2024 Crypto Industry Salary Report

TechFlow Selected TechFlow Selected

2024 Crypto Industry Salary Report

Check if your salary meets the standard?

Author: Nick Zurick, Pantera

Translation: AididiaoJP, Foresight News

Key Findings

-

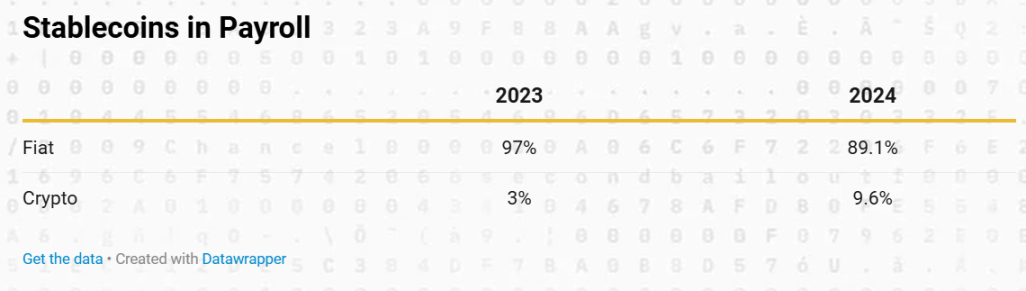

Last year, 3% of people received salaries in cryptocurrency; this year that figure has tripled to 9.6%. Stablecoins USDC and USDT dominate, with most crypto-salaried individuals choosing USDC.

-

Will the crypto industry return to in-office work? Probably not, but off-site office work has increased fourfold (reaching 6%).

-

In terms of median salary, holding an MBA does not mean higher pay in Web3. In fact, compensation slightly decreased.

-

Median salaries show women earn more than men in marketing, operations, and business development, while men outearn in engineering and executive roles.

-

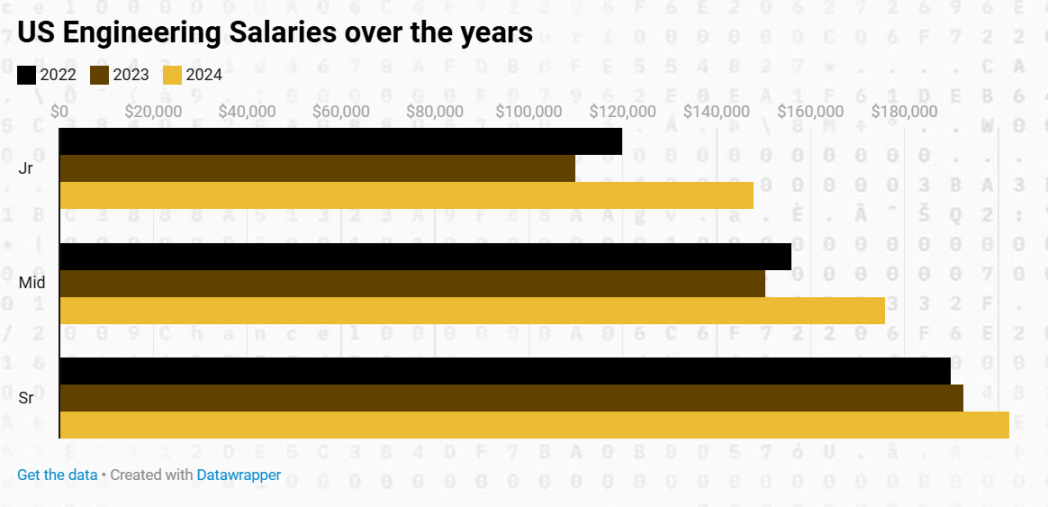

Engineering salaries rose across all levels, especially for junior and mid-level positions: junior engineers up 25.6%, mid-level up 14.49%, and senior engineers up 4.9%.

Methodology Overview

Our survey data comes from dozens of startups across various regions and hundreds of participants within the crypto community, covering a wide range of job types. These data reflect companies at different stages—from seed to late-stage—and span multiple sectors including DeFi, CeFi, and gaming.

In this report, "executive" refers to leaders and founders, "engineering" includes all technical roles, and "operations" broadly covers customer service, marketing, strategy, and similar functions.

The Pantera team has made every effort to anonymize the dataset. In certain cases, we excluded significant outliers, submissions with formatting errors, and specific details that could expose individual projects. We standardized the data based on experience level, geography, company domain, and job function.

In the following report, we combine this survey's data with our previous December 2023 findings where appropriate to provide a more comprehensive analysis. Unless otherwise noted, all salary figures are presented as median USD amounts.

Respondent Profile

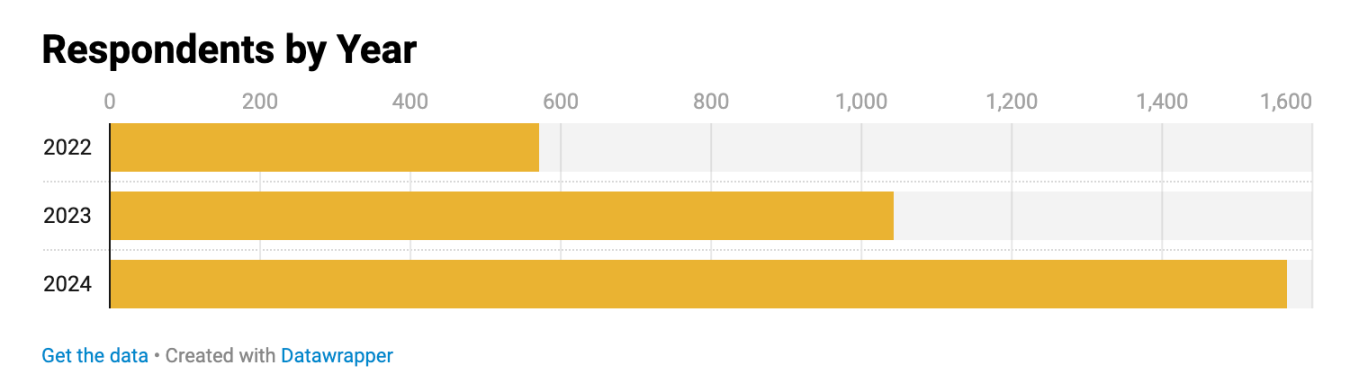

Our dataset includes over 1,600 responses, with 99% of respondents being professionals from the crypto industry.

