherently lower operating costs. This potential innovation thus becomes merely a “cost of doing business,” unable to reverse the company’s current structural decline.

Source: FXC Intelligence

The Real Opportunity: A Cash Bridge to the Digital Economy

Western Union’s future does not lie in trying to catch up with digital competitors, but in becoming something they cannot replicate: the world’s primary cash-to-stablecoin access layer. The company should fully leverage its 400,000 physical agent locations as its most strategic asset. By strengthening this network and building on its trusted brand, Western Union could solve a critical financial infrastructure problem: providing seamless connectivity between physical cash and the global digital economy—a service urgently needed in many emerging markets.

This strategic shift can be achieved in two ways. First, in-house traffic.

Western Union could directly integrate cash-to-stablecoin conversion into its well-regarded mobile app. Users could walk into a trusted Western Union agent location, hand over volatile local currency, and receive dollar-denominated stablecoins in their digital wallet within minutes. For users seeking to protect wealth through dollar stablecoins—especially in regions with high currency volatility—this would be a highly attractive solution.

The second, more powerful approach is through platform traffic.

Even greater potential lies in opening its agent network via APIs to third-party wallets and fintech companies. These partners could embed “Pay with Western Union” or “Cash out via Western Union” buttons directly in their apps. Market demand is already evident. McGranahan revealed during the earnings call that they were surprised by the “unexpectedly high demand” for deposit and withdrawal services. This transforms Western Union from a closed remittance provider into open infrastructure—an essential “last mile” link between the fast-growing digital ecosystem and the physical world.

Just from deposit and withdrawal services, Western Union could achieve substantial financial returns. Based on current fee structures and the agent economics model (factoring in pricing power in cash transactions), $1 billion in deposit/withdrawal volume could generate approximately $80 million in operating profit—a significant boost relative to the company’s current total profit of around $800 million. For comparison, digital rival Remitly added $50 billion in transaction volume last quarter alone.

Beyond transaction fees, Western Union’s digital wallet entry point enables further financial services, such as debit cards for online spending, credit products, and savings and investment offerings. Western Union is even considering issuing its own stablecoin, with its digital wallet and broad cash-in/cash-out network forming an attractive service bundle and efficient distribution channel. More importantly, unlike consumers in the West, the target users of these services are less sensitive to interest rates, potentially allowing Western Union to retain more of the margin.

These new capabilities would fundamentally redefine the role of Western Union agents. Agent locations would no longer be mere points to collect one-off remittances, but efficient banking branches for the digital age. For millions of unbanked or underbanked individuals, the local Western Union agent would become a physical gateway to global digital wallets, finally fulfilling the promise of “banking the unbanked.”

A Necessary Transformation, Full of Risks

This strategic shift comes with major challenges—from the immense execution risk facing a 172-year-old company to the long-term decline in cash usage and threats from informal P2P networks. Yet it is precisely the structural decline of its core business that makes this transformation imperative.

While defending its legacy business, Western Union urgently needs to inject new growth through deposit/withdrawal strategies. This approach not only deepens the company’s involvement in the rapidly expanding digital asset economy but also leverages its global physical network as a powerful differentiator, buying crucial time to become an indispensable cash bridge—if successfully executed.

Western Union’s recent announcement to acquire Intermex, a firm focused on cash remittances in Latin America, for $500 million, suggests a preference for synergies from consolidating declining operations and converting low-cost acquired users into digital ones. While the acquisition may consume significant time and effort—posing another risk to transformation—the added retail locations could also become strategic assets aligned with its potential future role as a cash bridge.

Conclusion

Western Union’s future cannot be secured by simply tweaking old business models with new technology. Today, the strategic choice is clear: either continue fighting defensively under rules set by digital-first competitors, or boldly transform into an indispensable cash bridge connecting the physical world to the fast-evolving digital asset economy. Stablecoins won’t save traditional remittance economics, but they are the key to unlocking the future platform economy. One path leads to an elegant fadeout; the other, to a renewed sense of purpose.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News