When Christie's can buy houses with cryptocurrency, a new milestone for the RWA sector

TechFlow Selected TechFlow Selected

When Christie's can buy houses with cryptocurrency, a new milestone for the RWA sector

With Crypto, playing real estate is like playing Monopoly.

Author: BUBBLE,律动

"Buy land—they're not making it anymore." This famous saying, often misattributed to Mark Twain in the 20th century, has frequently been used as a slogan in real estate sales. Gravity strongly supports this statement; if humans cannot achieve interstellar travel, land—like Bitcoin—is "non-inflationary."

In 2025, the crypto wave spread from Silicon Valley to Wall Street and finally influenced Washington. As regulatory compliance progresses, it is quietly reshaping the fundamental structure of the real estate industry. In early July, Christie's International Real Estate officially launched a dedicated department for cryptocurrency property transactions, becoming the first mainstream luxury real estate brokerage brand to fully support "pure digital currency home purchases" under a corporate name.

And this is just the beginning. From Silicon Valley entrepreneurs to Dubai developers, from Beverly Hills mansions in Los Angeles to rental apartments in Spain, a new wave of real estate trading platforms centered on blockchain technology and digital assets is emerging, forming a nascent "Crypto Real Estate" sector.

Why Crypto Can Drive the Next Wave of U.S. Real Estate

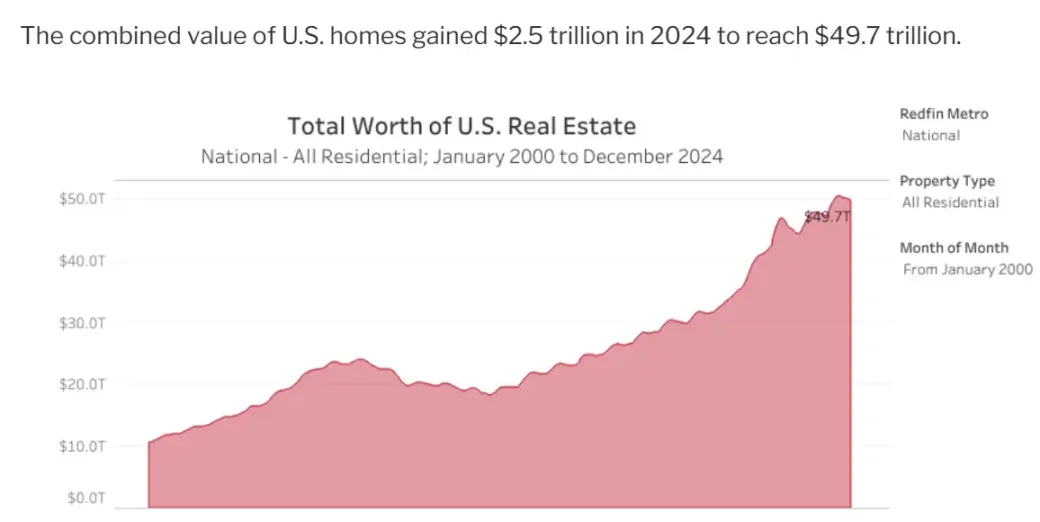

The value of U.S. real estate reached nearly $50 trillion in 2024, making it one of the most significant asset markets globally. A decade earlier in 2014, this figure was approximately $23 trillion—meaning the market has doubled in size over ten years.

Total U.S. real estate value, analysis report by Awealthofcommonsense

A June 2025 NAR report shows the median U.S. home price reached $435,300, up 2% year-on-year. Housing inventory stands at about 1.53 million units, with a supply-demand ratio of 4.7 months. High prices and persistent undersupply have raised entry barriers. Combined with sustained high mortgage rates (averaging around 6.75% for 30-year fixed loans in July 2025, and about 9% for Bitcoin-backed mortgages), which remain above annual property value appreciation, transaction volumes are suppressed. Low liquidity pushes real estate investors to seek new sources of liquidity.