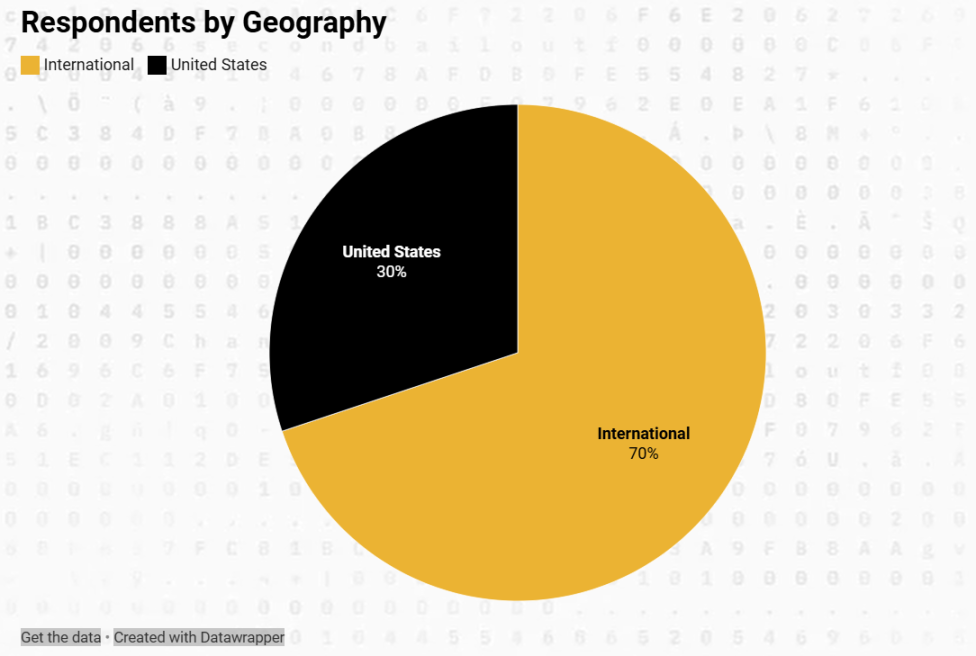

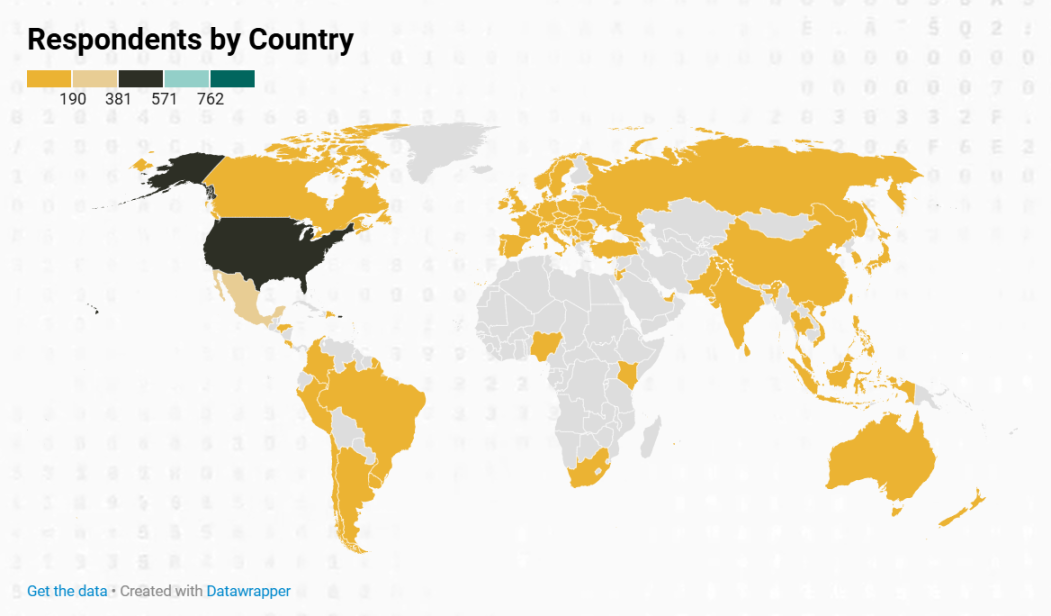

Data covers 77 different countries, with 72% from outside the United States and 28% from the U.S.

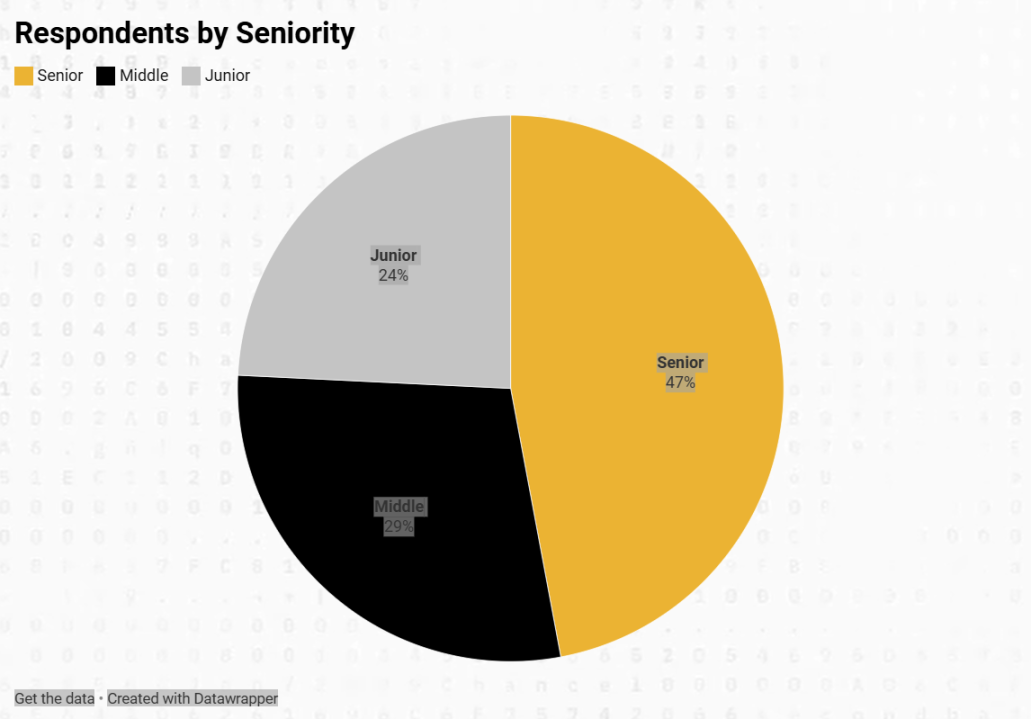

The results skew toward more experienced professionals, with most respondents classified as "senior" (over six years of experience). Career levels are defined as follows: junior (1–3 years), mid-level (3–6 years), and senior (6+ years).

By Function

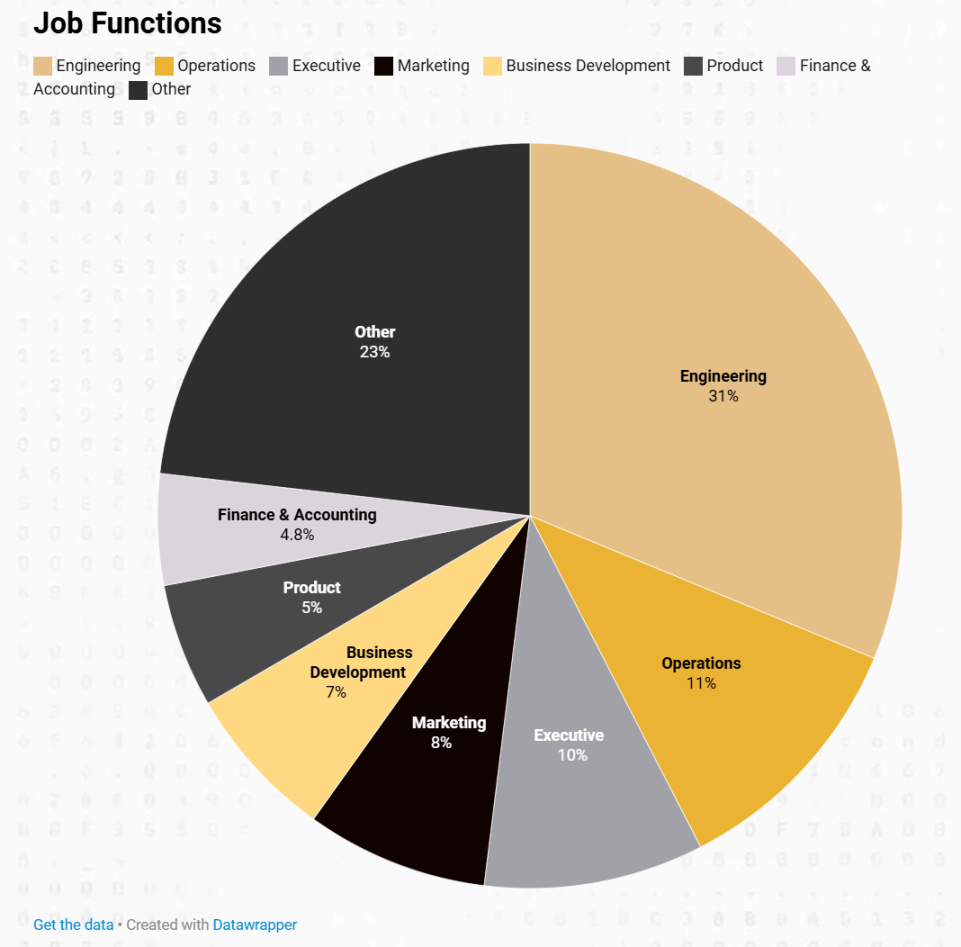

Job functions include engineering, operations, marketing, design, business development, product management, executive leadership, finance and accounting, legal, and others.

By Domain

These professionals operate across multiple domains, including DeFi, CeFi, infrastructure, consumer applications, NFTs, and gaming.

