Uncovering Potential Tokens: How to Build a P/E Ratio Monitoring System Using AI Models?

TechFlow Selected TechFlow Selected

Uncovering Potential Tokens: How to Build a P/E Ratio Monitoring System Using AI Models?

Teach you how to analyze the price-to-earnings ratio and build a corresponding monitoring system using AI models.

Author: Hoeem

Translation: Tim, PANews

What is the most overlooked metric in crypto? The price-to-earnings ratio (P/E). It helps you quickly determine whether a cryptocurrency is overvalued or undervalued, on the verge of a surge or hiding risks, a speculative gem or a bubble zone—and it reveals market sentiment.

This article will teach you how to analyze P/E ratios, but first, you need to understand this concept like a professional.

Understanding the Price-to-Earnings Ratio

1. Quickly Identify Overvalued and Undervalued Assets

P/E Ratio = Share Price per Share ÷ Earnings per Share

-

Indicates how much investors are willing to pay for each $1 of earnings

-

High P/E = Market expects growth (but may be overvalued)

-

Low P/E = Potential value investment opportunity or warning sign

2. Compare Protocols Within the Same Category

Rank similar companies or cryptocurrencies based on profitability

-

Project A has a P/E of 10; Project B has a P/E of 30

-

If they’re in the same sector with similar fundamentals, Project A might be undervalued

3. Gain Insight into Market Sentiment via P/E Ratios

The P/E ratio isn't just a number—it reflects market sentiment.

-

High P/E = Market optimism, hype, and growth expectations

-

Low P/E = Fear, doubt, or potential market mispricing

4. Conduct Scenario Analysis on Revenue

Raw profit ≠ The full truth

-

P/E ratios help place revenue in industry context.

-

It shows how the market values each dollar of net profit.

5. Identify Hidden Gems or High-Growth Candidates

-

Value investors favor low-P/E assets with strong fundamentals.

-

Growth investors chase high-P/E plays with room for rapid upside.

-

The key is understanding why the market prices them this way.

Bonus Tip

Think of the P/E ratio as a speedometer—it tells you how fast the market is pricing in expectations. But just as speed must be interpreted within context, valuations require background for a complete picture.