High interest rates don't just hinder real estate investors' liquidity issues. Over the past five years, homeowners' average wealth increased by $140,000. Yet many households still hesitate to use their properties as collateral for liquidity, because their monetization paths are generally limited to two options: selling the entire asset or renting it out. Given current interest rates, borrowing against property equity isn't an attractive choice, and selling during a period of rising prices doesn't seem like an optimal investment decision either.

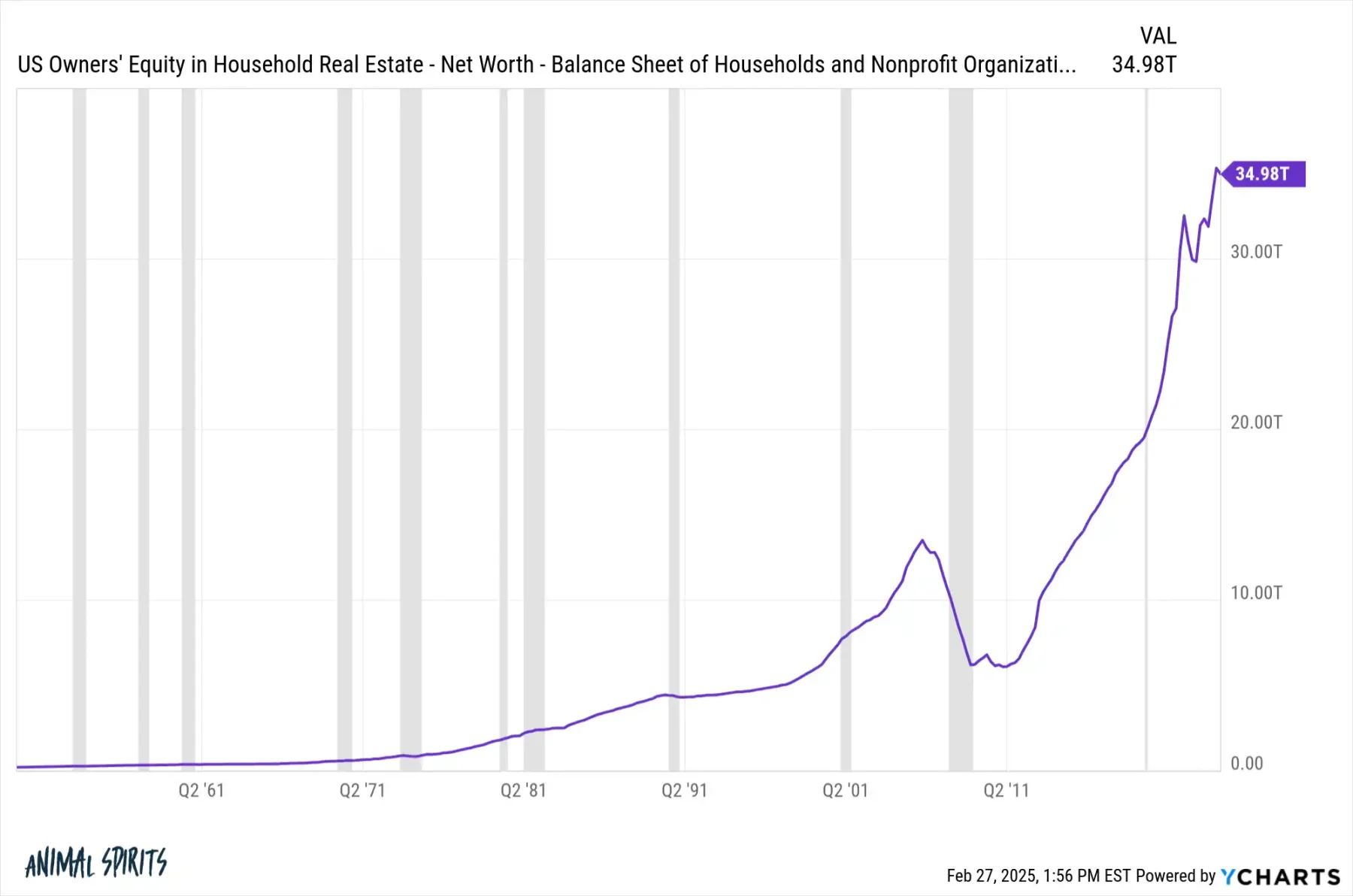

Therefore, within the overall $50 trillion real estate market, approximately 70% of equity (about $34.98 trillion) is held directly by owners, meaning only 30% is supported by debt financing, with the rest funded by buyers’ own capital. For example, a family owning a $500,000 home may nominally own it, but upon sale, they must subtract any outstanding loan balance to determine their actual equity. With 70% equity, they would hold $350,000 in actual ownership value.

