Token Unlock Approaching: Reviewing WLFI's Business, Background, Token Model, and Valuation Expectations

TechFlow Selected TechFlow Selected

Token Unlock Approaching: Reviewing WLFI's Business, Background, Token Model, and Valuation Expectations

If we calculate based on the current stablecoin scale of WLFI at $2.2 billion, the market cap of the WLFI project would be $2.2 billion * 0.66~0.76, corresponding to a project valuation between $1.452 billion and $1.672 billion, with the WLFI token price ranging from $0.0145 to $0.0167.

Author: Alex Xu, Mint Ventures

Introduction

Circle's stock has surged since its IPO (with a recent pullback), and stablecoin-related stocks across global markets have also become unusually volatile. The U.S. stablecoin bill, the Genius Act, has passed the Senate and is now advancing through the House of Representatives. Recently, World Liberty Financial—a "pure-blood" project backed by the Trump family—announced that its token may be unlocked earlier than expected, making it a major headline in an otherwise sluggish altcoin market lacking new narratives.

So how is World Liberty Financial actually performing? How is its token structured? And what should we use as a valuation anchor?

In this article, I will attempt to comprehensively analyze World Liberty Financial’s current business status, project background, token mechanics, and valuation expectations, offering readers multiple angles to assess the project.

PS: This article represents my interim thoughts as of publication, which may change over time. Views are highly subjective and may contain factual, data, or logical errors. All opinions herein are not investment advice. Feedback and discussion from industry peers and readers are welcome.

Business: Product Status and Core Competitive Advantages

World Liberty Financial (WLFI) is a decentralized finance platform co-founded by members of former U.S. President Donald Trump’s family. Its flagship product is USD1, a dollar-pegged stablecoin fully backed 1:1 by cash and U.S. Treasury reserves. WLFI also plans to launch lending (based on Aave) and DeFi app services, though these have not yet gone live.

USD1 Business Data

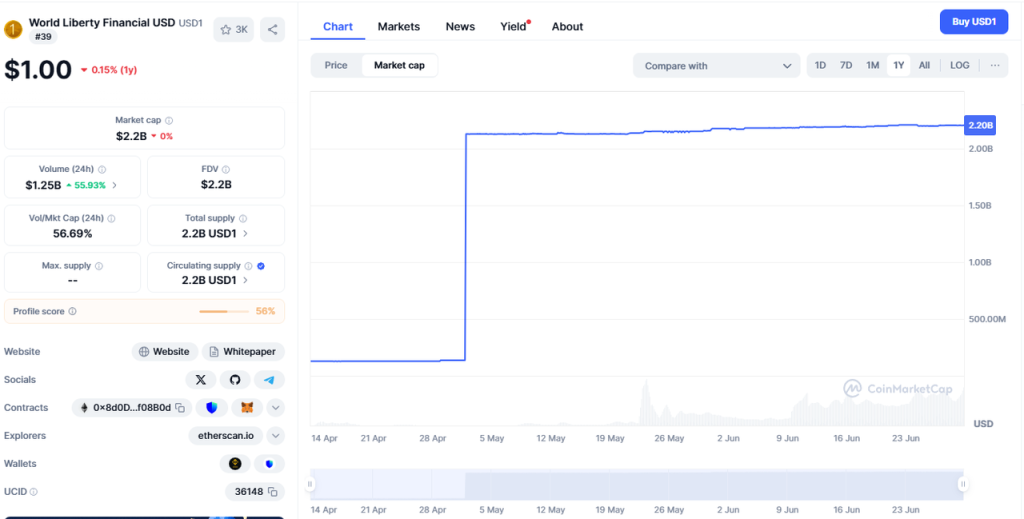

As of June 2025, the circulating supply of USD1 reached approximately $2.2 billion. Of this, $2.156 billion is on BNB Chain, $48 million on Ethereum, and $26,000 on Tron. USD1 issued on BNB Chain accounts for 97.8% of total issuance, with the vast majority deployed there.

In terms of on-chain user numbers, BNB Chain has 248,000 holder addresses, Ethereum has 66,000, while Tron currently has only one.

