Stablecoins Enter the "Earning Era": A Comprehensive Overview of Yield-Bearing Stablecoins

TechFlow Selected TechFlow Selected

Stablecoins Enter the "Earning Era": A Comprehensive Overview of Yield-Bearing Stablecoins

Beyond the "anchored" attribute, starting from 2025, stablecoins are entering a completely new phase of "earning potential."

By: imToken

Have you recently seen certain platforms offering 12% annualized yield on USDC?

This is not just a marketing gimmick. In the past, stablecoin holders were often interest-free "depositors," while issuers invested the pooled funds into safe assets like U.S. Treasury bonds and bills to earn substantial returns—USDT/Tether and USDC/Circle are prime examples.

Now, the exclusive benefits previously reserved for issuers are being redistributed. Beyond the USDC interest subsidy race, an increasing number of next-generation yield-bearing stablecoin projects are breaking down this "yield barrier," allowing token holders to directly share in the underlying asset yields. This shift not only transforms the value proposition of stablecoins but could also become a brand-new growth engine for the RWA and Web3 sectors.

1. What Are Yield-Bearing Stablecoins?

By definition, a yield-bearing stablecoin is one whose underlying assets generate returns, which are then directly distributed to holders—typically derived from U.S. Treasuries, RWAs, or on-chain yields. This stands in stark contrast to traditional stablecoins (like USDT/USDC), where such earnings go entirely to the issuer, leaving holders with only dollar pegging benefits and no interest income.

Yield-bearing stablecoins turn holding the token itself into a form of passive investment. Essentially, they redistribute the Treasury interest income that Tether/USDT previously kept entirely for itself. A simple example may make this clearer:

When Tether issues USDT, it's effectively equivalent to crypto users exchanging dollars to "buy" USDT. If Tether issues $10 billion worth of USDT, it means crypto users have deposited $10 billion with Tether in exchange for $10 billion in USDT tokens.

Once Tether receives this $10 billion, it does not need to pay interest back to those users. This gives Tether access to real-dollar capital at zero cost. If these funds are used to purchase U.S. Treasuries, Tether earns risk-free interest at essentially no cost.

