The crypto market five years ago was actually healthier than it is today.

TechFlow Selected TechFlow Selected

The crypto market five years ago was actually healthier than it is today.

Dorman calls for a return to the fundamental nature of “tokens as securities wrappers,” focusing on equity-like assets with cash flow generation capabilities, such as DePIN and DeFi.

Author: Jeff Dorman (Arca CIO)

Translated by: TechFlow

TechFlow Introduction:

Is the crypto market becoming increasingly dull? Jeff Dorman, Chief Investment Officer at Arca, argues in this article that although infrastructure and regulatory environments have never been stronger, the current investment environment is the worst in history.

He sharply critiques industry leaders’ failed attempt to forcibly reposition cryptocurrencies as “macro trading tools,” resulting in extreme correlation across asset classes. Dorman calls for a return to the fundamental nature of tokens—as securities—and urges focus on quasi-equity assets with cash-flow-generating potential, such as DePIN and DeFi protocols.

At a time when gold is surging while Bitcoin lags, this deeply reflective piece offers a vital perspective for re-evaluating Web3 investment logic.

The Full Article:

Bitcoin Is Facing an Unfortunate Situation

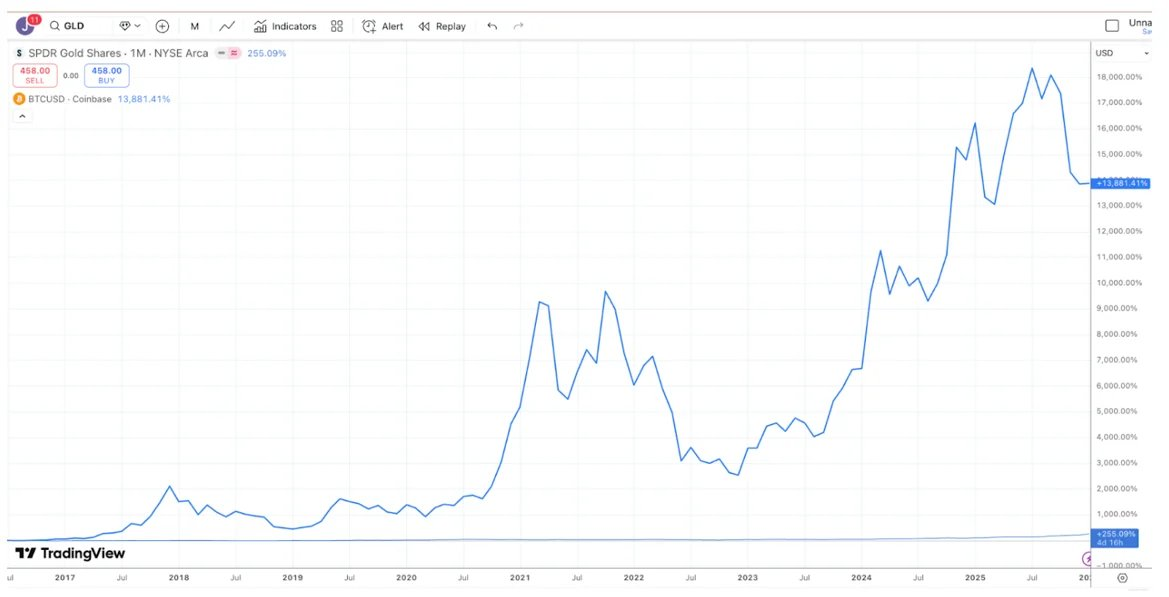

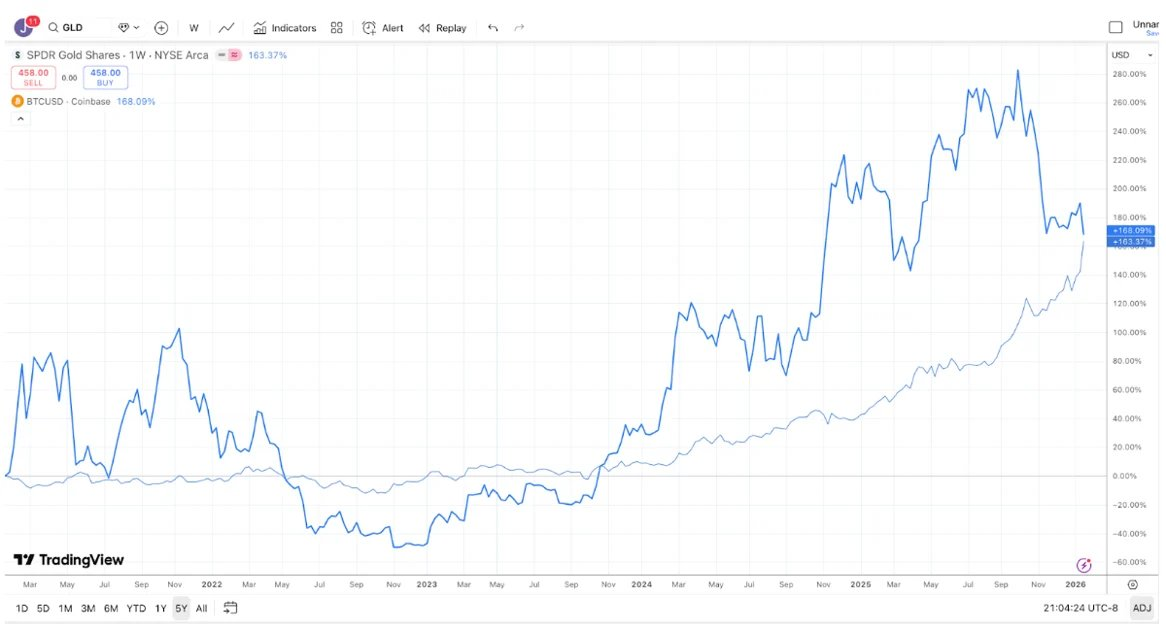

Most investment debates exist because participants operate on different time horizons—leading to frequent “talking past each other,” even though both sides may technically be correct. Take the debate between gold and Bitcoin: Bitcoin enthusiasts tend to claim Bitcoin is the superior investment, citing its far stronger performance over the past decade compared to gold.

Caption: Source TradingView—BTC vs. GLD returns over the past 10 years

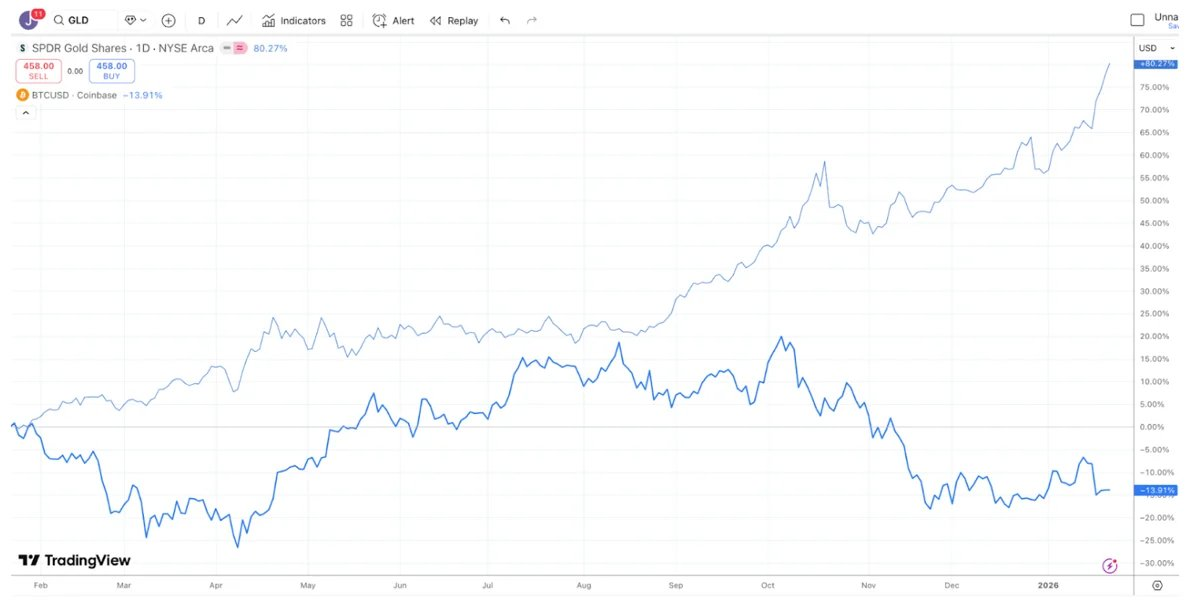

Gold investors, meanwhile, argue gold remains the best investment—and have recently mocked Bitcoin’s weakness, as gold has clearly outperformed Bitcoin over the past year (silver and copper show similar trends).

