The U.S. House of Representatives overwhelmingly passed three cryptocurrency bills, and the White House said Trump will sign them on Friday

TechFlow Selected TechFlow Selected

The U.S. House of Representatives overwhelmingly passed three cryptocurrency bills, and the White House said Trump will sign them on Friday

The Stablecoin Regulatory-related "Genius Act" received 2.5 times more votes in favor than against, gaining support from over 100 Democratic lawmakers who crossed party lines.

By Dan Li, Wall Street Horizon

The cryptocurrency industry is about to welcome the United States' first formal industry laws, which will help legitimize these digital assets and move them closer to becoming mainstream financial products.

On Thursday, July 17, Eastern Time, during the final trading session of US stocks, the US House of Representatives passed with overwhelming majority votes three legislative drafts concerning crypto regulation, including stablecoin oversight, sending them to President Trump for signature into law.

The GENIUS Act—focused on stablecoin regulation—received 308 votes in favor, more than 2.5 times the 122 opposing votes. Over 100 Democratic lawmakers, including Senate Democratic Leader Hakeem Jeffries, defected from their party and joined Republicans in supporting the bill.

Earlier during US midday trading, White House Press Secretary Levitt stated that Congress had enough votes to pass cryptocurrency legislation. She expressed confidence that Congress would continue advancing legislation on cryptocurrencies. Trump plans to sign the crypto bills, including the GENIUS Act, at an event on Friday, making them officially effective as law.