Looking at token holdings, 93.7% of USD1 on BNB Chain (equivalent to $2.02 billion) is held in two Binance addresses, with $1.9 billion concentrated in a single Binance address (0xF977814e90dA44bFA03b6295A0616a897441aceC).

Reviewing USD1’s scale growth, we find that its market cap was only around $130 million before May 1, 2025. On May 1, however, it surged to $2.13 billion—an overnight increase of nearly $2 billion.

USD1 Scale Growth Curve, Source: CMC

This sudden expansion primarily resulted from MGX, an Abu Dhabi investment firm, investing $2 billion in Binance via equity purchase using USD1 as the payment currency. The amount of USD1 currently held in Binance’s addresses aligns closely with this $2 billion figure.

This implies:

-

After receiving MGX’s investment in USD1, Binance did not convert it into USD or other stablecoins. It remains the largest holder of USD1, owning 92.8% of the total supply.

-

If we exclude this exchange-driven issuance, USD1 remains a small-scale stablecoin with a circulating market cap of just over $100 million.

This kind of business expansion model is likely to recur in the project’s future development.

Business Partnerships

In market expansion, WLFI has established partnerships with several institutions and protocols.

In June 2025, WLFI announced a collaboration with London-based crypto fund Re7 to launch USD1 vaults on Euler Finance (Ethereum) and Lista (BNB Chain’s staking platform), aiming to expand USD1’s influence within the Ethereum and BNB Chain ecosystems. Lista is a primary BNB staking platform backed by Binance Labs.

In addition, Aave—the largest decentralized lending platform—has proposed integrating USD1 into its markets on Ethereum and BNB Chain. The proposal has already passed community voting.

On exchanges, USD1 is listed on major CEXs including Binance, Bitget, Gate, and Huobi, as well as DEXs like Uniswap and PancakeSwap.

World Liberty’s Competitive Advantages

World Liberty’s competitive advantage is straightforward: the Trump family’s strong political influence gives the project inherent advantages in specific types of business development. It may serve as a conduit for individuals, organizations, or even nations seeking political or commercial favors from the Trumps.

Binance choosing USD1 as the vehicle for MGX’s massive investment—and continuing to hold it interest-free (effectively propping up USD1’s TVL)—while rapidly listing the token, serves as a prime example.

However, key risks for WLFI token holders include:

-

The Trump family has numerous channels for receiving benefits; World Liberty may not be the preferred choice for those seeking access (for more on the Trump family’s diverse wealth-generating methods, see Bloomberg’s late-May 2025 feature: THE TRUMP FAMILY’S MONEY-MAKING MACHINE, which details their wide-ranging tactics).

-

The $WLFI token itself is decoupled from the actual value of the World Liberty project (detailed further in the Token Model section below).

-

After—or even during—the Trump family’s token sale, they may largely abandon active project operations, resulting in a soft exit (as seen with all previous Trump-branded crypto assets, from Trump coins to various NFTs).

Background: Key Figures and Funding Details

Core Team Background

World Liberty Financial’s core team comes from political and business circles—this is the source of the project’s core competitiveness and influence.

