Chainbase: Beyond Data, See the Future

TechFlow Selected TechFlow Selected

Chainbase: Beyond Data, See the Future

As the AGI tsunami surges, Chainbase seeks to build a data ark on-chain.

Author: Bright, Foresight News

In Plato's "Republic," there is a famous "allegory of the cave": prisoners in a cave are chained and can only see shadows cast on the wall by candlelight, believing these shadows to be the only reality; it is not until someone breaks free and leaves the cave that they discover the real world illuminated by sunlight.

In today’s convergence of AI and blockchain, are we not also prisoners trapped in a "cyber cave," carried along by an overwhelming flood of data? The fragmented information from on-chain and off-chain sources resembles flickering shadows on the cave wall—false, disjointed, and unreliable. Developers struggle to build accurate applications due to incomplete data, investors miss valuable opportunities due to distorted signals, and AI models generate systemic biases because of unreliable inputs.

The capital market has already begun a land grab in the data supply side, with Silicon Valley-based AI data companies like Scale AI and Surge AI emerging rapidly, each valued at over ten billion dollars.

On-chain, DataFi has emerged accordingly. In the era of AGI (Artificial General Intelligence), DataFi will play the role of exiting the cyber cave—providing an open and transparent data interaction layer, building an AI stack foundation centered on data in a chain-native way, and ultimately transforming fragmented human behavioral data into verifiable, structured, and AI-ready executable assets.

