Another sighting of tokenized US stocks—I really miss that summer of 2020.

TechFlow Selected TechFlow Selected

Another sighting of tokenized US stocks—I really miss that summer of 2020.

Previously, those trading U.S. stocks couldn't understand why the crypto market was so hot; now, crypto traders are puzzled about why U.S. stocks with a crypto label keep climbing higher and higher.

By TechFlow

July, blazing sun. The scorching summer brings a wave of tokenized U.S. stocks to the crypto world.

Robinhood announced boldly that European users can trade U.S. stocks on Arbitrum around the clock; xStocks teamed up with Kraken and Solana to launch tokenized versions of 60 popular U.S. stocks, while Coinbase filed an application with the SEC to offer tokenized securities...

In no time, tokenized U.S. equities became one of the few correct narratives in an otherwise stagnant crypto space, dominating everyone’s timelines.

But this isn’t the first time U.S. stock tokenization has appeared.

Dormant memories start flooding back, making me nostalgic for that summer five years ago.

August 2020—the DeFi Summer blazed through the crypto world. Uniswap's liquidity mining ignited frenzy, Terra’s Luna chain and UST soared skyward. On-chain finance had already achieved many innovations, including the tokenization of U.S. stocks.

Back then, there was a protocol called Mirror on the Luna chain. I remember using just a few dollars’ worth of UST on Terra Station to mint mAAPL (the token representing Apple stock)—no KYC, no brokerage account—my first time touching Apple’s price pulse without going through traditional brokers.

There’s a song lyric that perfectly captures how old hands feel after experiencing all this:

"You left noise behind in my life, but after you left, it became eerily quiet."

Luna eventually collapsed. Mirror was crushed by an SEC lawsuit. The dreams of 2020 were shattered. Aside from transaction hashes, there seems little proof that tokenized U.S. stocks once existed five summers ago.

Now, xStocks and Robinhood are back. Tokenized U.S. stocks are reigniting hope. Will this attempt succeed? And what’s different compared to five years ago?

That Summer: Mirror's Libertarian Utopia

If you don’t recall Mirror Protocol—or weren’t even in crypto back then—let me help revive those distant memories.

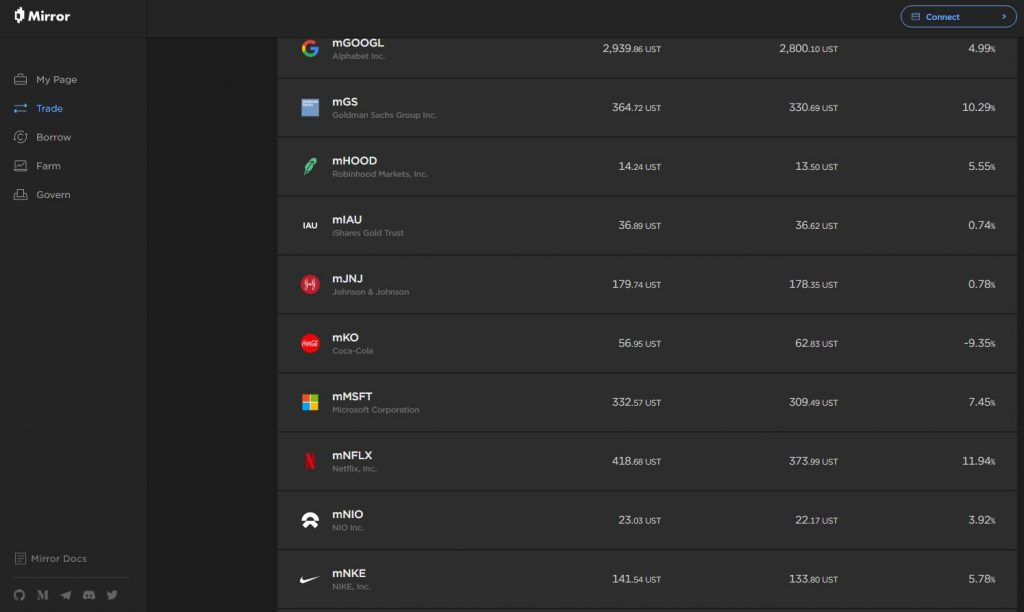

Mirror Protocol’s core idea was simple: use on-chain synthetic assets to track real-world U.S. stock prices. This gave birth to a class of assets known as mAssets.