U.S. real estate equity holdings, source: Ycharts

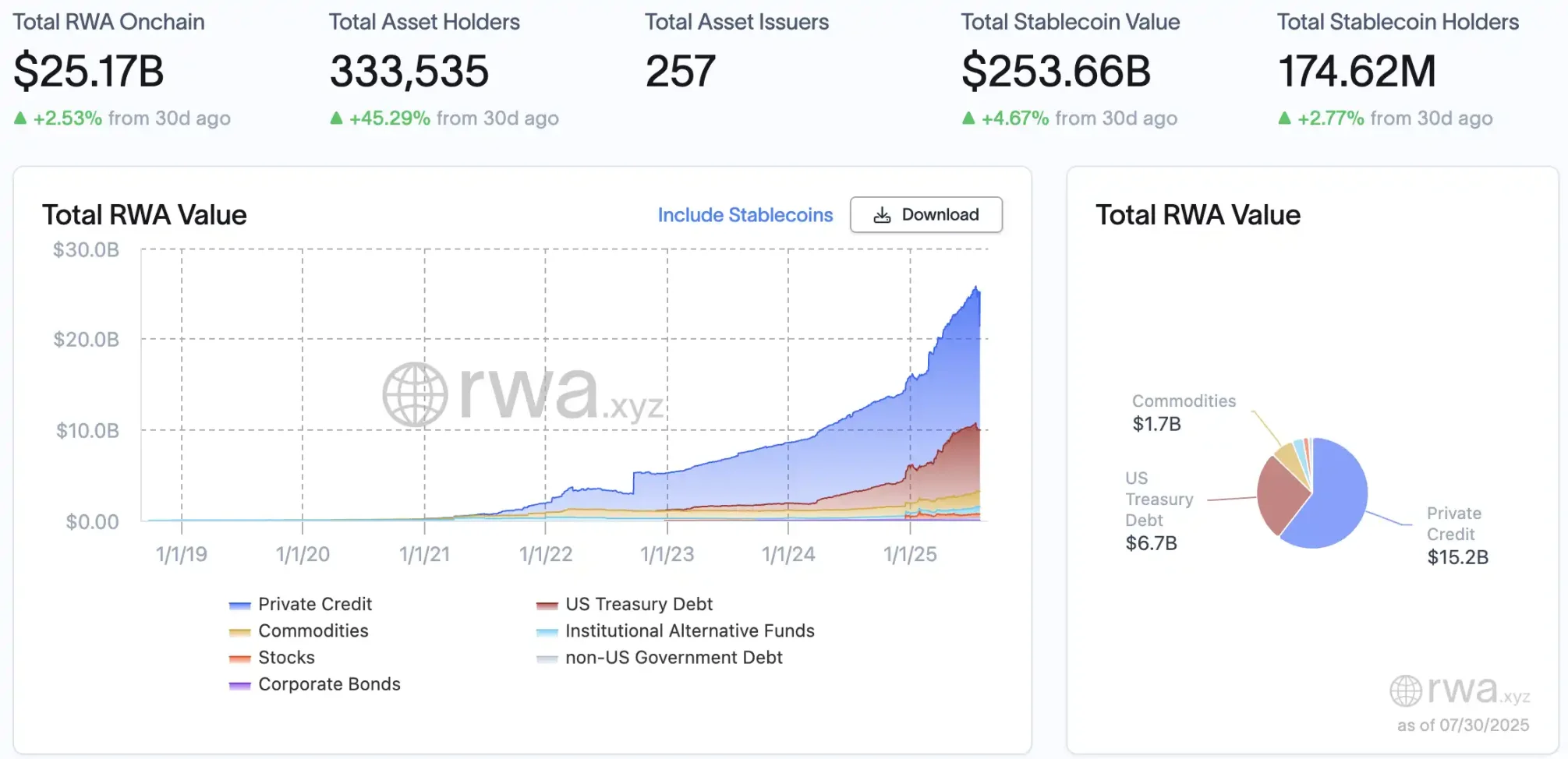

However, supply and demand dynamics alone aren't sufficient. The concept of RWA has existed for years but only began to truly explode recently, especially after Trump’s election in 2025 further steepened its growth curve.