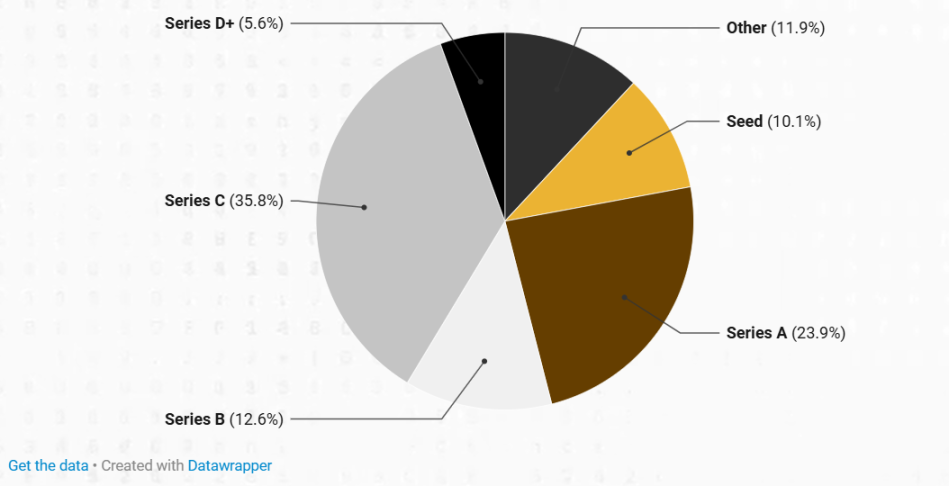

By Stage

The surveyed companies vary in size, from teams with fewer than five employees to those with over a hundred, spanning seed to growth stages. Below is the distribution of respondents by company stage.

Global Distribution

Remote Work Trends

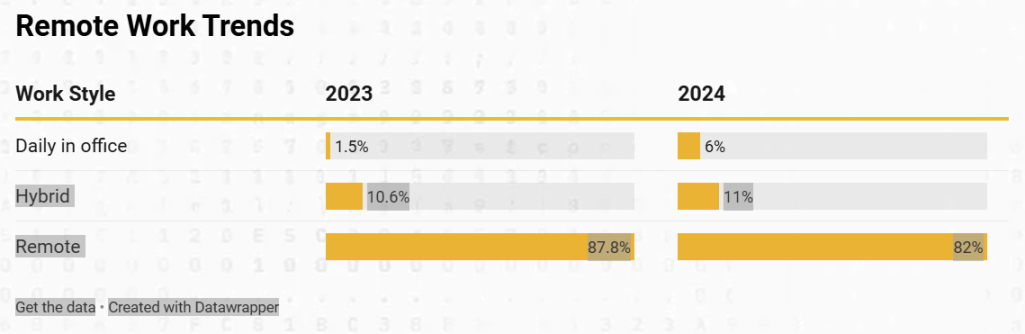

As part of our annual blockchain compensation survey, we collected data on workplace arrangements within the industry. Below are the work preferences and trends in 2024 compared to 2023.

● Is the crypto industry returning to in-office work? While the ecosystem remains predominantly remote, in-office work has significantly increased—from 1.5% in 2023 to 6% in 2024—indicating organizations are gradually calling employees back.

● Hybrid work remains stable: The proportion of hybrid work models stayed nearly unchanged, slightly adjusting from 10.6% in 2023 to 11% in 2024. This stability suggests hybrid work is becoming standard in the industry.

● Remote work still dominates: Despite the rise in in-office roles, blockchain remains largely remote, with 82% of respondents fully working remotely in 2024. Although this is down 5.8 percentage points from 2023, remote work remains central to the culture and operations of the sector.

The slight increase in office-based and hybrid models indicates that the "return-to-office" (RTO) trend is influencing the blockchain ecosystem. However, the decentralized ethos of blockchain continues to shape its work culture, with remote work remaining the preferred model for most organizations.

In Web2 or "traditional tech," recent surveys show about 70–80% of tech workers still prefer remote or hybrid arrangements. Companies like Meta, Google, and Amazon have begun enforcing stricter office policies, but employee resistance has slowed implementation.

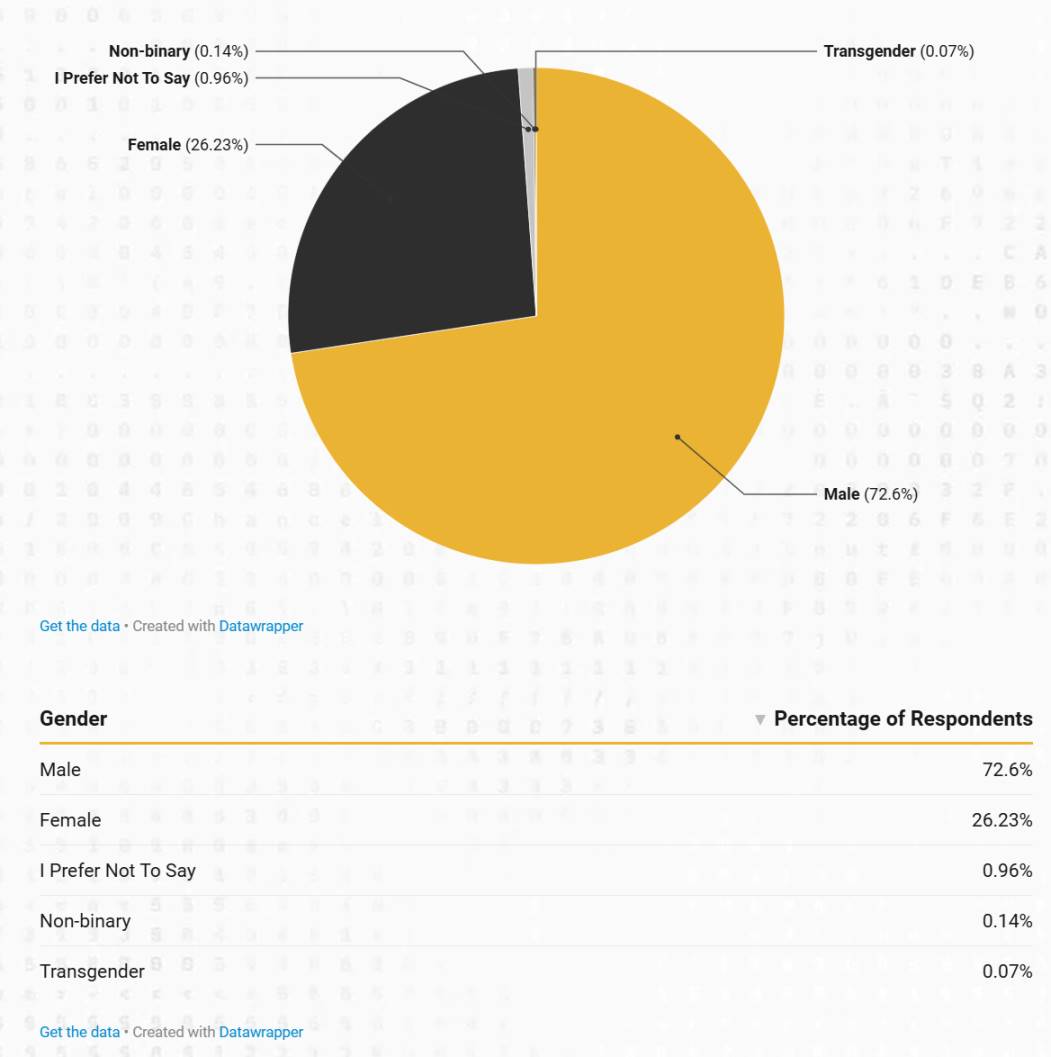

Gender Distribution of Respondents

According to 2024 data, men make up 72.6% of the workforce, while women account for 25.9%. This highlights the persistent gender gap in the industry.

Increase in Stablecoin Salaries

Key finding: Last year, 3% of people received salaries in cryptocurrency; this year, that proportion has tripled to 9.6%.