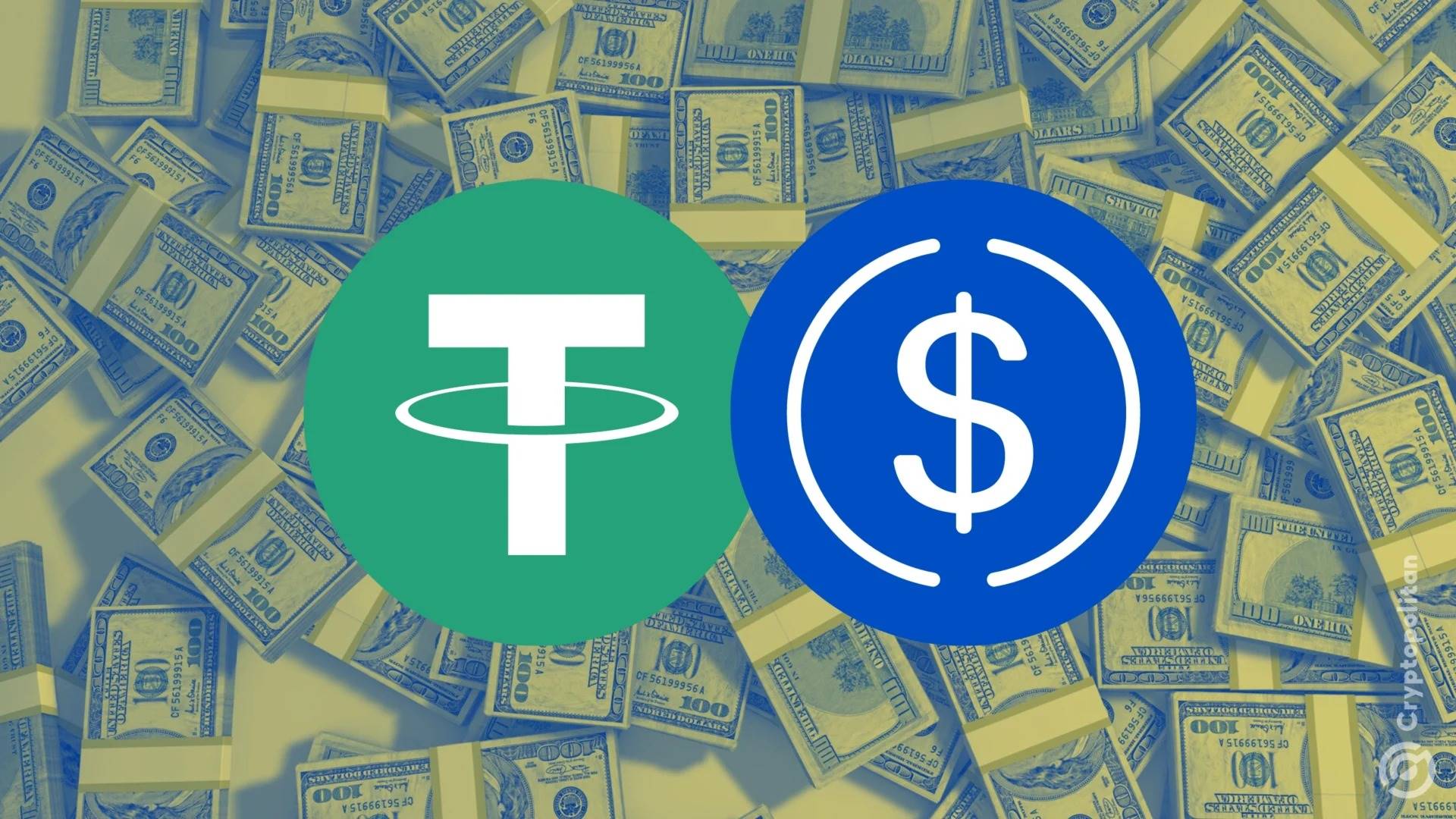

Source: Messari

According to Tether’s Q2 attestation report, it directly holds over $157 billion in U.S. government bonds (including $105.5 billion direct holdings and $21.3 billion indirect holdings), making it one of the largest holders of U.S. Treasuries globally. As per Messari data, as of July 31, 2025, Tether surpassed South Korea to become the 18th-largest holder of U.S. Treasuries.

This implies that even at a ~4% Treasury yield, Tether earns around $6 billion annually (roughly $700 million per quarter). Tether’s reported $4.9 billion operating profit in Q2 confirms the highly lucrative nature of this model.

Based on the market observation that “stablecoins are no longer tools defined by a single narrative—they are used differently depending on individual needs,” imToken has categorized stablecoins into multiple exploratory sub-sets (see further reading: Stablecoin Worldview: How to Build a User-Centric Stablecoin Classification Framework?).

Under imToken’s classification system, yield-bearing stablecoins are classified as a distinct subset that provides ongoing returns to holders, primarily falling into two categories:

-

Native Interest-Bearing Stablecoins: Users automatically earn yield simply by holding these tokens, similar to a bank’s demand deposit. The token itself functions as an interest-generating asset, such as USDe, USDS, etc.

-

Stablecoins with Official Yield Mechanisms: These stablecoins may not accrue interest automatically, but their issuers or governing protocols offer official yield channels. Users must perform specific actions—such as depositing into designated savings protocols (e.g., DAI’s DSR), staking, or converting into special yield certificates—to begin earning interest, as seen with DAI.

If 2020–2024 was the “expansion phase” of stablecoins, then 2025 will be the “dividend phase.” With balance among compliance, yield, and liquidity, yield-bearing stablecoins may emerge as the next trillion-dollar sub-sector within the stablecoin landscape.

Source: imToken Web (web.token.im) - Yield-Bearing Stablecoins

2. Leading Yield-Bearing Stablecoin Projects

In practice, most yield-bearing stablecoins are closely tied to tokenized U.S. Treasuries. The tokens users hold on-chain are effectively backed by U.S. Treasury assets held in custody. This approach preserves the low-risk profile and yield potential of Treasuries while adding the high liquidity of on-chain assets and enabling integration with DeFi components for leverage, lending, and other financial applications.

Currently, beyond established protocols like MakerDAO and Frax Finance doubling down, new entrants such as Ethena (USDe) and Ondo Finance are rapidly gaining momentum, forming a diverse ecosystem ranging from protocol-native to CeDeFi hybrid models.

Ethena’s USDe

As the flagship project driving the current yield-bearing stablecoin trend, Ethena’s USDe has recently surpassed the $1 billion supply mark.

Data from the Ethena Labs website shows that as of writing, USDe offers an annualized yield of 9.31%, having previously sustained rates above 30%. Its high yield comes from two main sources:

-

ETH LSD staking rewards;

-

Income from delta-hedged positions (i.e., funding rates from short perpetual futures positions);

The first source is relatively stable, currently hovering around 4%. The second depends entirely on market sentiment, meaning USDe’s annualized yield is somewhat contingent on overall network funding rates (market mood).

