ETH Reserve Companies Become the New Darling of US Stocks: Reviewing Businesses and Backers of 4 Star Firms

TechFlow Selected TechFlow Selected

ETH Reserve Companies Become the New Darling of US Stocks: Reviewing Businesses and Backers of 4 Star Firms

Ethereum reserves have become the new darling of the U.S. stock market.

By TechFlow

There's a clear trend emerging recently: people are turning bullish on Ethereum once again.

From claims that "Ethereum is the oil of the digital age" to chants at EthCC of "ETH will hit $10,000"—what could reignite ETH’s momentum?

The answer might not lie on-chain, but in the U.S. stock market.

As "Bitcoin reserves" become the new trend among publicly listed companies, Ethereum reserves are now capturing Wall Street's attention.

Last week, SharpLink announced another purchase of 7,689 ETH, making it the public company holding the largest ETH reserve; its stock (SBET) surged nearly 30% the same day.

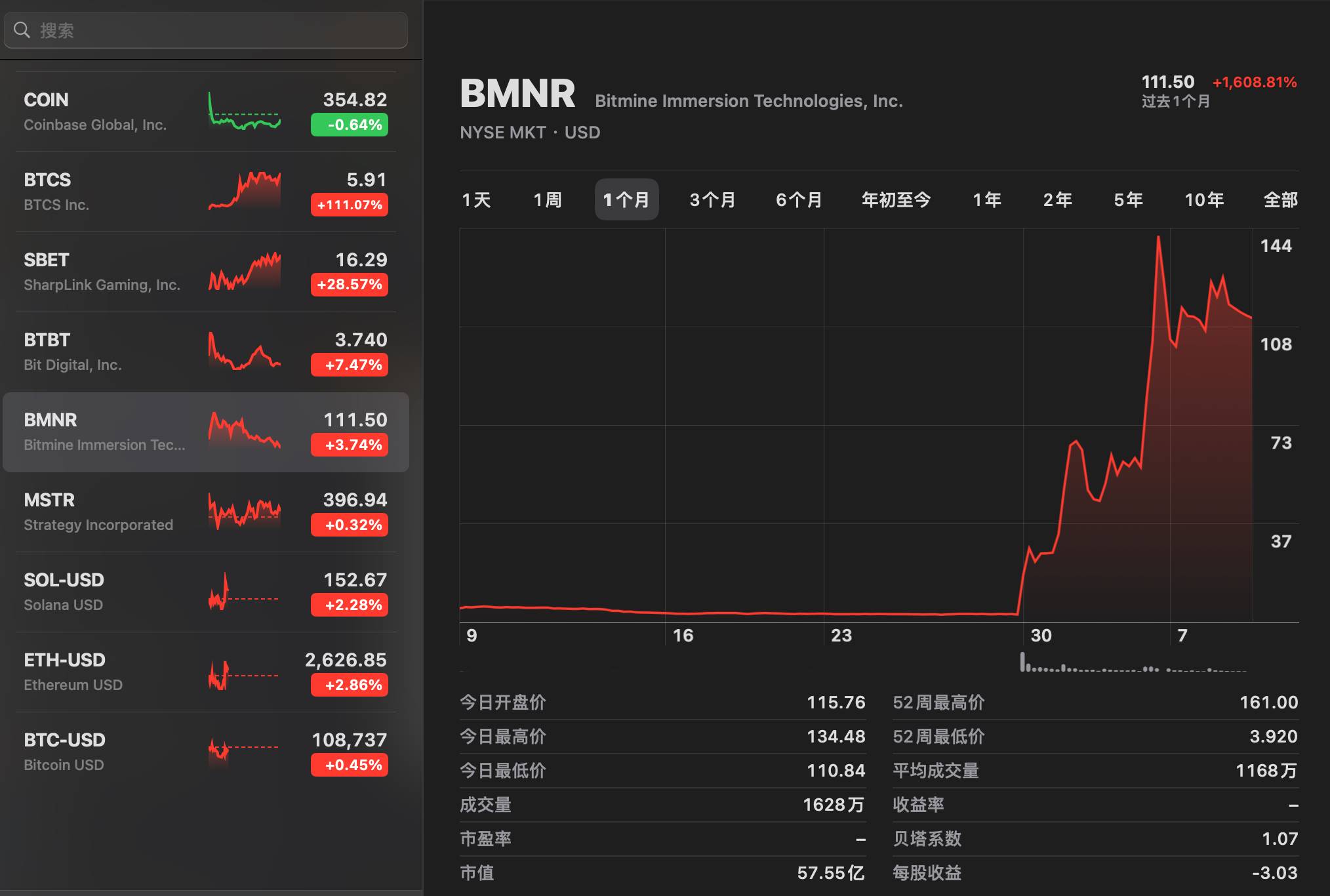

BitMine (BMNR), a Bitcoin mining firm, recently unveiled a $250 million ETH reserve initiative, aiming to emulate MicroStrategy. Its share price has already skyrocketed 16-fold in just one month—outperforming even some meme coins in short-term wealth creation.

Another U.S.-listed Bitcoin miner, Blockchain Technology Consensus Solutions (BTCS), followed suit by announcing plans on Tuesday to raise $100 million to buy ETH.

Upon the news, its stock surged 110%.

Even more aggressively, Bit Digital—engaged in both Bitcoin mining and Ethereum staking—announced a full pivot to Ethereum and selling off its Bitcoin holdings. Its stock BTBT jumped as much as 20% intraday yesterday.

These four firms represent a microcosm of how U.S. equities are embracing the Ethereum narrative—and they’ve become stars riding the wave of capital market sentiment.

Speculative capital has limited attention span. Markets rarely remember latecomers, which explains why these companies rush to announce their moves—to stake a clear claim and secure mindshare.

We’ve analyzed the business models and backing networks of these firms to offer insights for investors tracking crypto-equity convergence.