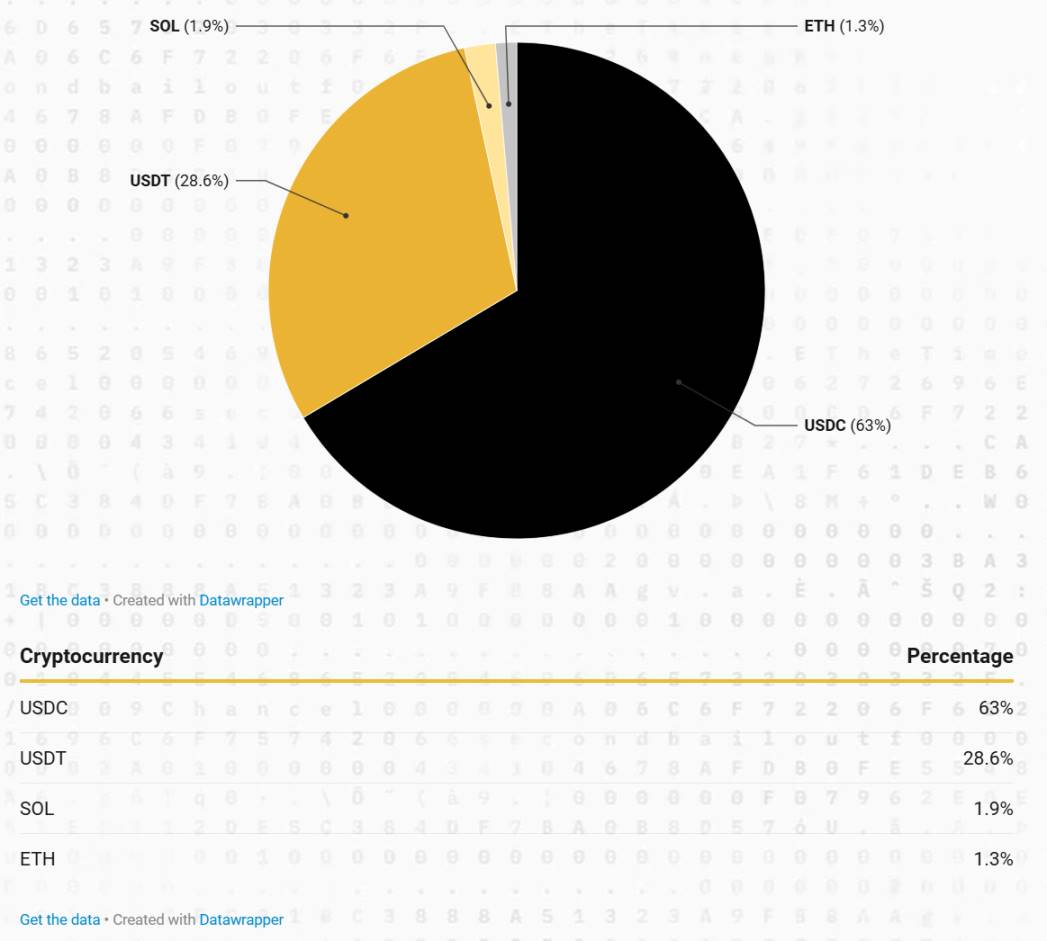

In 2024, the share of people paid in cryptocurrency rose from 3% in 2023 to 9.6%, doubling the previous rate. This growth underscores a shift toward digital asset compensation and the rising adoption of stablecoin payment channels. Within crypto salaries, stablecoins are the preferred method. USDC and USDT dominate, with most crypto-paid employees opting for USDC.

Stablecoins dominate:

● USDC (63%) and USDT (28.6%) together account for over 90% of crypto salaries, reinforcing their status as stable and liquid compensation options.

● Non-stablecoin options (such as SOL and ETH) attract only a small minority.

● Although USDT is the most traded stablecoin, USDC is more popular among employees. We initially thought this was due to the survey’s Western bias. Further research revealed that major payroll providers (like Deel, Remote, Rippling) currently do not support USDT payouts.

The dominance of stablecoins in crypto compensation aligns with broader industry trends. This data further supports Mason Nystrom and Ryan Barney’s view that stablecoins represent the next trillion-dollar opportunity. Their ability to bridge traditional finance and blockchain ecosystems makes them an increasingly vital component of the crypto economy—not just for institutions but also for individuals. As innovation and regulatory clarity progress in the stablecoin space, more companies may adopt stablecoin-based payroll systems.

Ongoing Education in Blockchain

Education Background and Salaries in the Blockchain Industry

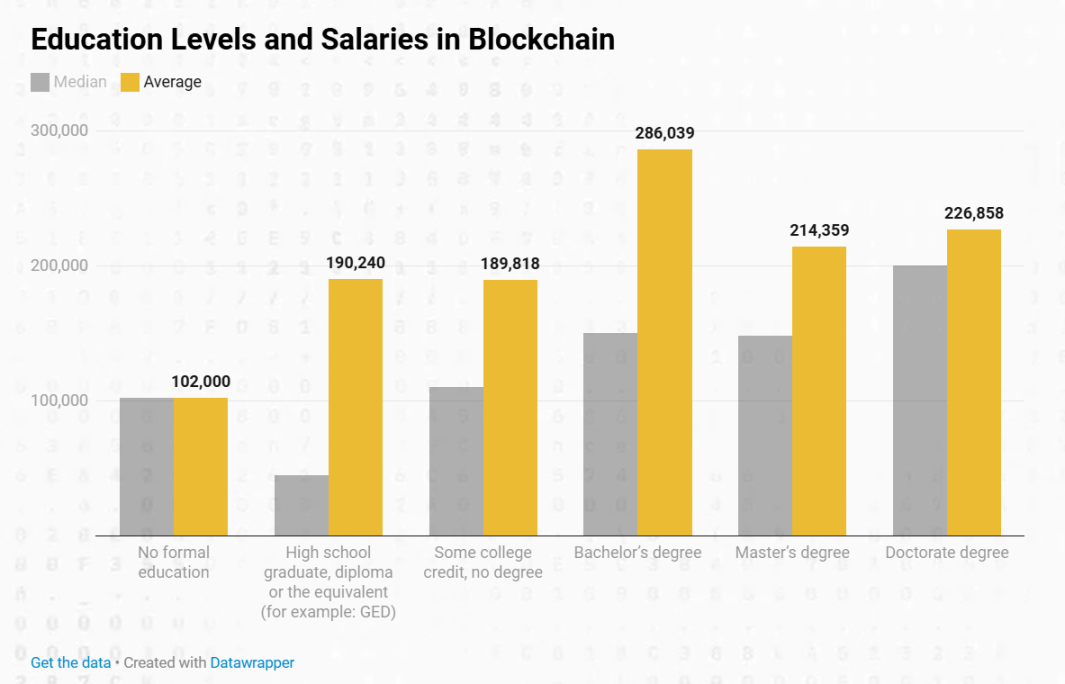

This year, we examined educational backgrounds within the industry and found some interesting results. Analysis of blockchain professionals' education levels reveals trends regarding the economic returns of continued education:

● Higher-than-bachelor’s education may not yield returns:

○ On average, professionals with master’s or doctoral degrees earn less than those with only bachelor’s degrees.

○ Average salaries drop from $286,039 (bachelor’s) to $214,359 (master’s) and $226,858 (doctorate).

● Median salaries reflect a similar trend:

○ The median salary for bachelor’s holders is $150,000, compared to $148,500 for master’s holders, suggesting that advanced education may not lead to significant salary gains in the blockchain industry.

● Advanced degrees do not guarantee higher pay:

○ Although PhD holders have the highest median salary ($200,000), the sample size is small. For many roles, industry experience and technical skills may matter more than formal credentials.

For professionals entering the blockchain industry, a bachelor’s degree delivers the most significant economic return. Continued education (such as an MBA or advanced degrees) appears not to boost average salaries, highlighting the industry’s emphasis on skills, experience, and practical abilities over academic background. That said, we note that advanced education still holds advantages in certain areas such as research and cryptography.

In most traditional industries, higher education typically leads to clear salary increases. For example, moving from a bachelor’s to a master’s degree usually increases earnings by about 20%, and a doctorate adds another 15%.

The blockchain field favors practical skills and real-world experience over formal education. Self-taught developers and individuals from non-traditional backgrounds can still command competitive salaries if they possess the necessary expertise. This skill-first approach contrasts sharply with other industries: in 2022, individuals with a master’s or higher degree earned 20% more in median income than those with only a bachelor’s degree.