Source: Ethena

Ondo Finance USDY

Ondo Finance, a standout project in the RWA space, has consistently focused on bringing traditional fixed-income products onto the blockchain.

Its USD Yield (USDY) is a tokenized note backed by short-term U.S. Treasuries and bank demand deposits. It functions essentially as a bearer instrument, allowing holders to enjoy yield without undergoing identity verification.

USDY provides on-chain capital with risk exposure close to that of Treasuries, while granting composability with DeFi modules such as lending and staking, enabling amplified returns. This design makes USDY a leading representative of on-chain money market fund equivalents.

PayPal’s PYUSD

Launched in 2023, PayPal’s PYUSD was initially positioned as a compliant payment-focused stablecoin, custodied by Paxos and fully backed by dollar deposits and short-term Treasuries.

In 2025, PayPal began experimenting with yield distribution mechanisms on PYUSD, particularly through partnerships with custodian banks and Treasury investment accounts, returning a portion of underlying interest (from Treasuries and cash equivalents) to token holders—aiming to combine both payment functionality and yield generation.

MakerDAO’s EDSR/USDS

MakerDAO’s dominance in the decentralized stablecoin space needs no introduction. Its USDS (an upgraded version of the original DAI Savings Rate mechanism) allows users to deposit tokens directly into the protocol and automatically earn interest linked to Treasury yields, without incurring additional operational costs.

The current Savings Rate (SSR) stands at 4.75%, with nearly 2 billion tokens deposited. Objectively, the rebranding reflects MakerDAO’s strategic evolution—from a native DeFi stablecoin issuer toward a platform for RWA yield distribution.

Source: makerburn

Frax Finance’s sFRAX

Frax Finance has long been one of the most proactive DeFi projects seeking alignment with the Federal Reserve—including applying for a Fed master account (allowing it to hold dollars and transact directly with the Fed). Its sFRAX vault leverages U.S. Treasury yields by partnering with Lead Bank in Kansas City to open a brokerage account purchasing U.S. Treasuries, thereby tracking the Fed rate.

As of writing, sFRAX has accumulated over 60 million tokens in stake, with an annualized interest rate of approximately 4.8%.

Source: Frax Finance

It should be noted, however, that not all yield-bearing stablecoins operate sustainably. For instance, the USDM project has announced its liquidation, with minting permanently disabled and only limited primary market redemptions available for a short period.

Overall, most current yield-bearing stablecoins allocate their underlying assets primarily to short-term Treasuries and Treasury repo agreements, offering interest rates mostly between 4%–5%, consistent with prevailing U.S. Treasury yields. As more CeFi institutions, compliant custodians, and DeFi protocols enter this space, such assets are poised to capture an increasingly significant share of the stablecoin market.

3. How Should We View Stablecoin Yield Enhancement?

As discussed above, the core reason yield-bearing stablecoins can offer sustainable returns lies in the稳健 configuration of their underlying assets. Most derive their yields from ultra-low-risk, stable-return RWA assets such as U.S. Treasuries.

In terms of risk structure, holding Treasuries carries nearly identical risk to holding dollars—but with the added benefit of generating ~4% or higher annual interest. Therefore, during periods of high Treasury yields, these protocols invest in such assets, earn returns, deduct operating costs, and distribute part of the interest to holders—forming a perfect “Treasury interest → stablecoin adoption” loop:

Holders simply need to possess the stablecoin as a claim to receive the “interest income” generated by the underlying financial asset—the U.S. Treasury. Given that current U.S. short- to medium-term Treasury yields are near or above 4%, most fixed-income projects backed by Treasuries offer interest rates in the 4%–5% range.

Objectively speaking, the “hold-and-earn” model is inherently attractive. Ordinary users can let idle funds generate passive income; DeFi protocols can use them as high-quality collateral to create loans, leverage, and perpetuals; institutional capital can enter the on-chain space under compliant and transparent frameworks, reducing operational and regulatory costs.

Thus, yield-bearing stablecoins may become one of the most intuitive and practical applications in the RWA sector. Consequently, we are seeing a surge of Treasury-backed RWA fixed-income products and stablecoins—from native on-chain protocols and payment giants to Wall Street-affiliated newcomers—shaping an emerging competitive landscape.

Regardless of how U.S. Treasury rates evolve in the future, this wave of yield-bearing stablecoins driven by the high-interest cycle has already shifted the value logic of stablecoins from mere “pegging” to active “dividend distribution.”

In the future, when we look back at this moment, we may recognize it not only as a turning point in the stablecoin narrative but also as another historic milestone in the convergence of crypto and traditional finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News