Caption: Source TradingView—BTC vs. GLD returns over the past year

Yet over the past five years, gold and Bitcoin delivered nearly identical returns. Gold often sits dormant for extended periods before soaring when central banks and trend-following investors step in; Bitcoin tends to surge dramatically, then crash sharply—but ultimately climbs higher.

Caption: Source TradingView—BTC vs. GLD returns over the past 5 years

Thus, depending on your investment horizon, you can effectively win—or lose—any argument about Bitcoin versus gold.

Nonetheless, it is undeniable that gold (and silver) have recently outperformed Bitcoin. In some ways, this is almost comical—or tragic. The largest companies in the crypto industry spent the past decade catering to macro investors rather than fundamental investors—only for those very macro investors to respond: “No thanks—we’ll just buy gold, silver, and copper.” We’ve long urged the industry to shift its mindset. There are over $60 trillion in fiduciary assets, held by a far stickier investor base. Many digital assets resemble bonds or equities—issued by revenue-generating companies that conduct token buybacks—yet market leaders inexplicably chose to ignore this entire token subsector.

Perhaps Bitcoin’s recent underperformance relative to precious metals will finally prompt major brokerages, exchanges, asset managers, and other crypto leaders to recognize their failed experiment of repositioning crypto as an all-encompassing macro trading tool. Instead, they may pivot toward educating—and targeting—the $60 trillion investor pool inclined to purchase cash-flow-generating assets. It’s not too late for the industry to begin focusing on quasi-equity tokens tied to cash-flow-generating technology businesses—including DePIN, CeFi, DeFi, and token issuance platform companies.

That said, if you simply move the finish line, Bitcoin remains king. So more likely than not—nothing will change.

Asset Differentiation

The “good old days” of crypto investing seem like ancient history. Back in 2020 and 2021, new narratives, sectors, use cases, and token types emerged almost monthly—and positive returns could be found across every corner of the market. While blockchain’s growth engine has never been stronger—fueled by legislative progress in Washington, stablecoin expansion, DeFi innovation, and real-world asset (RWA) tokenization—the investment environment has never been worse.

A healthy market exhibits dispersion and low cross-market correlation. You naturally expect healthcare and defense stocks to behave differently from tech and AI stocks—and emerging-market equities to decouple from developed-market equities. Dispersion is generally viewed as a positive sign.

2020 and 2021 are broadly remembered as “broad-based rallies,” but reality was more nuanced. Synchronized moves across the entire market were rare. More commonly, one sector rose while another fell: gaming tokens surged while DeFi declined; DeFi rallied while “dino-L1” tokens slumped; Layer-1 tokens soared while Web3 underperformed. A diversified crypto portfolio actually smoothed returns—and typically lowered overall portfolio beta and correlation. Liquidity ebbed and flowed with shifting interest and demand, yet returns remained heterogeneous. That was genuinely exciting. It made perfect sense for massive capital inflows into crypto hedge funds during 2020–2021: the investable universe was expanding, and returns were differentiated.