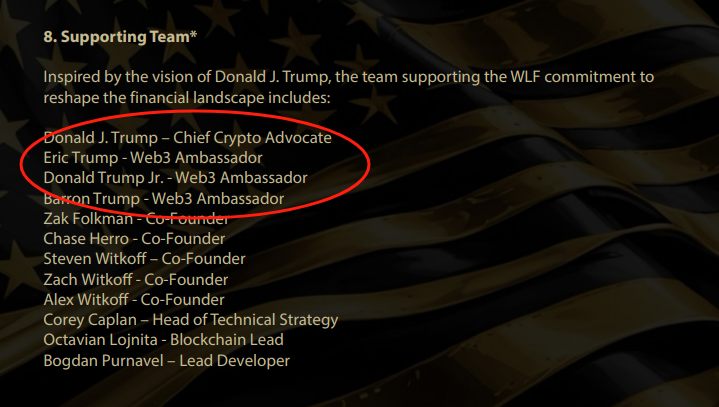

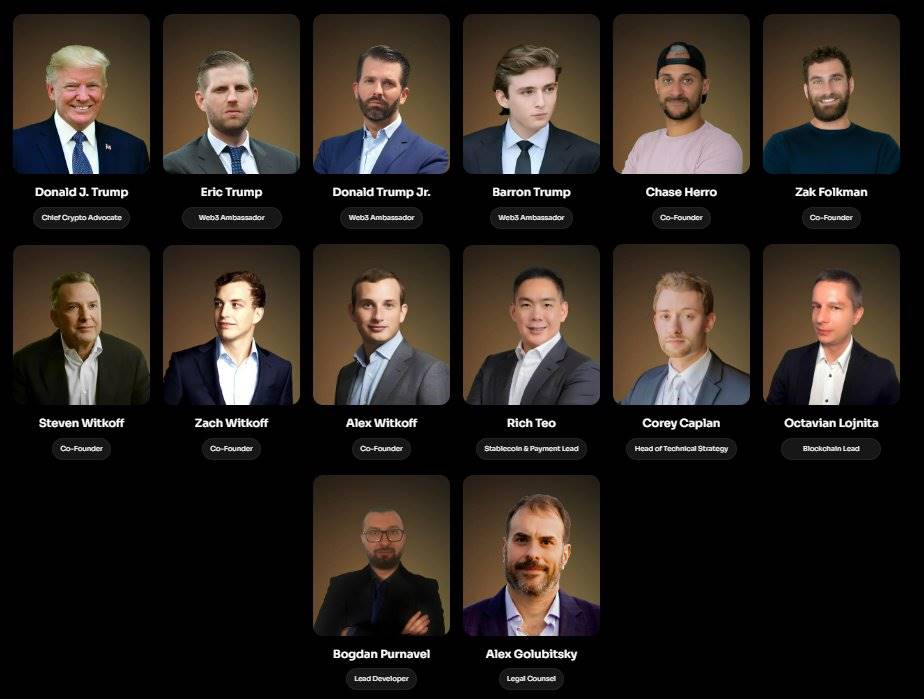

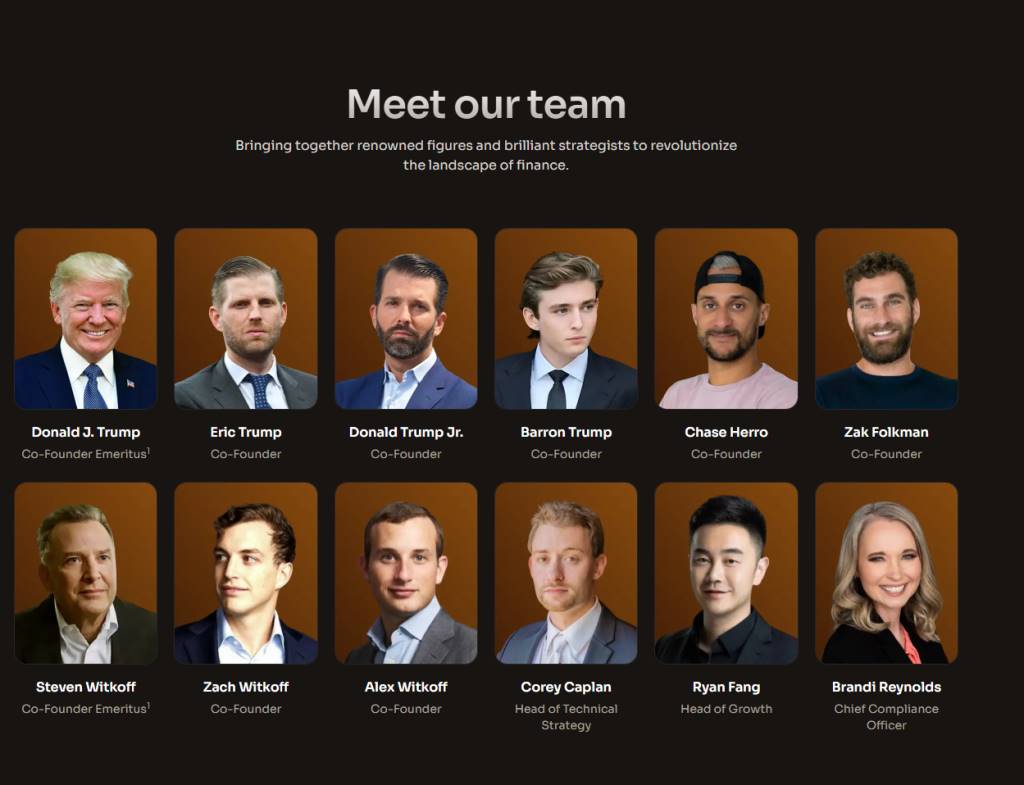

Undoubtedly, the central figures are Donald Trump, the 45th and 47th U.S. President, and his three sons—Donald Trump Jr., Eric Trump, and 17-year-old Barron Trump.

However, their official roles on the World Liberty Financial website have subtly changed in the past month. In mid-June, Donald Trump was listed with the largely symbolic title of “Chief Crypto Advocate,” while his three sons were titled “Web3 Ambassadors.”

The project’s “Golden Paper” defines the four Trump family members similarly:

Despite this, the four Trumps are positioned ahead of all other project co-founders.

World Liberty Financial Team Page, Mid-June

Recently, however, the official team page updated their titles: Donald Trump is now listed as “Honorary Co-Founder,” while his three sons are now full “Co-Founders.”

World Liberty Financial Team Page, Mid-June

A subtle detail: both Donald Trump and another “Honorary Co-Founder,” Steven Witkoff (previously listed as Co-Founder, now downgraded), now have a nearly invisible footnote “1” next to their titles. At the bottom of the page, in small print: “Removed upon taking office.” This means once either individual assumes public office, their “Honorary Co-Founder” status will be removed.

This is a typical compliance measure designed to prevent conflicts of interest when government officials take public roles, complying with U.S. ethics rules requiring public servants to sever private business ties.

But here’s the problem: Donald Trump is already a public official—the President of the United States.