Different Businesses, Same Goal: Turning Around Losses

SharpLink (SBET), BitMine (BMNR), Blockchain Technology Consensus Solutions (BTCS), and Bit Digital (BTBT) have all bet heavily on ETH, each with distinct operational logic behind their soaring stock prices.

SharpLink (SBET): From Betting to Betting on ETH

SharpLink Gaming (SBET) primarily operates in online sports betting and partners with sports media companies to provide strategic, product, and innovation solutions.

However, in 2024, its revenue was only $3.66 million, down 26% year-on-year. It only returned to profitability after divesting parts of its business.

Prior to this shift, SBET had a market cap around $10 million, traded near delisting levels (below $1), shareholder equity under $2.5 million, and faced compliance pressures. Its core business offered limited growth in a fiercely competitive industry.

In May 2025, SBET raised $425 million via private placement to aggressively buy ETH and now holds 205,634 ETH (as of July 9).

This large-scale financing made it one of the world’s largest publicly traded ETH holders—second only to the Ethereum Foundation.

Public data shows over 95% of SBET’s ETH is deployed in liquid staking protocols, generating 322 ETH in staking rewards so far.

While staking yields positively impact cash flow and balance sheet health, the bigger win lies in repositioning: SBET transformed from a struggling penny stock into a sought-after “crypto growth story” on Wall Street.

Amid stagnant core operations and the surge in Ethereum ETFs, SBET’s pivot resembles a high-stakes gamble. With ETH constituting such a large portion of assets, its valuation is extremely sensitive to ETH price swings—especially since ETH tends to be more volatile than BTC.

BitMine (BMNR): From BTC Mine to ETH Vault

As the name suggests, BitMine Immersion Technologies (BMNR) is a Bitcoin mining company using immersion cooling tech across mines in Texas and Trinidad.

Through self-operated mining and third-party hosting, BMNR generates Bitcoin revenue.

