Sun.io: From TRON Ecosystem DEX to Global Stablecoin Trading Hub

TechFlow Selected TechFlow Selected

Sun.io: From TRON Ecosystem DEX to Global Stablecoin Trading Hub

As TRON advances its strategic upgrade and attracts traditional capital, Sun.io is accelerating its transition from a decentralized exchange within the ecosystem to a global stablecoin trading hub.

In recent months, stablecoins have ignited a frenzy in financial markets and become a strategic battleground for global mainstream financial institutions. Countries are actively legislating to advance their compliance frameworks, attempting to integrate stablecoins into traditional financial systems. A fierce battle over monetary sovereignty has already begun.

In the global stablecoin landscape, Tether's USDT has a circulating supply exceeding $158.2 billion, capturing over 62% of the total market share. The amount of USDT issued on the TRON network has surpassed $80 billion, consistently accounting for more than 50% of the total USDT issuance. This means that one out of every two USDT tokens in circulation originates from the TRON network—solidifying its status as the undisputed "stablecoin powerhouse."

Leveraging TRON’s central role in the global stablecoin ecosystem, Sun.io—the largest all-in-one financial trading hub within the TRON ecosystem—has drawn significant attention from stablecoin traders worldwide. Through a diversified product matrix including the DEX platform SunSwap, stablecoin trading tools SunCurve and PSM, and meme coin launchpad SunPump, Sun.io has successfully aggregated core ecosystem traffic and is poised to become the world’s largest stablecoin trading hub.

Among these offerings, SunSwap enables stablecoins to circulate freely as base assets across the on-chain ecosystem, providing ample space for stablecoin transactions.

SunCurve and PSM, which focus specifically on stablecoin trading, offer low-slippage, precise stablecoin exchange services capable of meeting the large-scale transaction demands of institutional players.

With these advantages, Sun.io is undergoing a remarkable transformation—from a decentralized exchange (DEX) within the TRON ecosystem to a global core hub for stablecoin trading—redefining the boundaries of what a DEX can be.

Diversified Product Matrix Builds an All-in-One Financial Trading Hub

Within TRON’s thriving ecosystem, Sun.io has long transcended its initial role as a mere asset trading platform, evolving into a comprehensive, full-lifecycle financial service center. Through the synergistic operation of three core engines—SunSwap (asset trading), SunCurve/PSM (stablecoin trading), and SunPump (meme coin issuance)—Sun.io has established a closed-loop, end-to-end service system covering “asset issuance – trade matching – value appreciation.” It now serves as the central hub for traffic aggregation and value flow within the TRON ecosystem.

Asset Trading Engine: SunSwap

SunSwap primarily offers asset swap services and operates similarly to Uniswap, using an Automated Market Maker (AMM) model with a constant product formula to determine prices.

The platform has evolved through three iterations—V1, V2, and V3. The latest version, SunSwap V3, features a “dynamic fee mechanism” that allows liquidity providers (LPs) to deposit funds within specific price ranges and set different fee tiers. Currently, four fee levels are supported: 0.01%, 0.05%, 0.3%, and 1%, accommodating various risk profiles and trading characteristics.

According to official data, on July 2, the total value of crypto assets locked in SunSwap pools was approximately $715 million. There are over 25,000 liquidity pools on SunSwap, processing more than $400 million in trading volume over the past seven days, with over 84,000 transactions executed by more than 13,800 users. The most actively traded assets are TRX and USDT, each recording 24-hour trading volumes exceeding $40 million.

Stablecoin Trading Engines: SunCurve and PSM

SunCurve and PSM are dedicated to stablecoin trading. SunCurve functions similarly to Curve, offering users low-fee (0.04% per transaction) and low-slippage swaps among stablecoins such as USDD, USDT, TUSD, and USDC. PSM (Protocol Supported Mechanism) is a stablecoin swap tool launched by the TRON DAO specifically for its native stablecoin USDD. It enables 1:1 fixed-rate exchanges between USDD and other major stablecoins like USDT, USDC, and TUSD—with zero slippage and no fees—making it the primary destination for USDD conversions.

Meme Coin Launch Engine: SunPump

SunPump is the first meme coin issuance platform within the TRON ecosystem launched by Sun.io, enabling users to create and deploy their own meme coins with just one click. Each launch requires a creation fee of about 20 TRX (approximately $5). On June 27, the market cap of CSI, a meme coin listed on SunPump, briefly exceeded $10 million with a single-day surge of over 800%, becoming a new wealth-generating phenomenon widely discussed in the crypto community.