These "synthetic assets," or mAssets, were tokens that mimicked stock prices via smart contracts and oracles. Holders didn’t own actual shares—just digital shadows tracking price movements on-chain.

For example, mAAPL (Apple), mTSLA (Tesla), mSPY (S&P 500 ETF)—all relied on Band Protocol’s decentralized oracle to fetch real-time U.S. market data.

While not equivalent to owning real stocks, they offered convenience:

Minting mAssets was easy. Users could over-collateralize 150%-200% with UST, Terra’s stablecoin at the time, and mint corresponding tokenized stocks directly on Terra Station—no KYC, transaction fees around $0.1.

These tokens could be traded 24/7 on Terraswap (Terra’s DEX), as freely as any Uniswap pair, and also used as collateral within Anchor Protocol—a lending platform in Terra’s ecosystem—for borrowing or earning yield.

Enjoy growth from public U.S. companies while leveraging the flexibility of DeFi. Five years ago, it seemed DeFi had already cracked the code on tokenizing U.S. equities.

But the good times didn’t last. That summer’s dream ended abruptly.

May 2022—the infamous black swan event struck. Terra’s algorithmic stablecoin UST depegged, and Luna plummeted from $80 to pennies within days. mAssets wiped out overnight. Mirror nearly ceased operations.

Worse still, the U.S. SEC stepped in, accusing mAssets of being unregistered securities. Terraform Labs and its founder Do Kwon were dragged into legal battles.

From “Buckle up, fellas” to “Sorry, we failed”—Terra’s collapse erased U.S. stock tokenization from the blockchain entirely. In hindsight, its fatal flaws become clear:

Synthetic assets heavily depended on oracles and UST stability, with no underlying real stocks. Once the foundation crumbled, the entire structure turned to dust. Moreover, anonymous trading attracted users but inevitably crossed regulatory red lines. Back then, regulators were far less tolerant than today.

The fragility of synthetics, risks of algorithmic stablecoins, and lack of regulatory clarity made this experiment end in disaster.

This Time Around: What’s Different?

Past failure doesn't mean future failure.

The summer of 2020 is gone. Now Kraken, Robinhood, and Coinbase return with more mature technology and a stronger compliance posture, trying to rewrite the story.

As someone who lived through the DeFi Summer, I can’t help but compare: How is this round different from Mirror five years ago?

We might look at three aspects: product design, participants, and market environment.

-

Product: From On-Chain Shadows to Real-World Anchoring

As mentioned, tokens like mAAPL and mTSLA were merely simulated “shadows on-chain,” lacking real stock ownership—only mirroring price changes.

