Crypto exchanges hunting on Xiaohongshu

TechFlow Selected TechFlow Selected

Crypto exchanges hunting on Xiaohongshu

Folks, check out this exchange.

Author: Ada, TechFlow

"I heard you need 10,000 followers on Xiaohongshu to apply for Binance's campus recruitment?"

A screenshot from Xiaohongshu sparked heated discussion in crypto job-seeking groups.

"Harder than graduating from a 985 university," someone joked in the comments.

In reality, Binance’s official job description doesn’t include a "strict follower requirement," but it clearly states: "Candidates with experience in successfully operating social media accounts will be prioritized, especially those focused on video, Xiaohongshu, and AI-related content."

This is no joke. Crypto KOL "AB Kuai.Dong" stated bluntly on X (Twitter):

"For major exchanges, the question about Xiaohongshu has shifted from 'whether to do it' to 'how big can it grow,' and now they're even specifically hiring fresh graduates with Xiaohongshu account growth experience."

From Weibo and Twitter to Douyin, and now Xiaohongshu—the marketing battleground for exchanges is quietly shifting.

This shift isn’t impulsive.

Between 2023 and 2024, Xiaohongshu underwent a key demographic transformation: content around investment, overseas lifestyles, and remote work grew exponentially; users aged 25–35, living in first- and second-tier cities, with bachelor’s degrees or higher now make up over 60% of the platform.

These users are precisely the core audience that crypto exchanges most want to attract.

On this platform originally known for beauty and fashion, exchanges are cautiously testing boundaries, wrapping their ambitions in street interviews, workplace stories, and wealth journals.

Is Xiaohongshu truly a new growth paradise for the crypto industry?

The Migration of Crypto Traffic

To understand why exchanges are betting on Xiaohongshu, one must first grasp the “history of crypto traffic migration.”

In the memories of many veteran crypto enthusiasts, Weibo long served as the central hub of Chinese-speaking crypto discourse.

From 2017 to 2022, exchange executives battled publicly on Weibo—clashing personas, making bold claims—effectively turning it into an open arena for the industry. Countless newcomers made their first trades after reading educational posts or signals from crypto influencers on Weibo.

Whenever Bitcoin surged, an exchange would often buy a Weibo trending topic, pushing terms like “Bitcoin soars” to the top, drawing hordes of retail investors.

But everything came to a sudden halt when regulations arrived. As policies tightened, accounts of industry OGs like Justin Sun and He Yi were shut down, and numerous KOLs were purged. The entire community was forced to migrate, eventually converging on X (Twitter), forming today’s Chinese crypto social circle.

X (Twitter) is undoubtedly crypto’s largest “public square”—Vitalik posts Ethereum upgrade updates here, CZ responds to controversies, and KOLs debate fiercely. But therein lies the problem: it’s too “insider.”

After years of traffic battles, potential new crypto users have already been claimed by KOLs with referral links. Today’s market resembles a tug-of-war among existing users.

For Chinese-speaking audiences, Twitter remains behind a glass wall—unable to reach lower-tier markets or broader demographics.

Douyin was once seen as a potential “gold mine” for crypto traffic. It boasts unparalleled content virality, but the issue is: such virality rarely leads to lasting impact.

Frenetic, fast-food-style content consumption makes it difficult to build the trust required for financial products.

"Douyin content has an extremely short lifespan," says media analyst You Muzhi. "Its design aims for exposure and traffic, not trust. Outside Douyin, its influence quickly fades and struggles to embed itself into users’ daily lives."

Bilibili once hosted exchange educational content—from coin introductions to strategy tutorials—acting as a gateway for new user acquisition.

Like Weibo, however, tightening regulations led to systemic throttling of keywords like “Bitcoin” and “exchange.” Creators became exhausted managing restrictions, and exchange ad spending gradually lost stability.

Unlike these older platforms, Xiaohongshu has undergone a quiet yet profound evolution over the past two years.

It’s no longer just a community for beauty and fashion. Content on investing, tech exploration, and overseas life has grown exponentially, with users aged 25–35, holding bachelor’s degrees or higher, and residing in first- and second-tier cities now exceeding 60%.

This group is exactly the ideal customer base that crypto exchanges dream of.

More importantly, Xiaohongshu’s traffic distribution model differs fundamentally from Douyin’s.

It doesn’t rely on monopolization by top-tier influencers. Instead, even KOCs (Key Opinion Consumers) with just 1,000 followers can gain significant visibility. For example, a simple post by an ordinary user saying “Bybit still allows card registration—act fast” can receive thousands of likes and interactions.

Xiaohongshu’s other secret weapon is its natural “trust chain.”