In addition, SunGenX—an AI-powered token launch tool integrated with X (formerly Twitter)—enables “post-to-launch” functionality. Users simply need to mention @Agent_SunGenX in a post on X containing the token details, and the meme coin will be automatically deployed onto the SunPump platform.

In summary, Sun.io’s product ecosystem is driven by three core engines—SunSwap, SunCurve/PSM, and SunPump—that facilitate efficient capital flow across the ecosystem and deliver a seamless, one-stop financial experience. SunSwap, as a DEX, provides asset swapping and liquidity mining opportunities, allowing users to freely exchange assets while earning generous returns by providing liquidity (LP). SunCurve and PSM ensure low-slippage stablecoin trades, safeguarding value transfer and market stability. SunPump taps into long-tail traffic by supporting emerging meme assets, fueling continuous innovation within the community. Together, these engines generate sustained momentum for the entire Sun.io ecosystem.

This diversified strategy enables Sun.io to provide users with an integrated solution for asset issuance, trading, and value appreciation—all within a single platform. Users no longer need to navigate multiple platforms; instead, they can complete the entire process—from creating assets and executing large stablecoin swaps to increasing asset value—on Sun.io alone. This dramatically improves user experience and operational efficiency, making on-chain trading more convenient and effective than ever before.

Compared to general-purpose DEXs like Uniswap or PancakeSwap, Sun.io has redefined the DEX paradigm through its multi-product synergy model, carving out a unique and differentiated path with distinct competitive advantages. Individually, each product stands out at the forefront of its category. For example, despite Pump.fun’s first-mover advantage, SunPump surpassed it in revenue upon launch—thanks to TRON’s massive user base and abundant USDT liquidity—demonstrating how a latecomer can leapfrog ahead. Similarly, SunCurve and SunSwap benefit directly from TRON’s dominance in USDT issuance (over half of all USDT). When large-scale trading occurs, their advantages become even more pronounced, easily outperforming any competing DEX product.

Over 600 Million SUN Tokens Burned, TVL Firmly Ranked Among Top 5 Global DEXs

Sun.io’s ecosystem value extends beyond its robust product suite—it has also built dual moats through a unique tokenomics model and strong capital retention capabilities. SUN, the governance token of Sun.io, is gradually moving toward deflation due to a consistent buyback-and-burn mechanism. Meanwhile, Sun.io’s Total Value Locked (TVL) has remained firmly within the top five among global DEXs, providing a solid foundation for stable operations and future growth.

The SUN token plays a multifaceted role across SunSwap, SunCurve/PSM, and SunPump. It serves not only as the core instrument for platform governance and liquidity provider rewards but also continuously delivers value to holders through ongoing buybacks and burns.

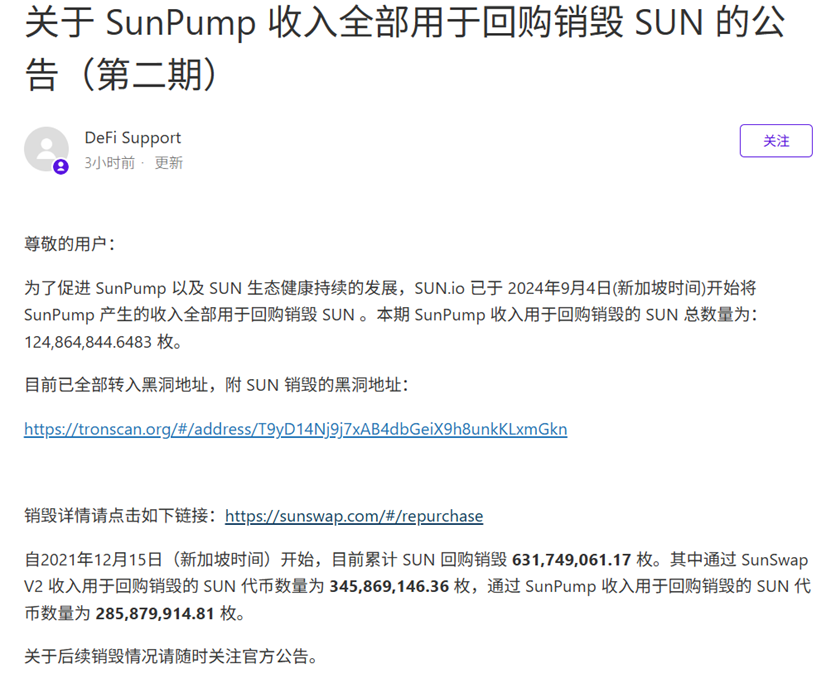

On July 2, SunPump released its second announcement titled *“All SunPump Revenue Dedicated to SUN Buyback and Burn,”* confirming that since September 4, 2024, all platform revenues have been used to repurchase and burn SUN tokens. In this cycle alone, 124 million SUN tokens were burned and sent to a black hole address. To date, over 285 million SUN tokens have been burned using SunPump-generated revenue.

