AI + Crypto Payments: A New Paradigm for Digital Transformation

TechFlow Selected TechFlow Selected

AI + Crypto Payments: A New Paradigm for Digital Transformation

The integration of encrypted payments and AI is not merely a simple technological addition, but a fundamental restructuring of the economic logic of "value transfer - data processing - user incentives," giving rise to entirely new business paradigms.

Author: Oak Grove Ventures Research Team

Executive Summary

As the Web3 ecosystem integrates deeply with artificial intelligence (AI) technologies, the crypto payments landscape is undergoing a paradigm shift—from being merely a transactional tool to becoming an enabler of broader ecosystem empowerment. This report focuses on the emerging frontier of "crypto payments + AI," analyzing three key cases—Crossmints' solution for Boba Guys, AEON’s crypto payment protocol for AI agents, and the collaboration between Gaia Network and MoonPay—to reveal how technological integration is reshaping payment workflows, user incentives, and ecosystem interactions.

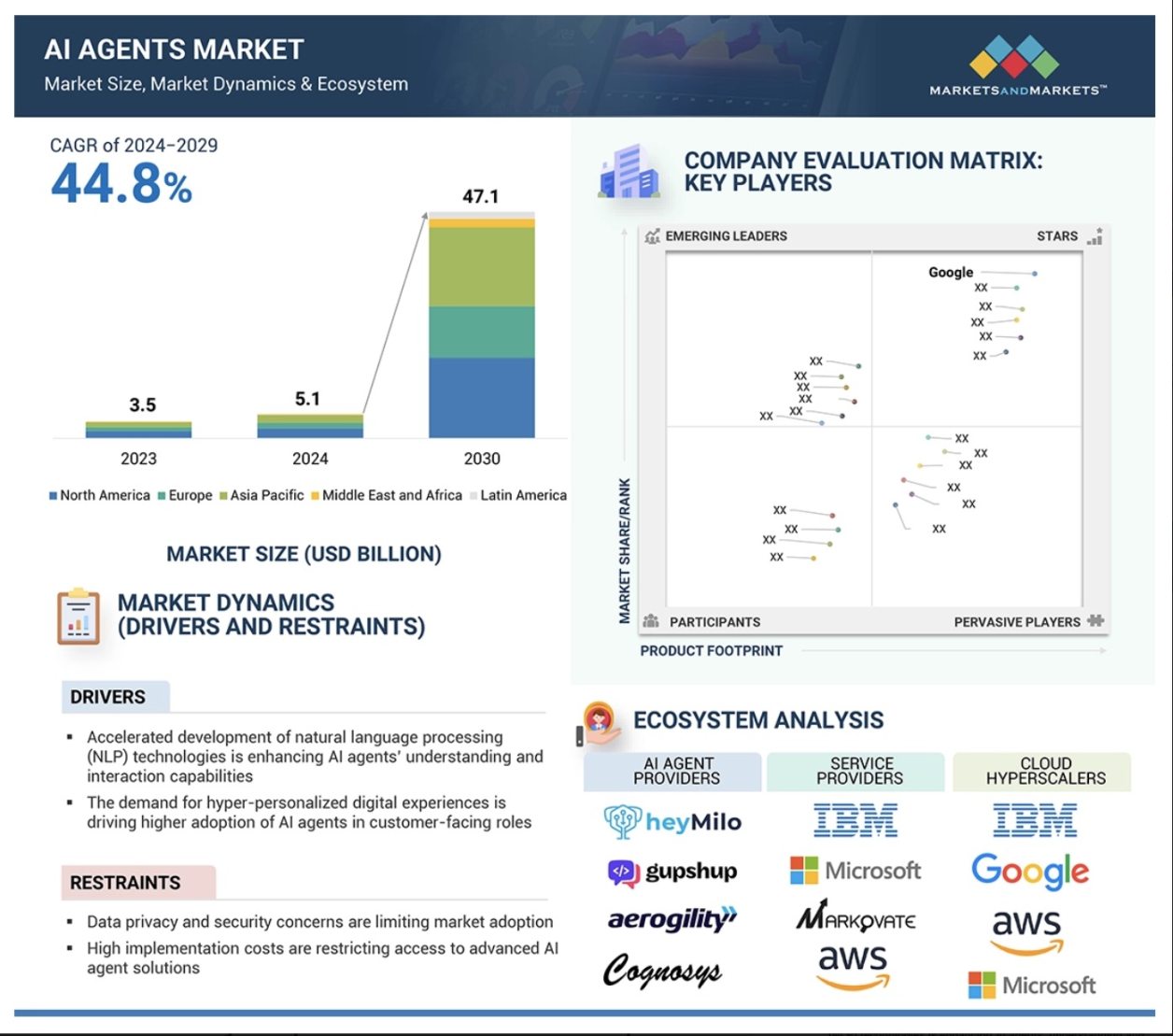

The core of this convergence lies in the synergy between technologies: AI endows payment systems with dynamic decision-making capabilities, while blockchain provides AI agents with a trustworthy execution environment, forming a closed loop of “on-chain data → intelligent processing → value transfer.” According to MarketsandMarkets, the AI agent market is projected to grow from $510 million in 2024 to $4.71 billion by 2030, representing a CAGR of 44.8%. As a critical value layer for AI agents, crypto payments are redefining Web3 interaction models—the digital transformation of traditional sectors is accelerating through the dual engine of “cryptocurrency payments + AI economic brain.”

