The Power Game Behind Stablecoins

TechFlow Selected TechFlow Selected

The Power Game Behind Stablecoins

Is crypto regulation a step back from the ideal of decentralization, or an inevitable evolution toward the standardization of financial systems?

Author: Buttercup Network, Thejaswini M A

Translation: Saorise, Foresight News

Translator's note: Cryptocurrency, once seen as a "revolution that would disrupt traditional finance," did not take the path of violent confrontation. Instead, it has become deeply intertwined with regulatory frameworks and political consensus—a "tamed revolution." From challenging tradition to seeking permission, from the ideal of decentralization to the reality of centralized regulation, the absurdity and contradictions of this "revolution" are precisely what this article aims to dissect. When rebels bow to the system, is it a博弈 of interests or an inevitability of the times?

In 2025, the rebel (cryptocurrency) didn't attack banks—it applied for a license from the Office of the Comptroller of the Currency (OCC).

I've been trying to make sense of the GENIUS Act phenomenon. The more I think about it, the more absurd and fascinating it becomes. So let me walk through how we shifted from "move fast and break things" to "move fast and comply with regulations."

The bill has been signed into law, and all the rules are now settled. Stablecoins are regulated, no longer mysterious. We know exactly who can issue them, who regulates them, and how they operate. But this raises an obvious question: What is the point of all this?

If you ask someone in crypto, they’ll passionately declare this is the moment cryptocurrency goes mainstream—a regulatory revolution that changes everything. They’ll excitedly talk about "regulatory clarity," "institutional adoption," and "the future of money," clutching the 47-page bill like it’s the Constitution.

If you ask a U.S. Treasury official, they’ll enthusiastically explain how this strengthens the dollar’s dominance like never before, ensures security, and brings investment back to America—spouting all the usual government talking points.

On the surface, both sides win. But honestly, the bigger advantage flows to the regulators. Cryptocurrency and Bitcoin once aimed to dismantle banks and end dollar hegemony. Now they want banks to issue dollar-backed cryptocurrencies.

At the heart of this entire situation lies an interesting contradiction: Banks are actually terrified of stablecoins—and for good reason. They’re watching trillions of dollars potentially flow out of traditional deposits into digital tokens that pay no yield but are fully reserved. Congress’s solution? Make it illegal for stablecoins to pay interest—effectively shielding banks from competitive threats.

The law states:

"No authorized payment stablecoin issuer or foreign payment stablecoin issuer shall pay any form of interest or return (whether in cash, tokens, or other consideration) solely for holding, using, or retaining a payment stablecoin."

Cryptocurrency was supposed to build a trustless, decentralized alternative to traditional finance. Yet today, you can send stablecoins on-chain—but only through embedded plugins, operating within venture-backed apps, settling with licensed issuers whose partner bank is JPMorgan Chase. The future has arrived, but it looks eerily familiar—just with better UX and more compliance paperwork.

The GENIUS Act creates a Rube Goldberg-like system—you can use revolutionary blockchain technology, but only if:

-

You get approval from the Office of the Comptroller of the Currency

-

You hold U.S. Treasuries at a 1:1 ratio as reserves

-

You submit monthly attestations signed by your CEO and CFO

-

You allow authorities to order token freezes

-

You promise never to pay interest

-

Your business activities are limited solely to "issuing and redeeming stablecoins"

The last point is especially telling: You can revolutionize finance, but you must never do anything else with that revolutionized finance.

We are witnessing a movement that was meant to oppose the system becoming institutionalized. Existing stablecoin issuers like Circle are thrilled—they were already mostly compliant and now get to watch less-regulated competitors get pushed out.

Meanwhile, Tether faces a life-or-death decision: either become transparent and accountable, or be banned from U.S. exchanges by 2028. For a company built on opacity and offshore banking, this is like asking a vampire to work the day shift.

Then again, given Tether’s size, it might not care much. With a market cap of $162 billion—bigger than Goldman Sachs, larger than most countries’ GDP, and arguably more influential than the entire regulatory apparatus trying to constrain it—by the time you reach that scale, “comply or leave” sounds less like a threat and more like a suggestion.

The "Libra provision," named after Facebook’s failed attempt to launch a global digital currency, essentially prevents tech giants from casually issuing stablecoins. Remember when everyone feared Facebook might undermine sovereign currencies? Under this new system, if Facebook wanted to issue a stablecoin, it would need unanimous approval from federal regulators, the token couldn’t pay interest, and it would have to be fully backed by U.S. government debt.

Now, let’s talk about the economic logic behind why everyone suddenly cares. U.S. merchants currently pay Visa and Mastercard 2%-3% per transaction—often their largest expense after payroll. Stablecoin payments cost mere cents; large settlements cost less than 0.1%, because blockchain infrastructure doesn’t require massive banks and card networks taking a cut. That’s $187 billion in annual swipe fees that could stay in merchants’ pockets. No wonder Amazon and Walmart are so interested in stablecoin solutions: Why pay rent to a duopoly when you can just send digital dollars directly?