Compensation

Executive and Founder Compensation

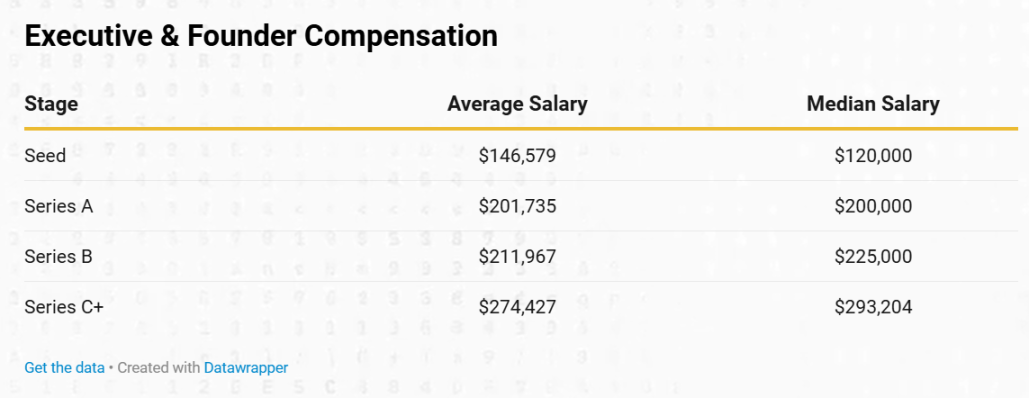

For executive roles, salaries increase as companies mature. At the seed stage, the average base salary is $146,579, with a median of $120,000. After Series A, it rises to an average of $201,735 and a median of $200,000. At Series B, average pay increases to $211,967, with a median of $225,000. By Series C and beyond, executive compensation grows substantially—to an average of $274,427 and a median of $293,204—reflecting greater financial stability and growth potential in later-stage companies.

Engineering

Engineering salaries rose significantly, especially for junior and mid-level roles

Engineering salaries increased across all levels, with the largest gains for junior and mid-level positions. The median salary for junior engineers rose from $110,000 in 2023 to $148,021 in 2024—a 25.6% increase—reflecting high demand for entry-level talent. Mid-level engineers saw a substantial 14.5% rise, reaching $176,000, while senior engineers grew more modestly by 4.9% to $202,500, indicating that salary growth stabilizes at higher levels.

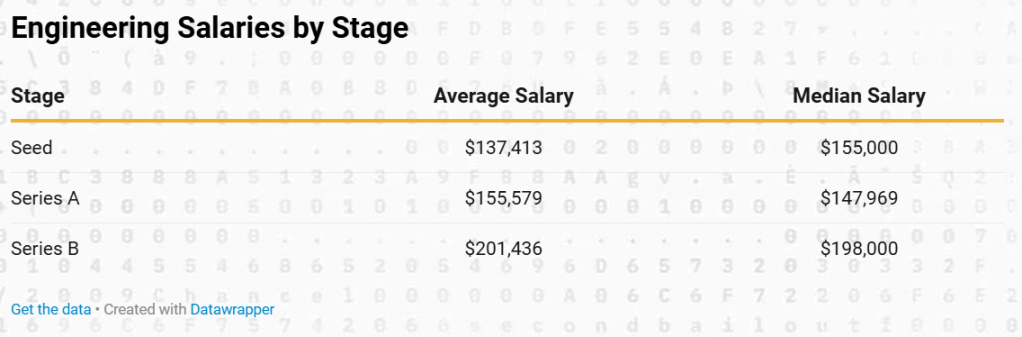

Salaries also vary by company stage, with later-stage startups generally offering higher pay. Seed-stage companies have a median salary of $155,000, while Series A companies are slightly lower at $147,969, though with a higher average ($152,579), suggesting a wider salary range. Series B companies lead in compensation, with a median of $198,000 and an average of $201,436, reflecting stronger financial capacity.

Overall, junior engineers saw the fastest growth, mid-level roles remain a key investment area, and senior engineers earn more but grow slower. Later-stage startups typically offer more competitive salaries, while early-stage companies compensate with more generous equity and token grants.

Product

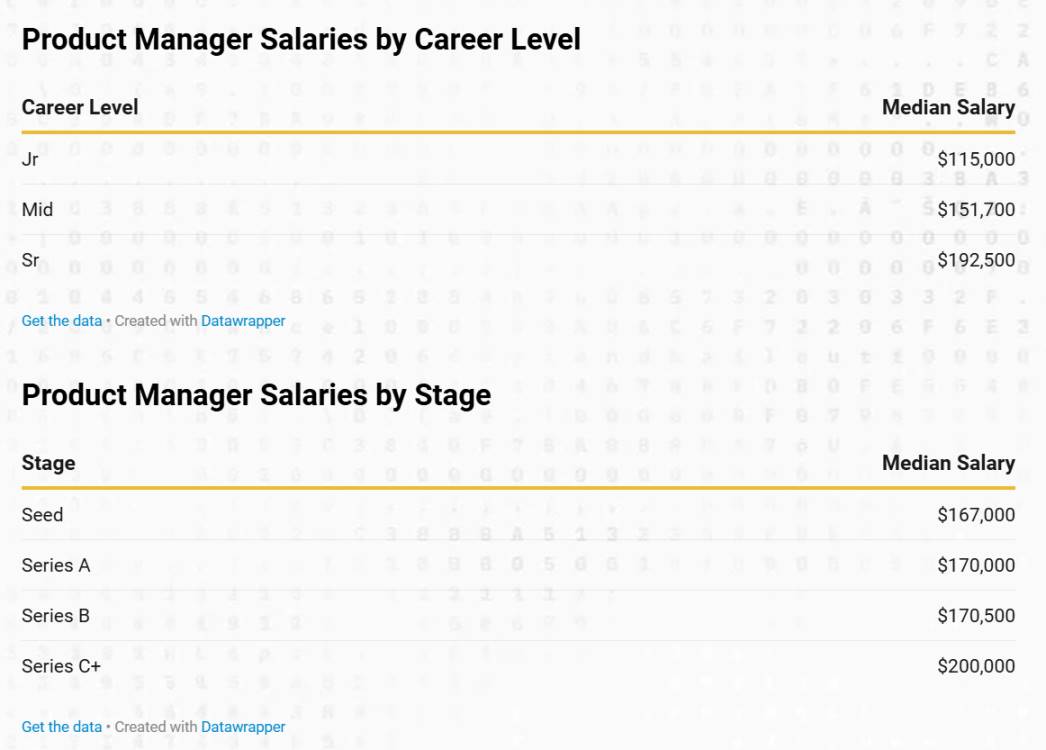

The median base salary for junior product managers is $115,000, $151,700 for mid-level, and $192,500 for senior roles.

From a company stage perspective, salaries grow with maturity. Seed-stage companies have a median of $167,000, Series A and B slightly higher at $170,000 and $170,500 respectively. By Series C and beyond, salaries reach $200,000, reflecting stability and growth in mature companies.

Go-to-Market (GTM)

Marketing, Sales, Business Development

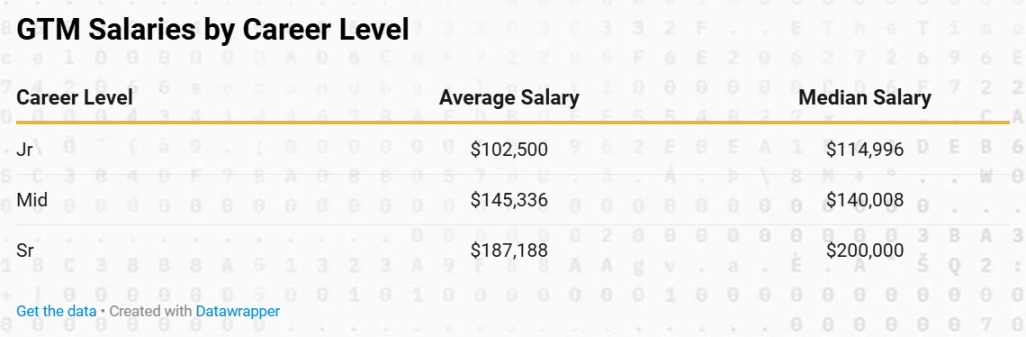

The average base salary for junior GTM roles is $102,500, with a median of $114,996. Mid-level roles average $145,336, with a median of $140,008. Senior roles average $187,188, with the median climbing to $200,000. This tiered progression reflects increasing compensation with experience and responsibility.

Marketing

By career level, the median base salary for junior marketers is $70,000, averaging $78,133. Mid-level professionals have a median of $123,500 and average of $127,167, while senior marketing roles have a median of $191,000 and average of $185,147.