The core lies in compliance, particularly crucial for investors in low-liquidity assets like real estate. In March 2025, FHFA’s newly appointed director William Pulte ordered mortgage giants Fannie Mae and Freddie Mac to develop plans allowing crypto assets to be counted as reserve assets when evaluating single-family mortgage risks, without requiring prior conversion into USD. This policy encourages banks to treat cryptocurrencies as qualifying savings assets, thereby expanding the borrower base.

In July 2025, Trump signed the GENIUS Act and pushed forward the CLARITY Act. The GENIUS Act formally recognizes stablecoins as legitimate digital currencies, requiring them to be fully backed 1:1 by safe assets such as U.S. dollars or short-term Treasuries, with mandatory third-party audits. The CLARITY Act aims to clarify whether digital tokens are classified as securities or commodities, offering clearer regulatory pathways for industry participants.

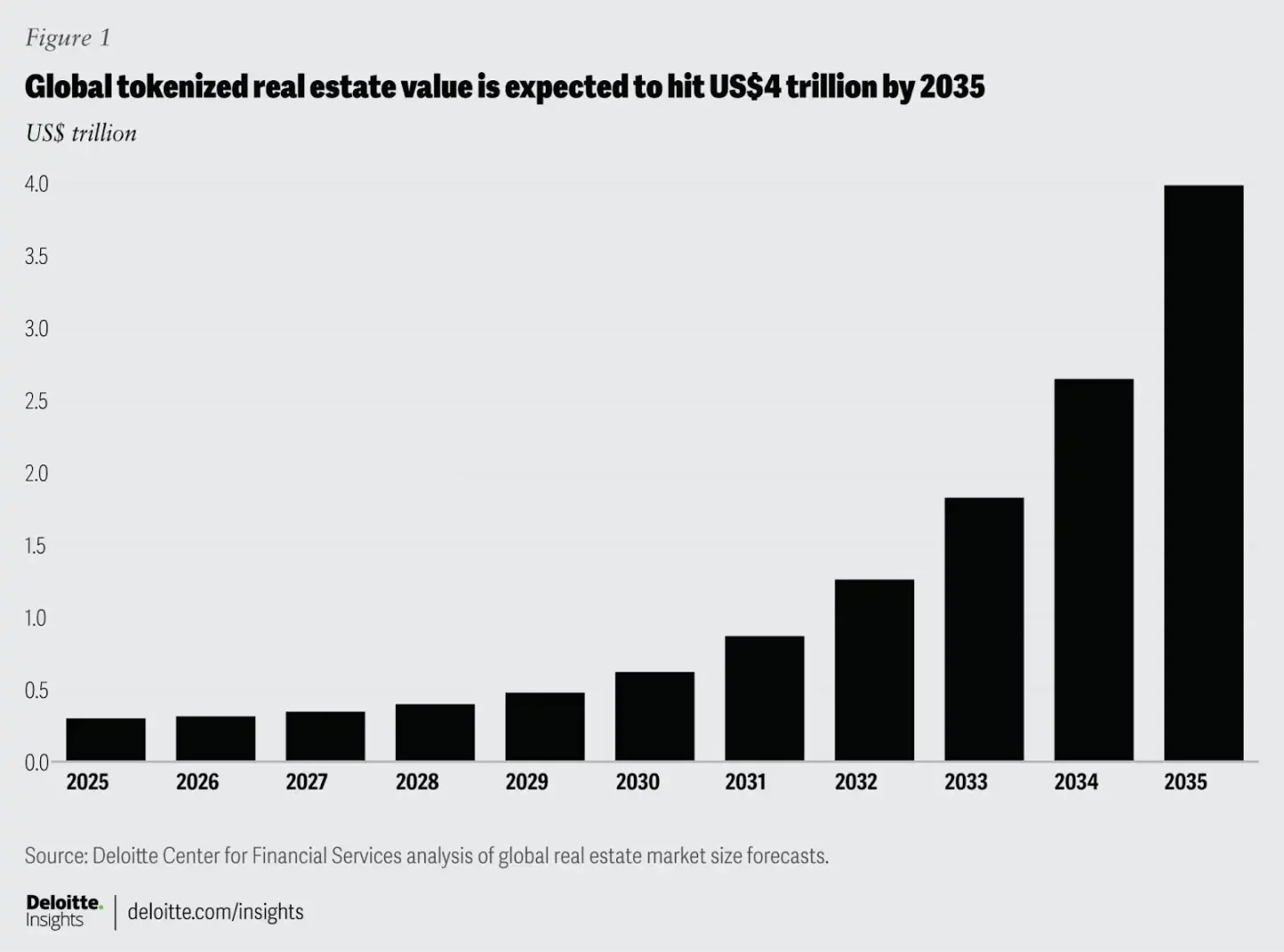

These combined measures have significantly enhanced safety margins in the sector. Coupled with real estate’s scarcity—similar to Bitcoin’s “non-inflationary” nature (land cannot increase, though buildings can; constructing homes is akin to mining)—the integration between the two becomes more natural. Digitization helps break down high barriers. Deloitte, one of the Big Four accounting firms, forecasts in its financial division report that by 2035, around $4 trillion worth of real estate could be tokenized—far exceeding less than $300 billion in 2024.

Tokenization allows large properties to be split into smaller shares, enabling global investors to participate with lower thresholds and higher liquidity, while generating cash flow for sellers and buyers previously constrained by capital. While appealing, the $4 trillion projection—much like institutional predictions that ETH’s market cap could reach $85 trillion—remains debatable. But how far has it actually come? We might find some alpha clues in the market.

Fractional Ownership? Lending? Renting? Providing Liquidity? Playing Real Estate Like DeFi

Unlike other illiquid physical assets such as gold or art, real estate inherently carries financial attributes. When connected to crypto, these attributes become even more diversified.

Although there were earlier attempts, the 2018 collaboration between Harbor and RealT, launching blockchain-based real estate tokenization services, is considered one of the earliest and more sizable projects in this space.

