Crypto Week kicks off—what new opportunities will the three crypto bills ignite?

TechFlow Selected TechFlow Selected

Crypto Week kicks off—what new opportunities will the three crypto bills ignite?

The three pieces of legislation target different areas, but all of them point to a common theme—“compliance.”

Author: TechFlow

July has brought another wave to the crypto market.

BTC continues to break new all-time highs, while ETH spot ETFs maintain nine consecutive weeks of net inflows. Last week alone, ETH spot ETFs saw a record $850 million in net inflows, demonstrating that capital flows have never paused—market sentiment is turning positive again.

However, the real catalyst may not lie in price charts, but in the U.S. House of Representatives in Washington, D.C.

From July 14 to 18, the House announced a "Crypto Week," during which it will concentrate on reviewing three landmark bills: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act—targeting stablecoins, digital asset classification, and central bank digital currencies (CBDC), respectively.

This legislative blitz is not only a turning point for the U.S. crypto industry but could also shape the trajectory and asset dynamics of the entire crypto market.

Let’s examine the progress of these three key bills this week and capture the pulse of Crypto Week.

Legislative Overview: Core Elements and Progress of the Three Bills

As of July 16, Crypto Week is in full swing.

The three bills under concentrated review by the House cover core sectors of the crypto market, touching upon stablecoin payments, decentralized finance (DeFi), and Bitcoin’s decentralization narrative.

While each bill focuses on different areas, they all converge on one central theme—"compliance."

GENIUS Act: The Legal Foundation for Stablecoins

The GENIUS Act, formally known as the "Guiding and Establishing National Innovation for U.S. Stablecoins," aims to establish a federal regulatory framework for stablecoins. It defines issuer qualifications, mandates 1:1 backing by U.S. dollars or Treasuries, and introduces transparent audit mechanisms. By enforcing 1:1 reserve requirements, the bill ensures stablecoins are truly "stable," helping prevent another Terra-like collapse in 2022.

