Metaplanet, Japan's tax-free Bitcoin

TechFlow Selected TechFlow Selected

Metaplanet, Japan's tax-free Bitcoin

Metaplanet's high valuation premium is no accident, but a product of Japan's unique policy environment.

Author: TechFlow

It's commonly said that the alt-season for crypto is playing out in the stock market, with Japan’s Metaplanet and America’s MicroStrategy—both known for their Bitcoin reserve strategies—seeing significant stock price gains.

As of June 25, 2025, Metaplanet’s share price has risen approximately 300% since the beginning of the year, reaching a market cap of around $600 million (854.8 billion yen), while MicroStrategy has seen a more modest 35% increase over the same period, with a market cap of about $10.5 billion.

Metaplanet is often dubbed the "Japanese version of MicroStrategy," yet public data shows it holds only 11,111 BTC, far below MicroStrategy’s 590,000 BTC.

Comparatively, Metaplanet has a smaller market cap and fewer Bitcoin reserves, yet its stock has surged much more.

So, can we draw a simple conclusion—that companies with lower market caps holding Bitcoin will have greater stock appreciation potential?

Yes, but also no.

On paper, this logic seems sound, and it similarly applies when comparing large-cap versus small-cap cryptocurrencies in the crypto space.

However, Metaplanet’s uniqueness lies deeper within its financial data.

Metaplanet: A Higher Valuation Premium

There are many comparative analyses of crypto-reserve companies today, but when aggregating all relevant metrics, one key indicator stands out: valuation premium.