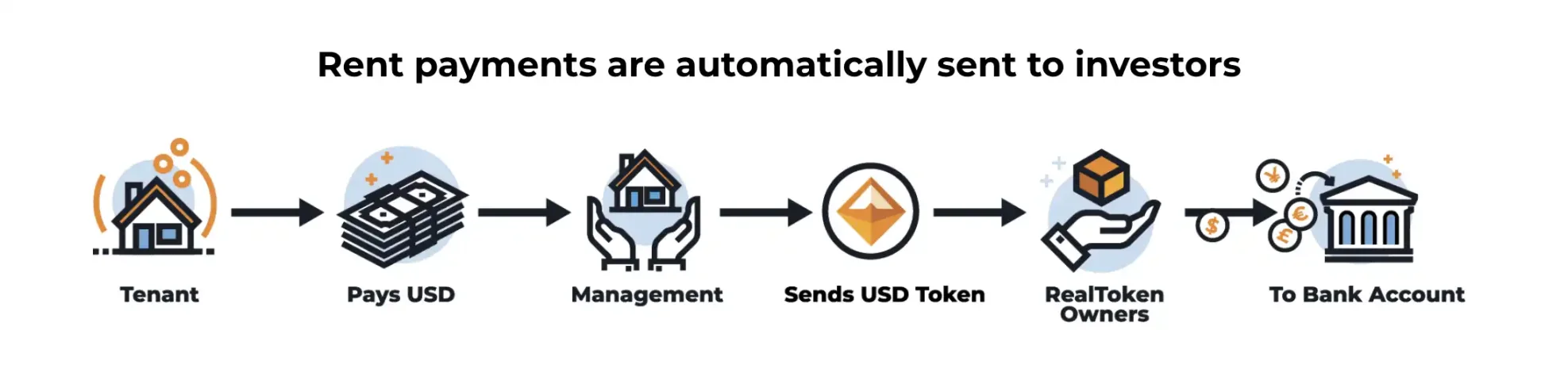

Specifically, RealT uses blockchain to divide property rights into tradable RealTokens. Each property is held by a separate company (Inc/LLC). Investors who purchase RealTokens effectively own shares in that company and receive proportional rental income. Using Ethereum's authorization mechanism, the platform lowers investment barriers (typically around $50) and completes all transactions and rent distributions on-chain, freeing investors from traditional landlord responsibilities. RealT distributes rental income weekly to holders in stablecoins (USDC or xDAI).

Returns are measured via Return on Net Assets (RONA): annual net rent divided by total property investment. For instance, if a property generates $66,096 in net annual rent with a total investment of $880,075, the RONA is 7.51%. This figure excludes leverage or property appreciation gains. Currently, the platform delivers average returns ranging between 6% and 16%.