Additionally, 0.05% of every transaction fee generated on SunSwap V2 is allocated to SUN token buybacks and burns. The Sun.io team has publicly disclosed 43 consecutive rounds of burn data.

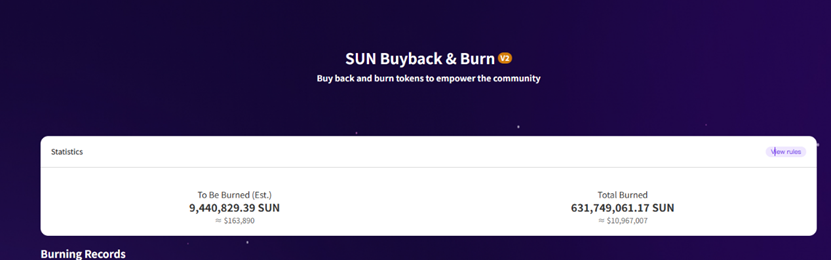

According to the latest figures, as of July 2, more than 600 million SUN tokens (approximately 632 million) have been burned, representing over 3% of the total SUN supply (around 19 billion). Of this, approximately 345 million SUN tokens were burned using SunSwap V2 revenue, and 285 million via SunPump revenue.

This continuous buyback-and-burn mechanism effectively reduces the circulating supply of SUN tokens. With a fixed total supply, increasing burns lead to automatic deflation. According to basic supply-demand principles, reduced supply under constant demand increases scarcity, thereby driving up value. As reported by CoinGecko, the current price of SUN is $0.017, reflecting a gain of over 50% in the past year.

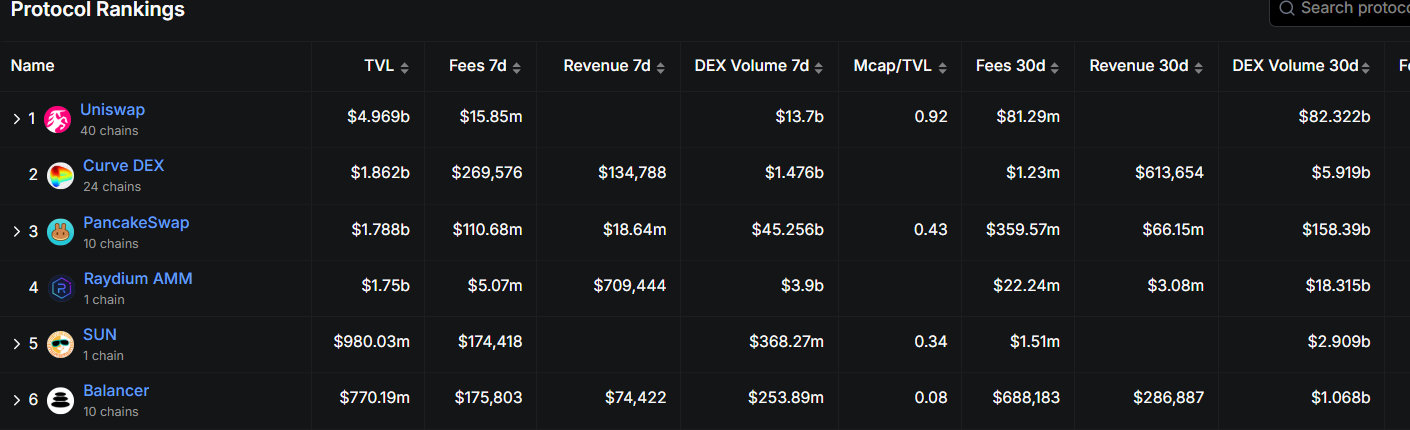

Sun.io’s competitiveness in the DEX landscape is further evidenced by its TVL metrics. According to DeFiLlama, as of July 2, Sun.io’s TVL exceeds $970 million, consistently ranking it among the top five DEX platforms globally.

TVL reflects not only the value of locked crypto assets but also serves as a key indicator of platform scale and market influence. High TVL indicates substantial user participation and asset staking, demonstrating strong trust and recognition. Moreover, high TVL creates a powerful network effect, attracting even more users and capital—a virtuous cycle that reinforces Sun.io’s leading position in the DEX market.