In Q1 2025, the company reported $3.31 million in revenue, but high energy costs and low margins (a net loss of $3.29 million in 2024) left it struggling. Pre-transition, BMNR had a market cap of just $26 million. Its mining operations were constrained by rising costs and intense competition, leaving little room for growth.

On June 30, the company announced a private fundraising round to acquire approximately 95,000 ETH, though actual holdings haven’t been disclosed. Following the announcement, BMNR’s share price rocketed from $4.50 to $111.50—an over 3,000% gain since June.

The surge lifted BitMine’s market cap to roughly $5.7 billion. Unlike SBET, BitMine continues operating its original Bitcoin mining business, suggesting its ETH reserve move may be more about short-term narrative than long-term strategy.

Blockchain Technology Consensus Solutions (BTCS): Old Business, New Narrative That Fits

BTCS differs from the previous two—its ETH reserve aligns naturally with its historical operations.

Founded in 2014, BTCS is one of the earliest Nasdaq-listed blockchain infrastructure firms. Its core business centers on operating infrastructure for Ethereum and other proof-of-stake (PoS) blockchains, including running Ethereum validator nodes and offering ChainQ, a data analytics platform providing staking and data services to DeFi and enterprise clients.

Still, its financials remain weak.

In 2024, BTCS generated about $2.6 million in revenue, down 12%, due to high node operation costs and increased competition. Net losses reached $5.8 million, trapped in a cycle of high investment with low returns.

BTCS has held ETH and operated validators since 2021, accumulating 14,600 ETH—well before the recent wave of corporate ETH accumulation. In June–July 2025, BTCS accelerated its ETH acquisition through Aave-based DeFi borrowing and traditional fundraising. On July 8, it announced plans to raise $100 million to further expand its ETH position.

Objectively, increasing ETH holdings strengthens BTCS’s core node validation capacity, boosting gas fee income and competitiveness. The market responded enthusiastically—the announcement sent BTCS shares up over 100% in a single day, jumping from $2.50 to $5.25.

Bit Digital (BTBT): Selling BTC, Fully Embracing ETH

Bit Digital, Inc. (BTBT), headquartered in New York, was founded in 2015 focusing initially on Bitcoin (BTC) mining. Since 2022, it gradually expanded into Ethereum staking infrastructure, GPU cloud computing, and asset management.

Financially, the company remains in the red. Its Q1 2025 report showed $25.1 million in revenue, but adjusted net losses of around $44.5 million.

In July 2025, BTBT raised $172 million via public offering and sold 280 BTC to increase its ETH holdings to 100,603 ETH (worth ~$264 million), making ETH account for 60% of its total assets. This places it second only to SharpLink in corporate ETH holdings.

Clearly, all four firms share common traits: poor financial health and low market caps—similar to low-revenue, low-cap protocols in crypto. Once they capture a compelling narrative and investor attention, their valuations can surge rapidly.