This trend further demonstrates that technology convergence is breaking down barriers between on-chain and off-chain environments, offering replicable transformation pathways for DeFi, retail, and other industries. By placing users at the center, linking data value via crypto payments, and leveraging AI to enable intelligent coordination between assets and behaviors, the internet of value is approaching a tipping point toward large-scale adoption.

1. Why Are Crypto Payments Suitable for AI? – The Mechanistic Foundation of Integration

The reason crypto payments have become the preferred execution path for AI systems lies in their inherent operational synergy. Compared to traditional payment methods, cryptocurrency offers AI agents greater autonomy, stronger automation capabilities, and superior response efficiency—making it an indispensable infrastructure for realizing “intelligent execution.”

Firstly, crypto payments support native automated invocation, allowing AI to directly generate and operate wallets to complete actions such as payments, authorizations, and interactions—truly enabling the concept of “machine as user.” Secondly, on-chain transactions are transparent and traceable; each payment becomes verifiable data, providing real-world anchors for AI explainability.

Moreover, crypto supports multi-chain interoperability and micropayments, making it ideal for the high-frequency, low-value transactions typical across diverse AI applications. Simultaneously, on-chain behavior itself can be parsed and utilized by AI, creating a closed-loop mechanism of payment → data → feedback, enhancing the system’s intelligent responsiveness.

Overall, crypto payments are not just tools for AI—they are integral components of its operational strategies and incentive mechanisms. Their integration opens vast opportunities for product innovation and business model development.