Besides the Trumps, another heavyweight is long-time Trump business partner and New York real estate tycoon Steven Witkoff, who serves as Honorary Co-Founder. He is founder and chairman of the Witkoff Group, having known Trump since the 1980s. They are frequent golf partners and publicly recognized “longtime friends and business associates.”

Since Trump took office, Witkoff has been appointed “U.S. Middle East Envoy,” reporting directly to Trump and playing a key role in major negotiations involving Israel, Qatar, Russia, and Ukraine. He also acts as Trump’s “private messenger” to Putin, having made multiple trips to Moscow to meet Russian leaders.

The Witkoff family is also deeply involved: his sons Zach Witkoff and Alex Witkoff are both WLFI co-founders.

Beyond political figures, WLFI’s tech and operations are managed by crypto industry veterans. Zak Folkman and Chase Herro, both co-founders, are serial entrepreneurs in crypto. They previously founded DeFi platform Dough Finance, which failed after an early hack—making their entrepreneurial track record questionable. Initially, Folkman and Herro were the main controllers of WLFI but transferred control to a Trump-family-controlled entity in January 2025.

Another key member, Richmond Teo, leads WLFI’s stablecoin and payments division. He was previously co-founder and former CEO for Asia at Paxos, a well-known compliant stablecoin firm. The team also includes blockchain professionals like Corey Caplan (Head of Technical Strategy) and Ryan Fang (Growth Lead), as well as traditional financial compliance experts such as Brandi Reynolds (Chief Compliance Officer).

The project has also brought on several advisors, including Polychain Capital partner Luke Pearson and Sandy Peng, co-founder of Ethereum Layer 2 Scroll network. Sandy Peng assisted with operations during the token sale.