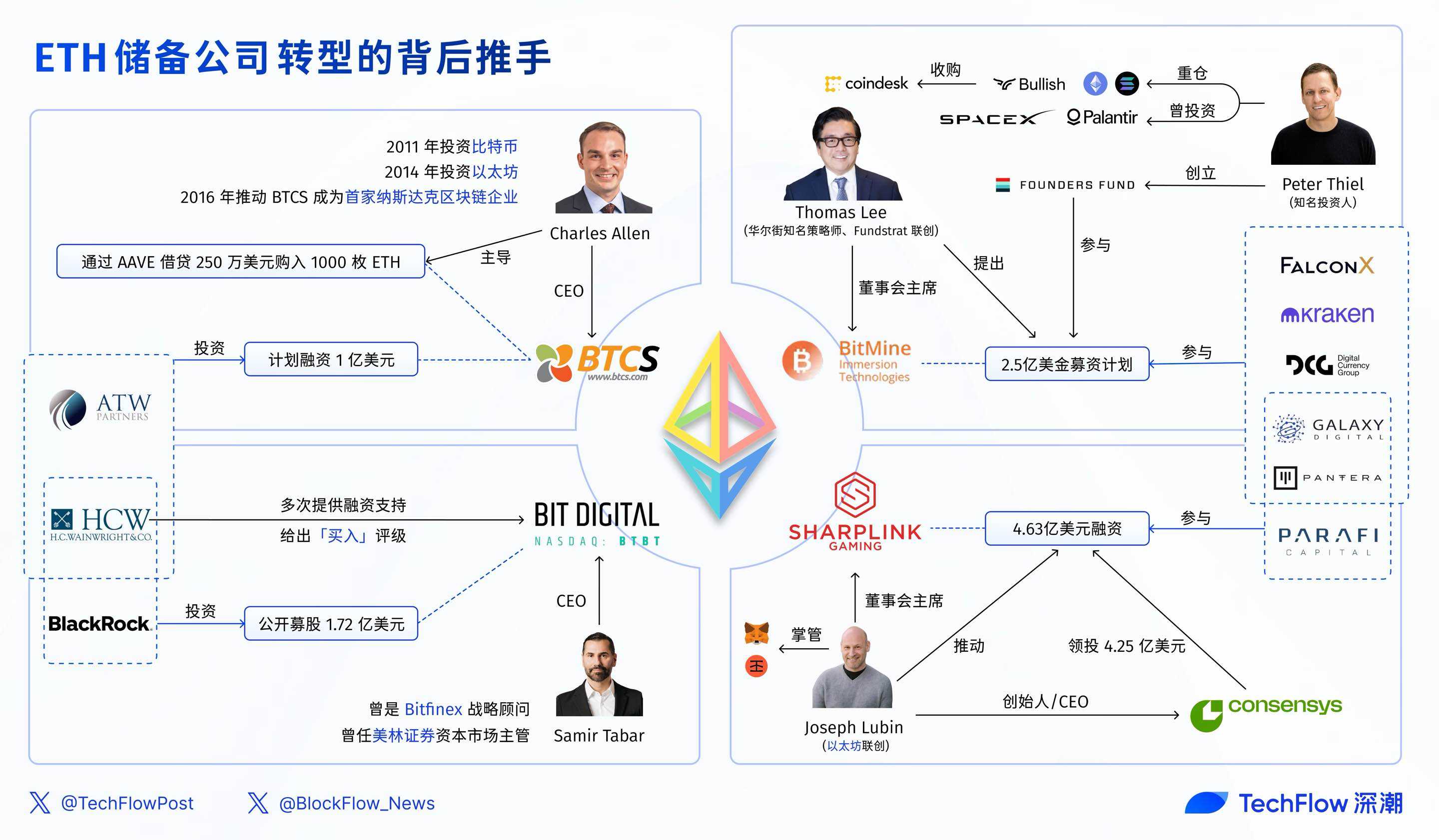

The Key Players Behind the Transformation

David Hoffman, co-founder of Bankless, offered a sharp insight in a recent article regarding the ETH reserve phenomenon:

"The strategy is simple: put ETH on your balance sheet, then sell ETH to Wall Street... Ethereum already has strong narratives; what ETH needs is someone energetic enough to excite Wall Street."

Connections are bridging crypto stories into traditional capital markets. From crypto titans to Wall Street insiders, each of these four companies has influential figures behind them.

SharpLink: Ethereum Co-Founder and His Crypto Alliance

SBET’s journey from near-delisting to becoming the largest corporate ETH holder was orchestrated by Ethereum co-founder Joseph Lubin.

As founder and CEO of ConsenSys, Lubin oversees critical Ethereum infrastructure such as MetaMask wallet and Infura—one of the largest Ethereum API providers handling over 50% of network traffic.

In May 2025, Lubin joined SBET’s board as chairman and spearheaded a $463 million fundraising round. This effort was closely tied to major crypto VCs who’ve backed Ethereum ecosystem projects:

His own firm, ConsenSys, led a $425 million private placement, joined by ParaFi Capital (top-tier DeFi VC behind Uniswap and Aave), Pantera Capital (early Ethereum investor managing over $5 billion), and Galaxy Digital (manager of Ethereum ETFs), among others.