As the TRON ecosystem grows increasingly attractive and draws in more users, Sun.io is expected to enter a phase of explosive growth in both user numbers and transaction volume. This will drive higher revenues and deeper capital retention, leading to larger buybacks and faster SUN token burn rates, while TVL continues to climb.

From TRON Ecosystem DEX to Global Stablecoin Trading Hub

Within TRON’s on-chain financial ecosystem, Sun.io’s full-stack product suite enables users to seamlessly complete the entire lifecycle—from asset creation to trading and value growth—on a single platform, making it the primary traffic aggregator for the TRON network. On the asset issuance front, SunPump and SunSwap significantly lower the barrier to entry for new projects, providing a fast-track growth stage for innovative ventures. On the trading side, SunSwap, SunCurve, and PSM offer billion-dollar-level liquidity depth. SunPump, acting as a new traffic gateway, actively channels assets into SunSwap for trading and encourages liquidity provision in LP pools, enhancing market activity and liquidity.

Sun.io is not only the core source of liquidity within the TRON ecosystem but also an essential coordinator. Like a precision-engineered central nervous system, it efficiently connects buyers and sellers, ensuring smooth and accurate trade execution. At the same time, as a critical entry point for project launches and asset issuance, it strategically guides new asset liquidity, helping every project and token find optimal trading opportunities. In doing so, Sun.io acts as the central nexus linking assets, projects, and users—driving continuous value circulation and consensus building within the TRON ecosystem—and laying a solid user foundation for its role as a stablecoin hub, ultimately redefining the boundaries of DEXs.

With TRON’s strategic upgrades and growing institutional adoption, Sun.io is accelerating its transition from an ecosystem DEX to a global stablecoin trading hub.

In the stablecoin arena, TRON has adopted a multi-pronged approach, building a “stablecoin matrix” tailored to diverse use cases. While reinforcing USDT’s dominant position, TRON is simultaneously pursuing a dual-track strategy combining “regulated stablecoins” and “decentralized stablecoins,” expanding its reach through a diversified lineup of “USDT + USDD + USD1.” As of July 3, TRON’s USDT issuance stands at $80.7 billion—an increase of over $20 billion since the beginning of the year. Its native decentralized stablecoin USDD has surpassed $450 million in issuance. Additionally, USD1—a regulated financial stablecoin backed by the Trump family—has already begun minting on the TRON network.

In traditional finance, TRON has successfully penetrated Wall Street as a publicly listed entity, bridging the gap between conventional finance and the blockchain world. In mid-June, TRON completed a reverse merger with Nasdaq-listed SRM Entertainment (SRM), officially entering the mainstream financial market. Concurrently, the “TRX MicroStrategy” initiative was launched, integrating TRX into the corporate treasury reserves. This allows traditional financial institutions to indirectly hold TRX by investing in SRM stock. On June 30, SRM announced it had deposited 365 million TRX tokens into JustLend DAO, TRON’s on-chain lending platform. With the anticipated approval of a TRX ETF drawing near, TRON is expected to attract billions of dollars in new institutional capital into its ecosystem.

Backed by a multibillion-dollar stablecoin infrastructure and the benefits of public listing, Sun.io is positioned to be a primary beneficiary—serving as the first point of entry and a key gateway for institutional capital inflows. Institutional investors have a strong demand for low-slippage, high-capacity trading channels. SunSwap, with its billion-dollar liquidity depth, is ideally suited for large institutional trades. SunCurve, with its 0.04% low fee, and PSM, which enables 1:1 fee-free conversion between USDD and other stablecoins like USDT and TUSD, will become the preferred platforms for stablecoin swaps.

Furthermore, Sun.io's products can work in tandem with other TRON ecosystem applications to create diversified yield strategies. Take stUSDT, a real-world asset (RWA) product, as an example: users who stake USDT receive stUSDT, a tokenized RWA certificate. This token can be freely swapped for other stablecoins or assets on SunSwap or used to provide liquidity, generating fee income and enabling asset appreciation. It can also integrate with the lending protocol JustLend DAO—users can stake stablecoins like USDT or USDD to borrow assets, then directly deposit those borrowed assets into SunSwap liquidity pools, creating a “deposit–borrow–mine” triple-yield loop with potential annualized returns exceeding 10%, delivering substantial and stable returns.

With deepening product diversification and ecosystem synergy, Sun.io has broken free from the limitations of a single-purpose DEX, emerging as a global stablecoin trading hub that bridges traditional finance (TradFi) and decentralized finance (DeFi), regulated and decentralized domains, and the physical and digital worlds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News