Washington "Crypto Week": How Will the Legislation Reshape the Fate of Cryptocurrencies?

TechFlow Selected TechFlow Selected

Washington "Crypto Week": How Will the Legislation Reshape the Fate of Cryptocurrencies?

"After the U.S. legislation supporting cryptocurrency passes, it can significantly boost the growth of the crypto industry while reducing risks."

Author: Matt Hougan, Chief Investment Officer at Bitwise

Translation: Luffy, Foresight News

Want to know why Bitcoin hit a new all-time high last week?

There are many reasons, including sustained demand from institutional investors and corporate treasuries. But one underreported factor is this: This week is "Crypto Week" in Washington, and you’ll see a wave of crypto-friendly news in the coming days.

This isn’t made up. On July 3, the U.S. House of Representatives quietly released a low-profile but highly significant press announcement formally declaring the week of July 14 as “Crypto Week,” pledging to advance three key cryptocurrency bills:

-

GENIUS Act: A clear regulatory framework for stablecoins

-

CLARITY Act: An overarching regulatory framework for digital assets

-

Anti-CBDC Surveillance State Act: A bill banning the United States from creating a central bank digital currency (CBDC)

The GENIUS Act has already passed the Senate, so if it clears the House, it will go to the President for signature and could become the first major crypto legislation in U.S. history.

The CLARITY Act and the Anti-CBDC Act still need Senate approval, but passage of either in the House would be a major milestone.

Why This Matters So Much for Crypto

I firmly believe that once pro-crypto legislation passes in the U.S., it will not only significantly drive growth in the crypto industry but also reduce risk.

The growth argument is obvious and widely discussed. Clear crypto legislation will better incentivize large financial institutions to build in crypto, bringing billions of dollars in investment into digital assets and guiding trillions in traditional capital onto blockchains. If you’ve ever wondered what crypto might look like with JPMorgan, BNY Mellon, and Nasdaq operating freely in the space, you’re about to find out.

But I think the bigger story lies in how this legislation affects risk—and how it will change the way crypto assets are traded in the future.

One of crypto’s biggest challenges has been its recurring history of blowups: FTX, Luna, Three Arrows Capital, Genesis, Celsius, QuadrigaCX, BitConnect, Mt. Gox.

Each failure dealt a massive blow to the industry and eroded investor trust. And each failure happened largely because of the lack of clear crypto regulation.

If clear rules allowed safer exchanges to operate domestically in the U.S., offshore platforms like FTX would never have flourished—with their weak internal controls and shoddy audits.

If major banks could custody crypto assets, investors wouldn’t shy away from crypto due to custody concerns.

If we had a law like the GENIUS Act, Ponzi-like stablecoins such as Luna would never have existed in the first place.

Of course, examples from traditional finance show that clear rules can’t prevent every scandal—Bernie Madoff’s fraud, Credit Suisse’s repeated misconduct were not stopped by regulations. But rules do make a big difference.

Another deterrent for investors is the frequent sharp drawdowns we see in Bitcoin and other crypto assets. Bitcoin has been the best-performing asset globally over the past 15 years, yet it has suffered seven declines of more than 70%.

For professional investors, it’s extremely difficult to buy an asset that could suddenly drop 70% due to a scandal on some unregulated offshore platform. As policymakers in Washington weigh these crypto bills, I believe the likelihood of such scandals will plummet.

Strong crypto legislation won’t eliminate market volatility, but I dare say that if these laws pass, crypto may never again experience drawdowns exceeding 70%.

Why I’m Not Worried About the Future of Crypto Policy

A common question people ask about crypto legislation is: Aren’t you worried the next administration could reverse these gains?

My answer: No.

Contrary to media narratives, crypto is one of the few policy issues with strong bipartisan support. The GENIUS Act passed the U.S. Senate by a vote of 68 to 30, with 18 Democratic senators voting in favor. It was one of the most bipartisan bills of the 2025 congressional session.

There are many reasons for this bipartisan backing, including crypto’s broad popularity among young voters. But perhaps the most important reason is support from the U.S. financial sector—traditionally a major source of funding for Democrats—who are eager to capture growth opportunities in crypto.

This economic incentive makes me confident that Washington’s support for crypto is sustainable in the long term. As more investors and companies get involved, it will become increasingly difficult for politicians to oppose crypto.