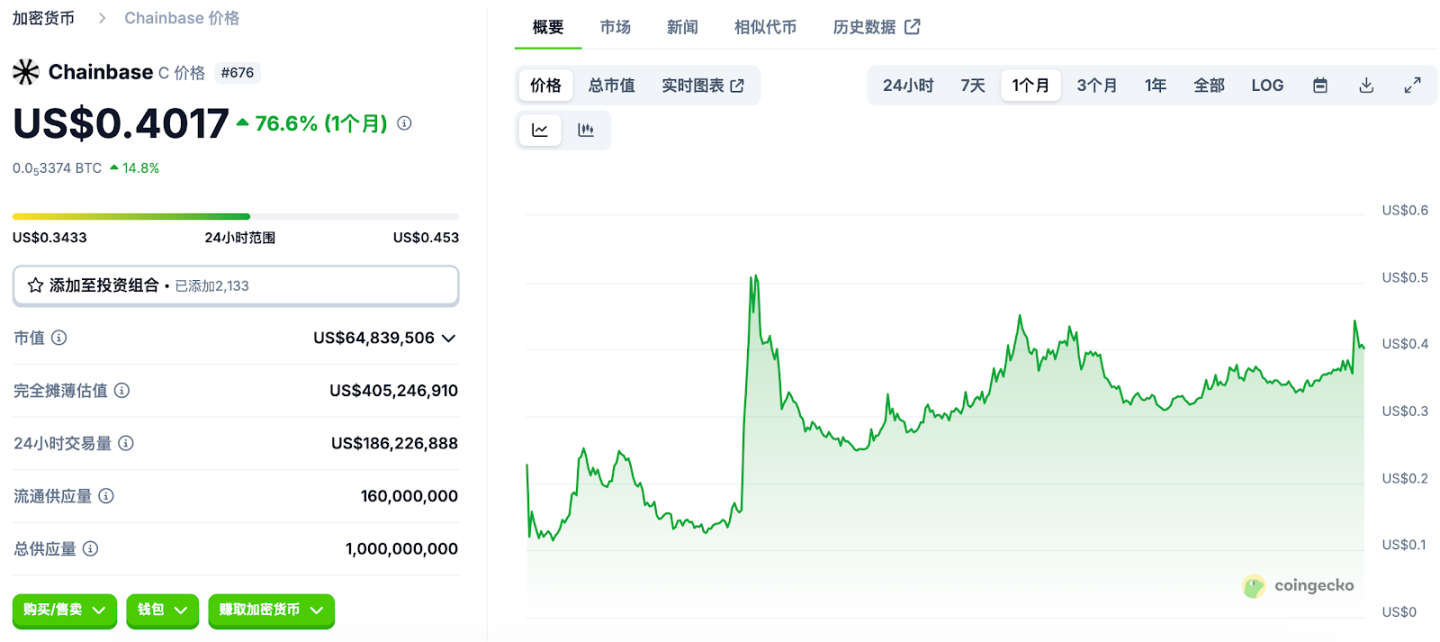

The strong performance of Chainbase, the cross-chain data network that successfully conducted its TGE in July and rose over 76% in one month, reflects the market's hunger for Web3 AI infrastructure.

Mining the On-Chain Data "Gold Mine"

Chainbase founder MOGU stated that today’s internet brings connectivity, cryptography brings ownership, and artificial intelligence brings intelligence—but intelligence does not emerge from nothing. It arises from the fusion of three elements: data, models, and compute. While AI has advanced rapidly in models and computing power, the data supply side remains clearly weak—human-generated "organic data" has hit a growth ceiling, and AGI is being "polluted" by the low-quality data it itself produces.

Therefore, the next decade of AI will be the decade of "data infrastructure." In this context, data is no longer a by-product of technology, nor merely a subordinate to productivity. Instead, it becomes a core production factor—measurable, tradable, and value-appreciable—like electricity or computing power.

