Web3 professionals' relocation to Japan and local life

TechFlow Selected TechFlow Selected

Web3 professionals' relocation to Japan and local life

In Japan, but not targeting the Japanese market.

Author: AB Kuai.Dong

It's now 2025, and before I knew it, I've gradually grown accustomed to life in Tokyo. If 2023 marked the beginning of a wave of industry professionals moving to Japan, then the first half of 2025 can be described as "clustering."

This article is revised and edited from my original "Digital Nomad Guide to Japan," with contributions from @starzqeth and @rubywxt1, focusing more on underlying reasons and environmental factors.

This migration wave has primarily been influenced by the following:

-

Ongoing tightening of visa renewals and permanent residency (PR) in multiple developed regions

-

Prolonged weakness in the yen exchange rate (1 USD = 146 JPY)

-

Relatively low barriers and shorter timelines for obtaining work visas and transitioning to PR

-

Establishment of financial special zones (with English-language administrative procedures)

➡️ This article covers:

🔹 Local market structure (What opportunities exist?)

🔹 Common visa types held (Can you apply for PR after 12 months?)

🔹 Rapid policy changes (Tax implications?)

🔹 Scale of foreign companies locally (e.g., Binance?)

🔹 Daily life and activity patterns of local peers

Hope this helps. ❤️

🎯 Japan Web3 Market

Overall, despite being one of Asia's more developed countries with a population of 124 million, Japan is seeing a steady decline in its youth population. Amid continuous highs in domestic stock markets, public interest in cryptocurrency has waned compared to previous years.

(The main reason is that demand across other industries is also booming—real estate, retail, tourism, elderly care—which reduces young people’s motivation to engage with Crypto.)

🔹 Characteristics: Middle-aged men favor stock trading; younger generations heavily use social platform X to express opinions; local crypto discussions are interest-driven with strong community cultures.

In terms of timeline, many Chinese industry peers divide the scene into pre-pandemic and post-pandemic eras.

Prior to 2023, the Chinese-speaking crypto community in Japan numbered only around a few hundred individuals, mostly engaged in local compliance operations, full-time trading, or development outsourcing.

After 2023, this group rapidly expanded. A large influx of project teams, trading groups, top-tier exchange employees, and retired industry freelancers began settling in Japan. These newcomers primarily operate remotely from Japan without targeting the Japanese market, instead focusing on Greater China or global operations.

Currently, there are approximately 10–20 active Chinese从业者 and bloggers in Japan. Those who have stayed longer and maintain influence in Chinese-speaking communities include Yishi@ohyishi (Tokyo), Suji@suji_yan (Tokyo), Guo Yu@turingou (Tokyo), Mao Zong@catmangox (Osaka), 𝗧𝗮𝗿𝗲𝘀𝗸𝘆@taresky (Fukuoka). Additionally, Kay Shen@keyahayek recently relocated to Tokyo.

Therefore, most newcomers treat Japan as a place for living, working, raising children, while maintaining communication with Japanese conglomerates and visiting industry peers.

The conclusion: Being in Japan, but not serving the Japanese market.

🪪 What Types of Visas Do People Hold?

Since 2023, the Japanese government has relaxed restrictions under the Highly Skilled Professional (J-Skip) program, aiming to attract high-net-worth individuals and knowledge workers to start businesses, work, or invest in Japan (ultimately for tax revenue), lowering eligibility thresholds.

This means that if employed by a Japanese company or planning to establish a business with substantial capital, those qualifying under the points-based system for the Highly Skilled Visa can apply for permanent residency (PR) as early as the 12th month after their initial arrival.

Based on informal surveys and conversations, most recent Chinese industry professionals in Japan hold the Highly Skilled Visa. They typically earn high scores due to master’s degrees, higher salaries and taxes paid, or extensive work experience.

Many peers who obtained the Highly Skilled Visa back in 2023 have already secured permanent residency (PR) this year (equivalent to a Japanese green card). For details, search: 高度専門職 1 号 or Highly Skilled Professional Visa. (Consult @0xdannytoma).

⁉️ Rapid Policy Changes (Tax Implications?)

The core reason why many crypto companies choosing Japan do so only as an office or R&D base—not targeting the local market—is that cryptocurrencies are still classified as miscellaneous income rather than traditional financial income under current Japanese regulations.