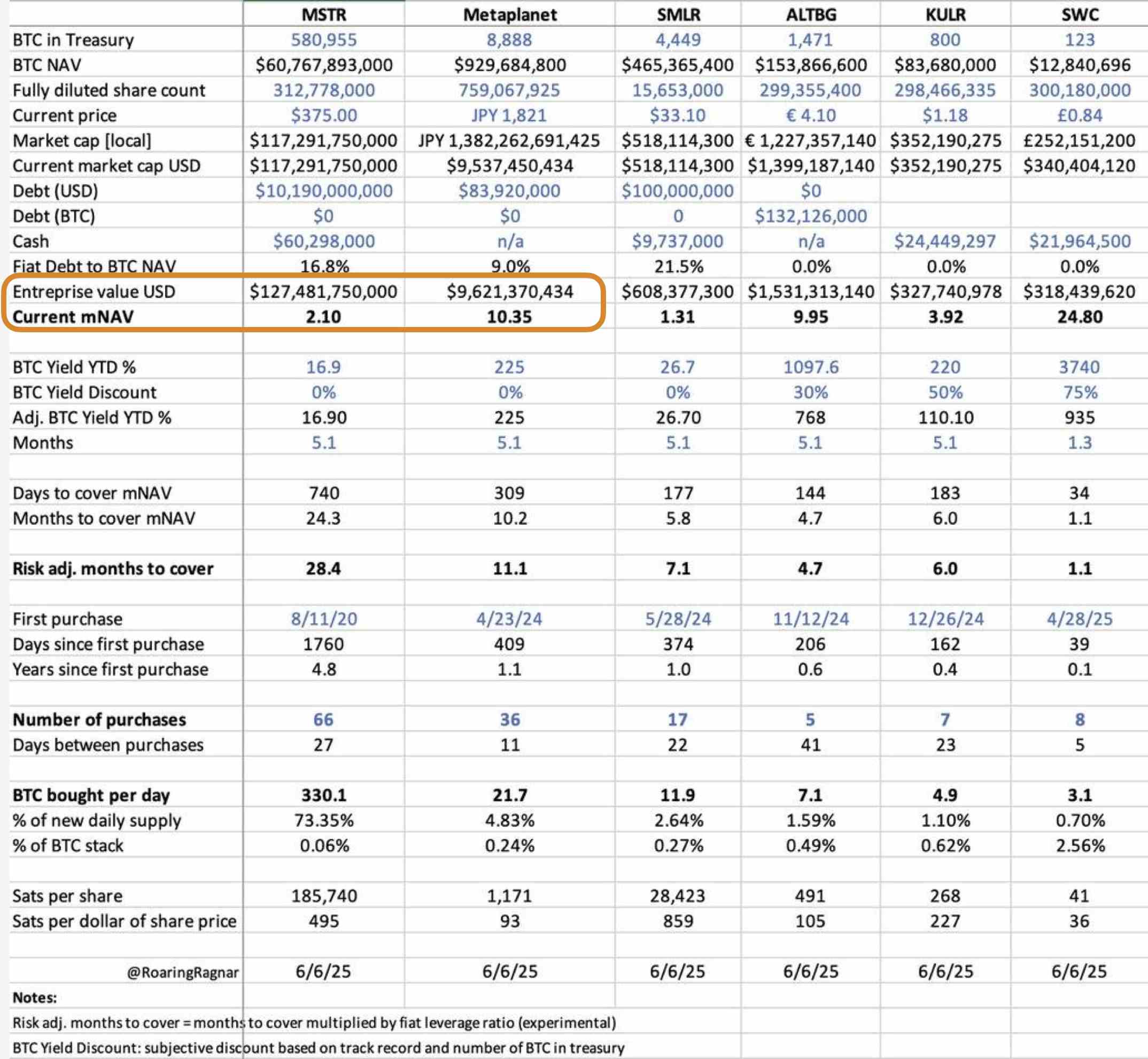

Last week, @YettaSing, investment partner at Primitive Ventures, clearly illustrated the difference in market valuation premiums between the two companies using a table.

Take, for example, the mNAV metric (Multiple of Net Asset Value). Metaplanet’s mNAV stands at 10.35, compared to MicroStrategy’s 2.10—a difference of nearly 5x.

What does this fivefold gap signify?

In simple terms, mNAV measures how much a company’s valuation exceeds the value of its held Bitcoin assets. The higher the number, the more investors are willing to pay in premium simply for the privilege of exposure to Bitcoin through the company.

Quantitatively, this means that for every $1 worth of Bitcoin held, the market pays an additional ~$9.35 in premium for Metaplanet shares, versus just $1.10 for MicroStrategy.

In other words, Japanese market participants show stronger willingness to buy Metaplanet stock than their U.S. counterparts do for MicroStrategy.

We won’t dive into other figures from the table here, but based solely on this metric, it’s clear that Metaplanet thrives on limited Bitcoin holdings coupled with high premium, whereas MicroStrategy relies on massive asset scale for stable valuation.

Still, given the vast difference in Bitcoin reserves—dozens of times larger for MicroStrategy—why does Metaplanet command a higher premium? Is it merely because Metaplanet is a smaller company?

Buying Metaplanet Is Like Buying Tax-Free BTC

Unlike the crypto market, national stock markets are heavily influenced by local economic conditions and policies. And Japan’s unique environment provides fertile ground for Metaplanet’s high premium.