2. Case Studies

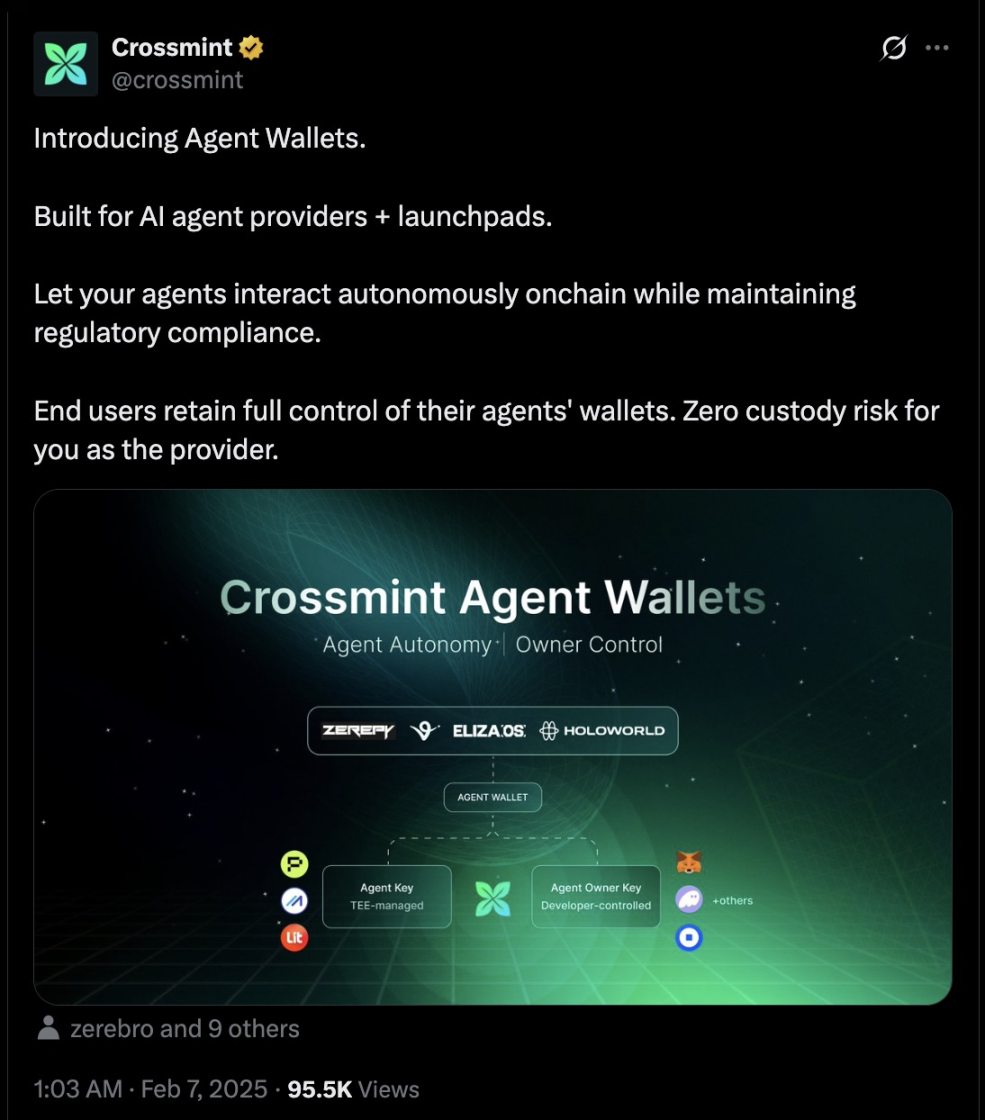

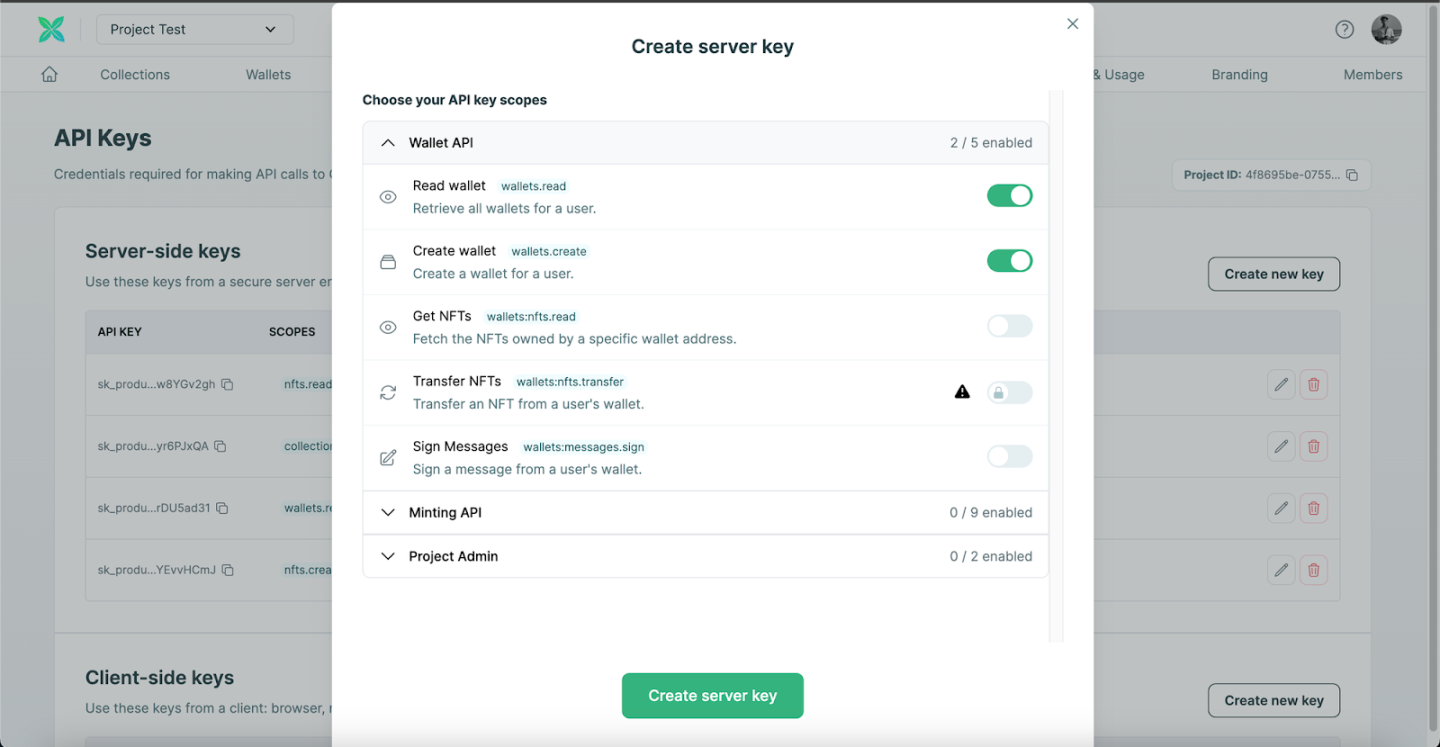

2.1 Crossmints: Web3 Infrastructure Empowering AI-Powered Payments

Crossmints, a leading player in the Web3 infrastructure space, has built an efficient suite of integrated payment tools for enterprises and developers, equipping AI agents with practical economic agency and enabling deep fusion between crypto payments and intelligent execution. Its system supports one-click wallet creation, on-chain contract calls, automated transaction execution, and compatibility with major networks including Ethereum, Polygon, and Solana.

Notably, Crossmints offers dynamic cross-chain switching. When Ethereum experiences congestion leading to soaring fees and delayed confirmations, the system continuously monitors network conditions and intelligently switches to more optimal chains—such as Polygon—based on metrics like gas costs and transaction speed. This entire process requires no manual intervention, significantly improving transaction efficiency and reliability.

Crossmints has achieved significant progress in integrating crypto payments with AI. The following case study with Boba Guys illustrates this impact.