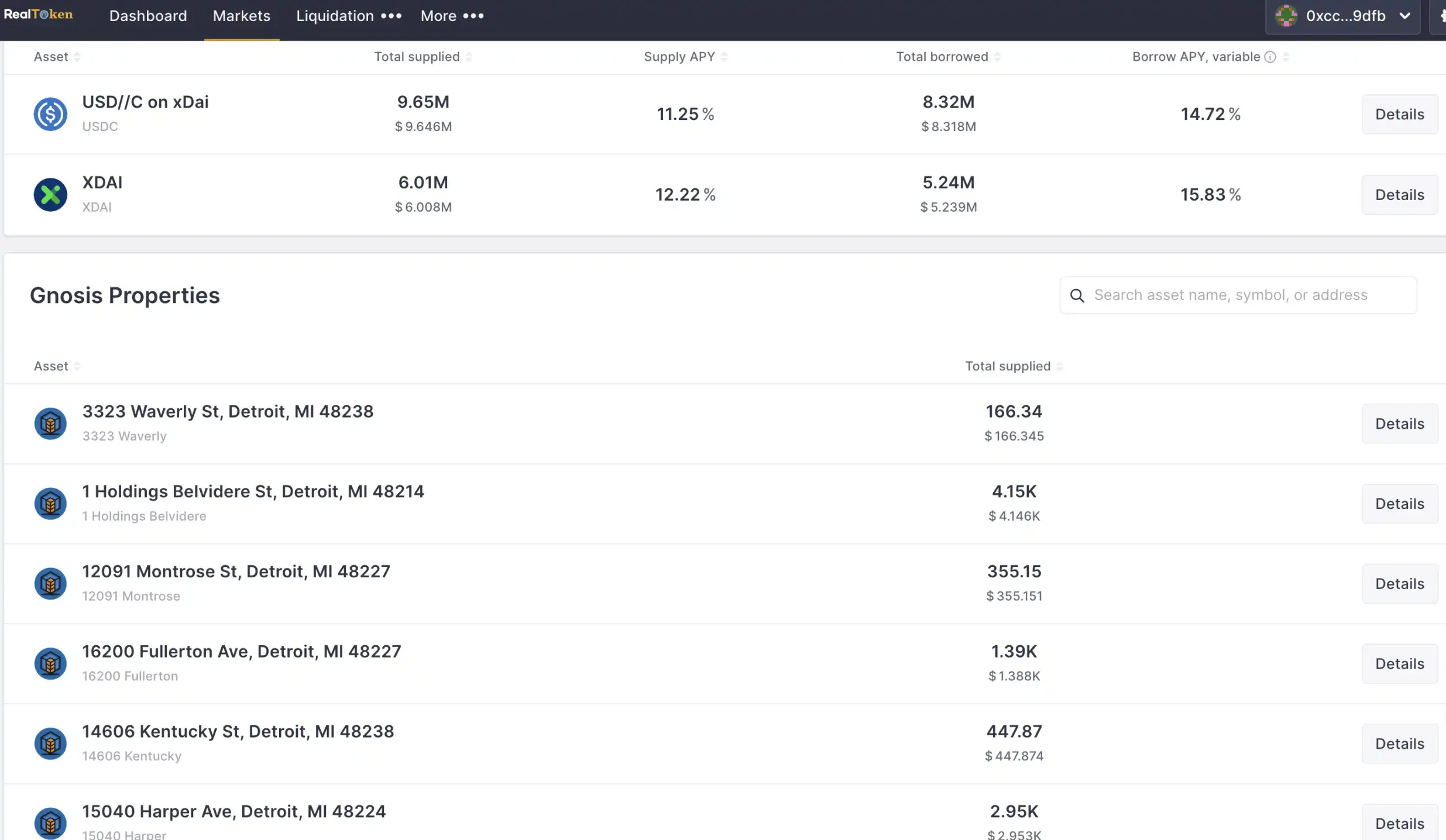

The next step after tokenization is application. RealT-owned properties carry no loans—all funding comes from RealToken sales. To give holders greater flexibility, RealT introduced the RMM (Real Estate Money Market) module.

Built on the Aave protocol, RMM enables two functions. First, users can provide liquidity—similar to earning LP yield in DeFi—by depositing USDC or XDAI into RMM and receiving ArmmTokens that accrue interest in real time. Second, users can borrow by pledging RealTokens or stablecoins as collateral to obtain assets like XDAI. Borrowing rates offer two options: stable rate (similar to short-term fixed rates, adjustable if utilization is too high or rates too low) and variable rate (fluctuating based on market supply and demand).

Opening lending enables leverage—just like property speculators decades ago who borrowed to buy homes, took out mortgages, then reused those loans to buy more homes. By mortgaging RealTokens to borrow stablecoins and reinvesting in more RealTokens, investors can repeat this process multiple times to boost overall returns. However, each additional layer of leverage reduces the health factor and increases risk.

Note: The health factor is the inverse of the ratio between collateral value and loan value. A higher health factor means lower liquidation risk. When the health factor drops to 1, collateral value equals loan value, potentially triggering liquidation. Avoiding liquidation involves repaying part of the loan or adding more collateral. (Similar to margin in perpetual contracts.)