How to Quickly Calculate Crypto P/E Ratios

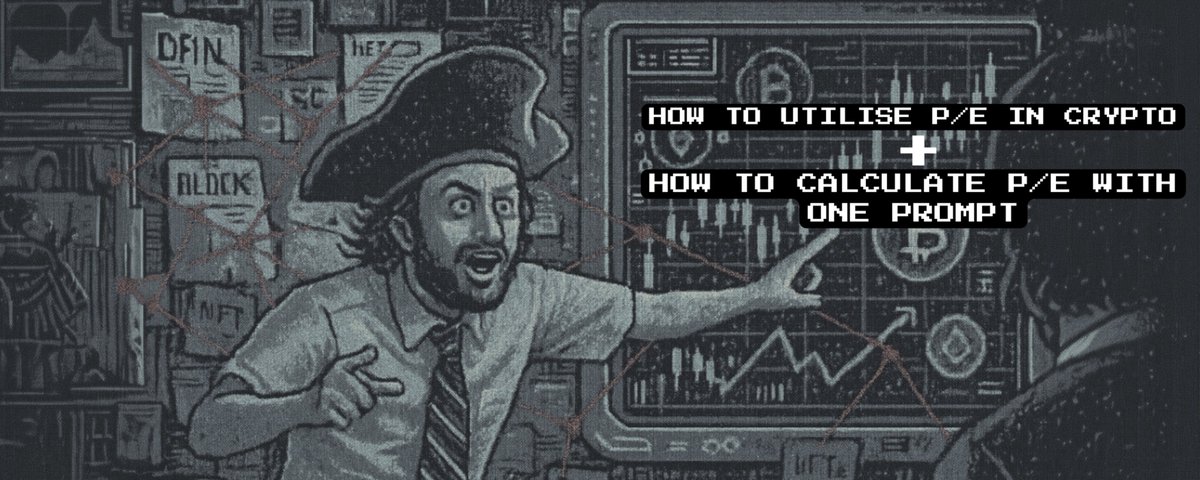

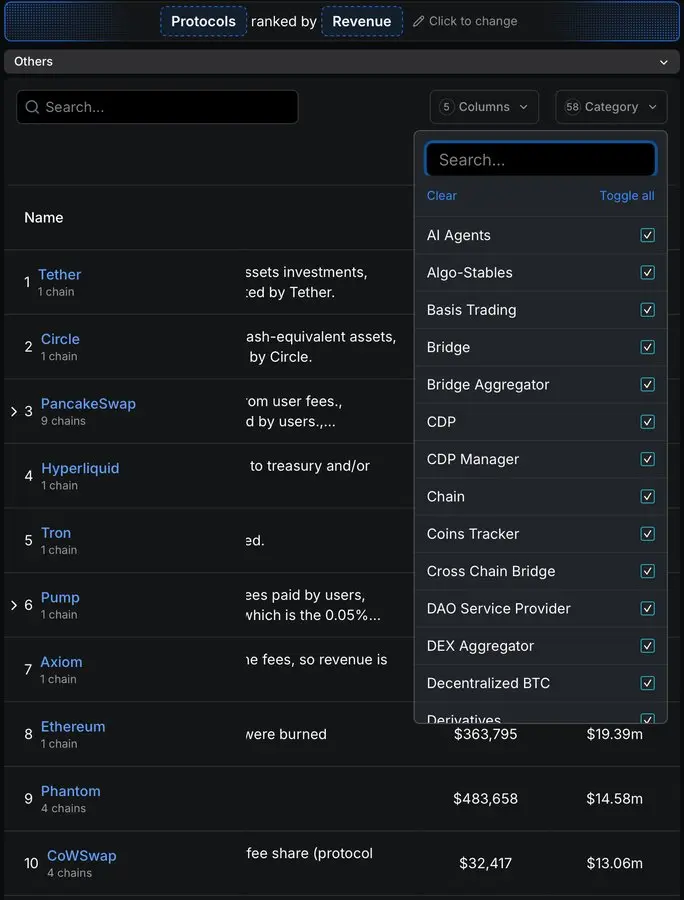

1. Visit DeFiLlama

Alright, I’m on DeFiLlama now—what’s next?

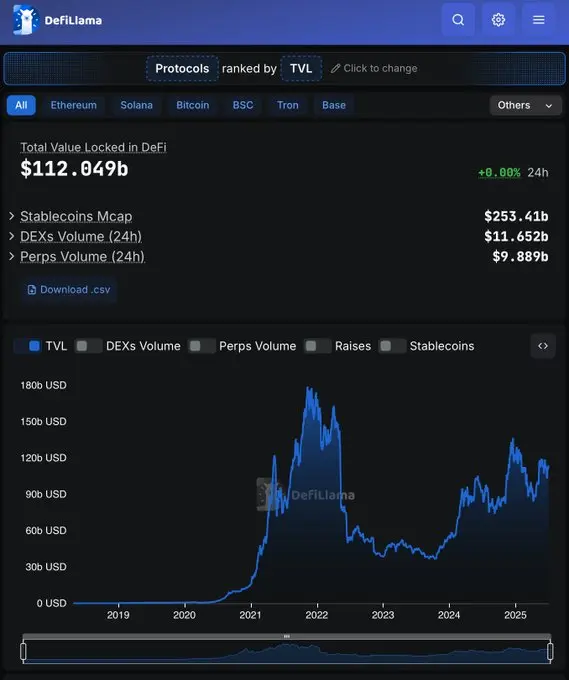

2. Navigate to the “Revenue” and “Fees” Page

Got it, I found that section. What now?

3. Select Your Comparison Category

I see. I can compare them all at once—this makes the analysis fairer.

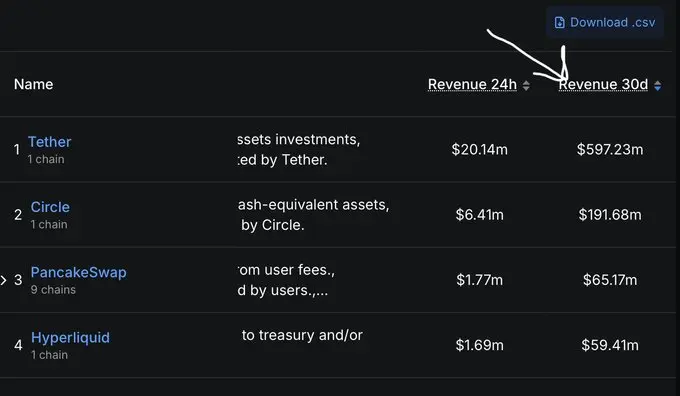

4. Click on “30-Day Revenue”

Yes, found it.