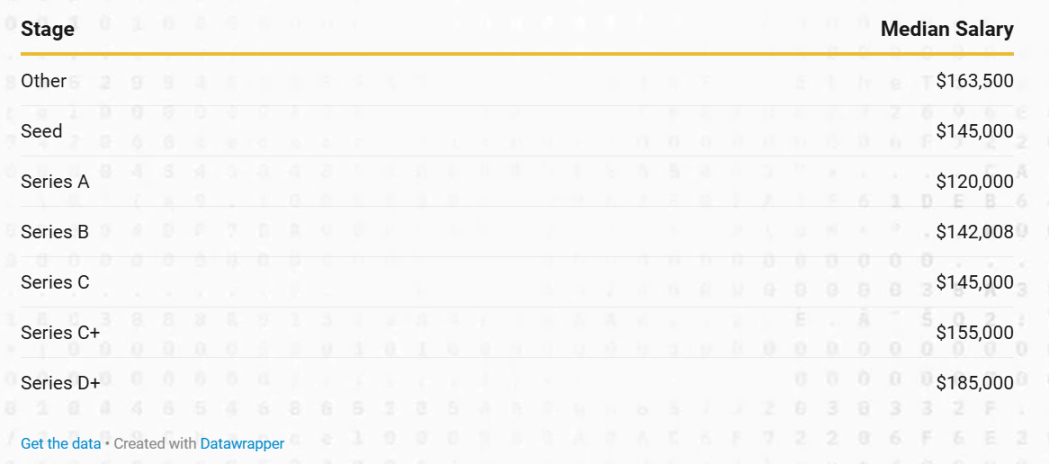

By company stage, seed organizations have a median salary of $145,000, which dips slightly to $120,000 at Series A. Series B median is $142,008, rebounding to $145,000 at Series C. Salaries continue rising post-Series C: $155,000 at Series C+, $185,000 at Series D+. The overall median across all stages is $140,000, with a total average of $145,725.

Business Development

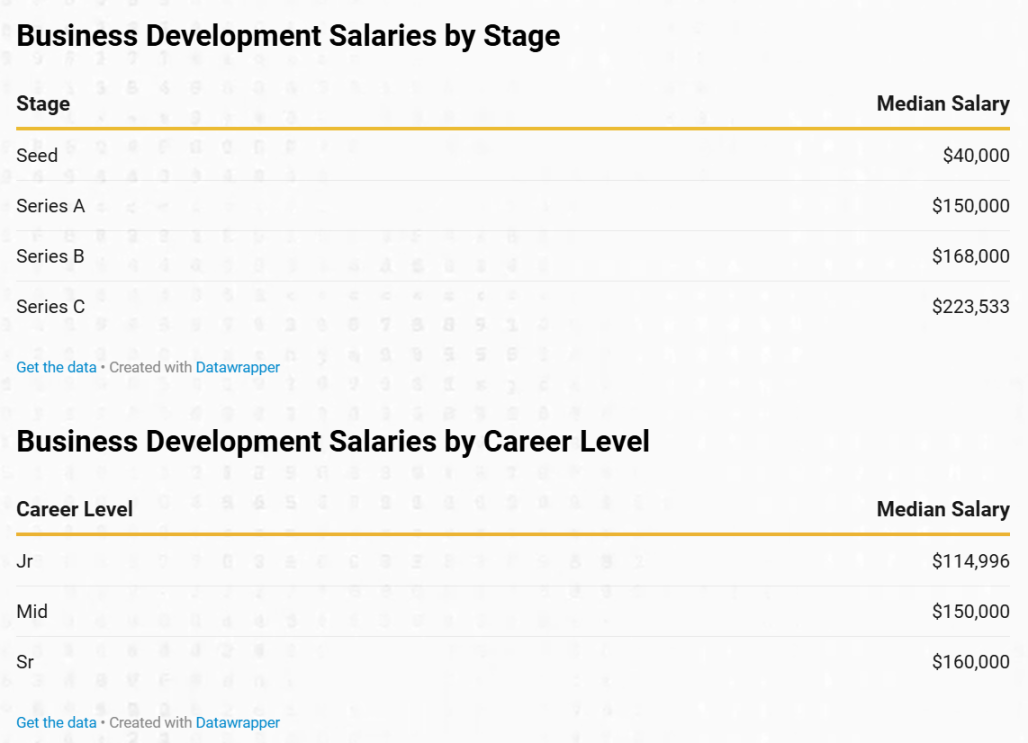

Base salaries for business development roles grow significantly across both company stage and career level. Seed-stage median base salary is $40,000, rising to $150,000 at Series A, $168,000 at Series B, and $223,533 at Series C. From a career progression standpoint, junior roles have a median of $114,996, mid-level $150,000, and senior $160,000.

Finance & Accounting

In 2024, the average salary for junior finance and accounting roles was $106,500, with a median of $97,500. Mid-level roles averaged $137,500 (median $135,000), and senior roles averaged $256,020 (median $250,000). These figures clearly demonstrate progressive compensation growth with experience and promotion.

Operations

The median base salary for junior operations staff is $92,500, $121,000 for mid-level, and $195,000 for senior roles—consistent with growing experience and responsibility.

By company stage, base salaries rise with maturity. Seed-stage companies offer $146,000, Series A $165,000, Series B $157,500. By Series C, salaries jump to $245,000.

Legal

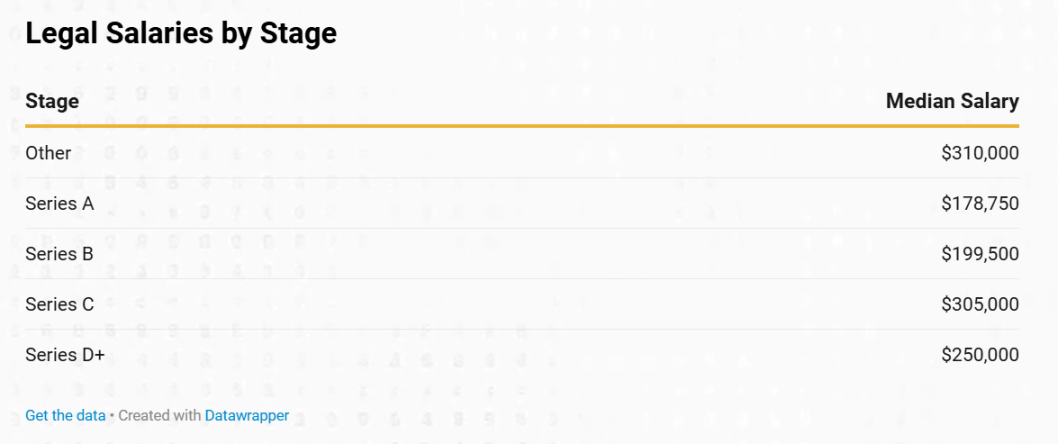

Legal compensation typically increases as companies advance through funding rounds. At Series A, the median base salary is $178,750, rising to $199,500 at Series B. By Series C, legal professionals see a significant jump to $305,000. These figures illustrate how legal compensation scales with company growth and maturity.