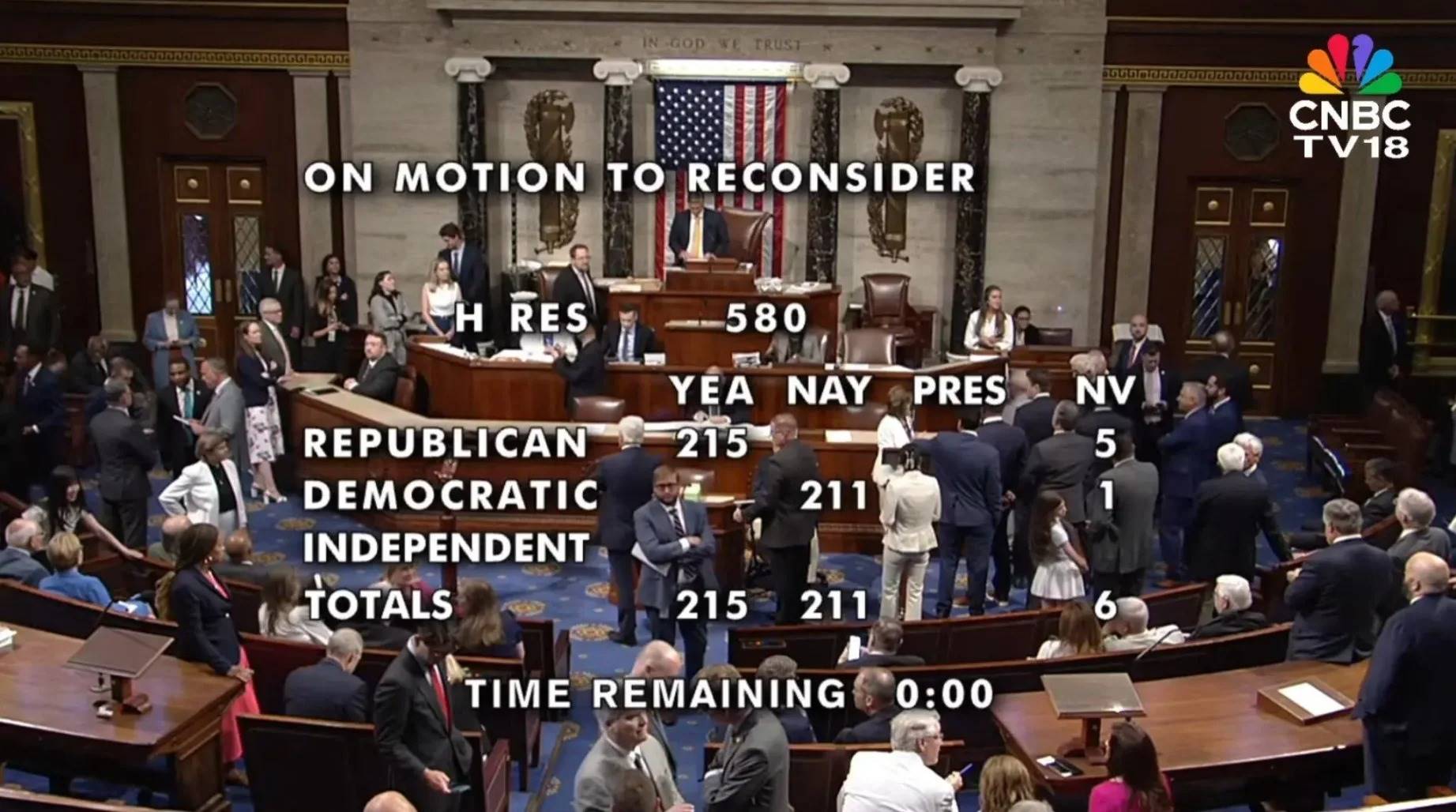

In terms of legislative progress, the Senate passed the bill in June 2025 with a 68:30 vote. During Crypto Week, the House originally planned to hold a vote on Thursday, July 17 (U.S. time). On July 15 (U.S. time), the House Rules Committee approved debate procedures, but a procedural vote—needed to advance the bill to formal debate—failed 196:223, blocked by 12 hardline Republican members.