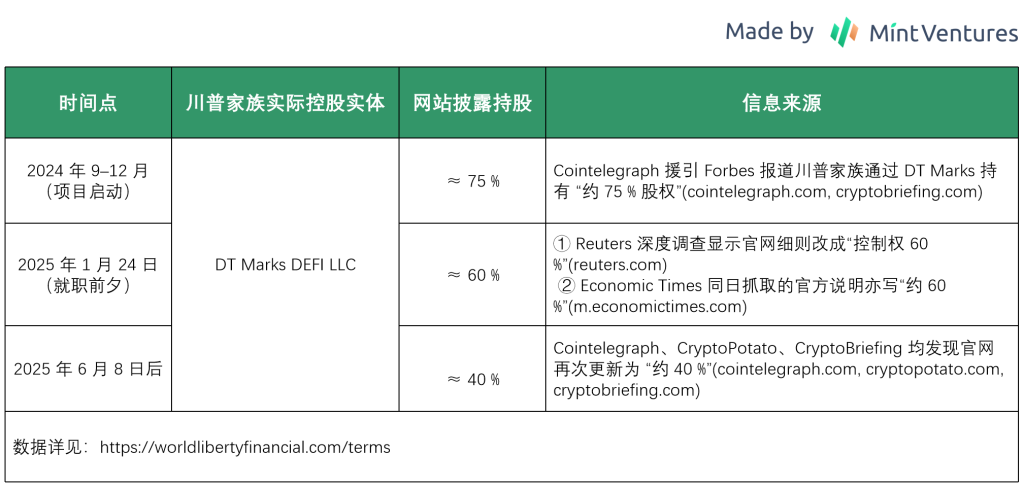

Equity Changes of the Trump Family in World Liberty Financial

In reality, the Trump family’s equity stake in World Liberty Financial has steadily declined—from an initial 75% down to 40%.

The 35% reduction in equity may have been transferred to figures such as Justin Sun, DWF Labs, and possibly the recently announced $100 million investor Aqua 1 Foundation (speculative).

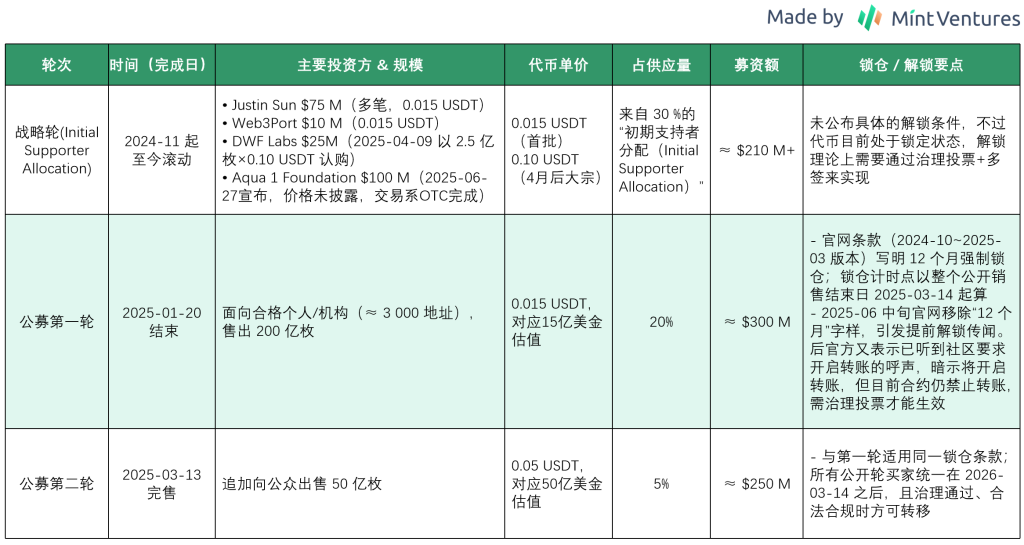

Funding History and Investors

Since launching in September 2024, World Liberty Financial has raised over $700 million through multiple funding rounds, with valuations rising sharply following Trump’s re-election and the project’s token launch.

