Web3 Japan Market: Latest Data, Size, and Analysis for 2025

TechFlow Selected TechFlow Selected

Web3 Japan Market: Latest Data, Size, and Analysis for 2025

Chinese-speaking regions have relatively limited research and information on Japan's Web3 market, so we decided to update a comprehensive study on the Japanese market.

After previously sharing the article "Web3 Professionals Relocating to and Living in Japan", despite clarifying multiple times that many peers moving to Japan for living or work do not target the Japanese market, numerous readers still expressed interest in understanding the specific conditions of Japanese users and industries.

Later, it became evident that research and information on Japan's Web3 market within Chinese-speaking communities are relatively outdated. Therefore, we decided to publish an updated analysis of Japan's market landscape.

This article draws data and information from sources including the Japan Virtual Currency Exchange Association, Japan's Financial Services Agency (FSA), and licensed exchanges, provided solely for research and reference purposes.

Main contents covered in this article:

-

Japan's Web3 market (growing user base)

-

Size and growth rate of Japan's crypto market (opportunity?)

-

Investor demographic profile (not engaging with on-chain?)

-

Government regulation (attitude toward non-compliant offshore exchanges?)

-

Taxation debate (increase or decrease?)

-

How projects operate (legal risks?)

We hope the above content is helpful to you. ❤️

Japan's Web3 Market

Overall, although Japan is a relatively developed Asian country with a population of 124 million, its youth population has been steadily declining. With local equities, real estate, anime culture, and tourism thriving, public attention is highly fragmented, resulting in limited youth interest in cryptocurrency—most participants are middle-aged.

However, due to global promotion and popularity of cryptocurrencies, the number of people in Japan participating in crypto has accelerated, reaching record highs in user scale and trading volume in May 2025.

Characteristics: 12.41 million users, primarily 30–40-year-old middle-class investors focused on financial planning and long-term allocation rather than pure speculation. Most earn under 7 million JPY annually (~320,000 CNY). High capital gains taxes lead most to hold assets without selling, awaiting the expected tax reduction policy in 2026.

Size and Growth Rate of Japan's Crypto Market

In 2022, the total spot trading volume across all licensed exchanges in Japan was only about 1 trillion JPY (~6.8 billion USD). In 2023, it increased slightly to 1.13 trillion JPY (~7.6 billion USD), a year-on-year growth of around 13%.

However, in 2024—after Bitcoin began being widely adopted by Wall Street—the national crypto spot trading volume surged to 2.06 quadrillion JPY (~14 billion USD), representing an 82% year-on-year increase and marking Japan’s emergence as a market of significant scale.

In terms of trading instruments: Bitcoin (BTC) accounts for approximately 70%, while Ethereum (ETH) makes up only about 14%. This has led many compliant Japanese exchanges to focus marketing efforts on BTC purchases—for example, TikTok frequently features exchange ads promoting Bitcoin.

Additionally, starting in 2024, XRP’s popularity slightly surpassed that of ETH.

A 12.41 million-user crypto market

While this figure may seem modest, the growth has only recently accelerated beginning in 2024.

In 2022, Japan had only 5.61 million crypto users; in 2023, this rose to 6.46 million, a mere 15% growth. However, in 2024, the number sharply increased to 9.17 million, a 41% growth rate.

By May 2025, the figure reached 12.419 million. Thus, Japan’s domestic crypto market is experiencing accelerating user growth, with custodied assets exceeding 4.26 quadrillion JPY (~27.5 billion USD).

Investor Demographic Profile

As of May 2025, Japan’s crypto user base has reached 12.41 million, accounting for approximately 15% of the adult population.

The main investor group consists of middle-class individuals aged 30–40, characterized by:

-

Heavy reliance on social media platforms such as YouTube and X

-

Stable income levels

-

Annual income below 7 million JPY

In terms of investment behavior and motivation:

-

Focused on wealth management and long-term allocation, not speculation

-

Most participate with small amounts via exchange apps

-

Low trading frequency, with most placing only a few orders per year

-

Only a tiny fraction actively engage in native on-chain activities

Overall, Japan’s crypto user base is gradually becoming mainstream, with strong preferences for safety and simplicity.

As a result, most Japanese project teams and exchanges have found that advertising through traditional media is less effective than forming long-term partnerships with influencers on YouTube and X. Consequently, Japan’s crypto space has evolved into an influencer-driven ecosystem where everyone aspires to be a content creator, while traditional media faces increasing pressure.

Regulatory Environment

Japan’s crypto regulatory model resembles that of the United States, featuring a three-tiered collaboration between the FSA (Financial Services Agency), JVCEA (industry self-regulatory association), and JCBA (industry group).

Therefore, most crypto companies targeting the Japanese market are members of both JVCEA and JCBA. For example, Binance Japan publicly states on Twitter its membership in JVCEA (Japan Virtual Currency Exchange Association).