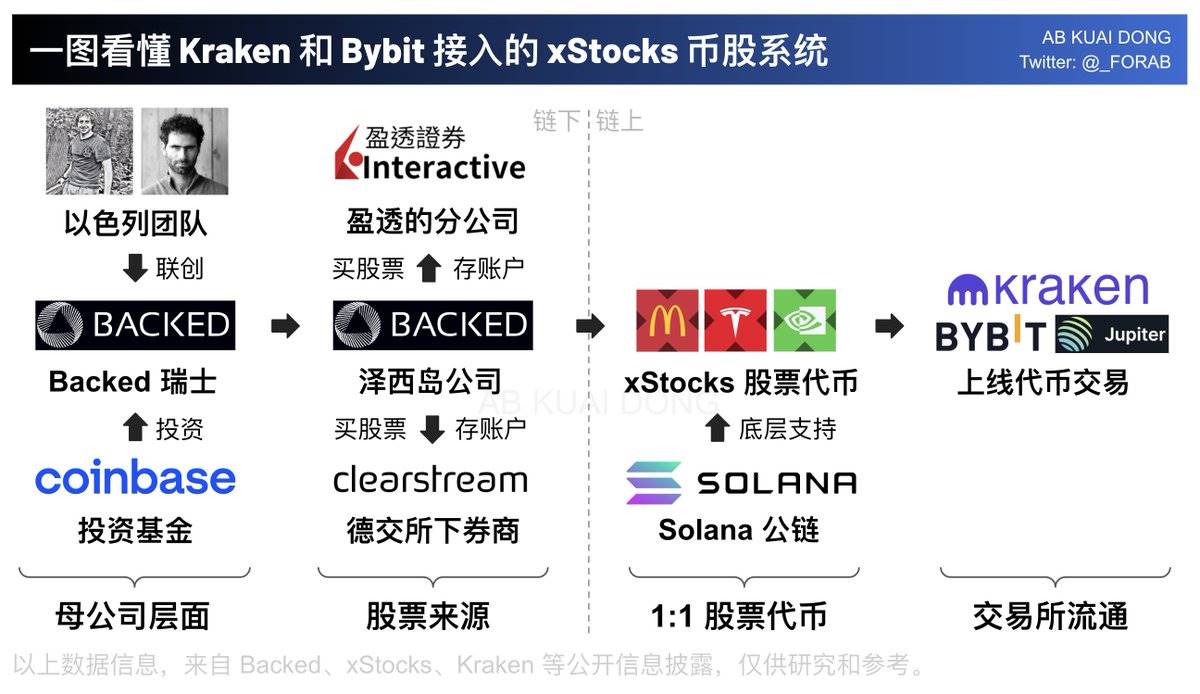

Today’s xStocks takes a different path. xStocks is backed by regulated broker-dealers, ensuring cash value redemption after stock purchases.

This tokenization process is managed by Backed Assets, a Swiss-registered issuer responsible for purchasing and tokenizing assets.

It buys stocks such as Apple or Tesla via Interactive Brokers’ IBKR Prime (a professional brokerage service connected to U.S. markets), then stores them in Clearstream (Deutsche Börse’s custodian) under segregated accounts. Each token is legally audited to ensure a 1:1 backing with real holdings.

In short, every on-chain purchase corresponds directly to an actual stock acquisition off-chain.

(Image source: X user @_FORAB)

Beyond trading, xStocks allows holders to redeem physical shares through Backed Assets—an option that breaks free from Mirror’s purely speculative framework, bridging on-chain and off-chain worlds.

-

Participants: From DeFi-Native to TradFi Integration

Mirror belonged to the DeFi-native crowd. Retail investors and developers from the Terra community drove adoption, fueled by heated discussions on Discord and Twitter. Mirror’s rise rode the wave of Luna and UST mania—its comet-like brilliance powered by grassroots experimentation.

Truly, times have changed.

The current wave of stock tokenization is led by traditional financial giants and compliant crypto firms.

xStocks leverages Kraken’s regulated platform; Robinhood brings traditional brokerage expertise on-chain; BlackRock’s tokenization pilot signals institutional arrival.

Solana’s DeFi ecosystem (e.g., Raydium, Jupiter) adds vibrancy—users can deploy tokens in liquidity mining or lending, preserving some DeFi DNA.

Yet compared to Mirror’s community-driven model, xStocks feels more like a grand production directed by exchanges and TradFi titans: bigger scale, less wild energy.

-

Market & Regulatory Environment: From Gray Zones to Compliance First

Mirror emerged from a regulatory gray zone. During the DeFi Summer, compliance was largely ignored—anonymous transactions were the norm. In 2022, the SEC ruled mAssets were unregistered securities, dragging Terraform Labs into lawsuits where anonymity proved fatal.

At the time, the market was small—DeFi felt like a playground for tech enthusiasts.

In 2025, both market and regulation look vastly different. Projects like xStocks prioritize compliance—mandatory KYC/AML, adherence to EU MiCA regulations and U.S. securities laws.

After Trump’s administration took office in January 2025, new SEC Chair Paul Atkins hailed tokenization as the “digital revolution of finance.” Looser policies began encouraging innovation. In June 2025, Dinari obtained the U.S.’s first tokenized stock brokerage license, paving the way for Kraken and Coinbase.

Mainstream finance’s embrace and shifting regulations allow xStocks and Robinhood to avoid Mirror’s legal pitfalls—but perhaps at the cost of losing that original grassroots spirit.

Summer’s Echo

Crypto these past few years—somehow changed, yet somehow unchanged.

The 2020 version of stock tokenization felt like an untamed celebration—full of passion but lacking stability. Today, crypto wears a suit of compliance. The journey is steadier, but also less spontaneous, less rebellious.

Similar products, different eras.

As more people see BTC as digital gold, institutions gear up, and crypto increasingly becomes a tool to boost traditional capital markets, two distinct communities may have quietly swapped roles:

Back then, stock traders couldn’t understand why crypto was so hot. Now, crypto natives wonder why tokenized equities keep climbing higher.

Yet that summer feeling—the FOMO rush when everyone scrambled to join, the pervasive sense of frontier spirit and hacker ethos—may have already faded into the wind.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News