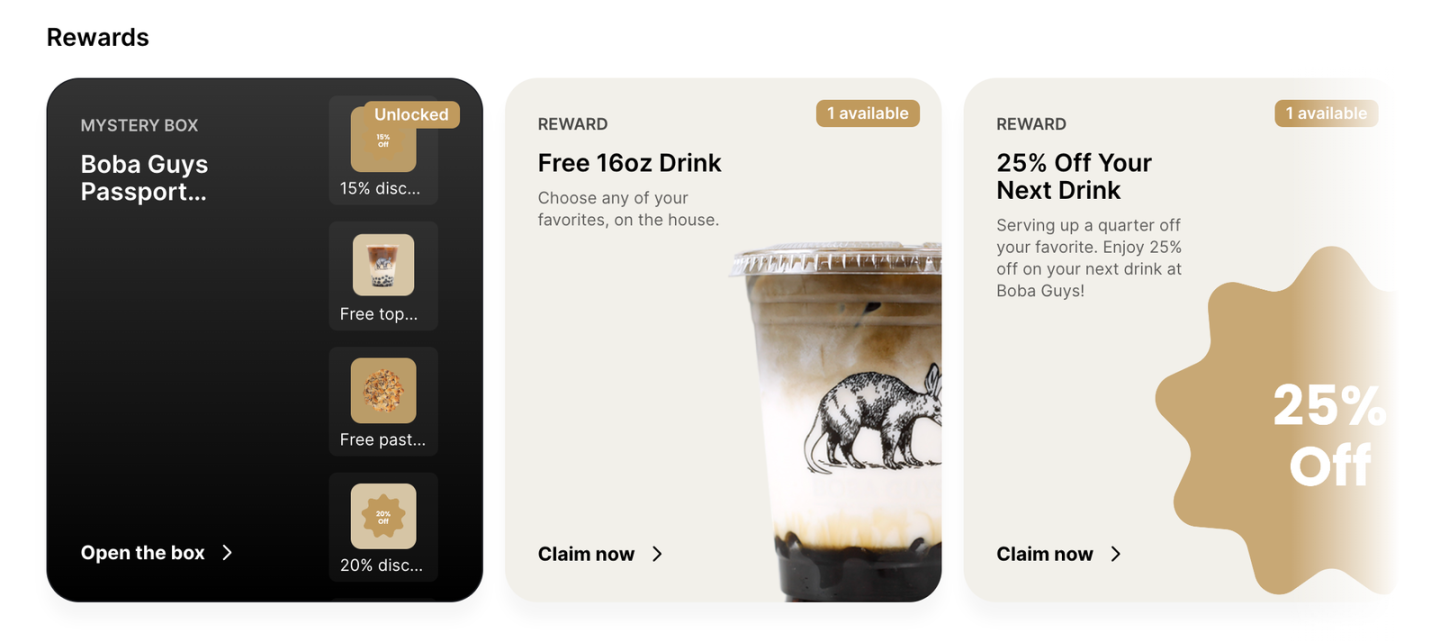

2.1.1 Boba Guys + Crossmints Case: AI-Driven On-Chain Loyalty Program Using Crypto Payments

-

Core Overview

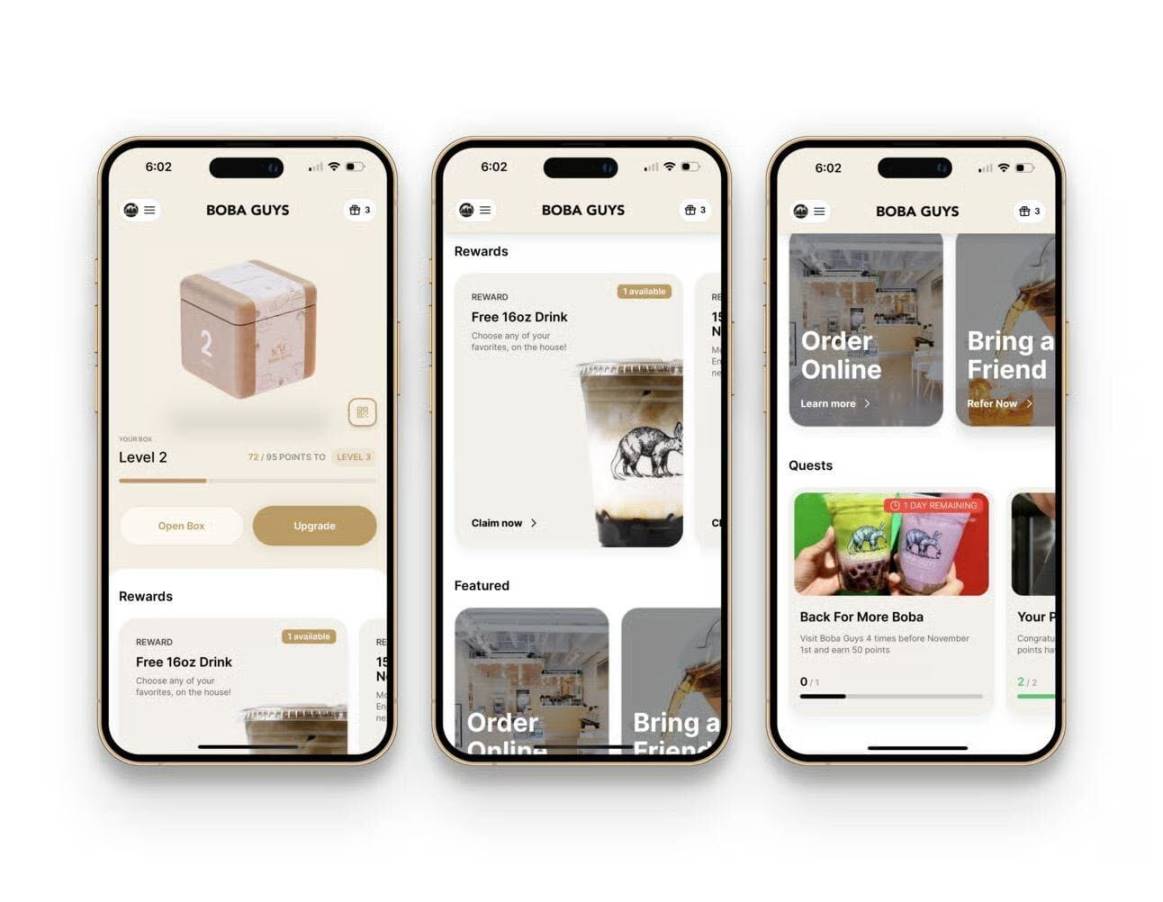

Boba Guys, a popular boba tea brand in the U.S., faced a disconnect between traditional payment systems and customer loyalty programs, preventing them from leveraging the full potential of crypto-based incentives. By partnering with Crossmints, Boba Guys launched an AI-driven, Solana-based on-chain loyalty program that tightly integrates crypto payments with user behavior data—enabling digital transformation in a conventional retail setting. The project combines automatic wallet generation, seamless transaction experience, and multi-chain support, using AI to analyze spending patterns and deliver personalized marketing strategies, significantly boosting user engagement and payment efficiency.

Key Pain Points for Boba Guys

Fragmentation between traditional payment systems and loyalty programs prevented effective use of crypto incentives

Lack of AI integration made intelligent analysis of payment and behavioral data impossible

Crossmints’ Corresponding Solutions

Crypto Payment Integration

-

Automated Wallet Creation: Users receive a crypto wallet upon registration, supporting payments in major cryptocurrencies

-

Seamless Transaction Experience: No manual gas fee management required; all transactions are instantly recorded on-chain

-

Multi-Chain Support: Compatible with Ethereum, Polygon, and other blockchain networks

AI Applications

-

Behavioral Analysis: Builds user profiles based on purchase amount, frequency, category, and timing

-

Personalized Recommendations: Delivers targeted promotions and suggests new drink trials based on past preferences