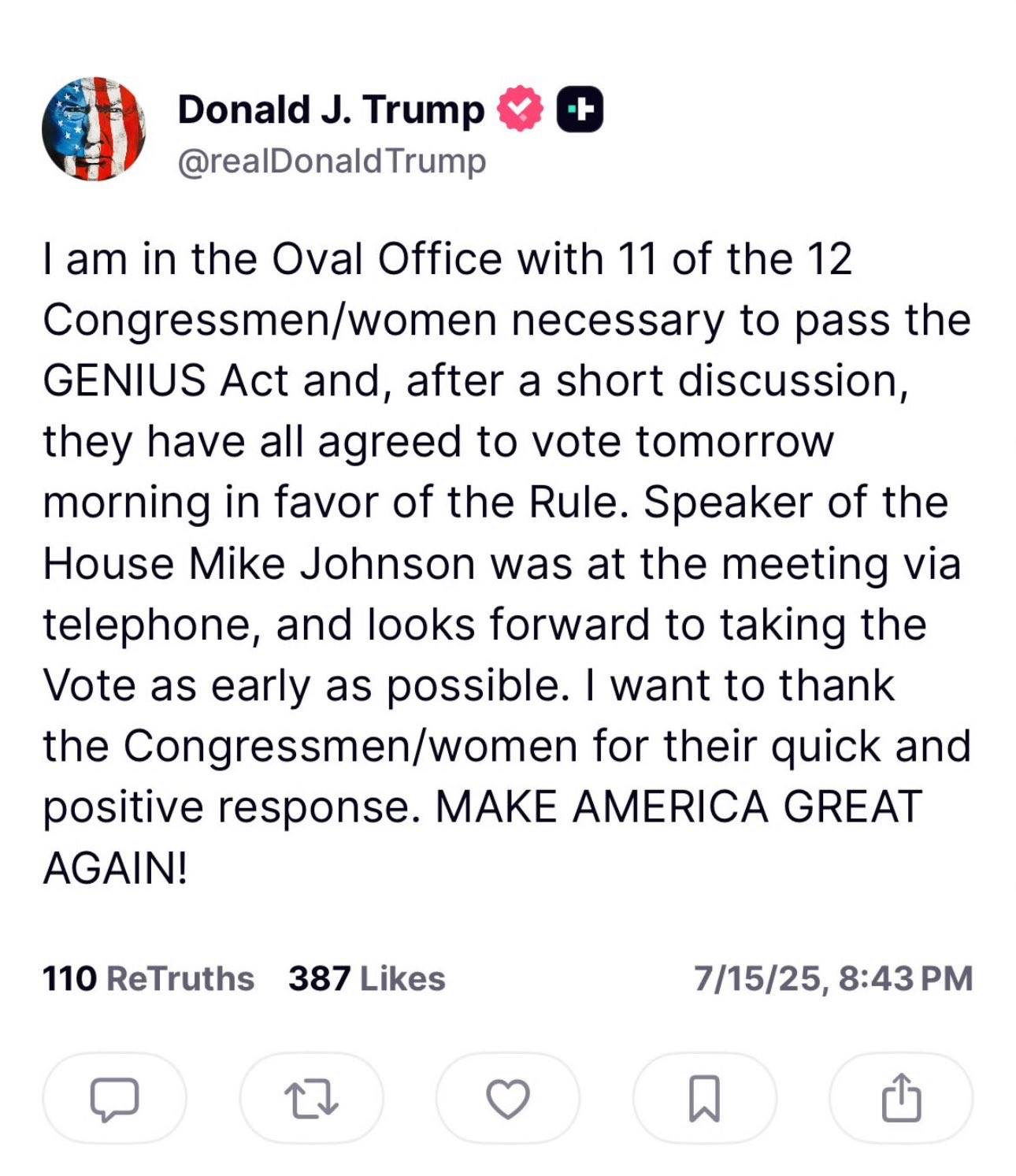

On the evening of July 15 (U.S. time), Trump posted on Truth Social stating he had met with 11 opposing Republican lawmakers who agreed to support a re-vote on rule provisions on the morning of July 16 (U.S. time). House Speaker Johnson expressed hope to retry the procedural vote on Wednesday.

Despite this unexpected setback, the chances of the GENIUS Act eventually passing remain high. If the upcoming vote succeeds, the GENIUS Act could become the first law enacted during Crypto Week, paving the way for stablecoins to integrate into mainstream finance.

CLARITY Act: The Innovation Engine for Exchanges and DeFi

The CLARITY Act, formally titled the "Digital Asset Market Clarity Act of 2025," focuses on defining digital assets and clarifying regulatory jurisdiction. If passed, it would end the long-standing regulatory confusion between the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission).

The bill specifies which crypto assets fall under securities (regulated by the SEC) and which are commodities (regulated by the CFTC), and creates a "mature blockchain" category for decentralized networks, exempting certain developers from money transmitter compliance obligations.

Introduced on May 29, 2025, by the House Financial Services and Agriculture Committees, the bill was originally scheduled for a vote today. However, due to the failed procedural vote on July 15 (U.S. time), it shares the same hurdle as the GENIUS Act and has not yet entered formal debate.

Trump has indicated he has persuaded the opposing lawmakers to support passage, with a potential vote expected on the afternoon of July 16 (U.S. time). The likelihood of passage remains strong. If successful, the act would reduce compliance costs for exchanges like Coinbase and DeFi protocols like Uniswap, unlocking innovation potential.