Token Incentives

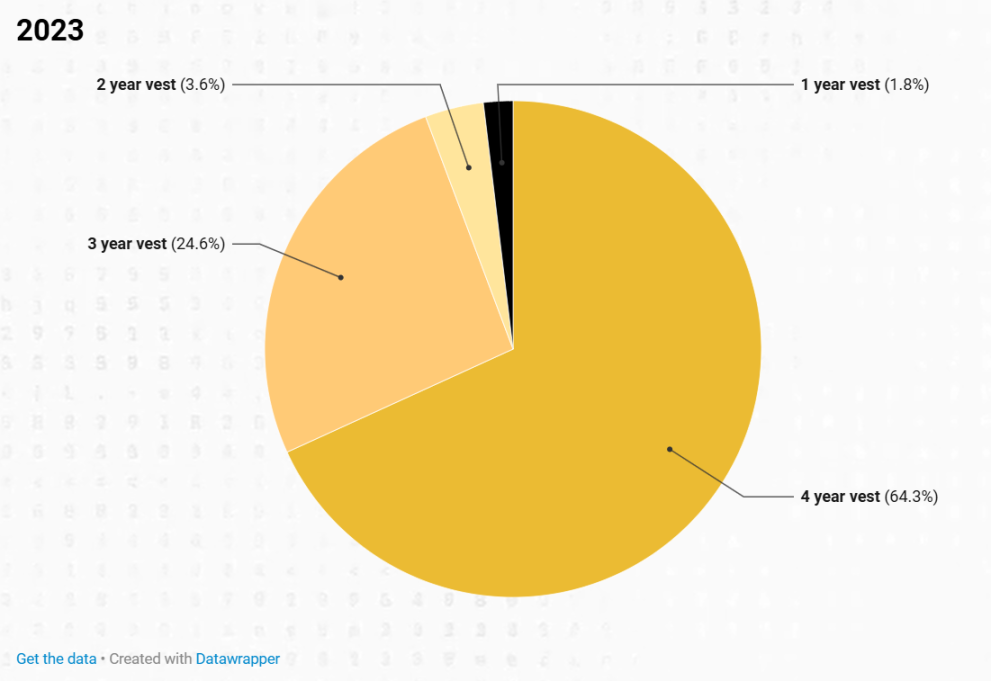

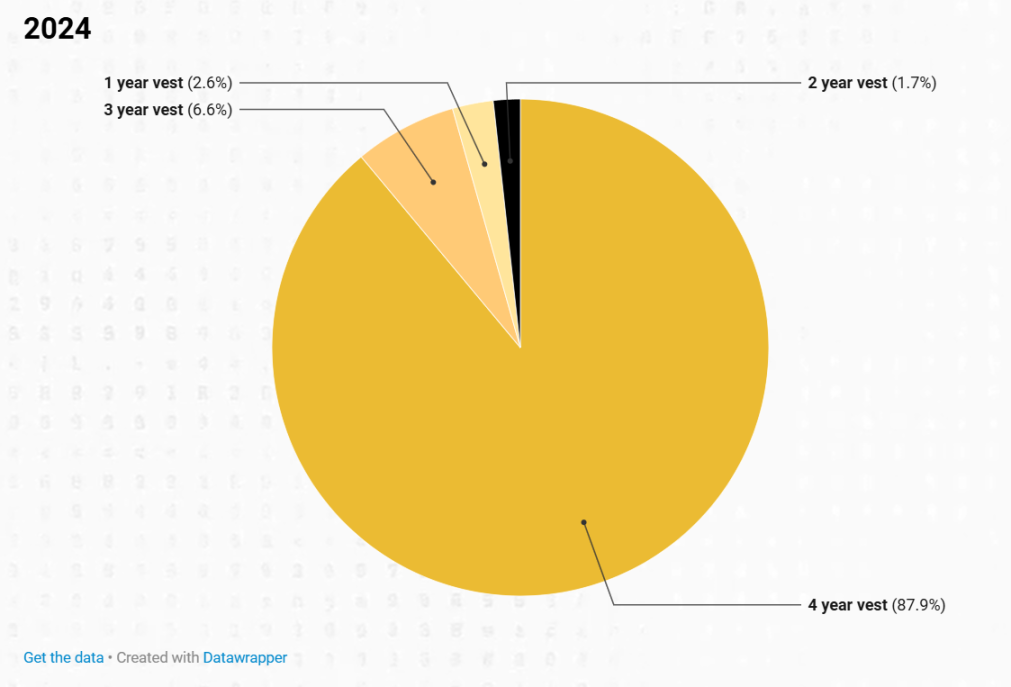

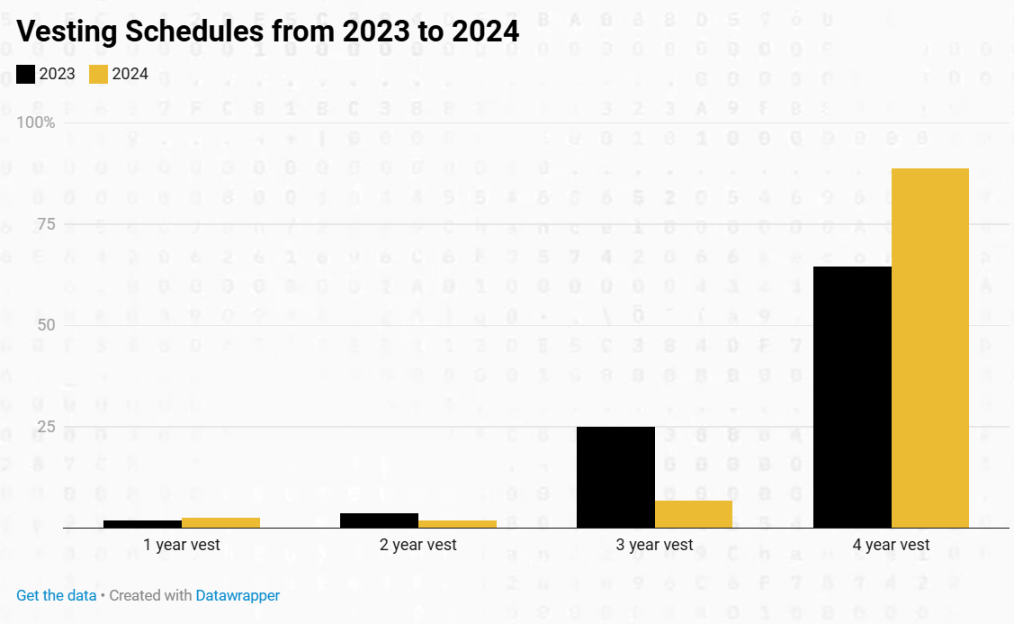

The vast majority of token vesting periods last four years—64.3% in 2023 and rising to 87.85% in 2024. In contrast, shorter lock-up periods (one, two, or three years) are less common. In 2023, they ranged between 1.80% and 24.60%; in 2024, between 1.72% and 6.58%. This shows a clear market preference for longer vesting periods, particularly in 2024.