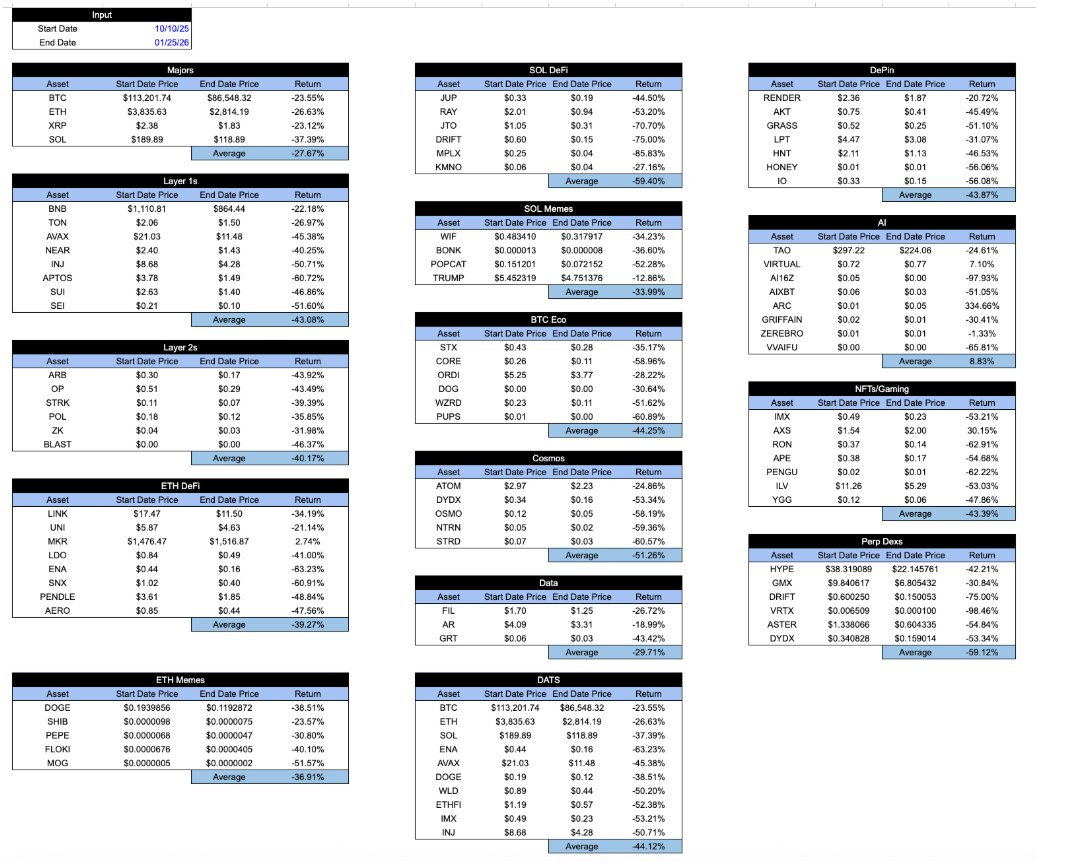

Fast-forward to today: all assets “wrapped” in crypto packaging deliver nearly identical returns. Since the flash crash on October 10, sector-wide drawdowns have been virtually indistinguishable. Regardless of what you hold—how the token captures economic value—or the project’s development trajectory—returns are largely uniform. This is profoundly frustrating.

Caption: Internal Arca calculations and CoinGecko API data for a representative sample of crypto assets