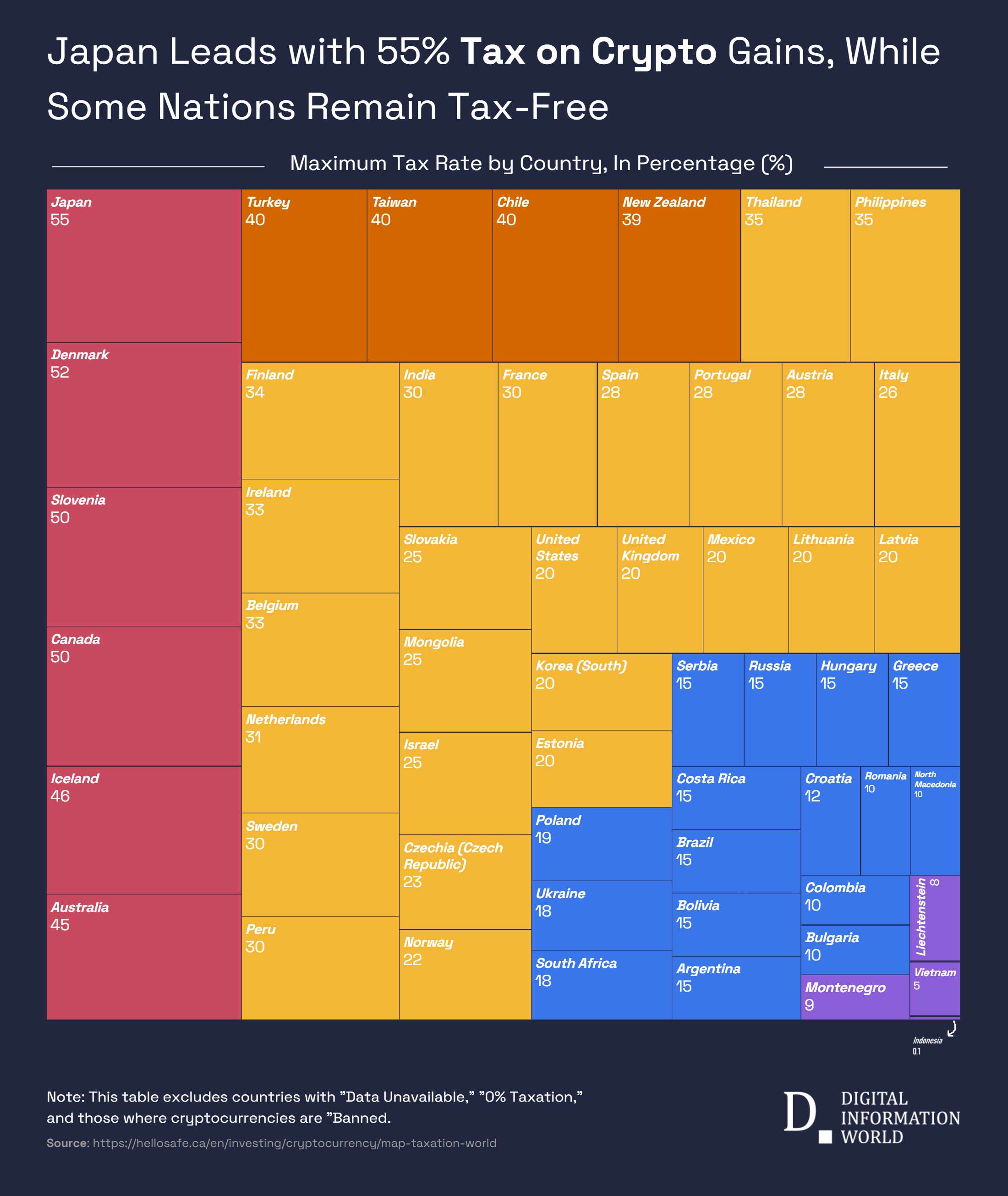

In Japan, cryptocurrency trading profits are classified as miscellaneous income, subject to progressive taxation with rates as high as 55% (including local taxes). This applies to individual investors who directly hold and sell crypto, whether via exchanges or peer-to-peer transactions.

In contrast, capital gains tax on stock investments is capped at just 20% (including local taxes).

Moreover, Japan offers the favorable NISA program (Nippon Individual Savings Account), a tax-free investment account system designed to encourage personal savings and investing.

Under NISA, individuals can invest up to 3.6 million yen annually (approximately $25,000) with full exemption from taxes on capital gains and dividends. Starting in 2024, the annual limit increases to 6 million yen, expanding its reach.

This means investing in Metaplanet shares through a NISA account allows investors to earn completely tax-free returns within the limit. This stark tax disparity makes direct Bitcoin ownership particularly costly in Japan.

Metaplanet’s “Bitcoin reserve” strategy thus offers a tax-optimized alternative. By purchasing Metaplanet stock, investors gain indirect exposure to Bitcoin while significantly reducing their tax burden.

This tax advantage directly fuels demand for Metaplanet shares and is a major contributor to its valuation premium being five times that of MicroStrategy.

Beyond taxation, Japan’s macroeconomic backdrop further supports Metaplanet’s premium valuation.

