Re-examining the Stablecoin Trilemma: The Current Decline of Decentralization

TechFlow Selected TechFlow Selected

Re-examining the Stablecoin Trilemma: The Current Decline of Decentralization

Aside from speculation, stablecoins are one of the few products in the cryptocurrency space with a clear product-market fit (PMF).

Author: Chilla

Translation: Block unicorn

Introduction

Stablecoins are receiving a lot of attention, and for good reason. Beyond speculation, stablecoins are one of the few products in the cryptocurrency space that have achieved clear product-market fit (PMF). Today, there's widespread discussion about trillions of dollars in stablecoins expected to flow into traditional finance (TradFi) markets over the next five years.

However, not all that glitters is gold.

The Original Stablecoin Trilemma

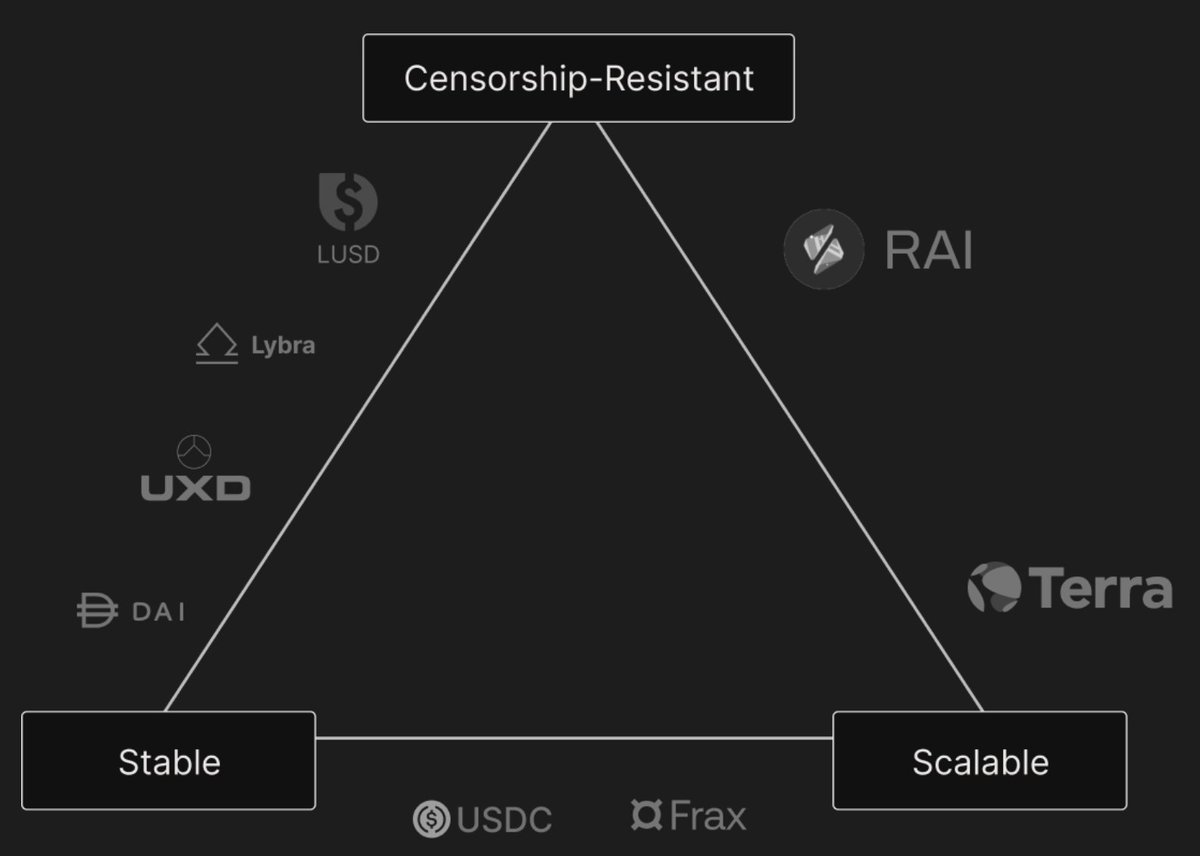

New projects often use charts to position themselves against major competitors. One striking yet frequently overlooked trend is the clear step back in decentralization.

The market is evolving and maturing. The need for scalability is clashing with past anarchic ideals. Still, some balance must be found.

Originally, the stablecoin trilemma was based on three key concepts:

-

Price stability: The stablecoin maintains a stable value, typically pegged to the U.S. dollar.

-

Decentralization: No single entity has control, providing censorship resistance and trustlessness.

-

Capital efficiency: The ability to maintain the peg without requiring excessive collateral.

Yet, after numerous controversial experiments, scalability remains a challenge. As a result, these concepts are evolving to meet these challenges.

The above image comes from one of the most prominent stablecoin projects in recent years. It deserves credit largely due to its strategy of expanding beyond just being a stablecoin into a broader ecosystem.

However, you can see that price stability remains unchanged. Capital efficiency is now equated with scalability. But decentralization has been replaced with censorship resistance.

Censorship resistance is a fundamental feature of crypto, but compared to decentralization, it’s only a subset. This is because most new stablecoins—excepting Liquity and its forks, along with a few other exceptions—exhibit notable centralized characteristics.

For example, even if these projects utilize decentralized exchanges (DEXs), there is still a team managing strategies, seeking yield, and redistributing it to holders who effectively function like shareholders. In this case, scalability stems from the volume of yield generated, rather than composability within DeFi.

True decentralization has been undermined.