Unlike public traffic platforms, Xiaohongshu centers around human connection. Users interact with creators in comments, send private messages, and even join chat groups—making the process feel like word-of-mouth recommendations among friends, not cold advertising.

For high-barrier, high-learning-curve products like crypto, this trust chain means shorter conversion paths.

A NewRank research report even calls Xiaohongshu a “trust engine for social commerce”:

It blends influencer traffic, sales information flows, and consumer opinion leadership. Traffic relies more on user-initiated searches than platform recommendations, enabling more precise conversions while minimizing backlash.

So when we see Binance, OKX, and Bitget directing resources toward Xiaohongshu, this isn’t a whimsical “novel tactic,” but a strategic bet aligned with new traffic logic.

The Exchanges’ Hidden Growth Tactics

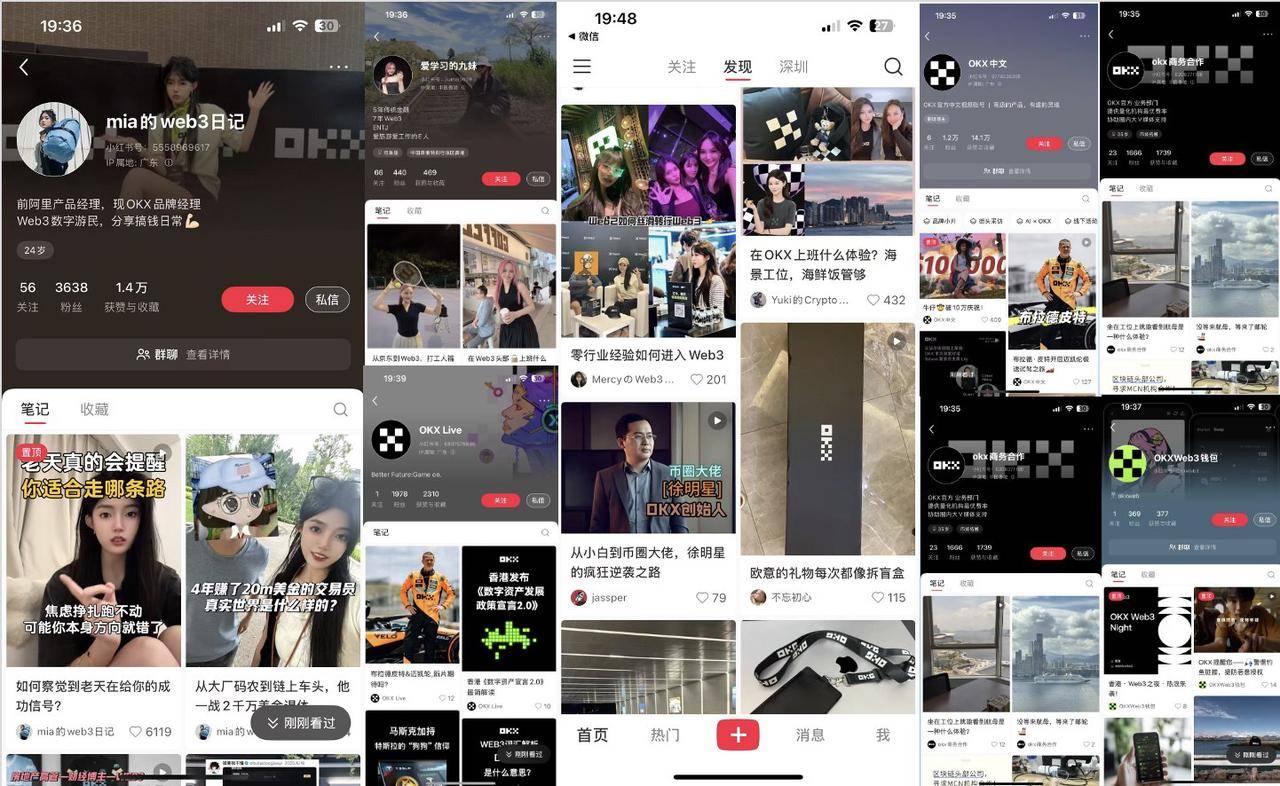

"OKX slashed most of its KOL budget on Twitter and is now aggressively focusing on Xiaohongshu. Internally, multiple departments are running Xiaohongshu operations—nearly the entire Chinese-speaking team is involved."

Crypto blogger Wuwei revealed on X.

On Xiaohongshu, OKX’s street interview video themed around a “Beijing Film Academy beauty queen” garnered over 87,000 likes. Similar street interview themes routinely surpass 10,000 likes, and AI shorts like the Nezha series earn thousands of saves.