Although some in the community suspect collusion with the Ethereum Foundation, Lubin’s connections and ConsenSys’ resources undeniably give SBET the potential to lead Ethereum’s integration into Wall Street.

BitMine: Thomas Lee and Silicon Valley VC Network

Thomas Lee, renowned Wall Street strategist and co-founder of Fundstrat, known for his accurate market calls, is the mastermind behind BitMine’s (BMNR) ETH reserve strategy.

Lee has been bullish on Bitcoin since 2017. In 2024, he predicted ETH would reach $5,000–$6,000. In June 2025, he officially joined BMNR’s board as chairman.

In an interview, he explained his rationale for backing Ethereum:

"Frankly, my real reason for choosing Ethereum is the explosion of stablecoins. Circle is one of the best IPOs in five years, trading at 100x EBITDA, delivering strong returns for funds... Stablecoins are crypto’s ChatGPT—they’ve gone mainstream, and they’re evidence that Wall Street is trying to 'equitize' tokens. Meanwhile, the crypto world is 'tokenizing' equity—like tokenized dollars."

He also stated on CNBC that BMNR would become the “MicroStrategy of Ethereum.”

Within BitMine’s $250 million fundraising plan, we see participation from Founders Fund, the prominent Silicon Valley VC founded by Peter Thiel. Known for early bets on SpaceX and Palantir, Founders Fund began investing heavily in crypto in 2021, including Ethereum, Solana, and Bullish Group—which later acquired CoinDesk.

Additionally, native crypto institutions like Pantera, FalconX, Kraken, Galaxy Digital, and DCG also participated.

Bit Digital: CEO Formerly Advised Bitfinex

Samir Tabar is the architect behind Bit Digital’s (BTBT) ETH reserve strategy, bringing cross-domain experience from Wall Street to crypto.

Tabar previously served as Head of Capital Markets at Merrill Lynch and was strategic advisor to Bitfinex from 2017 to 2018, where he optimized USDT transaction flows on Ethereum. He joined Bit Digital in 2021.

In a CNBC interview, Tabar described Ethereum as a "blue-chip asset reshaping the financial system," highlighting its vast potential in stablecoins and DeFi applications. His dual expertise in traditional finance and crypto lends credibility to Bit Digital’s transformation, and his use of the term “blue-chip asset” perfectly fits the renewed bullish narrative around Ethereum.

In June 2025, Bit Digital raised $172 million through an ATM public offering to buy ETH. Key backers included BlackRock and investment bank H.C. Wainwright, which has repeatedly supported Bit Digital’s financings and reaffirmed a “Buy” rating on BTBT in 2025, with a target price of $5–$7.