-

Dynamic Incentives: Adjusts point redemption rates based on activity levels and sends retention rewards to inactive users

Results

-

Over 15,000 members joined the program within less than three months

-

Loyalty members increased store visits by over 244% compared to non-members

-

Loyalty members spent 3.5 times more than non-members

Innovation and Industry Implications

This case establishes a new retail paradigm: “crypto payment as user incentive.” By converting consumer behavior into on-chain, verifiable, and tradable digital assets (e.g., NFT rewards), Boba Guys not only boosted repeat purchases but also created a decentralized membership ecosystem.

In this process, Crossmints’ AI functions as a “data hub”—enabling real-time on-chain data recording and intelligent analytics while reducing operational overhead through automation. This offers a replicable transformation blueprint for traditional industries such as retail and food service: use crypto payments as the entry point and AI algorithms as the engine to rebuild the “payment → data → incentive” loop, driving physical-world scenarios toward digital and intelligent upgrades.

2.2 AEON: An AI-Powered Crypto Payment Protocol Redefining Agent Execution

Project Positioning

AEON is a crypto payment protocol designed specifically for AI agents, aiming to provide a cross-chain, highly available payment execution layer. Unlike traditional payment systems, AEON is not a standalone application but rather an embeddable payment interface serving various autonomous agents, smart contracts, and Web3 applications. Since late 2024, AEON has rapidly expanded, now covering multiple ecosystems including BNB Chain, Solana, TON, TRON, and Stellar.