Below is a summary of each funding round:

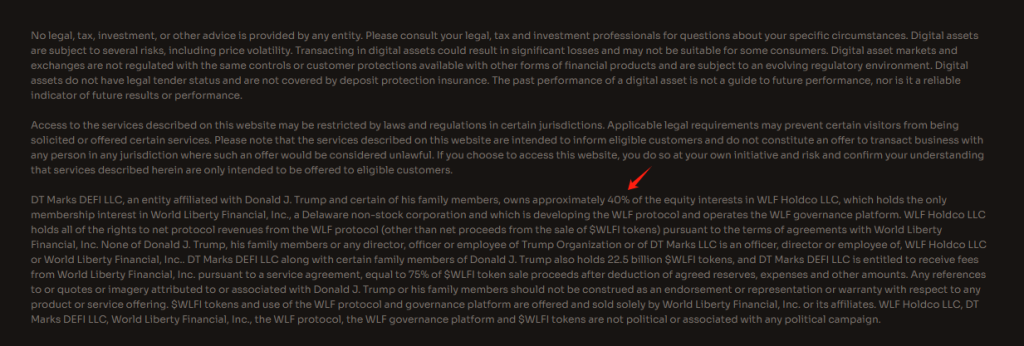

Notably, according to the project’s Golden Paper and website disclosures, the Trump family is entitled to 75% of net proceeds from token sales (which, through later equity transfers, effectively amounted to indirect resale of token revenue), plus 60% of future business net profits (from operating the stablecoin).

Token: Distribution, Functionality, and Protocol Revenue

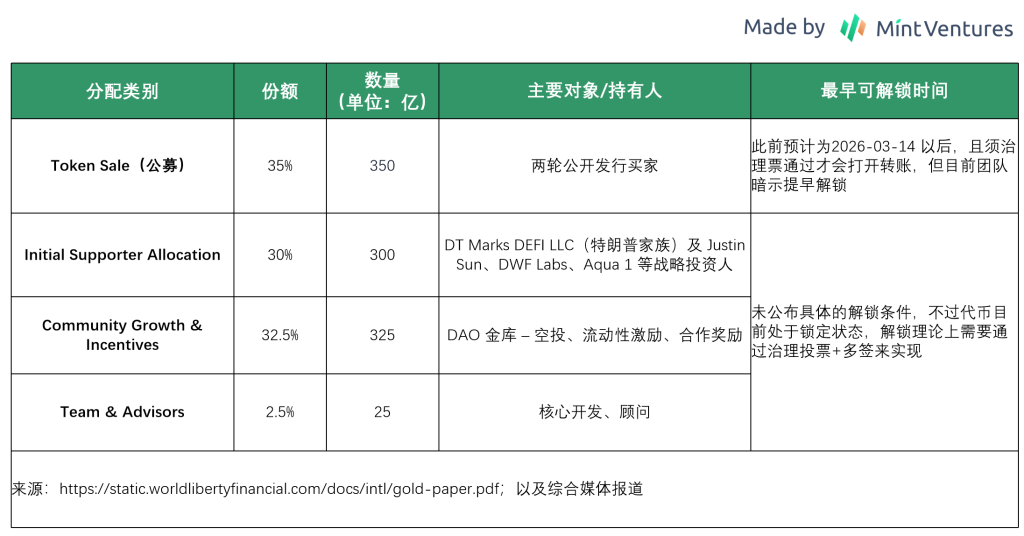

Token Distribution and Unlocking Details

The $WLFI governance token has a total supply of 100 billion. According to the official “Golden Paper” tokenomics, the distribution and unlock schedule is as follows:

It’s worth noting that 35% of tokens were allocated to token sales, but only 25% has been sold publicly so far—the fate of the remaining 10% remains unclear.

Additionally, while the public sale portion includes a clause specifying an anticipated 12-month lock-up (expected around December), other allocations lack clear unlocking conditions or timelines. Currently, all non-public-sale tokens are non-transferable, similar to the public sale batch.

The ambiguity around unlocking terms for non-public tokens introduces significant uncertainty.

The worst-case scenario would be the team prematurely unlocking and dumping these tokens on the secondary market without prior notice. A more reasonable approach would be to announce unlocking plans ahead of the public sale unlock and conduct phased unlocks via formal community governance votes.

Token Utility

$WLFI is purely a governance token. It carries no dividend rights, profit-sharing rights, or equity claims in the project company. Its value stems solely from governance participation.