Beyond using real estate as "collateral" for loans, recent discussions increasingly focus on native crypto asset collateral for mortgage lending. FinTech firm Milo allows borrowers to use Bitcoin as collateral to secure mortgages up to 100% of property value. By early 2025, Milo had completed $65 million in crypto-backed mortgages, disbursing over $250 million in total loans. Regulatory policies are also greenlighting this model: the U.S. Federal Housing Finance Agency (FHFA) now requires Fannie Mae and Freddie Mac to consider compliant crypto assets in risk assessments. Although crypto mortgage rates are generally close to or slightly higher than traditional mortgages, their main appeal lies in enabling financing without selling crypto holdings.

Meanwhile, a Redfin survey reveals that post-pandemic, about 12% of first-time homebuyers in the U.S. used crypto earnings (via sale or collateralized borrowing) for down payments. Combined with shifting policy winds, this trend is undoubtedly attracting major corporations to enter the space, and "Crypto Real Estate" is now seeing its first wave of high-end real estate firms joining in.

In July 2025, Christie's International Real Estate became the first global luxury real estate firm to establish a dedicated crypto-focused department—a landmark case of convergence between traditional high-end brokerages and digital assets. Interestingly, this move wasn't driven top-down strategically, but rather in response to genuine demand from high-net-worth clients.

Christie's executives stated, "An increasing number of wealthy buyers want to complete real estate transactions directly using digital assets, prompting us to build a full-service infrastructure supporting end-to-end crypto payments." In Southern California, Christie's has already completed several mansion deals paid entirely in cryptocurrency, totaling over $200 million—all involving eight-figure premium residences. Currently, Christie's portfolio of crypto-friendly properties exceeds $1 billion in value, including numerous luxury homes open to "pure crypto offers."