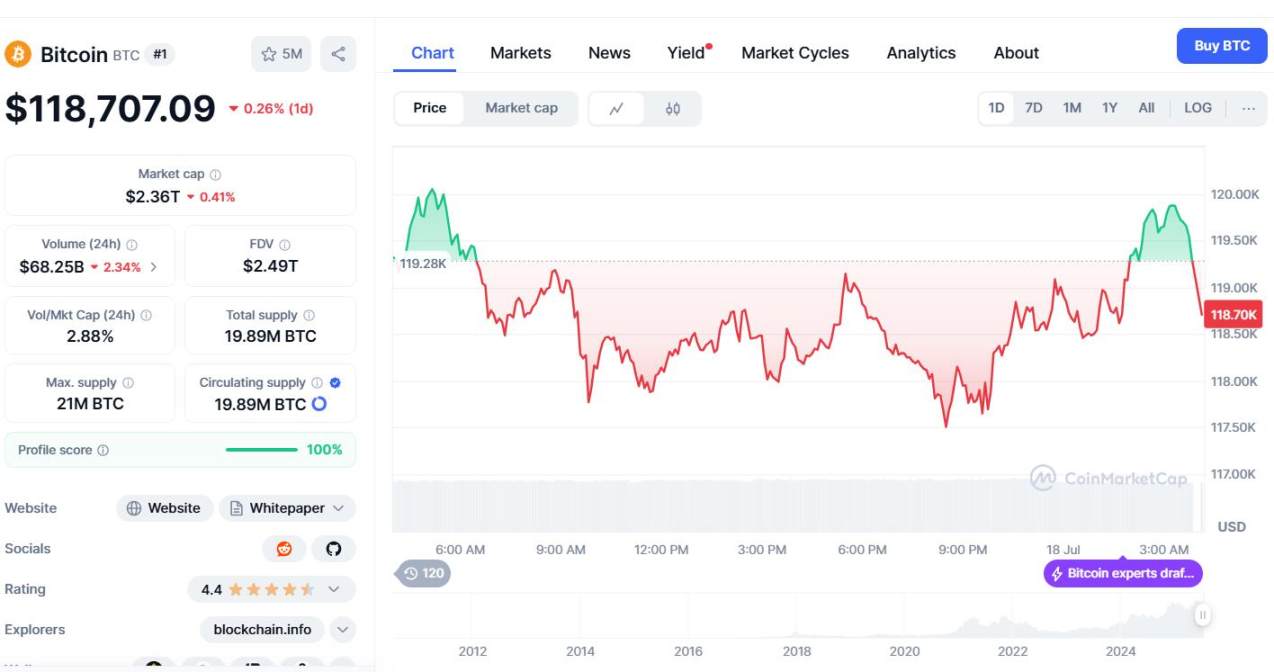

During Levitt’s remarks, Bitcoin briefly turned positive. According to CoinMarketCap data, Bitcoin rose above $119,800, nearing the $120,000 mark, up over $2,000—or nearly 2%—from its intraday low below $117,600 during European trading hours. After the House approval, Bitcoin dropped below $119,000 in post-market trading, down more than 0.4% during the session.