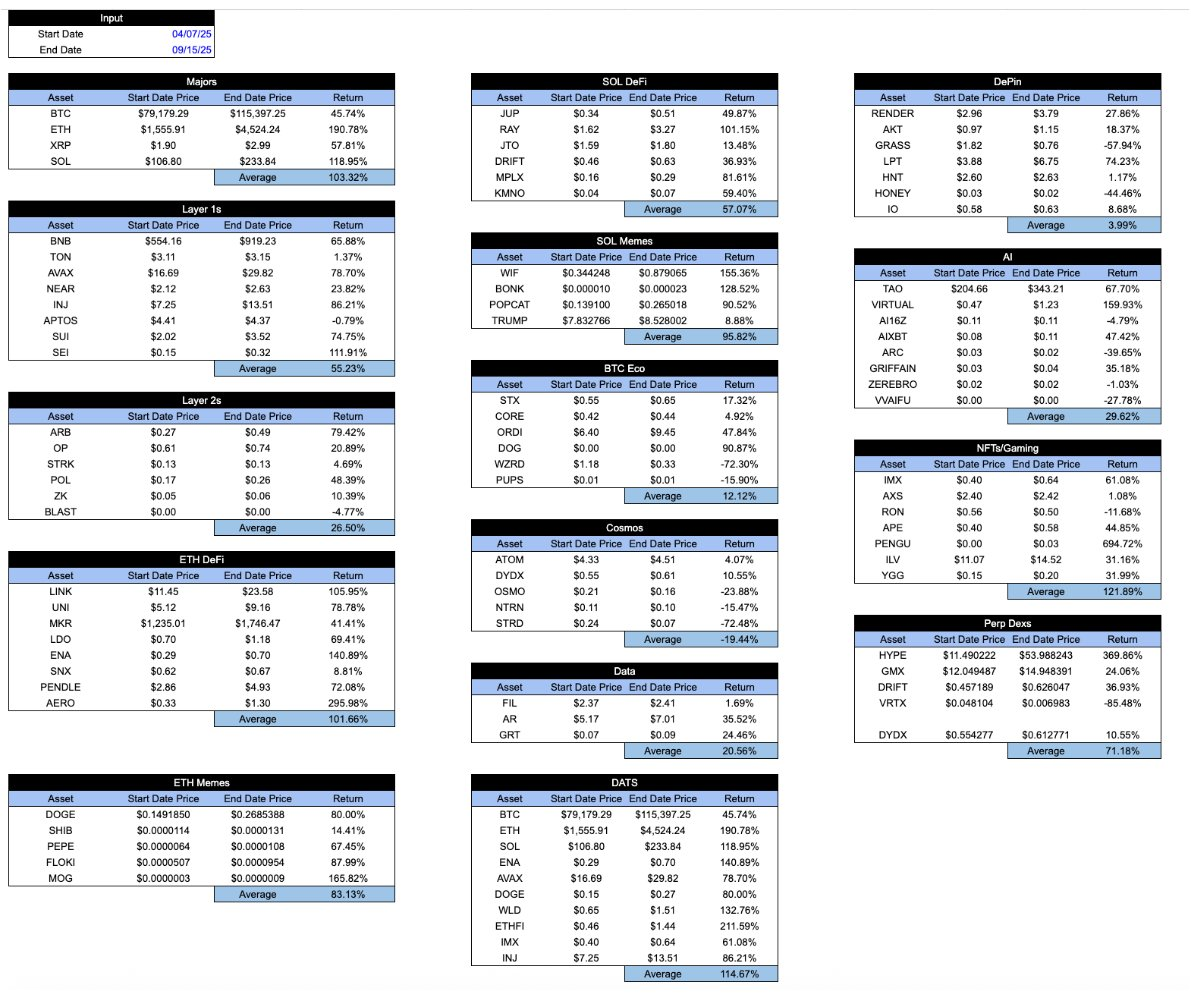

During bull markets, this table looks slightly more encouraging: “good” tokens often outperform “bad” ones. But a healthy system should work the opposite way—you want good tokens to outperform during bad times, not just in good ones. Below is the same table covering the period from the April 7 low to the September 15 high.

Caption: Internal Arca calculations and CoinGecko API data for a representative sample of crypto assets

Interestingly, during crypto’s infancy, market participants worked hard to distinguish among crypto asset types. For instance, in a 2018 article I wrote, I categorized crypto assets into four buckets:

- Cryptocurrencies/Money

- Decentralized Protocols/Platforms

- Asset-Backed Tokens

- Pass-Through Securities

This classification was novel at the time and attracted many investors. Crucially, crypto assets were evolving—from Bitcoin alone, to smart contract protocols, asset-backed stablecoins, and finally to equity-like pass-through securities. Researching distinct growth areas was the primary source of alpha; investors sought to understand the valuation methodologies appropriate for each asset type. Most crypto investors back then didn’t even know when unemployment claims data would be released—or when FOMC meetings occurred—and rarely looked to macro data for signals.

These distinct asset categories survived the 2022 crash. Fundamentally, nothing changed. But marketing approaches shifted dramatically. “Gatekeepers” declared Bitcoin and stablecoins the only things that mattered; media outlets decided they’d write only about TRUMP tokens and other memecoins. Over the past few years, not only did Bitcoin outperform most other crypto assets—but many investors even forgot these other asset types (and sectors) existed. Underlying companies’ and protocols’ business models didn’t become less relevant—but as investors fled and market makers dominated price action, asset correlations inevitably rose.