One such mansion accepting pure crypto payment, valued at $118 million, is "La Fin" located in Bel-Air, Los Angeles. It features 12 bedrooms, 17 bathrooms, a 6,000-square-foot nightclub, private wine cellar, sub-zero vodka tasting room, cigar lounge, and a fitness center with a climbing wall. Previously listed at $139 million, source: realtor

Christie's crypto real estate division not only supports payment channels via major cryptocurrencies like Bitcoin and Ethereum but also collaborates with custodians and legal teams to ensure compliance. Services include crypto payment escrow, tax and regulatory support, and asset matching (curating exclusive crypto-property portfolios tailored to high-net-worth clients' specific investment needs).

Aaron Kirman, CEO of Christie's Real Estate, predicts, "Within the next five years, over one-third of U.S. residential real estate transactions may involve cryptocurrency." Christie's transformation indirectly confirms the penetration of crypto assets among the wealthy and signals a structural shift in traditional real estate transaction models.

Infrastructure Maturing, But User Education Still Has a Long Way to Go

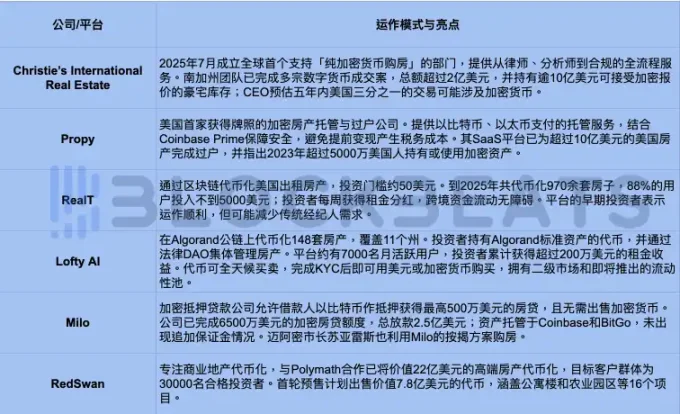

To date, real estate tokenization projects have achieved initial scale, yet fall short of expectations. RealT has tokenized over 970 rental homes, delivering nearly $30 million in pure rental income to users. Lofty has tokenized 148 properties across 11 states, attracting around 7,000 monthly active users who collectively earn about $2 million annually in rental income through token ownership. Most projects hover in the hundreds of millions to low billions in scale, failing to break through for various reasons.

On one hand, blockchain indeed removes geographical constraints, enabling cross-border instant settlement with lower transaction fees compared to traditional property transfer costs. However, investors must recognize this isn’t a "zero-cost" ecosystem: minting fees, asset management fees, trading commissions, network gas fees, and potential capital gains taxes form a new cost structure. Unlike the "one-stop service" offered by traditional real estate agents and lawyers, crypto real estate demands that investors actively learn and understand smart contracts, on-chain custody, and crypto tax rules.

On the other hand, while liquidity is a key selling point, it brings higher volatility. Tokenized properties can trade 24/7 on secondary markets, allowing investors to collect rent and exit positions anytime. But during periods of low liquidity, token prices may deviate significantly from the underlying property’s true valuation, with price swings even outpacing physical real estate cycles—increasing speculative tendencies in short-term trading.

Additionally, many platforms incorporate DAO (decentralized autonomous organization) governance, enabling investors to vote on matters like rent levels and maintenance. This participatory experience feels like "playing Monopoly," lowering barriers and enhancing engagement—but also imposes new demands: users must not only grasp property management but also develop on-chain governance and compliance awareness. Without adequate education, investors may misjudge risks, treating digital real estate as a short-term arbitrage tool rather than a long-term asset allocation strategy.

In other words, the real barrier to crypto real estate isn't technological—it's cognitive. Users need to understand concepts like loan-to-value ratios, liquidation mechanisms, on-chain governance, and tax reporting. For those accustomed to traditional home buying, this represents a disruptive shift.

As regulations become clearer, platform experiences improve, and mainstream financial institutions get involved, crypto real estate may shorten this educational curve. But in the foreseeable years ahead, the industry must invest more resources in user training, risk education, and compliance guidance to truly transition "crypto real estate" from niche experimentation to mass adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News