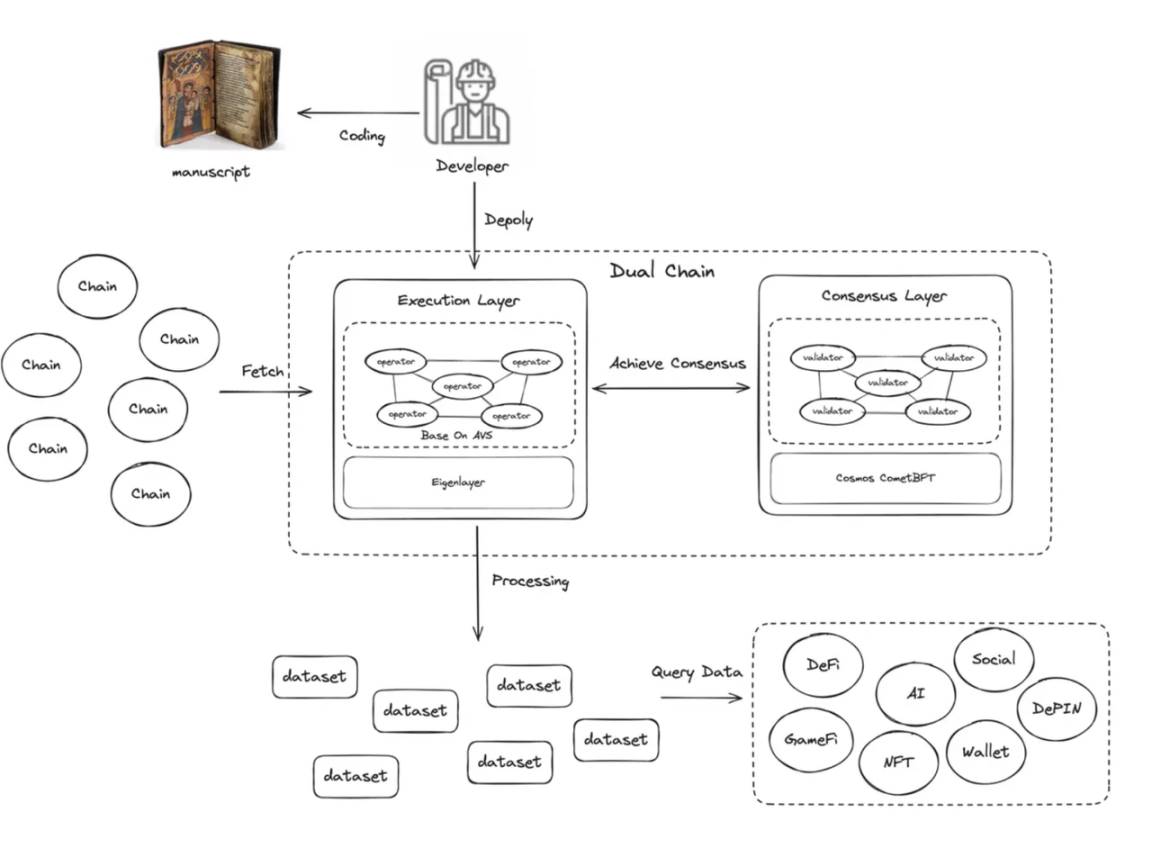

Within the Chainbase Hyperdata Network, operators, validators, developers, and delegators each have their roles. Data circulates based on a structure called "manuscripts," which consist of two parts: Schema and Operators. The Schema defines the data types and corresponding parameters of on-chain transactions, while Operators serve as methods for data extraction and analysis. After developers compile a manuscript, operators (who must register with EigenLayer) index these manuscripts and confirm them with validators, who ensure data security and integrity. Delegators stake native ETH or protocol token CBT; if tampering occurs, smart contracts trigger penalty mechanisms such as slashing staked ETH, thus ensuring economic-layer security.

Enabling Free Circulation of the "Gold Mine"

Previously, established on-chain data infrastructures such as The Graph and Dune still required external intervention and manual configuration for data acquisition and processing, making automated data handling difficult. This requirement limited the comprehensiveness and scalability of traditional data stacks. Users without native programming skills found it hard to extract useful information or build practical applications within these data infrastructures.

To meet complex application scenarios, Chainbase, supported by its next-generation data stack architecture, has built and open-sourced Theia, a chain-native large AI model. Theia is based on an 8-billion-parameter general large language model and over 200 million crypto-specific parameters, trained using the D2ORA algorithm. Most importantly, Theia supports natural language interaction. Crypto users can converse with Theia just as naturally as using ChatGPT, personally obtaining the on-chain data they need.

Chainbase Market Outlook

Prior to TGE, Chainbase completed a $15 million Series A round led by Matrix Partners China, with participation from Folius Ventures, Hash Global, JSquare, Mask Network, and Bodl Ventures—clear evidence that traditional internet giants believe in the future of DataFi.

One month after TGE, Chainbase stood out among Binance Alpha projects of the same period. Chainbase currently has a circulating market cap of $63.6 million and a total market cap nearing $400 million, with daily trading volume exceeding $200 million across all platforms. Its token C launched on Binance Alpha on July 14 and distributed an airdrop of 750 C tokens to eligible users, worth over $380 at peak prices. At the same time, token C debuted exclusively on Bitget Launchpool, distributing 2.5 million C tokens worth over $1 million in total to VIP and regular users through the BGB pool.

Today, C is listed on major exchanges including Binance and Bitget for both spot and perpetual contract trading. Additionally, on July 29, C officially launched on South Korea's highly wealth-generating exchange Bithumb. According to CoinMarketCap data, on its first day of listing, C achieved a trading volume of $22.717 million on Bithumb, ranking 14th in exchange-wide trading volume.

Currently, according to official Chainbase disclosures, Chainbase has integrated over 200 blockchains, onboarded more than 50,000 developers and over 10,000 on-chain projects, achieved data refresh intervals under 3 seconds to ensure real-time performance, processed an average of 500 million queries per day, successfully handled over 600 billion queries in total, and launched 3 million wallets. Moreover, Chainbase AVS is secured by 600,000 ETH via EigenLayer, ensuring decentralized execution. Chainbase has also formed comprehensive partnerships with Eigenlayer, Altlayer, io.net, Google Cloud, TON, Sui, Mask, and Particle.

It can be said that as the AGI tsunami surges forward, DataFi has created a new paradigm for the assetization and financialization of on-chain data. Chainbase’s Hyperdata Network, built “from the chain,” will continue empowering AI both on-chain and off-chain, constructing a pure data ark for users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News