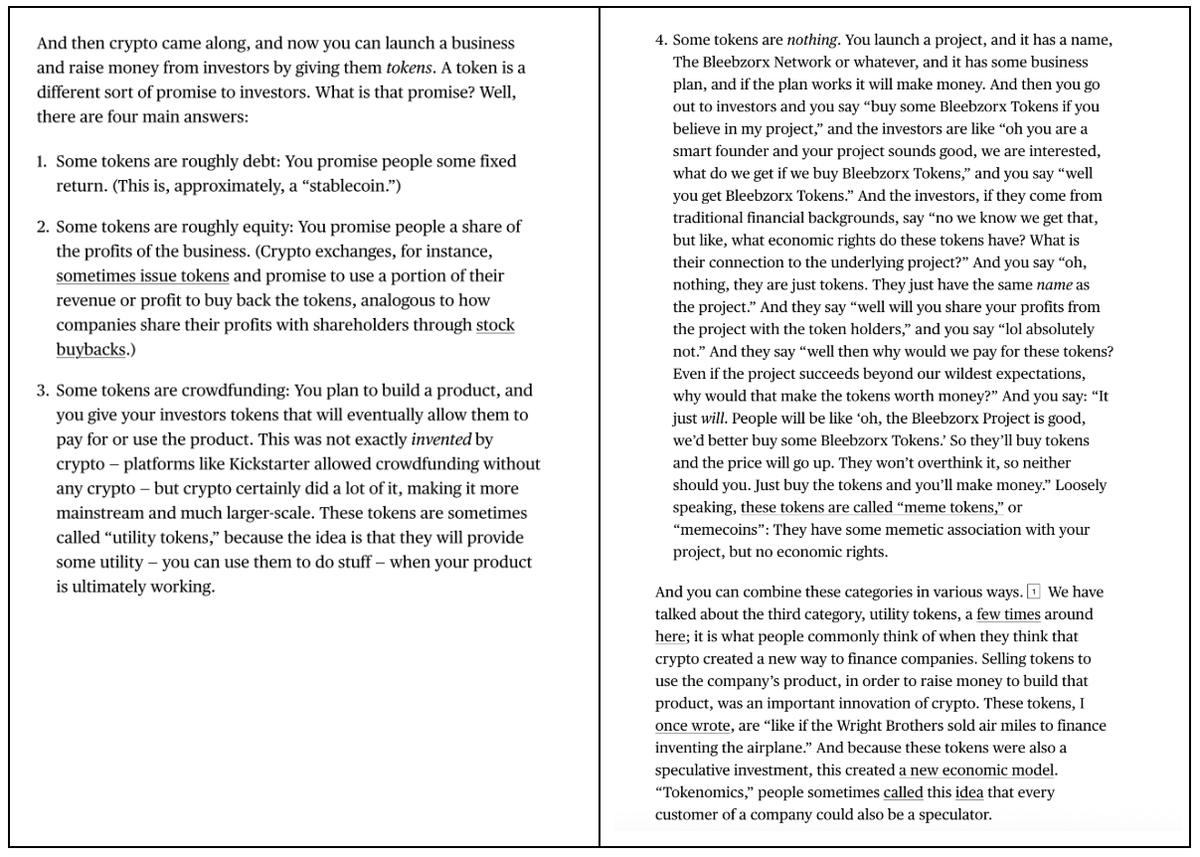

This is why Matt Levine’s recent article on tokens was so surprising—and widely praised. In just four paragraphs, Levine precisely captured the distinctions and nuances among token types. It gave me hope that this kind of analysis remains viable.

Leading crypto exchanges, asset managers, market makers, OTC desks, and pricing services still refer to everything beyond Bitcoin as “altcoins”—and appear to publish only macro-focused research, bundling all “cryptocurrencies” together as one monolithic asset class. Did you know that Coinbase, for example, seems to maintain only a tiny research team led by a single lead analyst (David Duong), whose work focuses primarily on macro analysis? I have no issue with Mr. Duong—he produces excellent analysis. But who specifically visits Coinbase for macro insights?

Imagine if leading ETF providers and exchanges published only generic articles about ETFs—e.g., “ETFs Fell Today!” or “ETFs Reacted Negatively to Inflation Data.” They’d be laughed out of business. Not all ETFs are alike—just because they share the same “wrapper.” And those selling and promoting ETFs fully grasp this. What matters most is what’s inside the ETF—and investors appear capable of intelligently distinguishing among them, largely because industry leaders help clients understand the differences.

Likewise, a token is merely a “wrapper.” As Matt Levine eloquently described, what’s inside the token matters. Token type matters. Sector matters. Token attributes—whether inflationary or amortizing—matter.

Perhaps Levine isn’t the only one who understands this. But he explains the industry better than those who profit most directly from it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News