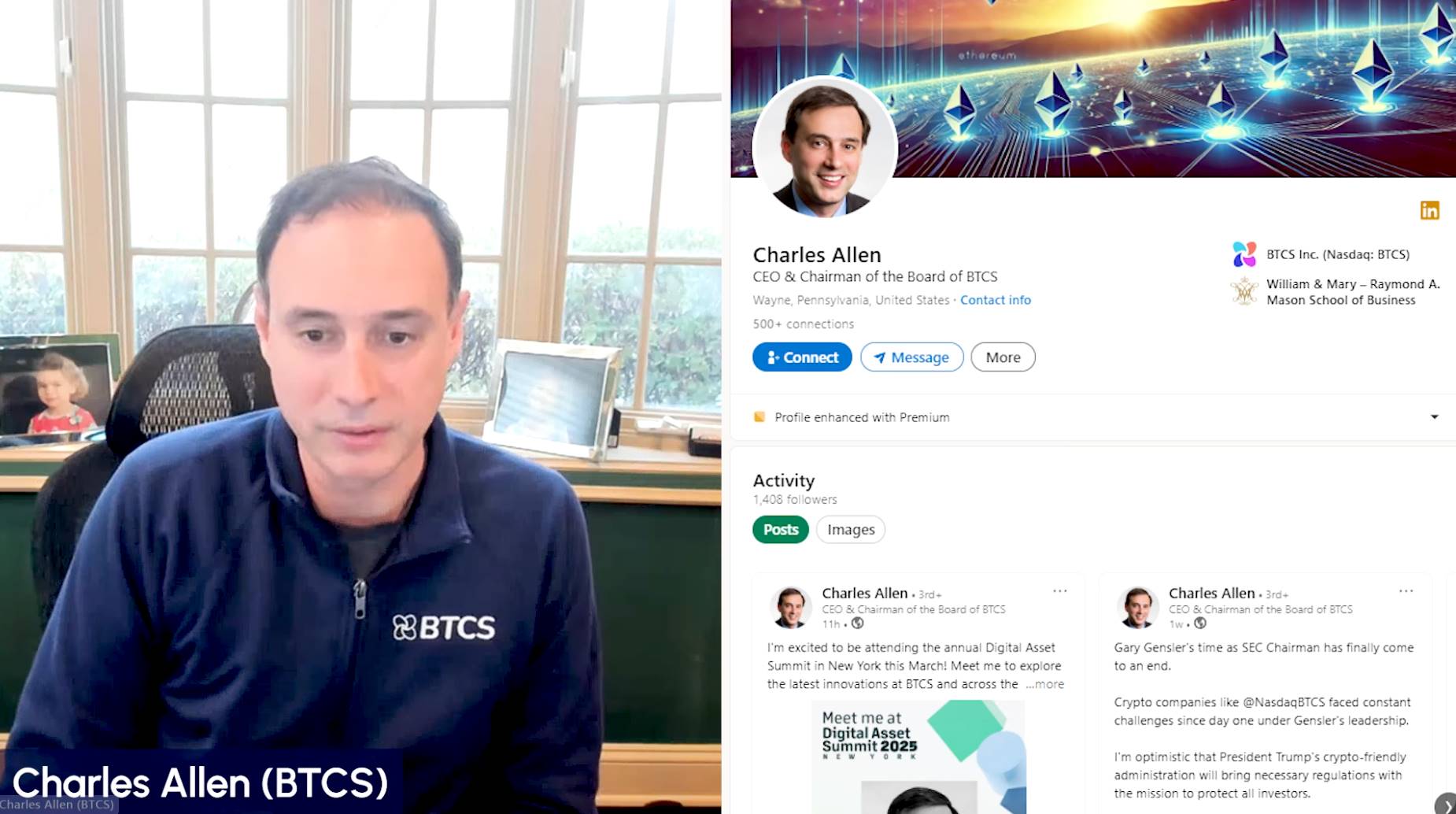

BTCS: Leveraging Aave to Borrow and Buy ETH

Compared to the others, BTCS CEO Charles Allen maintains a lower profile.

Yet he’s a veteran in the space—his blockchain journey began with Bitcoin investments in 2011, shifted to Ethereum in 2014, and in 2016, he led BTCS to become the first Nasdaq-listed blockchain company.

In June 2025, Allen led BTCS to borrow $2.5 million via Aave to purchase 1,000 ETH. In July, the company announced plans to raise $100 million. Backers include ATW Partners and H.C. Wainwright. The former is a New York-based hybrid venture capital/private equity firm investing in both debt and equity instruments.

A key takeaway from these four cases:

Each company has a central figure linked to the crypto world, and their funding sources show significant overlap.

Crypto funds and traditional investors with prior exposure to Ethereum are quietly driving this ETH reserve trend. The broad reach of Ethereum’s capital network may itself be a testament to the robustness of the Ethereum ecosystem.

Money never sleeps. As ETH-reserve firms become the new meme stocks of 2025, these corporate transformations are set to create a new wave of paper millionaires. For now, this crypto-equity feast shows no signs of ending.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News