Anti-CBDC Act: Decentralization Over Government Control

The Anti-CBDC Act, formally known as the "Anti-CBDC Surveillance State Act," primarily prohibits the Federal Reserve from issuing a central bank digital currency (CBDC), citing concerns over excessive government surveillance of personal finances. The bill aligns with crypto users’ emphasis on privacy, strengthens the status of decentralized assets like BTC, and removes a competitive threat to crypto’s future development.

While the exact timeline for voting on the Anti-CBDC Act remains unclear, the House Financial Services Committee has confirmed it will be placed on the agenda during Crypto Week. If the U.S. government signals support later, it could significantly boost market confidence and indirectly drive growth in privacy coins and anonymity technologies.

Legislative Outlook and Market Expectations

Under U.S. legislative procedure, a bill must pass both the House (435 seats, requiring 218 votes) and the Senate (100 seats, requiring 51 votes) in identical form before being sent to the President for signature.

Crypto Week represents the critical window for House votes. Overall, the GENIUS Act is closest to becoming law, while the CLARITY and Anti-CBDC Acts may require more time.

We can quickly summarize the progress and details of the three bills in the table below:

How These Three Laws Could Reshape the Crypto Landscape

Clearly, the final outcomes of Crypto Week will directly impact market sentiment.

More profoundly, these bills do more than just provide regulatory frameworks—they signal a shift from "wild west" growth toward maturity and mainstream adoption. Let’s now look at their detailed impacts on different crypto sectors.

Stablecoins: Stepping Into the Spotlight

Stablecoins are undoubtedly one of the dominant narratives in global financial markets this year. From Circle, issuer of USDC, seeing its stock surge 900% in three weeks post-IPO, to JD.com and Ant Group launching Hong Kong dollar-pegged stablecoin initiatives, and Citigroup's CEO announcing exploration into issuing stablecoins—each step indicates that stablecoins, once vilified after the Terra crash, are steadily moving into the mainstream spotlight.

The GENIUS Act formalizes a regulatory framework for stablecoins, granting them legitimacy and stability. The $2.38 trillion stablecoin market is already central to global payments and DeFi. Ripple effects are emerging: banks and retail giants (Walmart, Amazon, etc.) are integrating stablecoin payments, accelerating their use in cross-border remittances and transactions. DeFi protocols reliant on stablecoin liquidity (Aave, Curve, etc.) will also see increased TVL as a result.

Exchanges and DeFi: Catalysts for Innovation and Institutional Capital

By clearly defining regulatory oversight, the CLARITY Act removes compliance hurdles for exchanges and DeFi, unleashing significant potential. Centralized exchanges like Coinbase and decentralized platforms like Uniswap have long faced repeated enforcement actions from the SEC and CFTC due to regulatory ambiguity. Once the bill passes, reduced compliance costs will drive trading volume surges and attract more retail and institutional users.

Opportunities in DeFi will be especially pronounced: regulatory clarity could激励 developers to launch new protocols, fueling explosive growth in Web3, NFTs, and decentralized identity (DID).

Hidden opportunities include institutional inflows and a startup boom: financial institutions may accelerate launches of more crypto ETFs, while developer protection clauses could spark a wave of blockchain startups, attracting venture capital. Compared to the EU’s strict regulations, U.S. leniency could create substantial cross-border arbitrage opportunities for investors.

Decentralized Assets: Building a Moat Around "Privacy"

The Anti-CBDC Act defends decentralization, reinforcing BTC’s role as "digital gold" and opening new frontiers for privacy technologies. Bitcoin gains driven by institutional investment and community belief will be further amplified by the bill’s passage, strengthening its anti-censorship narrative and attracting long-term holders. Privacy coins (Monero, Zcash, etc.) and anonymity tech will also rise amid growing demand for privacy protection.

Unlike other nations advancing CBDCs, proponents of the Anti-CBDC Act argue that government-issued CBDCs would function as financial surveillance tools, directly contradicting Web3’s core principle of decentralization. The U.S. taking an early stand against CBDCs will likely make it a preferred “base” for crypto communities and capital. If the U.S. becomes a safe haven for decentralized assets, its appeal in the global crypto market will grow stronger.