Motivations

Dreams abound, but reality falls short. On Thursday, March 12, 2020, amid the pandemic-induced market crash, DAI’s struggles became widely known. Since then, reserves have primarily shifted toward USDC, making it an alternative and tacitly acknowledging the failure of full decentralization in the face of Circle and Tether’s dominance. Meanwhile, attempts at algorithmic stablecoins like UST or rebase models like Ampleforth failed to deliver as expected. Later, regulations worsened the situation. At the same time, the rise of institutional stablecoins dampened experimental momentum.

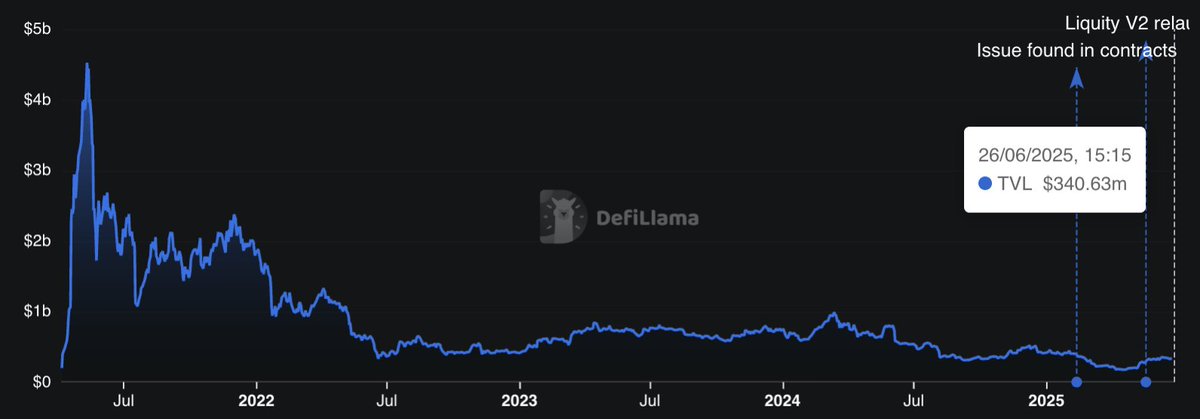

Yet, one attempt did achieve growth. Liquity stood out due to its contract immutability and use of Ethereum as collateral, pushing pure decentralization forward. However, it suffered from limited scalability.

Now, they’ve recently launched V2, enhancing peg security through multiple upgrades and offering improved interest rate flexibility when minting their new stablecoin BOLD.

Still, several factors limit its growth. Compared to capital-efficient, non-yielding stablecoins like USDT and USDC, its loan-to-value ratio (LTV) for the stablecoin is around 90%, which isn’t particularly high. Moreover, direct competitors offering intrinsic yield—such as Ethena, Usual, and Resolv—have achieved LTVs of up to 100%.

But the main issue may be the lack of a large-scale distribution model. Because it remains closely tied to the early Ethereum community, it pays less attention to use cases such as spreading across DEXs. While the cypherpunk vibe aligns with crypto ethos, without balancing integration with DeFi or retail adoption, it risks limiting mainstream growth.

Despite limited total value locked (TVL), Liquity stands as one of the most TVL-rich projects among forks in crypto, with V1 and V2 combined reaching $370 million—an intriguing figure.

The GENIUS Act

This legislation should bring greater stability and recognition to U.S. stablecoins. However, it focuses exclusively on traditional, fiat-backed stablecoins issued by licensed and regulated entities.

Any decentralized, crypto-collateralized, or algorithmic stablecoins are either left in regulatory gray areas or explicitly excluded.

Value Proposition and Distribution

Stablecoins are the shovels in a gold rush. Some are hybrid projects targeting institutions (e.g., BlackRock’s BUIDL and World Liberty Financial’s USD1), aiming to expand into traditional finance (TradFi). Others come from Web2.0 (e.g., PayPal’s PYUSD), aiming to grow their total addressable market (TAM) by tapping into native crypto users—but they face scalability challenges due to lack of experience in this new domain.

Then there are projects focused primarily on underlying strategies: RWA-based ones (like Ondo’s USDY and Usual’s USDO), aiming to generate sustainable returns tied to real-world assets (as long as interest rates remain high), and delta-neutral strategies (like Ethena’s USDe and Resolv’s USR), focused on creating yield for holders.

All these projects share one thing in common—albeit to varying degrees: centralization.

Even DeFi-focused projects using delta-neutral strategies are managed by internal teams. While they may leverage Ethereum in the backend, overall governance remains centralized. In practice, these projects should theoretically be classified as derivatives rather than stablecoins—an argument I've made before.

Emerging ecosystems like MegaETH and HyperEVM also bring fresh hope.

For instance, CapMoney will initially adopt a centralized decision-making model, aiming to gradually transition toward decentralization via the economic security provided by EigenLayer. Additionally, Liquity forks like Felix Protocol are experiencing significant growth and establishing themselves as the native stablecoin on their respective chains.

These projects choose to focus on distribution models centered around emerging blockchains, leveraging the “novelty effect.”

Conclusion

Centralization itself isn't inherently negative. For projects, it's simpler, more controllable, scalable, and better aligned with regulation.

Yet, it contradicts the original spirit of cryptocurrency. What guarantees that a stablecoin is truly censorship-resistant? That it’s more than just a dollar on-chain, but a genuine user-owned asset? No centralized stablecoin can make that promise.

Therefore, despite the appeal of emerging alternatives, we must not forget the original stablecoin trilemma:

-

Price stability

-

Decentralization

-

Capital efficiency

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News