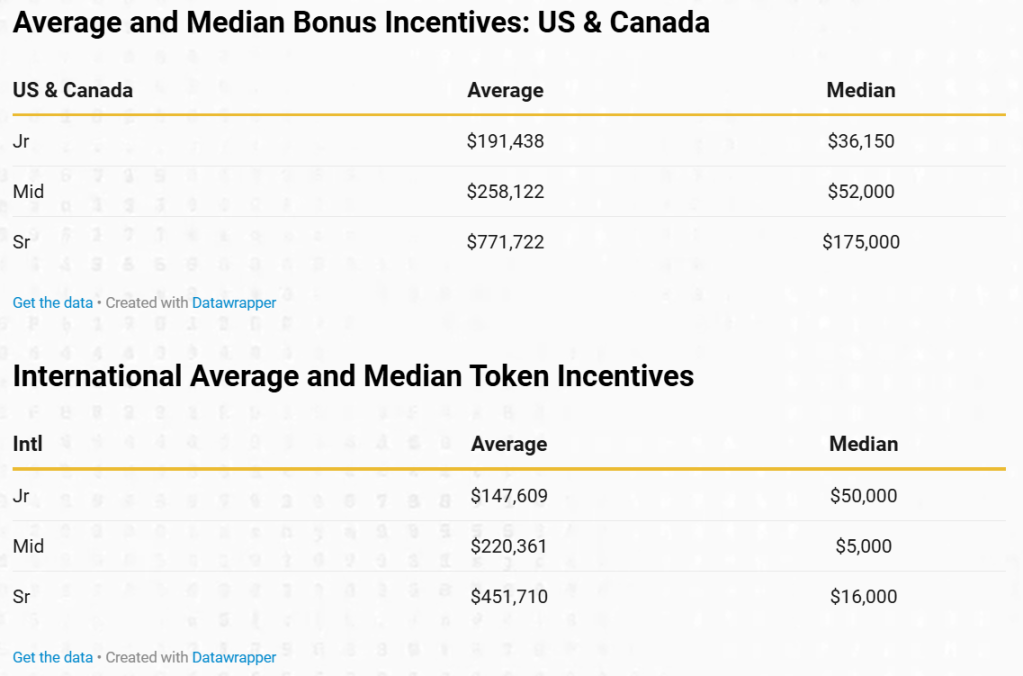

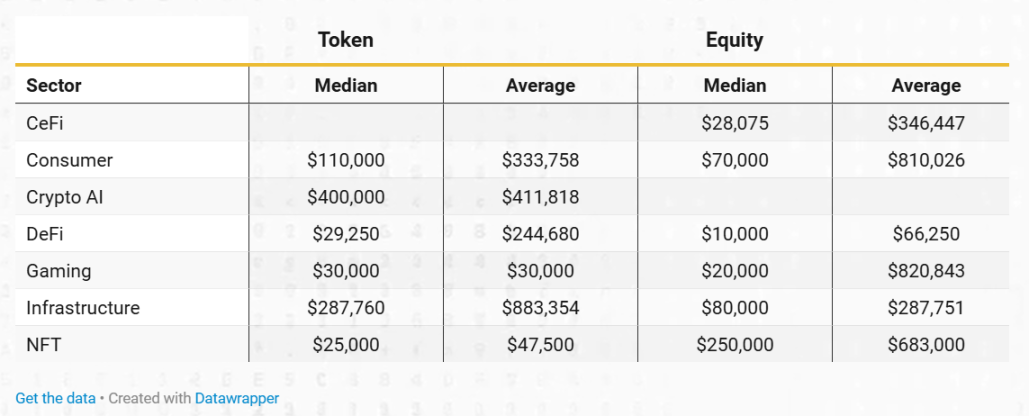

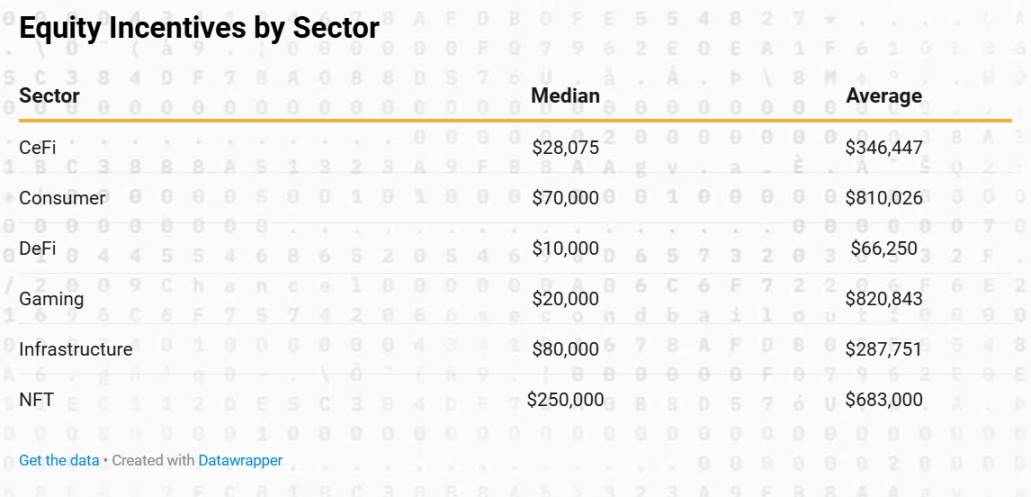

Median equity incentives vary by domain. DeFi projects are lowest at $10,000, CeFi at $28,075, gaming at $20,000. Consumer-focused areas stand at $70,000, infrastructure at $80,000. NFTs have the highest median equity incentive at $250,000.

Gender Pay in Crypto

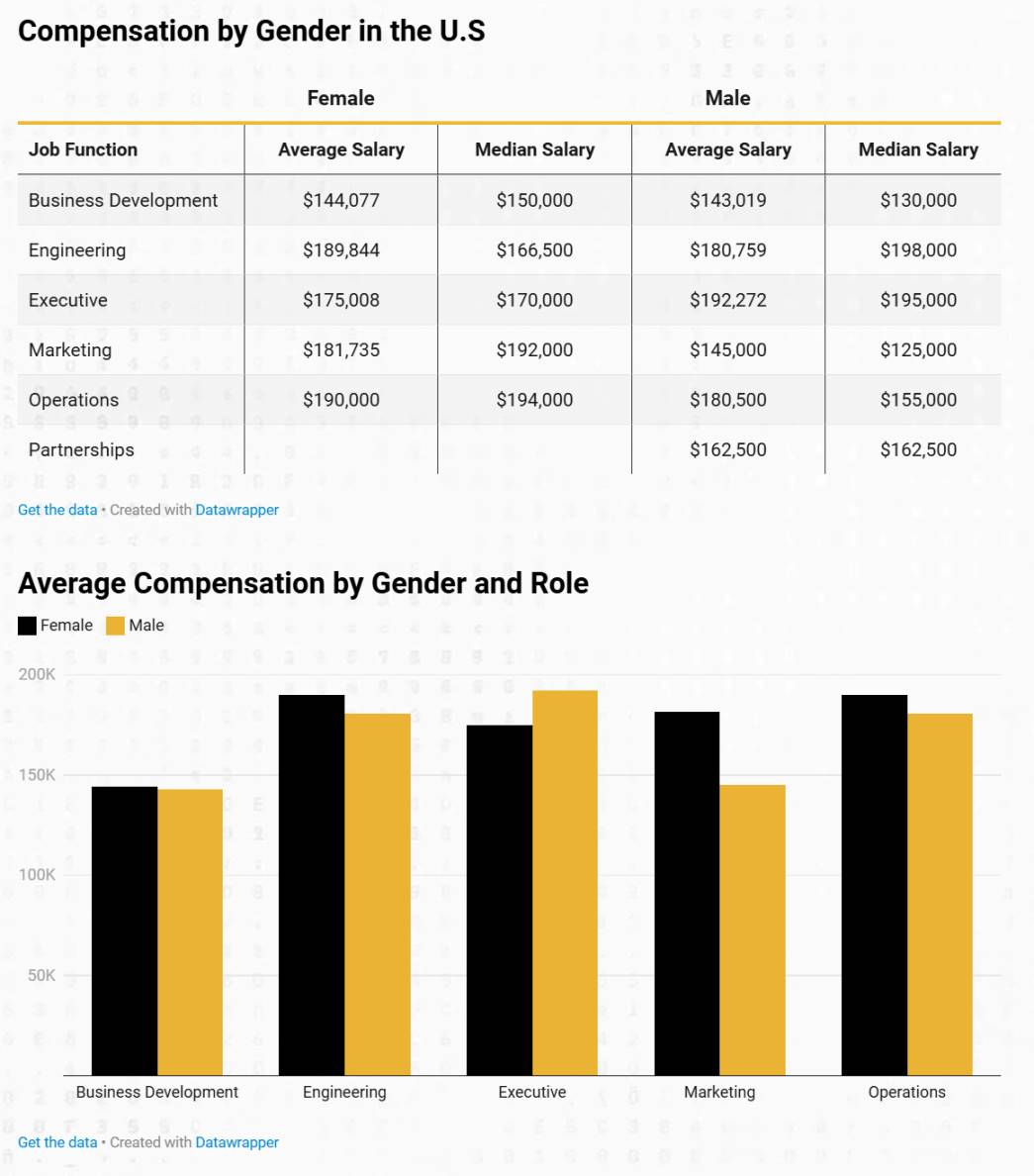

On average, women earn slightly more than men, except in executive roles. In terms of median pay, women outearn men in marketing, operations, and business development, but not in engineering or executive positions.

Our research engineer Ally Zach analyzed this:

"Full-time female crypto employees in the U.S. have a median salary approximately 14% higher than males, but this difference may stem from multiple factors. Women in the industry tend to have more work experience, which may explain part of the pay gap. Additionally, although not statistically significant, women are more often in administrative and operational roles, which typically have lower base salaries than technical or non-executive roles. However, women may also be overrepresented in high-paying managerial roles, leading to higher initial base salaries. Long-term, however, men may earn more due to greater access to equity or token compensation. Men in crypto tend to negotiate more aggressively for equity or tokens, often accepting lower base salaries but with higher long-term earning potential. Still, due to variability in additional compensation data, it's difficult to draw definitive conclusions about total income differences between genders."

Conclusion

Our goal is to support portfolio companies and the success of the entire crypto ecosystem. In this process, we've observed a lack of sufficient salary databases in the industry, and we hope this survey marks a first step toward greater compensation transparency in crypto.

We believe in the "power of cause and effect" embodied by the blockchain industry. In that spirit, we will share the anonymized dataset with all participants. We believe that by providing such data, the industry can make better hiring and compensation decisions, ultimately driving greater success for everyone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News