Currently, exchanges and custodians must obtain proper licenses and qualifications to operate legally in Japan and join these associations. In recent years, asset managers and exchanges entering Japan have commonly used shell acquisition methods to establish operations.

Attitude toward Non-Compliant Offshore Exchanges

Beyond compliant exchanges, numerous non-compliant platforms previously operated and promoted services in Japan, acquiring large user bases. The primary reasons Japanese users engaged with offshore exchanges include:

-

Tax avoidance

-

Greater variety of cryptocurrencies available

-

Full range of leverage and derivatives products

As of February 2025, these exchanges were jointly targeted by Japan’s Financial Services Agency and government authorities. Related download and access channels have been completely removed from the Japanese versions of Apple Store and Google Play. Some Japanese influencers who promoted these platforms have also received official notices.

However, since Japan does not impose website access restrictions, users can still access these offshore, non-compliant exchanges. A segment of users continues trading on them, though local promotional activities have become more conservative.

Taxation Debate

Earlier surveys by local statistical agencies revealed that tax burden and reporting complexity are major pain points for crypto users—especially since most Japanese retail investors treat crypto as a financial product (holding coins), making comprehensive taxation and accounting procedures a significant barrier.

It is well known that if you purchase 30 million JPY worth of BTC through a domestic compliant exchange and realize profits, you would pay 45% miscellaneous income tax plus 10% residential tax the following year—totaling approximately 55%.

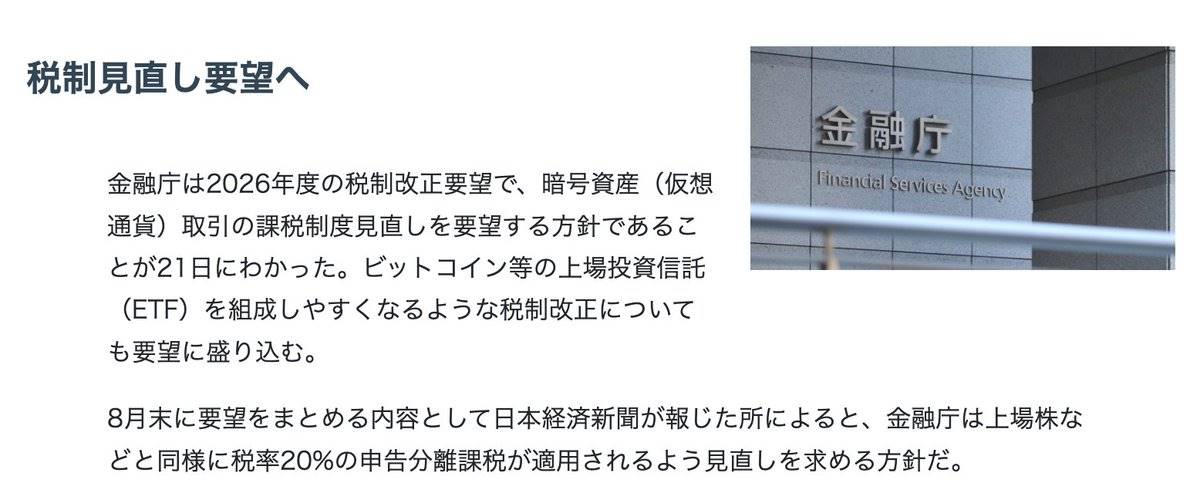

Currently, the Financial Services Agency has confirmed that crypto taxation will be adjusted in 2026, aligning it with stock taxation at a rate of approximately 20%.

This means individual investors will ultimately pay a maximum of 15.315% national tax and 5% local resident tax. Once paid, no further taxes are required. For corporate investors, only the 15.315% national tax applies, excluding local taxes.

This reform is expected to take effect alongside Japan’s BTC and XRP spot ETF launches in 2026.

How Projects Operate

Finally, the most frequently asked question recently: how do projects operate in Japan, and what limitations do they face?

According to previous statistics, at least 20+ projects with some market recognition currently have offices or residents in Japan. However, most operate locally under the name of R&D or operational companies.

The main reason is that if a project intends to conduct large-scale operations in Japan (e.g., issuing tokens to raise funds from Japanese users or listing on compliant Japanese exchanges), it must pass review by JVCEA (Japan Virtual Currency Exchange Association). Compared to regions like Southeast Asia or Dubai, Japan’s compliance threshold is higher and significantly more costly.

Therefore, most projects based in Japan do not target the Japanese market. Token issuance and fundraising activities are conducted through BVI or other offshore entities, while personnel, product development, office operations, and fixed-cost activities are handled via Japanese entities.

This reflects the current reality for both native Japanese projects and foreign teams operating in Japan.

Being in Japan, but not serving the Japanese market.

We hope the above content is helpful to you. ❤️

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News