@Visa

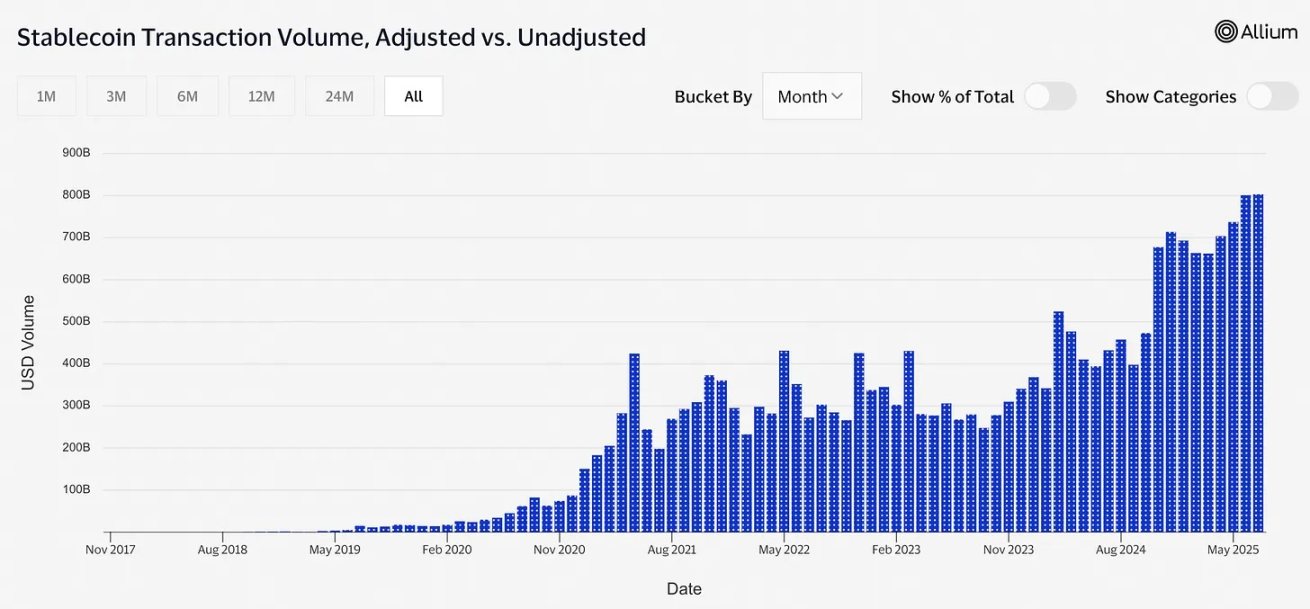

And then there’s a terrifying feedback loop no one wants to discuss: If stablecoins truly go mainstream and grow to several trillion dollars in issuance, a significant portion of demand for U.S. Treasuries will come from stablecoin reserves.

This sounds great—until you realize stablecoin demand is inherently more volatile than traditional institutional buyers. If confidence collapses and mass redemptions begin, all those Treasuries would flood the market overnight. Then, U.S. government borrowing costs would depend on the mood of crypto Twitter users that day—like basing your mortgage repayment on the emotional state of a day trader. The U.S. Treasury market has weathered many storms, but "algorithmic sell-offs triggered by panicked stablecoin holders" is a new one.

Most telling of all, this reflects crypto’s evolution from “anarchist money” to “institutional asset class.” Bitcoin was supposed to be trustless, peer-to-peer electronic cash. Now, a federal law dictates that digital dollars can only be issued by highly trusted, heavily regulated third parties—who themselves answer to even higher authorities.

The law requires stablecoin issuers to freeze tokens on the blockchain when authorities demand it. This means every “decentralized” stablecoin must have a centralized “emergency stop switch.” It’s not a bug—it’s a feature.

We’ve successfully created censorship-resistant money that also has built-in mandatory censorship.

Don’t get me wrong—I fully support regulatory clarity and dollar-backed stablecoins. It’s fantastic: crypto innovation now has rules, and the mainstreaming of digital dollars is genuinely revolutionary. I’m all for it. But don’t pretend this is some generous act of regulatory enlightenment. Regulators didn’t suddenly fall in love with crypto innovation. Someone walked into the Treasury and said: “Why not get the world to use more dollars—digitally—and make them buy more U.S. Treasuries to back them?” And just like that, stablecoins transformed from “dangerous crypto toys” into “brilliant tools of dollar dominance.”

Every USDC issued means another Treasury bond sold. $242 billion in stablecoins translates to tens of billions flowing directly into Washington, boosting global demand for U.S. debt. Every cross-border payment avoiding euros or yen, every FX market listing a regulated U.S. stablecoin, is another franchise outlet in the American monetary empire.

The GENIUS Act is the most sophisticated act of foreign policy disguised as domestic financial regulation.

This raises some interesting questions: What happens when the entire crypto ecosystem becomes a subsidiary of U.S. monetary policy? Are we building a more decentralized financial system, or the world’s most complex dollar distribution network? If 99% of stablecoins are pegged to the dollar and any meaningful innovation requires OCC approval, have we accidentally turned revolutionary technology into the ultimate export business for fiat currency? If crypto’s rebellious energy is channeled into making the existing monetary system more efficient rather than replacing it—and as long as settlement is faster and everyone profits—does anyone really care? These aren’t necessarily problems—just very different from the issues this movement originally set out to solve.

I’ve been mocking this whole thing, but the truth is, it might actually work. Much like how the free banking era of the 1830s evolved into the Federal Reserve System, crypto may be transitioning from chaotic adolescence into maturity, becoming a systemically important part of financial infrastructure.

To be honest, 99.9% of people just want fast, low-cost transfers and couldn’t care less about monetary theory or decentralization ideals.

Banks are already positioning themselves to become primary issuers of these new regulated stablecoins. JPMorgan Chase, Bank of America, and Citigroup are reportedly preparing to offer stablecoin services to clients. The very institutions that crypto was supposed to disrupt are now the biggest beneficiaries of crypto regulatory legitimacy.

This isn’t the revolution anyone expected—but perhaps it’s the revolution we ended up with. Strange as it sounds, that’s kind of… genius.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News