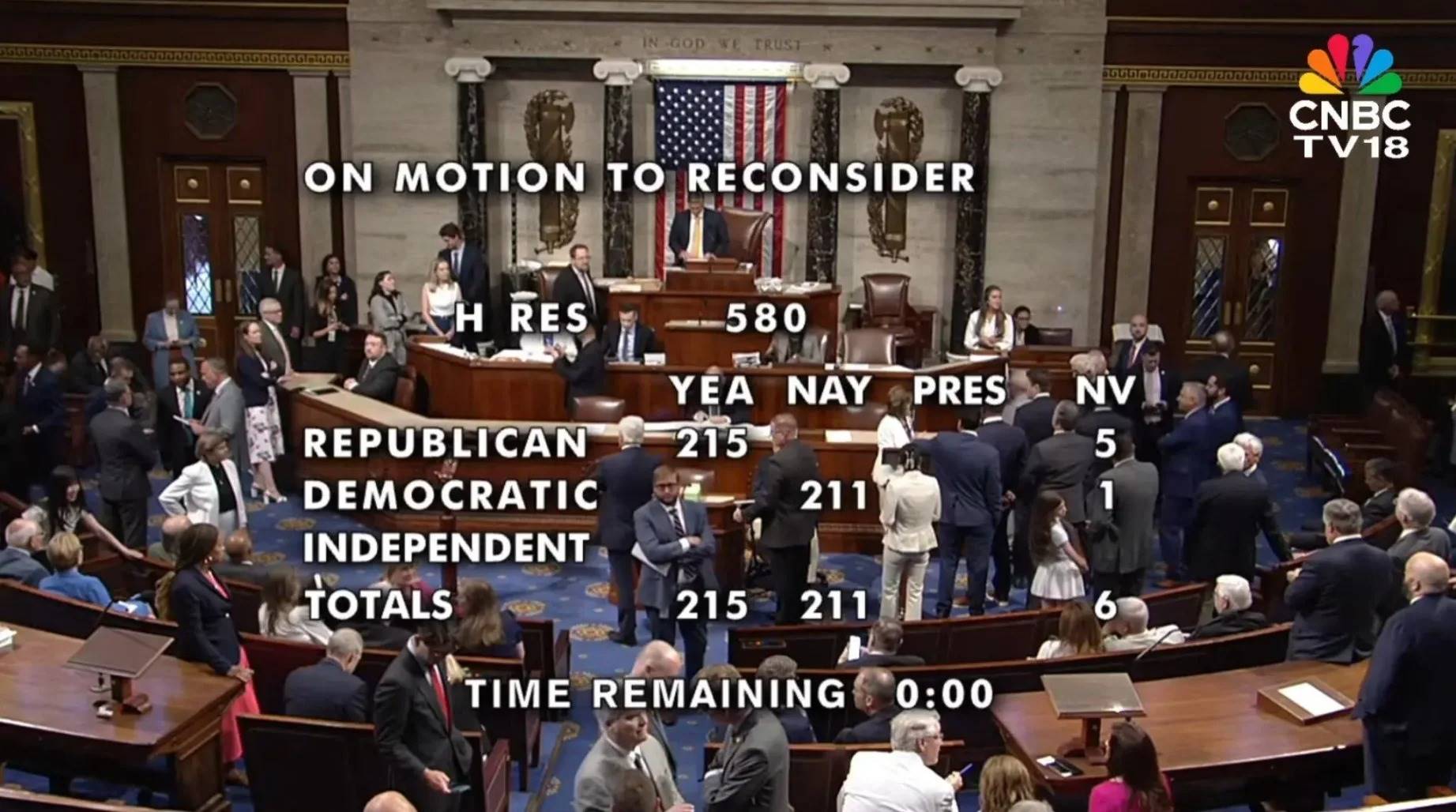

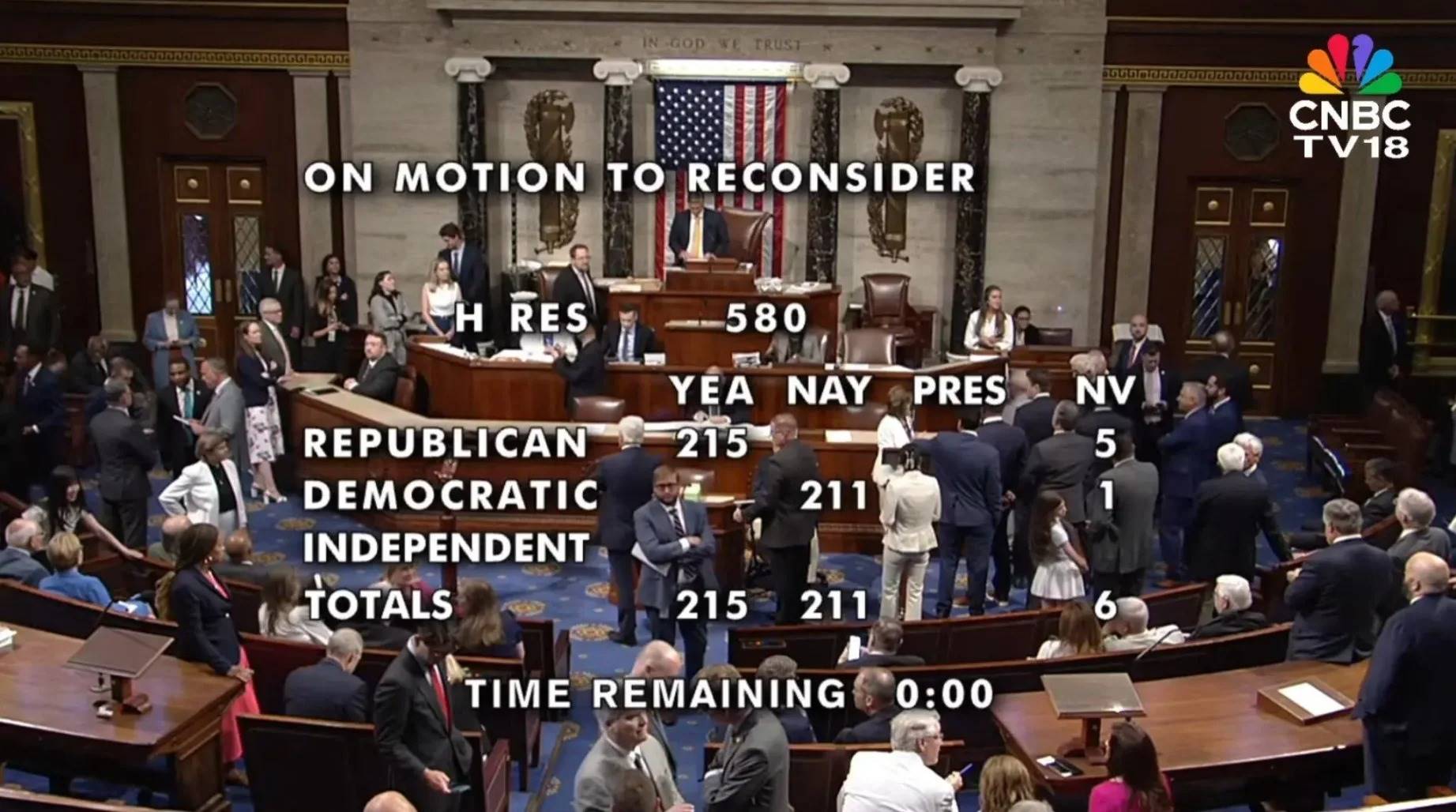

Prior to Levitt's statement, on Wednesday evening, the GENIUS Act and other crypto bills narrowly cleared a critical procedural vote in the US House, winning by just five votes. A day earlier, these bills failed in the first round of procedural voting due to Republican infighting.