2.2.1 AI-Driven Payment Execution Pathway

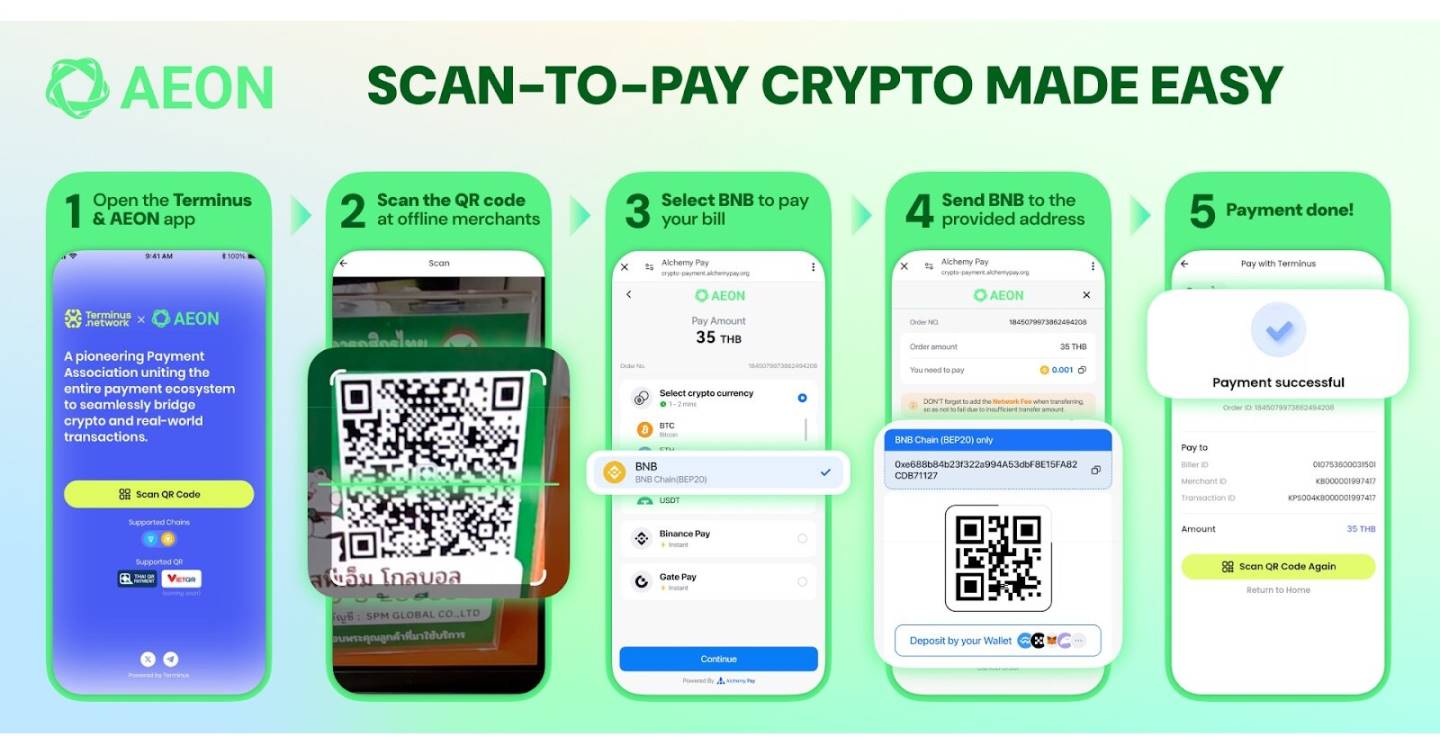

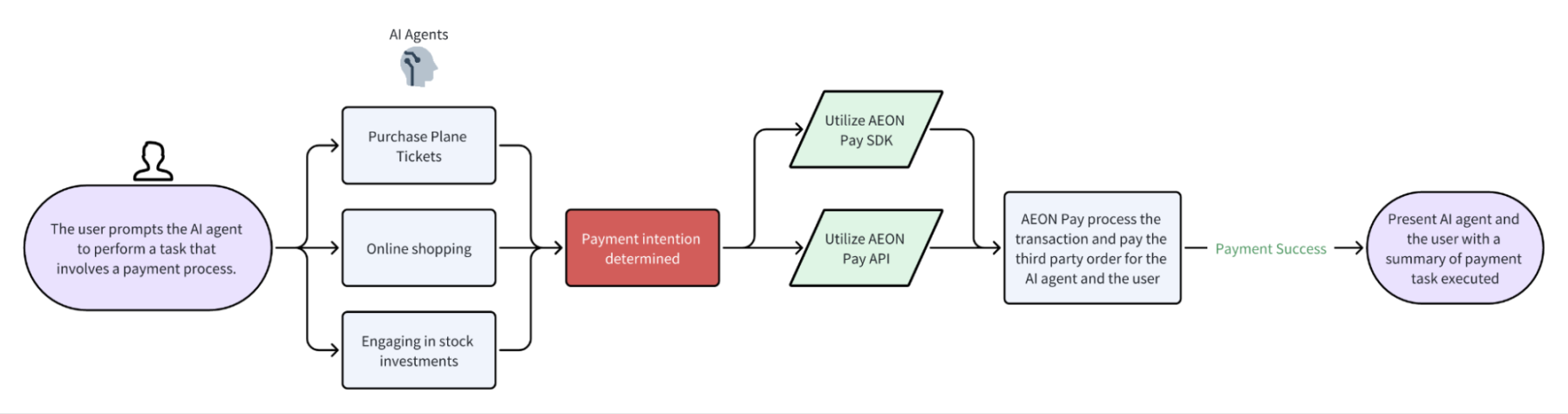

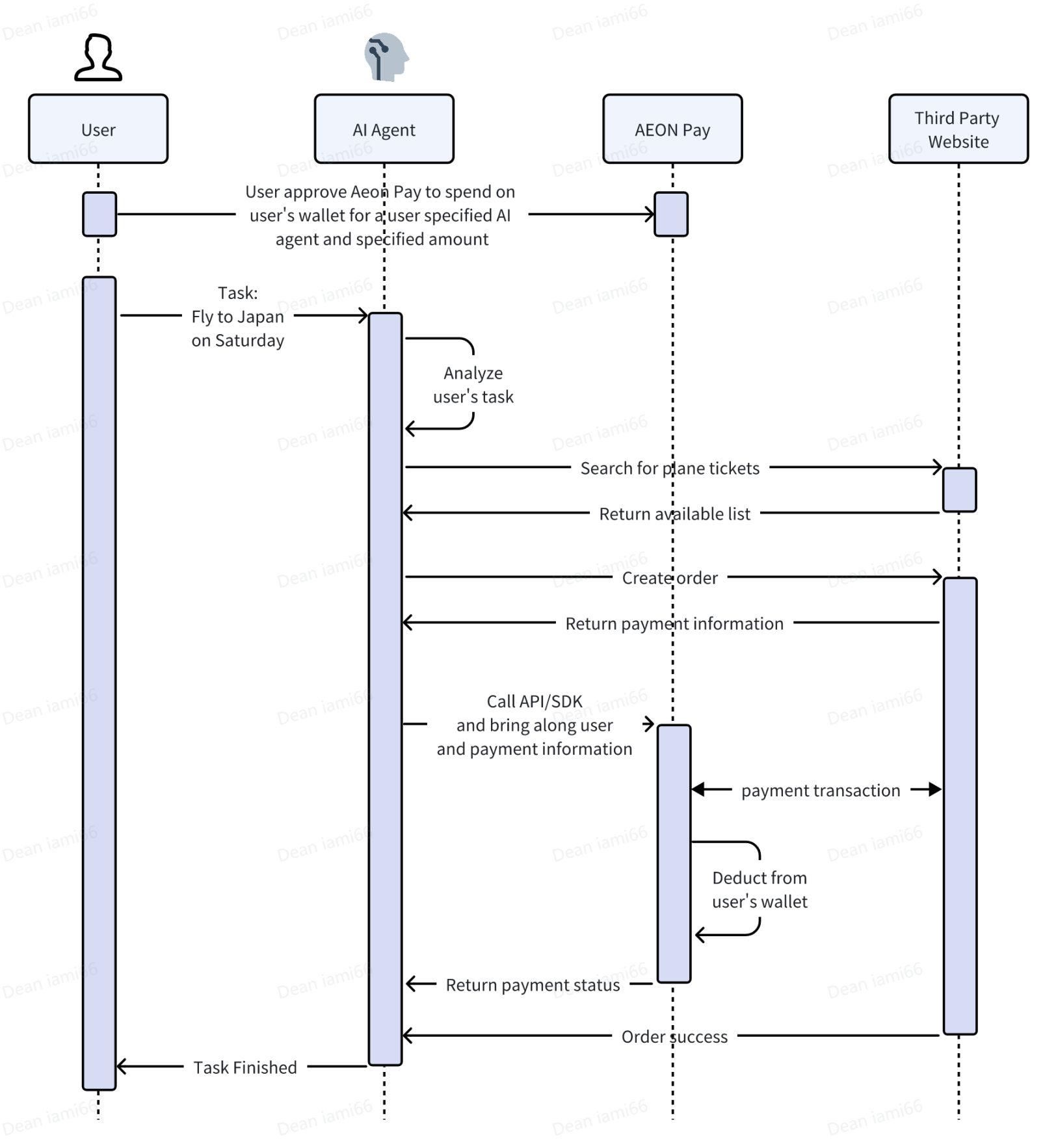

Unlike cases where AI is used solely for analytics or recommendations, AEON focuses on building direct, callable payment capabilities for AI. In essence, its goal is to enable AI agents to independently and securely execute real-world payments—facilitating the deployment of autonomous systems in practical transaction scenarios. When users issue natural language commands like “book a flight” or “buy coffee,” AI can directly invoke the AEON API to initiate payment requests, handling amount identification, asset selection, cross-chain exchange, and settlement—all without human intervention.

The system features two key innovations:

-

Payment Intent Recognition (KYA): Uses language models to verify whether the AI truly understands the task and possesses payment authorization, preventing errors and malicious command execution

-

Smart Multi-Chain Routing: Dynamically selects the optimal payment path based on real-time gas fees and network congestion, improving transaction efficiency

This architecture allows AI agents to move beyond information processing and recommendations to actually perform commercial transactions, significantly increasing autonomy and coordination efficiency within Web3 environments.

2.2.2 Real-World Deployment and Ecosystem Integration