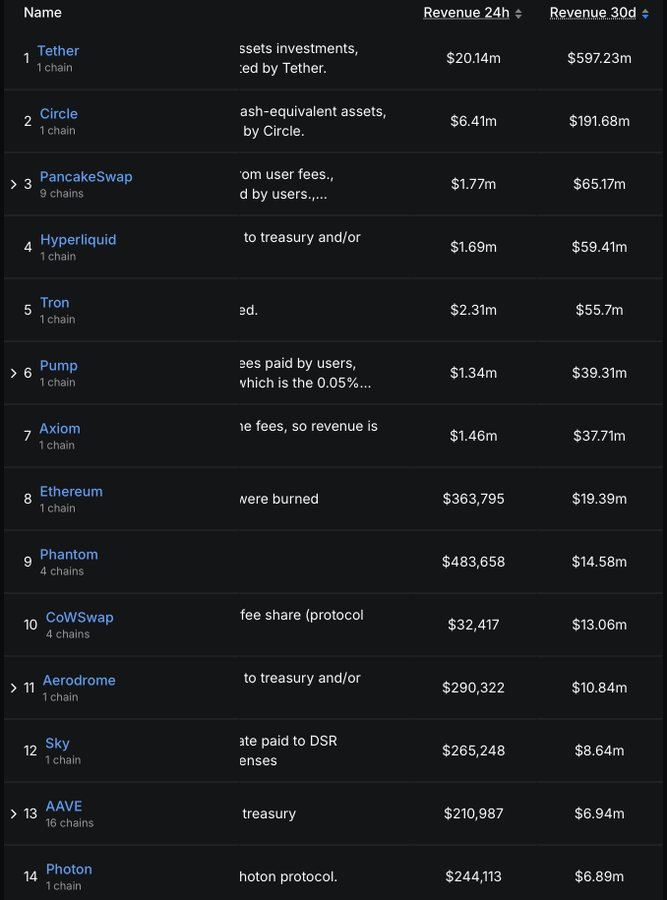

5. Take a Screenshot of the Data Page

This step is super simple.

6. Open a Web-Connected Large Language Model Platform

7. Input the Prompt + Screenshot (copy and paste below)

Prompt

You are a professional cryptocurrency fundamental analyst.

Data Collection Process

-

Revenue – Extract the protocol's 30-day revenue (USD) from the provided DeFiLlama screenshot using OCR technology. Ignore any entries where revenue is empty or ≤0.

-

Market Cap & Fully Diluted Valuation (FDV) – Retrieve real-time data from CoinGecko or CoinMarketCap (preferably same-day data). Match by token symbol. Skip protocols missing either data point.

-

Category Focus – Only consider categories specified by the user on DeFiLlama (e.g., DEX, Lending, LST, Perps, etc.).

-

Filtering and Screening

-

Exclude protocols with P/E < 0 or > 1000

-

Calculate P/E = Market Cap ÷ (30-day Revenue × 12)

-

Return the top 20 projects with the lowest P/E (i.e., most "undervalued")

-

For each project, also calculate the “Revenue to FDV Ratio” = (30-day Revenue ÷ FDV) × 100%

-

Output: Generate a clean Markdown table sorted in ascending order by P/E, with an additional header row showing the average P/E and average Revenue-to-FDV ratio for the final list.

-

Format numbers using K/M/B abbreviations for readability.

Columns:

1. Protocol Name

2. Token Symbol

3. P/E

4. 30-Day Revenue (USD)

5. Circulating Market Cap (USD)

6. Fully Diluted Market Cap (FDV, USD)

7. Chain

8. Brief Description

9. Revenue-to-FDV Ratio (%)

Quality Checks – Ensure:

1. Both revenue and FDV are clearly presented.

2. Classification tags match DeFiLlama’s official categories.

3. Data is up-to-date (scraped from CoinGecko or CoinMarketCap within the last 48 hours).

4. Table is easy to read with no missing values.

Goal: Help cryptocurrency investors quickly identify potentially mispriced tokens within selected sectors using core metrics (P/E and Revenue-to-FDV ratio).

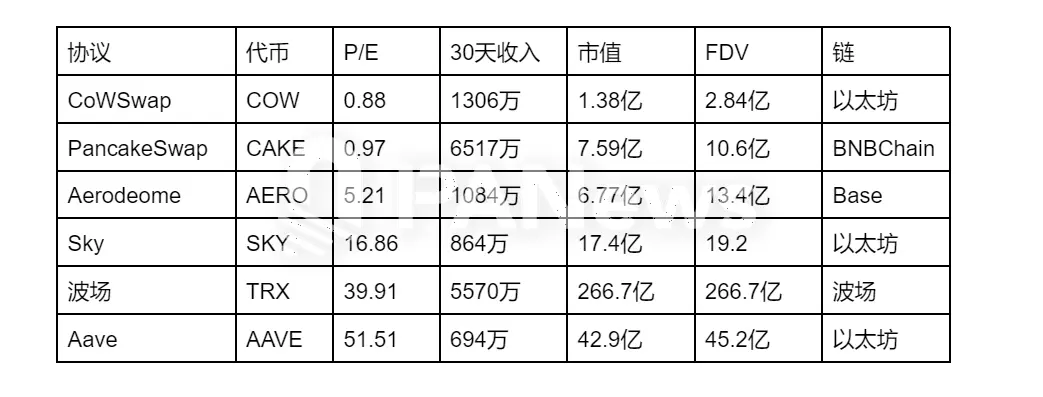

Example:

It’s also important to compare circulating market cap with fully diluted valuation and monitor upcoming token unlocks.

Now you understand how to use the P/E ratio—and how to find it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News