According to CCTV News, on the evening of the 16th local time, US media reported that the US House passed a procedural vote on cryptocurrency legislation by 217 to 212, allowing the bills to proceed to debate. The vote lasted over eight hours, setting a record for the longest vote since the electronic voting system was introduced.

The full name of the GENIUS Act is the "Guidance and Establishment of National Innovation for US Stablecoins Act." It had already passed a Senate vote on June 17 and was submitted to the House this week. The House also added two other major crypto industry bills—the CLARITY Act and the Anti CBDC Act.

The three crypto bills were jointly reviewed and voted on in the House, leading the chamber to dub this week "Crypto Week."

However, during the House procedural vote on Tuesday, 13 Republican lawmakers switched sides and voted with Democrats against the procedural motion, causing all three bills to fail. The opposition outnumbered support by 27 votes, with the final tally at 196 in favor and 223 opposed.

Wall Street Horizon previously noted that after the vote, House Speaker Johnson said hardline critics within the Republican Party wanted to consolidate several crypto bills into a single package, which was why they blocked the procedural vote.

Media reports indicated that after Trump intervened to mediate, the legislative deadlock was resolved. Republican lawmakers who initially opposed the bills met with Trump at the White House late Tuesday and held over nine hours of private negotiations on Wednesday, reaching a compromise between hardline Republicans and party leadership, enabling the three key crypto bills to advance to the procedural voting stage.

Crypto Legislation Passage Could Boost Demand for US Treasuries

All three bills currently being pushed by House Republican leaders have Trump's support. They aim to establish a clear regulatory framework for the digital asset industry and are seen as a significant milestone in US crypto policy.

The GENIUS Act establishes a regulatory framework for dollar-pegged stablecoins and is widely viewed as beneficial for strengthening consumer protection and enhancing the legitimacy of the crypto industry. Stablecoins are a type of cryptocurrency designed to maintain a relatively stable value relative to certain assets, typically fiat currencies.

The CLARITY Act primarily addresses market structure issues, providing clear guidance on digital asset trading and regulation. The Anti CBDC Act aims to prevent the Federal Reserve from issuing central bank digital currency (CBDC) directly to individuals or using CBDC for monetary policy implementation without congressional authorization.

21st Century Business Herald pointed out that two systemic changes brought by the three crypto bills deserve attention.

First, regulatory responsibilities will be restructured: the Commodity Futures Trading Commission (CFTC), the top regulator for commodity futures in the US, will become the primary regulator for digital commodities, while the Securities and Exchange Commission (SEC)—often seen as America's securities watchdog—will only oversee security tokens and initial offerings, signaling a partial relaxation in crypto regulation.

Second, global capital flows may be reshaped. The mandatory US Treasury reserve requirement could make stablecoin issuers the third-largest buyer of US Treasuries, reinforcing the dollar's on-chain circulation system. US Treasury Secretary Beient predicted that demand for US Treasuries generated by the stablecoin bill could reach $2 trillion.

Earlier this month, CCTV cited media commentary stating that if cryptocurrencies become more mainstream, they could impact the US bond market. The GENIUS Act will require tokens to be backed by liquid assets such as the US dollar or short-term US government bonds and mandate monthly disclosure of reserve holdings by token issuers. This means issuers must purchase more short-term US government bonds.

Beient previously urged lawmakers to pass the GENIUS Act, arguing it would stimulate demand for US Treasury securities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News