Since 2024, AEON has advanced its “AI Payment as IT Foundation” roadmap, expanding into multiple countries and ecosystem contexts:

-

Offline Expansion: AEON has deployed QR code payment systems in Southeast Asia, notably Vietnam, where AI agents autonomously complete scanning, conversion, and payment processes

-

Token Ecosystem Integration: Supports a wide range of native crypto assets in payments and is now accepted by over 10,000 merchants across electronics, lifestyle services, and digital content

-

Agent-to-Agent Collaboration: Enables modular cooperation among agents—for example, one agent creates an order while another handles payment—in an intelligent, coordinated workflow

2.2.3 Diagrams: AI Integration Logic with Payment Workflow

The following two diagrams illustrate the AI agent call flow when using AEON Pay and the technical interaction details.

Figure 1: Standard Flowchart of AI Agent Calling AEON Pay

After the AI agent parses the user's instruction, it initiates a payment action via the AEON Pay SDK or API. Once the on-chain execution completes, the result is fed back to both the user and the agent, closing the loop.

Figure 2: Sequence Diagram of Interaction Between AI Agent and AEON Pay

This shows the full interaction chain: “User → AI → AEON → Merchant.” Starting from a natural language command, the process proceeds through five stages—task interpretation, order creation, payment confirmation, on-chain deduction, and status feedback—achieving fully automated payment completion.