This means that if you purchase 30 million JPY worth of BTC through a compliant local exchange and realize profits,

You will owe 45% national tax on miscellaneous income plus 10% resident tax the following year—totaling approximately 55%.

However, starting in 2025, various policies and trends are shifting this landscape, such as:

-

MicroStrategy model: Companies hold tokens; investors buy shares (already implemented)

-

Spot ETFs: Investors make normal investments (in progress)

-

Tax reduction: Lowering maximum rate from 55% to a flat 20% (in progress)

Under these new models, investors would ultimately pay up to 15.315% national tax and 5% local resident tax after gains. Once paid, this tax settles all obligations permanently, with no further liabilities. For corporate investors: only 15.315% national tax applies, excluding local tax.

As a result, many professionals have moved to Japan but are holding off on entering the local market, instead monitoring policy developments. Some have already tested the MicroStrategy approach in Japanese equities, yielding several successful companies.

Meanwhile, major conglomerate SBI has begun pushing forward spot BTC and XRP ETFs.

The Financial Services Agency (FSA) is also advancing proposals to reduce relevant tax rates. Recently, stocks linked to the MicroStrategy model in Japan have started correcting based on news sentiment.

For further analysis: Link

🔐 Scale of Foreign Companies Locally (e.g., Binance?)

Currently, the number of full-time Chinese-speaking crypto professionals in Japan is estimated at around several hundred. Major employers include Binance, Backpack, OSL, OK Japan, SBI Group and its affiliated market makers or funds, along with secondary trading teams based in Tokyo.

In addition, OneKey, Mask, Alpha (formerly KEKKAI), have successively hired peers interested in relocating to Japan—all headquartered in Tokyo.

As of 2024, only four regions have been designated as financial special zones in Japan, enjoying unique channels and English-language administrative processes: Tokyo Metropolis, Osaka Prefecture, Fukuoka Prefecture, and Hokkaido.

Currently, the head of Binance Japan is Takeshi Chino (Chinoshi Takeshi), formerly the legal representative of Kraken Japan, with prior experience at PwC and the Tokyo Stock Exchange, and an Oxford University alumnus.

However, from operational and compliance perspectives, Binance Japan serves only domestic users. Chinese-language support remains under the global site’s responsibility.

🧋 Daily Life and Activity Scope of Local Peers

Compared to Hong Kong, Singapore, or Shenzhen, where gatherings are frequent, Chinese professionals in Japan generally prefer decentralized lifestyles (living separately, minding their own business—don’t disturb my Japanese life).

Hence, Japan has become a hub for introverts offline and extroverts online.

About 90% of full-time crypto从业者 live in Tokyo and surrounding areas, with roughly 30% having physical offices in Toranomon, Minato Ward. This area is centrally located with numerous WeWork shared offices, where private room rentals start around 10,000 RMB per month.