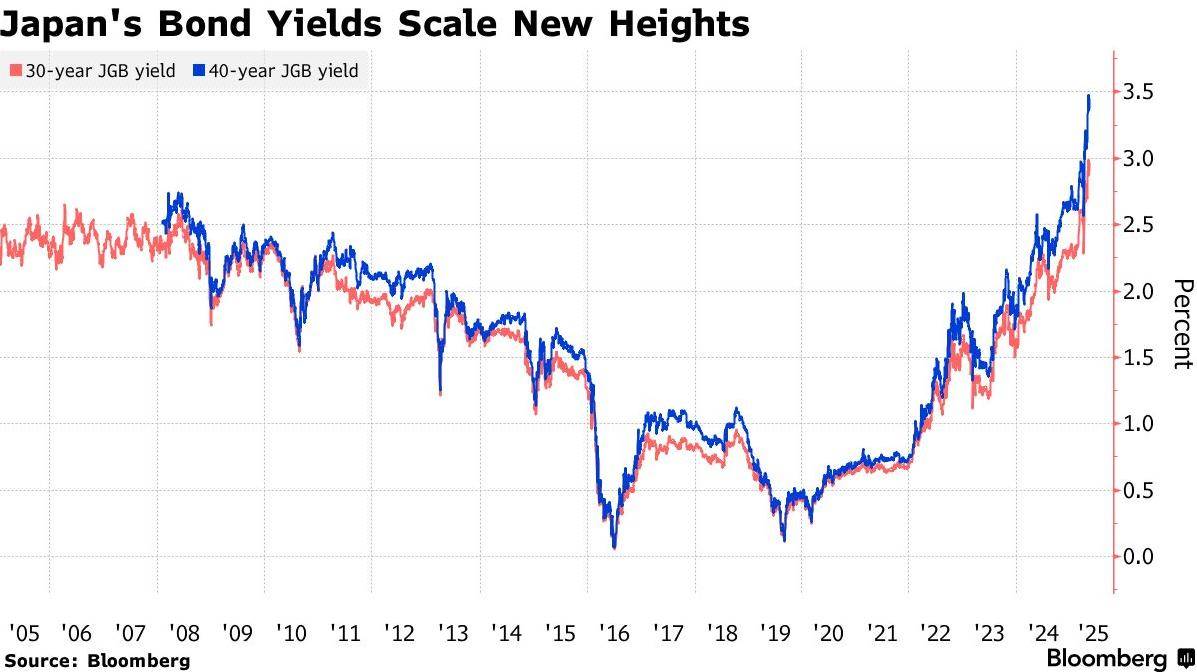

Japan’s debt-to-GDP ratio has soared to 235%, and its 30-year government bond yield has climbed to 3.20%, reflecting structural stress in the bond market. In this environment, investor concerns over yen depreciation and inflation are intensifying.

Metaplanet’s Bitcoin holdings are viewed as a hedge—offering protection against both yen depreciation and domestic inflation. This macro-level hedging demand further inflates its market premium.

Additionally, Japan’s capital markets are dominated by retail investors, whereas U.S. markets are primarily driven by institutional players. Retail investors tend to be more responsive to policy incentives and market sentiment, which may amplify Metaplanet’s premium.

In contrast, U.S. institutional investors prioritize fundamentals and asset scale, explaining why MicroStrategy’s appeal centers on “massive Bitcoin reserves,” while Metaplanet competes on “high premium, small scale.”

When Environment Becomes the Key Variable

Thus, Metaplanet’s high valuation premium is no accident—it’s a product of Japan’s unique policy landscape. From tax regulations and the NISA program to structural features of its capital markets, these factors collectively shape the premium attached to its stock.

Focusing solely on Bitcoin holdings and market cap fails to reveal such insights. Compared to the crypto market, stock markets may place even greater emphasis on local context—environment is everything.

Premiums driven by policy open new opportunities for crypto investing.

Now that it’s widely accepted that the alt-season is unfolding in equities, evaluating “crypto stocks” requires looking beyond mere Bitcoin reserves or market cap. Policy tailwinds, investor composition, and macroeconomic pressures jointly determine valuation levels.

More small- and mid-sized crypto-reserve firms are rapidly emerging, replicating Metaplanet’s high-premium model—though the reasons behind their premiums vary.

In some ways, this presents investors with more complex decision-making than trading altcoins in the crypto market.

The rise of crypto-linked stocks not only expands the geographic reach of Bitcoin and other cryptocurrency investments but could also reshape global capital flows—posing greater demands on crypto investors’ attention and analytical capabilities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News