Protocol Revenue Allocation

In WLFI’s official Golden Paper, the handling of protocol revenue is described as follows:

"The initial $30 million in net protocol revenue will be held in reserve under multi-sig control by WLF (the project, initially abbreviated as WLF, later changed to WLFI), to cover operational expenses, compensation, and obligations. Net protocol revenue includes all income streams to WLF, including but not limited to platform fees, token sale proceeds, advertising revenue, or other sources, after deducting agreed expenses and ongoing operational reserves. Any remaining net protocol revenue will be paid to entities affiliated with our founders and certain service providers (initial supporters), such as DT Marks DEFILLC, Axiom Management Group, LLC, and WC Digital Fi LLC. These entities have indicated they intend to use most of the received funds to support the deployment of the WLF protocol once launched."

In short, protocol revenues primarily go to corporate entities behind WLFI (though these entities claim they’ll reinvest most funds back into the protocol). Crucially, the $WLFI token itself is not directly tied to business revenue.

Valuation: What Is WLFI Worth Long-Term?

Given that WLFI’s core business is a stablecoin, we can reference the valuation of its main publicly traded competitor, Circle, using its “market cap / stablecoin market cap” ratio to roughly estimate a fair valuation range for WLFI.

By end-June, USDC’s market cap stood at approximately $61.7 billion.

Circle’s market cap was $41.1 billion at the same time, with a fully diluted valuation (including options and convertible notes) of about $47.1 billion.

Thus, Circle’s “market cap / stablecoin market cap” ratio ranges from 411/617 to 471/617, or 0.66–0.76.

Applying this ratio to WLFI’s current stablecoin scale of $2.2 billion, the project’s implied market cap would be 2.2 × (0.66–0.76), or $1.452–1.672 billion. This translates to a $WLFI token price of $0.0145–$0.0167.

Clearly, this number would be difficult for WLFI investors to accept—placing early public sale participants barely at break-even. High expectations for WLFI stem from possible arguments such as:

-

WLFI starts with partial unlocks; its circulating market cap is much smaller than FDV, allowing for higher premiums.

-

WLFI is in early stages, with far greater potential growth than Circle.

-

WLFI possesses strong political capital, warranting a “Trump premium,” attracting many projects eager to collaborate.

-

Crypto market sentiment and bubbles are more aggressive than traditional markets, so WLFI could command a higher multiple than Circle.

-

WLFI may time its token launch around the passage of the U.S. Genius stablecoin bill, riding high market enthusiasm.

...

Yet counterarguments exist:

-

Stablecoins exhibit extremely strong network effects; leaders should enjoy stronger competitive advantages and higher valuations than newcomers (consider Tether’s profitability versus Circle’s).

-

WLFI’s project revenue does not flow to the $WLFI token, which lacks value capture—justifying a significant valuation discount.

-

93% of WLFI’s current stablecoin supply is held by Binance, indicating minimal organic adoption and severely inflated metrics.

-

WLFI may be just one of many “branded licensing projects” for the Trump family, who may treat it as ruthlessly as previous Trump coins and NFTs—abandoning it post-token-sale without long-term commitment.

-

Liquidity in the crypto market, especially for altcoins, has dried up. Secondary market players no longer believe in stories without solid business fundamentals—most newly launched tokens experience freefall.

...

As an investor, which side do you lean toward? Opinions vary.

In my view, the key determinant of WLFI’s short-term price performance hinges not only on the final content and timing of the Genius Act, but more importantly on whether the Trump family chooses to place WLFI at the center of their benefit-exchange ecosystem. Specifically, will influential individuals, corporations, or sovereign states actively embed USD1—even symbolically—into their operations (e.g., using USD1 for equity investments or cross-border settlements) to gain political or commercial favor?

If such high-profile business integrations fail to materialize after launch, WLFI’s position within the Trump family’s broader business portfolio appears weak—they likely have better return channels.

Let’s wait and see how WLFI evolves after launch.

When exactly will $WLFI tokens become transferable?

I suspect it will be shortly after the U.S. Genius Act officially passes (it has already cleared the Senate). That moment will mark when the project team gains full operational freedom—and it won’t be long now.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News