Industry Significance and Future Outlook

AEON exemplifies a standardized pathway for “AI agent-to-pay”: abstracting payments into a callable service that autonomous agents can access on demand. This architecture enhances composability and intelligence in payment systems and introduces a new operational logic to the Web3 ecosystem.

Looking ahead, AEON plans to extend support to off-chain consumption systems powered by Visa and Mastercard, building a seamless bridge between Web3-native users and the real-world economy—further advancing the “AI-initiated → crypto-settled → real-world completed” payment paradigm.

2.3 Gaia Network x MoonPay Collaboration: Advancing the Fusion of Crypto Payments and AI

2.3.1 Background of the Partnership

MoonPay is a global leader in crypto payment infrastructure, enabling instant fiat-to-crypto conversions across more than 180 countries, processing over $15 billion in annual transaction volume. Gaia is a decentralized AI agent network that enables developers to create, deploy, and monetize AI agents. Its flagship product, Mother DAO, serves as an AI agent launchpad within the Ethereum ecosystem.

2.3.2 Synergies and Technical Integration Post-Collaboration

Deep Synergy Between Payments and AI Agents

-

Automated Transaction Flow: Users issue natural language commands (e.g., “Buy $100 worth of ETH”), triggering Gaia agents to invoke the MoonPay API to complete fiat-to-crypto conversion and on-chain transfers—no manual wallet operations needed

-

Intelligent Pricing & Settlement: Gaia agents dynamically adjust service pricing based on market volatility, while MoonPay handles real-time crypto settlements in USDC, ETH, and other stablecoins and major assets

Developer Ecosystem Enablement

-

Low-Code Integration: MoonPay offers pre-built payment modules (e.g., embedded checkout widgets), allowing developers to quickly integrate payment functionality into Gaia agents via APIs

-

Cross-Chain Interoperability: MoonPay’s multi-chain support (e.g., Solana, Polygon) enables Gaia agents to expand into high-frequency trading environments and other cross-chain use cases

User Experience Enhancement

-

Simplified Fiat On-Ramp: Non-crypto users can directly purchase AI agent services using fiat via MoonPay, lowering the barrier to Web3 adoption

-

Transaction Transparency: On-chain records are publicly viewable via blockchain explorers, allowing users to track payment status and agent execution results in real time

2.3.3 Market Impact and Data

-

User Growth: Gaia hosted its first fully autonomous hackathon in 2024, attracting over 2,000 developers. Following the launch of Mother DAO, monthly active users surpassed 50,000

-

Transaction Scale: Helio, prior to acquisition, had processed over $1.5 billion in transactions. With the Gaia partnership, its on-chain payment functionality is expected to improve transaction efficiency by 30%

-

Industry Recognition: In December 2024, MoonPay became one of Europe’s first crypto payment firms to obtain a MiCA license, strengthening trust in its collaboration with Gaia through enhanced compliance

The collaboration between MoonPay and Gaia marks a new phase in the convergence of crypto payments and AI. By integrating robust payment infrastructure with a decentralized AI agent platform, the partnership delivers a full-stack solution—from creation and deployment to monetization—for both developers and end users. Despite challenges related to technical complexity and regulatory compliance, this model offers valuable insights for the intelligent evolution of the Web3 ecosystem.

3. Industry Challenges and Future Outlook

3.1 Core Challenges

-

Technical Complexity: Multi-chain coordination and AI algorithm optimization still require breakthroughs

-

Regulatory Risks: Divergent regulatory frameworks across jurisdictions for crypto and AI—MoonPay must balance innovation and compliance under regimes such as MiCA and SEC

-

User Education Costs: Although these cases reduce entry barriers, non-crypto users still require long-term education on concepts like “on-chain wallets” and “smart contracts”

3.2 Future Trends

-

Downstream Use Cases and Lightweight Adoption: Focus on high-frequency, small-value scenarios such as micropayments, membership programs, and in-game item trading, using “AI + crypto payments” to boost user stickiness (e.g., replicating the Boba Guys model in convenience stores and gyms)

-

Standardization of Infrastructure: Promote cross-platform API interoperability (e.g., integration between Crossmints and MoonPay), reducing developer integration costs and establishing a common tech stack for “payments → agents → data”

-

Integration of RegTech: Leverage AI for compliance tasks such as automatic sanctions screening and anti-money laundering monitoring, achieving dynamic balance between innovation and regulation

4. Conclusion

The convergence of crypto payments and AI is not a mere technological overlay—it fundamentally restructures the economic logic of “value transfer, data processing, and user incentives,” giving rise to entirely new business paradigms. From Crossmints’ revolution in retail loyalty, to AEON’s autonomous payment agents, to the global infrastructure synergy between Gaia and MoonPay, these cases demonstrate that when blockchain’s “decentralized trust” deeply couples with AI’s “intelligent decision-making,” digital transformation in traditional industries will transcend current efficiency limits, entering a new era defined by “automation, personalization, and globalization.” As technology matures and regulatory frameworks evolve, this integration trend is poised to become the primary driver for the large-scale adoption of Web3, ushering in a new era of the “intelligent payment economy.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News