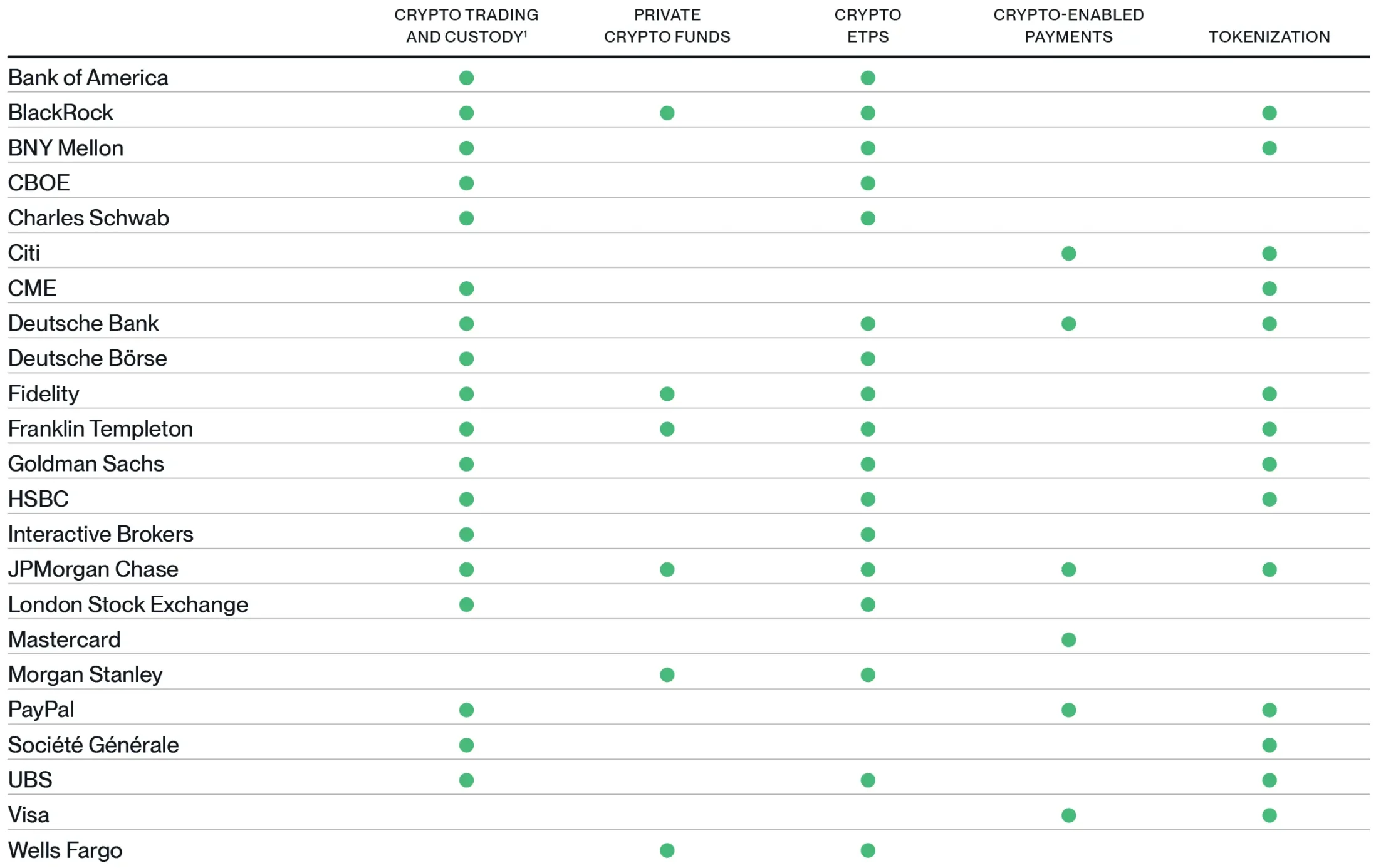

Consider this: Today, nearly every major U.S. financial institution has some exposure to crypto. Once BlackRock, JPMorgan, Morgan Stanley, thousands of American companies, and millions of Americans have made substantial investments in crypto, it becomes politically impossible to turn back.

Institutional Adoption of Crypto

Source: Bitwise Asset Management, data as of June 30, 2025. "Cryptocurrency trading and custody" includes spot, futures, and derivatives trading in digital assets.

In short: Once the genie is out of the bottle, it can’t be put back. If these bills pass Congress during Crypto Week and are signed into law, we’ll enter a new era.

Crypto is going mainstream, risks are falling, and Wall Street is moving in full force.

No wonder Bitcoin hit a new all-time high.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News