🔹 Housing

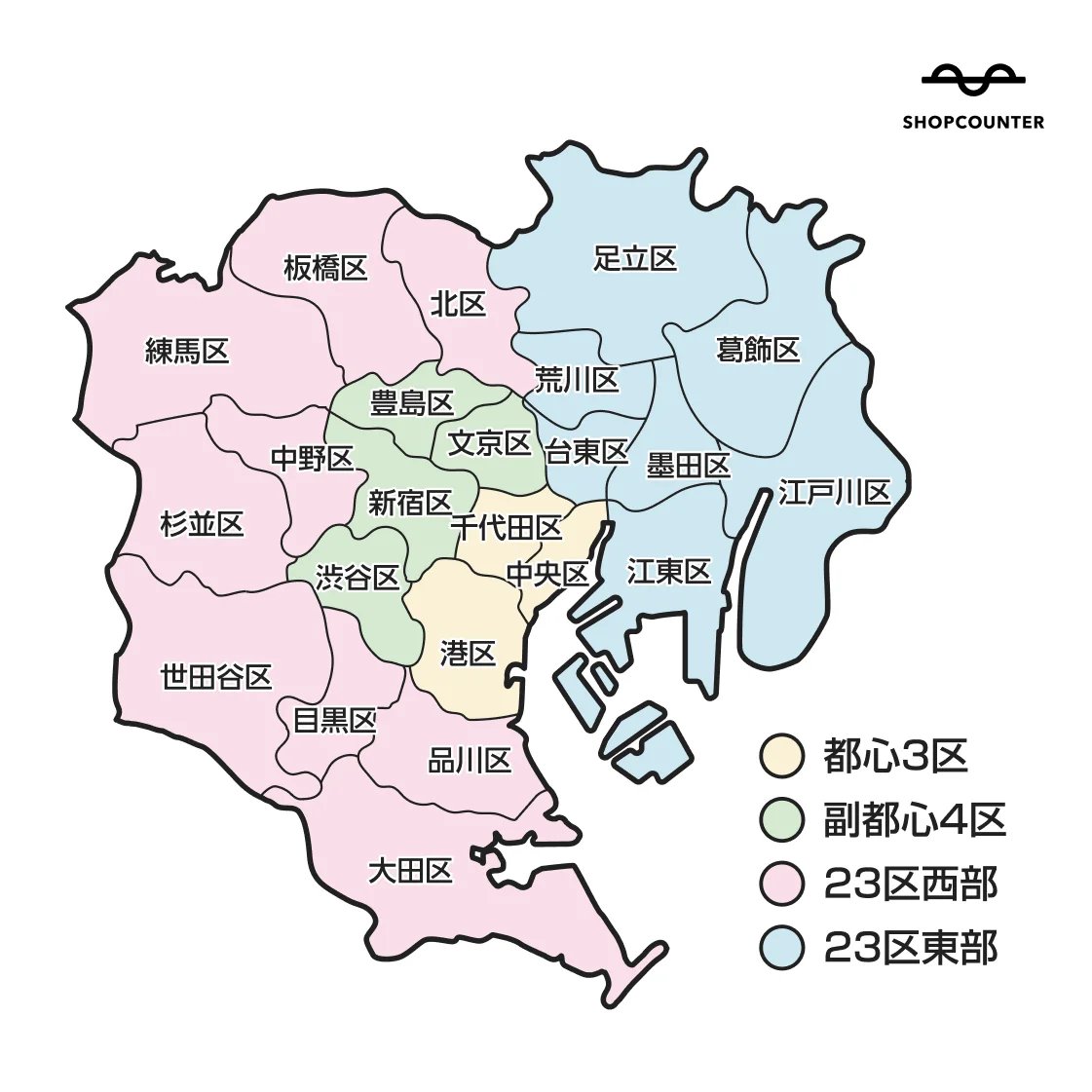

Tokyo's "Big Six" wards represent the country’s most central districts: Chiyoda, Chūō, Minato, Shinjuku, Shibuya, and Bunkyo. For example, Minato Ward is a common office location, while Shibuya hosts most events.

However, most peers don’t actually reside in these areas. Besides small apartment sizes, high prices, and crowded streets, the biggest issue is that living in central wards feels like never having left home—lacking the quiet, anime-like small-town atmosphere. Also, due to population surges, local administrations face heavy pressure, leading to slower document processing.

🔹 Education

Most Tokyo从业者 send their children to international schools. Around 30% attend the British School in Tokyo (BST) in Minato Ward, with annual tuition of 2.73 million JPY—approximately 110,000 RMB after national and local education subsidies.

The school alternates daily between Japanese and English instruction.

🔹 Dining

Uber Eats pricing is similar to core areas of Beijing and Shanghai, but delivery fees start at 1,000 JPY (about 50 RMB). Chain stores are abundant, with McDonald's and Domino's offering dedicated delivery, often arriving within 10 minutes.

For in-person dining, most rely on nearby local restaurants or cooking at home. Items like wagyu beef, cabbage, bean sprouts, and tomatoes are affordable, while certain fruits (e.g., melons, watermelons, peaches) remain expensive.

🔹 Accommodation

In recent years, tourist numbers have surged, but the number of people willing to work in hotels hasn't kept pace, causing hotel prices in Tokyo to double or triple compared to 2023 levels.

This trend also affects Kyoto, Osaka, and other cities. Hotel prices in central Tokyo now exceed those in Singapore, though rental prices haven't seen significant fluctuations.

🔹 Living Arrangements

With a monthly budget of 10,000 RMB, a new apartment in Ueno or Shinagawa offers only about 20 sqm. However, just a few train stops away, one can find units of 50–80 sqm.

Thus, many peers choose to live outside Tokyo’s Big Six wards, opting instead for the pink and blue zones shown below.

❤️ That concludes this overview of Web3 relocation and daily life in Japan. Hope this information helps. Thank you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News