OKX isn’t just good at making videos. Its approach on Xiaohongshu resembles a carefully orchestrated marketing campaign: official accounts create topics, employee accounts infiltrate niche content circles, achieving matrix-style penetration.

Beyond the official account, employees like Jiumei, Mercy, and Mia have built large followings through content on “transitioning to Web3” and “daily life at an exchange.” Though seemingly independent, they frequently engage with the official account in comments, creating secondary exposure and enhancing relatability.

This matrix strategy not only mitigates account suspension risks but also enables brands to reach more segmented audiences—such as young professionals aiming to enter Web3 or digital nomads pursuing location-independent lifestyles.

However, for exchanges, Xiaohongshu may serve less as a direct user acquisition tool and more as a “brand showcase”—using content to familiarize and win over potential users, so that when they’re ready to trade, the exchange comes to mind first.

Actual high-efficiency conversions often happen in the “underground world.”

Multiple grassroots studios continuously run引流 (traffic-driving) campaigns on Xiaohongshu.

These posts often hide behind titles like “avoiding pitfalls,” “financial diaries,” or “beginner guides,” luring users into groups or private chats before sending registration links. Once users deposit and begin trading, promoters earn long-term referral commissions—some studios even directly post ads on Xiaohongshu, one of the most stable gray-market businesses in crypto.

On Xiaohongshu, cryptocurrency is often not presented as a cold financial instrument, but as a lifestyle choice.

Rather than say “invest in crypto,” it’s framed as ‘how I achieved over 10,000 RMB in monthly passive income’; instead of charts, it’s digital nomads sharing financial insights; rather than technical analysis, it’s Gen Z’s path to financial freedom…

This “lifestyle” packaging perfectly fits Xiaohongshu’s content ecosystem and lowers psychological barriers for users.

Crypto blogger Viki summarized currently commercially viable Web3 account types on Xiaohongshu:

Career Consulting: Sharing transition experiences to attract job seekers;

Investment Insights: Appearing as lifestyle logs, but serving as investment tutorials;

Lifestyle Narratives: Stories of digital nomadism, remote work, and overseas living;

Personal IP: Building trust through strong identity branding.

"Exchanges partner with KOLs or KOCs running these four types of accounts, ultimately guiding users into communities and converting them via referral links," Viki explained.

Beneath this lies an attempt at long-term brand reinvention: transforming from cold transaction tools into communities, companions, and even “narrative leaders.”

Dancing on Thin Ice

The influx of crypto exchanges into Xiaohongshu may seem like the first step out of “crypto jargon” and into mainstream social discourse—but this path is far from smooth.

A trader with 50,000 followers on X, “Bidu,” bluntly called it “an extremely low ROI effort.” Having created countless accounts only to get repeatedly banned, he paid the price of over 20 accounts before understanding the rules.

"Back then, the crypto scene hadn’t fully invaded yet. Now every exchange is rushing in—traffic is no longer a blue ocean," said another KOL, “Digital Surge,” describing current efforts as “intra-wall rat races” where the红利 (golden window) has already closed.

Beyond fierce competition, platform moderation poses another high barrier.

"Low traffic means no results; high traffic triggers manual review," Viki noted. "Repeated violations lead to shadow-banning at best, full account suspension at worst. Creating content feels like dancing in shackles."

To avoid pitfalls, many creators have developed unique strategies across copywriting, layout, and traffic diversion—further reducing input-output ratios.

More troubling are compliance and user awareness risks. Xiaohongshu’s primary user base consists of young people unfamiliar with contracts, leverage, or on-chain assets. Misleading content could easily cause financial losses, potentially triggering stricter regulation. Even though the platform currently allows some ambiguity around crypto content, as financial content governance becomes standardized, any single PR disaster could result in widespread bans.

The risks are obvious, yet exchanges continue to invest heavily.

"If you don’t push forward, your competitors will take the lead," said a marketing manager at one exchange.

This mirrors the classic "prisoner's dilemma":

-

If only you act, you capture the early advantage

-

If everyone acts, advantages diminish and risks amplify

-

If you don’t act, you watch rivals claim all the users

So even knowing it might be a traffic trap with hidden dangers, everyone still jumps in.

Breaking into the mainstream always comes at a cost—the real question is whether the price is worth it.

The exchanges’ venture into Xiaohongshu is like dancing on thin ice—each step could be the last, but when the music starts, no one wants to stop.

How long will this traffic carnival last? No one knows.

One thing is certain: in today’s world of increasingly expensive traffic and tightening regulations, the era of “easy money” is gone. Exchanges must now consider not just how to acquire users, but how to create real value under compliant and sustainable conditions.

Otherwise, today’s Xiaohongshu could become tomorrow’s Weibo.

History doesn’t repeat itself, but it often rhymes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News