Crypto Week Sets the Tone for the Industry’s Future

Since the rise of the so-called "crypto president" Trump, the U.S. government’s stance on cryptocurrencies has undergone a dramatic shift.

Wall Street institutions and U.S.-listed companies have sensed this change. Regulatory clarity eliminates their last reservations about entering the space. A market without rules can only absorb limited capital, but one with clear rules can welcome massive inflows. This will undoubtedly drive huge investments into mainstream cryptos like BTC and ETH, as well as broader crypto sectors.

Structural Investment Opportunities Amid the Legislative Wave

Given this transformative trend, what opportunities might investors consider?

Note: All views below reflect the author’s personal insights and experience, not investment advice. The crypto market is highly volatile. While legislation brings tailwinds, thorough research remains essential.

-

GENIUS Act (Stablecoins)

The GENIUS Act’s greatest contribution is injecting regulatory momentum into the stablecoin market, boosting its use in payments and DeFi, with potential for rapid market expansion.

The bill’s relatively lax regulatory environment compared to the EU’s MiCA could attract more global stablecoin issuers to register in the U.S., creating regulatory arbitrage opportunities.

Beyond Circle and Tether, when more companies can issue and operate compliant stablecoins, their stocks may benefit from favorable crypto narratives and deliver strong performance.

Additionally, wallet providers—the front-end for stablecoin usage—will gain unprecedented opportunities. Wallets integrating KYC/AML features will attract more institutional and retail users.

In terms of specific assets, cryptocurrencies such as USDC, USDT (growing market share); DeFi protocols like Aave, Compound (lending), Curve (stablecoin swaps); and U.S. stocks such as Circle (CRCL), Coinbase (COIN, high stablecoin trading volume), PayPal (PYPL, exploring stablecoin payments), Visa/Mastercard (V/MA, payment integration) warrant close attention.

(Reference: GENIUS Act Passes Vote—Which Crypto Assets Will Benefit?)

-

CLARITY Act: Growth Potential for Exchanges and DeFi

By clarifying asset classification and protecting developers, the CLARITY Act reduces compliance costs for exchanges and DeFi projects, driving transaction volumes and innovation. Both centralized and decentralized exchanges will benefit from user growth.

Favored assets include: cryptocurrencies such as ETH (core of DeFi), SOL (high-performance blockchain), UNI (Uniswap); U.S. stocks such as Coinbase (COIN), Robinhood (HOOD, supports crypto trading), Grayscale (GBTC, Bitcoin/Ethereum trusts); DeFi protocols such as Uniswap, SushiSwap, Chainlink (cross-chain).

-

Anti-CBDC Act: Long-Term Value of Decentralized Assets

The Anti-CBDC Act bans the Fed from issuing a CBDC, enhancing Bitcoin’s appeal as a decentralized store of value and attracting long-term holders and institutional capital. The bill’s focus on privacy also creates narrative space for privacy coins (e.g., Monero, Zcash) and anonymous transaction technology.

Favored assets include: cryptocurrencies such as BTC, ETH, XMR, ZEC; U.S. stocks such as MicroStrategy (MSTR), Bitwise (BITW, crypto asset management), and companies holding ETH reserves; DeFi protocols such as Tornado Cash (anonymous transactions).

(Reference: ETH Reserve Companies Become Wall Street Favorites: Four Key Players and Their Backers)

Overall, the three bills are driving three major trends: accelerated institutional inflows, deeper integration between crypto and traditional finance, and the rise of Web3 startups.

If there were a recommended investment strategy, it would be: short-term focus on stablecoin-related assets and companies, mid-term allocation to blue-chip DeFi projects, and long-term positioning in BTC, privacy coins, and Web3 startups compliant with new regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News